High Purity Gallium Oxide Powder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432724 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

High Purity Gallium Oxide Powder Market Size

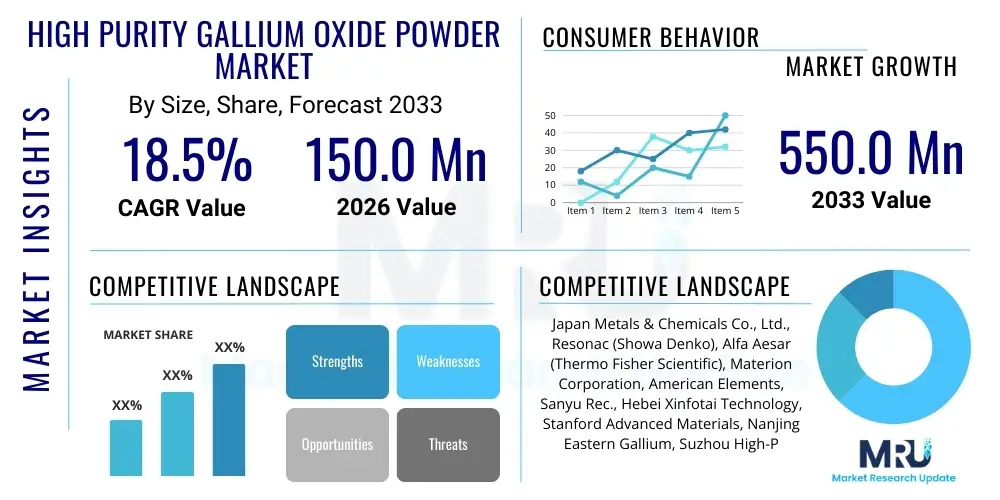

The High Purity Gallium Oxide Powder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at $150.0 million in 2026 and is projected to reach $550.0 million by the end of the forecast period in 2033.

High Purity Gallium Oxide Powder Market introduction

High Purity Gallium Oxide (Ga2O3) powder serves as a critical precursor material for the synthesis of bulk Gallium Oxide substrates and epitaxial layers, essential components for next-generation wide-bandgap semiconductor devices. Its primary chemical advantage lies in its ultra-wide bandgap energy (approximately 4.8 eV to 4.9 eV), significantly higher than Silicon Carbide (SiC) or Gallium Nitride (GaN), enabling devices capable of handling extreme voltage, temperature, and radiation environments. The high thermal stability and inherent resistance to high electric fields position HP Ga2O3 as a disruptive material for maximizing energy efficiency in power electronics, offering substantial improvements over traditional silicon-based devices. The purity of this precursor material, often ranging from 4N (99.99%) to 6N (99.9999%), directly dictates the performance and yield of the resulting semiconductor wafer, making stringent quality control during synthesis paramount.

The major applications driving the demand for High Purity Gallium Oxide powder are concentrated in the fields of high-voltage power switching devices, solar-blind ultraviolet (UV) photodetectors, and high-frequency communication systems. In power electronics, Ga2O3-based devices promise superior performance in power converters for electric vehicles (EVs), renewable energy systems (solar inverters), and industrial motor control due to minimized switching losses and higher operational temperatures. Furthermore, the material's excellent intrinsic responsivity in the deep UV spectrum makes it invaluable for photodetectors used in flame sensing, space communications, and missile guidance systems, where traditional silicon sensors are ineffective or suffer performance degradation.

Key driving factors accelerating market expansion include burgeoning global investment in advanced defense technologies requiring radiation-hardened components, alongside the widespread commercialization of electric vehicles and sophisticated 5G/6G communication infrastructure. Governments worldwide recognize the strategic importance of wide-bandgap semiconductors, leading to significant funding for research into scalable and cost-effective bulk crystal growth techniques utilizing HP Gallium Oxide powder as the foundational raw material. The inherent benefits of Ga2O3—such as its theoretical capacity for high critical electric field strength—translate directly into smaller, lighter, and more efficient power modules, providing a compelling economic and performance advantage over existing materials, thus solidifying its market position.

High Purity Gallium Oxide Powder Market Executive Summary

The High Purity Gallium Oxide Powder Market is currently defined by intense technological competition and a critical race among material scientists to achieve cost-effective production methods for high-quality bulk substrates. Business trends indicate a strong focus on strategic vertical integration, where companies involved in raw material processing are increasingly partnering with or acquiring firms specializing in crystal growth and device fabrication to secure reliable, high-purity supply chains. The market is transitioning from research-focused consumption to initial industrial deployment, particularly spurred by military and aerospace procurement initiatives in North America and advanced consumer electronics prototyping in Asia. Significant private equity and venture capital investments are channeling towards companies that can consistently deliver 5N and 6N purity grades required for complex high-power electronic devices, signalling maturation in the production technology landscape.

Regionally, the Asia Pacific (APAC) sector maintains overwhelming dominance, primarily driven by large-scale electronic manufacturing bases in China, Japan, and South Korea, which serve as global hubs for semiconductor production and advanced material sourcing. Japan, in particular, remains at the forefront of Ga2O3 crystal growth research, holding key patents and intellectual property related to large-area substrate manufacturing techniques such as the Edge-defined Film-fed Growth (EFG) method. North America and Europe, while lagging in bulk production volume, are primary consumers and innovators in the downstream application segment, focusing heavily on defense, high-reliability automotive components, and strategic energy applications, ensuring strong demand for imported high-purity precursors.

Segment trends highlight a noticeable shift in demand away from lower purity (4N) powders toward ultra-high purity materials (5N and 6N). This transition is directly correlated with the increasing complexity and performance expectations of commercializing Ga2O3 transistors and diodes. The application segment focused on power devices, especially high-voltage MOSFETs and Schottky barrier diodes, is projected to experience the fastest growth due to the immense market potential within the Electric Vehicle (EV) and smart grid sectors. Furthermore, advancements in specialized analytical instrumentation capable of detecting trace impurities are enabling manufacturers to certify and guarantee these higher purity grades, fostering greater confidence among critical semiconductor fabrication end-users and accelerating the qualification process for new material suppliers.

AI Impact Analysis on High Purity Gallium Oxide Powder Market

User queries regarding the impact of Artificial Intelligence (AI) on the High Purity Gallium Oxide Powder Market frequently focus on how AI can address the material's primary challenge: achieving scalability and reducing crystal defect densities. Users are keenly interested in whether AI-driven predictive modeling can optimize the complex parameters involved in high-temperature synthesis and purification processes, ensuring consistent ultra-high purity (5N and 6N) necessary for reliable device fabrication. Key themes emerging from these questions include the role of AI in quality control, accelerating materials discovery, and optimizing the upstream supply chain for raw gallium, often a byproduct of aluminum processing. The underlying expectation is that AI will be the crucial tool that moves Ga2O3 from a niche research material to a globally competitive industrial semiconductor substrate.

AI's influence is being integrated across the entire high-purity material value chain, fundamentally transforming traditional laboratory synthesis methods into data-driven industrial processes. Specifically, machine learning algorithms are being employed to analyze large datasets derived from real-time monitoring of calcination temperatures, atmospheric control, and crystallization kinetics during the powder preparation phase. This predictive modeling allows manufacturers to identify and mitigate minor process variations that could introduce contaminants or crystalline defects, thus maximizing batch yield and drastically improving material uniformity. By minimizing trial-and-error experimentation, AI significantly reduces the time and cost associated with qualifying new production techniques and meeting stringent semiconductor quality standards.

In the context of bulk crystal growth, which relies heavily on high-purity powder precursors, AI-powered image analysis and sensor fusion are critical for defect detection. Systems using deep learning models can rapidly analyze X-ray diffraction patterns or optical microscopy images of the finished Ga2O3 crystals to pinpoint structural imperfections, such as threading dislocations or inclusions, far faster and more accurately than human inspection. This capability ensures that only the highest quality substrates, grown from the best precursors, proceed to the epitaxy stage. Furthermore, AI is crucial in supply chain resilience, forecasting potential bottlenecks in raw gallium supply, optimizing inventory management for specialized purification chemicals, and ensuring the stable, long-term sourcing required to support the projected high growth rates of the Ga2O3 device market.

- AI optimizes material synthesis parameters (temperature, pressure, duration) to ensure ultra-high purity consistently.

- Machine learning algorithms predict and mitigate crystal defects during the bulk growth phase, improving substrate yield.

- AI enhances quality control through automated analysis of spectroscopic and structural material characterization data.

- Predictive modeling aids in stabilizing the volatile raw material supply chain for critical elements like gallium.

- AI accelerates the discovery and qualification of novel dopants and material compositions for enhanced electronic properties.

- Robotics and AI-driven automation reduce human interaction in sensitive purification environments, minimizing contamination risks.

DRO & Impact Forces Of High Purity Gallium Oxide Powder Market

The High Purity Gallium Oxide Powder Market dynamics are characterized by a powerful interplay between compelling technological drivers and significant material production restraints, creating substantial market opportunities fueled by evolving geopolitical and industrial demands. The core driver is the superior electrical performance that Ga2O3 offers over established alternatives like SiC and GaN, particularly its higher theoretical breakdown voltage, which is essential for maximizing efficiency in high-power applications such as server power supplies, solar inverters, and high-frequency communication base stations. Simultaneously, the limited availability of high-purity single-crystal substrates—a direct downstream product of the powder—acts as a primary restraint, complicating mass industrial adoption and keeping production costs elevated. The strategic opportunity lies in penetrating the defense and aerospace sectors where cost sensitivity is lower, and the demand for radiation-hardened, high-temperature devices is immediate, effectively seeding the technology for future commercial scaling. These forces, when combined with regulatory pressures for energy efficiency, exert a powerful shaping influence on market investment and technological development pathways.

The primary restraint involves the technological immaturity of large-scale, high-yield single-crystal growth processes, specifically for producing substrates necessary for advanced device fabrication. While the powder precursor itself is refined to high purity, converting it into large-diameter, defect-free single crystals remains challenging, often resulting in high scrap rates and increased final device costs. Another significant restraint is the relative scarcity and price volatility of elemental gallium, which is typically recovered as a byproduct of bauxite (aluminum) and zinc processing, making the supply chain vulnerable to fluctuations in these primary metal markets. However, mitigating this, key opportunities abound in developing new low-cost growth methods, such as controlled sputtering or solution growth, and utilizing Gallium Oxide's natural potential for forming large substrates from the melt, unlike SiC, which requires complex vapor deposition techniques. The rapid innovation cycle currently underway aims to overcome these production hurdles, leading to a projected dramatic increase in market volume toward the end of the forecast period.

The impact forces driving market acceptance are primarily economic and regulatory. Economically, the promise of smaller, more efficient power systems translates into lower lifetime operating costs for end-users, creating a strong pull from the automotive and industrial sectors. Regulatory mandates, particularly in Europe and Asia, pushing for mandatory energy efficiency standards (e.g., in data centers and consumer electronics), indirectly stimulate demand for materials like Ga2O3 capable of surpassing current efficiency benchmarks. The pervasive impact of digitalization and the expansion of data infrastructure, requiring robust power management, acts as a fundamental underlying driver. Furthermore, increasing geopolitical emphasis on domestic semiconductor supply chain resilience (e.g., CHIPS Act in the US) accelerates investment in local HP Ga2O3 research and manufacturing, ensuring that the technology matures rapidly under strategic government support and becomes competitive with foreign alternatives, thereby dramatically impacting global market distribution.

Segmentation Analysis

The High Purity Gallium Oxide Powder Market is comprehensively segmented based on its critical characteristics, including the purity level, which determines the target application; the physical form, whether powder or specialized bulk crystal; and the diverse end-use applications in which the material is integrated. Purity is the most crucial differentiator, separating research-grade material (often 4N) from semiconductor-grade material (5N and 6N), with trace metallic contaminants measured in parts per million or billion, directly correlating to device breakdown voltage and reliability. The segmentation ensures that manufacturers can tailor production methods to specific client requirements, catering to both high-volume industrial users and specialized research facilities demanding ultra-low defect rates and exceptional uniformity.

Segmentation by application clarifies the diverse economic drivers of the market. While power devices represent the largest current and future growth segment due to the vast need for efficient power management in EVs and renewable grids, the photonics and optical sector, centered around solar-blind UV detectors, provides a high-value, albeit smaller, market segment driven by defense and aerospace demands. Understanding these distinct application needs allows producers to optimize purification processes; for instance, power device precursors must minimize deep-level traps caused by impurities, while optical applications require materials with optimized structural integrity for high transparency in the UV spectrum. This granular segmentation helps in targeted marketing and research investment, ensuring that technological advancements meet specific industrial needs.

Further segmentation by form factors, particularly the distinction between basic powder precursors and advanced intermediate forms like sputtering targets or pre-synthesized substrates, reflects the varying stages of the value chain. As the market matures, the demand for sophisticated, application-ready intermediate forms will increase, driving competition among specialized material processors. The current market is heavily dominated by the HP powder segment, serving as the foundational building block. However, the fastest growth is anticipated in the high-purity substrate segment (derived from the powder), signaling industrial progress and movement toward standardized manufacturing protocols. Accurate segmentation provides clarity on where the greatest investment opportunities lie, particularly in bridging the gap between raw material synthesis and high-volume wafer production.

- By Purity Grade:

- 4N Grade (99.99%)

- 5N Grade (99.999%)

- 6N Grade and Above (99.9999%+)

- By Application:

- Power Devices (MOSFETs, Diodes)

- Photodetectors (Solar-Blind UV Sensors)

- Substrate Manufacturing (Epitaxy)

- High-Frequency Communication Components

- Other Research and Development Applications

- By Form:

- Powder

- Bulk Single Crystal/Substrate

- Sputtering Targets

Value Chain Analysis For High Purity Gallium Oxide Powder Market

The High Purity Gallium Oxide Powder value chain is characterized by highly specialized stages, beginning with the challenging upstream extraction and purification of raw gallium, extending through sophisticated midstream synthesis of the high-purity powder, and culminating in advanced downstream device fabrication. The upstream segment involves mining and refining bauxite or zinc ores to isolate elemental gallium, which is then subjected to multi-stage chemical purification processes such as electrolysis and fractional crystallization to achieve the precursor grade required for Ga2O3 synthesis. Due to the high sensitivity of the final semiconductor performance to trace contaminants, the initial purification step is capital-intensive and requires highly specialized chemical expertise, creating significant barriers to entry for new market participants and centralizing control over the raw material supply among a few dominant players, primarily located in East Asia.

The midstream stage, where the high-purity gallium is oxidized and processed into HP Gallium Oxide powder, is defined by advanced material science techniques, including high-temperature calcination and zone refining, designed to control stoichiometry and particle size distribution. The quality of this powder is crucial; it serves as the feed material for subsequent bulk crystal growth methods like EFG or Czochralski techniques. Companies excelling in this stage possess proprietary expertise in furnace design, atmospheric control, and high-precision analytical testing. Distribution channels for the powder are often direct, moving from the specialized material producer to crystal growth facilities or advanced semiconductor research institutions. Indirect distribution, involving specialized chemical distributors, typically handles smaller volumes destined for academic or general R&D purposes, emphasizing speed and specialized handling requirements.

The downstream activities involve converting the HP Ga2O3 powder into functional electronic devices. This includes the difficult task of growing large, defect-free single-crystal substrates, followed by epitaxy (layer deposition), lithography, and final device packaging. Key downstream participants are major semiconductor manufacturers and defense contractors who integrate these substrates into high-performance devices (e.g., transistors for power modules or photodetectors). The direct channel dominates here, as these high-value, sensitive materials necessitate strict control over shipping, handling, and quality assurance protocols, linking the precursor supplier directly with the final device fabricator. This integrated approach ensures full traceability and rapid feedback loops concerning material performance, which is vital for the emerging wide-bandgap semiconductor industry.

High Purity Gallium Oxide Powder Market Potential Customers

The potential customer base for High Purity Gallium Oxide Powder is highly concentrated within the advanced technology manufacturing and research sectors, driven by the need for superior semiconductor performance that existing materials cannot provide. The primary end-users are large semiconductor fabrication plants (fabs) and specialized crystal growth houses that purchase the powder as the essential starting material for producing bulk Ga2O3 single-crystal substrates. These customers require ultra-high purity grades (5N and 6N) to minimize deep-level defects, which can severely compromise the operational lifespan and voltage capabilities of high-power transistors and diodes. Their purchasing decisions are heavily influenced by supplier consistency, batch-to-batch uniformity, and the ability to scale delivery volumes corresponding to future market adoption of Ga2O3 devices in high-volume applications like electric vehicle inverters.

A second major segment comprises original equipment manufacturers (OEMs) and defense contractors specializing in high-reliability systems, including aerospace, satellite communication, and military radar and UV detection systems. These buyers are particularly interested in Ga2O3's inherent resistance to radiation damage and high-temperature operation, properties crucial for mission-critical hardware deployed in harsh environments. For defense applications, the focus shifts slightly towards materials optimized for specific wavelength responses in photodetectors. Procurement for this sector is often driven by government contracts and long qualification cycles, requiring suppliers to demonstrate robust quality management systems and guaranteed long-term supply stability, often through direct contractual agreements with specialized material providers.

Furthermore, academic institutions and corporate research and development laboratories constitute a continuous, albeit lower-volume, demand segment. These customers utilize HP Ga2O3 powder for fundamental research into doping effects, novel crystal growth methodologies, and prototyping next-generation devices such as high-frequency oscillators and sensors. While volume requirements are smaller, the demand for specialized, often customized, purity and particle size distributions is high. These research customers serve as key indicators of future technological shifts, requiring suppliers to maintain flexible production capabilities and a strong technical support team capable of collaborating on cutting-edge material science challenges.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $150.0 Million |

| Market Forecast in 2033 | $550.0 Million |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Japan Metals & Chemicals Co., Ltd., Resonac (Showa Denko), Alfa Aesar (Thermo Fisher Scientific), Materion Corporation, American Elements, Sanyu Rec., Hebei Xinfotai Technology, Stanford Advanced Materials, Nanjing Eastern Gallium, Suzhou High-Precision Electronic Materials, Goodfellow, ALB Materials Inc., Atlantic Equipment Engineers, JX Nippon Mining & Metals Corporation, Saint-Gobain Crystals, Semiconductor Wafer Inc. (SWI), Tantec GmbH, Suzhou Gallium Technology Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Purity Gallium Oxide Powder Market Key Technology Landscape

The technological landscape surrounding the High Purity Gallium Oxide Powder market is primarily focused on achieving maximum material purity and optimizing the subsequent conversion of this powder into usable substrates. The critical precursor production involves advanced chemical processes, including highly controlled thermal decomposition and calcination of gallium salts or hydroxides under specific atmospheric conditions (often high-purity oxygen or inert gas) to form the Ga2O3 powder. The key technology here is the implementation of multi-stage purification techniques, such as solvent extraction and zone refining, to reduce residual metallic and non-metallic impurities below the parts per billion level, especially crucial for 6N grade material. Innovation in this sector revolves around improving yield efficiency and reducing the energy footprint of these high-temperature chemical reactions, requiring specialized, contamination-free reactor materials and precise temperature gradient control systems that ensure uniformity across large production batches.

A second major technological area involves the advanced metrology and analytical instrumentation required to certify the high purity levels. Technologies such as Inductively Coupled Plasma Mass Spectrometry (ICP-MS) and Glow Discharge Mass Spectrometry (GD-MS) are indispensable for detecting trace elements that could act as performance-degrading deep-level traps in the final device. The technological evolution in this area focuses on improving the detection limits and sample throughput, enabling rapid verification of material quality before it proceeds to the substrate growth phase. Furthermore, Powder X-ray Diffraction (PXRD) and Scanning Electron Microscopy (SEM) are vital for characterizing the powder’s crystallographic phase (typically the stable monoclinic beta-Ga2O3 polymorph) and particle morphology, which significantly impacts its handling properties and efficiency as a feed material for crystal growth.

The downstream technology landscape, though not strictly part of the powder market, heavily dictates the required specifications for the powder precursor. Bulk single-crystal growth methods like Edge-defined Film-fed Growth (EFG), Floating Zone (FZ), and Vertical Bridgman (VB) are the primary consumers of the HP Ga2O3 powder. EFG is currently the most commercially viable method for producing larger substrates, but it is highly sensitive to the purity and particle size distribution of the input powder. Technological breakthroughs in this field—such as developing novel crucibles (e.g., iridium substitutes) and implementing AI-controlled growth parameter optimization—rely entirely on the sustained availability of highly pure, consistent powder feedstocks. Thus, continuous innovation in HP powder synthesis is intrinsically linked to the commercial success of wide-bandgap Ga2O3 devices.

Regional Highlights

The regional distribution of the High Purity Gallium Oxide Powder Market exhibits a clear geographical specialization, largely influenced by manufacturing capabilities, governmental support, and downstream market maturity. Asia Pacific (APAC) stands as the dominant market in terms of production volume and supply chain control, primarily driven by substantial investments in advanced semiconductor materials across China, Japan, and South Korea. Japan is recognized globally for its pioneering role in Ga2O3 substrate technology, holding key patents related to crystal growth techniques like EFG, positioning it as a major hub for high-grade powder consumption. China, leveraging its robust chemical and materials industry, is rapidly expanding its capacity for precursor production, aiming to secure domestic supply for its ambitious goals in power electronics and 5G infrastructure. South Korea also contributes significantly through its large-scale electronics manufacturers, demanding consistent supply for advanced R&D.

North America represents a high-value, high-demand market focused intensely on downstream applications, particularly within the defense, aerospace, and advanced power management sectors. The United States government, through strategic initiatives and funding mechanisms (such as the CHIPS Act), is heavily prioritizing the establishment of domestic supply chains for wide-bandgap materials to reduce reliance on foreign sources for strategic technologies. Demand here centers on ultra-high purity 6N grade powder for military-grade UV detectors and high-power switching modules, where performance and reliability outweigh cost considerations. R&D collaboration between major universities, defense contractors, and specialized material companies defines the market activity in this region, ensuring a sustained, high-specification demand for precursors.

Europe constitutes a rapidly growing market, driven primarily by the automotive industry’s aggressive push toward Electric Vehicles (EVs) and the widespread adoption of renewable energy technologies, both requiring highly efficient power electronic systems. Germany, France, and the Nordic countries are major centers for EV manufacturing and smart grid development, creating significant potential demand for Ga2O3-based power modules. European market growth is supported by environmental regulations mandating increased energy efficiency, pushing manufacturers to explore materials superior to SiC and GaN in specific high-voltage segments. While Europe has a smaller production base for the powder itself compared to APAC, its strong downstream application market makes it a crucial consumer region, often sourcing its HP Ga2O3 precursors through specialized global suppliers.

- Asia Pacific (APAC): Dominant region in precursor production, led by Japan (technology leadership) and China (manufacturing scale). Focus on mass production for consumer electronics and industrial applications.

- North America: Key consumer market, especially for defense, aerospace, and strategic government applications. Demand focused on ultra-high purity (6N) grades for military hardware and advanced R&D.

- Europe: High-growth region driven by Electric Vehicle (EV) adoption, renewable energy infrastructure, and strong regulatory push for energy efficiency in industrial electronics.

- Latin America and Middle East & Africa (MEA): Emerging markets with growing investment in localized power infrastructure and telecommunications, generating nascent demand for power electronics precursors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Purity Gallium Oxide Powder Market.- Japan Metals & Chemicals Co., Ltd.

- Resonac (Showa Denko)

- Alfa Aesar (Thermo Fisher Scientific)

- Materion Corporation

- American Elements

- Sanyu Rec.

- Hebei Xinfotai Technology

- Stanford Advanced Materials

- Nanjing Eastern Gallium

- Suzhou High-Precision Electronic Materials

- Goodfellow

- ALB Materials Inc.

- Atlantic Equipment Engineers

- JX Nippon Mining & Metals Corporation

- Saint-Gobain Crystals

- Semiconductor Wafer Inc. (SWI)

- Tantec GmbH

- Suzhou Gallium Technology Co., Ltd.

- Midas Advanced Materials

- Nippon Rare Earth Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the High Purity Gallium Oxide powder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is High Purity Gallium Oxide (Ga2O3) used for in the semiconductor industry?

High Purity Gallium Oxide is primarily used as the precursor material for manufacturing ultra-wide bandgap semiconductor substrates and epitaxial layers. These substrates are essential for fabricating next-generation power electronic devices (diodes and transistors) and solar-blind ultraviolet (UV) photodetectors, enabling high-voltage, high-temperature operation and superior energy efficiency compared to silicon.

What purity grade of Gallium Oxide is required for advanced power devices?

Advanced power electronic devices require Ultra-High Purity (UHP) Gallium Oxide, typically 5N (99.999%) or, increasingly, 6N (99.9999%) grade. Achieving this high purity is critical because trace metallic impurities can introduce crystal defects and deep-level traps, significantly compromising the device's breakdown voltage and overall reliability.

How does Gallium Oxide compare to Gallium Nitride (GaN) and Silicon Carbide (SiC)?

Ga2O3 possesses a significantly wider bandgap (approx. 4.8 eV) than both GaN (3.4 eV) and SiC (3.3 eV). This wider bandgap gives Ga2O3 a much higher theoretical critical electric field strength, making it ideal for extremely high-voltage power applications, although its thermal conductivity is currently lower than its counterparts.

What are the primary technical restraints facing the commercialization of the Ga2O3 market?

The primary technical restraints include the difficulty and high cost associated with growing large-diameter, low-defect single-crystal Ga2O3 substrates from the precursor powder. Achieving scalability and consistently reducing crystalline defects are crucial challenges that the industry is actively addressing through novel growth techniques like EFG.

Which geographical region leads the global supply chain for High Purity Gallium Oxide precursors?

The Asia Pacific (APAC) region, particularly Japan and China, leads the global supply chain. This dominance is due to established high-purity chemical processing infrastructure, technological leadership in bulk crystal growth (Japan), and significant government investment in securing the domestic supply of strategic semiconductor materials.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager