High Purity Arsenic Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439514 | Date : Feb, 2026 | Pages : 242 | Region : Global | Publisher : MRU

High Purity Arsenic Market Size

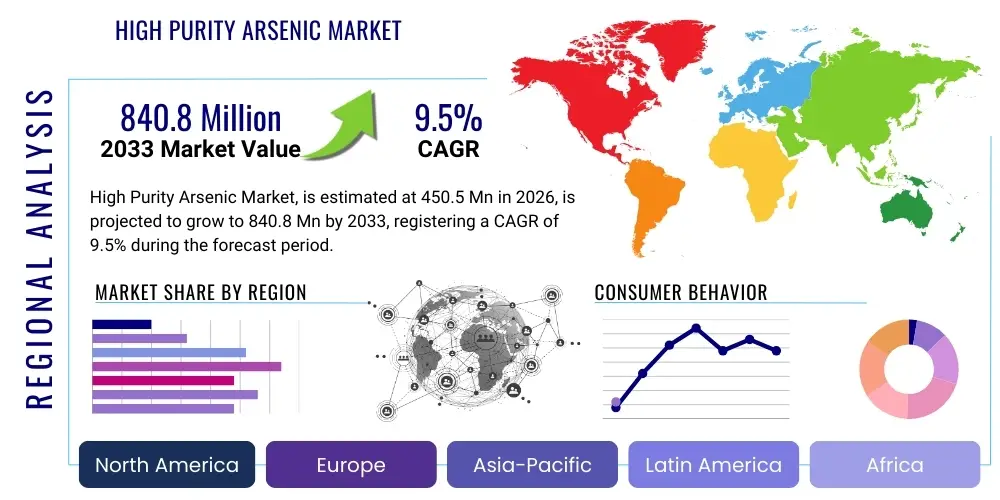

The High Purity Arsenic Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 840.8 Million by the end of the forecast period in 2033.

High Purity Arsenic Market introduction

High Purity Arsenic (HPA), a material defined by exceptional purity levels often exceeding five nines (99.999%, or 5N) and reaching up to seven nines (7N), serves as a foundational component in the highly sophisticated compound semiconductor industry. This specialized material is indispensable for the synthesis of III-V semiconductor compounds, notably Gallium Arsenide (GaAs) and Indium Arsenide (InAs), which are created through meticulous chemical processes such as Metalorganic Chemical Vapor Deposition (MOCVD) or Molecular Beam Epitaxy (MBE). The superior intrinsic properties of these HPA-derived compounds, including their direct bandgap for efficient light emission and absorption, and significantly higher electron mobility compared to traditional silicon, are crucial for modern high-performance electronic and optoelectronic devices. The demand for HPA is thus directly linked to technological advancement in areas requiring speed, efficiency, and specific light-handling capabilities.

HPA is primarily supplied in two critical forms: metallic elemental arsenic, used for crystal growth, and ultra-pure gaseous derivatives like arsine (AsH3), which is a key precursor used in MOCVD reactors for atomic layer deposition. The major applications leveraging HPA’s unique attributes include the manufacturing of semiconductor wafers for high-frequency Radio Frequency (RF) components utilized in 5G and emerging 6G telecommunications infrastructure. Furthermore, HPA is fundamental to advanced solar energy, particularly in the production of highly efficient multi-junction and Concentrator Photovoltaic (CPV) cells, where minimizing defects is paramount to achieving maximum energy conversion efficiency. Other significant uses involve high-power lasers, Vertical-Cavity Surface-Emitting Lasers (VCSELs) for 3D sensing, and specialized infrared detectors for defense and civil imaging systems. The benefit of using HPA-based materials lies in their ability to achieve device performance—such as high linearity and low noise—that is simply unattainable using conventional silicon substrates, establishing HPA as a non-substitutable strategic material.

Driving factors for the substantial market growth include the explosive global demand for advanced wireless communication technologies, particularly 5G and the nascent stages of 6G development, requiring faster, more efficient radio frequency (RF) components. Furthermore, the increasing complexity and volume of data processing necessitate specialized chips where high electron mobility is paramount. Global initiatives focused on renewable energy also bolster demand, as HPA is essential for manufacturing highly efficient Concentrator Photovoltaic (CPV) solar cells and tandem cells, pushing the limits of energy conversion efficiency in the commercial sector. These structural demands solidify HPA's role as a strategic material in the global high-tech supply chain, ensuring sustained investment in purification and application technologies. The technological imperative for faster, smaller, and more efficient electronic devices guarantees the enduring necessity and high value of ultra-pure arsenic materials in the global high-tech supply chain, supporting substantial capital investment across the value chain, from mining to final purification and processing.

High Purity Arsenic Market Executive Summary

The High Purity Arsenic Market operates within a narrow, highly competitive sphere dominated by a few key global suppliers capable of meeting the rigorous quality standards of the semiconductor industry. Current business trends emphasize vertical integration and secure sourcing, as semiconductor manufacturers seek to stabilize their supply of 6N and 7N HPA to mitigate risks associated with geopolitical volatility and single-source dependency. There is a strong commercial focus on enhancing the repeatability of purification processes, leveraging advanced analytics and automation to maintain ultra-low impurity levels, often targeting specific metallic and non-metallic trace elements that can severely compromise device performance. Furthermore, strategic alliances between material suppliers (e.g., 5N Plus, AXT Inc.) and device fabricators are increasingly common, aimed at co-developing specialized precursor materials tailored for next-generation epitaxial growth systems used in critical applications like advanced micro-LEDs and high-speed memory interfaces, securing long-term demand visibility.

Regional dynamics clearly place the Asia Pacific (APAC) region, primarily led by powerhouse economies such as China, South Korea, and Taiwan, as the dominant force in both HPA consumption and capacity expansion. This supremacy is a direct consequence of the region’s massive, sustained investment in state-of-the-art semiconductor fabrication facilities (fabs) and global leadership in consumer electronics manufacturing and assembly. While APAC focuses heavily on high-volume production of standard GaAs wafers for consumer devices, North America and Europe retain specialized significance. These Western markets prioritize the highest-value, lowest-volume applications, particularly military, space-grade electronics, and advanced R&D initiatives involving materials for quantum computing and highly specialized photonic devices. This regional segmentation means that while APAC dictates market volume and pricing, North America often sets the technical benchmark for the maximum achievable purity grade (7N and above), driving innovation in purification technology globally, and ensuring the market is balanced between high volume requirements and extremely high specification needs, contributing significantly to market structure consolidation.

Segment trends confirm the ascendancy of the higher purity grades, particularly the 6N and 7N segments, which are experiencing accelerated growth rates due to the ongoing miniaturization of semiconductor components and the push for performance limits in optoelectronic devices. The Application segment remains firmly anchored by Semiconductor Manufacturing, constituting the largest share, fueled by ubiquitous wireless infrastructure demands. However, the Lasers and Optoelectronics segment, which includes VCSELs used in consumer depth sensing (e.g., smartphones and automotive LiDAR) and high-power industrial lasers, is emerging as the fastest-growing application segment. This structural shift highlights the transition from HPA simply being a material for high-speed components to becoming an essential element for complex sensing and photonic systems, demanding even more rigorous control over material quality and consistency across various product forms, including both metallic sources and arsine gas precursors. The diversification of applications ensures market resilience against potential saturation in any single end-user category and guarantees continuous technological investment in the HPA sector.

AI Impact Analysis on High Purity Arsenic Market

User queries regarding Artificial Intelligence (AI) frequently explore how AI infrastructure directly drives the consumption of High Purity Arsenic, focusing on the specialized hardware needed to support compute-intensive AI workloads. The underlying reality is that AI necessitates vast data transfer capabilities, and HPA-derived Gallium Arsenide (GaAs) components, specifically power amplifiers (PAs) and filters, are non-negotiable for the highly efficient 5G and nascent 6G networks that feed massive datasets to AI training clusters globally. Users also question the efficiency gains achievable by applying AI/Machine Learning (ML) within the HPA value chain itself, particularly concerning the notoriously difficult processes of ultra-purification and defect reduction during crystal growth. The community seeks clarification on whether AI enables smarter manufacturing, thereby reducing the production bottleneck associated with attaining 7N purity, or if its primary role is solely as a massive demand generator for the high-speed infrastructure that HPA enables.

The core commercial impact of AI on the HPA market stems from its role as an enabling technology requiring advanced communications infrastructure. AI training models and large language models (LLMs) depend on massive data centers interconnected by high-speed optical fiber networks. These optical networks increasingly rely on photonic integrated circuits (PICs) and Vertical-Cavity Surface-Emitting Lasers (VCSELs) for intra-data center communication—components frequently fabricated using GaAs and other III-V materials derived from HPA precursors. This indirect, yet powerful, demand drives sustained consumption, particularly in the optoelectronics segment. Furthermore, the deployment of AI at the edge (e.g., autonomous vehicles, smart manufacturing) demands robust, high-speed connectivity, reinforcing the requirement for highly reliable GaAs RF components, which are essential for transmitting real-time sensor data efficiently back to centralized AI systems for processing and decision-making. The increasing reliance on sensor data processing and rapid decision cycles ensures that the demand for high-speed, HPA-enabled communication hardware will only intensify as AI integration deepens across all industrial sectors.

Technologically, AI is poised to revolutionize the material science and manufacturing processes intrinsic to HPA production. Achieving 7N purity requires controlling impurities at the parts-per-trillion level, a monumental task traditionally managed through iterative physical processes like zone refining. ML algorithms are now being deployed to analyze real-time spectral and thermodynamic data from purification chambers, predicting optimal refinement cycle duration and power application to maximize impurity segregation. This predictive capability minimizes wasted material and reduces the expensive, time-consuming quality assurance testing cycle. Similarly, in the downstream process of growing GaAs wafers, AI models analyze in-situ sensor data during MOCVD to predict and mitigate crystal lattice defects, directly improving the yield of high-quality HPA-derived semiconductor wafers. This application of AI transforms HPA manufacturing from a heuristic process into a data-driven science, lowering operational variances and solidifying the reliable supply of ultra-high purity material essential for next-generation AI hardware accelerators and sensors, thereby enhancing supply chain resilience and material cost efficiency across the board.

- AI drives demand for HPA in enabling 5G and optical interconnects foundational to data centers.

- Increased utilization of HPA-based RF components (GaAs PAs) for AI data transmission infrastructure.

- AI algorithms optimize HPA purification processes (zone refining, sublimation) for higher yields and purity (e.g., 7N).

- Machine learning models predict and monitor defects during MOCVD/MBE growth of GaAs wafers, improving material consistency.

- AI necessitates high-speed optoelectronic components (VCSELs) utilizing HPA for faster intra-data center communication.

- Predictive maintenance in complex HPA processing equipment reduces downtime and operational costs.

- AI enhances HPA quality control by interpreting advanced mass spectrometry data (ICP-MS/GDMS) for trace element analysis.

- ML aids in the development of new HPA-based compound semiconductor formulations for specialized AI processors.

DRO & Impact Forces Of High Purity Arsenic Market

The growth trajectory of the High Purity Arsenic Market is powerfully accelerated by several key Drivers, most notably the relentless global investment in 5G and forthcoming 6G network infrastructure, which inherently relies on the superior switching speeds and linearity offered by Gallium Arsenide (GaAs) components derived from HPA. This infrastructural demand is compounded by the burgeoning commercialization of optoelectronics, particularly high-volume manufacturing of VCSELs for 3D sensing and advanced displays (e.g., micro-LEDs), which mandate materials of 6N purity or higher. Furthermore, the strategic imperative of securing high-efficiency solar cells for both terrestrial and aerospace applications provides a stable, long-term driver for specialized HPA consumption. These drivers create a compelling economic justification for the significant capital expenditure required in high-purity material production, ensuring continuous market momentum despite the numerous hurdles present in the supply chain, while technological advancements in epitaxial growth further necessitate purer starting materials, intensifying this driving force.

Conversely, the market faces significant Restraints that temper growth and elevate operational complexity. The most critical restraint is the extreme toxicity of arsenic, which necessitates rigorous, costly regulatory compliance (such as the EU's REACH regulations and strict OSHA guidelines in the US) throughout the entire value chain—from sourcing and refinement to transportation and waste disposal. This high regulatory burden acts as a substantial barrier to entry, limiting competition and concentrating supply among experienced, highly compliant players. An additional restraint is the high capital investment required for purification equipment, such as state-of-the-art zone refiners and ultra-pure gas handling systems, coupled with the inherent low yield rates associated with achieving 7N purity, contributing to high production costs and pricing volatility for the end-user. The limited geographical distribution of primary raw material sources, often tied to base metal mining, also poses a significant risk of supply disruption due to geopolitical events or sudden mining capacity changes.

Opportunities for sustained market expansion are concentrated in technological diversification and process innovation. The emerging potential of HPA-based materials in advanced computing, including niche quantum device fabrication and specialized high-temperature/high-radiation electronics for defense and space, promises high-value, albeit lower-volume, market segments. Moreover, technological advancements in recycling and closed-loop material recovery systems present a dual Opportunity: reducing reliance on volatile primary raw material sources (often byproducts of other metal mining) and simultaneously mitigating environmental liability by minimizing hazardous waste. The key Impact Forces affecting the market equilibrium include geopolitical tensions that threaten the stability of the highly centralized global supply of raw arsenic feedstock, and competitive pressures from alternative wide-bandgap semiconductors like Gallium Nitride (GaN) and Silicon Carbide (SiC) in certain power electronics applications, although these alternatives do not fully substitute GaAs in high-frequency RF applications, compelling HPA producers to focus on differentiated, non-substitutable performance attributes.

Segmentation Analysis

The High Purity Arsenic Market segmentation is fundamentally driven by the required purity level, which is directly correlated with the sensitivity and performance specifications of the final device. The market is rigorously divided into 5N, 6N, and 7N grades, where the demand shift is overwhelmingly moving towards 6N and 7N materials as device architectures become smaller, faster, and more defect-intolerant. These purity grades determine the applicability, with 7N material exclusively reserved for the most demanding epitaxial processes used in high-performance solar cells and military-grade infrared sensors. Furthermore, the market is segmented by the physical Form in which HPA is delivered (elemental solid arsenic, arsine gas, or precursor compounds), reflecting the differing input needs of various semiconductor manufacturing techniques like MBE and MOCVD, ensuring that material suppliers meet the precise chemical and physical requirements of the downstream process engineers.

- By Purity Grade:

- 5N (99.999%): Standard industrial grade for less sensitive applications.

- 6N (99.9999%): Critical for most high-speed RF and standard optoelectronic devices.

- 7N (99.99999%): Essential for multi-junction solar cells, advanced lasers, and critical military applications.

- Other Grades (e.g., 8N potential): Future grades for specialized quantum computing research.

- By Form:

- Elemental Arsenic: Used for bulk crystal growth, typically via Vertical Gradient Freeze (VGF) or Liquid Encapsulated Czochralski (LEC) methods.

- Arsine Gas (AsH3): Ultra-pure precursor gas, crucial for Metalorganic Chemical Vapor Deposition (MOCVD) processes.

- Arsenic Compounds: Specialized compounds used in niche synthesis or doping.

- By Application:

- Semiconductor Manufacturing (GaAs, InAs Wafers): Dominant segment driven by RF and high-speed logic circuits.

- Solar Cells (CPV and Multijunction Cells): Requires 7N purity to maximize conversion efficiency.

- Lasers and Optoelectronics (VCSELs, LEDs, Detectors): Rapidly growing segment driven by 3D sensing and fiber optics.

- Chemicals Synthesis and Catalysis: Niche use in specialized chemical production.

- Aerospace and Defense: High-reliability components for satellite and radar systems.

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Value Chain Analysis For High Purity Arsenic Market

The High Purity Arsenic value chain initiates with the upstream sourcing of raw materials, where arsenic trioxide is typically recovered as a byproduct of smelting non-ferrous metals like copper, lead, and zinc. This initial sourcing stage is crucial because the quality and concentration of arsenic in the primary ore significantly influence the complexity and cost of subsequent purification. Geopolitical risk factors are prominent here, as raw material supply is highly concentrated in specific regions, making secure, long-term off-take agreements critical for stable downstream production. Initial purification steps involve chemical refining and reduction to produce industrial-grade metallic arsenic, which then enters the specialized high-purity refinement stage, characterized by substantial capital investment in specialized infrastructure and high energy consumption for initial material processing and handling before the ultra-purification begins in earnest.

The midstream segment is where the intrinsic value is added through highly proprietary, multi-stage purification techniques, including repeated cycles of zone refining, high-vacuum distillation, and fractional sublimation. This segment is dominated by a few global material specialists (e.g., 5N Plus, Umicore) who possess the intellectual property and analytical capabilities (GDMS, ICP-MS) necessary to certify materials at 6N and 7N purity. Simultaneously, other specialists convert elemental HPA into ultra-pure precursor gases like arsine (AsH3), requiring intricate chemical processing and specialized cylinder technology to maintain purity and safety during transport. The successful transformation of industrial arsenic into ultra-high purity semiconductor precursors represents the most significant technological hurdle in the entire chain, defining market control and profitability. The strict quality gates imposed by the downstream industry necessitate continuous monitoring and iterative refinement of these midstream processes to eliminate trace metallic contaminants and achieve parts per trillion purity levels.

The downstream segment includes the compound semiconductor wafer growers who utilize the HPA precursors to create substrates (e.g., GaAs wafers) via advanced epitaxial techniques. These wafers are subsequently processed by device manufacturers—such as RF integrated circuit producers, laser manufacturers, and defense contractors—to create final high-performance electronic components. Distribution channels are predominantly direct, characterized by highly secured logistics protocols due to the material's toxicity and high value. Direct contracts ensure material traceability, rapid response to quality deviations, and optimized just-in-time delivery to sensitive cleanroom environments. Indirect distribution through specialized chemical and gas intermediaries is limited primarily to regional markets or lower-volume research applications, emphasizing the strategic importance of close, direct manufacturer-supplier relationships to maintain product integrity and stable sourcing for critical national technology supply chains, thereby minimizing contamination risk during handling and transit.

High Purity Arsenic Market Potential Customers

The market for High Purity Arsenic is defined by a highly selective customer base that relies on the material for specialized, performance-driven manufacturing. Primary customers are large-scale Compound Semiconductor Wafer Manufacturers, such as AXT Inc. and Sumitomo Electric, who operate advanced fabrication facilities that grow single-crystal GaAs, InAs, and other alloys. These entities require bulk quantities of HPA precursors (both elemental arsenic and arsine gas) that meet stringent 6N or 7N purity specifications to ensure high yield rates for their expensive, highly customized wafer products. Their procurement strategy emphasizes long-term contracts and dual-sourcing to guarantee stability and prevent contamination, as their entire manufacturing process is dependent on the certified purity of the feedstock HPA, which directly impacts the performance of thousands of downstream electronic devices.

A second crucial segment includes manufacturers of Radio Frequency (RF) and Microwave components, serving the telecommunications and defense sectors. Companies like Qorvo, Broadcom, and Skyworks, who fabricate power amplifiers, switches, and monolithic microwave integrated circuits (MMICs) for 5G devices and radar systems, are key indirect consumers, demanding wafers derived from HPA. This segment’s requirement is driven by the necessity for high power handling and linearity which GaAs provides over silicon, cementing HPA's role in the wireless connectivity ecosystem. Their procurement impact flows back to the wafer manufacturers, creating persistent, high-volume demand for reliable HPA supply for high-end consumer and military RF front-ends, with a critical emphasis on lot-to-lot consistency to maintain device performance standards necessary for global network reliability and efficiency.

Finally, the growing sectors of Optoelectronics and Advanced Energy constitute another core customer base. This includes firms producing Vertical-Cavity Surface-Emitting Lasers (VCSELs) for consumer electronics (e.g., depth mapping, LiDAR), high-efficiency solar energy companies specializing in multi-junction cells, and manufacturers of sophisticated infrared sensors. These customers require HPA for its optical properties (direct bandgap). Their technical specifications often demand the absolute highest purity levels (7N), and they are willing to pay a premium for materials that ensure minimal defects, maximum device lifetime, and superior optical efficiency, supporting the continuous investment in advanced purification technologies across the market. Niche customers also include academic and corporate research labs focused on advanced materials for quantum computing, requiring unique, small-batch, extremely high-purity HPA compounds for experimental purposes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 840.8 Million |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 5N Plus, Umicore, Xtal Technology, AXT Inc., Materion Corporation, China Germanium, II-VI Incorporated (Coherent), Sumitomo Electric Industries, Saint-Gobain, Wafer Technology Ltd., Advanced Chemical Company, PAM-XIAMEN, Luvata, Semiconductor Wafer, Inc., IQE plc, JX Nippon Mining & Metals Corporation, Hebei Pengda Group, Nanjing Germanium Co., Ltd., Merck KGaA, ALB Materials Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Purity Arsenic Market Key Technology Landscape

The technological core of the High Purity Arsenic market revolves around mastery over fractional purification techniques designed to remove impurities down to parts per billion and even parts per trillion concentrations. Zone refining remains the cornerstone technology for metallic arsenic purification, utilizing the principle that impurities are preferentially soluble in the molten phase compared to the solid phase. Modern zone refining equipment employs magnetic stirring, precise temperature gradient control, and ultra-clean environments to perform hundreds of passes, systematically segregating residual contaminants such as metallic trace elements (Fe, Zn, Cu) and non-metallics (Si, C). Continuous technological improvements focus on refining the thermal profile accuracy and automating the process via sensors and proprietary software to increase yield rates and reduce the operational cycle time required to achieve the necessary 6N and 7N purity levels for advanced semiconductor applications, demanding extensive R&D investment into proprietary process control algorithms.

Complementary to zone refining are advanced chemical processes, critically high-vacuum fractional sublimation and specialized distillation, necessary for preparing ultra-pure arsine gas (AsH3), a key precursor used in MOCVD. Sublimation techniques leverage the high vapor pressure of arsenic to separate it from less volatile impurities under high vacuum. The challenge in arsine production is not only the purification of the gas itself but also the maintenance of this purity during storage and delivery, necessitating specialized, inert gas handling systems and high-integrity storage cylinders to prevent degradation or contamination by oxygen or moisture. Rigorous analytical verification using highly sensitive techniques like GDMS (Glow Discharge Mass Spectrometry) and HR-ICP-MS (High-Resolution Inductively Coupled Plasma Mass Spectrometry) is an integral part of the technology landscape, providing certified quality assurance to end-users by confirming impurity levels are below the required detection limits, often demanding analytical instrumentation capable of measuring below 1 ppt, which requires highly specialized cleanroom laboratory environments.

Looking forward, the technology landscape is being shaped by environmental sustainability and process efficiency. Innovation is directed towards developing safer handling procedures, establishing efficient material recycling loops, and reducing the energy footprint of purification. Research into advanced solvent extraction methods and electrochemical purification techniques offers alternatives to traditional energy-intensive zone refining. Crucially, the integration of Industry 4.0 principles, including high-throughput experimentation and AI-driven process modeling, is enabling manufacturers to predict material behavior during purification and growth processes. This predictive modeling allows for rapid adjustment of parameters, moving the industry toward a digitally optimized manufacturing paradigm that promises higher throughput, improved material consistency, and accelerated development of even purer grades (8N), essential for experimental quantum and terahertz technologies, securing the market's long-term competitive technological edge against potential silicon-based substitutes and minimizing exposure to hazardous handling through automation.

Regional Highlights

- Asia Pacific (APAC): APAC solidifies its position as the global powerhouse for High Purity Arsenic consumption, fueled by the strategic semiconductor hubs in Taiwan, South Korea, and China. The region's extensive ecosystem, which includes the majority of the world's compound semiconductor foundries, drives unparalleled demand for high-volume GaAs and InAs wafers used in 5G smartphones, wireless base stations, and high-density computing. Government-backed initiatives, particularly in China and South Korea, aimed at achieving self-sufficiency in critical electronic materials, continue to inject massive capital into expanding both the capacity for raw material purification and downstream wafer fabrication, leading to the highest concentration of HPA market activity globally and setting the pace for medium-purity (5N/6N) market pricing and volume trends.

- North America: North America is defined by its focus on premium, highly specialized, and defense-related HPA applications. The demand centers around high-performance RF components for military radar and secure communication, as well as cutting-edge R&D in optoelectronics (LiDAR, space-grade solar cells). The region is a key driver for 7N purity demand, as these applications tolerate zero defects and require maximum operational reliability in extreme environments. Although the volume of consumption is lower than APAC, the value per unit of HPA sold is typically higher, reflecting the extreme quality assurance and certification requirements, with major manufacturers maintaining stringent control over material sourcing to comply with defense regulations and secure critical technology supply chains, often engaging in highly bespoke supply agreements.

- Europe: The European market maintains a steady, mature presence, characterized by strong demand from the automotive sector for advanced sensing and lighting systems (e.g., matrix LEDs, LiDAR components) and a substantial presence in industrial laser and research institutions focusing on photonics. Europe's market growth is often slower but highly stable, influenced significantly by its pioneering role in environmental and safety regulation (e.g., strict management of hazardous materials under REACH). This regulatory environment necessitates that HPA suppliers operating in Europe adopt the highest standards for waste management and transportation, pushing technological innovation toward safer, cleaner production methods and ensuring material quality is maintained throughout complex supply logistics, contributing to high operational stability.

- Latin America, Middle East, and Africa (LAMEA): This combined region currently represents the smallest market share, with consumption largely reliant on imported finished components rather than local HPA purification or wafer fabrication. However, the Middle East is witnessing emerging, high-value demand linked to regional governmental pushes for large-scale digital transformation and the establishment of major data centers, requiring significant optoelectronics infrastructure utilizing HPA-derived components. Latin America and Africa hold potential as sources for raw arsenic feedstock due to extensive mining operations, but the high-tech infrastructure necessary for ultra-purification remains underdeveloped, positioning these areas primarily as upstream resource suppliers rather than advanced material consumers in the short to medium term, relying heavily on foreign expertise for material processing.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Purity Arsenic Market.- 5N Plus

- Umicore

- Xtal Technology

- AXT Inc.

- Materion Corporation

- China Germanium

- II-VI Incorporated (Coherent)

- Sumitomo Electric Industries

- Saint-Gobain

- Wafer Technology Ltd.

- Advanced Chemical Company

- PAM-XIAMEN

- Luvata

- Semiconductor Wafer, Inc.

- IQE plc

- JX Nippon Mining & Metals Corporation

- Hebei Pengda Group

- Nanjing Germanium Co., Ltd.

- Merck KGaA

- ALB Materials Inc.

Frequently Asked Questions

Analyze common user questions about the High Purity Arsenic market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is High Purity Arsenic and why is its purity level critical for semiconductors?

High Purity Arsenic (HPA) refers to material with purity exceeding 99.999% (5N). It is a foundational precursor for III-V compound semiconductors like Gallium Arsenide (GaAs). Extremely high purity (6N or 7N) is critical because even trace impurities, measured in parts per billion (ppb), can significantly alter the electronic properties and crystal structure of the resulting epitaxial wafer, leading to reduced device reliability and premature failure in high-speed RF components and sensitive optoelectronic devices such as VCSELs.

Which applications drive the majority of demand in the High Purity Arsenic Market, particularly for 5G?

The primary driver of HPA demand is the Semiconductor Manufacturing sector, specifically for creating GaAs wafers used in Radio Frequency (RF) components. These components, including high-efficiency power amplifiers and low-noise switches, are essential for transmitting and receiving signals in 5G/6G wireless communication infrastructure and satellite radar systems, leveraging GaAs's superior electron mobility compared to standard silicon technology.

How do purification technologies like Zone Refining contribute to achieving 7N purity HPA?

Zone refining is a critical technological process for HPA purification. It involves repeatedly melting and solidifying the arsenic material under tightly controlled conditions. Impurities are segregated to the molten zone due to differing solubility, allowing them to be systematically removed. Multiple passes of this technique are required, combined with high-vacuum processing and rigorous analytical verification (GDMS), to achieve ultra-high purity grades like 7N for mission-critical applications.

What are the main restraints to market growth considering the material's toxic nature?

The main restraints are the extreme regulatory burden and high capital expenditure associated with safely handling toxic arsenic. Compliance with global environmental safety standards (e.g., REACH, specific hazardous waste disposal protocols) imposes significant operational costs, creates high barriers to entry, and necessitates specialized, capital-intensive infrastructure for purification, transport, and storage, limiting the number of global suppliers.

What role does the Asia Pacific region play in the global High Purity Arsenic Market?

The Asia Pacific (APAC) region is the global leader in both the consumption and specialized production of HPA. Fueled by massive investments in semiconductor fabs and compound semiconductor foundries in countries like China, South Korea, and Taiwan, APAC dominates the downstream manufacturing processes that rely on HPA precursors for high-volume applications in consumer electronics, 5G devices, and solar energy systems, setting the global pace for market volume and material supply.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager