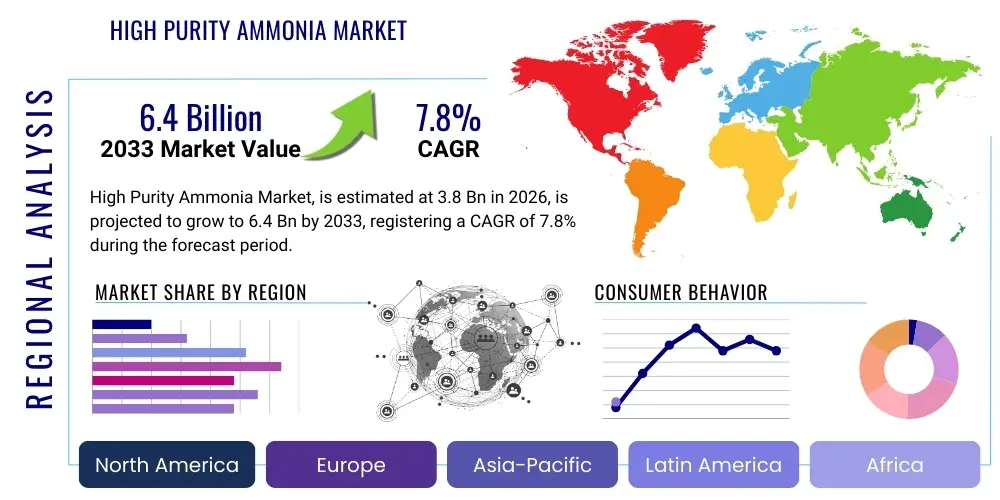

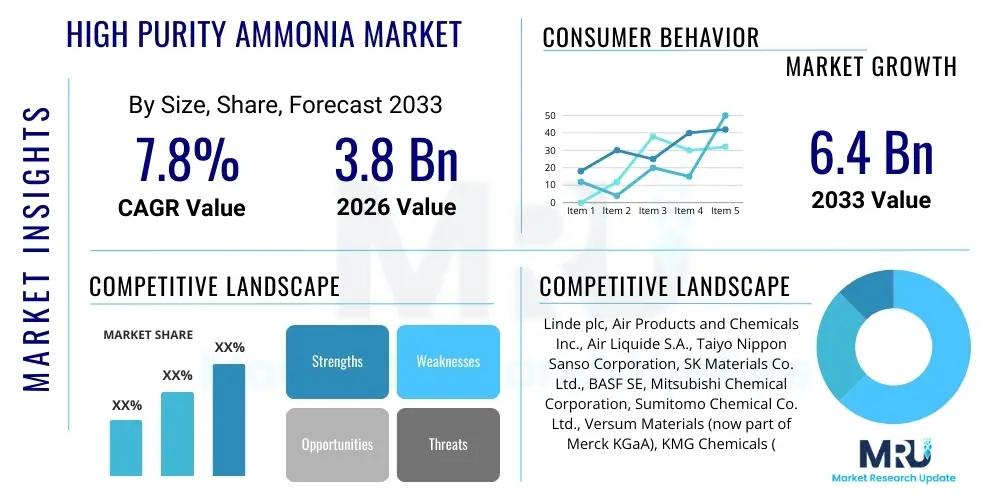

High Purity Ammonia Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439778 | Date : Jan, 2026 | Pages : 257 | Region : Global | Publisher : MRU

High Purity Ammonia Market Size

The High Purity Ammonia Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 3.8 Billion in 2026 and is projected to reach USD 6.4 Billion by the end of the forecast period in 2033.

High Purity Ammonia Market introduction

High Purity Ammonia (HPA) is a critical raw material extensively utilized in a myriad of advanced technological applications, particularly within the electronics industry. Characterized by its extremely low levels of impurities, HPA is indispensable for manufacturing sensitive components where even trace contaminants can severely compromise performance and reliability. Its unique chemical properties and high purity levels make it a foundational element for processes demanding precision and consistency, far beyond the capabilities of standard industrial-grade ammonia. This stringent purity requirement is driven by the escalating miniaturization and sophistication of modern electronic devices, which necessitate materials with unparalleled quality to ensure optimal functionality and longevity.

The primary applications of High Purity Ammonia span across the semiconductor, LED, and flat panel display industries, where it serves as a vital nitrogen source for deposition processes such as Metalorganic Chemical Vapor Deposition (MOCVD) and Atomic Layer Deposition (ALD). In semiconductor fabrication, HPA is crucial for creating gallium nitride (GaN) and other III-V compound semiconductors, which are foundational for high-performance transistors, diodes, and advanced memory chips. Similarly, in the production of LEDs, HPA is fundamental to synthesizing GaN layers that emit light efficiently, enabling brighter, more energy-efficient lighting solutions. The rapid expansion of these industries, fueled by global demand for consumer electronics, communication technologies, and energy-efficient lighting, directly underpins the increasing demand for HPA.

The benefits derived from using High Purity Ammonia are manifold, including enhanced device performance, extended product lifespan, and improved manufacturing yields due to reduced defect rates. These advantages are particularly significant in industries where product failure can result in substantial financial losses and reputational damage. Key driving factors for the HPA market include the relentless technological advancements in electronics, the booming adoption of 5G and IoT devices requiring more sophisticated chip architectures, the global push towards energy-efficient LED lighting, and the growing demand for renewable energy technologies such as solar cells. Furthermore, stringent quality standards and increasing investment in R&D for next-generation materials and manufacturing processes are continuously propelling the demand for even higher purity grades of ammonia.

High Purity Ammonia Market Executive Summary

The High Purity Ammonia market is currently experiencing robust growth, primarily driven by the insatiable demand for advanced electronic components across various sectors. Business trends indicate a strong emphasis on supply chain resilience, with manufacturers increasingly investing in backward integration and diversifying sourcing strategies to mitigate geopolitical risks and ensure a consistent supply of this critical material. There is a discernible trend towards partnerships and collaborations between HPA producers and end-users, fostering innovation in purification technologies and tailored product offerings. Furthermore, environmental, social, and governance (ESG) considerations are becoming pivotal, influencing production methods towards more sustainable and energy-efficient processes, alongside stringent waste management practices. The market is also seeing consolidation efforts as larger players seek to gain economies of scale and enhance their technological capabilities.

Regional trends highlight Asia-Pacific as the undisputed leader in HPA consumption, largely attributed to the region's dominance in semiconductor manufacturing, LED production, and flat panel display fabrication, particularly in countries like China, South Korea, Japan, and Taiwan. This geographical concentration of high-tech industries dictates significant demand patterns and ongoing investments in production capacities within the region. North America and Europe are also demonstrating steady growth, driven by their respective robust R&D ecosystems, niche high-tech manufacturing, and increasing adoption of HPA in specialty applications such as advanced medical devices and defense technologies. Emerging markets in Southeast Asia are showing nascent but accelerating demand as new manufacturing hubs for electronics begin to establish their footprint, signaling future growth opportunities beyond the established powerhouses.

From a segmentation perspective, the market is overwhelmingly skewed towards the electronics grade HPA, with ultra-high purity grades (6N, 7N, and beyond) commanding premium prices due to their critical role in advanced semiconductor and LED manufacturing. Within applications, the semiconductor segment holds the largest share, constantly pushing the boundaries for higher purity and lower detection limits for impurities. The LED and flat panel display segments also contribute significantly, with continuous innovation in display technologies and lighting solutions fueling steady demand. In terms of form, gaseous HPA is predominant for direct process injection, while liquid HPA is crucial for bulk storage and various chemical processes. The market is also witnessing a gradual shift towards more localized production capabilities, aiming to reduce logistical complexities and enhance responsiveness to regional demand fluctuations, especially for the most sensitive purity grades.

AI Impact Analysis on High Purity Ammonia Market

The advent and rapid integration of Artificial Intelligence (AI) technologies are poised to exert a multifaceted impact on the High Purity Ammonia market, primarily by amplifying demand in core end-use sectors and revolutionizing production efficiencies. Common user questions related to AI's influence often center on how AI-driven advancements in semiconductors will translate into increased HPA consumption, the role of AI in optimizing HPA manufacturing processes, and the potential for AI to enhance quality control and supply chain resilience. Users are keen to understand if AI's exponential growth will lead to a proportional increase in the need for ultra-high purity materials like HPA, and how the market will adapt to these escalating purity and volume requirements. The overarching themes suggest an expectation of AI as both a demand driver and an operational enhancer within the HPA ecosystem.

AI's most direct impact stems from its foundational reliance on advanced semiconductor technology. The development and deployment of sophisticated AI models, particularly in areas like deep learning, neural networks, and generative AI, necessitate increasingly powerful and complex processing units. These AI-specific chips, including GPUs, TPUs, and specialized AI accelerators, require cutting-edge manufacturing processes that rely heavily on ultra-high purity materials like HPA. As AI applications proliferate across industries—from autonomous vehicles and smart cities to advanced analytics and personalized medicine—the demand for these high-performance semiconductors will surge, creating a direct and significant pull for greater volumes and even higher purity grades of ammonia. This cascading effect makes AI a critical long-term growth catalyst for the HPA market, driving continuous innovation in both product purity and production capacity.

Beyond demand generation, AI also offers transformative potential for the HPA manufacturing and supply chain processes themselves. AI-powered analytics and machine learning algorithms can be deployed to optimize various stages of HPA production, from raw material purification to quality control and logistics. Predictive maintenance systems can reduce downtime and improve asset utilization, while AI-driven process control can fine-tune purification parameters to achieve desired purity levels with greater efficiency and consistency. Furthermore, AI can enhance supply chain visibility and predictability, enabling HPA producers to better forecast demand, manage inventory, and mitigate disruptions. This operational intelligence can lead to significant cost reductions, improved product quality, and a more resilient and responsive supply chain, ultimately benefiting both producers and end-users of High Purity Ammonia.

- Increased demand for AI-specific semiconductors, directly boosting HPA consumption.

- AI-driven optimization of HPA manufacturing processes for enhanced efficiency and yield.

- Improved quality control through AI-powered anomaly detection in HPA production.

- Enhanced supply chain management and logistics for HPA using predictive analytics.

- Acceleration of R&D for next-generation materials and purification techniques through AI simulation.

- Development of advanced sensor technologies for HPA impurity detection, often AI-integrated.

- Potential for AI to drive sustainability initiatives in HPA production by optimizing energy use.

DRO & Impact Forces Of High Purity Ammonia Market

The High Purity Ammonia market is influenced by a dynamic interplay of Drivers, Restraints, and Opportunities, collectively shaped by various Impact Forces. Key drivers include the exponential growth of the semiconductor industry, fueled by advancements in AI, 5G, and IoT, which continuously demand higher volumes and purity grades of HPA for chip fabrication. The burgeoning LED lighting market, driven by energy efficiency mandates and smart city initiatives, also significantly contributes to HPA demand as it is essential for GaN-based LED manufacturing. Furthermore, the expansion of renewable energy sectors, particularly solar cells where HPA is used in deposition processes, along with increasing adoption in specialty medical and pharmaceutical applications, collectively propel market expansion. These factors underpin the market's robust growth trajectory, emphasizing HPA's indispensable role in advanced technological ecosystems.

However, several restraints pose challenges to market growth and stability. The high capital expenditure associated with establishing and maintaining HPA production facilities, which require sophisticated purification technologies and stringent quality control measures, can deter new entrants and limit expansion for existing players. The complex and energy-intensive purification processes, coupled with the volatility in raw material (conventional ammonia) prices and supply chain vulnerabilities, contribute to high production costs and potential supply disruptions. Moreover, strict environmental regulations concerning ammonia emissions, hazardous material handling, and transportation present significant operational challenges and necessitate substantial investment in compliance technologies. These restraints often lead to pricing pressures and can impact the overall profitability of HPA manufacturers, demanding strategic adaptations and technological innovation to overcome.

Despite these challenges, significant opportunities exist for market participants. Continuous innovation in purification technologies, such as advanced cryogenic distillation, selective adsorption, and membrane separation, can lead to more efficient and cost-effective production of ultra-high purity HPA. The emergence of new applications in areas like quantum computing, advanced materials science, and next-generation medical devices presents untapped market segments requiring bespoke HPA solutions. Geographical expansion into developing regions with growing electronics manufacturing bases, particularly in Southeast Asia and parts of Latin America, offers new avenues for market penetration. Furthermore, strategic collaborations and joint ventures with end-users and technology providers can foster innovation, secure long-term supply agreements, and mitigate market risks, enabling sustainable growth and diversification for HPA suppliers.

Segmentation Analysis

The High Purity Ammonia market is segmented across several critical dimensions, allowing for a detailed understanding of its dynamics and growth drivers. These segmentation categories typically include purity grade, application, form, and end-use industry, each reflecting distinct market characteristics and demand patterns. The purity grade segment is particularly crucial, as the performance requirements of advanced electronic devices dictate the specific level of HPA purity needed, ranging from 5N to 7N and beyond. Application segmentation highlights the diverse industrial uses, predominantly in high-tech manufacturing, while the form (gaseous or liquid) addresses different delivery and usage preferences. Analyzing these segments provides strategic insights into market trends, competitive landscapes, and opportunities for product development and market penetration.

- By Purity Grade:

- 5N (99.999%)

- 6N (99.9999%)

- 7N (99.99999%)

- Higher than 7N

- By Application:

- Semiconductors

- LEDs (Light Emitting Diodes)

- Flat Panel Displays (FPD)

- Solar Cells

- Medical & Pharmaceutical

- Others (e.g., specialty chemicals, research & development)

- By Form:

- Gaseous

- Liquid

- By End-use Industry:

- Electronics

- Energy

- Healthcare

- Chemical

- Others

Value Chain Analysis For High Purity Ammonia Market

The value chain for High Purity Ammonia is an intricate process, commencing from the upstream sourcing of raw materials to the downstream distribution and consumption by end-users. At the upstream stage, the primary raw material is industrial-grade ammonia, typically produced via the Haber-Bosch process using natural gas or coal as a feedstock. This initial ammonia, while pure enough for many industrial uses, contains impurities that are unacceptable for high-tech applications. Sourcing stability, cost-effectiveness, and the environmental footprint of this initial production are critical considerations for HPA manufacturers. Key players in this phase often include large petrochemical companies or chemical suppliers specializing in bulk ammonia production, setting the foundation for the subsequent purification steps.

The midstream segment involves the highly specialized and capital-intensive purification of industrial-grade ammonia into its high-purity variants. This stage utilizes advanced technologies such as cryogenic distillation, adsorption, membrane separation, and specialized filtration systems to remove trace impurities like oxygen, water, hydrocarbons, and various metallic contaminants to sub-parts-per-billion levels. Rigorous quality control, employing highly sensitive analytical techniques like ICP-MS (Inductively Coupled Plasma Mass Spectrometry) and GC-MS (Gas Chromatography-Mass Spectrometry), is paramount to ensure the product meets the stringent purity specifications required by the electronics and other sensitive industries. This purification process is the most critical and value-adding step, defining the quality and market segment of the final HPA product.

In the downstream segment, the purified HPA is carefully packaged into specialized cylinders or bulk containers, designed to maintain its ultra-high purity during storage and transportation. Distribution channels are typically direct, given the specialized nature and high value of the product, with HPA manufacturers often working closely with end-users to provide tailored delivery solutions and technical support. Indirect channels, involving specialized chemical distributors with expertise in handling hazardous and high-purity gases, also play a role, particularly for smaller volumes or specific regional markets. The relationship between HPA producers and end-users is often collaborative, involving long-term supply agreements and joint efforts to innovate and meet evolving purity demands. This direct engagement ensures precise delivery, safe handling, and optimized integration into the customer's manufacturing processes, completing the value chain from raw material to final application.

High Purity Ammonia Market Potential Customers

The primary potential customers for High Purity Ammonia are predominantly in industries that rely on advanced material deposition and chemical processes requiring extremely low levels of contaminants. These end-users are typically manufacturers of sophisticated electronic components, where the integrity and performance of their products are directly proportional to the purity of the raw materials used. The semiconductor industry stands as the largest and most demanding customer segment, as HPA is a critical precursor for gallium nitride (GaN) and other III-V compound semiconductors used in microprocessors, memory chips, and various integrated circuits. These manufacturers, including global giants and smaller specialized foundries, purchase HPA in various purity grades to facilitate precise and defect-free deposition processes essential for chip fabrication.

Beyond semiconductors, the LED (Light Emitting Diode) and Flat Panel Display (FPD) industries represent significant customer bases. LED manufacturers utilize HPA for the MOCVD growth of GaN layers, which are fundamental to producing high-efficiency and bright light sources for general lighting, automotive applications, and display backlighting. Similarly, FPD producers, including those making LCD, OLED, and micro-LED displays, require HPA for specific deposition steps to create transparent conductive layers and other critical components that ensure display clarity and performance. These industries are characterized by continuous innovation and increasing production volumes, driving consistent and growing demand for high-quality HPA to meet evolving technological standards and consumer expectations.

Furthermore, the solar cell industry, particularly for CIGS (Copper Indium Gallium Selenide) and other thin-film photovoltaic technologies, uses HPA in certain fabrication processes. The medical and pharmaceutical sectors are also emerging as potential customers, where HPA might be utilized in specialty chemical synthesis or as a precise reagent in controlled environments. Research and development institutions, universities, and specialized laboratories also constitute a customer segment, procuring HPA for experimental purposes, material science research, and the development of next-generation technologies. These diverse end-users, each with unique purity requirements and application specifics, collectively form the robust customer landscape for the High Purity Ammonia market, underscoring its broad applicability in high-tech manufacturing and innovation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.8 Billion |

| Market Forecast in 2033 | USD 6.4 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Linde plc, Air Products and Chemicals Inc., Air Liquide S.A., Taiyo Nippon Sanso Corporation, SK Materials Co. Ltd., BASF SE, Mitsubishi Chemical Corporation, Sumitomo Chemical Co. Ltd., Versum Materials (now part of Merck KGaA), KMG Chemicals (now part of Cabot Corporation), Showa Denko K.K., Messer Group GmbH, Iwatani Corporation, UBE Corporation, Praxair (now part of Linde plc), Jiangsu Nata Opto-electronic Material Co. Ltd., Wuhan Newradar Special Gas Co. Ltd., Suzhou Jinhong Gas Co. Ltd., Hangzhou Jingying Chemicals Co. Ltd., Chengdu Huarui Industrial Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Purity Ammonia Market Key Technology Landscape

The High Purity Ammonia market is critically dependent on advanced technological landscapes across its entire production and delivery chain, focusing primarily on achieving and maintaining ultra-high purity levels. The core technologies revolve around sophisticated purification methods designed to remove even trace impurities that could compromise sensitive manufacturing processes in end-use industries like semiconductors and LEDs. These purification techniques include multi-stage cryogenic distillation, where differences in boiling points are exploited to separate ammonia from less volatile components. Additionally, highly selective adsorption processes utilizing specialized zeolites or activated carbon are employed to remove gaseous contaminants, while advanced membrane separation technologies offer precise molecular sieving capabilities, all contributing to the attainment of 6N, 7N, and even higher purity grades.

Beyond the purification itself, the technology landscape encompasses rigorous quality control and analytical methodologies that are essential for verifying and certifying the extreme purity of the HPA. Techniques such as Inductively Coupled Plasma Mass Spectrometry (ICP-MS) are crucial for detecting metallic impurities down to parts per trillion (ppt) levels, while Gas Chromatography-Mass Spectrometry (GC-MS) is employed to identify and quantify organic and inorganic gaseous contaminants. Laser-based analytical methods and advanced sensor technologies are also increasingly being integrated for real-time, in-line monitoring of impurity levels during the production process. These analytical advancements not only ensure product quality but also drive continuous improvement in purification efficiency, pushing the boundaries of what is technically achievable in terms of material purity.

Furthermore, the technology landscape extends to safe handling, storage, and distribution systems, which are vital for preventing recontamination and ensuring the integrity of HPA until its point of use. This includes specialized materials for storage cylinders and piping that prevent leaching of impurities, advanced valve technologies, and inert gas purging systems. Packaging innovations, such as electropolished cylinders with specific surface treatments, are designed to minimize particulate generation and adsorption of impurities. The integration of advanced process control systems, often leveraging AI and machine learning, optimizes production parameters, enhances safety protocols, and improves overall operational efficiency. This holistic technological approach, from raw material processing to final delivery, underpins the consistent supply of the extremely pure ammonia required by today's most demanding high-tech industries.

Regional Highlights

The global High Purity Ammonia market exhibits distinct regional dynamics, with demand primarily concentrated in areas boasting robust electronics manufacturing ecosystems. Asia-Pacific stands as the unequivocal leader, driven by the presence of major semiconductor foundries, LED production facilities, and flat panel display manufacturers in countries such as China, South Korea, Japan, and Taiwan. This region not only consumes the largest share of HPA but also sees significant investments in expanding production capacities to meet the escalating local demand. The sheer volume of electronics production, coupled with ongoing technological advancements and government support for high-tech industries, solidifies Asia-Pacific's dominant position, making it the most critical market for HPA suppliers and a hotbed for innovation in purity and application.

North America and Europe represent mature markets for High Purity Ammonia, characterized by a strong emphasis on research and development, specialty chemical manufacturing, and advanced niche applications. In North America, demand is propelled by the semiconductor industry's innovation hubs, the growing aerospace and defense sectors, and increasing investments in medical device manufacturing, all of which require ultra-high purity materials. European demand is similarly driven by its established chemical industry, a focus on high-value-added electronics, and stringent quality standards for industrial gases. While these regions may not match Asia-Pacific in terms of sheer volume, they contribute significantly to the market through their high-purity, specialized requirements and continuous push for technological advancements, often serving as pioneers for new applications and purification techniques.

Latin America, the Middle East, and Africa (MEA) currently hold smaller shares in the High Purity Ammonia market, but these regions are poised for gradual growth due to developing industrial bases and increasing investments in infrastructure. Latin America's emerging electronics manufacturing and chemical industries present nascent opportunities, while the MEA region, with its growing petrochemical sector and efforts towards economic diversification, could see increased HPA demand for specialty chemical production and potentially new high-tech ventures. These regions are likely to grow as global supply chains continue to diversify and as local economies prioritize the development of advanced manufacturing capabilities. The pace of growth in these emerging markets will be influenced by foreign direct investment, technological transfer, and the establishment of local industrial ecosystems that require high-purity materials.

- Asia-Pacific: Dominant market due to vast semiconductor, LED, and FPD manufacturing bases in China, South Korea, Japan, and Taiwan; highest consumption and investment.

- North America: Significant market driven by advanced semiconductor R&D, aerospace, defense, and medical device manufacturing; high demand for ultra-high purity grades.

- Europe: Mature market with strong specialty chemical, high-value electronics, and industrial gas sectors; focus on quality and innovation in niche applications.

- China: Largest consumer and producer in APAC, fueled by massive electronics production and government industrial policies.

- South Korea: Key player in memory, logic chips, and display manufacturing, driving substantial HPA demand.

- Japan: Important for advanced materials, specialized semiconductors, and technology innovation, requiring top-tier HPA.

- United States: Central to semiconductor design and fabrication, advanced R&D, and defense applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Purity Ammonia Market.- Linde plc

- Air Products and Chemicals Inc.

- Air Liquide S.A.

- Taiyo Nippon Sanso Corporation

- SK Materials Co. Ltd.

- BASF SE

- Mitsubishi Chemical Corporation

- Sumitomo Chemical Co. Ltd.

- Versum Materials (now part of Merck KGaA)

- KMG Chemicals (now part of Cabot Corporation)

- Showa Denko K.K.

- Messer Group GmbH

- Iwatani Corporation

- UBE Corporation

- Praxair (now part of Linde plc)

- Jiangsu Nata Opto-electronic Material Co. Ltd.

- Wuhan Newradar Special Gas Co. Ltd.

- Suzhou Jinhong Gas Co. Ltd.

- Hangzhou Jingying Chemicals Co. Ltd.

- Chengdu Huarui Industrial Co. Ltd.

Frequently Asked Questions

Analyze common user questions about the High Purity Ammonia market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is High Purity Ammonia (HPA) and why is it important?

High Purity Ammonia (HPA) is ammonia purified to extremely low levels of impurities, often 99.999% (5N) or higher. It is crucial because even trace contaminants can severely impair the performance and reliability of sensitive electronic components, making HPA indispensable for advanced manufacturing processes in industries like semiconductors, LEDs, and flat panel displays. Its high purity ensures superior device performance, extended lifespan, and improved manufacturing yields by minimizing defects.

Which industries are the primary consumers of High Purity Ammonia?

The semiconductor industry is the largest consumer of High Purity Ammonia, utilizing it as a critical nitrogen source for manufacturing microprocessors, memory chips, and other integrated circuits, especially for gallium nitride (GaN) based devices. Other significant consumers include the LED (Light Emitting Diode) industry for creating energy-efficient lighting, the Flat Panel Display (FPD) industry, and increasingly, the solar cell and specialty medical/pharmaceutical sectors.

What are the key factors driving the growth of the HPA market?

The primary drivers for the High Purity Ammonia market include the booming global demand for advanced electronics (smartphones, AI chips, 5G infrastructure, IoT devices), the continuous expansion of the LED lighting market driven by energy efficiency, and the growth of the renewable energy sector, particularly solar cells. Additionally, stringent quality standards in high-tech manufacturing and ongoing technological advancements in material science contribute significantly to market expansion.

What challenges does the High Purity Ammonia market face?

The HPA market faces several challenges, including high production costs due to complex and energy-intensive purification processes, significant capital expenditure for state-of-the-art manufacturing facilities, and the volatility of raw material prices (industrial-grade ammonia). Furthermore, stringent environmental regulations regarding emissions and hazardous material handling, along with potential supply chain vulnerabilities, pose significant operational and financial restraints for market players.

How does AI impact the demand for High Purity Ammonia?

AI significantly impacts HPA demand by driving the need for more powerful and complex semiconductors, such as specialized AI chips (GPUs, TPUs). As AI applications proliferate, the manufacturing of these advanced chips requires higher volumes and increasingly purer grades of HPA for critical deposition processes. AI also influences HPA production by enabling optimization of manufacturing processes, enhancing quality control, and improving supply chain efficiency through predictive analytics.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager