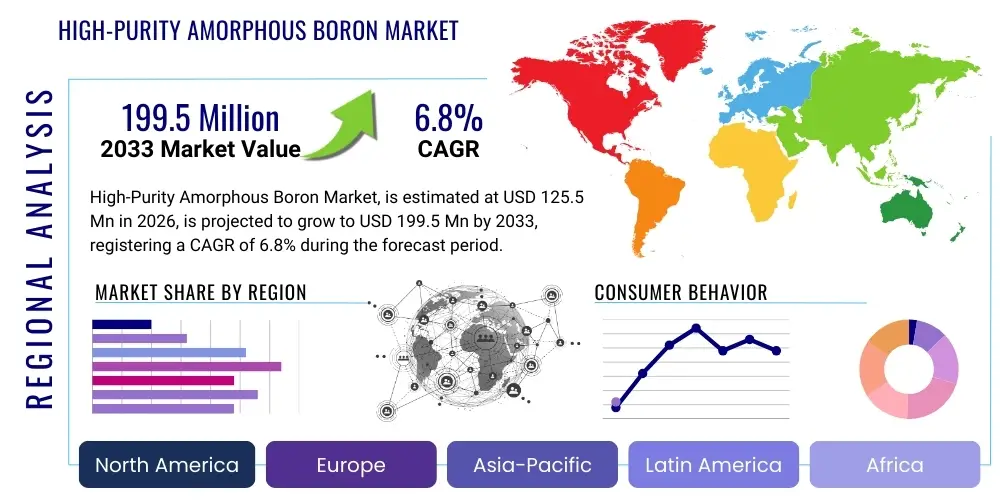

High-Purity Amorphous Boron Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436080 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

High-Purity Amorphous Boron Market Size

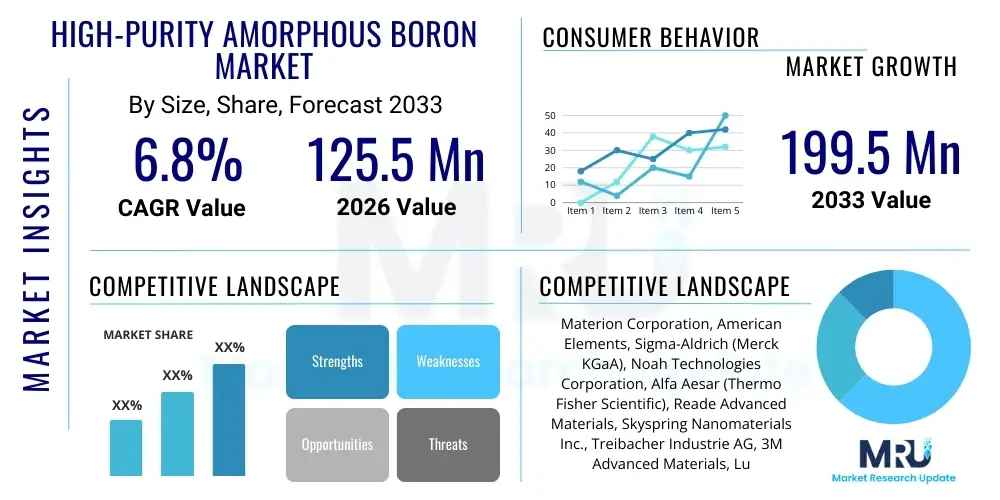

The High-Purity Amorphous Boron Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 125.5 Million in 2026 and is projected to reach USD 199.5 Million by the end of the forecast period in 2033.

High-Purity Amorphous Boron Market introduction

The High-Purity Amorphous Boron Market encompasses the production and utilization of boron material characterized by an elemental purity exceeding 99.99% and lacking crystalline structure, crucial for demanding high-technology applications. This exceptional purity ensures minimal impurity interference, which is paramount in sectors like nuclear energy, where neutron absorption cross-section integrity is vital, and in semiconductor manufacturing, where even trace contaminants can compromise device performance. High-Purity Amorphous Boron (HPAB) is specifically sought after for its versatility, high melting point, extreme hardness, and specific nuclear properties, positioning it as a strategic material in global supply chains focused on advanced materials.

The primary applications of HPAB span across neutron shielding and control rods in nuclear reactors, specialized semiconductors for high-frequency electronics, precursors for advanced ceramics, and production of specific metal borides utilized in aerospace alloys and armor. Recent developments highlight its increasing relevance in solid-state battery technology and photovoltaic cell manufacturing due to its unique electrochemical stability and light absorption characteristics. The inherent benefits of HPAB include superior thermal stability, enhanced electrical conductivity (when doped or integrated into specific compounds), and unparalleled consistency in performance compared to lower-grade alternatives, driving its indispensable status in mission-critical systems.

The market growth is primarily propelled by the resurgence in global nuclear power infrastructure development, particularly the deployment of small modular reactors (SMRs) which rely heavily on efficient neutron absorbers, and the exponential expansion of the high-performance electronics sector, including advanced compound semiconductors like boron carbide thin films. Furthermore, sustained investments in military and defense applications, utilizing boron compounds for lightweight armor and specialized pyrotechnics, continue to provide a stable demand foundation. These driving factors, coupled with technological advancements in purification processes, solidify the market's trajectory toward substantial expansion over the forecast period.

High-Purity Amorphous Boron Market Executive Summary

The High-Purity Amorphous Boron market is exhibiting robust expansion characterized by significant business trends focusing on vertical integration and geopolitical supply chain diversification. Key industry players are increasingly investing in proprietary purification technologies, such as plasma processing and chemical vapor deposition (CVD) derived methods, to achieve the necessary ultra-high purity levels required for advanced applications like deep ultraviolet light-emitting diodes (UV-LEDs) and specialized scintillation detectors. The overarching business strategy revolves around securing long-term supply contracts with defense organizations and semiconductor fabricators, establishing niche dominance based on material specifications rather than sheer volume. Furthermore, mergers and acquisitions targeting smaller, technology-focused material science firms are common, aiming to consolidate intellectual property related to high-yield synthesis methods and reduce reliance on volatile external raw material sourcing.

Regionally, Asia Pacific, specifically China, South Korea, and Japan, dominates consumption owing to its massive footprint in the electronics manufacturing and advanced ceramic industries, alongside significant state-backed nuclear energy programs. North America and Europe are pivotal in terms of high-value innovation, leading research in boron neutron capture therapy (BNCT) and next-generation battery development, which utilizes HPAB precursors. However, geographical concentration of key raw materials, primarily borate minerals, poses a persistent risk, prompting regional governments to prioritize domestic production capabilities or secure stable supply lines from politically stable regions, thereby creating heterogeneous growth profiles across continents.

In terms of segment trends, the electronics and semiconductor application segment is anticipated to witness the fastest growth, fueled by the demand for high-performance thermal management solutions and non-volatile memory devices where boron-based materials are critical components. Concurrently, the nuclear sector, while steady, commands the highest average selling price (ASP) due to stringent regulatory compliance and the absolute requirement for isotopic consistency, particularly Boron-10 enriched materials. The trend across all segments indicates a shift toward materials with tailored surface functionalities and particle size distributions, facilitating easier integration into complex manufacturing processes such as additive manufacturing (3D printing) of specialized components.

AI Impact Analysis on High-Purity Amorphous Boron Market

User queries regarding the impact of Artificial Intelligence (AI) on the High-Purity Amorphous Boron Market frequently center on three critical areas: optimization of the complex synthesis and purification processes, enhancement of material property prediction for novel applications, and the accelerating demand for AI-enabling hardware. Users are keenly interested in how machine learning algorithms can manage the multi-variable inputs of chemical vapor deposition (CVD) or plasma reduction techniques to consistently yield 5N (99.999%) purity, reducing batch failure rates and overall production costs. There is also significant user curiosity regarding AI-driven materials informatics platforms that can simulate and predict the performance of boron compounds in new energy storage devices or extreme radiation environments, thereby significantly cutting down R&D cycles.

The deployment of AI in synthesis control allows manufacturers to monitor critical process parameters—such as temperature gradients, gas flow rates, and precursor concentrations—in real-time. This level of granular control is crucial for maintaining the non-crystalline structure and achieving ultra-high purity, which are often mutually exclusive goals in traditional manufacturing. By leveraging predictive maintenance and quality assurance models trained on historical production data, companies can preemptively adjust parameters, leading to higher throughput and greater consistency across batches. This technological adoption mitigates the high capital expenditure and operational complexity traditionally associated with high-ppurity material production.

Furthermore, the indirect influence of AI proliferation drives demand for HPAB. The massive computational power required by large language models (LLMs) and deep learning applications necessitates advanced cooling and thermal management solutions, often relying on high-performance ceramics derived from boron, such as boron nitride and boron carbide. Moreover, the shift toward sustainable and robust computing infrastructure requires advanced power electronics and sensors, where HPAB derivatives play a role. Thus, AI not only optimizes the supply side by improving production efficiency but also dramatically stimulates the demand side by creating new, high-specification requirements in end-use technology sectors, thereby cementing HPAB’s long-term market relevance.

- AI-driven optimization of purification processes, reducing waste and increasing 5N purity yields.

- Machine learning algorithms applied to material informatics for predicting novel boron compound performance in extreme conditions.

- Enhanced quality control and predictive maintenance in manufacturing facilities utilizing sensors and real-time data analysis.

- Accelerated demand for high-performance thermal management ceramics utilizing boron, driven by AI data center expansion.

- Simulation of HPAB integration into next-generation semiconductor substrates for AI hardware components.

DRO & Impact Forces Of High-Purity Amorphous Boron Market

The High-Purity Amorphous Boron market dynamic is governed by a robust interaction between technological imperatives, raw material constraints, and strategic geopolitical alignment. The primary drivers stem from critical infrastructural needs in nuclear and semiconductor sectors, demanding materials with uncompromising purity and reliability. Conversely, the market faces significant restraints related to the extremely high cost and energy intensity of the purification process necessary to remove contaminants like carbon and oxygen below parts-per-million levels. Opportunities arise mainly from revolutionary technological breakthroughs in energy storage (solid-state batteries) and specialized medical therapies (BNCT), opening entirely new, lucrative vertical markets. These internal and external pressures collectively constitute the impact forces, dictating pricing stability, investment direction, and competitive landscape structure within this niche but vital commodity market.

Drivers: A major impetus is the global push for carbon neutrality, leading to significant governmental and private investment in nuclear fission technology, particularly advanced fast reactors and SMRs, which rely heavily on Boron-10 enrichment (derived from high-purity boron) for crucial safety and control mechanisms. Simultaneously, the relentless miniaturization and performance enhancement of electronic components demand materials that can withstand increasingly harsh operating conditions, such as high temperatures and radiation fluxes. HPAB derivatives fulfill this requirement, essential for sectors like 5G infrastructure, aerospace electronics, and high-reliability automotive systems. The consistent, non-negotiable requirement for material integrity in these high-stakes applications ensures sustained high demand.

Restraints: The most significant hurdle is the prohibitive complexity and cost associated with achieving ultra-high purity (>99.99%). The production often involves vacuum melting, zone refining, and chemical purification steps that consume vast amounts of energy and require specialized, expensive equipment, translating into high final product prices that limit broader industrial adoption in less critical applications. Furthermore, the market is constrained by the limited geographic distribution of mineable borate reserves, with Turkey holding the majority of global resources. This reliance creates significant supply chain vulnerability, subject to geopolitical shifts, export policies, and logistical disruptions, impacting price volatility and security of supply for manufacturers globally.

Opportunities: Potential for market growth is substantial in emerging technology spaces. The development of solid-state lithium-ion batteries and other advanced energy storage devices requires high-purity boron as a key component in electrolytes or protective layers, offering a high-volume, future-proof application. Additionally, the increasing utilization of HPAB in advanced refractory materials, high-performance optical fibers, and specialized neutron detectors (crucial for counter-terrorism and nuclear non-proliferation efforts) provides diversified revenue streams that are less susceptible to economic fluctuations in the traditional semiconductor cycle. Successful commercialization of localized, low-energy purification techniques represents a massive opportunity to democratize production and reduce costs.

Segmentation Analysis

The High-Purity Amorphous Boron market is segmented based on the critical parameters of purity level, primary application, and end-use industry, reflecting the specialized demands across various high-technology sectors. Purity level segmentation is fundamental, as it directly correlates with the material's suitability for nuclear versus electronic applications; ultra-high purity material (99.999% and above) often commands a severe price premium. Application segmentation highlights the material's multifunctional utility, ranging from thermal management and refractory uses to specialized alloying agents. The end-use segmentation reveals the main purchasing power centers, dominated by the electronics/semiconductor and nuclear energy industries, providing a clear structural roadmap for market strategists aiming to penetrate specific, high-barrier entry sectors.

- By Purity Level:

- 99.9% to 99.99% (3N-4N Purity)

- 99.99% to 99.999% (4N-5N Purity)

- Above 99.999% (5N+ Purity)

- By Application:

- Neutron Shielding and Control

- Advanced Ceramics and Composites

- Semiconductor Dopants and Thin Films

- Pyrotechnics and Explosives

- Specialized Alloying Agents

- Energy Storage Components (e.g., Solid-State Batteries)

- By End-Use Industry:

- Nuclear Energy

- Electronics and Semiconductors

- Aerospace and Defense

- Chemical and Material Science R&D

- Automotive (Specialty Components)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For High-Purity Amorphous Boron Market

The value chain for High-Purity Amorphous Boron is complex and highly specialized, beginning with the mining of borate minerals (Upstream Analysis) and extending through energy-intensive purification processes, specialized manufacturing, and highly controlled distribution channels, ultimately reaching high-tech end-users (Downstream Analysis). Upstream activities are dominated by a few global suppliers of raw borates, requiring complex hydrometallurgical processing before the material is ready for refinement. The midstream involves numerous proprietary high-tech refining steps, including chemical purification, crystallization, and reduction techniques (like magnesium reduction or vapor phase reduction), where the highest value addition occurs due to the complexity required to achieve ultra-high purity levels.

The midstream processing stage is a significant choke point, characterized by high barriers to entry due to the technical expertise, specialized equipment, and substantial capital investment required. Once refined, HPAB is typically converted into tailored forms (e.g., fine powders, sputtering targets, or precursor gases) by specialized material converters. The distribution channel is bifurcated: Direct channels involve long-term supply agreements between primary producers and large-scale industrial consumers (e.g., nuclear operators or tier-one semiconductor fabs), ensuring secure, traceable supply lines. Indirect channels utilize specialized chemical distributors and agents, particularly for smaller R&D institutions or niche manufacturers requiring bespoke quantities and specifications.

Downstream activities center on integration into complex systems. In the semiconductor industry, HPAB is often used in ion implantation processes or as part of thin film deposition for advanced memory chips (MRAM) or power devices. In the nuclear sector, strict regulatory oversight dictates that the material must meet rigorous standards for isotopic content and structural integrity before being integrated into control rod assemblies or shielding tiles. The high criticality of the end applications mandates robust traceability, quality control protocols, and often exclusive vendor qualification, making relationship management and consistent product quality paramount for maintaining market share throughout the value chain.

High-Purity Amorphous Boron Market Potential Customers

Potential customers for High-Purity Amorphous Boron are predominantly institutions and corporations operating within mission-critical sectors where material failure is unacceptable and performance demands exceed standard industrial materials. The primary buyers are large-scale energy producers managing nuclear fission power plants (both conventional and next-generation SMRs), requiring HPAB for essential neutron absorbing components that manage reactor criticality and safety. These end-users demand rigorous documentation, certified isotopic purity (especially B-10 enrichment), and adherence to international nuclear safety standards, making them highly sticky and quality-focused buyers.

Another dominant customer segment is the global electronics and semiconductor industry, encompassing major fabrication plants (fabs) and integrated device manufacturers (IDMs). These customers purchase HPAB either as sputtering targets for depositing thin films of boron compounds or as high-purity chemical precursors for doping silicon and compound semiconductors to manipulate electrical conductivity and thermal performance. The continuous demand for smaller, faster, and more heat-tolerant microchips ensures that this sector remains a perennial and rapidly growing buyer, focusing heavily on surface quality and particle size distribution consistency for high-precision manufacturing processes.

Additionally, the aerospace and defense sector constitutes a critical, high-value customer base. Defense contractors utilize HPAB and its derivatives (like boron carbide) for manufacturing lightweight, high-performance armor ceramics for personnel and vehicles, as well as specialized components in high-temperature engine parts and tactical pyrotechnics. Finally, advanced materials research laboratories, particularly those focused on developing new battery technologies (solid-state electrolytes) and specialized medical radiation therapies (BNCT), serve as vital early adopters and purchasers, driving demand for experimental quantities of ultra-high purity material for prototype development and clinical trials.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 125.5 Million |

| Market Forecast in 2033 | USD 199.5 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Materion Corporation, American Elements, Sigma-Aldrich (Merck KGaA), Noah Technologies Corporation, Alfa Aesar (Thermo Fisher Scientific), Reade Advanced Materials, Skyspring Nanomaterials Inc., Treibacher Industrie AG, 3M Advanced Materials, Luoyang Wumeng Boron Carbide Co., Ltd., China Rare Metal Material Co., Ltd., New Materials Inc., Ceradyne (3M subsidiary), Atom-Metal S.A., Dalian Jinma Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High-Purity Amorphous Boron Market Key Technology Landscape

The technology landscape governing High-Purity Amorphous Boron production is highly sophisticated and proprietary, primarily focused on refining processes that transition from standard commercial-grade boron to ultra-high purity levels necessary for sensitive applications. Historically, the primary method involved the high-temperature reduction of boron halides, often using magnesium or hydrogen, followed by vacuum distillation. However, modern high-purity production increasingly relies on specialized chemical vapor deposition (CVD) or plasma reduction techniques. CVD allows for the precise deposition of boron films onto heated substrates, resulting in non-crystalline structures with significantly reduced inclusion of volatile impurities like carbon, oxygen, and nitrogen, crucial for electronic applications.

A key technological advancement involves isotopic separation and enrichment, particularly for Boron-10, which is paramount for the nuclear sector due to its high thermal neutron capture cross-section. Technologies like fractional distillation of boron trifluoride or ion-exchange chromatography are utilized to achieve the necessary enrichment levels, which are often bundled with subsequent high-purity amorphous synthesis. Furthermore, nanotechnology applications are gaining traction, with research focusing on synthesizing high-purity amorphous boron nanoparticles (nanoborides) with uniform size distribution for enhanced performance in composite materials and specialized drug delivery systems, requiring advanced milling and surface functionalization techniques.

Process analytical technology (PAT) is critical in maintaining product consistency across batches. Advanced spectroscopic methods, such as Inductively Coupled Plasma Mass Spectrometry (ICP-MS) and Glow Discharge Mass Spectrometry (GD-MS), are integral for confirming purity levels in the parts-per-billion range, ensuring compliance with stringent end-user specifications, particularly within the defense and semiconductor industries. The intellectual property surrounding these purification and analysis technologies represents a major competitive barrier, forcing market participants to continuously invest in R&D to optimize energy consumption and improve material yield while maintaining absolute purity standards.

Regional Highlights

The High-Purity Amorphous Boron market exhibits distinct regional dynamics driven by varying levels of industrialization, strategic governmental investments in energy and defense, and the geographic concentration of electronics manufacturing centers. Asia Pacific (APAC) stands out as the predominant consumption hub, fueled by the staggering scale of its semiconductor fabrication and consumer electronics industries. Countries like China, South Korea, and Japan are massive consumers of HPAB for doping agents, specialized sputtering targets, and advanced ceramic components used in thermal management solutions for high-density computing. Furthermore, China's aggressive expansion of its domestic nuclear power generation capacity and its robust aerospace sector contribute substantially to regional demand, often leveraging significant state resources to secure domestic supply chains for high-purity materials, which often leads to complex trade dynamics and pricing variances compared to Western markets.

North America, led by the United States, represents a major locus for both innovation and high-value consumption, particularly within the defense and specialized scientific research sectors. The market here is characterized by extremely stringent quality requirements mandated by government contracts for nuclear propulsion systems, advanced materials testing laboratories, and strategic weapons programs. The U.S. focus on developing SMRs and advanced reactor designs ensures a steady, high-specification demand for Boron-10 enriched HPAB. The region also hosts leading global semiconductor research institutions and specialized material producers who are constantly pushing the boundaries of purification technology, making North America critical for defining future material standards and applications, especially in emerging areas like BNCT and advanced photonics.

Europe presents a mature but steadily growing market, concentrating highly on advanced material science, automotive specialty components, and the revitalization of its civilian nuclear infrastructure, notably in France and the UK. European manufacturers often emphasize sustainable and energy-efficient production processes for HPAB, driven by stricter environmental regulations. Demand is robust from industrial clusters focused on high-performance alloys and refractory ceramics, which rely on the hardness and high melting point of boron compounds. Furthermore, European research programs dedicated to advanced energy solutions, including specialized materials for fusion energy experimentation, contribute to a stable, if slightly more regulated, demand profile for ultra-high purity amorphous boron, driving market focus toward certified ethical sourcing and supply chain transparency.

The Latin America (LATAM) and Middle East & Africa (MEA) regions currently account for a smaller share of the global HPAB market but show signs of emergent growth tied to specific national strategic investments. In LATAM, growth is often linked to localized industrial mineral processing and nascent research in specialized electronics, although reliance on imports for high-purity grades remains substantial. The MEA region is increasingly relevant due to heavy investments in defense procurement and the long-term strategic plans of Gulf nations to diversify energy portfolios, which includes exploring nuclear power generation. If these nuclear programs materialize, the demand for HPAB for shielding and control mechanisms could dramatically increase, transforming the regional market dynamic from a marginal consumer to a strategic procurement center, necessitating the establishment of dedicated supply channels.

The APAC region’s dominance is expected to be maintained, primarily driven by the ongoing technological arms race in semiconductors and the vast scaling of consumer electronics production. Regional players focus heavily on optimizing production efficiency to capture market share through competitive pricing, contrasting with the Western focus on ultra-specialized, high-margin applications. The interdependencies between raw borate suppliers (often concentrated) and high-tech processors (concentrated in APAC) define the flow and pricing power within the global value chain. Addressing supply chain resilience and purity validation remains the key challenge across all regions, especially given the dual-use nature of HPAB in both civilian and military applications, leading to complex export controls and licensing requirements that further segment the global market based on regulatory compliance capacity.

- Asia Pacific (APAC): Dominates consumption due to vast electronics, semiconductor manufacturing, and expanding nuclear energy sectors in China, South Korea, and Japan.

- North America: Key hub for technological innovation, high-value defense applications, SMR development, and advanced research (e.g., BNCT and aerospace materials).

- Europe: Focuses on advanced material science, stringent quality control, and automotive specialty ceramics; stable demand driven by established industrial bases.

- Latin America (LATAM): Emerging market with localized demand tied primarily to mineral processing and early-stage specialized industrial components.

- Middle East and Africa (MEA): Growth potential linked to future nuclear energy projects and current defense expenditure, dependent on securing stable import channels.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High-Purity Amorphous Boron Market.- Materion Corporation

- American Elements

- Sigma-Aldrich (Merck KGaA)

- Noah Technologies Corporation

- Alfa Aesar (Thermo Fisher Scientific)

- Reade Advanced Materials

- Skyspring Nanomaterials Inc.

- Treibacher Industrie AG

- 3M Advanced Materials

- Luoyang Wumeng Boron Carbide Co., Ltd.

- China Rare Metal Material Co., Ltd.

- New Materials Inc.

- Ceradyne (3M subsidiary)

- Atom-Metal S.A.

- Dalian Jinma Group

- Eti Maden (Raw Material Supplier Influence)

- Washington Mills Electro Minerals, Corp.

- Advanced Technology & Materials Co., Ltd. (AT&M)

- H.C. Starck GmbH

- Stanford Materials Corporation

Frequently Asked Questions

Analyze common user questions about the High-Purity Amorphous Boron market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications driving the demand for High-Purity Amorphous Boron?

The primary applications are neutron shielding and control in nuclear reactors, specialized semiconductor manufacturing (dopants and thin films), and the production of advanced ceramics like boron carbide for aerospace and defense applications.

Why is the purity level of amorphous boron crucial in this market?

High purity (often 99.99% or higher) is critical because impurities compromise performance in sensitive high-tech systems. In nuclear applications, contaminants interfere with neutron absorption, and in semiconductors, trace elements can disrupt device electrical properties, leading to failure.

How do geopolitical factors impact the supply chain for High-Purity Amorphous Boron?

Geopolitical factors heavily influence the market because the primary raw material, borate minerals, is geographically concentrated. This concentration creates supply vulnerabilities and price volatility, prompting end-users to seek diversified sourcing strategies and stable, long-term contracts.

Is High-Purity Amorphous Boron used in next-generation energy storage solutions?

Yes, HPAB is increasingly relevant in next-generation energy storage, specifically in the development of solid-state batteries, where boron compounds serve as critical components in protective layers or specialized electrolyte formulations due to their stability and electrical properties.

Which geographical region dominates the consumption of High-Purity Amorphous Boron?

The Asia Pacific (APAC) region currently dominates consumption, driven by its expansive electronics and semiconductor manufacturing industry, coupled with significant investments in both civilian nuclear energy infrastructure and advanced materials research.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager