High Pressure Tank Cleaner Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438193 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

High Pressure Tank Cleaner Market Size

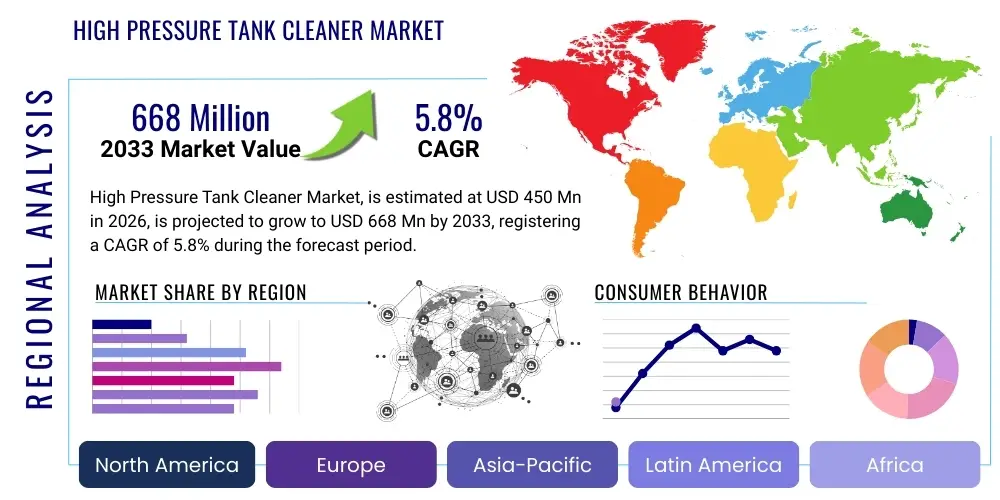

The High Pressure Tank Cleaner Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 668 Million by the end of the forecast period in 2033.

High Pressure Tank Cleaner Market introduction

The High Pressure Tank Cleaner Market encompasses specialized industrial equipment designed for the automated and efficient internal cleaning of tanks, vessels, reactors, intermediate bulk containers (IBCs), and silos across various process industries. These systems utilize high-velocity fluid streams, often water or cleaning agents, propelled at pressures typically ranging from 100 to over 200 bar, to remove stubborn residues, scale, and contaminants from internal surfaces. The core product offering includes both fixed, installed cleaning heads and portable, mobile units, characterized by precision nozzle technology, rotational mechanisms (like impingement cleaners), and flow rates optimized for complete coverage and reduced resource consumption. These advanced systems are crucial for maintaining hygiene, preventing cross-contamination, ensuring product quality consistency, and adhering to stringent regulatory standards, particularly in the food and beverage, pharmaceutical, and chemical manufacturing sectors.

Major applications of high pressure tank cleaning technology span critical processes such as batch changeover cleaning in chemical synthesis, sanitation-in-place (SIP) in brewing and dairy production, degreasing in marine and transportation industries, and descaling in oil and gas storage facilities. The inherent benefits of these systems—including significant reduction in manual labor costs, improvement in operator safety by minimizing entry into confined spaces, enhanced cleaning effectiveness compared to traditional methods (like spray balls or low-pressure systems), and reduced cycle times—are driving substantial market penetration. The continuous push toward automation and digitalization in processing plants further accentuates the demand for high-efficiency, repeatable, and validated cleaning cycles, which these high-pressure solutions inherently provide. This technological evolution focuses not only on cleaning efficacy but also on sustainable operation, minimizing water and chemical usage.

Key driving factors accelerating the market expansion include the increasingly complex nature of substances processed (requiring higher impact cleaning forces), the global expansion of hygiene-sensitive industries (especially pharmaceuticals and biologics), and the heightened global regulatory scrutiny imposed by bodies like the FDA, EMEA, and local food safety agencies demanding meticulous validation of cleaning processes. Furthermore, the robust adoption of customized cleaning solutions, tailored to specific tank geometries and residue characteristics (such as sticky polymers or biological films), is opening new opportunities. The necessity of minimizing downtime in high-volume production environments makes the reliability and rapid deployment capabilities of high-pressure cleaning systems indispensable for maximizing operational efficiency and throughput.

High Pressure Tank Cleaner Market Executive Summary

The global High Pressure Tank Cleaner Market is experiencing robust growth fueled primarily by the stringent regulatory landscape governing hygiene in process industries and the continuous industry shift towards automated cleaning solutions to mitigate operational risks and enhance throughput. Business trends indicate a strong preference for impingement-style cleaning devices that offer 360-degree coverage and high impact forces necessary for removing challenging residues like viscous liquids, hardened materials, and pharmaceutical grade coatings. Investment is heavily concentrated in developing sophisticated monitoring and validation systems integrated with cleaning equipment, allowing operators to verify cleaning performance in real-time. Furthermore, strategic partnerships between equipment manufacturers and specialized chemical providers are becoming essential to offer holistic, validated cleaning protocols, addressing complex contamination scenarios across diverse industrial applications, particularly within biopharma and specialized chemicals.

Regional trends reveal that North America and Europe currently dominate the market, largely due to the presence of mature pharmaceutical, food & beverage, and petrochemical industries characterized by high capitalization and early adoption of advanced automation technologies. However, the Asia Pacific (APAC) region is projected to exhibit the highest CAGR during the forecast period, driven by rapid industrialization, burgeoning domestic production capacities in developing economies like China and India, and increasing adherence to international quality standards for food safety and drug manufacturing. In terms of segmentation, the Automatic Operation segment is expected to maintain market leadership, reflecting the industry's sustained commitment to minimizing human intervention and ensuring repeatable cleaning cycles. The Food & Beverage segment remains the largest end-user, though the Chemical and Pharmaceutical segments are demonstrating the fastest adoption rates, necessitated by the imperative for zero-tolerance cross-contamination controls.

Segment trends emphasize technological advancements focused on customization and sustainability. There is a growing demand for high pressure cleaners constructed from specialized materials, such as specific grades of stainless steel or hastelloy, suitable for highly corrosive environments encountered in chemical manufacturing. Moreover, the market is pivoting towards systems offering water recycling and minimized chemical usage, aligning with global environmental, social, and governance (ESG) targets. The evolution of nozzle design, leveraging computational fluid dynamics (CFD) simulations, is enhancing cleaning efficiency while simultaneously reducing energy consumption, thereby lowering the total cost of ownership for end-users. This integrated focus on performance, safety, and environmental stewardship is defining the competitive landscape and influencing product development pipelines among key market participants.

AI Impact Analysis on High Pressure Tank Cleaner Market

Analysis of common user questions reveals a strong focus on how Artificial Intelligence (AI) can move tank cleaning from reactive or scheduled maintenance to predictive and prescriptive processes. Users frequently inquire about the integration of AI-driven sensors for detecting biofilm growth or determining residue buildup levels inside tanks without manual inspection. Key concerns revolve around the feasibility and accuracy of using machine learning algorithms to optimize cleaning cycle parameters—such as pressure, temperature, duration, and chemical concentration—based on real-time data from conductivity sensors, turbidity meters, or optical imaging systems. Users anticipate that AI integration will significantly reduce resource consumption (water, energy, chemicals) by dynamically adjusting cleaning cycles, rather than relying on standardized, often over-cautious, fixed protocols. Furthermore, there is high expectation regarding AI’s role in automating compliance reporting and cleaning validation processes, streamlining regulatory audits, and improving operational efficiency across highly regulated sectors.

The primary expectation is that AI will enhance the precision and reliability of cleaning validation, transforming the current methodology into a data-driven, closed-loop control system. AI algorithms can process vast amounts of sensor data, acoustic analysis, and visual data captured by endoscopic cameras inserted into tanks, correlating cleaning inputs with required surface cleanliness levels. This level of analysis allows systems to identify optimal cleaning trajectories for high-pressure nozzles specific to the current residue load and tank geometry, minimizing cleaning time while guaranteeing complete sterilization or sanitation. This shift promises substantial economic benefits by drastically reducing non-productive time associated with extended cleaning cycles or re-cleaning due to inadequate initial sanitation. This integration requires robust networking and computing capabilities embedded within the cleaning unit control panels, connecting directly to the plant's Manufacturing Execution Systems (MES).

However, implementation challenges related to the initial cost of integrating AI-capable sensor arrays and the need for specialized training for maintenance personnel are often raised. Data security and ensuring the integrity of the collected validation data—critical for regulatory compliance—also represent significant concerns. Users are keen on understanding the return on investment (ROI) associated with moving to predictive cleaning. The market expects that specialized AI modules will be developed to handle specific cleaning challenges, such as pharmaceutical validation where achieving defined microbial reduction levels is paramount, or chemical cleaning where managing exothermic reactions during residue removal is essential. The ability of AI to learn from past cleaning failures and successes provides a critical step towards achieving truly autonomous and self-optimizing industrial sanitation processes.

- AI-driven Predictive Maintenance: Scheduling cleaning based on real-time contamination levels rather than fixed intervals.

- Optimized Resource Management: Machine learning algorithms dynamically adjust water pressure, flow rate, and chemical dosing to minimize consumption.

- Automated Cleaning Validation: AI analyzes sensor data (turbidity, conductivity, imaging) to confirm cleanliness instantaneously and generate compliance reports.

- Enhanced Cycle Efficiency: Algorithms optimize nozzle trajectory and impingement zones based on tank geometry and known residue type, reducing cycle time.

- Fault Detection and Diagnostics: AI monitors cleaning system performance (pump health, nozzle wear) to predict failures before they occur.

- Improved Safety Protocols: Automated, AI-verified cleaning minimizes the need for human entry into confined spaces for inspection or manual cleaning tasks.

DRO & Impact Forces Of High Pressure Tank Cleaner Market

The High Pressure Tank Cleaner Market is significantly shaped by a powerful combination of driving forces, inherent restraints, and emerging opportunities, all interacting to define the trajectory of adoption and innovation. The primary driver is the pervasive and non-negotiable requirement for high levels of hygiene and safety mandated by regulatory bodies globally, forcing industries such as food and beverage, pharmaceuticals, and specialty chemicals to invest in validated, high-efficiency cleaning systems. This regulatory pressure, coupled with the rising operational costs associated with manual cleaning (labor intensity, safety risks, and lengthy downtime), makes automated high-pressure solutions economically compelling. The continuous advancements in nozzle technology, material science, and automation controllers further fuel market growth by offering superior cleaning performance and reduced utility consumption, enhancing the overall value proposition of these specialized industrial assets.

However, the market faces several restraining forces that moderate its expansion rate. The most significant restraint is the high initial capital investment required for procuring and installing sophisticated, fully automated high-pressure tank cleaning systems, particularly for Small and Medium Enterprises (SMEs) in developing regions. Furthermore, the specialized infrastructure requirements, including high-capacity pumps, dedicated utility lines (water and steam), and specialized drainage systems capable of handling high-flow effluent, pose technical barriers. Another critical challenge relates to the complexity of validating cleaning cycles for novel residues or highly unique tank geometries, particularly in biopharmaceutical manufacturing where regulatory expectations for cleaning validation reports are exceptionally rigorous. The perceived complexity of maintenance and the requirement for highly skilled technicians to operate and troubleshoot these advanced systems also act as deterrents for some potential adopters.

Opportunities for market growth are abundant, focusing primarily on technological differentiation and geographic expansion. The increasing global adoption of single-use systems in biotechnology creates a compensatory demand for highly efficient cleaning solutions for upstream process equipment (like fermentation tanks) that remain reusable. Furthermore, the burgeoning demand for specialized cleaning heads designed for complex geometries, such as those found in reactors with agitators, baffles, or cooling coils, presents significant opportunity for product specialization. The shift towards sustainable manufacturing practices is also driving opportunities for manufacturers to develop and commercialize systems that integrate advanced water recycling technologies and employ environmentally benign cleaning agents, effectively appealing to corporate ESG mandates. The expansion into untapped segments, such as waste water treatment facilities, specialized agriculture containers, and large-scale utility power plants, offers diversified revenue streams and further market penetration for high-pressure cleaning technology providers.

Segmentation Analysis

The High Pressure Tank Cleaner Market is primarily segmented based on Type, Operation, Flow Rate, and End-Use Industry, reflecting the diverse application requirements and operational scales across the industrial landscape. This granular segmentation allows manufacturers to tailor product specifications—ranging from nozzle impact force and material compatibility to automation level—to meet the exacting standards of specific end-users. The segmentation by Type, specifically differentiating between Fixed and Portable units, addresses the operational flexibility required by different facility designs; fixed units are typically used in large, dedicated processing vessels, while portable units are indispensable for facilities utilizing numerous smaller, multi-purpose vessels like IBCs or mobile trailers, emphasizing versatility and ease of deployment.

The operational segmentation, dividing the market into Automatic and Semi-Automatic systems, highlights the industry's trend toward automation. Automatic systems, which typically integrate sophisticated programmable logic controllers (PLCs) and validation sensors, command the largest market share due to their ability to provide repeatable, verifiable, and resource-efficient cleaning cycles, crucial for compliance in regulated environments. Conversely, the segmentation by Flow Rate (Low, Medium, High) directly correlates with the size of the tank and the type of residue being removed; high flow systems are necessary for large-volume storage tanks containing heavy, sticky, or hardened materials, ensuring sufficient cleaning coverage and impact over vast surface areas.

Crucially, the End-Use Industry segmentation dictates the material specification, regulatory compliance required, and the level of necessary validation. The Food & Beverage sector demands high sanitary design and often stainless steel construction, while the Chemical and Oil & Gas industries require highly robust, corrosion-resistant materials and systems capable of handling volatile or hazardous residues. Understanding these specific sectoral needs is vital for market participants to strategically allocate R&D resources and marketing efforts, ensuring that the high-pressure cleaning solutions they offer not only clean effectively but also comply strictly with industry-specific safety and material compatibility standards, thereby securing long-term contracts and brand loyalty within specialized industry niches.

- By Type:

- Fixed Installation Tank Cleaners

- Portable Tank Cleaners

- By Operation:

- Automatic Tank Cleaning Systems

- Semi-Automatic Tank Cleaning Systems

- By Flow Rate:

- Low Flow (Under 100 L/min)

- Medium Flow (100–300 L/min)

- High Flow (Above 300 L/min)

- By End-Use Industry:

- Food & Beverage Processing (Dairy, Brewing, Soft Drinks)

- Pharmaceutical and Biopharmaceutical (API Production, Fermentation)

- Chemical Processing (Specialty Chemicals, Polymers, Resins)

- Oil & Gas and Petrochemical (Storage Tanks, Refineries)

- Marine and Transportation (Tanker Ships, Rail Cars)

- Others (Pulp & Paper, Water Treatment)

Value Chain Analysis For High Pressure Tank Cleaner Market

The value chain for the High Pressure Tank Cleaner Market begins with upstream activities centered on the procurement and processing of specialized raw materials, primarily high-grade stainless steel (304, 316L) and increasingly exotic alloys like Hastelloy or Duplex steel, necessitated by the demanding operating environments involving high pressure, temperature, and corrosive chemicals. Key upstream suppliers include specialized metallurgy companies providing precision components, seals, bearings, and high-tolerance gearing for rotational mechanisms, as well as manufacturers of high-pressure pumps and motors (often electric or pneumatic). Innovation at this stage focuses on material strength, corrosion resistance, and component durability, directly impacting the lifespan and reliability of the final tank cleaning unit. Successful value chain management requires strong supplier relationships to ensure traceability and certification of materials, particularly critical for compliance in pharmaceutical applications.

The manufacturing stage involves the precision assembly and testing of the core cleaning head, including nozzle engineering (ensuring optimal jet patterns and impact force) and the integration of control systems (PLCs, sensors, and telemetry equipment). Manufacturers often rely on highly specialized intellectual property related to fluid dynamics and rotational technology, differentiating their products through superior cleaning efficacy and reduced utility consumption. Distribution channels are varied, incorporating both direct sales models, particularly for large, highly customized industrial projects requiring extensive engineering consultation, and indirect channels relying on a network of specialized industrial equipment distributors and integrators. These distributors provide localized sales support, installation services, and essential post-sale maintenance contracts, ensuring optimal system uptime.

Downstream activities are dominated by installation, commissioning, training, and long-term service agreements. Given the complexity and criticality of tank cleaning systems, after-sales service represents a significant revenue stream. This includes providing validated spare parts, recalibration services, and preventative maintenance to ensure continuous performance validation, especially important in highly regulated industries where documented proof of cleaning efficacy is mandatory. Direct interaction with end-users at this stage allows manufacturers to gather crucial feedback regarding residue challenges and operating conditions, feeding into the continuous product improvement cycle. The effective handling of the downstream lifecycle, ensuring high customer satisfaction and minimal operational disruption, solidifies market position and competitive advantage.

High Pressure Tank Cleaner Market Potential Customers

The primary potential customers for High Pressure Tank Cleaner systems are large-scale industrial processors operating in highly regulated or contamination-sensitive sectors that utilize enclosed vessels for storage, reaction, mixing, or fermentation. These customers are characterized by high volume production, complex residue profiles, and a critical need for rapid, repeatable, and validated cleaning processes. Major buyers include multinational pharmaceutical companies requiring rigorous compliance with Current Good Manufacturing Practices (cGMP) for preventing cross-contamination between batches of Active Pharmaceutical Ingredients (APIs) or biological products. Their purchasing decisions are heavily influenced by documentation packages, validation support, and material certifications guaranteeing sterile or sanitized conditions post-cleaning, making performance validation a critical non-negotiable factor.

Another significant customer segment is the Food & Beverage industry, encompassing dairy producers, breweries, soft drink manufacturers, and specialty food processors. These buyers require equipment that adheres to strict sanitary design standards (e.g., EHEDG) and can handle the removal of organic residues, sugars, fats, and proteins efficiently without compromising material integrity. Due to the high frequency of cleaning cycles needed to prevent microbial growth and maintain product quality consistency, these customers prioritize systems that offer rapid cycle times, minimal water consumption (due to sustainability mandates), and robust reliability under continuous operation. The purchase decision is often driven by the return on investment (ROI) derived from reduced cleaning time and lower utility costs, making efficiency and durability key selling points.

Furthermore, the Chemical and Oil & Gas sectors represent substantial end-users, albeit with different priorities. Chemical processors, particularly those handling viscous polymers, resins, or hazardous compounds, require systems designed for maximum chemical compatibility and explosion-proof environments (ATEX compliance). The systems must efficiently remove difficult, often hardened, residues that necessitate extremely high impact forces, prioritizing power and robustness over purely sanitary design. In the Oil & Gas industry, customers typically purchase high flow rate systems for periodic, large-scale cleaning of crude oil storage tanks and refinery vessels to remove sludge, scale, and accumulated solids. For these applications, operational safety, system power, and the ability to operate reliably in harsh, outdoor environments are paramount considerations for the purchasing departments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 668 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sellers, Inc., Alfa Laval AB, GEA Group Aktiengesellschaft, Spraying Systems Co., Kärcher (Alfred Kärcher SE & Co. KG), Gamajet Cleaning Systems (subsidiary of Fluid Air Inc.), Suncombe Ltd., URACA GmbH & Co. KG, Cloud Tech Inc., CEE-BEE Cleaning Systems, LLC, Enz Technik AG, Hugh Baker Tankwash Equipment, M&W Pump Corp., Pollet, Toftejorg, LLC, Lechler GmbH, RotaTank Ltd., Dohmeyer Tank Cleaning Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Pressure Tank Cleaner Market Key Technology Landscape

The technological landscape of the High Pressure Tank Cleaner Market is rapidly evolving, driven by the demand for improved cleaning efficiency, reduced cycle times, and enhanced verification capabilities. Central to this evolution is the advancement of impingement cleaning technology, where specialized gearboxes and fluid-driven mechanisms rotate cleaning heads in highly predictable, 360-degree patterns (often employing 3D rotation). This ensures that the high-impact jets cover every interior surface area, unlike static or simple spray ball systems. Modern cleaning heads feature precision-machined nozzles designed using Computational Fluid Dynamics (CFD) modeling to optimize jet stream integrity, minimizing energy dissipation over distance and maximizing mechanical scrubbing force at the tank wall. Furthermore, material innovations, utilizing highly durable ceramic or sapphire nozzle inserts, extend the operational lifespan of the components under continuous high-pressure use, reducing maintenance frequency and costs for end-users operating demanding process lines.

Automation and control technology integration represent another critical pillar of the modern market. Sophisticated cleaning systems now incorporate Programmable Logic Controllers (PLCs) and Human-Machine Interfaces (HMIs) that allow operators to program customized cleaning recipes based on tank size, residue type, and required cleanliness level. This integration extends to cleaning validation through the incorporation of sensors (e.g., flow meters, pressure transducers, temperature sensors) and, increasingly, advanced sensors like Riboflavin or UV detection systems for monitoring cleaning agent concentration and residual organic matter. The data collected by these systems is often integrated directly into plant enterprise resource planning (ERP) systems, allowing for automated documentation crucial for compliance audits, particularly in pharmaceutical manufacturing where validation protocols must be meticulously documented and verified before a batch can proceed.

A significant trend is the incorporation of IoT (Internet of Things) capabilities, enabling remote monitoring and diagnostics of cleaning unit performance. Smart cleaning heads can report operational parameters (such as rotation speed and pressure consistency) back to a central control room or cloud platform, allowing predictive maintenance alerts to be generated if performance drifts from validated standards. This proactive approach minimizes unexpected downtime and ensures the cleaning efficiency remains consistent. Additionally, the development of specialized, compact, and often retractable cleaning systems tailored for aseptic processing environments is gaining momentum. These systems minimize the risk of contamination associated with insertion and removal, requiring extremely high-tolerance seals and smooth, self-draining surfaces to meet the stringent sanitation requirements of the biopharmaceutical sector, thereby setting a new standard for hygienic design in the equipment market.

Regional Highlights

The global demand for high-pressure tank cleaning systems shows distinct regional variations influenced by industrial maturity, regulatory enforcement levels, and capital investment capacities. North America, driven by the United States and Canada, represents a leading market, characterized by mature pharmaceutical, chemical, and brewing industries that have stringent quality control standards and high labor costs. This necessitates widespread adoption of fully automated, validated cleaning systems to ensure compliance and cost efficiency. The region exhibits a high demand for custom-engineered solutions that integrate seamlessly into existing complex plant infrastructures and are compatible with advanced data logging and validation software, positioning it as a key market for high-value, technology-intensive cleaning equipment.

Europe, particularly Western Europe (Germany, UK, France), maintains a significant market share, fueled by rigorous EU food safety directives (HACCP) and the presence of major global chemical and automotive manufacturers. European customers show a strong preference for durable equipment adhering to European Hygienic Engineering and Design Group (EHEDG) standards and often prioritize systems that offer superior energy and water efficiency, aligning with the region’s strong emphasis on sustainability and environmental protection. This focus drives innovation in areas such as optimized nozzle geometry and advanced water recycling units integrated within the cleaning station infrastructure. The replacement market, due to long-standing industrial facilities, remains a crucial revenue stream for manufacturers in this region.

The Asia Pacific (APAC) region is poised for the fastest growth, primarily attributed to rapid industrial expansion in countries like China, India, South Korea, and Southeast Asia. As domestic industries in these countries expand their capacity and increasingly export products globally, they are compelled to adopt international hygiene and quality standards (e.g., cGMP, ISO). This mass industrial migration from manual or basic cleaning methods to automated high-pressure systems drives unprecedented market demand, particularly for medium-flow, semi-automatic, and automatic portable units that offer flexibility and a lower initial investment threshold compared to fully fixed installations. However, localized manufacturing and robust distribution networks are critical for success in this geographically diverse and price-sensitive region.

- North America: Market leader in high-value, highly automated systems; strong regulatory compliance drives demand in pharma and chemical sectors; focus on data logging and validation.

- Europe: High adoption driven by sustainability mandates (water/energy efficiency) and strict sanitary standards (EHEDG); significant replacement market presence; strong demand for chemical resistance.

- Asia Pacific (APAC): Fastest-growing region due to rapid industrialization, increasing export mandates, and growing adoption of international hygiene standards in food and pharma production; high demand for flexible and cost-effective solutions.

- Latin America (LATAM): Emerging market, growth concentrated in major industrial nations like Brazil and Mexico; adoption rates accelerating due to foreign investment in food and beverage processing, requiring modernization of cleaning processes.

- Middle East and Africa (MEA): Growth linked to expansion of oil & gas storage infrastructure and water treatment projects; demand centered on large-scale, high-flow systems for heavy industrial cleaning and descaling tasks.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Pressure Tank Cleaner Market.- Sellers, Inc.

- Alfa Laval AB

- GEA Group Aktiengesellschaft

- Spraying Systems Co.

- Kärcher (Alfred Kärcher SE & Co. KG)

- Gamajet Cleaning Systems (subsidiary of Fluid Air Inc.)

- Suncombe Ltd.

- URACA GmbH & Co. KG

- Cloud Tech Inc.

- CEE-BEE Cleaning Systems, LLC

- Enz Technik AG

- Hugh Baker Tankwash Equipment

- M&W Pump Corp.

- Pollet

- Toftejorg, LLC

- Lechler GmbH

- RotaTank Ltd.

- Dohmeyer Tank Cleaning Systems

- Rochford Supply

- CIP Technologies, Inc.

Frequently Asked Questions

Analyze common user questions about the High Pressure Tank Cleaner market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key benefits of using high-pressure impingement cleaners over traditional low-pressure spray balls?

High-pressure impingement cleaners offer significantly superior cleaning efficacy because they utilize high-impact solid stream jets (typically >100 bar) that exert mechanical force on residues, effectively removing sticky, hardened, or heavy contaminants that low-pressure spray balls (which rely primarily on cascading fluid flow) cannot adequately dislodge. This results in faster cleaning cycles, reduced consumption of water and chemicals, and guaranteed repeatable sanitation necessary for regulatory compliance in sensitive industries like pharmaceuticals and brewing, ultimately leading to reduced operational downtime.

How does the integration of IoT and AI technology affect the total cost of ownership (TCO) for tank cleaning systems?

While the initial capital expenditure for IoT and AI-enabled tank cleaning systems is higher, the integration significantly lowers the TCO over the system's lifespan. AI optimizes cleaning cycles based on real-time contamination sensing, drastically reducing water, energy, and chemical usage. IoT enables predictive maintenance by monitoring component health, preventing unexpected system failures, and minimizing costly emergency repairs and non-productive downtime, providing a strong long-term ROI through enhanced resource efficiency and maximized operational reliability.

Which end-use industry is driving the highest growth and adoption rate in the High Pressure Tank Cleaner Market?

The Pharmaceutical and Biopharmaceutical industry is currently driving the highest growth and adoption rates. This rapid growth is mandated by increasingly strict global cGMP regulations requiring zero cross-contamination risk, particularly in the production of high-potency drugs and biologics. High-pressure cleaning systems offer the necessary validation capabilities, verifiable cleaning cycles, and material compatibility required to meet these stringent regulatory thresholds, making them indispensable assets for ensuring product safety and quality consistency across complex fermentation and API production vessels.

What critical factors should be considered when selecting a high-pressure tank cleaner for a complex reactor vessel?

Selection must focus on the vessel's specific internal geometry (including baffles, agitators, and coils), the characteristics of the residue (viscosity, hardening tendency, chemical compatibility), and required cleaning efficacy (sanitation or sterilization). Key specifications include nozzle impact force and throw length, the coverage pattern validation (ensuring 360-degree impingement coverage), the system's material of construction (must resist process chemicals and cleaning agents), and the integration capability with existing CIP/SIP systems for automated cycle control and documented validation reporting.

What is the importance of cleaning cycle validation in regulated industries and how do high-pressure systems achieve it?

Cleaning cycle validation is critical in regulated sectors like food and pharma, requiring documented proof that the cleaning process consistently reduces contamination to predetermined, acceptable levels (e.g., specified microbial reduction). High-pressure systems achieve this through programmable logic controllers (PLCs) that standardize parameters (pressure, time, temperature) and utilize integrated sensors (turbidity, conductivity) to monitor effluent quality in real time. The ability of modern high-pressure systems to generate auditable, time-stamped reports confirms the repeatable achievement of sanitation criteria, essential for regulatory compliance and product batch release.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager