High Purity Fused Quartz Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439036 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

High Purity Fused Quartz Market Size

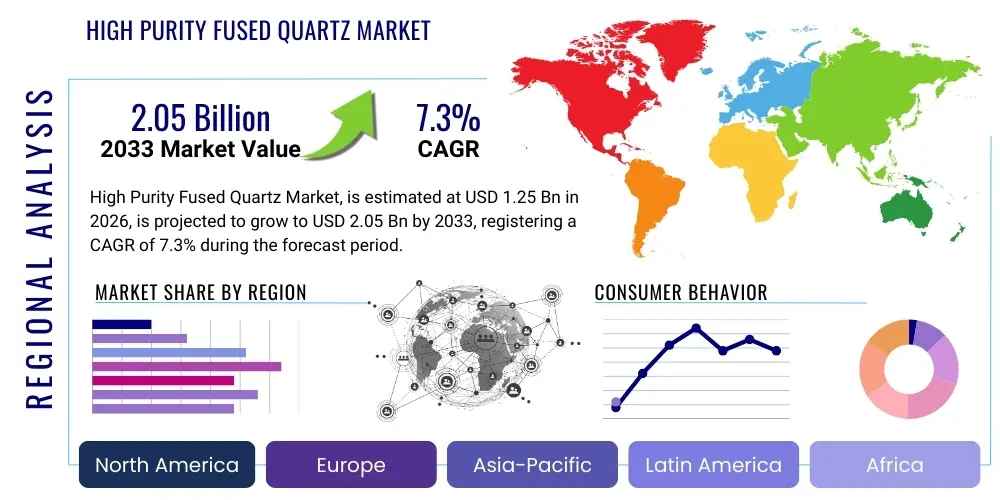

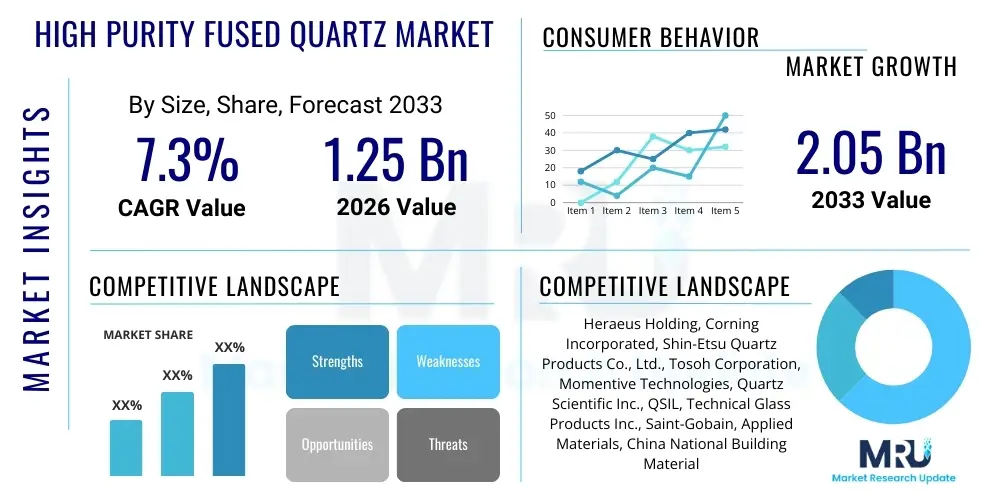

The High Purity Fused Quartz Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.3% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 2.05 Billion by the end of the forecast period in 2033.

High Purity Fused Quartz Market introduction

High Purity Fused Quartz (HPFQ) is an amorphous form of silica (SiO2) characterized by extreme purity, excellent thermal resistance, superior optical transmission across a wide spectrum (especially deep UV), and outstanding chemical inertness. This unique combination of properties makes it indispensable for applications where reliability and precision are paramount, particularly within high-stress operating environments. The material’s low coefficient of thermal expansion allows it to withstand rapid and extreme temperature fluctuations without fracturing, a critical requirement in semiconductor processing equipment.

The product, often categorized into opaque and transparent variants based on manufacturing technique and resultant inclusion levels, serves as a cornerstone material in several high-technology industries. Major applications include crucibles, furnace tubes, wafer carriers, and chamber components in semiconductor fabrication; protective sleeves and reactor components in photovoltaic (solar) cell production; high-intensity lighting systems; and specialized optical components such as lenses and prisms. Its benefits—including resistance to thermal shock, high working temperature, and negligible metallic contamination—drive consistent demand from industries pursuing miniaturization and efficiency gains.

Driving factors propelling the market include the exponential expansion of global semiconductor manufacturing capacity, fueled by digitization, 5G deployment, and the rise of the Internet of Things (IoT). Furthermore, sustained investment in renewable energy infrastructure accelerates the demand for HPFQ in solar photovoltaic applications. Continuous advancements in manufacturing processes, such such as synthetic fused quartz production, are ensuring the availability of materials meeting the stringent purity requirements of next-generation Extreme Ultraviolet (EUV) lithography, further cementing the market's growth trajectory.

High Purity Fused Quartz Market Executive Summary

The High Purity Fused Quartz market is experiencing robust growth driven primarily by structural expansion within the global semiconductor industry and increasing complexity in chip manufacturing processes, demanding ultra-high purity materials to prevent yield losses. Key business trends indicate intensified vertical integration among major quartz suppliers and end-user industries (fabs) to secure stable supply chains and customized product specifications. Furthermore, strategic alliances focusing on advanced material R&D, particularly concerning the suppression of bubbles and impurities in synthetic quartz, are becoming crucial competitive differentiators, especially as the industry transitions towards larger wafer sizes (e.g., 300mm and 450mm) and sophisticated lithography techniques requiring defect-free quartz glass components.

Regionally, the Asia Pacific (APAC) region dominates the market share, largely due to the concentration of major semiconductor foundries (Taiwan, South Korea, China) and significant solar panel production capacity. APAC is also projected to exhibit the highest growth rate during the forecast period, reflecting ongoing massive capital expenditure in wafer fabrication facilities and government initiatives promoting domestic chip production. North America and Europe maintain significant market presence, driven by specialized R&D activities, the development of advanced optical systems, and the installation of high-end semiconductor equipment manufacturing hubs that utilize premium HPFQ components.

Segment trends reveal that the Semiconductor application segment holds the largest market share, correlating directly with the sustained high demand for integrated circuits across all electronic devices. Within product types, transparent fused quartz, manufactured using sophisticated synthesis or vacuum-melting techniques, is showing faster growth due to its mandatory use in high-precision optics and deep UV lithography systems where exceptional transmission and homogeneity are required. The synthetic fused quartz manufacturing process segment is expected to outpace traditional methods, driven by its superior capability to achieve purity levels measured in parts per billion (ppb) or lower, critical for advanced microelectronics.

AI Impact Analysis on High Purity Fused Quartz Market

User inquiries regarding the intersection of Artificial Intelligence (AI) and the High Purity Fused Quartz market primarily revolve around two themes: the indirect impact of AI-driven chip demand and the direct application of AI in HPFQ manufacturing optimization. Users are keen to understand how the proliferation of high-performance computing (HPC) and data centers, essential infrastructure for AI model training and deployment, translates into increased demand for advanced semiconductor manufacturing equipment, which heavily relies on HPFQ components. Concerns often center on whether the volatility of AI investment cycles could cause demand fluctuations for materials like fused quartz. Furthermore, there is significant interest in how AI and machine learning algorithms are being integrated into quartz manufacturing processes—specifically for defect detection, process control (such as thermal profiling during fusion), and predictive maintenance of high-temperature equipment, aiming to boost yield rates and minimize costly material waste inherent in achieving ultra-high purity standards.

The direct application of AI in manufacturing provides a crucial competitive edge. AI systems are increasingly used to analyze complex spectroscopic data in real-time to identify trace impurities (such as OH content or metallic contaminants) that compromise quartz performance, allowing for immediate process correction. In wafer fabrication, the demand for HPFQ components (e.g., crucibles, tubes) with tighter geometrical tolerances is intensified by AI-optimized wafer handling and etching processes. AI-driven simulation tools are also accelerating the development of new high-purity material formulations designed to withstand plasma etching environments utilized in advanced semiconductor nodes, thereby extending the component lifecycle and reducing operational costs for chip manufacturers.

The consensus emerging from market analysis is that AI serves as a dual catalyst: indirectly driving substantial volume growth through accelerated semiconductor demand, and directly enabling efficiency and quality improvements in the supply side, ensuring that quartz manufacturers can meet the increasingly stringent purity specifications required for AI-specific chips (like specialized GPUs and TPUs). This technological synergy solidifies HPFQ's role as a foundational material for the ongoing AI revolution, making high yield and stable supply critical for the entire technology ecosystem.

- AI-driven semiconductor demand accelerates the need for HPFQ in advanced lithography and etch systems.

- Machine learning optimizes real-time process control in quartz melting and forming, reducing defect rates.

- Predictive analytics minimizes equipment downtime in high-temperature quartz manufacturing facilities.

- AI enhances defect inspection systems, ensuring ultra-high purity standards required for EUV applications.

- Simulation tools powered by AI accelerate material discovery for plasma-resistant fused quartz components.

DRO & Impact Forces Of High Purity Fused Quartz Market

The High Purity Fused Quartz market is governed by a robust interplay of Drivers, Restraints, and Opportunities (DRO) that collectively shape its trajectory and competitive landscape. The primary driver is the pervasive digitization trend and the resultant insatiable demand for semiconductors, particularly advanced chips requiring stringent material specifications. Restraints often manifest as high capital expenditure requirements for establishing or upgrading ultra-clean manufacturing facilities, coupled with volatility in raw material supply (natural quartz) and the immense technical complexity involved in scaling synthetic quartz production without compromising purity. Opportunities lie prominently in the transition to next-generation technologies like EUV lithography, the rapid expansion of 5G infrastructure globally, and emerging applications in specialized medical and defense optics, all of which require tailored, ultra-premium quartz products.

Impact forces significantly influence market dynamics. The Intensity of Rivalry is high, driven by a small number of technologically advanced global players competing intensely on purity, dimensional stability, and supply reliability, rather than purely on price. The Threat of New Entrants is moderate to low due to the immense investment needed, proprietary manufacturing know-how (especially for synthetic quartz), and the high barriers to entry imposed by rigorous customer qualification processes in the semiconductor industry. Buyer Power is considerable, particularly for large-scale semiconductor manufacturers who negotiate volumes and specifications aggressively, pressuring suppliers to maintain high quality at competitive costs. Supplier Power is moderate, as specialized raw materials (synthetic precursors or high-grade natural quartz) are controlled by a limited pool of specialized suppliers, giving them leverage over pricing, though this is mitigated by backward integration efforts by major HPFQ producers.

Technological change acts as a powerful impact force; the shift from traditional DUV (Deep Ultraviolet) to EUV (Extreme Ultraviolet) lithography necessitates a quantum leap in quartz material purity and defect tolerance, immediately rendering non-compliant materials obsolete and accelerating innovation among leading suppliers. Geopolitical risks, particularly trade tensions affecting the semiconductor supply chain, also serve as a crucial external impact force, potentially disrupting established raw material and finished product trade routes, compelling manufacturers to diversify their sourcing and manufacturing footprints across multiple regions to ensure supply resilience.

Segmentation Analysis

The High Purity Fused Quartz market is segmented primarily based on application, type, and manufacturing process, reflecting the diversity of end-user requirements and material purity specifications. The primary goal of segmentation is to distinguish between the high-volume industrial applications (like furnace tubes) and the ultra-high-precision, low-volume applications (like EUV reticle substrates), as these require drastically different levels of material quality and incur vastly different manufacturing costs. Understanding these segments is vital for suppliers to align their production capabilities—whether focusing on cost-efficient natural quartz or premium-priced synthetic quartz—with specific industry demands, thereby maximizing profitability and market penetration.

The segmentation by type—Transparent vs. Opaque Fused Quartz—directly correlates with light transmission requirements. Transparent quartz is used where optical clarity (especially in the UV range) is non-negotiable, dominating the photolithography and specialized optics sectors. Opaque quartz, while lacking transparency, is valued for its superior thermal characteristics and lower cost in high-temperature, non-optical applications like general furnace insulation and diffusion tubes. Analyzing the growth rates across these segments highlights the technological push: segments utilizing transparent and synthetic quartz are experiencing accelerated expansion due to the relentless pursuit of smaller feature sizes in microelectronics, demanding perfection in light transmission and chemical cleanliness.

Further granularity in segmentation involves the manufacturing process, dividing the market into synthetic, continuous melting, and direct melting methods. The synthetic process, involving hydrolysis of silicon compounds, yields the highest purity product, critical for advanced node semiconductors. Continuous and direct melting processes utilize natural quartz sand, offering cost advantages but with inherent limitations in impurity levels. This categorization allows market participants to assess the maturity and technological specialization required within each segment, enabling strategic decisions regarding capacity expansion and target market focus, such as prioritizing the high-margin synthetic segment driven by advanced computing and AI infrastructure.

- By Application:

- Semiconductor (Wafer Processing, Furnaces, Etching, Diffusion)

- Solar/Photovoltaic (Crucibles, Reactor Tubes)

- Lighting (UV Lamps, Halogen Lamp Envelopes)

- Optical Fiber and Telecommunications

- Others (Aerospace, Chemical Processing, Labware)

- By Type:

- Transparent Fused Quartz

- Opaque Fused Quartz

- By Manufacturing Process:

- Synthetic Fused Quartz (Hydrolysis/Vapor Phase Deposition)

- Continuous Melting

- Direct Melting

Value Chain Analysis For High Purity Fused Quartz Market

The value chain of the High Purity Fused Quartz market begins with upstream activities focused on securing high-quality raw materials, either natural quartz deposits characterized by extremely low impurity levels or specialized silicon precursor chemicals (e.g., SiCl4) necessary for synthetic quartz production. The initial stage is highly critical; variations in raw material purity directly determine the final product quality and yield achievable in subsequent manufacturing steps. Key upstream players include specialized mining companies for natural quartz sand and major chemical manufacturers supplying ultra-pure precursors. The increasing reliance on synthetic quartz for advanced applications has shifted focus towards chemical purity and stable supply of precursor materials, reducing dependency on geographically concentrated natural quartz mines.

The core manufacturing stage involves complex, high-energy processing, including melting, forming, annealing, and meticulous finishing. This stage requires significant technological expertise and proprietary equipment to maintain ultra-clean conditions and achieve specified dimensions and thermal properties. Companies at this stage differentiate themselves through intellectual property related to proprietary melting techniques (e.g., plasma melting or vacuum processes) that reduce bubble content and improve homogeneity. The output consists of bulk quartz materials (ingots, tubes, rods), which are then transferred to component fabricators.

Downstream activities involve specialized fabrication, precision machining (grinding, polishing), and component assembly to produce final products such as semiconductor crucibles, diffusion tubes, or optical lenses. Distribution channels are typically direct for high-value semiconductor components, involving direct sales teams and specialized technical support collaborating closely with major fabs (Foundries). For standardized products like lamp envelopes, distribution may utilize indirect channels through industrial distributors and specialized resellers. The direct channel ensures tight quality control, rapid feedback loops on performance, and adherence to non-disclosure agreements regarding customized geometries, which is essential in the technologically sensitive semiconductor segment. The efficiency and quality control throughout the downstream fabrication and distribution are critical for securing long-term contracts with demanding end-users.

High Purity Fused Quartz Market Potential Customers

Potential customers for High Purity Fused Quartz are predominantly large-scale, high-technology manufacturers whose operational efficiency and product quality depend critically on the chemical and thermal stability of contact materials. The primary buyers are semiconductor device manufacturers (fabs/foundries) such as TSMC, Samsung, Intel, and Micron, which utilize HPFQ components extensively in wafer processing steps including deposition, etching, diffusion, and oxidation. These customers demand quartz components with purity levels below 1 ppm and increasingly below 1 ppb of metallic contaminants, making them the most stringent and valuable customer segment.

The second major cohort includes manufacturers in the renewable energy sector, specifically companies producing photovoltaic cells and modules (solar panel manufacturers). These customers utilize large HPFQ crucibles for crystal growth (e.g., polysilicon melting) and various tubes and reactors used in the high-temperature processing of silicon wafers. While the purity demands are generally lower than those in cutting-edge semiconductor applications, the requirement for sheer volume and consistency in thermal performance drives significant demand for cost-effective, high-quality fused quartz products, particularly from the opaque segment.

Furthermore, specialized industrial customers form a significant potential buyer base. This includes manufacturers of specialty lighting (e.g., high-intensity discharge lamps, germicidal UV lamps), requiring high UV transmission capabilities; telecommunications companies utilizing quartz in optical fiber preforms; and specialized chemical and analytical laboratories that rely on chemically inert labware for sensitive experiments. These diverse end-users require highly tailored products, ranging from large-scale industrial components to miniature, precision-machined optical parts, reinforcing the market's reliance on technical specialization and custom fabrication services.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 2.05 Billion |

| Growth Rate | 7.3% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Heraeus Holding, Corning Incorporated, Shin-Etsu Quartz Products Co., Ltd., Tosoh Corporation, Momentive Technologies, Quartz Scientific Inc., QSIL, Technical Glass Products Inc., Saint-Gobain, Applied Materials, China National Building Material (CNBM), Atlantic Ultraviolet Corporation, Ranco Fused Quartz, LEL Technologies, MARUWA Co., Ltd., Zibo Quartz Microcrystalline, Russia's Quartz JSC, Advanced Glass Industries, Ohara Corporation, Beijing Guojing Quartz Glass Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Purity Fused Quartz Market Key Technology Landscape

The technological landscape of the High Purity Fused Quartz market is defined by continuous innovation aimed at increasing purity, reducing defects (bubbles and inclusions), and enhancing dimensional stability to meet the demanding requirements of microelectronics. A key technological advancement is the transition from natural quartz-based manufacturing (using electric arc or continuous melting) to the Synthetic Fused Quartz (SFQ) process. SFQ production, typically involving the flame hydrolysis of silicon tetrachloride, allows manufacturers to achieve impurity levels measured in parts per trillion (ppt) and virtually eliminate trace metallic elements, which is non-negotiable for components used in 7nm process nodes and below, particularly in contact with wafers during high-temperature or plasma processes.

Another critical area of technological focus is precision fabrication and surface engineering. As semiconductor fabrication moves to Extreme Ultraviolet (EUV) lithography, the tolerance for surface defects and internal impurities in quartz components like reticle substrates and optical systems has tightened exponentially. Manufacturers are investing heavily in advanced machining techniques, including ultrasonic milling and femtosecond laser processing, to achieve nanometer-scale smoothness and accuracy without introducing sub-surface damage or contamination. Furthermore, specialized cleaning and packaging technologies are essential, ensuring that the HPFQ components maintain their ultra-pure state from the factory floor to the cleanroom installation at the customer site, preventing costly contamination during transit or handling.

Thermal processing technology remains central, particularly regarding the manufacture of large-diameter quartz tubing and crucibles. Innovations in continuous melting processes focus on optimizing thermal gradients and vacuum levels to minimize bubble formation and control the hydroxyl (OH) content within the fused quartz, which impacts its viscosity and transmission characteristics. The development of doped or coated quartz materials designed to resist specific plasma etching chemistries (e.g., fluorine-based or chlorine-based plasma) represents a critical technological frontier. By modifying the surface or bulk material composition, suppliers are extending component lifetimes in harsh processing environments, directly reducing the maintenance costs and increasing the uptime for semiconductor manufacturers globally, thereby offering a crucial value proposition beyond mere purity.

Regional Highlights

- Asia Pacific (APAC) Market Dominance and Growth Drivers

- North America Market for High-End Technology and R&D

- European Market and Industrial Specialization

The Asia Pacific region commands the largest market share and is forecast to demonstrate the highest growth rate globally for High Purity Fused Quartz. This dominance is intrinsically linked to its status as the world's primary manufacturing hub for semiconductors, solar cells, and advanced displays. Countries such as Taiwan, South Korea, Mainland China, and Japan house the largest concentration of capital-intensive wafer fabrication plants (fabs) and are undergoing massive expansion driven by government subsidies and strategic national goals (e.g., China's Made in China 2025 initiative and South Korea's K-Semiconductor Strategy). This concentration necessitates a massive and stable supply of high-purity quartz components for processes like etching, diffusion, and crystal pulling, making APAC the key consumption center.

The rapid adoption of advanced packaging techniques and the proliferation of memory and logic chips required for AI, 5G, and electric vehicles further solidify APAC's leading role. Additionally, the region is the epicenter of global photovoltaic production, with manufacturers in China and Southeast Asia heavily relying on large-format HPFQ crucibles for silicon crystallization. Key regional manufacturers of fused quartz are also heavily investing in synthetic quartz capacity within APAC to meet the stringent specifications of local semiconductor giants, ensuring shorter lead times and localized technical support which are critical factors for securing high-volume contracts.

Market dynamics in APAC are characterized by fierce competition among regional suppliers and global conglomerates establishing local manufacturing footprints. The strategic importance of maintaining intellectual property and securing raw material sourcing is paramount. The region is seeing rapid technological transfer, especially from Japanese and US quartz leaders, enabling local manufacturers to gradually close the quality gap, particularly in the production of mid-range purity quartz components used in solar and non-critical semiconductor applications, while the highest-end synthetic quartz remains dominated by a few established multinational firms.

North America holds a significant position, particularly in the development and initial commercialization of cutting-edge semiconductor equipment and advanced optical systems. The market demand here is heavily skewed towards ultra-high purity, synthetic fused quartz required for the most advanced applications, including space-based optics, specialized defense technologies, and R&D for next-generation lithography systems. Major players headquartered in this region are often pioneers in developing proprietary quartz synthesis methods and sophisticated fabrication techniques necessary for EUV applications and 450mm wafer readiness.

Recent policy shifts, such as the CHIPS and Science Act in the US, are driving massive investments in establishing new domestic fabrication facilities, stimulating localized demand for high-quality domestic suppliers of HPFQ materials. This trend aims to mitigate supply chain risks exposed during global disruptions. While the volume consumption might be lower than APAC, the value generated per unit of quartz consumed is exceptionally high, reflecting the use of the material in high-margin equipment and niche, mission-critical applications where failure tolerance is near zero. Companies here focus on innovation, purity certifications, and developing materials resistant to new plasma chemistries.

The customer base in North America includes major equipment manufacturers (like Applied Materials and Lam Research) and integrated device manufacturers (IDMs). These entities often work in lockstep with quartz suppliers to custom-design components optimized for proprietary processing equipment, necessitating tight integration and technological collaboration. Growth is steady, focused on vertical integration and technological superiority, ensuring the region remains a powerhouse for high-value quartz products and innovation leadership.

Europe represents a mature and technologically sophisticated market for High Purity Fused Quartz, characterized by strong demand from specialized industrial sectors and high-end research institutions. The region excels in advanced optical manufacturing, specialized lighting (including high-efficiency UV and germicidal lamps for water purification), and complex chemical processing applications requiring maximum chemical inertness and temperature resistance. European demand is stable and driven by adherence to stringent quality and environmental standards (e.g., REACH regulations).

Major market drivers include investments in industrial automation and the continued relevance of the region's automotive and industrial electronics sectors, which rely on robust semiconductor supply chains. Key European suppliers are renowned for their expertise in glass processing, ensuring exceptionally tight dimensional tolerances and surface quality for niche applications. They often specialize in synthesizing high-transmission quartz glass tailored for specific wavelength requirements, crucial for high-precision scientific instrumentation and specialized laser optics.

While the volume of consumption does not rival that of APAC, the European market commands a premium for specialized, high-specification products. Furthermore, environmental regulations push European HPFQ manufacturers toward energy-efficient production processes and strict control over emissions, inadvertently driving technological innovation in process optimization and sustainability within the quartz melting domain.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Purity Fused Quartz Market.- Heraeus Holding GmbH

- Corning Incorporated

- Shin-Etsu Quartz Products Co., Ltd.

- Tosoh Corporation

- Momentive Technologies

- Quartz Scientific Inc.

- QSIL

- Technical Glass Products Inc.

- Saint-Gobain S.A.

- Applied Materials Inc. (Through subsidiaries/component reliance)

- China National Building Material (CNBM)

- Atlantic Ultraviolet Corporation

- Ranco Fused Quartz

- LEL Technologies

- MARUWA Co., Ltd.

- Zibo Quartz Microcrystalline Products Co., Ltd.

- Russia's Quartz JSC

- Advanced Glass Industries

- Ohara Corporation

- Beijing Guojing Quartz Glass Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the High Purity Fused Quartz market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for High Purity Fused Quartz?

The primary driver is the exponential growth and increasing technological sophistication of the global semiconductor industry, particularly the transition to sub-10nm manufacturing nodes and the adoption of EUV lithography, which mandates ultra-high purity materials to prevent wafer contamination and maximize yield.

What is the difference between Transparent and Opaque Fused Quartz applications?

Transparent fused quartz is primarily used in optical systems, photolithography, and UV applications requiring high transmission across the visible and deep UV spectrum. Opaque fused quartz, which is not transparent, is utilized for its superior thermal shock resistance and insulation properties in non-optical, high-temperature applications like furnace linings and general diffusion tubes.

How does Synthetic Fused Quartz differ from Natural Fused Quartz?

Synthetic Fused Quartz (SFQ) is manufactured chemically using ultra-pure precursor gases (like SiCl4), resulting in exceptionally low impurity levels (ppt range) and minimal defects (e.g., bubbles). Natural Fused Quartz uses mined quartz sand and has slightly higher impurity concentrations, making SFQ mandatory for critical semiconductor processes.

Which geographical region dominates the consumption of High Purity Fused Quartz?

The Asia Pacific (APAC) region dominates consumption due to the high concentration of advanced semiconductor manufacturing facilities (fabs) and large-scale solar photovoltaic production capacity located in countries such as Taiwan, South Korea, and China.

What challenges face manufacturers in the High Purity Fused Quartz market?

Manufacturers face challenges including extremely high capital investment requirements for cleanroom facilities, complexity in maintaining ultra-high purity levels during processing, volatility in specialized raw material supply, and meeting the continuously tightening dimensional and surface quality tolerances required by leading-edge semiconductor technology.

Why is High Purity Fused Quartz essential for EUV lithography?

HPFQ is essential for EUV lithography, specifically for reticle substrates and critical optical elements, because its near-zero coefficient of thermal expansion ensures dimensional stability under intense heat, and its ultra-low defect count prevents imperfections that would compromise pattern accuracy at the nanometer scale.

What is the role of fused quartz in the photovoltaic industry?

In the photovoltaic industry, fused quartz is primarily used for large crucibles required to melt and grow large silicon ingots and for specialized tubes and components in reactors used during various high-temperature processing stages of solar cell manufacturing, leveraging its thermal stability and chemical inertness.

Are there viable substitutes for High Purity Fused Quartz in semiconductor manufacturing?

While materials like silicon carbide (SiC) and specialized technical ceramics are used in certain high-temperature, non-optical applications (e.g., susceptors), HPFQ remains largely irreplaceable for applications requiring high UV transmission, extremely low thermal expansion, and ultra-low metallic contamination, especially in critical etching and lithography processes.

How does the quality of natural quartz sand impact the final fused quartz product?

The quality of natural quartz sand directly dictates the achievable purity, especially concerning trace metallic elements (Fe, Al, Ti), and determines the presence of crystalline inclusions. Only the highest-grade deposits, often found in specific geographical locations, can be used for manufacturing quartz suitable for non-critical semiconductor applications.

What is the impact of 5G infrastructure rollout on the HPFQ market?

The 5G infrastructure rollout significantly boosts HPFQ demand indirectly by accelerating the need for high-performance processors and advanced memory chips, which in turn drives increased capital expenditure on advanced semiconductor fabrication equipment utilizing HPFQ components.

What specialized fabrication techniques are used for HPFQ components?

Specialized fabrication techniques include highly precise grinding and polishing (often to nanometer tolerances), ultrasonic machining to shape complex geometries, and advanced laser processing to minimize sub-surface damage, all critical for optical and reticle applications.

Which segment of the HPFQ market is projected to grow fastest?

The Synthetic Fused Quartz segment, driven by applications in advanced semiconductor processing (7nm and below) and specialized high-performance optics, is projected to exhibit the fastest growth rate due to the increasing demand for ultra-high purity standards.

How do manufacturers control the hydroxyl (OH) content in fused quartz?

Manufacturers control OH content, which impacts quartz viscosity and transmission, by employing specialized drying processes and carefully managing the ambient atmosphere during melting. Low OH content quartz is often preferred for high-temperature applications to prevent crystallization.

What role does the Low Coefficient of Thermal Expansion (CTE) play in HPFQ usage?

The exceptionally low CTE of HPFQ is crucial in applications experiencing rapid temperature cycling, such as semiconductor processing furnaces, as it prevents thermal shock and material deformation, ensuring dimensional stability and precision during critical manufacturing steps.

How is AI integrated into the manufacturing process of HPFQ?

AI is integrated by utilizing machine learning for real-time analysis of material purity via spectroscopic data, optimizing the thermal profiles of melting furnaces to reduce defects, and improving robotic handling systems to minimize human contamination during finishing and cleaning processes.

What is the primary restraint regarding capital investment in the HPFQ industry?

The primary restraint is the immense capital expenditure required to build or upgrade specialized manufacturing facilities that can maintain the necessary ultra-clean environment (Class 10 or better) and house the proprietary, energy-intensive equipment needed for high-purity synthesis and melting.

Why is chemical inertness a key feature of High Purity Fused Quartz?

Chemical inertness means the quartz resists reacting with aggressive chemicals, such as corrosive acids and plasma gases, used extensively in semiconductor etching and cleaning processes. This resistance prevents component degradation and, critically, avoids the leaching of contaminants onto sensitive silicon wafers.

What are the key characteristics required for HPFQ components used in high-intensity lighting?

For high-intensity discharge and UV lamps, HPFQ components must exhibit excellent UV transmission characteristics, strong thermal resistance to contain high internal temperatures, and resistance to solarization (damage from intense UV exposure) to maintain optical performance over time.

How does the trend toward larger wafer sizes affect the HPFQ market?

The shift to larger wafer sizes (e.g., from 200mm to 300mm, and potentially 450mm) necessitates the production of significantly larger HPFQ components, such as crucibles and furnace tubes, demanding greater precision in large-scale forming and increasing the total volume of quartz material required per fab.

Which segment (By Application) holds the largest market share?

The Semiconductor application segment consistently holds the largest market share globally due to the extremely high volumes and stringent quality requirements for components used across etching, diffusion, oxidation, and deposition processes in wafer fabrication facilities worldwide.

What is the main concern regarding raw material supply for HPFQ?

The main concern involves the limited availability of natural quartz sand deposits that meet the necessary low-impurity threshold for high-purity applications, leading to potential price volatility and supply concentration risk for manufacturers relying on natural quartz.

How do major players maintain competitiveness in the HPFQ market?

Leading players maintain competitiveness through continuous investment in R&D for proprietary synthesis and fabrication technologies, securing long-term contracts with key semiconductor customers, achieving vertical integration into raw material sourcing, and ensuring global technical support and supply chain resilience.

What role does the distribution channel play for semiconductor-grade HPFQ?

The distribution channel for semiconductor-grade HPFQ is predominantly direct, ensuring strict quality chain control, specialized technical consultation, customized component design, and rapid feedback loops between the manufacturer and the end-user fabrication plant.

What are the potential uses of HPFQ in the telecommunications industry?

In telecommunications, HPFQ is crucial for manufacturing preforms used in drawing optical fibers due to its exceptional optical clarity, low attenuation, and ability to be drawn into fine, high-quality fibers necessary for high-speed data transmission infrastructure.

What is the significance of eliminating metallic contaminants in HPFQ?

Eliminating metallic contaminants (like Iron or Sodium) is critical because even trace amounts can diffuse into silicon wafers during high-temperature processing, causing electrical defects that severely compromise chip performance and yield, making ultra-low metallic content mandatory for advanced chips.

How are environmental regulations affecting HPFQ production?

Environmental regulations, particularly in Europe and North America, are increasingly pressuring HPFQ manufacturers to adopt more energy-efficient melting processes and reduce emissions associated with traditional electric arc methods, driving innovation toward cleaner technologies like plasma melting.

What market opportunity is presented by the aerospace and defense sectors?

Aerospace and defense sectors present opportunities for specialized HPFQ components requiring extreme thermal stability, radiation resistance, and precise optical properties for use in advanced sensor windows, gyroscope components, and critical optical systems utilized in harsh environments.

What is direct melting and why is it used for some HPFQ products?

Direct melting is a process where refined natural quartz sand is melted using high heat, often in a vacuum furnace. It is typically used for producing opaque or semi-transparent fused quartz that is required in high volumes for solar and general industrial applications where cost-efficiency is prioritized over ultra-high optical transmission.

How is the market for opaque fused quartz evolving?

The opaque fused quartz market, while slower growing than the synthetic segment, remains crucial and is evolving through improvements in thermal uniformity and mechanical strength, essential for large-scale, high-temperature processes such as annealing and diffusion tubes in mature semiconductor nodes and solar production.

What is the approximate size of the High Purity Fused Quartz Market by the end of the forecast period?

The High Purity Fused Quartz Market is projected to reach approximately USD 2.05 Billion by the end of the forecast period in 2033, reflecting a compound annual growth rate of 7.3% driven by sustained demand from the semiconductor and solar industries.

How important is proprietary technology for market leaders?

Proprietary technology, especially relating to synthetic quartz production methods, bubble suppression during melting, and nanoscale surface finishing, is highly critical as it differentiates market leaders by allowing them to meet the exacting purity and tolerance requirements of advanced semiconductor fabrication facilities, securing high-margin contracts.

What is the role of HPFQ in the chemical processing industry?

In the chemical processing industry, HPFQ is used to manufacture specialized labware, heat exchangers, and reaction vessels due to its superior resistance to almost all acids (except hydrofluoric acid) and its ability to withstand extreme temperatures without contributing contaminants, ensuring experimental or industrial process purity.

Does the price of raw silicon impact the cost of HPFQ?

While HPFQ is made from silica (SiO2) rather than elemental silicon, the price of precursor chemicals used in synthetic quartz production (like silicon tetrachloride) and the price of high-grade natural quartz sand are major cost factors, indirectly linking to the broader silicon materials supply chain economy.

How does the market address the issue of thermal stability in HPFQ?

The market addresses thermal stability by rigorously controlling the fusion and annealing processes to ensure an amorphous structure and low internal stress, resulting in the material’s inherently low coefficient of thermal expansion, maximizing its resistance to thermal shock and minimizing dimensional changes.

What opportunities are presented by the development of 6G technology?

The future development of 6G technology will intensify demand for higher performance computing and memory, requiring further advancements in chip manufacturing capabilities, thus creating sustained, long-term opportunities for ultra-high purity, defect-free synthetic fused quartz components.

What factors constrain the entry of new manufacturers into the HPFQ market?

New entrants are constrained by the necessity for enormous initial capital investment, the proprietary nature of existing high-purity manufacturing know-how, and the lengthy and complex certification process required by major semiconductor and optical end-users before they approve a new material supplier.

In which region are most new semiconductor fabrication facilities being established?

Most new and expansionary semiconductor fabrication facilities (fabs) are currently being established in the Asia Pacific region, specifically in China, Taiwan, South Korea, and increasingly Southeast Asia, driving localized demand for fused quartz components.

What is the definition of "High Purity" in this market context?

"High Purity" generally refers to quartz materials containing metallic contaminants and other impurities in levels ranging from parts per million (ppm) down to parts per billion (ppb) or even parts per trillion (ppt), necessary to prevent performance degradation in sensitive electronic and optical devices.

How does the demand for electric vehicles influence the HPFQ market?

The demand for electric vehicles (EVs) indirectly drives the HPFQ market by fueling the need for power management chips (like SiC MOSFETs) and specialized sensor technologies, requiring significant investment in semiconductor fabrication where HPFQ components are essential processing tools.

What is the primary function of fused quartz in diffusion furnace systems?

In diffusion furnace systems, fused quartz tubes and boats provide a highly clean, thermally stable, and chemically inert environment necessary to perform high-temperature processes like doping, ensuring precise control over the introduction of impurities into the silicon wafer without external contamination.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager