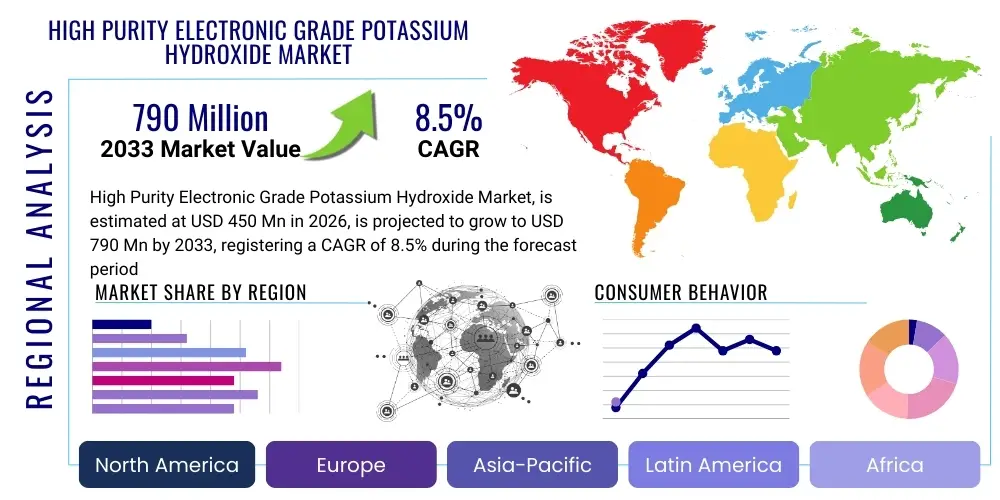

High Purity Electronic Grade Potassium Hydroxide Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439093 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

High Purity Electronic Grade Potassium Hydroxide Market Size

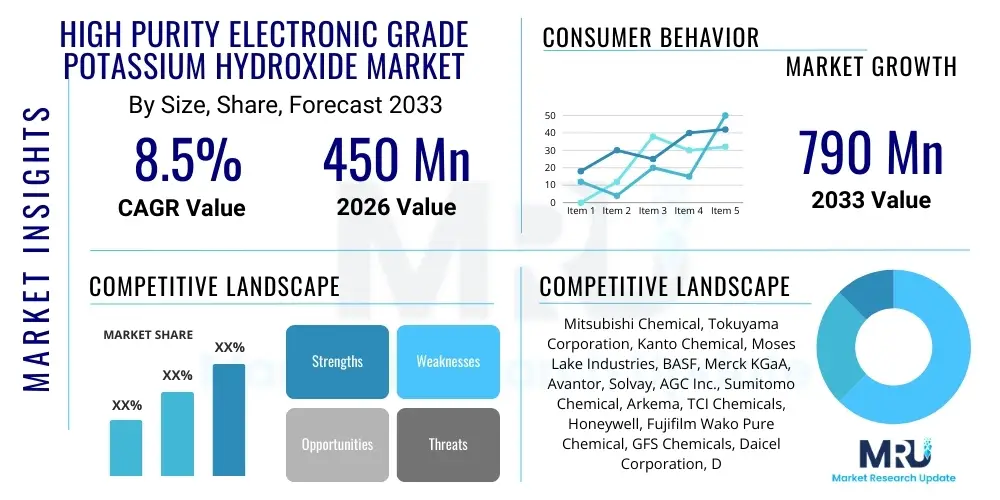

The High Purity Electronic Grade Potassium Hydroxide Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 790 Million by the end of the forecast period in 2033.

High Purity Electronic Grade Potassium Hydroxide Market introduction

High Purity Electronic Grade Potassium Hydroxide (KOH) is a critical chemical utilized extensively in the high-tech electronics and semiconductor industries. Distinguished by its exceptionally low levels of metallic impurities, typically measured in parts per billion (ppb) or parts per trillion (ppt), this specialty chemical is indispensable for processes requiring ultra-clean environments and precise chemical reactions, ensuring the integrity and performance of advanced electronic components. Its market growth is intrinsically tied to the rapid expansion of semiconductor fabrication plants (fabs) and the increasing complexity of integrated circuits (ICs), which demand higher purity etching and cleaning agents.

The product, often delivered in aqueous solution form, serves primarily as an anisotropic etchant for silicon wafers, a crucial step in Micro-Electro-Mechanical Systems (MEMS) production, and a cleaning agent for sensitive electronic substrates. Furthermore, it plays a vital role in the manufacturing of advanced display technologies, including OLED and high-resolution LCD panels, where the quality of the raw materials directly impacts the final display performance. Its dual functionality as both a precise etchant and a high-efficiency cleaning solution positions it as a foundational material supporting the global digital infrastructure.

Major driving factors include the relentless miniaturization trend in electronics, necessitating stricter purity standards for wet chemicals, the massive governmental and private investments into domestic semiconductor supply chains (such as the CHIPS Act in the US and similar initiatives in Europe and Asia), and the burgeoning demand for consumer electronics, automotive electronics, and high-speed computing infrastructure. The inherent benefits of using high purity electronic grade KOH—namely, reduced defect rates, enhanced device reliability, and compliance with stringent industry specifications—solidify its position as a high-value commodity within the specialty chemicals landscape.

High Purity Electronic Grade Potassium Hydroxide Market Executive Summary

The High Purity Electronic Grade Potassium Hydroxide market is experiencing significant upward momentum, primarily fueled by robust global demand for advanced semiconductors, particularly those used in 5G infrastructure, electric vehicles, and high-performance computing centers. Business trends indicate a strong focus on supply chain resilience, leading to increased strategic partnerships between specialty chemical producers and major foundries. Manufacturers are heavily investing in capacity expansion and purification technology upgrades, aiming to achieve ultra-high purity levels (6N and 7N) to meet the evolving requirements of sub-10nm node fabrication. Pricing stability, despite fluctuating raw material costs, is maintained due to the specialized nature and high barrier to entry for producing electronic-grade chemicals.

Regionally, Asia Pacific maintains its dominance, driven by the concentration of leading semiconductor manufacturing hubs in countries like Taiwan, South Korea, China, and Japan. This region exhibits the highest growth trajectory due to ongoing massive fab construction projects and government incentives promoting local chemical sourcing. North America and Europe are also showing accelerated growth, largely attributed to governmental efforts aimed at reshoring semiconductor manufacturing capabilities, thereby increasing localized demand for essential process chemicals like high purity KOH. Latin America and MEA currently represent niche markets but are expected to see moderate growth associated with localized electronics assembly.

Segment trends reveal that the highest growth rate is observed in the ultra-high purity segment (6N and above), reflecting the industry's shift towards advanced logic and memory chips. Application-wise, semiconductor etching remains the largest segment, but solar cell production and advanced display fabrication are gaining traction as high-growth secondary applications. Strategic shifts towards sustainable manufacturing processes, including optimized recycling and reduced chemical consumption, are also influencing product development and delivery mechanisms across all market segments.

AI Impact Analysis on High Purity Electronic Grade Potassium Hydroxide Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the High Purity Electronic Grade Potassium Hydroxide (HP EG KOH) market center around how AI-driven demand affects chemical purity requirements, the role of AI in optimizing chemical production processes, and whether AI can accelerate the development of alternative etching or cleaning agents. Key themes include the exponential growth in demand for High-Performance Computing (HPC) chips necessary for training and running large AI models, which directly translates into a need for increased volumes of ultra-pure process chemicals. Concerns often revolve around whether the current supply chain can scale quickly enough to support the sudden, massive expansion required by AI data centers, and how AI can be integrated into Quality Control (QC) to maintain consistent purity at the ppb/ppt levels required.

AI's influence is multifaceted: on the demand side, it significantly boosts the volume and complexity of semiconductor manufacturing, ensuring sustained high demand for HP EG KOH. Specifically, advanced AI chips (GPUs, TPUs, specialized accelerators) utilize the most advanced lithography nodes, which are highly sensitive to impurities, thereby driving the need for 6N and 7N purity levels. On the supply side, AI and machine learning algorithms are increasingly being used to optimize the highly complex purification and quality assurance stages during KOH production. This includes predictive maintenance of electrolytic cells and real-time monitoring of impurity levels, leading to higher yields and reduced production variability, which are critical competitive advantages in the specialty chemical sector.

Furthermore, AI-powered predictive modeling is accelerating R&D efforts in formulating next-generation chemical solutions. While AI might not replace KOH immediately, it aids in optimizing the etching recipes where KOH is used, improving process efficiency, and potentially lowering overall consumption per wafer through highly precise robotic dispensing systems. The requirement for vast server farms and data centers to run AI applications solidifies the long-term consumption outlook for HP EG KOH as an essential material for the underlying hardware infrastructure.

- AI-driven semiconductor demand accelerates the market size and complexity, especially for advanced nodes (sub-10nm).

- AI enhances manufacturing efficiency and yield in KOH production via real-time purity monitoring and predictive maintenance.

- HPC and data center infrastructure expansion, driven by AI adoption, necessitates large, consistent supplies of ultra-high purity KOH.

- Machine Learning aids in optimizing chemical etching processes, potentially improving the efficiency of KOH utilization in fabs.

- Increased investment in AI chip manufacturing heightens the market focus on 6N and 7N purity grades.

DRO & Impact Forces Of High Purity Electronic Grade Potassium Hydroxide Market

The High Purity Electronic Grade Potassium Hydroxide market is influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming the Impact Forces shaping its future trajectory. Key drivers center on the insatiable global demand for electronic devices and advanced computing power, directly translating into increased semiconductor manufacturing output. Significant governmental investment in localized semiconductor supply chains across North America, Europe, and India is acting as a major catalyst, diversifying demand away from traditional Asian hubs and creating new geographical consumption centers. The rapid adoption of IoT, 5G, and advanced automotive electronics further reinforces the consistent need for ultra-pure process chemicals.

However, the market faces significant restraints. The primary challenge is the exceedingly high capital expenditure required for establishing and maintaining ultra-purification facilities, creating substantial entry barriers for new competitors. Furthermore, the handling, storage, and transportation of corrosive, high-purity chemicals present complex logistical and safety challenges, which increase operational costs. Supply chain vulnerabilities, particularly concerning sourcing of high-grade raw materials and specialized equipment, coupled with stringent environmental regulations regarding effluent treatment, pose ongoing hurdles for manufacturers attempting rapid expansion.

Opportunities for growth are abundant, particularly in innovation. The push towards 7N purity and beyond, driven by advanced 3nm and 2nm node manufacturing, offers premium pricing potential for technologically capable suppliers. The increasing importance of MEMS devices in sensors and actuators creates a significant application niche for KOH etchants. Moreover, developing localized, closed-loop supply systems that incorporate advanced chemical recycling and regeneration technologies offers a dual benefit: reducing environmental impact and mitigating supply risks, presenting a lucrative avenue for future investment and differentiation among market players. These impact forces collectively dictate production strategies and investment decisions within this highly specialized market segment.

- Drivers: Global expansion of semiconductor manufacturing; rising demand for advanced consumer electronics; government-backed initiatives for supply chain localization; proliferation of 5G, IoT, and electric vehicle components.

- Restraints: Extremely high capital costs for purification infrastructure; stringent purity requirements (high rejection rates); complex logistics and safety regulations for handling corrosive chemicals; dependency on a few specialized equipment suppliers.

- Opportunities: Development of ultra-high purity grades (7N and above); expansion into high-growth applications like advanced flexible displays and MEMS sensors; implementing sustainable chemical recycling and regeneration technologies; tapping into emerging semiconductor manufacturing regions (India, Southeast Asia).

- Impact Forces: High barrier to entry maintains market stability; supply chain resilience is paramount; technological innovation in purification defines competitive advantage; market growth pace is directly coupled with semiconductor capital expenditure cycles.

Segmentation Analysis

The High Purity Electronic Grade Potassium Hydroxide market is comprehensively segmented based on purity level, application, and form, reflecting the diversified demands originating from the microelectronics industry. Analyzing these segments is crucial for understanding market dynamics, investment hotspots, and technological requirements across the value chain. Purity level segmentation is arguably the most critical dimension, as modern semiconductor fabrication requires increasingly lower metallic contamination thresholds, driving the market toward the ultra-high purity tiers (6N and 7N) to minimize defects in sensitive device structures.

Application segmentation illustrates where the highest volumes of HP EG KOH are consumed. While the semiconductor industry, specifically silicon etching and cleaning, dominates the demand, the rapid growth in advanced display technologies (OLEDs) and emerging energy solutions (solar cells) provides critical diversification and stable long-term growth platforms. Furthermore, the segmentation by form (aqueous solution vs. solid pellets/flakes) addresses logistical and application-specific needs, with aqueous solutions being preferred for wet processes within fabs due to ease of handling and precise concentration control.

Geographic segmentation, detailed elsewhere, highlights the significant influence of Asia Pacific due to its semiconductor manufacturing dominance. However, strategic analysis of purity and application segments allows producers to tailor their product offerings. For instance, manufacturers focused on the 7N purity segment primarily target leading logic foundries, while those specializing in 5N purity can serve the broader LCD display and general electronics cleaning markets. This granular segmentation provides a clear roadmap for market penetration and product portfolio management.

- By Purity Level:

- 5N Grade (99.999% purity)

- 6N Grade (99.9999% purity)

- 7N Grade (99.99999% purity and above)

- By Application:

- Semiconductor Etching and Cleaning (Silicon Wafer Processing)

- Micro-Electro-Mechanical Systems (MEMS) Production

- LED Manufacturing (Epitaxial Growth and Cleaning)

- Solar Cell Production (Texturing and Cleaning)

- Advanced Display Fabrication (OLED/LCD)

- By Form:

- Aqueous Solution (Various concentrations, typically 45%)

- Solid (Flakes/Pellets)

- By End-User:

- Integrated Device Manufacturers (IDMs)

- Foundries (Fabs)

- Display Manufacturers

- Solar/Photovoltaic Manufacturers

Value Chain Analysis For High Purity Electronic Grade Potassium Hydroxide Market

The value chain for High Purity Electronic Grade Potassium Hydroxide is complex and highly specialized, beginning with upstream raw material acquisition and culminating in precise delivery to technologically demanding end-users. The upstream phase involves the procurement of industrial-grade potassium hydroxide, typically produced via the chloralkali process. Success in this stage requires secure, long-term contracts for raw materials and efficient basic chemical manufacturing infrastructure. The crucial step distinguishing electronic grade from commodity grade is the intensive purification process, often involving proprietary technologies like advanced membrane filtration, ion exchange, and multi-stage distillation to achieve ppb/ppt impurity levels. Control over these purification technologies is a primary source of competitive advantage.

Midstream activities focus on formulation, quality control, and specialized packaging. HP EG KOH is formulated into specific concentrations as requested by fabs (e.g., 45% solution) and packaged in ultra-clean, corrosion-resistant containers, often requiring Class 100 or Class 10 cleanroom environments for filling. Distribution is characterized by sophisticated logistics, involving specialized tankers or drums capable of maintaining purity integrity throughout transit. Distribution channels are largely indirect, relying on specialized chemical distributors who possess expertise in handling corrosive electronic-grade materials and navigating strict regulatory compliance, although large multinational suppliers often utilize a mix of direct sales channels for key foundry accounts.

Downstream activities involve the end-users—semiconductor foundries, display manufacturers, and solar cell producers—who integrate the chemical into their wet process steps (etching, cleaning, stripping). The performance of the chemical in these processes dictates the yield and reliability of the final electronic device. Direct interaction between the chemical supplier and the end-user (direct channel) is vital for technical support, process optimization, and immediate response to quality deviations. The indirect channel, utilizing regional chemical distributors, is crucial for smaller fabs or geographically dispersed customers, ensuring timely supply and local regulatory compliance, rounding out a value chain defined by rigorous quality control and specialized logistical requirements.

High Purity Electronic Grade Potassium Hydroxide Market Potential Customers

The primary potential customers for High Purity Electronic Grade Potassium Hydroxide are global organizations heavily invested in the manufacture of microelectronic components and advanced display technologies, where chemical purity directly impacts device functionality and production yield. These entities are characterized by massive capital expenditure on fabrication facilities (fabs) and a stringent requirement for reliable, high-volume chemical supply. Leading Integrated Device Manufacturers (IDMs) like Intel, Samsung, and Micron, along with pure-play foundries such as TSMC and GlobalFoundries, represent the largest consumption centers, utilizing the chemical for critical silicon wafer etching, especially in advanced node production (5nm, 3nm).

Beyond the core semiconductor sector, potential customers include manufacturers specializing in niche but rapidly growing electronic components. This encompasses Micro-Electro-Mechanical Systems (MEMS) companies that rely on the anisotropic etching properties of KOH for creating complex sensor structures (e.g., accelerometers, gyroscopes). Furthermore, major global display manufacturers (producing OLED and advanced LCD panels for smartphones, TVs, and monitors) constitute a significant customer base, using high purity KOH in cleaning and stripping processes during thin-film transistor (TFT) fabrication to ensure defect-free substrates and optimal display uniformity.

The emerging market of high-efficiency photovoltaic (solar) cell producers also constitutes a valuable customer segment. High purity KOH is employed in texturing silicon wafers to enhance light absorption, a critical step in increasing solar panel efficiency. These customers prioritize suppliers who can maintain cost-effectiveness while adhering to 5N purity standards. Ultimately, the potential customer landscape is broad yet demanding, centered around high-tech manufacturing processes where purity, consistency, and a secure supply chain are non-negotiable prerequisites for operational success.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 790 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mitsubishi Chemical, Tokuyama Corporation, Kanto Chemical, Moses Lake Industries, BASF, Merck KGaA, Avantor, Solvay, AGC Inc., Sumitomo Chemical, Arkema, TCI Chemicals, Honeywell, Fujifilm Wako Pure Chemical, GFS Chemicals, Daicel Corporation, Dow Chemical, Evonik Industries, SACHEM, Pioneer Chemical |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Purity Electronic Grade Potassium Hydroxide Market Key Technology Landscape

The technological landscape for High Purity Electronic Grade Potassium Hydroxide is dominated by proprietary purification and quality control methodologies essential for meeting the stringent requirements of advanced semiconductor nodes. The core technology centers around achieving ultra-low metallic and organic contamination levels, often involving highly sophisticated multi-stage refining processes. These processes typically start with high-grade commodity KOH and employ techniques such as continuous ion exchange, pressure filtration using advanced membrane systems, and high-vacuum distillation. The ability to precisely control trace elements, sometimes down to femtogram levels, is the defining technological competitive edge, necessitating continuous R&D investment in chemical processing equipment and analytical instrumentation.

A second crucial technological area is advanced analytical testing, integral to Quality Assurance (QA) and Quality Control (QC). Manufacturers rely heavily on cutting-edge analytical instruments such as Inductively Coupled Plasma Mass Spectrometry (ICP-MS) and Atomic Absorption Spectroscopy (AAS) to accurately detect and quantify impurities in the parts per trillion (ppt) range. The integration of inline real-time monitoring systems is increasingly vital, allowing manufacturers to adjust purification parameters immediately, minimizing batch rejection and ensuring compliance with customer specifications, especially for 6N and 7N grades where process windows are extremely narrow.

Finally, technology related to packaging and delivery ensures the chemical maintains its purity until the point of use. This involves utilizing specialized high-density polyethylene (HDPE) or PFA containers and advanced inert gas blanketing systems to prevent contamination from air or packaging material leaching during storage and transport. Furthermore, advanced digital tracking and supply chain management software are being adopted to provide full traceability from production batch to the fab usage point, addressing the industry's need for strict regulatory compliance and quick defect resolution if issues arise. Technological advancement in this market is fundamentally a race to higher purity levels and tighter process control.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing regional market, primarily due to the overwhelming concentration of global semiconductor fabrication facilities (fabs) and leading integrated device manufacturers (IDMs) located in countries like Taiwan, South Korea, China, and Japan. The region benefits from massive governmental support and investment aimed at bolstering domestic chip production, such as China's "Made in China 2025" and South Korea's aggressive foundry expansion plans. This necessitates exceptionally high consumption volumes of electronic-grade process chemicals, particularly for the ultra-high purity grades required by leading-edge foundries. The proximity of major chemical suppliers to these fabs also provides logistical advantages, although regional supply chain resilience remains a strategic priority.

- North America: North America represents a market experiencing accelerated revitalization, largely driven by the U.S. CHIPS and Science Act, which provides substantial financial incentives for constructing new fabs domestically (e.g., Arizona, Ohio). While North America traditionally relied on imported electronic chemicals, the push for supply chain security and localization is dramatically increasing domestic production capacity and consumption. The market demand here is heavily skewed towards supplying R&D centers and advanced logic manufacturing facilities, emphasizing requirements for 7N purity KOH. Localized production is expected to significantly reduce dependence on cross-border logistics.

- Europe: The European market is poised for significant growth, supported by the European Chips Act, aiming to double the EU’s share of global semiconductor production by 2030. Key countries like Germany, France, and Ireland are focal points for new fab construction, increasing regional demand for essential process chemicals. Europe excels in MEMS and automotive electronics manufacturing, providing a specialized, high-value application segment for high purity KOH. The regional focus often includes stringent sustainability standards for chemical production and recycling, influencing procurement decisions.

- Latin America (LATAM): LATAM remains a nascent market for HP EG KOH, primarily focused on electronics assembly and basic manufacturing rather than advanced wafer fabrication. Demand is stable but smaller, largely satisfied through imports. Growth potential is moderate, tied to the development of local electronics ecosystems and potential future assembly plant expansion.

- Middle East and Africa (MEA): The MEA market is currently marginal in terms of HP EG KOH consumption. Demand is typically limited to small-scale electronics manufacturing and R&D activities. Future growth will be dependent on regional diversification initiatives that include investments in renewable energy (solar cells, which use KOH) and potential, albeit distant, entry into basic semiconductor assembly.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Purity Electronic Grade Potassium Hydroxide Market.- Mitsubishi Chemical Corporation

- Tokuyama Corporation

- Kanto Chemical Co. Inc.

- Moses Lake Industries (Tama Chemicals)

- BASF SE

- Merck KGaA

- Avantor Inc.

- Solvay S.A.

- AGC Inc.

- Sumitomo Chemical Co. Ltd.

- Arkema S.A.

- TCI Chemicals (India) Pvt. Ltd.

- Honeywell International Inc.

- Fujifilm Wako Pure Chemical Corporation

- GFS Chemicals Inc.

- Daicel Corporation

- SK Materials Co. Ltd.

- Stella Chemifa Corporation

- Pioneer Chemical Co. Ltd.

- Evonik Industries AG

Frequently Asked Questions

Analyze common user questions about the High Purity Electronic Grade Potassium Hydroxide market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is High Purity Electronic Grade Potassium Hydroxide primarily used for?

HP EG KOH is predominantly used in the semiconductor and microelectronics industry as an anisotropic etchant for silicon wafers, a critical process in manufacturing Integrated Circuits (ICs), MEMS devices, and advanced display panels (OLEDs/LCDs). Its ultra-low impurity level ensures minimal defects in sensitive electronic components.

How is the market demand for 7N purity KOH changing?

Demand for 7N purity KOH is rapidly escalating, driven by the shift towards advanced logic and memory manufacturing (sub-5nm nodes). These nodes require significantly stricter impurity control to achieve acceptable yields, making 7N purity essential for cutting-edge foundries globally.

Which region dominates the consumption of Electronic Grade Potassium Hydroxide?

The Asia Pacific (APAC) region currently dominates consumption due to the high concentration of major semiconductor fabrication plants (fabs) and electronics manufacturers located in countries such as Taiwan, South Korea, China, and Japan. This dominance is sustained by continued massive investment in regional chip manufacturing capacity.

What are the primary restraints affecting the High Purity Electronic Grade KOH market growth?

Key restraints include the extremely high capital investment required for ultra-purification facilities, stringent environmental regulations governing corrosive chemical production, and the technical complexity involved in maintaining ppt-level purity during large-scale manufacturing and distribution.

How do global semiconductor supply chain issues affect the KOH market?

Semiconductor supply chain vulnerabilities, including shortages and geopolitical trade tensions, directly influence the HP EG KOH market by increasing the focus on supply localization and resilience. This drives investment in capacity expansion outside of traditional Asian manufacturing hubs, particularly in North America and Europe, diversifying the supply base.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager