High Purity Acetic Acid Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434341 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

High Purity Acetic Acid Market Size

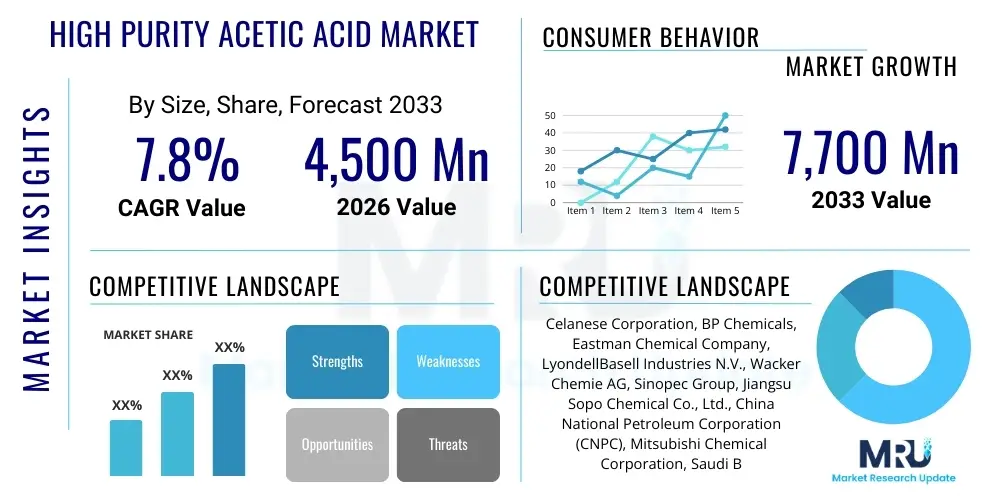

The High Purity Acetic Acid Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.7 Billion by the end of the forecast period in 2033.

High Purity Acetic Acid Market introduction

The High Purity Acetic Acid (HPAA) market encompasses the production and utilization of glacial acetic acid that meets stringent specifications regarding trace metal contamination, moisture content, and particulate matter. Unlike technical or commercial grades, HPAA is typically required to have purity levels exceeding 99.9%, often necessitating parts-per-billion (ppb) or even parts-per-trillion (ppt) control over specific impurities like heavy metals, chlorides, and formaldehyde. This premium grade chemical is essential for applications where even minimal contamination can critically compromise the performance or yield of the final product, such as in the manufacturing of specialty polymers, high-performance solvents, and sophisticated electronic components. The reliance on highly refined separation and purification techniques, often involving multi-stage distillation and proprietary ion exchange processes, differentiates the production of HPAA from conventional acetic acid manufacturing.

The product description for High Purity Acetic Acid emphasizes its exceptional clarity, colorlessness, and negligible non-volatile residue. The primary raw material feedstocks for its production include methanol and carbon monoxide, typically utilizing the high-efficiency Cativa or Monsanto processes, followed by meticulous purification steps tailored to the target application’s specification, particularly for semiconductor or pharmaceutical uses. Major applications driving the market include the production of high-grade Purified Terephthalic Acid (PTA) used in PET resins, which demand high purity to ensure polymer clarity and strength. Furthermore, HPAA serves as a critical reaction medium and solvent in the synthesis of advanced pharmaceuticals, agrochemicals, and specialized electronic chemicals like cleaning agents and photoresist thinners.

Key benefits associated with the adoption of HPAA include improved efficiency and reduced failure rates in sensitive manufacturing processes. For instance, in semiconductor fabrication, the use of ultra-pure solvents minimizes defects, leading to higher chip yields and improved device reliability. Driving factors for market growth include the rapid expansion of the electronics industry, particularly in Asia Pacific, the escalating demand for high-quality packaging materials (PET), and increasingly stringent regulatory requirements in the pharmaceutical sector concerning solvent purity. The continuous innovation in materials science and the development of new high-performance polymers also contribute significantly to the sustained demand for this high-specification chemical intermediate.

High Purity Acetic Acid Market Executive Summary

The High Purity Acetic Acid (HPAA) market demonstrates robust growth, primarily fueled by specialized industrial applications demanding exceptional chemical quality. Key business trends indicate a strong focus on capacity expansion among leading chemical manufacturers, particularly in regions with burgeoning downstream electronics and specialty chemical sectors. There is a discernible trend toward backward integration, where major producers are investing heavily in advanced purification technologies (such as continuous fractional distillation and molecular sieves) to meet the ever-tightening specifications required by semiconductor and flat-panel display industries. Furthermore, sustainability is becoming a key business driver, pushing R&D towards carbon capture utilization and storage (CCUS) integrated production methods to reduce the carbon footprint associated with methanol carbonylation, even though purity remains the paramount concern.

Geographically, the Asia Pacific (APAC) region dominates the HPAA market, primarily due to the massive scale of its electronics manufacturing hub, coupled with substantial growth in PTA production driven by China and India’s consumer markets. Regional trends highlight that while North America and Europe maintain technological leadership in research and pharmaceutical standards, the rapid industrialization and associated investment in large-scale PTA and VAM plants in Southeast Asia are cementing APAC’s leading market share. Regulatory environments in Europe, emphasizing REACH compliance and stringent purity standards for food contact materials and pharmaceuticals, ensure stable, high-value demand in that region, necessitating reliable, high-specification supply chains.

Segmentation trends reveal that the Electronics/Semiconductor application segment is the fastest-growing end-use sector for HPAA, specifically for solvents used in cleaning and etching processes, driven by miniaturization and the transition to advanced nodes (e.g., 5nm and 3nm). By grade, the Ultra-High Purity (UHP) segment, typically defined by metal impurity levels below 10 ppb, commands the highest premium and exhibits superior growth compared to lower-purity grades. The Purified Terephthalic Acid (PTA) segment remains the largest volume consumer, providing a stable foundation for the overall market, although its growth rate is surpassed by the high-value specialty segments.

AI Impact Analysis on High Purity Acetic Acid Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the High Purity Acetic Acid market often center on how AI can enhance manufacturing efficiency, ensure consistent ultra-high purity, and optimize supply chain resilience. Common concerns revolve around predictive maintenance for complex purification equipment, AI-driven quality control systems capable of real-time trace impurity detection, and the potential for autonomous process optimization to minimize energy usage and chemical waste. Users are keenly interested in whether AI algorithms can analyze complex spectroscopic data faster than traditional methods, thereby improving the consistency of ppb-level specifications required for microelectronics. The prevailing expectation is that AI integration will primarily function as an enabler of operational excellence, pushing the limits of achievable purity and reducing operational variance in capital-intensive chemical plants.

- AI-Powered Process Optimization: Utilizing machine learning algorithms to continuously adjust temperature, pressure, and flow rates in multi-stage distillation columns, maximizing separation efficiency and purity yield.

- Predictive Maintenance: Deploying AI to analyze sensor data from pumps, heat exchangers, and reactors, predicting equipment failure before catastrophic contamination events occur, ensuring consistent production runs.

- Real-Time Quality Control (RTQC): Implementation of AI vision systems or analytical spectral analysis (e.g., Raman or FTIR spectroscopy) linked to deep learning models for instantaneous detection of trace impurities, enabling immediate process correction.

- Supply Chain and Logistics Optimization: Using AI to forecast demand variability from sensitive end-users (like semiconductor fabs) and optimizing inventory levels and delivery routes for specialized, temperature-sensitive HPAA packaging.

- Energy Consumption Reduction: AI-driven modeling of complex energy flows within carbonylation and purification units to significantly reduce steam and cooling water usage, lowering operational costs and environmental impact.

DRO & Impact Forces Of High Purity Acetic Acid Market

The dynamics of the High Purity Acetic Acid market are governed by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming the Impact Forces. Key drivers include the relentless technological advancement in electronics, demanding cleaner and purer solvents for sub-micron fabrication processes, coupled with the robust growth in PTA production, particularly in emerging economies where lifestyle changes drive demand for PET packaging and textiles. However, the market faces significant restraints, notably the high capital expenditure required for establishing and maintaining ultra-purification facilities, stringent environmental regulations governing chemical waste disposal, and volatility in the pricing of key raw materials like methanol, which is highly sensitive to natural gas market fluctuations. Opportunities abound in the development of bio-based HPAA, technological breakthroughs in catalytic purification methods, and expansion into niche markets such as specialized battery electrolytes and high-performance adhesives.

Drivers: The increasing complexity of semiconductor manufacturing requires HPAA with metal impurity levels often below 10 ppb, ensuring market growth in the UHP segment. Global demand for PTA remains the foundation, providing stable volume off-take. Furthermore, the pharmaceutical sector's pivot towards continuous manufacturing processes necessitates highly consistent, low-trace solvent inputs, bolstering demand for certified high-grade acetic acid. The adoption of advanced chemical synthesis techniques across various specialty chemical domains continually drives the need for high-purity reaction media.

Restraints: The primary restraint lies in the high energy intensity and complexity of the purification train, making HPAA significantly more expensive to produce than standard chemical grade acetic acid. Regulatory hurdles surrounding the transportation and storage of corrosive, high-purity chemicals present logistical challenges, especially when catering to sensitive end-users globally. Additionally, potential substitution risks, particularly in less demanding applications (VAM production) where alternative C2 feedstocks or process optimization can reduce reliance on super-premium acetic acid, could temper growth in some sub-segments.

Opportunities & Impact Forces: Significant opportunities exist in geographical diversification, especially through establishing purification facilities closer to high-demand Asian electronics clusters, reducing supply chain lead times and contamination risks during transit. The development of advanced analytical tools, such as in-line purity sensors, offers competitive advantages in quality assurance. The overall impact forces are strongly positive, driven by the non-negotiable demand for purity in high-tech manufacturing, where the cost of raw material purity is minimal compared to the cost of product failure (e.g., a defective microchip batch). This intrinsic linkage ensures that demand for HPAA is highly inelastic concerning pricing and resilient against macroeconomic slowdowns affecting general commodity chemicals.

Segmentation Analysis

The High Purity Acetic Acid market is comprehensively segmented based on Purity Grade, Application, and Geography, reflecting the diverse and specialized requirements of the end-user industries. Segmentation by purity grade is crucial as it directly determines the processing complexity, manufacturing cost, and suitability for ultra-sensitive applications, with classifications typically ranging from High Purity (HP) suitable for PTA to Ultra-High Purity (UHP) reserved for electronics. Segmentation by application highlights the volume disparity between the commodity-like demand of PTA production and the high-value, low-volume demand of specialized solvent markets like pharmaceuticals and semiconductors. This granular analysis is essential for manufacturers to strategically allocate resources and tailor purification investments to maximize returns across these vastly different market segments.

The market structure is defined by the rigid specifications mandated by technical standards bodies and proprietary customer requirements. For instance, the semiconductor industry adheres to strict SEMI standards (e.g., C8) for metal content, driving the UHP segment. Conversely, the PTA sector, while consuming the largest volumes, requires high consistency regarding specific impurities like acetaldehyde and formic acid, which impact final polymer quality. Understanding these distinct specifications allows vendors to differentiate their product offerings. The fastest growth is observed in segments linked to digital transformation and advanced healthcare, underscoring the market's shift toward high-value, performance-critical applications.

- By Purity Grade:

- Standard High Purity (99.9% - 99.99%)

- Ultra High Purity (UHP > 99.999% - requiring < 50 ppb metals)

- Electronic Grade (Sub-parts per billion specifications)

- By Application:

- Purified Terephthalic Acid (PTA) Production

- Vinyl Acetate Monomer (VAM) Production (Specialty Grades)

- Electronic Chemicals (Solvents and Thinners)

- Pharmaceuticals and Agrochemicals

- Food Grade (Additives and Preservatives)

- Specialty Chemical Intermediates

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For High Purity Acetic Acid Market

The value chain for High Purity Acetic Acid starts with the upstream sourcing of raw materials, primarily methanol and carbon monoxide, which are typically sourced from the petrochemical industry, making the initial stages highly sensitive to oil and gas price volatility. Methanol production often relies on natural gas (methane) reforming. Key activities in the upstream segment involve the synthesis of crude acetic acid, usually through the carbonylation process (Cativa technology being dominant). Given the high purity requirement, upstream players must ensure the initial reaction media and catalyst systems minimize the generation of undesirable by-products, such as propionic acid and ethyl acetate, which are difficult to separate in later stages.

The middle segment of the value chain is dominated by the complex and capital-intensive purification train. This segment involves multiple stages of fractional distillation, azeotropic separation, and proprietary polishing techniques, including ion exchange or molecular sieve filtration, specifically designed to remove trace metals (Fe, Ni, Cr) and volatile organic impurities to meet ppb standards. The efficiency and consistency of this purification process are the primary value-add for HPAA producers. Distribution channels for HPAA are highly specialized; direct sales are common for large-volume contracts (like PTA producers), while specialty grades for electronics often utilize indirect, highly controlled distribution networks involving certified distributors who maintain specialized, non-contaminating storage and handling facilities, including inert gas blanketing and specialized packaging (e.g., fluoropolymer-lined drums or stainless steel containers).

Downstream analysis focuses on the end-use applications, where HPAA serves as a critical ingredient or processing solvent. The largest consumption occurs in the synthesis of PTA, which is then polymerized into PET resins used in bottles and fibers. In the electronics segment, HPAA is used directly in formulation centers to create specialized cleaning solutions, etchants, or solvents for photolithography. The direct distribution channel prevails when large chemical companies supply integrated petrochemical complexes. Conversely, the indirect channel thrives in the fragmented electronics and pharmaceutical markets where small-to-medium formulators require certified, small-batch quantities of UHP material, relying on specialized chemical logistics providers to ensure product integrity right up to the point of use.

High Purity Acetic Acid Market Potential Customers

Potential customers for High Purity Acetic Acid are typically large-scale industrial consumers operating in high-precision or high-volume chemical synthesis environments where quality control is paramount. The primary end-users, or buyers, are major petrochemical companies that utilize HPAA as a solvent or feedstock in continuous processes. These buyers demand stringent consistency, reliable long-term contracts, and high volume delivery capabilities, often negotiating prices based on prevailing methanol costs plus a purification premium. Specifically, PTA producers represent the single largest customer base, acting as anchor tenants for HPAA production facilities globally, utilizing millions of tons of the acid annually in their oxidation reactors.

A secondary, but rapidly growing and high-value, customer base includes multinational electronics and semiconductor fabrication companies, along with their specialized chemical suppliers (formulators). These customers purchase UHP or Electronic Grade HPAA for applications such as wafer cleaning, resist stripping, and solvent formulation. For these buyers, price is secondary to guaranteed purity (sub-ppb specifications), certificate of analysis (CoA) transparency, and consistent supply chain management to prevent disruption to multi-billion dollar fabrication lines. Furthermore, major pharmaceutical and biotechnology companies and their contract manufacturing organizations (CMOs) constitute another critical customer segment, requiring certified, audited HPAA for use as a reaction solvent in complex active pharmaceutical ingredient (API) synthesis, demanding compliance with strict Good Manufacturing Practices (GMP) and pharmacopeial standards.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4,500 Million |

| Market Forecast in 2033 | USD 7,700 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Celanese Corporation, BP Chemicals, Eastman Chemical Company, LyondellBasell Industries N.V., Wacker Chemie AG, Sinopec Group, Jiangsu Sopo Chemical Co., Ltd., China National Petroleum Corporation (CNPC), Mitsubishi Chemical Corporation, Saudi Basic Industries Corporation (SABIC), PetroChina Company Limited, Gujarat Alkalies and Chemicals Ltd. (GACL), Daicel Corporation, Reliance Industries Limited, Helm AG, Korea Alcohol Industrial Co., Ltd., Shanghai Wujing Chemical Co., Ltd., Sekisui Chemical Co., Ltd., INEOS Group, Praxair Technology, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Purity Acetic Acid Market Key Technology Landscape

The technological landscape for High Purity Acetic Acid production is fundamentally anchored in the catalytic carbonylation of methanol, primarily leveraging proprietary technologies like Celanese's Cativa process or BP's established Monsanto process. These technologies are valued for their high selectivity, allowing for efficient initial synthesis of crude acetic acid with minimal by-products. However, the unique aspect of the HPAA market lies not in the synthesis but in the subsequent purification technology. Achieving Ultra-High Purity levels necessitates sophisticated, multi-column distillation systems utilizing specialized column designs (e.g., dividing wall columns) and optimized pressure profiles to separate acetic acid from difficult-to-remove impurities like water, formic acid, and trace metal complexes.

Beyond distillation, the integration of advanced polishing technologies is critical for meeting ppb specifications, especially for the electronics market. Key technologies include proprietary ion exchange resins designed to selectively capture metallic contaminants down to sub-ppb levels without leaching organic matter into the final product. Furthermore, adsorption techniques using activated carbon or specialized molecular sieves are employed to remove trace organic color bodies and particulate matter. The move toward continuous, integrated purification trains, often monitored by sophisticated process analytical technology (PAT) and automated control systems, represents the frontier of HPAA manufacturing technology, focusing on minimizing operational variability and energy usage while maximizing output purity.

In addition to purification methods, the technological landscape includes innovations in materials handling and storage. Since HPAA is highly corrosive and susceptible to contamination from container materials, specialized storage solutions, such as high-grade stainless steel (e.g., duplex or super duplex grades) and inert lining materials (PTFE/PFA), are mandatory. Future technological advancements are centered on sustainable production methods, particularly leveraging bio-fermentation processes to produce bio-based acetic acid (bio-HPAA). While current bio-routes face challenges in achieving the same economic efficiency and trace impurity control as petrochemical routes, ongoing research aims to utilize genetic engineering and advanced fermentation media to deliver competitive, low-carbon HPAA feedstocks, representing a significant long-term technological opportunity driven by environmental mandates.

Regional Highlights

The Asia Pacific (APAC) region stands as the undisputed powerhouse in the High Purity Acetic Acid market, driven by the colossal manufacturing output of China, South Korea, Taiwan, and Japan. This region hosts the largest concentration of PTA production facilities globally, ensuring massive volume consumption of high-grade acetic acid. More critically, APAC is the epicenter of global semiconductor and flat-panel display manufacturing, generating the highest demand for the premium-priced Ultra-High Purity (UHP) and Electronic Grade HPAA used in wafer fabrication and display processing. Regulatory support for chemical production and the availability of affordable methanol feedstock further cement APAC’s dominant market position, driving both production capacity expansion and consumption growth rates.

North America and Europe represent mature markets characterized by stringent quality standards and high-value specialty chemical and pharmaceutical sectors. In North America, demand is heavily influenced by domestic PTA production, specialty polymers, and the demanding specifications of the regional aerospace and pharmaceutical industries. European demand is stable, defined by tight environmental regulations and a focus on high-quality pharmaceutical solvents and advanced materials, with suppliers needing to adhere strictly to REACH regulations. These regions are primary centers for HPAA technological innovation and proprietary purification methods, but their volume consumption growth rates lag behind APAC due to limited expansion in commodity chemical manufacturing.

- China: Dominates PTA production and leads global consumption of HPAA due to massive petrochemical capacity and rapid expansion of its domestic electronics industry.

- South Korea & Taiwan: Key regional hubs for semiconductor and display panel manufacturing, representing the highest concentration of demand for Electronic Grade and UHP Acetic Acid.

- India: Experiencing substantial growth in downstream PTA/PET capacity, fueling strong, consistent demand increases.

- United States: Major consumer for specialty chemical synthesis, high-grade polymers, and pharmaceutical applications, focusing on product consistency and long-term contracts.

- Germany: Leading European market for pharmaceutical and specialty chemical solvents, requiring robust certification and adherence to strict purity specifications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Purity Acetic Acid Market.- Celanese Corporation

- BP Chemicals

- Eastman Chemical Company

- LyondellBasell Industries N.V.

- Wacker Chemie AG

- Sinopec Group

- Jiangsu Sopo Chemical Co., Ltd.

- China National Petroleum Corporation (CNPC)

- Mitsubishi Chemical Corporation

- Saudi Basic Industries Corporation (SABIC)

- PetroChina Company Limited

- Gujarat Alkalies and Chemicals Ltd. (GACL)

- Daicel Corporation

- Reliance Industries Limited

- Helm AG

- Korea Alcohol Industrial Co., Ltd.

- Shanghai Wujing Chemical Co., Ltd.

- Sekisui Chemical Co., Ltd.

- INEOS Group

- Praxair Technology, Inc.

Frequently Asked Questions

Analyze common user questions about the High Purity Acetic Acid market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between High Purity and Technical Grade Acetic Acid?

The primary difference lies in the concentration of trace impurities, particularly heavy metals and water. High Purity (HP) acetic acid must meet specifications often measured in parts per billion (ppb) for metals, making it suitable for sensitive applications like electronics and pharmaceuticals, whereas Technical Grade has higher acceptable impurity levels and is used in less demanding industrial processes.

Which application segment drives the highest growth rate for Ultra-High Purity Acetic Acid?

The Electronic Chemicals and Semiconductor segment drives the highest growth rate. The continuous miniaturization of semiconductor chips and the need for defect-free wafer processing require Ultra-High Purity (UHP) acetic acid as a critical solvent or cleaning agent to prevent yield losses caused by trace metallic contamination.

How does the methanol carbonylation process affect the final purity of Acetic Acid?

Methanol carbonylation, utilizing technologies like Cativa, is highly efficient but produces crude acetic acid containing impurities such as water, propionic acid, and trace metal catalyst residues. The purity level is achieved through subsequent, energy-intensive purification trains involving complex distillation and specialized polishing steps, not the initial synthesis process itself.

Why is Asia Pacific the leading region in the High Purity Acetic Acid Market?

Asia Pacific (APAC) dominates the market due to its massive, integrated petrochemical infrastructure supporting high-volume Purified Terephthalic Acid (PTA) production and its role as the global manufacturing hub for microelectronics and flat-panel displays, which collectively consume the largest volumes of both high-grade and UHP acetic acid.

What major regulatory standard governs the use of HPAA in pharmaceutical applications?

In pharmaceutical applications, HPAA must primarily comply with national Pharmacopeial standards (such as USP, EP, or JP) and must be manufactured under strict Good Manufacturing Practices (GMP). Specific requirements relate to non-volatile residue, heavy metal limits, and identity confirmation to ensure its safe use as a solvent in Active Pharmaceutical Ingredient (API) synthesis.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager