High Pressure Piston Pumps Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435078 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

High Pressure Piston Pumps Market Size

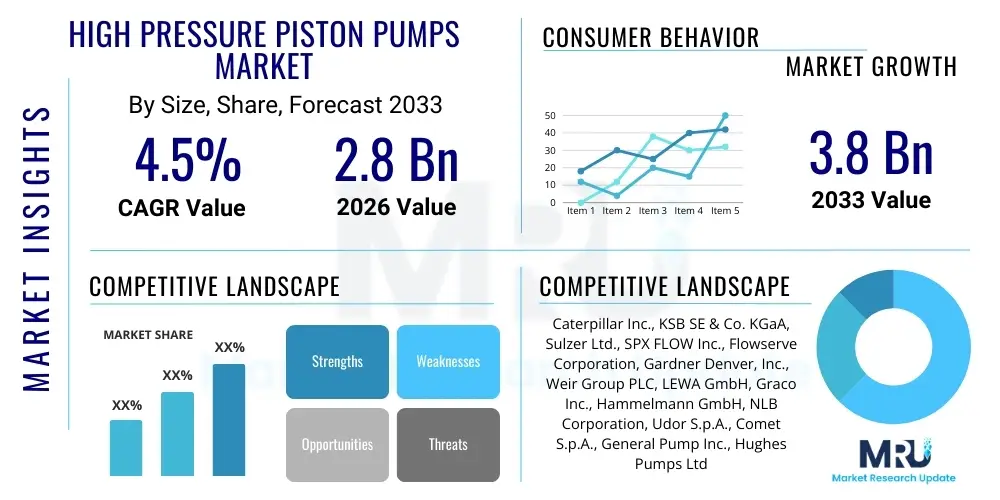

The High Pressure Piston Pumps Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 2.8 Billion in 2026 and is projected to reach USD 3.8 Billion by the end of the forecast period in 2033.

High Pressure Piston Pumps Market introduction

The High Pressure Piston Pumps Market encompasses specialized fluid transfer devices designed to generate and sustain extremely high fluid pressures, often exceeding 5,000 psi, for various demanding industrial processes. These pumps utilize reciprocating motion of pistons or plungers within a cylinder to displace fluid, providing high volumetric efficiency and pressure capabilities essential for critical applications such as ultra-high-pressure cleaning, waterjet cutting, chemical dosing, oil and gas extraction, and reverse osmosis desalination. The robustness and precision offered by these pumps distinguish them from standard centrifugal or low-pressure pumps, enabling superior performance in environments characterized by high viscosity, abrasive media, or stringent flow control requirements.

The core mechanism of high pressure piston pumps, typically involving multiple synchronized pistons (triplex, quintuplex), ensures smooth flow delivery and minimizes pressure pulsation, a crucial benefit in processes demanding consistent pressure application, like hydraulic fracturing or industrial cleaning systems. Major applications span across heavy industries, including automotive manufacturing for specialized spray coatings, mining for dewatering and dust suppression, and power generation where high-pressure seal flushing is required. The inherent design benefits, such as durability, long service life, and adaptability to handle corrosive or non-lubricating fluids, solidify their position as indispensable components in complex fluid dynamics systems globally.

Market growth is predominantly driven by increasing global demand for energy-efficient industrial solutions, the expansion of the oil and gas sector (particularly unconventional resource recovery requiring high-pressure injection), and rapid industrialization in developing economies, which necessitates advanced water treatment and cleaning technologies. Furthermore, stringent environmental regulations regarding industrial effluent treatment and the increasing adoption of high-precision waterjet technology for material processing are significantly contributing to the sustained demand for reliable, high-performance pumping solutions.

High Pressure Piston Pumps Market Executive Summary

The High Pressure Piston Pumps market is characterized by robust investment in advanced materials science and digitalization, fundamentally shaping business trends toward enhanced efficiency and longevity. Leading manufacturers are focusing heavily on developing smart pumping systems integrated with IoT capabilities for predictive maintenance and real-time performance monitoring, addressing the industry's critical need to minimize unplanned downtime. Segment trends reveal that the Triplex pump design dominates due to its optimal balance of flow rate, pressure capability, and size, although Quintuplex pumps are gaining traction in large-scale applications such as deep-sea oil exploration where exceptional power density is crucial. Furthermore, the rising demand for ceramic and specialized alloy components within the pump heads reflects a necessary adaptation to handle increasingly aggressive and varied fluid media across chemical and pharmaceutical sectors.

Geographically, Asia Pacific (APAC) stands as the principal engine of market expansion, propelled by accelerated infrastructural development, rapid industrial capacity expansion in China and India, and significant investments in water and wastewater management facilities utilizing high-pressure reverse osmosis systems. North America and Europe, while mature, maintain leadership in technological innovation, particularly in integrating variable frequency drives (VFDs) and sophisticated control algorithms to optimize energy consumption, aligning with stringent regional energy efficiency standards. The Middle East and Africa (MEA) region demonstrates escalating demand, primarily dictated by massive state-led investments in desalination projects and the inherent requirement for high-pressure fluid management in upstream and downstream oil and gas activities.

Key strategic priorities for market participants include securing resilient supply chains for high-quality components, pursuing strategic mergers and acquisitions to consolidate technological expertise, and expanding service portfolios to offer comprehensive lifecycle support, ranging from installation and commissioning to specialized field maintenance. The competitive landscape is defined by the dichotomy between large established global players providing full-suite solutions and niche manufacturers specializing in highly customized pump designs for specific, high-specification applications, leading to a dynamic environment focused on continuous product refinement and application specialization.

AI Impact Analysis on High Pressure Piston Pumps Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) can enhance the operational efficiency and predictive lifespan of high pressure piston pumps, which are expensive capital assets prone to wear and tear under extreme conditions. The primary concerns revolve around mitigating catastrophic failures, optimizing energy consumption in variable load applications, and automating complex maintenance scheduling. Users expect AI to move beyond simple monitoring (SCADA systems) into true predictive diagnostics, using high-frequency sensor data (vibration, temperature, pressure signature) to detect subtle anomalies indicative of seal failure, bearing degradation, or valve seating issues before they lead to operational stoppage. The integration of AI is expected to revolutionize lifecycle management by providing actionable insights that dramatically reduce Total Cost of Ownership (TCO) and maximize uptime in mission-critical environments.

- AI-driven Predictive Maintenance (PdM) analyzing vibration and acoustic data to forecast component failure, significantly reducing unscheduled downtime.

- Optimization of pump performance through real-time adjustment of flow and pressure settings using ML algorithms, enhancing energy efficiency by up to 15-20%.

- Automated fault detection and diagnosis, enabling immediate alerts for pressure spikes or drops indicative of internal leakage or cavitation.

- AI integration into control systems for autonomous modulation of Variable Frequency Drives (VFDs) based on process demand fluctuations.

- Enhanced material science R&D, utilizing ML to model and predict the lifespan of specialized piston and plunger materials under diverse chemical and thermal stresses.

DRO & Impact Forces Of High Pressure Piston Pumps Market

The High Pressure Piston Pumps market growth is profoundly influenced by the stringent operational requirements of key end-user industries and the technological constraints inherent in generating extreme pressure reliably. Major drivers include the global energy transition requiring sophisticated high-pressure injection systems for CO2 sequestration and geothermal applications, alongside the unwavering demand from the oil and gas sector for enhanced oil recovery (EOR) techniques. Restraints largely center around the high initial capital investment required for these precision-engineered pumps and the specialized maintenance expertise needed to handle systems operating at pressures often exceeding 10,000 psi, which creates barriers for smaller operators. Opportunities arise from the rapidly expanding desalination market globally, particularly in arid and semi-arid regions, where high-efficiency pumps are crucial for reverse osmosis processes, alongside the diversification into specialized applications like high-pressure food processing (Pascalization) and pharmaceutical homogenization.

The impact forces driving the market include technological advancements in material composition—specifically the development of more durable ceramics and superalloys that resist cavitation, corrosion, and erosion, thereby extending Mean Time Between Failure (MTBF). External forces, such as fluctuating crude oil prices, directly influence investment cycles in the upstream oil and gas sector, which traditionally consumes a large volume of these pumps. Conversely, tightening global environmental regulations act as a critical impact force, mandating the use of highly efficient pumping systems and promoting the shift towards electrically driven pumps over diesel-powered alternatives, particularly in remote or offshore installations. This regulatory push accelerates innovation toward pumps that offer lower operational noise levels and minimal environmental footprint.

The interplay between escalating industrial precision requirements and the limitations posed by fluid dynamics at high pressures dictates the market trajectory. While drivers pull the market forward through increasing application scope, restraints such as complex system integration and high maintenance costs necessitate continuous innovation in user-friendly designs and smart monitoring features to sustain widespread adoption. The market equilibrium is maintained through a consistent push for superior efficiency (opportunity) against the high barrier to entry (restraint) associated with manufacturing these technically demanding machines, making strategic technological breakthroughs essential for competitive advantage.

Segmentation Analysis

The High Pressure Piston Pumps market is comprehensively segmented based on three primary characteristics: pump design (Simplex, Duplex, Triplex, etc.), the type of drive mechanism (electric, hydraulic, diesel), and the end-user industry application. The pump design segmentation is critical as it directly correlates with flow rate and pressure stability; Triplex and Quintuplex configurations dominate the high-flow segments due to their superior ability to minimize pulsation. The drive mechanism segmentation reflects the operational environment, with electric drives preferred for efficiency and indoor use, while diesel drives remain essential for mobile or remote applications like pipeline cleaning and field hydrotesting. End-user applications represent the primary demand vectors, with Water & Wastewater Treatment and Oil & Gas dominating the high-value procurement sectors globally.

- By Type/Design:

- Simplex Piston Pumps

- Duplex Piston Pumps

- Triplex Piston Pumps

- Quintuplex Piston Pumps

- Sextuplex Piston Pumps

- By Pressure Range:

- Up to 5,000 psi

- 5,001 to 10,000 psi

- 10,001 to 15,000 psi

- Above 15,000 psi (Ultra-High Pressure)

- By Drive Mechanism:

- Electric Motor Driven

- Hydraulic Driven

- Diesel Engine Driven

- By End-User Industry:

- Oil & Gas (Upstream, Midstream, Downstream)

- Chemical & Petrochemical

- Water & Wastewater Treatment (Desalination, RO)

- Manufacturing & Industrial Cleaning (Waterjetting)

- Power Generation

- Pharmaceutical & Food Processing

- Mining & Construction

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For High Pressure Piston Pumps Market

The value chain for High Pressure Piston Pumps is characterized by a high degree of vertical specialization, beginning with the critical sourcing of specialized raw materials. Upstream activities involve procuring high-grade stainless steel alloys, specialized ceramics for plungers, and advanced sealing materials designed to withstand extreme pressure and chemical exposure. Manufacturing then transforms these materials into high-precision components like crankshafts, connecting rods, pump heads, and valve assemblies. This stage requires rigorous quality control and specialized machining capabilities. Downstream activities focus on system integration, often incorporating VFDs, pulsation dampeners, and control systems, before the products are distributed to end-users.

The distribution channel is multifaceted, relying heavily on specialized distributors and system integrators who possess the technical expertise to size, install, and service these complex machines. Direct sales channels are frequently employed for large capital projects, particularly in the oil and gas or power generation sectors, allowing manufacturers to maintain close relationships with key engineering procurement and construction (EPC) firms. Indirect channels, involving regional agents and certified third-party service providers, are crucial for reaching smaller industrial clients and providing localized, rapid maintenance support, which is a significant value addition given the pumps' demanding operational profile.

Effective value capture within this chain is largely concentrated in the manufacturing and post-sale service phases. Innovation in proprietary pump head designs and material coatings provides manufacturers with a competitive edge and higher margins. Furthermore, offering comprehensive aftermarket services, including spare parts supply, preventative maintenance contracts, and pump refurbishment, creates recurring revenue streams and strengthens customer loyalty, securing the overall profitability of the pump system throughout its extensive operational lifespan.

High Pressure Piston Pumps Market Potential Customers

Potential customers for high pressure piston pumps are geographically and sectorally diverse but share a common requirement for reliable fluid pressurization in highly regulated or capital-intensive operations. The largest consumer segment consists of companies involved in Oil & Gas exploration and production, where these pumps are essential for hydraulic fracturing (fracking), cementing, pipeline pressure testing, and chemical injection for flow assurance. Utilities and large industrial complexes engaged in water purification and desalination (using Reverse Osmosis and Nanofiltration) form another major customer base, prioritizing energy efficiency and resistance to corrosive seawater environments. These buyers look for long-term operational guarantees and robust, customized solutions.

The second tier of potential customers includes specialized service contractors and manufacturing firms. Industrial cleaning service providers rely on ultra-high pressure units for surface preparation, paint removal, and vessel cleaning within chemical plants and shipyards. Similarly, manufacturers utilizing high-precision cutting technology (waterjet cutting) in aerospace and automotive sectors are key buyers, demanding systems that offer impeccable pressure consistency and repeatability to ensure cutting precision. The purchasing decision for all these end-users is heavily influenced by total cost of ownership (TCO), Mean Time Between Failure (MTBF), and the availability of immediate technical field support, making long-term contractual relationships highly valued.

Emerging customer segments include those in high-pressure food processing (HPP) and specialized chemical synthesis, where pumps are used for homogenization and reaction initiation. These customers, particularly in the food and beverage industry, require pumps designed to meet stringent hygienic standards (3-A Sanitary Standards) while delivering pressures high enough to achieve microbial inactivation without heat. Thus, the market is shifting from solely focusing on raw power and durability toward application-specific customization that balances pressure capability with regulatory compliance and energy optimization.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.8 Billion |

| Market Forecast in 2033 | USD 3.8 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Caterpillar Inc., KSB SE & Co. KGaA, Sulzer Ltd., SPX FLOW Inc., Flowserve Corporation, Gardner Denver, Inc., Weir Group PLC, LEWA GmbH, Graco Inc., Hammelmann GmbH, NLB Corporation, Udor S.p.A., Comet S.p.A., General Pump Inc., Hughes Pumps Ltd., Woma GmbH, Danfoss A/S, Maximator GmbH, RIX Industries, Cat Pumps Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Pressure Piston Pumps Market Key Technology Landscape

The technological landscape of the High Pressure Piston Pumps market is rapidly advancing, focusing primarily on enhancing component longevity, improving energy efficiency, and integrating smart monitoring capabilities. A critical area of development is in material science, particularly the utilization of advanced solid ceramics (such as alumina and zirconia) and specialized proprietary composite coatings for plungers and pump heads. These materials offer superior hardness, chemical resistance, and thermal shock resilience compared to traditional metal alloys, dramatically extending the operational life in highly abrasive or corrosive media environments common in deep-sea oil extraction and mining. Furthermore, innovations in dynamic sealing technology, including the adoption of self-adjusting PTFE seals and specialized gland packings, are crucial for minimizing leakage and reducing frictional losses at ultra-high pressures, thereby directly contributing to higher volumetric efficiency.

Another significant technological driver is the pervasive adoption of advanced control systems, centered around Variable Frequency Drives (VFDs) and sophisticated electronic monitoring units. VFD integration allows for precise control over flow rates and pressure output by regulating the pump motor speed, leading to substantial energy savings when operating under fluctuating load demands, particularly in industrial waterjetting and chemical dosing applications. These intelligent control units facilitate integration with plant-wide supervisory control and data acquisition (SCADA) systems, enabling remote diagnostics and optimized operating profiles that adapt in real-time to process variables, moving operations toward a fully automated environment.

The market is also witnessing a concerted push towards developing modular and standardized pump units that allow for easier maintenance and faster field servicing. This modular approach reduces the technical complexity associated with overhauling highly pressurized equipment. Furthermore, noise reduction technology, employing specialized acoustic dampening enclosures and precision-machined flow paths, is becoming standard, addressing increasingly strict occupational health and safety regulations, particularly in European and North American industrial settings. This holistic technological advancement ensures that pumps not only deliver the required pressure but do so reliably, efficiently, and with minimal environmental or operational impact.

Regional Highlights

- Asia Pacific (APAC): APAC is anticipated to exhibit the fastest growth trajectory, primarily fueled by massive infrastructure investments across China, India, and Southeast Asian nations. The region's accelerating industrialization, coupled with immense population density, drives high demand for clean water solutions, necessitating the deployment of high-pressure pumps in large-scale reverse osmosis desalination plants and municipal wastewater treatment facilities. Furthermore, the burgeoning manufacturing sector, particularly in automotive and electronics, is increasing the adoption of high-precision waterjet cutting and cleaning technologies, securing APAC's dominance in volume consumption.

- North America: North America remains a technology leader and a critical market, driven largely by the high-demand oil and gas industry. The extensive use of hydraulic fracturing and coiled tubing services mandates robust, high-power piston pumps, often utilizing diesel or natural gas engines for mobility and power in remote field locations. Market maturity in this region means growth is focused on replacement cycles, digitalization, and the retrofit of existing pump fleets with IoT and AI capabilities to comply with evolving energy efficiency and emission standards.

- Europe: The European market is characterized by high adoption rates of electric-driven piston pumps, aligning with the region's strong commitment to sustainability and strict energy efficiency directives. Key demand stems from the chemical and pharmaceutical industries, requiring pumps that meet extremely high precision, cleanliness, and chemical inertness standards. Germany, in particular, leads in specialized industrial cleaning (jetting) equipment manufacturing and consumption, focusing on advanced triplex and quintuplex pump systems integrated with sophisticated process control mechanisms.

- Middle East and Africa (MEA): Growth in the MEA region is intrinsically linked to massive government-backed investments in oil & gas infrastructure and large-scale water security projects. Desalination forms the backbone of water supply in the GCC countries, creating immense, stable demand for large, reliable high-pressure pumps. Fluctuations in global oil prices significantly impact the upstream market, but long-term strategic projects ensure a sustained need for injection and testing pumps across the Arabian Peninsula and North African hydrocarbon fields.

- Latin America (LATAM): The LATAM market, while exhibiting volatility, shows consistent demand driven by established mining operations (Chile, Peru) that require high-pressure slurry and dewatering pumps, and developing offshore oil and gas fields (Brazil). Market expansion hinges on stable economic environments and foreign direct investment into regional infrastructure, driving demand for heavy-duty, durable pumping units capable of handling challenging field conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Pressure Piston Pumps Market.- Caterpillar Inc.

- KSB SE & Co. KGaA

- Sulzer Ltd.

- SPX FLOW Inc.

- Flowserve Corporation

- Gardner Denver, Inc.

- Weir Group PLC

- LEWA GmbH

- Graco Inc.

- Hammelmann GmbH

- NLB Corporation

- Udor S.p.A.

- Comet S.p.A.

- General Pump Inc.

- Hughes Pumps Ltd.

- Woma GmbH

- Danfoss A/S

- Maximator GmbH

- RIX Industries

- Cat Pumps Corporation

Frequently Asked Questions

Analyze common user questions about the High Pressure Piston Pumps market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Triplex and Quintuplex high pressure pumps?

The primary difference lies in the number of pistons and their impact on flow stability. Triplex pumps use three pistons, offering a strong balance of pressure and flow, and are widely used. Quintuplex pumps use five pistons, which significantly reduces the pressure pulsation (flow variation) during the pumping cycle, making them ideal for high-volume, extremely stable flow applications like hydraulic fracturing and large desalination systems where smooth operation is critical.

How is the High Pressure Piston Pumps market influenced by the expansion of reverse osmosis (RO) desalination?

RO desalination is a major driver, as the process requires high-pressure feed pumps to force water through semi-permeable membranes. Modern RO plants necessitate highly energy-efficient and corrosion-resistant high pressure pumps, often requiring specialized materials to handle seawater. Market growth is directly correlated with global investment in water security and the construction of new mega-desalination facilities, particularly in the MEA and APAC regions.

What are the typical maintenance challenges associated with ultra-high pressure piston pumps?

Maintenance challenges primarily involve managing extreme wear and tear on fluid end components. High pressures rapidly degrade seals, plungers, and valves due to cavitation, erosion, and fatigue. This requires frequent, specialized inspection and replacement using high-cost, precision-machined spare parts, emphasizing the need for robust predictive maintenance programs utilizing sensor technology and AI to optimize component lifespan and prevent catastrophic failure.

Which end-user segment accounts for the highest demand for high pressure piston pumps?

The Oil & Gas industry segment historically accounts for the highest demand, driven by their reliance on high-pressure fluid injection systems for critical operations such as hydraulic fracturing (fracking), cementing, and Enhanced Oil Recovery (EOR). These applications require immense fluid power and highly reliable equipment to operate under harsh and varying subsurface conditions, making oilfield service providers major purchasers of high-power pump skids.

How do technological advancements, such as advanced material usage, impact pump efficiency and lifespan?

Technological advancements in materials, specifically the use of ceramic plungers and specialized superalloys, significantly increase the pump's efficiency and lifespan. These materials offer superior resistance to abrasive media and chemical corrosion compared to standard metals, minimizing internal friction (boosting efficiency) and drastically extending the Mean Time Between Failure (MTBF) of critical components, thereby reducing the overall total cost of ownership (TCO) for industrial operators.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager