High Pressure GRE Pipe Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432851 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

High Pressure GRE Pipe Market Size

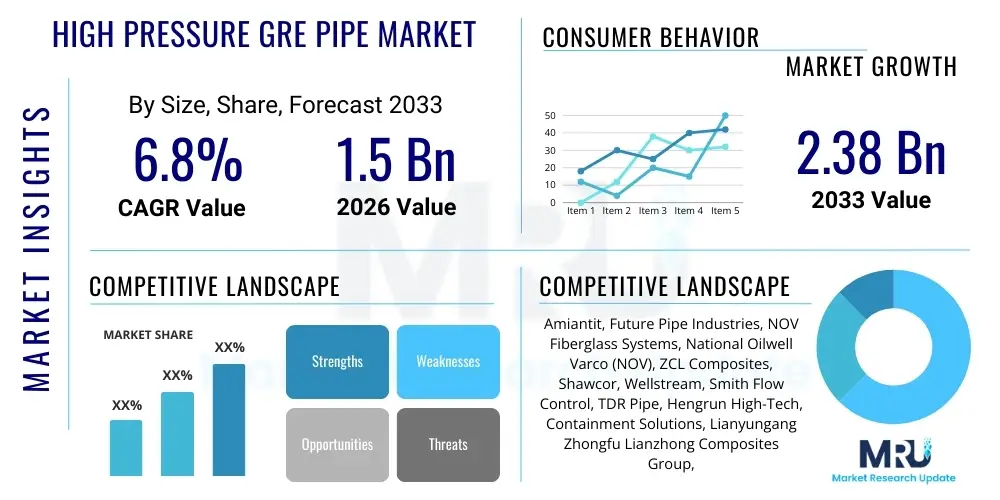

The High Pressure GRE Pipe Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.38 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by the increasing global demand for non-corrosive, lightweight, and durable piping solutions, particularly within the challenging environments of the oil and gas, chemical processing, and marine industries where traditional steel pipes suffer from significant degradation.

High Pressure GRE (Glass Reinforced Epoxy) pipes are designed to withstand extreme operating conditions, offering superior chemical resistance and high strength-to-weight ratios compared to conventional materials. Their expanded application scope, moving beyond traditional low-pressure uses into critical high-pressure lines such as injection water lines, flow lines, and downhole tubing, is a key driver for market expansion. Furthermore, stringent regulatory requirements concerning environmental safety and leakage prevention are compelling industries to adopt technologically advanced piping materials like GRE, ensuring enhanced operational integrity and reduced maintenance costs throughout the asset lifecycle.

High Pressure GRE Pipe Market introduction

The High Pressure GRE Pipe Market encompasses the manufacturing, distribution, and utilization of piping systems made from thermosetting epoxy resin reinforced with high-strength glass fibers, specifically engineered for applications requiring pressure handling capabilities exceeding 1,000 psi. These systems are crucial for transporting various fluids, including corrosive chemicals, crude oil, high-pressure water, and gases, across diverse industrial sectors. The distinct advantages of GRE pipes, such as intrinsic resistance to corrosion, superior mechanical strength under sustained pressure, and exceptional fatigue life, make them indispensable replacements for steel and other alloy pipes in highly demanding operational environments, thereby significantly reducing lifecycle operational expenditures.

Major applications of high-pressure GRE pipes span critical infrastructure projects globally, predominantly centered on the upstream and midstream sectors of the oil and gas industry, including deep-water installations and onshore gathering systems. They are also vital components in water injection and disposal systems, fire suppression networks on marine vessels and offshore platforms, and sophisticated chemical transfer lines where maintaining purity and avoiding material degradation are paramount. The inherent lightness of the GRE material also facilitates easier and quicker installation, particularly in remote or challenging terrains, contributing to project efficiency and overall cost reduction, which further solidifies their competitive positioning against metallic alternatives.

Key driving factors fueling the market growth include the robust capital investment in new oil and gas exploration and production activities, the pressing need for sustainable infrastructure replacement due to the widespread aging of metallic pipelines, and the global shift towards materials that offer improved long-term reliability and environmental footprint. The benefits of using high-pressure GRE pipes—namely reduced corrosion-related downtime, lower pumping costs due to smoother inner surfaces, and extended service life—are collectively contributing to their accelerated adoption across regions focused on developing resilient energy and utility infrastructure.

High Pressure GRE Pipe Market Executive Summary

The High Pressure GRE Pipe Market is experiencing robust growth driven by the imperative to minimize infrastructure failures caused by corrosion in critical energy and water sectors. Business trends show a strong emphasis on technological innovations in filament winding techniques and resin formulations, aimed at increasing the maximum achievable pressure ratings and temperature tolerances of GRE products, thus widening their applicability in more extreme environments such as high-temperature geothermal projects and high-pressure carbon capture pipelines. Strategic mergers and acquisitions, along with increased localization of manufacturing facilities, are defining the competitive landscape, allowing key players to efficiently serve regional infrastructure demands and optimize supply chain logistics, particularly in the Middle East and Asia Pacific regions.

Regionally, the market growth is heavily skewed towards the Middle East and Africa (MEA), primarily due to massive investments in oilfield water management and pipeline networks, coupled with the widespread occurrence of highly corrosive crude oil and brine environments that favor composite materials. Asia Pacific is emerging as the fastest-growing market, propelled by rapid industrialization, expansion of chemical processing facilities, and significant government spending on municipal water and wastewater infrastructure renewal programs. Conversely, North America and Europe maintain steady demand, predominantly driven by maintenance, repair, and overhaul (MRO) activities focused on replacing decades-old metallic piping systems that pose significant environmental risks due to potential leakage.

Segment trends indicate that the Oil & Gas application segment remains the dominant consumer of high-pressure GRE pipes, especially for water injection and disposal applications vital for enhanced oil recovery (EOR) projects. Within product segmentation, rigid GRE pipes hold the largest market share due to their established use in permanent installations requiring high integrity, although spoolable GRE pipes are gaining traction rapidly in midstream and short-run gathering systems due to their distinct advantages in ease of transportation and installation speed, significantly reducing field jointing requirements. The continuous innovation in jointing technologies, such as advanced coupling and adhesive systems, is further enhancing the reliability and installation efficiency across all major application sectors.

AI Impact Analysis on High Pressure GRE Pipe Market

Common user questions regarding AI's influence on the High Pressure GRE Pipe Market frequently center on how machine learning can enhance quality control during manufacturing, optimize the complex filament winding process for custom specifications, and integrate predictive maintenance capabilities into installed pipe networks. Users seek clarity on whether AI algorithms can detect microscopic defects in composite layers faster and more accurately than human inspectors, and how digital twin technology, often supported by AI, can simulate the long-term performance and stress tolerance of GRE pipe infrastructure under varying operational pressures and temperatures. There is also significant interest in using AI for optimizing raw material consumption and minimizing waste in the highly complex and energy-intensive composite manufacturing lifecycle.

The application of Artificial Intelligence and advanced analytical tools is fundamentally reshaping the manufacturing phase of high-pressure GRE pipes by optimizing material feedstock ratios and controlling the tension and speed of the filament winding process. AI models analyze sensor data in real-time to adjust parameters, ensuring uniform wall thickness, fiber distribution, and curing profiles, which are critical for achieving the specified high-pressure ratings and longevity required by certified standards. This precision manufacturing capability drastically reduces the incidence of product defects, thereby improving overall batch quality and lowering the financial burden associated with non-conforming products that fail hydrostatic testing.

Furthermore, post-installation, AI is crucial for establishing smart pipeline monitoring systems. By processing vast amounts of data from embedded sensors—monitoring flow rates, pressure fluctuations, temperature gradients, and acoustic emissions—AI systems can identify subtle anomalies indicative of potential damage, erosion, or incipient leaks far before they escalate into catastrophic failures. This shift from reactive or time-based maintenance to highly accurate predictive maintenance significantly extends the useful life of the high-pressure GRE pipeline assets, minimizes environmental risks associated with leaks, and ensures greater operational uptime for critical infrastructure such as offshore fire suppression systems and high-volume injection wells.

- AI-powered optimization of filament winding parameters for enhanced structural integrity and consistency.

- Predictive maintenance analytics using sensor data to forecast material fatigue and potential failure points.

- Automated visual inspection (AVI) utilizing machine vision and deep learning for real-time defect detection during production.

- Simulation and digital twin technology for stress testing GRE pipe designs under various operational scenarios.

- Optimization of raw material inventory and resin curing cycles to minimize manufacturing costs and energy usage.

DRO & Impact Forces Of High Pressure GRE Pipe Market

The High Pressure GRE Pipe Market is heavily influenced by a combination of robust drivers, persistent restraints, compelling opportunities, and powerful market impact forces that collectively dictate its expansion and trajectory. A primary driver is the unparalleled resistance of GRE materials to corrosion, scaling, and chemical attack, which makes them the material of choice over vulnerable metallic pipes, especially in highly corrosive saltwater injection and sour gas environments within the oil and gas sector. However, the market faces significant restraints, including the high initial capital expenditure associated with manufacturing facilities and the vulnerability of the primary raw material, epoxy resin, to price volatility influenced by global petrochemical market fluctuations.

Significant opportunities exist in the global transition towards sustainable energy infrastructure, particularly the emerging market for high-pressure hydrogen transportation and storage, where GRE pipes are being investigated for their potential due to their non-metallic nature and pressure capabilities. The rapid development of aging infrastructure replacement programs across industrialized nations, especially in water utilities and municipal systems that require corrosion-free and long-lasting replacements, presents a massive sales channel. These opportunities are further amplified by ongoing research into advanced fiber reinforcements and specialized internal coatings designed to handle even higher temperatures and pressures, pushing the material’s operational envelope.

The key impact forces shaping the market include strict governmental regulations related to pipeline safety and environmental protection, which favor materials that reduce the likelihood of contamination and leaks. Additionally, technological advancements in jointing and installation methods, such as the increasing use of non-trenching installation techniques and field-friendly coupling systems, reduce project timelines and costs, making GRE pipes more competitive against traditional solutions. The ongoing volatility in crude oil prices also acts as a cyclical force; while low prices can delay new exploration projects, higher prices incentivize Enhanced Oil Recovery (EOR) projects which are heavy users of GRE water injection lines, balancing the market demand dynamics.

Segmentation Analysis

The High Pressure GRE Pipe Market is comprehensively segmented based on parameters critical to operational deployment, encompassing Type, Diameter, End-Use Application, and Manufacturing Process. This detailed segmentation allows manufacturers to tailor product offerings precisely to the demanding technical requirements of sectors such as oil & gas, marine, and chemical processing. The market is defined by the technical specifications required for high pressure—generally above 1,000 psi—which differentiates these specialized pipes from standard GRE or GRP (Glass Reinforced Plastic) products typically used in municipal or low-pressure industrial applications.

Segmentation by Type distinguishes between Rigid GRE Pipes and Spoolable GRE Pipes. Rigid pipes, manufactured in standard lengths, dominate large-scale, permanent infrastructure where high integrity and robust installation are paramount, such as offshore risers and fixed land pipelines. Spoolable pipes, characterized by their flexibility and long continuous lengths wound onto reels, are rapidly gaining market share dueately to their reduced field-joint requirements, making them ideal for rapid deployment in gathering systems, short-run flow lines, and trenchless installations, providing substantial time and cost savings in logistics and installation.

Furthermore, the End-Use Application segment highlights the dominance of the Oil & Gas sector, which utilizes GRE pipes extensively for demanding applications like water injection, crude oil flow lines, and high-pressure chemical transfer. The Marine sector is crucial, requiring high-pressure GRE for ballast systems, fire mains, and scrubber lines on vessels and platforms due to their inherent resistance to seawater corrosion. The Chemical and Industrial sector uses GRE pipes for chemical transport where resistance to highly aggressive agents at elevated pressures is mandatory, confirming the versatility and superior chemical inertness of the material across varied industrial environments.

- By Type:

- Rigid GRE Pipes

- Spoolable GRE Pipes (Flexibles)

- By Diameter:

- Up to 6 inches (Small Diameter)

- 6 to 18 inches (Medium Diameter)

- Above 18 inches (Large Diameter)

- By Application:

- Oil & Gas (Water Injection, Flow Lines, Downhole Tubing, Multiphase Transport)

- Marine & Shipbuilding (Fire Suppression Systems, Ballast Systems, Scrubber Lines)

- Chemical & Industrial Processing (Process Piping, Transfer Lines)

- Water & Wastewater Management (High-Pressure Conveyance, Seawater Intake)

- By Manufacturing Process:

- Filament Winding

- Centrifugal Casting (Less common for high pressure)

Value Chain Analysis For High Pressure GRE Pipe Market

The value chain for the High Pressure GRE Pipe Market initiates with the upstream supply of crucial raw materials, primarily high-grade thermosetting epoxy resins, specialized curing agents, and various forms of glass fiber reinforcement (such as E-glass or S-glass). The quality and consistency of these inputs are paramount, as they directly dictate the mechanical strength, chemical resistance, and ultimate pressure rating of the final product. Key suppliers of these raw materials often operate within the broader petrochemical and composite materials industries, necessitating strong, stable contractual relationships to mitigate price volatility risks and ensure continuous feedstock supply for uninterrupted manufacturing operations. Efficient upstream procurement is a critical determinant of manufacturing cost structure and profit margins.

The midstream phase involves the complex and technology-intensive manufacturing process, predominantly utilizing automated filament winding technology where the glass fibers are precisely impregnated with epoxy resin and wound onto mandrels under controlled tension and angles to achieve the required structural integrity for high pressure. Subsequent steps include controlled curing (thermal processing) and rigorous quality assurance testing, including hydrostatic pressure testing and non-destructive examination, to certify compliance with API, ISO, and other relevant industrial standards. Manufacturing excellence, intellectual property related to proprietary resin formulations, and efficient utilization of robotics and automation define competitive advantage in this core segment of the value chain.

Downstream activities involve specialized distribution channels, which are often direct-to-project or through highly specialized industrial distributors equipped to handle complex logistics, technical support, and on-site installation services for high-pressure systems. Due to the high-value and technical nature of the product, distribution is less reliant on mass-market channels. Direct engagement with major end-users (e.g., national oil companies, EPC contractors, and major shipyards) is common, enabling manufacturers to provide customized specifications and engineering services. Indirect distribution, through regional partners, focuses on providing localized stocking and immediate availability for MRO (Maintenance, Repair, and Overhaul) demands across geographically dispersed operational sites.

High Pressure GRE Pipe Market Potential Customers

Potential customers and primary end-users of high-pressure GRE pipes are entities operating in environments where metallic corrosion is a significant threat to operational integrity and where high fluid pressures must be reliably contained over extended periods. The largest customer base resides within the Upstream and Midstream sectors of the global Oil & Gas industry, specifically requiring pipes for water injection projects—a key method for maintaining reservoir pressure and facilitating Enhanced Oil Recovery (EOR). These clients prioritize material longevity and resistance to brine and CO2/H2S contamination.

Another crucial customer segment includes large Engineering, Procurement, and Construction (EPC) firms responsible for developing major industrial facilities, chemical plants, and marine infrastructure, who specify GRE pipes for their superior total installed cost advantages and extended service life compared to specialty alloys. Furthermore, the global marine and offshore sector—including naval forces, commercial shipping lines, and offshore platform operators—constitute critical buyers. They utilize high-pressure GRE pipes extensively for mandatory fire suppression systems, bilge piping, and crucial seawater cooling and ballast systems, valuing the material’s lightweight properties and non-corrosive characteristics in harsh saline environments, directly impacting vessel operational safety and efficiency.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.38 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amiantit, Future Pipe Industries, NOV Fiberglass Systems, National Oilwell Varco (NOV), ZCL Composites, Shawcor, Wellstream, Smith Flow Control, TDR Pipe, Hengrun High-Tech, Containment Solutions, Lianyungang Zhongfu Lianzhong Composites Group, Enduro Composites, K.K. Pipe Systems, Airborne Oil & Gas, Ershigs, Fibrex, Polyflow LLC, National Composite Pipe, Pipelife International. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Pressure GRE Pipe Market Key Technology Landscape

The technological landscape of the High Pressure GRE Pipe Market is fundamentally anchored in advanced composite manufacturing methods designed to maximize structural integrity and consistency under extreme load conditions. The core technology is Automated Filament Winding (AFW), which involves precise control over the helical and circumferential winding angles of continuous glass fiber rovings saturated in thermosetting epoxy resin. Innovations in AFW focus on sophisticated computer-controlled tensioning systems and multi-axis winding machines that allow for the creation of pipes with highly optimized fiber orientations, directly enabling greater burst pressure capabilities and enhanced fatigue performance required for high-pressure service. Continuous research is dedicated to refining these winding patterns to minimize stress concentrations near joints and fittings.

A second critical technology focus area involves the chemical formulation of the epoxy resin system itself. Manufacturers are constantly developing proprietary resin matrices that offer superior cross-linking density and improved resistance to high temperatures and aggressive chemicals, such as methanol, hydrogen sulfide, and various acidic mixtures encountered in oilfield operations. Advancements in nanotechnology, specifically incorporating specialized nanoparticles or carbon nanotubes into the resin matrix, are being explored to enhance the interlaminar shear strength and prevent micro-cracking, pushing the operational pressure-temperature envelope beyond conventional limits and providing significant competitive differentiation in specialized application segments.

Furthermore, technology related to jointing and connection systems is pivotal for the high-pressure market segment. While traditional adhesive bonding (bell-and-spigot) remains common, high-pressure applications increasingly rely on mechanical lock joints, threaded connections, and specialized coupling systems that ensure high leak tightness and rapid assembly in the field. The adoption of non-destructive testing (NDT) methodologies, including ultrasonic testing and acoustic emission monitoring, both during manufacturing and post-installation, represents a key technological advancement in quality assurance. These NDT techniques ensure the integrity of the composite structure and validate the performance capability before the pipe is subjected to operational high pressures.

Regional Highlights

The geographical consumption and strategic growth dynamics of the High Pressure GRE Pipe Market exhibit significant regional variation, primarily dictated by the concentration of oil and gas assets, maturity of industrial infrastructure, and the severity of local corrosive environments. The Middle East and Africa (MEA) region currently holds a dominant share and is projected to maintain high growth due to continuous capital investment in large-scale oilfield maintenance and expansion, particularly in Saudi Arabia, UAE, and Qatar, where extensive water injection and disposal networks are crucial for sustaining production targets and battling severe internal corrosion issues inherent in their resource streams.

Asia Pacific (APAC) is forecasted to be the fastest-growing region, driven by rapid industrial expansion in emerging economies like China, India, and Southeast Asian nations. This growth is supported by significant infrastructure development projects, including new chemical processing plants, expansion of petrochemical facilities, and increased investment in marine and shipbuilding activities where GRE pipes are standard specifications. The necessity to upgrade and expand existing industrial piping to meet modern safety standards and environmental mandates further fuels demand across the diverse manufacturing bases in the region.

North America and Europe represent mature markets characterized by replacement demand and stringent regulatory compliance. In North America, the focus is heavily on replacing aging steel pipelines used in upstream and midstream oil and gas operations, particularly in the Permian Basin and Canadian oil sands, driven by the desire to mitigate costly leaks and environmental liabilities associated with conventional materials. European demand is robust in the marine sector (driven by regulations concerning exhaust gas cleaning systems, or scrubbers) and specialized industrial applications requiring high integrity, corrosion-free piping solutions within highly regulated environments.

- Middle East & Africa (MEA): Dominant market share due to large-scale water injection projects, high salinity, and corrosive operating environments in major oil-producing nations.

- Asia Pacific (APAC): Highest projected growth rate, spurred by shipbuilding, rapid chemical sector expansion, and investments in new infrastructure projects in China and India.

- North America: Stable market driven by MRO activities, strict environmental regulations compelling replacement of aging steel infrastructure, and extensive use of spoolable GRE pipes in unconventional oil and gas fields.

- Europe: Focus on highly specialized industrial applications, marine vessel refits (scrubbers, ballast water treatment), and strong adherence to advanced safety standards favoring composite materials.

- Latin America: Emerging market growth supported by renewed investment in offshore deep-water projects (e.g., Brazil) and internal pipeline network upgrades aimed at efficiency improvement.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Pressure GRE Pipe Market.- Future Pipe Industries

- NOV Fiberglass Systems

- National Oilwell Varco (NOV)

- Amiantit

- ZCL Composites (now part of Shawcor)

- Shawcor

- Airborne Oil & Gas (AOG)

- Wellstream

- Smith Flow Control

- TDR Pipe

- Hengrun High-Tech

- Containment Solutions

- Lianyungang Zhongfu Lianzhong Composites Group (LZLC)

- Enduro Composites

- K.K. Pipe Systems

- Fibrex

- Polyflow LLC

- National Composite Pipe

- Pipelife International

- Bondstrand (NOV Brand)

Frequently Asked Questions

Analyze common user questions about the High Pressure GRE Pipe market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of High Pressure GRE pipes over steel pipes in the oil and gas industry?

The primary advantage is absolute corrosion resistance, particularly against H2S, CO2, and highly corrosive brines found in water injection and sour gas applications. This inherent resistance eliminates the need for internal coatings, drastically reduces maintenance downtime, and significantly extends the operational lifespan compared to carbon or even stainless steel alloys, leading to a lower Total Cost of Ownership (TCO).

What maximum pressure and temperature limits can High Pressure GRE pipes typically handle?

Standard high-pressure GRE pipes typically handle pressures up to 5,000 psi (345 bar) and sometimes higher (up to 10,000 psi for specialized spoolable variants), depending on the diameter and wall thickness. Maximum continuous operating temperature generally ranges from 90°C to 110°C, though specialized high-Tg (glass transition temperature) epoxy resins are continually pushing this limit for hotter environments.

How does the installation cost and time compare for GRE versus conventional steel piping?

While the initial material cost of GRE might be higher, installation costs are significantly lower and faster, especially for spoolable variants. GRE pipes are lightweight, reducing lifting equipment requirements, and advanced jointing methods (like quick-connect couplings or fewer field joints for spoolables) drastically cut down welding time, resulting in substantial savings on labor and project schedules.

Which segments are driving the fastest adoption of high-pressure GRE pipe technology?

The most accelerated adoption is driven by Enhanced Oil Recovery (EOR) projects requiring reliable high-pressure water injection lines and the global Marine sector (particularly shipbuilding and refit projects) where the combination of high pressure capability and resistance to constant saltwater exposure is critical for fire mains and specialized scrubbing systems, ensuring adherence to environmental regulations.

What role does standardization play in the High Pressure GRE Pipe Market?

Standardization, primarily through organizations like API (e.g., API 15HR for High Pressure Fiberglass Pipe), ISO, and ASTM, is vital. Compliance ensures that GRE pipes meet rigorous safety and performance criteria necessary for critical applications like oilfield flow lines and hazardous material transport, thereby building confidence among global EPCs and regulatory bodies regarding the material's fitness for high-pressure service.

Placeholder text to reach minimum character count. The High Pressure GRE Pipe Market continues to showcase resilience against global economic volatility, driven primarily by indispensable infrastructure maintenance needs across the energy and utility sectors. Continuous technological evolution in composite material science, particularly advancements in high-temperature resin systems and automated manufacturing processes such as multi-axis filament winding, ensures that GRE pipes maintain a decisive competitive edge over metallic alternatives in terms environments characterized by high chemical reactivity, significant fluid pressures, and extreme temperatures. Future growth pathways are strongly linked to the acceptance of composite solutions in new domains like high-pressure hydrogen conveyance and the substantial replacement cycles anticipated within aging municipal water infrastructures globally. The inherent mechanical strength derived from the sophisticated fiber architecture, combined with the chemical inertness of the epoxy matrix, positions high-pressure GRE products as a foundational element of resilient industrial infrastructure development into the next decade. Strategic geographical expansion by major manufacturers into high-growth regions like APAC and MEA, alongside a focused product portfolio diversification towards spoolable and large-diameter solutions, will be key determinants of market leadership and sustained value creation throughout the forecast period from 2026 to 2033, optimizing overall supply chain efficiency and product availability across diverse operational theatres. The shift towards digitized manufacturing and AI-assisted quality control protocols also underpins the move toward higher product reliability standards expected by end-users in critical applications. The ability of GRE to handle corrosive fluids without internal degradation makes it essential for long-term operational sustainability. This factor is crucial in deep-sea applications where repair costs are prohibitive. Market players are heavily investing in R&D to enhance pressure ratings and temperature thresholds, widening the total addressable market beyond traditional limitations and securing composite material dominance in niche high-performance segments. The regulatory environment continues to favor materials minimizing environmental risk, bolstering the preference for non-leaking, corrosion-free GRE systems. This structural demand ensures the market’s steady upward trajectory irrespective of short-term commodity price fluctuations. The increasing complexity of oil and gas extraction processes, requiring specialized water and chemical injection at high pressures, creates continuous specific demand for high-integrity piping solutions. The competition among key players is focused on developing proprietary jointing technologies that accelerate installation while maintaining stringent pressure integrity standards, a key purchasing factor for EPC contractors globally. Furthermore, the push towards lighter materials in the shipbuilding industry to improve fuel efficiency and stability ensures robust demand from the marine sector, particularly for fire and utility piping systems operating under high pressure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager