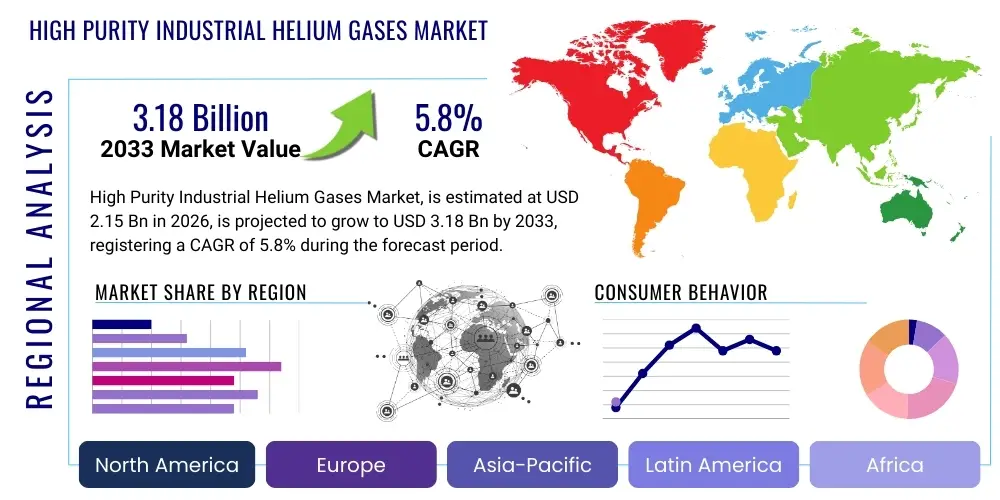

High Purity Industrial Helium Gases Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437417 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

High Purity Industrial Helium Gases Market Size

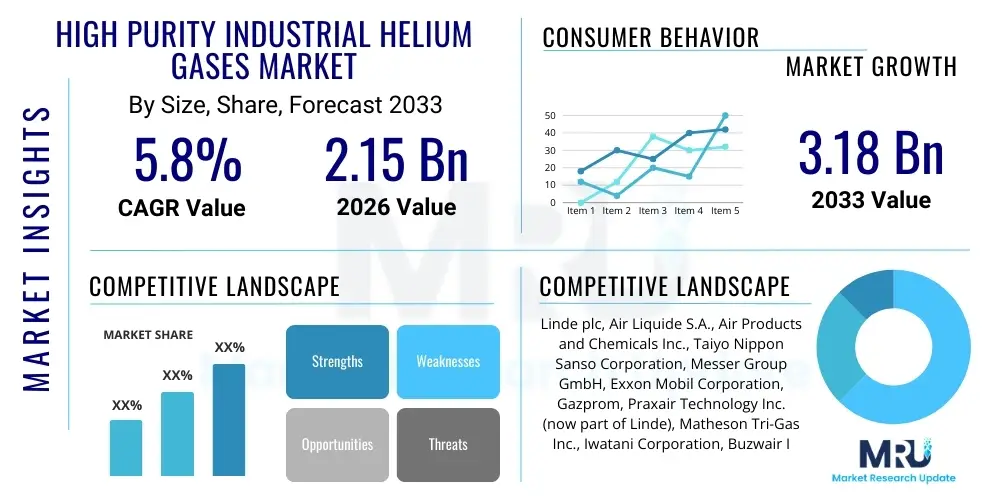

The High Purity Industrial Helium Gases Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $2.15 Billion USD in 2026 and is projected to reach $3.18 Billion USD by the end of the forecast period in 2033.

High Purity Industrial Helium Gases Market introduction

The High Purity Industrial Helium Gases Market encompasses the production, storage, distribution, and utilization of helium gas refined to extreme purity levels (typically 99.999% and above). High purity helium is chemically inert, non-flammable, and possesses the lowest boiling point of all elements, making it indispensable across several advanced industrial sectors. This market is fundamentally driven by its unique physical properties, particularly its exceptional heat transfer capabilities and cryogenic applications, which are critical for supporting high-tech manufacturing and advanced research worldwide. Market dynamics are heavily influenced by the scarcity of natural helium sources and the complex, capital-intensive infrastructure required for its extraction and purification.

High purity helium finds primary application in the electronics and semiconductor industry, where it is used as an inert carrier gas, a protective atmosphere, and for cooling intricate manufacturing processes like crystal growth and thin-film deposition. In the medical field, its cryogenic properties are vital for cooling the superconducting magnets in Magnetic Resonance Imaging (MRI) scanners. Furthermore, it plays a key role in fiber optics manufacturing, aerospace propulsion systems, laboratory chromatography, and controlled atmosphere welding. The benefits derived from using high purity helium include enhanced operational efficiency, reduced contamination risk in sensitive manufacturing environments, and enabling technologies that rely on extreme low temperatures or precise inert environments.

Major driving factors fueling the expansion of this market include the relentless global demand for advanced semiconductors, the increasing adoption of MRI technology in emerging economies, and sustained investment in space exploration and high-energy physics research. The miniaturization trend in electronics necessitates stricter atmospheric control, thereby driving demand for ultra-high purity grades (UHP helium). However, the market faces constraints related to unreliable global supply chain logistics, geographical concentration of natural reserves, and the high cost associated with advanced purification technologies necessary to meet stringent industrial specifications.

High Purity Industrial Helium Gases Market Executive Summary

The High Purity Industrial Helium Gases Market is characterized by robust growth anchored by non-discretionary demand across critical technology sectors. Business trends indicate a strong focus on supply diversification, as major industrial gas companies invest heavily in new liquefaction and refining capacities outside traditional North American sources, particularly in Qatar and Russia, to stabilize price volatility and ensure long-term availability. Technological innovations are centering on advanced helium conservation and recycling systems, particularly in large-volume consuming sectors like semiconductor fabrication plants (fabs) and MRI installations, aiming to mitigate the impact of periodic supply shortages. Strategic partnerships focusing on vertical integration—from source acquisition to end-user delivery—are becoming crucial for maintaining competitive advantage and securing supply contracts in high-growth regions.

Regionally, the Asia Pacific (APAC) stands out as the primary engine of market growth, overwhelmingly driven by the massive expansion of the electronics manufacturing base in countries like China, Taiwan, South Korea, and Japan. North America and Europe maintain stable, high-value consumption due to mature medical device manufacturing and advanced aerospace programs, although growth rates are comparatively modest. Emerging markets in Latin America and the Middle East are exhibiting increasing demand, primarily fueled by infrastructure development, expansion of local healthcare facilities, and nascent efforts to establish indigenous high-tech manufacturing capabilities. The geopolitical stability of source regions remains a critical determinant of regional market performance.

Segmentation trends highlight the dominance of the Electronics and Semiconductor segment, which requires the highest purity levels (typically 6.0 grade, 99.9999%), commanding premium pricing and driving innovation in quality control. The Cryogenics segment, predominantly linked to MRI scanners, represents consistent, large-volume demand but is increasingly focused on zero-boil-off technology to reduce reliance on replenishment. By purity level, ultra-high purity (UHP) grades are experiencing the fastest uptake due to stringent requirements in advanced manufacturing. Overall, the market remains inelastic concerning price fluctuations due to the essential, non-substitutable nature of high purity helium in these critical applications.

AI Impact Analysis on High Purity Industrial Helium Gases Market

User queries regarding the impact of Artificial Intelligence (AI) on the High Purity Industrial Helium Gases Market predominantly focus on supply chain resilience, process efficiency, and demand forecasting in high-tech end-user industries. Common concerns revolve around how AI can mitigate the inherent risks of helium supply shortages, optimize highly complex purification processes, and enhance the efficiency of helium conservation systems in large-scale cryogenic applications. Users seek confirmation on whether AI-driven predictive maintenance and sensor integration will reduce helium consumption rates in semiconductor manufacturing and MRI operations. The key expectation is that AI tools will provide greater visibility and control over global helium logistics, stabilizing pricing mechanisms and ensuring reliable delivery to critical infrastructure.

AI's primary influence is observed in optimizing the operational expenditure (OPEX) for both helium producers and large-scale consumers. Producers are leveraging machine learning algorithms to fine-tune gas separation and purification columns, optimizing energy consumption and maximizing yield from crude helium sources. This precision monitoring, driven by AI, minimizes waste and ensures that purity specifications (such as 99.999% or higher) are maintained consistently, reducing batch failures. Furthermore, AI-powered predictive analytics are revolutionizing the maintenance schedules for compressors and liquefiers, preventing unplanned downtime which is particularly detrimental in helium production where continuous operation is critical for efficiency.

In the consumer domain, particularly semiconductor fabs and medical centers, AI integration is vital for optimizing helium consumption through real-time monitoring of leak detection systems and flow controllers. Smart systems use AI to identify micro-leaks instantaneously and provide prescriptive recommendations for system adjustments, substantially reducing fugitive emissions—a major source of helium loss. Moreover, AI is crucial in enhancing the computational power and efficiency of quantum computing prototypes, which rely heavily on ultra-low temperatures sustained by helium cryogenics. As quantum computing research scales up, AI ensures the precise thermal management required for qubit stability, indirectly increasing the efficiency and value derived from high purity helium consumption in this cutting-edge application.

- AI optimizes complex helium liquefaction and purification processes, improving yield and reducing energy costs.

- Predictive maintenance schedules for cryogenic equipment (e.g., MRI chillers) are enhanced by AI, minimizing unplanned helium venting.

- Machine learning algorithms significantly improve real-time leak detection and fugitive emission management in semiconductor fabs.

- AI-driven supply chain platforms enhance global logistics visibility, optimizing transport routes and buffer stock management for market stability.

- Advanced AI modeling supports demand forecasting, aiding suppliers in allocating scarce high purity helium resources efficiently to critical sectors.

DRO & Impact Forces Of High Purity Industrial Helium Gases Market

The High Purity Industrial Helium Gases Market operates under significant pressure from inherent scarcity, high growth applications, and stringent regulatory requirements. The primary driver is the accelerating demand from the semiconductor industry, specifically related to advanced lithography (EUV) and the increasing number of large-scale fabrication plants globally, which mandate ultra-high purity helium for cooling and creating inert processing environments. This demand is complemented by steady growth in the medical sector, particularly the deployment of new MRI machines in developing regions, which require reliable helium resupply for cryogenics. However, the market is severely restrained by the concentrated geographic sources of natural helium, making the supply chain vulnerable to geopolitical instability, natural disasters, and planned maintenance shutdowns at major production facilities (e.g., Qatar and the US Federal Helium Reserve). This leads to volatile pricing and periods of critical undersupply, hindering long-term planning for consumers.

Opportunities in the market center on technological advancements aimed at supply resilience and efficiency. Significant investment in helium recycling and conservation equipment, particularly closed-loop systems in high-consumption applications like semiconductors and cryogenics research, presents a viable path to mitigating scarcity risks. Furthermore, exploration and development of unconventional, non-hydrocarbon-associated helium reserves in regions like Tanzania and South Africa offer potential diversification of the global supply base. The long-term prospect of scaling quantum computing, which requires specialized cryogenic infrastructure, represents a high-value future application, driving demand for the highest grades of purity.

The market is governed by high impact forces. Supply volatility exerts a critical influence, forcing end-users to secure long-term contracts, often at inflated prices, transforming helium from a commodity into a strategic material. The technological force driving miniaturization in electronics directly translates to a demand for ever-increasing purity standards (6.0 grade and 7.0 grade), necessitating expensive upgrades in purification technology by suppliers. Environmental and regulatory forces, though less direct than supply factors, are pushing manufacturers towards zero-emission production and mandatory recycling measures, increasing capital expenditure but ultimately improving resource efficiency and market sustainability.

Segmentation Analysis

The High Purity Industrial Helium Gases Market is meticulously segmented based on purity level, application, and end-use industry, reflecting the diverse and stringent requirements of various technology sectors. The classification by purity level is particularly critical, as different manufacturing processes demand varying degrees of inertness and contaminant control, directly influencing pricing and production complexity. Application segmentation highlights the core dependency of the electronics, medical, and aerospace industries on the unique properties of helium, providing clarity on consumption patterns and growth drivers specific to each use case. This detailed segmentation allows producers to optimize their supply allocation and investment strategies toward the highest-growth, highest-margin segments, predominantly those requiring ultra-high purity grades.

The dominant segment by purity remains the 5.0 Grade (99.999%), widely used across various industrial and laboratory applications, offering a balance between cost and performance. However, the fastest growth is observed in the 6.0 Grade (99.9999%) and above, driven exclusively by advanced semiconductor manufacturing, where minimal impurities are non-negotiable for chip functionality. Geographically, segmentation analysis confirms the APAC region's commanding lead in consumption due to its semiconductor dominance, while North America and Europe continue to dominate high-value segments such as specialized cryogenics research and high-precision aerospace applications. Understanding these segments is key to addressing specific operational bottlenecks and investing in localized distribution networks.

- Purity Level

- 5.0 Grade (99.999%)

- 5.5 Grade (99.9995%)

- 6.0 Grade (99.9999%)

- Higher Purity Grades (7.0 Grade and above)

- Application

- Cryogenics (MRI, NMR, Particle Accelerators)

- Lifting and Ballooning

- Electronics and Semiconductor Manufacturing

- Welding and Metal Fabrication (Inert Shielding Gas)

- Fiber Optics Production

- Laboratory and Analysis (Carrier Gas in Gas Chromatography)

- Aerospace and Defense (Pressurization and Cooling)

- End-Use Industry

- Healthcare and Medical

- Manufacturing (General Industrial)

- Electronics and Energy

- Research and Development (R&D)

Value Chain Analysis For High Purity Industrial Helium Gases Market

The value chain for the High Purity Industrial Helium Gases Market is complex, beginning with upstream activities focused on the extraction and purification of crude helium, which is typically co-produced with natural gas. Upstream analysis involves exploration, drilling, and separation processes where crude helium, concentrated at less than 1% volume in the gas stream, is isolated. This crude gas must then undergo extensive cryogenic processing, purification, and liquefaction at temperatures near absolute zero (-269°C) to achieve initial commercial purity (99.995%). The high cost and technological complexity of these upstream processes represent a significant barrier to entry, concentrating market control among a few global players who own or operate major helium recovery plants.

The midstream phase involves transportation and logistics, a critical and highly expensive component due to the nature of the product. Liquefied helium (LHe) must be transported in specialized, highly insulated cryogenic containers (Dewar flasks or ISO containers) to bulk storage hubs worldwide. Conversion of LHe back into gaseous helium (GHe) and further refinement to achieve ultra-high purity (UHP) grades (e.g., 6.0 Grade) occurs at regional purification centers. Distribution channels are twofold: bulk supply (direct-to-consumer delivery of LHe in large containers for MRI facilities or fabs) and packaged gas distribution (cylinders of GHe for laboratories, welding, and smaller industrial users). Direct channels dominate the high-volume, continuous supply contracts for semiconductor and large cryogenics end-users.

Downstream analysis focuses on end-use consumption and recycling efforts. Indirect channels, typically regional gas distributors, serve fragmented markets such as smaller medical centers, universities, and welding shops. The downstream complexity is increasingly defined by helium conservation technologies. Due to supply constraints, high-volume consumers are forced to invest in sophisticated recycling systems that capture vented helium, purify it on-site, and reliquefy it for reuse. This recycling loop, while technically challenging, adds a vital, high-cost component to the downstream value chain, shifting the focus from simple consumption to circular usage, which stabilizes long-term costs for major buyers.

High Purity Industrial Helium Gases Market Potential Customers

Potential customers (end-users/buyers) for high purity industrial helium gases represent a cross-section of advanced technological and scientific industries, all requiring an inert atmosphere or extreme cryogenic cooling capabilities. The largest and most strategically important customers are semiconductor fabrication plants, which rely on continuous, high-volume supply of 6.0 grade helium for processes such as sputtering, etching, and heat dissipation in lithography tools. These customers typically negotiate long-term, direct supply contracts with major industrial gas providers to ensure supply security, minimizing the risk associated with global shortages.

The second largest customer base resides within the healthcare and medical sector, primarily hospitals, diagnostic imaging centers, and specialized clinics utilizing Magnetic Resonance Imaging (MRI) machines. These facilities are critical consumers of liquid helium for cooling the superconducting magnets, requiring reliable delivery and maintenance services. Academic and governmental research institutions, particularly those involved in high-energy physics (like particle accelerators), fusion research, and quantum computing, form a high-value niche segment demanding the highest purity grades for highly sensitive experiments and cryogenic research.

Other significant buyers include manufacturers in the fiber optics industry, which uses helium as an inert protective gas during the drawing process to prevent impurities from compromising signal quality. Furthermore, large aerospace and defense contractors utilize helium for pressurizing fuel tanks, leak testing, and in advanced welding applications requiring extremely clean shield gases. These diverse end-users are characterized by their inelastic demand for helium; in most cases, there are no effective, technically feasible substitutes for high purity helium in their core operational processes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.15 Billion USD |

| Market Forecast in 2033 | $3.18 Billion USD |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Linde plc, Air Liquide S.A., Air Products and Chemicals Inc., Taiyo Nippon Sanso Corporation, Messer Group GmbH, Exxon Mobil Corporation, Gazprom, Praxair Technology Inc. (now part of Linde), Matheson Tri-Gas Inc., Iwatani Corporation, Buzwair Industrial Gases, PurityPlus Gases, Lehnert & Co. GmbH, Gulf Cryo, Acme Cryogenics, Noble Helium Ltd., Weil Group, IACX Energy, PGNiG S.A., Qatargas Operating Company Limited. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Purity Industrial Helium Gases Market Key Technology Landscape

The technological landscape of the High Purity Industrial Helium Gases Market is dominated by advancements in cryogenic separation, ultra-purification, and, increasingly, conservation and recycling. Extraction technology primarily relies on cryogenic distillation processes to separate helium from natural gas streams, requiring extremely low temperatures (below -200°C). Recent innovations focus on improving the efficiency of heat exchange and minimizing energy consumption in these liquefaction plants, often through advanced process control systems and novel refrigerants. The purification stage is crucial for achieving high-purity grades required by the semiconductor sector, utilizing adsorption technologies, membrane separation, and catalytic processes to remove trace contaminants like neon, hydrogen, and volatile organic compounds (VOCs) down to parts per billion (ppb) levels.

A major technological focus is the development of robust and efficient helium recovery and recycling systems. Due to escalating costs and supply unpredictability, large consumers are adopting sophisticated closed-loop systems. These systems incorporate multi-stage compression, specialized scrubbers for contaminant removal, and compact, high-efficiency reliquefiers that capture boil-off gas from cryogenic applications (like MRI or particle accelerators) and purify it back to the required standard for reuse. Zero-boil-off technology, particularly in MRI magnet cooling, utilizes cryocoolers to re-condense helium vapor directly, significantly reducing the frequency of costly refills and minimizing atmospheric venting, thus extending the lifespan of the initial charge.

Furthermore, distribution and storage technology continues to evolve. While traditional Dewars are still utilized, there is growing adoption of advanced, super-insulated cryogenic tankers and storage tanks employing multi-layer insulation and vacuum jacketed piping to reduce heat leak and subsequent helium loss during transit and storage. Sensor technology and the integration of the Industrial Internet of Things (IIoT) enable real-time tracking of purity levels, pressure, and temperature within the supply chain, enhancing quality control and ensuring secure delivery of these highly sensitive gases to the end-user facilities. These technological advancements collectively aim to increase global supply stability and improve resource utilization efficiency.

Regional Highlights

Regional dynamics are fundamentally shaped by the geographical distribution of helium reserves and the concentration of high-tech manufacturing industries.

- Asia Pacific (APAC): APAC is the largest and fastest-growing regional market, overwhelmingly driven by the semiconductor industry expansion, particularly in Taiwan, South Korea, China, and Japan. These economies host the world’s leading chip manufacturers (fabs) which necessitate massive, continuous supplies of UHP helium (6.0 Grade). Government investments in 5G infrastructure, consumer electronics manufacturing, and domestic medical device production further solidify APAC’s dominance.

- North America: Historically a major production hub (due to the US Federal Helium Reserve), North America remains a significant consumer, characterized by high-value, research-intensive applications. Demand is steady from advanced medical cryogenics, aerospace and defense programs (NASA), and leading R&D institutions involved in quantum computing and high-energy physics. The region is heavily focused on implementing recycling technologies to manage costs and volatile global supplies.

- Europe: Europe is a mature market with robust demand from the medical sector (MRI), industrial manufacturing (high-precision welding), and a strong academic/research base (CERN). The region is highly dependent on imports from Qatar and Russia and is characterized by stringent environmental regulations encouraging the adoption of sophisticated helium conservation methods among end-users.

- Middle East and Africa (MEA): MEA is critical primarily due to its role as a major supply source, notably Qatar, which is a leading global helium producer. Consumption in the region is relatively small but growing, driven by infrastructure projects, oil and gas sector requirements (leak detection), and increasing investment in localized healthcare facilities.

- Latin America: This region represents a smaller but emerging market, with growth tied to the modernization of healthcare systems (new MRI units) and limited industrial gas applications. Market penetration is often reliant on packaged gas distribution imported via global suppliers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Purity Industrial Helium Gases Market.- Linde plc

- Air Liquide S.A.

- Air Products and Chemicals Inc.

- Taiyo Nippon Sanso Corporation (A Mitsubishi Chemical Holdings Company)

- Messer Group GmbH

- Exxon Mobil Corporation

- Gazprom

- Matheson Tri-Gas Inc.

- Iwatani Corporation

- Buzwair Industrial Gases

- Qatargas Operating Company Limited

- IACX Energy

- Noble Helium Ltd.

- PGNiG S.A.

- Gulf Cryo

- Acme Cryogenics

- Weil Group

- PurityPlus Gases

- Lehnert & Co. GmbH

- Universal Industrial Gases Inc.

Frequently Asked Questions

Analyze common user questions about the High Purity Industrial Helium Gases market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is high purity industrial helium and how is it graded?

High purity industrial helium is gas refined to exceptional purity levels, typically 99.999% or higher. It is graded based on the number of nines in its purity percentage; for example, 5.0 Grade is 99.999% pure, and 6.0 Grade (UHP) is 99.9999% pure, essential for advanced electronics manufacturing.

Why is the global supply of high purity helium often unstable?

The supply is unstable because natural helium reserves are geographically concentrated, primarily co-produced with natural gas in a few key locations (e.g., Qatar, the US, Russia). Geopolitical events, planned maintenance shutdowns at major liquefaction plants, and complex, expensive cryogenic transportation logistics all contribute to periodic shortages and price volatility.

Which end-use industry drives the highest demand for UHP helium?

The Electronics and Semiconductor Manufacturing industry drives the highest demand for Ultra-High Purity (UHP) helium, particularly the 6.0 Grade. It is critically used as an inert atmosphere and coolant in advanced processes like Extreme Ultraviolet (EUV) lithography and semiconductor wafer production to prevent minute contamination.

How are companies mitigating the risk of helium shortages?

Companies are mitigating shortage risks through several strategies: investing in advanced helium recovery and recycling systems (closed-loop systems), securing long-term supply contracts with major global producers, and actively seeking to diversify crude helium supply sources outside of traditional producing regions.

What role does cryogenics play in the High Purity Industrial Helium Market?

Cryogenics is paramount as helium is the only element that remains liquid at temperatures near absolute zero (-269°C). High purity liquid helium is indispensable for cooling the superconducting magnets used in Magnetic Resonance Imaging (MRI) scanners, Nuclear Magnetic Resonance (NMR) spectroscopy, and high-energy physics research.

The global demand for high-purity industrial helium remains robust, directly correlating with investment cycles in advanced manufacturing and medical diagnostics. The market structure, defined by high barriers to entry and non-substitutability, necessitates continuous strategic planning by major consumers to secure long-term availability amidst ongoing supply chain volatility. Future market growth will be intrinsically linked to the successful deployment of new recycling technologies and the exploitation of untapped global reserves to ensure stability in this critical industrial gas sector.

Technological advancement is not solely focused on purification but is equally dedicated to efficiency at the point of use. Innovations in cryocooler performance and the integration of smart, AI-driven monitoring systems are proving essential for minimizing loss, particularly in sensitive research environments and high-throughput semiconductor fabrication facilities where the cost of lost helium significantly impacts operational budgets. The focus on sustainability through conservation and reuse is reshaping the competitive landscape and driving partnership formation between gas suppliers and technology developers.

Regional competitive dynamics show intense rivalry, particularly in the Asia Pacific region, where localized supply agreements are highly prized. Major industrial gas companies leverage their global logistics networks and multi-source supply capabilities to service this demanding market. As emerging technologies like quantum computing mature, the requirements for helium purity and continuous, reliable supply will only become more stringent, further segmenting the market into highly specialized, premium-priced niches demanding superior grade delivery and support services.

The market faces ongoing structural challenges related to the finite nature of terrestrial helium sources. Therefore, pricing mechanisms are expected to remain elevated compared to historical averages, reflecting the high capital intensity of extraction and purification processes, compounded by the logistical complexity of maintaining a cryogenic supply chain across continents. This environment favors large, diversified industrial gas players capable of absorbing volatile procurement costs and investing proactively in resource diversification projects worldwide.

Detailed analysis of end-user budgets reveals a shifting trend where capital expenditure for helium recycling equipment is increasingly prioritized over operational expenditure for constant replenishment. This strategic shift indicates a maturity in how critical consumers manage resource scarcity, treating helium not as a consumable utility but as a carefully managed asset requiring significant upfront investment for long-term supply resilience. This factor will influence the competitive strategies of equipment manufacturers specializing in cryogenic recycling and purification systems.

Further market assessment highlights the critical role of governmental policies and international trade agreements in shaping helium supply routes. Any disruption to these agreements or imposition of tariffs can swiftly cascade through the value chain, impacting global electronics production schedules and healthcare service delivery. Monitoring geopolitical developments in regions with major reserves is therefore a crucial component of risk management for all stakeholders in the High Purity Industrial Helium Gases Market.

The expansion of the fiber optics sector, fueled by global demand for faster internet and data center interconnectivity, represents a consistent, high-specification application. Although not as volume-intensive as semiconductors or cryogenics, the fiber optics industry demands strict purity controls, placing pressure on suppliers to maintain impeccable quality standards and zero-defect delivery protocols to ensure the integrity of the optical fiber manufacturing process.

In summary, the High Purity Industrial Helium Gases Market is characterized by high growth in demand, critical supply constraints, and a technology focus on conservation. Success in this market is determined by the ability to secure diversified feedstock, manage complex cryogenic logistics efficiently, and deliver ultra-high purity grades reliably to the world’s most advanced technology sectors.

The increasing complexity of scientific research, particularly in areas requiring extreme superconductivity, continues to push the boundaries of purity requirements. Research laboratories and physics institutions often require specialized mixtures and unique packaging, demanding flexibility and bespoke purification capabilities from suppliers. This segment, while small in volume, contributes significantly to technological advancement and maintains high barriers to entry for standard industrial gas providers.

Furthermore, the environmental footprint associated with helium extraction and processing is coming under increased scrutiny. Although helium itself is inert, the associated extraction from natural gas and the energy intensity of cryogenic liquefaction require sustainable practices. Leading companies are adopting renewable energy sources for their purification plants and developing carbon capture technologies to align with global environmental mandates, adding another layer of complexity and cost to the upstream segment.

The competitive environment is highly consolidated, with the top three global industrial gas companies holding a commanding share. Competition is less focused on price and more centered on reliability of supply, efficiency of logistics, and specialized service offerings, such as on-site bulk storage management and guaranteed replenishment timelines. Smaller regional players often thrive by specializing in local distribution and servicing the packaged gas segment for laboratories and smaller industrial users.

Future R&D efforts are concentrated on non-cryogenic separation techniques, such as advanced membrane filtration, which could potentially lower the energy requirements and capital costs associated with traditional cryogenic distillation. While these technologies are currently nascent for high-volume commercial production, successful scaling could disrupt the upstream segment, reducing reliance on highly energy-intensive cryogenic infrastructure and potentially diversifying the global production map.

The long-term outlook for the market remains positive, underpinned by secular trends in digital transformation and healthcare infrastructure build-out globally. While supply management remains the paramount challenge, continuous technological investment in resource optimization ensures that high purity helium will continue to serve as an enabling material for key global technological innovations through the forecast period and beyond.

The specialized nature of delivery equipment, including certified transportation vessels and high-pressure cylinders designed for ultra-high purity gases, represents a key infrastructure investment. Maintaining the integrity of the gas purity during transfer from the liquefaction plant to the point of use requires rigorous quality control procedures and specialized training for logistics personnel, further distinguishing this market from standard industrial gas segments.

In conclusion, stakeholders must navigate a challenging matrix of geopolitical risks, inelastic demand from critical sectors, and substantial technological hurdles related to efficient conservation. The shift toward a circular economy model—prioritizing recovery and reuse—is not merely an option but a necessary operational mandate for high-volume consumers to ensure the continuity of their mission-critical processes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager