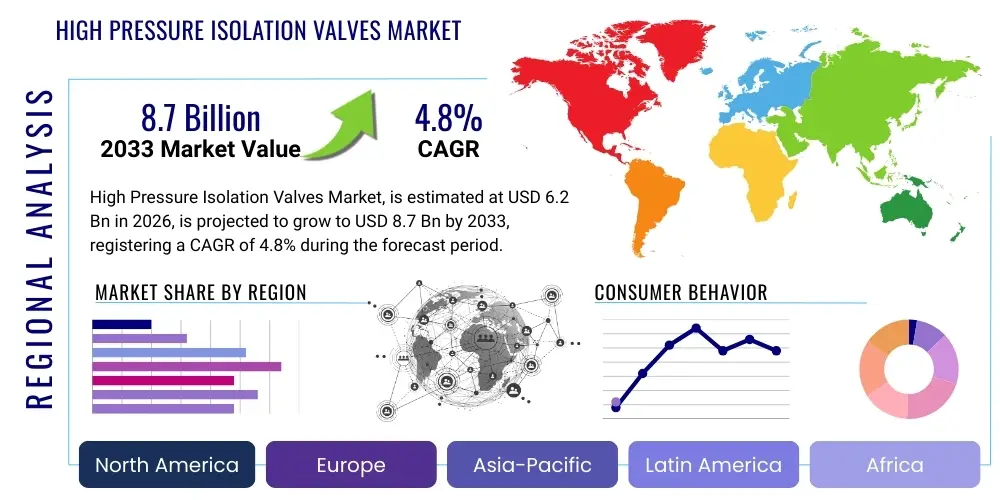

High Pressure Isolation Valves Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436517 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

High Pressure Isolation Valves Market Size

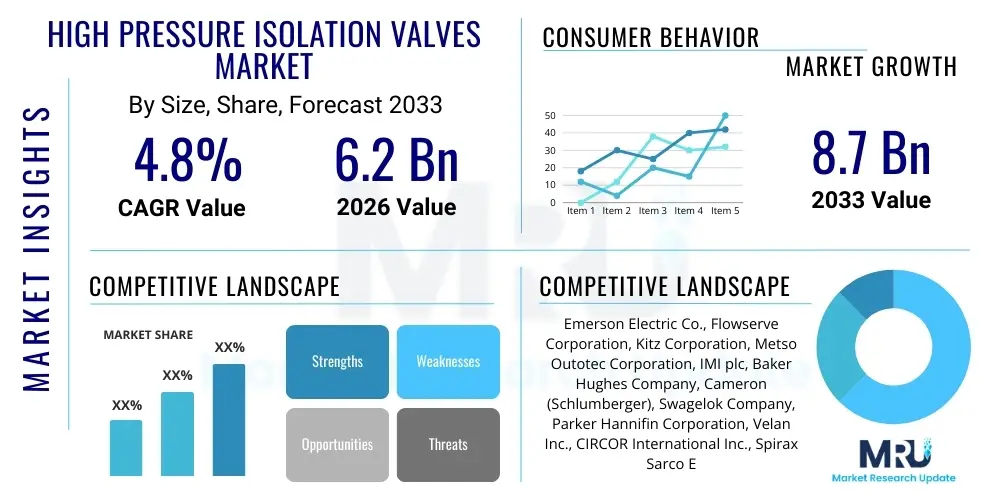

The High Pressure Isolation Valves Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 6.2 Billion in 2026 and is projected to reach USD 8.7 Billion by the end of the forecast period in 2033.

High Pressure Isolation Valves Market introduction

The High Pressure Isolation Valves Market encompasses specialized fluid control devices engineered to reliably shut off or redirect flow in systems operating above 10,000 psi (689 bar). These critical components are foundational in industries where safety, precision, and endurance under extreme conditions are paramount. Key products include high-pressure ball valves, needle valves, check valves, and gate valves, predominantly manufactured from robust materials such as stainless steel alloys, specialized polymers, and often incorporating unique sealing technologies to withstand corrosive media and thermal stress alongside high pressure. The design complexity and stringent testing requirements differentiate these valves from standard industrial components, positioning them as high-value assets within demanding operational environments.

Major applications driving the demand for high pressure isolation valves are concentrated in the oil and gas sector, particularly deep-sea exploration, hydraulic fracturing (fracking), and pipeline infrastructure. Additionally, these valves are indispensable in power generation (especially supercritical boilers), chemical processing, aerospace hydraulics, and high-pressure testing equipment. The primary benefits derived from using these specialized valves include enhanced operational safety by preventing catastrophic failure under high stress, superior fluid control accuracy, extended maintenance cycles due to durable construction, and regulatory compliance in high-risk applications. Driving factors for market expansion include escalating global energy demand necessitating deeper and more complex resource extraction, the continuous modernization of industrial infrastructure, and heightened regulatory standards mandating safer high-pressure systems.

High Pressure Isolation Valves Market Executive Summary

The High Pressure Isolation Valves Market is poised for stable growth, fueled primarily by sustained investment in upstream oil and gas exploration, particularly in unconventional resource development like shale gas and deepwater drilling which inherently require high-pressure systems for extraction and transportation. Business trends emphasize miniaturization and weight reduction in valve design, especially for aerospace and subsea applications, while concurrently focusing on integrating smart features such as condition monitoring sensors for predictive maintenance, aligning with Industry 4.0 principles. Suppliers are increasingly partnering with specialized material science companies to develop seals and body materials capable of handling extremely high temperatures and highly corrosive sour gas (H2S) environments, thus enhancing product longevity and reliability. Furthermore, the push towards green energy, specifically high-pressure hydrogen handling and carbon capture utilization and storage (CCUS) projects, represents a significant emerging opportunity, diversifying the market beyond traditional fossil fuels.

Regionally, Asia Pacific is anticipated to exhibit the fastest growth, largely due to rapid industrialization, extensive expansion of chemical and petrochemical processing facilities in China and India, and increasing reliance on natural gas infrastructure. North America maintains its dominance in terms of market value, driven by robust shale gas activities and significant capital expenditure in pipeline integrity management systems across the United States and Canada. Segment trends indicate that the ball valve category, owing to its superior sealing capability and quick shut-off mechanism, will retain the largest share, although specialized needle and choke valves designed for precise flow control in severe service conditions are expected to witness accelerated adoption. The material segment favors specialty alloys like Inconel and Duplex stainless steel due to their resilience to extreme pressure and temperature cycles, shifting procurement focus towards long-term durability over initial cost.

AI Impact Analysis on High Pressure Isolation Valves Market

User inquiries regarding the impact of Artificial Intelligence on the High Pressure Isolation Valves Market generally focus on how AI can enhance operational safety, optimize maintenance schedules, and improve valve design efficiency. Key user themes center on the potential of machine learning algorithms to predict seal degradation or mechanical failure based on real-time sensor data (vibration, pressure fluctuations, temperature anomalies). Users are highly interested in migrating from reactive or time-based maintenance to predictive maintenance (PdM) frameworks enabled by AI, thereby maximizing uptime in critical, high-consequence applications such as subsea pipelines or nuclear facilities. Furthermore, questions often arise about the application of generative design AI tools to create lighter, stronger valve bodies and internal components that comply with stringent high-pressure safety standards while minimizing material usage.

The implementation of AI-driven analytics is transforming how high-pressure valve performance is monitored and managed. By processing vast datasets collected from smart valves—including acoustic emissions, torque measurements during actuation, and fluid dynamics information—AI models can identify subtle patterns indicative of impending failure long before conventional diagnostic methods. This capability is particularly critical for isolation valves in remote or inaccessible locations, such as deep-sea or high-altitude installations, where manual inspections are costly and time-consuming. AI systems are increasingly being embedded into Industrial Internet of Things (IIoT) platforms, providing operators with actionable insights that extend the mean time between failures (MTBF) and significantly reduce the risk of catastrophic pressure releases, thereby directly enhancing facility safety and environmental protection.

Despite the high initial investment required for sensor integration and data infrastructure, the long-term benefits of AI in this sector are compelling. AI algorithms are also assisting engineers in materials selection and fatigue analysis. Simulation software integrated with machine learning can rapidly iterate through thousands of material combinations and geometry variations to optimize performance under specific pressure-temperature envelopes, leading to bespoke valve designs that are more reliable and cost-effective than those developed through traditional engineering cycles. This accelerated design process allows manufacturers to quickly respond to the evolving demands of demanding sectors like high-pressure hydrogen transport and next-generation energy storage applications.

- AI-enabled Predictive Maintenance (PdM) reduces unplanned downtime by forecasting valve failures based on IIoT data streams.

- Generative design using AI optimizes valve structure for maximum pressure resistance and minimal material weight.

- Real-time anomaly detection in actuation torque prevents component stress and extends operational life in severe service.

- Machine Learning algorithms enhance quality control by analyzing manufacturing tolerance data for defects in valve bodies and seals.

- AI supports optimized inventory management by predicting the required spare parts based on component wear modeling across installed valve fleets.

DRO & Impact Forces Of High Pressure Isolation Valves Market

The market dynamics for High Pressure Isolation Valves are governed by a complex interplay of drivers (D), restraints (R), and opportunities (O), creating distinct impact forces. The primary driver is the pervasive need for robust infrastructure in the energy sector, specifically the continuous global investment in exploring and developing deep-sea and unconventional oil and gas reserves, which operate inherently at extremely high pressures. Concurrently, the accelerating pace of industrial safety regulations globally, particularly post-industrial accidents, mandates the adoption of certified, high-integrity pressure containment equipment, directly benefiting specialized valve manufacturers. Furthermore, technological advancements in material science enabling valves to withstand harsher environments (e.g., extremely corrosive or abrasive media) amplify market growth, ensuring product suitability for future complex operations.

However, significant restraints temper this growth trajectory. The exceptionally high cost associated with manufacturing, testing, and certifying high-pressure valves—owing to the specialized materials and rigorous standards required—acts as a barrier, particularly for smaller projects or developing economies. The industry also faces the challenge of long sales cycles and high switching costs, as end-users prioritize proven reliability and supply chain continuity over quick adoption of new technologies. Moreover, the inherent vulnerability of high-pressure systems means that component failure carries catastrophic consequences, leading to extreme conservatism among operators, who may delay adopting innovative, yet unproven, sealing or actuation technologies.

Opportunities for expansion are fundamentally linked to emerging energy paradigms. The global commitment to decarbonization drives demand for high-pressure valves in novel applications, notably high-pressure hydrogen production (electrolysis), storage, and transportation infrastructure, as well as Carbon Capture, Utilization, and Storage (CCUS) projects, where CO2 is handled at supercritical pressures. Geopolitical shifts encouraging energy independence necessitate the expansion of localized drilling and processing capabilities, creating localized demand surges. The impact forces are further shaped by the need for digital transformation; the integration of smart sensors (IIoT) into valves for real-time monitoring and predictive maintenance introduces new revenue streams and enhances product value, making data-driven reliability a key competitive differentiator in the specialized high-pressure domain.

Segmentation Analysis

The High Pressure Isolation Valves Market is highly segmented based on valve type, material, pressure rating, application, and end-use industry, reflecting the specialized requirements of diverse operational environments. Understanding these segments is crucial for manufacturers targeting specific industry verticals that require unique combinations of pressure resistance, temperature tolerance, and material compatibility. The performance specifications dictated by standards such as API, ASME, and ISO heavily influence product segmentation, ensuring that specific valve geometries (e.g., ball, gate, globe, needle) are matched to the required function, such as tight shut-off versus throttling capability, under extreme stress conditions. The critical parameters guiding purchasing decisions revolve around safety integrity level (SIL) ratings and the total cost of ownership, heavily favoring high-integrity components.

By Type, ball valves dominate due to their superior quarter-turn operation and excellent sealing capabilities in high-flow, high-pressure environments. However, needle and choke valves are indispensable in applications requiring extremely fine and regulated control of flow, such as wellhead chemical injection or high-pressure testing rigs. Segmentation by Material underscores the necessity for chemical and thermal resistance; while forged carbon steel is common for mid-range applications, specialty alloys like Duplex, Super Duplex, and Titanium are mandatory for highly corrosive (sour gas) or subsea deepwater service where reliability is non-negotiable. The pressure rating segmentation (e.g., 10,000 psi, 15,000 psi, 20,000 psi, and above) directly correlates with the severity of the operating environment, impacting design complexity and material thickness significantly.

End-Use segmentation clearly shows the market's reliance on the Oil and Gas sector, specifically upstream (drilling and exploration) and midstream (pipelines and compression stations), followed by Power Generation and Chemicals/Petrochemicals. New segmentation is emerging rapidly within the Renewable Energy sector, particularly hydrogen infrastructure, which requires unique high-pressure valving to handle cryogenic storage and high-pressure compression safely and efficiently. Regional segmentation highlights variations in product demand driven by local regulatory frameworks and the dominant types of energy infrastructure present, such as shale oil focus in North America versus petrochemical dominance in the Middle East and parts of Asia.

- By Type:

- Ball Valves

- Needle Valves

- Gate Valves

- Globe Valves

- Check Valves

- Choke Valves

- By Material:

- Stainless Steel (316, Duplex, Super Duplex)

- Forged Carbon Steel

- Alloy Steels (Inconel, Hastelloy, Monel)

- Titanium and Specialty Alloys

- By Pressure Rating:

- 10,000 psi – 15,000 psi

- 15,000 psi – 20,000 psi

- Above 20,000 psi (Ultra-High Pressure)

- By End-Use Industry:

- Oil and Gas (Upstream, Midstream)

- Chemical and Petrochemical Processing

- Power Generation (Supercritical/Ultra-supercritical)

- Aerospace and Defense

- Hydraulics and Testing Equipment

- New Energy (Hydrogen, CCUS)

Value Chain Analysis For High Pressure Isolation Valves Market

The value chain for the High Pressure Isolation Valves Market is characterized by highly specialized stages, beginning with the procurement of niche raw materials. Upstream activities are dominated by specialized material suppliers providing high-grade metal alloys (e.g., Duplex stainless steel, specialized nickel alloys) that meet stringent metallurgical specifications required for extreme pressure and temperature resistance. Quality control at this stage is paramount, as material defects directly translate to catastrophic failure risk. Manufacturing involves sophisticated processes including forging, precise CNC machining, welding, and heat treatment. Crucially, the middle segment of the chain focuses on advanced testing and certification (hydrostatic testing, cryogenic testing, non-destructive examination) to ensure compliance with international standards like API 6A and PED, significantly adding to the product's value and cost.

Downstream activities involve specialized distribution channels and highly skilled after-sales service. Due to the critical nature of the product, procurement often bypasses general industrial distributors, favoring direct sales relationships with major EPC contractors and operating companies (IOCs/NOCs). Specialized valve distributors or system integrators are necessary when the valve must be part of a larger packaged unit, such as a wellhead control system or a reactor skid. After-sales service is a vital component, encompassing technical consulting, field support, and the supply of certified spare parts and repair kits, driving customer loyalty and long-term contracts. The distribution model, whether direct or indirect, is heavily influenced by the complexity and customization level required, with highly engineered, ultra-high pressure valves typically sold directly.

Direct sales channels are favored for large, strategic projects or custom-engineered solutions where the manufacturer needs to engage closely with the end-user’s engineering team to ensure precise fit-for-purpose specifications. Indirect channels utilize specialized agents and distributors who possess deep regional knowledge and maintain inventory for standard replacement parts, particularly in less critical, but still high-pressure, industrial applications. The effectiveness of the value chain is determined by minimizing lead times for highly customized components and maintaining impeccable quality assurance throughout the manufacturing and testing phases, mitigating the high risks associated with high-pressure fluid control systems.

High Pressure Isolation Valves Market Potential Customers

The potential customer base for High Pressure Isolation Valves is highly concentrated within industries that handle volatile or highly stressed fluids and gases, placing a premium on safety and reliable containment. The largest segment of end-users are major energy companies—including International Oil Companies (IOCs), National Oil Companies (NOCs), and independent exploration and production (E&P) firms—engaged in upstream activities such as drilling, fracking, and subsea development. These buyers require valves certified for extreme pressure ratings (15,000 psi and above) for use in wellheads, manifold systems, and blowout preventers (BOPs), where system integrity is a life-or-death operational concern.

Beyond traditional oil and gas, the secondary cluster of high-value customers includes companies in the chemical and petrochemical sectors, specifically those operating high-pressure reactors, synthesis gas production units, and specialized polymer manufacturing facilities. Power generation facilities utilizing supercritical or ultra-supercritical boiler technology also constitute a crucial customer group, requiring valves capable of managing extremely high temperature and pressure steam cycles to maximize efficiency. These customers prioritize materials engineered for corrosion and creep resistance over long operational periods, often demanding compliance with specific jurisdictional pressure equipment directives (e.g., PED in Europe).

Emerging markets like aerospace, high-pressure testing laboratories, and the burgeoning hydrogen economy represent high-growth potential customer segments. Aerospace companies procure specialized, often miniaturized, high-pressure valves for hydraulic systems, propulsion control, and ground testing equipment where weight and reliability are non-negotiable. Crucially, companies developing and managing hydrogen infrastructure—including electrolyzer manufacturers, compression station operators, and long-haul pipeline developers—are becoming significant buyers, requiring new valve designs tailored for hydrogen embrittlement mitigation and leak-tightness under very high pressure for storage and transmission applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.2 Billion |

| Market Forecast in 2033 | USD 8.7 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Emerson Electric Co., Flowserve Corporation, Kitz Corporation, Metso Outotec Corporation, IMI plc, Baker Hughes Company, Cameron (Schlumberger), Swagelok Company, Parker Hannifin Corporation, Velan Inc., CIRCOR International Inc., Spirax Sarco Engineering plc, Oliver Valves Ltd, High Pressure Equipment Company (HiP), BTG Pactual, Valvitalia Group, Nikkiso Co., Ltd., Zwick Armaturen GmbH, Richards Industries, Graco Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Pressure Isolation Valves Market Key Technology Landscape

The High Pressure Isolation Valves market is characterized by continuous technological refinement focused primarily on enhancing safety, reliability, and leak integrity under extreme operating conditions. A key technological focus is on advanced sealing mechanisms, moving beyond traditional soft seats to incorporate proprietary metal-to-metal seating designs and specialized packing materials (such as high-density PEEK or modified PTFE) that maintain a tight seal under cryogenic temperatures or high-heat, high-pressure cycles. Actuation technology is also advancing, with the adoption of high-torque, explosion-proof pneumatic and electro-hydraulic actuators that provide rapid and reliable shut-off capability in Safety Instrumented Systems (SIS), meeting stringent SIL certification requirements essential for high-risk applications like high-pressure pipelines and wellheads.

Material science innovation forms the backbone of the high-pressure valve industry. Manufacturers are heavily investing in research related to novel corrosion-resistant alloys, particularly those engineered to mitigate Hydrogen Embrittlement (HE) effects crucial for the expanding hydrogen and fuel cell infrastructure. This includes advanced heat treatment processes and surface coatings like plasma nitriding or ceramic overlays to improve component hardness and wear resistance against abrasive slurries or high-velocity fluid flows common in fracking and mining. The emphasis remains on achieving higher pressure ratings (20,000 psi+) while simultaneously improving the lifespan of the valve components under cyclical fatigue loading, a common stress factor in dynamic deepwater environments.

The digitalization trend, encapsulated by IIoT and Industry 4.0, is profoundly impacting the key technology landscape. Modern high-pressure isolation valves are increasingly equipped with embedded sensors for monitoring temperature, pressure, vibration, and stem position. These smart valves transmit data wirelessly to centralized predictive maintenance platforms, utilizing AI/ML analytics to optimize performance and prevent failure. This integration of digital monitoring technology transforms the valve from a static mechanical device into an active, data-generating asset, reducing the need for costly manual inspection and enhancing overall system safety and efficiency. Furthermore, advanced manufacturing techniques such as additive manufacturing (3D printing) are being explored for prototyping and producing complex geometries in specialized valve components, offering faster lead times and customization potential.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand, technology adoption, and competitive landscape of the High Pressure Isolation Valves Market, reflecting localized energy policies, industrial maturity, and regulatory environments.

- North America (United States, Canada, Mexico)

North America maintains market leadership, primarily driven by the prolific shale oil and gas industry, which heavily relies on high-pressure systems for hydraulic fracturing and subsequent processing. The United States, in particular, exhibits high demand for valves rated 15,000 psi and above for upstream wellhead and drilling applications. The robust midstream sector, focused on expansive pipeline networks, also mandates certified high-integrity valves for compression stations and storage facilities. Regulatory compliance, often governed by API and ASME standards, is strictly enforced, compelling operators to invest in high-quality, long-lifecycle valves, promoting advanced domestic manufacturing capabilities and technological innovation.

The Canadian energy sector, particularly in Alberta's oil sands and offshore Atlantic development, also contributes significantly to demand, requiring specialized valves that can handle highly viscous fluids and extreme cold temperatures. Furthermore, North America is at the forefront of the hydrogen economy buildup, with major initiatives for hydrogen production and distribution. This creates a new, high-growth segment requiring ultra-high pressure valves optimized for hydrogen service, pushing manufacturers toward advanced material research to mitigate hydrogen embrittlement risks. High capital expenditure in infrastructure modernization and integrity management ensures sustained demand across the forecast period.

- Europe (Germany, UK, France, Russia)

Europe’s market is characterized by stringent environmental regulations and a strong focus on transitioning to cleaner energy sources. While the region’s traditional oil and gas sector (e.g., North Sea operations) still requires specialized high-pressure subsea isolation valves for aging infrastructure, the primary growth impetus now comes from major investment in Carbon Capture, Utilization, and Storage (CCUS) projects and the rapid development of the hydrogen pipeline network. CCUS requires valves capable of handling high-pressure CO2 capture and injection, driving demand for specialized alloys and sealing technologies.

The implementation of the EU Pressure Equipment Directive (PED) dictates mandatory high standards for all pressure equipment, favoring manufacturers who can provide comprehensive certification and traceability. Germany, being a manufacturing powerhouse, also sustains demand through its high-end chemical and petrochemical processing industry. Russia, with its expansive gas transportation network and planned exploration activities, remains a critical consumer of high-pressure gate and ball valves designed for harsh climatic conditions, although geopolitical factors introduce volatility to this segment's growth trajectory.

- Asia Pacific (China, India, Japan, South Korea)

The Asia Pacific region is projected to be the fastest-growing market, driven by rapid industrial expansion, massive infrastructure development, and increasing energy needs, especially in China and India. China's enormous domestic refinery and petrochemical expansion, coupled with ongoing efforts to maximize natural gas utilization, fuels significant demand for medium to ultra-high pressure isolation valves in both greenfield and brownfield projects. Government policies supporting domestic energy security further stimulate market activity.

India’s increasing investment in deepwater exploration and pipeline connectivity, along with its burgeoning chemical manufacturing industry, creates substantial market opportunities. Furthermore, countries like Japan and South Korea, which are technological leaders, are making substantial commitments to hydrogen fuel technology and associated infrastructure development. This commitment is leading to a growing need for advanced, high-performance valves capable of meeting the technical demands of hydrogen storage and transportation systems, often requiring collaborative ventures between local and international valve manufacturers to meet complex specifications.

- Middle East and Africa (MEA)

The Middle East remains a cornerstone of global oil and gas production, making it a critical market for high pressure isolation valves. Demand is consistently high, driven by major national oil companies (NOCs) undertaking massive capital projects aimed at maintaining and expanding production capacity, especially related to sour gas (high H2S content) reservoirs which require extremely corrosion-resistant valve materials (like Inconel and Duplex). Countries such as Saudi Arabia, the UAE, and Qatar are continuously investing in sophisticated upstream and gas processing facilities, demanding highly reliable valve systems that minimize downtime in harsh desert environments.

In Africa, particularly West and East Africa, emerging deepwater and ultra-deepwater gas discoveries (e.g., Mozambique, Nigeria) necessitate complex subsea production systems. These projects require specialized, highly engineered subsea ball and choke valves capable of high-pressure service and remote actuation, often under extreme seabed temperatures. Political stability and commodity price volatility often influence the pace of project approvals, but the region’s massive resource potential ensures sustained, long-term demand for critical high-pressure components.

- Latin America (Brazil, Argentina, Colombia)

The Latin American market is predominantly influenced by Brazil's massive pre-salt deepwater oil reserves, which necessitate the deployment of advanced, ultra-high pressure subsea infrastructure. Petrobras’s ongoing large-scale development programs are a primary source of demand for specialized subsea isolation and control valves. These applications require high-integrity pressure protection systems (HIPPS) and high-performance metal-seated valves designed to operate reliably thousands of meters beneath the surface.

Argentina’s Vaca Muerta shale formation is driving significant capital expenditure in high-pressure surface equipment required for hydraulic fracturing and associated gathering pipelines, mirroring the US shale market dynamics. Mexico’s energy sector liberalization and subsequent investment in pipeline infrastructure and exploration also contribute to stable demand. Overall, the market here is characterized by projects requiring extremely high technical specifications, often relying on global manufacturers with proven deepwater expertise and robust local service capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Pressure Isolation Valves Market.- Emerson Electric Co.

- Flowserve Corporation

- Kitz Corporation

- Metso Outotec Corporation

- IMI plc

- Baker Hughes Company

- Cameron (Schlumberger)

- Swagelok Company

- Parker Hannifin Corporation

- Velan Inc.

- CIRCOR International Inc.

- Spirax Sarco Engineering plc

- Oliver Valves Ltd

- High Pressure Equipment Company (HiP)

- BTG Pactual

- Valvitalia Group

- Nikkiso Co., Ltd.

- Zwick Armaturen GmbH

- Richards Industries

- Graco Inc.

Frequently Asked Questions

What is the projected CAGR for the High Pressure Isolation Valves Market?

The High Pressure Isolation Valves Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033, driven primarily by increasing global energy demands and stricter safety regulations in high-pressure industrial applications.

Which end-use industry dominates the demand for high pressure isolation valves?

The Oil and Gas industry, specifically the upstream segment (deepwater drilling, subsea systems, and hydraulic fracturing), remains the dominant end-user, due to the critical need for reliable isolation components operating under extreme pressures typically exceeding 10,000 psi.

How is AI impacting the maintenance of high-pressure valves?

AI is significantly impacting maintenance through Predictive Maintenance (PdM) programs. AI algorithms analyze real-time sensor data from smart valves (IIoT) to forecast mechanical failures, optimizing operational uptime and transitioning maintenance schedules from time-based to condition-based.

What new opportunities are driving market growth beyond traditional oil and gas?

Emerging opportunities are concentrated in the New Energy sector, specifically the development of high-pressure infrastructure for hydrogen production, storage, and transport, along with extensive capital projects related to Carbon Capture, Utilization, and Storage (CCUS).

Which material type is crucial for severe high-pressure service applications?

Specialty alloys such as Duplex stainless steels, Super Duplex, and corrosion-resistant alloys like Inconel and Hastelloy are crucial for severe service applications, offering superior resistance to stress, corrosion, and high temperatures encountered in sour gas or deep-sea environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager