High Pressure Sodium Lamps Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440271 | Date : Jan, 2026 | Pages : 253 | Region : Global | Publisher : MRU

High Pressure Sodium Lamps Market Size

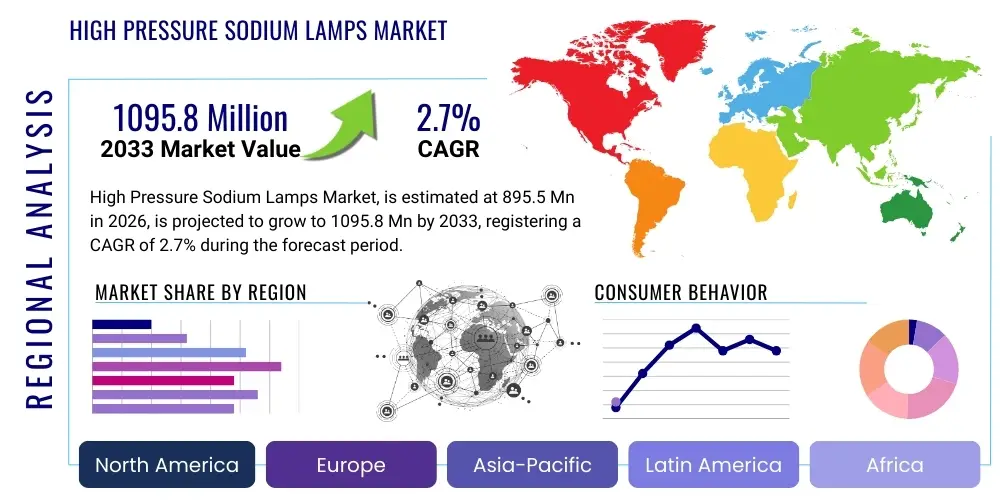

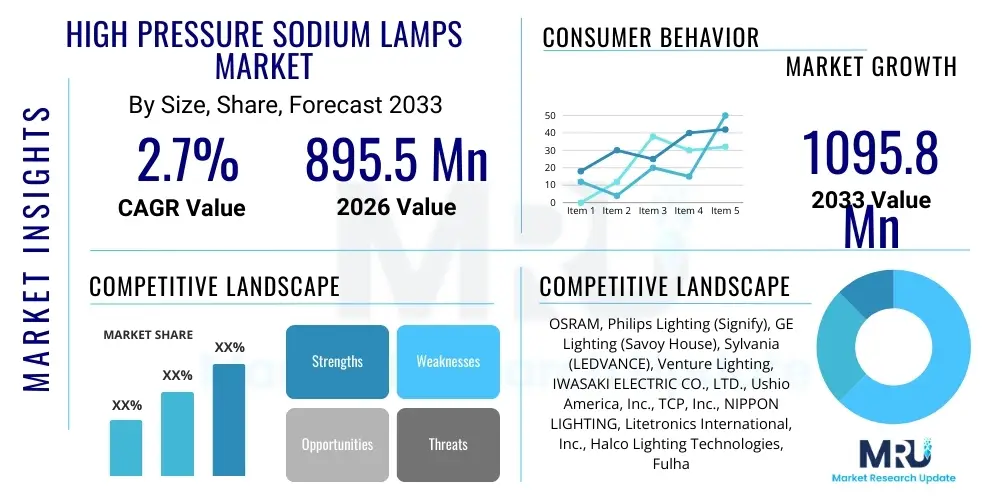

The High Pressure Sodium Lamps Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 2.7% between 2026 and 2033. The market is estimated at USD 895.5 Million in 2026 and is projected to reach USD 1095.8 Million by the end of the forecast period in 2033. This growth, while modest compared to emerging lighting technologies, is primarily driven by the sustained demand for replacement lamps in existing infrastructure and specialized applications where their unique characteristics remain advantageous, alongside a strategic focus on optimizing operational lifecycles of current installations rather than widespread new deployments.

High Pressure Sodium Lamps Market introduction

The High Pressure Sodium (HPS) Lamps market encompasses the production, distribution, and sale of gas-discharge lamps that utilize sodium in an excited state to produce light. These lamps are characterized by their distinctive orange-pink glow and high luminous efficacy, making them a preferred choice for large-scale outdoor and industrial illumination for many decades. The core product, the HPS lamp, operates by creating an electric arc through vaporized sodium metal, which generates light primarily in the yellow-orange part of the visible spectrum. Historically, HPS lamps offered a significant improvement in energy efficiency and light output compared to incandescent and mercury vapor lamps, contributing to their widespread adoption in municipal street lighting, area lighting, industrial facilities, and various agricultural applications such as greenhouse horticulture. Their robust design, ability to operate effectively in a wide range of ambient temperatures, and long operational lifespan under challenging conditions further cemented their position in these critical infrastructure sectors.

Major applications for High Pressure Sodium lamps span across diverse sectors, fundamentally addressing requirements for durable, high-output lighting solutions. In municipal infrastructure, HPS lamps have been instrumental in illuminating streets, highways, tunnels, and public spaces, providing essential visibility and contributing to public safety. Within industrial settings, they are extensively used in warehouses, factories, ports, railway yards, and construction sites where broad area illumination and reliability are paramount. Furthermore, the unique spectral output of HPS lamps, rich in the red and orange wavelengths, makes them exceptionally suitable for horticultural lighting, stimulating plant growth and flowering in controlled environments suchike greenhouses and indoor farms. The inherent benefits of HPS lamps include their high energy efficacy per watt consumed, particularly when first introduced, translating into lower operational costs for large installations. Their proven reliability and resistance to voltage fluctuations, combined with a relatively low initial capital outlay compared to some modern alternatives, have ensured their continued, albeit more specialized, market presence. These lamps also boast a respectable operational lifespan, reducing maintenance frequency in hard-to-reach locations.

Despite the emergence of advanced lighting technologies, particularly Light Emitting Diodes (LEDs), the High Pressure Sodium Lamps market continues to find sustained demand in specific niches. Driving factors for the ongoing market include the vast installed base of HPS fixtures globally, which necessitates a steady supply of replacement lamps for maintenance and continuity of service. The cost-effectiveness of HPS lamps, both in terms of unit price and the lower initial investment in supporting electrical infrastructure compared to complete LED retrofits, appeals to budget-constrained municipalities and industrial operators, particularly in developing regions. Moreover, for specific applications like professional horticulture, the tailored spectrum and heat output of HPS lamps are still considered highly effective for certain plant species and growth stages. The robustness and reliable performance in extreme weather conditions further bolster their appeal in harsh industrial environments. These combined elements underscore a market that, while mature, remains vital for specific operational needs and existing asset management strategies.

High Pressure Sodium Lamps Market Executive Summary

The High Pressure Sodium Lamps market is currently navigating a complex landscape characterized by a blend of persistent demand and transformative technological shifts. Business trends indicate a pivot from aggressive expansion to strategic replacement and niche application focus. While new installations increasingly favor LED technology due to superior energy efficiency and smart capabilities, the substantial existing global infrastructure reliant on HPS lamps ensures a consistent aftermarket for replacement units. Manufacturers are adapting by offering optimized HPS lamp designs with improved longevity and slightly enhanced efficacy, catering to operators keen on extending the life of their current HPS luminaires rather than undergoing costly overhauls. Consolidation among traditional lighting manufacturers and a sharper focus on specific industrial, outdoor, and horticultural segments are defining current business strategies, emphasizing reliability and cost-efficiency over cutting-edge innovation. Supply chain management has become crucial, with an emphasis on ensuring the availability of components and finished products to serve this replacement-driven demand efficiently and economically.

Regional trends within the High Pressure Sodium Lamps market showcase a varied adoption and replacement trajectory. Developed regions, particularly North America and Western Europe, are experiencing a steady decline in new HPS installations, with aggressive LED retrofit programs dominating public and commercial lighting projects. However, these regions still represent a significant replacement market due to decades of HPS infrastructure build-out. Conversely, emerging economies in Asia Pacific, Latin America, and the Middle East & Africa exhibit a more diversified trend. While urban centers in these regions are also increasingly adopting LEDs for new developments, HPS lamps continue to be a cost-effective solution for expanding infrastructure in less affluent areas, particularly for basic street lighting and industrial facilities where budget constraints prioritize lower upfront costs. This bifurcated regional dynamic means that while the market contracts in some areas, it retains a vital, albeit diminishing, role in others, especially where the economic advantages of HPS outweigh the long-term efficiency benefits of newer technologies.

Segmentation trends reveal distinct patterns in demand and application. By type, the standard HPS lamps dominate the replacement market, while specific enhanced-performance or long-life variants cater to particular industrial needs. White HPS lamps, offering improved color rendering, carved out a small niche but never challenged the mainstream. Application-wise, street lighting remains the largest segment for HPS lamp replacements, driven by municipal maintenance schedules. Industrial and security lighting also form significant portions of demand, valued for their robustness in harsh environments. The horticultural lighting segment stands out as a unique growth pocket, where the specific spectrum of HPS lamps is still highly valued for certain plant cultivation strategies, ensuring continued, albeit specialized, demand. End-user segments reflect these applications, with government entities (municipalities), industrial enterprises, and agricultural businesses forming the primary customer base. The trend across all segments is towards extending the life of existing HPS assets, delaying the transition to LED where immediate capital investment is a barrier, thereby sustaining the replacement market over the forecast period.

AI Impact Analysis on High Pressure Sodium Lamps Market

Users frequently inquire about the longevity of High Pressure Sodium lamps in the era of smart lighting, the economic viability of maintaining HPS infrastructure versus upgrading to AI-integrated LED systems, and how AI can potentially optimize the performance or maintenance of existing HPS installations. Common concerns revolve around whether AI could prolong the relevance of HPS by enabling "smarter" HPS systems, or if AI's primary role is accelerating the transition to LED by demonstrating superior efficiencies and functionalities. There's also curiosity regarding AI's influence on the manufacturing efficiency of HPS lamps, predictive failure analysis for large HPS deployments, and the integration of HPS lighting data into broader smart city analytics platforms. Essentially, users are weighing the potential for AI to either give HPS a new lease on life through smart management or to highlight its obsolescence through comparative performance metrics and advanced predictive capabilities of newer technologies.

- Predictive Maintenance Optimization: AI algorithms can analyze historical operational data from large HPS installations, including failure rates, operational hours, and environmental conditions, to predict lamp failures and optimize replacement schedules. This shifts from reactive or scheduled maintenance to condition-based maintenance, reducing operational costs and maximizing lamp lifespan.

- Inventory and Supply Chain Management: AI-driven forecasting models can predict demand for HPS replacement lamps based on geographical installation bases, lamp ages, and observed failure patterns, allowing manufacturers and distributors to optimize inventory levels and streamline supply chain logistics, reducing waste and ensuring timely availability.

- Energy Consumption Analytics: While HPS lamps are not inherently smart, AI can analyze their energy consumption patterns across different times and conditions, identifying inefficiencies in existing grid infrastructure or usage profiles, even if it eventually recommends replacement with more efficient technologies.

- Comparative Performance Analysis: AI can be employed to benchmark the performance and total cost of ownership of existing HPS systems against potential LED retrofits, incorporating energy prices, maintenance costs, and capital expenditures, thus providing data-driven recommendations for modernization strategies.

- Optimized Manufacturing Processes: In the production of HPS lamps, AI can enhance quality control and optimize manufacturing parameters, leading to more consistent product quality and reduced defect rates, thereby improving the overall reliability and appeal of HPS products for their remaining lifespan.

- Smart City Integration (Hybrid Scenarios): In cities transitioning to smart lighting, AI platforms can manage and monitor a hybrid lighting infrastructure that includes both HPS and LED systems. AI helps ensure that even HPS segments contribute data for overall city management, like anomaly detection (e.g., unexpected outages) within specific zones.

- Market Demand Forecasting: AI can analyze macroeconomic indicators, infrastructure development projects, and historical sales data to provide more accurate forecasts for the future demand of HPS lamps, particularly in developing regions or specialized sectors, aiding strategic business planning for manufacturers.

DRO & Impact Forces Of High Pressure Sodium Lamps Market

The High Pressure Sodium Lamps market is significantly shaped by a complex interplay of enduring drivers, formidable restraints, and emerging opportunities, all under the influence of various impact forces. The primary drivers for the market include the extensive global installed base of HPS luminaires, which necessitates a continuous supply of replacement lamps for maintenance and operational continuity, particularly for municipalities and industrial facilities that have not yet fully transitioned to LED technology. The inherent robustness and reliability of HPS lamps, especially in harsh environmental conditions and for demanding applications such as street lighting and industrial facilities, continue to be valued, particularly in regions where extreme weather or budget constraints make advanced systems less practical. Furthermore, the comparatively lower initial capital cost of HPS lamps and fixtures, relative to a complete LED retrofit, continues to appeal to budget-conscious entities and emerging markets that prioritize immediate expenditure control. The specialized spectral output of HPS lamps is also a critical driver for niche segments like horticulture, where its red and orange light components are highly effective for specific plant growth stages.

However, the market faces significant restraints that limit its growth potential. The most dominant restraint is the pervasive and rapid adoption of LED lighting technology, which offers superior energy efficiency, significantly longer lifespans, greater design flexibility, and advanced smart control capabilities. LEDs consume considerably less electricity for comparable light output, leading to substantial operational cost savings over time. Environmental concerns associated with HPS lamps, specifically their mercury content, present another significant restraint, driving regulatory pressures and consumer preferences towards mercury-free alternatives. The lack of inherent dimming and smart control features in traditional HPS systems, which are increasingly demanded in modern smart city and smart building initiatives, further diminishes their competitive edge. These technological and environmental disadvantages collectively pose a substantial barrier to any significant growth in new HPS installations, confining its market largely to replacements.

Despite these challenges, opportunities still exist within the High Pressure Sodium Lamps market. The vast existing infrastructure represents a substantial retrofit and replacement market, allowing manufacturers to sustain operations by catering to the demand for direct-replacement HPS lamps. There is an opportunity for improved HPS lamp designs that offer extended lifespan or slightly enhanced efficacy, providing a more attractive interim solution for those not yet ready for a full LED conversion. Niche applications, such as specialized industrial lighting where light penetration and robustness are prioritized over perfect color rendering, and particularly in the horticultural sector, where HPS spectrums are still preferred for certain crops and growth cycles, offer sustained demand pockets. Additionally, in developing economies, the initial cost-effectiveness of HPS lamps allows for the expansion of basic lighting infrastructure where budgets are tight, creating a temporary market before these regions eventually transition to more advanced technologies. The impact forces influencing the market are primarily technological disruption from LEDs, tightening environmental regulations, global energy efficiency mandates, and evolving infrastructure investment priorities, all generally pushing the market towards more sustainable and intelligent lighting solutions, making the HPS market largely a function of legacy asset management.

Segmentation Analysis

The High Pressure Sodium Lamps market is segmented to provide a granular understanding of its various components and underlying demand dynamics. This segmentation helps in analyzing distinct market behaviors based on product characteristics, intended applications, and the types of end-users. The market is typically categorized by lamp type, which distinguishes between standard HPS lamps and specialized variants. Further segmentation by application highlights the primary uses across different sectors, reflecting where HPS lamps have historically been, and continue to be, most prevalent. Finally, end-user segmentation focuses on the key purchasing entities, offering insights into their specific requirements and procurement patterns, which are crucial for manufacturers and distributors in this mature but persistent market. Understanding these segments is vital for strategic planning, allowing stakeholders to identify lucrative niches, manage supply chains effectively, and adapt product offerings to meet evolving demands for replacement and specific new installations.

- By Type:

- High Pressure Sodium Vapor Lamps (Standard): These are the most common type, recognized for their high efficacy and distinctive yellow-orange light. They form the bulk of the replacement market.

- White High Pressure Sodium Lamps: Offering improved color rendering compared to standard HPS, these lamps found niche applications where better visual clarity was desired without a full transition to other lamp types.

- Specialized HPS Lamps (e.g., Long Life, High Output): Designed for specific industrial or outdoor conditions requiring extended operational periods or higher lumen packages, catering to demanding environments.

- By Application:

- Street Lighting: The largest historical application, encompassing roads, highways, and urban public areas. This segment continues to be the primary driver for replacement demand.

- Industrial Lighting: Includes warehouses, factories, ports, manufacturing plants, and other large industrial spaces where robust, high-output lighting is essential.

- Horticultural Lighting: Utilized in greenhouses and indoor farms to stimulate plant growth and flowering, leveraging the specific red and orange spectrum of HPS lamps.

- Security Lighting: Employed in perimeters, parking lots, and other areas requiring reliable illumination for security and surveillance purposes.

- Sports Arena and Area Lighting: For large outdoor venues and open spaces, though increasingly superseded by more advanced technologies.

- By End-User:

- Municipalities and Government Bodies: Primary purchasers for street and public area lighting infrastructure maintenance.

- Commercial & Industrial Enterprises: Companies operating factories, warehouses, and other large facilities requiring robust and efficient lighting solutions.

- Agriculture and Horticulture Businesses: Farms, greenhouses, and indoor cultivators utilizing HPS lamps for plant growth.

- Construction and Infrastructure Companies: Temporary lighting solutions for large-scale projects.

Value Chain Analysis For High Pressure Sodium Lamps Market

The value chain for the High Pressure Sodium Lamps market is characterized by several distinct stages, beginning with the sourcing of raw materials and culminating in the end-user application and eventual disposal or recycling. Upstream analysis focuses on the acquisition of critical components and raw materials necessary for lamp manufacturing. This includes highly specialized glass for the arc tube and outer envelope, electrodes made from specific metals like tungsten, various gases for starting and operating the lamp (e.g., argon, xenon, mercury vapor), and crucially, high-purity sodium metal. Other materials include ceramic for seals, various metals for bases, and electronic components for ignitors and ballasts. Suppliers in this segment are often specialized chemical and materials manufacturers, and their ability to provide high-quality, consistent materials at competitive prices directly impacts the production cost and reliability of HPS lamps. The procurement process involves managing relationships with a global network of suppliers, ensuring compliance with quality standards and environmental regulations, especially concerning mercury. Efficiency in this upstream segment is vital for maintaining cost-effectiveness in a competitive and increasingly challenged market.

Downstream analysis in the HPS market encompasses the processes that occur after the lamp's manufacturing, primarily focusing on distribution, sales, installation, and post-sales support. Once manufactured, HPS lamps move through various distribution channels to reach end-users. These channels can be direct, where manufacturers sell directly to large industrial clients or government bodies for bulk orders, or indirect, involving a network of wholesalers, distributors, electrical contractors, and retailers. Wholesalers and distributors play a critical role in inventory management and regional supply, particularly for replacement demand. Electrical contractors are essential for installation and maintenance services, often sourcing lamps through distributors. For horticultural applications, specialized agricultural suppliers and distributors form a key part of the downstream chain. Post-sales support, including warranty services and technical assistance, is also important for maintaining customer satisfaction and supporting the longevity of existing HPS installations. The effectiveness of the downstream segment relies heavily on efficient logistics, strong distribution networks, and knowledgeable support teams capable of serving a diverse customer base.

The distribution channels for High Pressure Sodium Lamps are primarily structured to serve both the large-scale industrial and municipal sectors, as well as specialized niche markets. Direct channels typically involve direct sales forces from major lighting manufacturers engaging with large governmental contracts for street lighting maintenance or bulk purchases by major industrial conglomerates. These direct relationships facilitate customized orders, technical support, and often long-term supply agreements. Indirect channels, on the other hand, are more pervasive and rely on a multi-tiered network. This includes large electrical distributors and wholesalers who stock a wide range of lighting products, making HPS lamps readily available to electrical contractors, maintenance companies, and smaller businesses. Retailers, including hardware stores and specialized agricultural supply stores, also play a role, particularly for smaller quantity purchases or specific horticultural lamps. The choice of channel depends on the volume, urgency, and specific application of the lamps. As the market shifts towards replacement demand, the efficiency and accessibility of these indirect channels become increasingly critical for ensuring that existing HPS infrastructure can be maintained effectively and economically, minimizing downtime and supporting operational continuity across various end-user segments.

High Pressure Sodium Lamps Market Potential Customers

Potential customers for the High Pressure Sodium Lamps market are predominantly those entities with existing infrastructure heavily reliant on HPS technology, alongside specific niche sectors that continue to value the unique characteristics of these lamps. The largest segment of end-users comprises municipalities and various government bodies responsible for public infrastructure maintenance. This includes city councils, state transportation departments, and public utility companies that manage vast networks of streetlights, highway lighting, and public area illumination installed decades ago with HPS fixtures. For these entities, the primary motivation for purchasing HPS lamps is replacement and maintenance, aimed at preserving functionality and safety within budget constraints, often delaying costly full-scale LED retrofits. These customers seek reliable, cost-effective replacement lamps that are compatible with their existing ballasts and luminaires, ensuring minimal disruption to service and maximizing the operational life of their current assets. The emphasis for these buyers is on longevity, consistent performance, and value for money in a replacement context.

Another significant group of potential customers includes commercial and industrial enterprises, particularly those operating large-scale facilities such as manufacturing plants, warehouses, logistics hubs, port facilities, and outdoor storage yards. These environments often require robust, high-output lighting that can withstand harsh conditions, temperature variations, and potential physical impact. HPS lamps, with their proven durability and efficacy for broad area illumination, remain a viable choice for replacement in these settings. For these industrial buyers, factors such as lamp robustness, resistance to voltage fluctuations, and the ability to provide sufficient light penetration in dusty or expansive areas are key considerations. The capital expenditure required for a complete lighting system overhaul to LED can be substantial, leading many industrial customers to opt for HPS lamp replacements to extend the life of their current lighting infrastructure, especially where existing systems are still performing adequately and immediate financial outlay is a primary concern.

Furthermore, the agricultural and horticultural sectors represent a distinct and robust niche for HPS lamps. Growers, particularly those managing large greenhouses for vegetables, flowers, or cannabis cultivation, continue to be significant purchasers. The specific light spectrum emitted by HPS lamps, rich in the red and orange wavelengths, is highly effective for promoting vegetative growth and encouraging flowering in many plant species. This makes them a preferred choice for supplemental grow lighting, often used in conjunction with natural sunlight or other light sources. For these buyers, the light spectrum, intensity, and even the heat output (which can contribute to greenhouse heating in cooler climates) are critical factors. While LED grow lights are gaining traction, the established efficacy, reliability, and cost-effectiveness of HPS lamps for certain crops and cultivation strategies ensure a consistent demand from professional growers. Other potential customers include construction companies requiring temporary site lighting, security firms for perimeter lighting, and even smaller businesses or private entities for floodlighting purposes, all seeking durable and effective illumination within specific budgetary or functional parameters.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 895.5 Million |

| Market Forecast in 2033 | USD 1095.8 Million |

| Growth Rate | 2.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | OSRAM, Philips Lighting (Signify), GE Lighting (Savoy House), Sylvania (LEDVANCE), Venture Lighting, IWASAKI ELECTRIC CO., LTD., Ushio America, Inc., TCP, Inc., NIPPON LIGHTING, Litetronics International, Inc., Halco Lighting Technologies, Fulham Co., Inc., EYE Lighting International, Eiko Global LLC, Plusrite USA, Green Creative, Howard Lighting Products, MaxLite, Lithonia Lighting (Acuity Brands), RAB Lighting |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Pressure Sodium Lamps Market Key Technology Landscape

The core technology underpinning the High Pressure Sodium Lamps market revolves around the principles of gas discharge lighting, specifically the excitation of sodium vapor within a high-pressure environment. The fundamental components include a translucent or transparent alumina ceramic arc tube, electrodes, and a starting gas mixture (typically xenon or argon) within a hermetically sealed outer glass envelope. The technological innovation within HPS lamps has historically focused on improving luminous efficacy, extending lamp lifespan, enhancing color rendering, and ensuring reliable ignition. Advancements included the development of more robust arc tube materials capable of withstanding higher internal pressures and temperatures, leading to higher efficiency. Innovations in electrode design and coatings contributed to longer operational life by reducing electrode erosion, while improved getter materials inside the outer envelope helped maintain vacuum integrity and absorb impurities. The design of the ballast and ignitor, crucial external components, also underwent significant development, moving from magnetic to more efficient electronic ballasts that offer better voltage regulation and power factor correction, though most existing HPS installations still rely on magnetic ballasts due to their durability and lower initial cost.

In the context of a modern lighting landscape, the "key technology landscape" for HPS lamps is less about revolutionary new lamp designs and more about optimizing existing technology for sustained performance and managing the transition to newer alternatives. Current technological efforts in the HPS space are often geared towards producing highly reliable, long-life replacement lamps that are direct drop-in replacements for older HPS models, requiring no changes to existing fixtures or electrical infrastructure. This involves fine-tuning manufacturing processes to achieve tighter tolerances, better material consistency, and improved quality control to extend useful life and maintain lumen output over time. Another aspect of the technological landscape is the development of compatible electronic ballasts that can further enhance the energy efficiency and lifespan of HPS lamps, albeit with an additional upfront cost. Furthermore, the technology for recycling and safe disposal of HPS lamps, given their mercury content, is an important part of the overall environmental and regulatory technology landscape, ensuring responsible end-of-life management for these products. This focus reflects a market that is mature and predominantly driven by the need to support a vast legacy installed base rather than pushing the boundaries of new lighting performance.

Moreover, while HPS lamps themselves are a mature technology, the broader "technology landscape" impacting their market includes innovations in adjacent and competing lighting solutions. The rapid evolution of LED technology, for instance, with advancements in chip efficiency, thermal management, optics, and smart control systems, directly influences the HPS market by offering increasingly attractive alternatives for new installations and retrofits. Technologies enabling IoT connectivity, data analytics, and artificial intelligence in lighting control systems represent a significant shift, creating "smart lighting" ecosystems that HPS lamps typically cannot integrate with directly due to their fundamental operating principles. Therefore, while the core HPS lamp technology remains relatively static, the surrounding technological environment, particularly the competitive advancements in smart, energy-efficient, and environmentally friendly lighting, defines the strategic position and future trajectory of the HPS market. Manufacturers in this space must consider how to best support their existing customer base with reliable HPS solutions while potentially diversifying into or assisting customers with the transition to these newer, more advanced lighting technologies.

Regional Highlights

The global High Pressure Sodium Lamps market exhibits distinct regional dynamics, influenced by varying levels of economic development, infrastructure maturity, energy policies, and the pace of technological adoption. Each region presents a unique set of drivers and challenges for the continued demand and supply of HPS lamps, primarily revolving around the balance between maintaining existing assets and transitioning to more modern lighting solutions. Understanding these regional nuances is critical for market players to tailor their strategies, from product distribution to pricing and customer engagement, in a market that is increasingly defined by specific local conditions rather than broad global trends. While certain areas are rapidly phasing out HPS, others still rely heavily on them due to budgetary constraints or specific application needs. This diverse landscape necessitates a granular analysis to identify enduring pockets of demand and areas of accelerated decline, ensuring that business strategies remain relevant and effective across different geographies.

- North America: This region, encompassing the United States and Canada, has a substantial installed base of HPS street lighting and industrial facility illumination, primarily from extensive infrastructure development in the mid to late 20th century. While there's a strong governmental and commercial push towards LED retrofits due to energy efficiency mandates and smart city initiatives, a significant replacement market persists. Municipalities and industrial firms often seek cost-effective HPS replacement lamps to extend the life of existing fixtures, especially in areas where full LED conversion is financially prohibitive or phased over a long period. The horticultural sector in this region, particularly for cannabis cultivation, continues to be a strong niche for HPS lamps due to their proven effectiveness for specific growth stages.

- Europe: Similar to North America, Europe has a vast legacy HPS infrastructure, particularly in older urban centers and industrial zones. However, European countries, driven by stringent energy efficiency regulations and environmental policies (such as the RoHS directive limiting hazardous substances), have been at the forefront of the transition away from HPS to LED lighting. Despite this accelerated transition, a considerable replacement market remains, especially in Southern and Eastern European countries where budget constraints slow down large-scale retrofitting projects. The demand here is primarily for basic, reliable HPS lamps to maintain existing public and industrial lighting until full modernization is feasible. Horticultural demand is also present, albeit with increasing competition from specialized LED grow lights.

- Asia Pacific (APAC): The APAC region presents a mixed landscape. Developed countries like Japan, South Korea, and Australia are rapidly adopting LEDs, mirroring trends in North America and Europe, thus reducing demand for new HPS installations. However, rapidly urbanizing and industrializing economies such as India, China, and Southeast Asian nations still represent a significant market for HPS lamps, particularly for initial infrastructure build-out and replacements in less developed urban and rural areas. Here, the lower initial cost and proven reliability of HPS lamps make them an attractive option for municipal street lighting, industrial facilities, and basic area illumination, especially where budget is a primary concern. The region also boasts a significant agricultural sector, further fueling horticultural demand for HPS.

- Latin America: This region is characterized by ongoing infrastructure development and varying levels of economic stability across its countries. HPS lamps continue to be a popular choice for public lighting and industrial applications due to their cost-effectiveness and robustness, particularly in areas facing budget limitations. While some major cities are embarking on LED conversion projects, the widespread replacement and new installation of HPS lamps persist, driven by the need for reliable, low-cost illumination. The market here is largely focused on balancing essential lighting provision with economic realities, ensuring a sustained, though perhaps stable, demand for HPS products.

- Middle East and Africa (MEA): In the MEA region, the demand for HPS lamps is primarily driven by expanding infrastructure development, particularly in parts of the Middle East and rapidly urbanizing African nations. Many countries in these regions prioritize extending basic lighting infrastructure due to rapid population growth and development projects, often opting for the more affordable and reliable HPS technology for initial installations and subsequent maintenance. While oil-rich nations in the Middle East are also investing in smart city and LED initiatives, the broader region continues to be a significant market for HPS due to economic viability and robust performance in harsh desert or tropical climates. The replacement market is steadily growing as initial installations mature, ensuring a stable, albeit not rapidly growing, market for HPS lamps.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Pressure Sodium Lamps Market.- OSRAM

- Philips Lighting (Signify)

- GE Lighting (Savoy House)

- Sylvania (LEDVANCE)

- Venture Lighting

- IWASAKI ELECTRIC CO., LTD.

- Ushio America, Inc.

- TCP, Inc.

- NIPPON LIGHTING

- Litetronics International, Inc.

- Halco Lighting Technologies

- Fulham Co., Inc.

- EYE Lighting International

- Eiko Global LLC

- Plusrite USA

- Green Creative

- Howard Lighting Products

- MaxLite

- Lithonia Lighting (Acuity Brands)

- RAB Lighting

Frequently Asked Questions

What is the primary factor driving demand in the High Pressure Sodium Lamps market today?

The primary factor driving demand is the extensive global installed base of existing HPS lighting infrastructure. This necessitates a continuous supply of replacement lamps for maintenance and operational continuity, particularly for municipal street lighting, industrial facilities, and older commercial properties that have not yet undergone full LED retrofits. The cost-effectiveness of these replacements often outweighs the immediate capital expenditure of converting to newer technologies for budget-constrained entities, sustaining the aftermarket demand.

How do High Pressure Sodium lamps compare to LED lighting in terms of energy efficiency and lifespan?

High Pressure Sodium lamps are generally less energy-efficient than modern LED lighting solutions, consuming more power to produce comparable lumen output. LEDs typically offer superior lumens per watt. In terms of lifespan, LEDs significantly outperform HPS lamps, often lasting 2-5 times longer (e.g., 50,000-100,000+ hours for LEDs versus 24,000-40,000 hours for HPS), leading to lower maintenance costs and reduced frequency of replacements over the long term for LED systems. This gap in performance is a major driver of the shift towards LED technology.

What are the main applications where High Pressure Sodium lamps are still preferred or widely used?

HPS lamps are still widely used and preferred in specific applications due to their unique characteristics. Key applications include horticultural lighting, where their specific red and orange light spectrum is highly effective for promoting plant growth and flowering in greenhouses. They are also prevalent in industrial lighting (e.g., warehouses, factories, ports) and street lighting applications where existing infrastructure dictates their use for replacement purposes, valued for their robustness, high output, and cost-effectiveness in maintaining legacy systems.

What impact do environmental regulations have on the High Pressure Sodium Lamps market?

Environmental regulations, particularly those concerning mercury content and energy efficiency, have a significant restrictive impact on the HPS market. HPS lamps contain mercury, a hazardous substance, which drives regulatory pressures for phasing them out in favor of mercury-free alternatives like LEDs. Additionally, global mandates for increased energy efficiency further disincentivize new HPS installations due to their lower energy efficacy compared to modern lighting, pushing market demand towards more environmentally friendly and sustainable lighting solutions.

Can AI improve the performance or extend the relevance of existing High Pressure Sodium lamp installations?

While AI cannot directly alter the fundamental performance of an HPS lamp, it can significantly improve the management and operational efficiency of existing HPS installations. AI can be used for predictive maintenance, analyzing failure patterns to optimize replacement schedules and reduce downtime. It can also assist in energy consumption analytics for existing grids and provide data-driven comparisons for potential LED retrofits, thereby helping decision-makers manage their HPS assets more effectively and extend their useful life before a full transition.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager