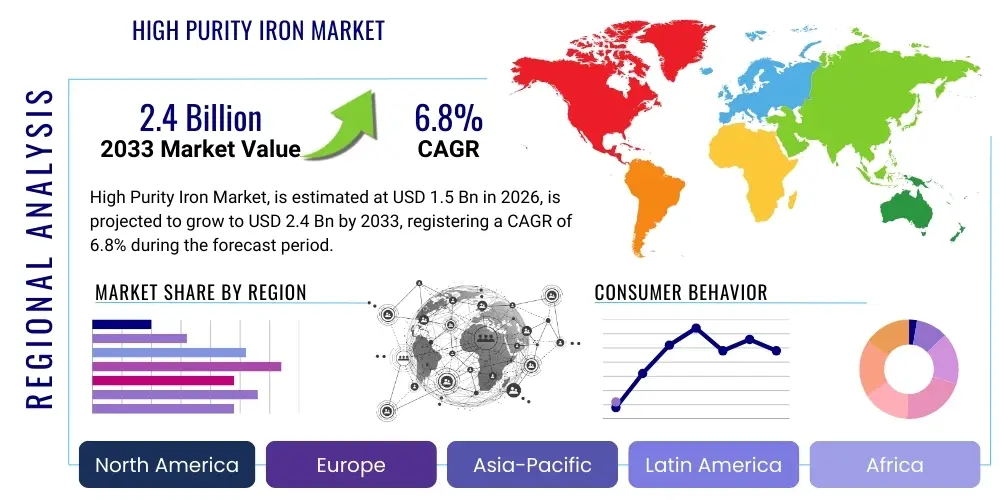

High Purity Iron Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437821 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

High Purity Iron Market Size

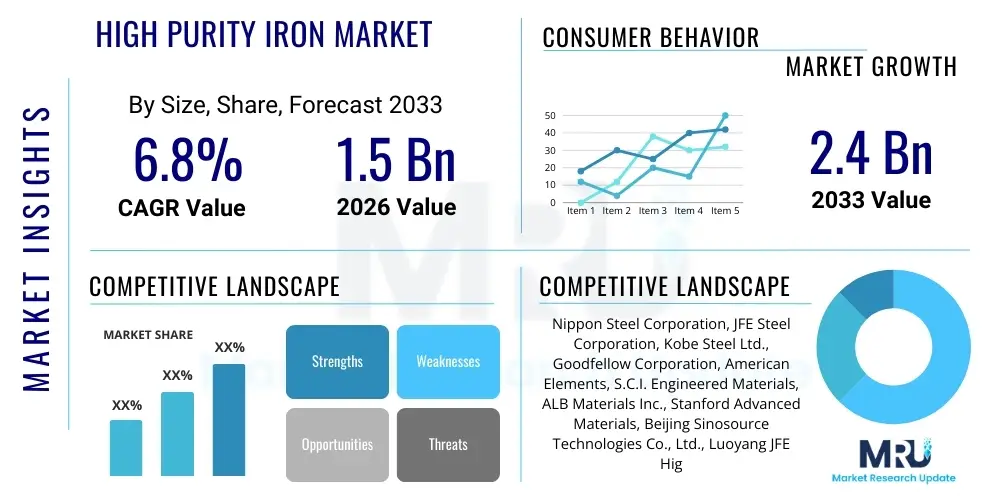

The High Purity Iron Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.4 Billion by the end of the forecast period in 2033.

High Purity Iron Market introduction

The High Purity Iron (HPI) market encompasses the production, distribution, and consumption of iron materials characterized by extremely low levels of interstitial and metallic impurities, typically defined as having a purity level ranging from 99.99% (4N) up to 99.9999% (6N). This specialized material is critical for numerous high-technology applications where standard commercial iron or steel would fail due to the negative impact of trace elements on material properties such as magnetic permeability, electrical resistivity, and mechanical integrity under extreme conditions. The manufacturing process of HPI involves complex metallurgical steps, including vacuum melting, electrolytic refining, and specialized chemical purification techniques, all aimed at reducing contaminants like carbon, sulfur, phosphorus, and specific heavy metals to parts per million (ppm) or even parts per billion (ppb) levels. The high cost and technological complexity associated with achieving these purity standards define the structure of this niche, yet strategically vital, market segment.

The primary product forms of High Purity Iron include rods, wires, ingots, powders, and, most critically, sputtering targets and specialized pellets. These products are foundational inputs for several high-growth industries. Major applications span across the electronics sector, where HPI is indispensable for creating high-performance magnetic shields, advanced memory cores, and vacuum components. In the nuclear industry, HPI is used in research reactors and specialized cladding materials due to its controlled neutron absorption cross-section and superior radiation resistance. Furthermore, the material is increasingly utilized in the production of specialized alloys for the aerospace and defense sectors, where reliability and performance under extreme stress are paramount. The material’s unique combination of high saturation magnetization and low coercivity makes it irreplaceable in precision electrical motors and sensor technologies.

The market is predominantly driven by the relentless miniaturization and increasing complexity of electronic devices, particularly the global expansion of semiconductor manufacturing capacity, which demands higher quality sputtering targets for integrated circuit fabrication. The transition towards high-efficiency electric vehicles (EVs) and renewable energy systems also fuels demand for specialized magnetic materials derived from HPI. Key benefits of HPI include enhanced magnetic properties, improved corrosion resistance, and superior ductility, which allow for the creation of components that function reliably in sophisticated environments. However, the market growth is moderately constrained by the high capital expenditure required for purification facilities and the inherent volatility in the pricing of raw materials, coupled with a specialized and complex global supply chain that requires rigorous quality control and certification processes.

High Purity Iron Market Executive Summary

The global High Purity Iron market is experiencing an accelerating growth phase, fundamentally propelled by critical business trends centered on technological innovation and supply chain resilience. Manufacturers are prioritizing the development of continuous flow purification techniques, such as advanced zone melting and high-temperature vacuum induction melting (VIM), to improve yield and reduce the energy footprint associated with ultra-purification processes. A significant business trend involves strategic partnerships between HPI producers and major semiconductor foundries to ensure a stable supply of tailor-made sputtering targets, addressing the stringent quality requirements and just-in-time delivery mandates of the rapidly expanding chip industry. Furthermore, the rising geopolitical focus on securing strategic materials is pushing companies to diversify sourcing and establish regional production hubs outside traditional centers of excellence.

Regionally, the Asia Pacific (APAC) maintains its undisputed dominance, acting both as the principal consumer and the largest production region, largely owing to its established ecosystem for high-volume electronics, electric vehicle (EV) components, and advanced battery manufacturing, particularly in China, Japan, and South Korea. These nations benefit from governmental support for material science research and advanced metallurgy infrastructure. North America and Europe, while accounting for smaller volume, represent high-value markets driven by aerospace, medical, and defense applications, where material certification and regulatory compliance command premium pricing. The current trend in these Western markets is an investment in localized, small-scale, high-purity production facilities to mitigate reliance on overseas suppliers, emphasizing strategic independence and quality assurance.

Segmentation trends reveal robust demand across the 4N (99.99%) to 5N (99.999%) purity grades, which form the bedrock of magnetic components and standard electronic shielding. The segment demonstrating the most rapid growth, however, is the ultra-high purity 6N (99.9999%) category, critically required for advanced semiconductor metallization layers and next-generation data storage technologies, where even minute impurities can lead to device failure. Application-wise, sputtering targets continue to be the primary revenue driver, reflecting massive global investment in semiconductor fabrication. Simultaneously, the accelerating transition towards sustainable energy systems is establishing specialized magnetic materials for high-efficiency motors (used in wind turbines and EVs) as a high-growth ancillary segment. These trends collectively underscore a market moving towards specialization, where purity level, rather than volume, dictates market value and competitive advantage.

AI Impact Analysis on High Purity Iron Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the High Purity Iron market typically revolve around three key areas: process optimization, quality control enhancement, and demand forecasting driven by AI-accelerated end-user industries. Users frequently ask how machine learning can be applied to the highly complex purification stages, such as electrolytic refinement or zone melting, to predict and control the distribution of trace elements in real-time, thereby maximizing yield and minimizing energy consumption. Another major theme is the use of computer vision and sensor fusion, powered by AI, for automated, non-destructive quality assurance and impurity mapping within HPI ingots, a critical step to meet semiconductor-grade requirements. Furthermore, users are keenly interested in how the explosive growth of AI infrastructure—data centers, advanced processors, and specialized cooling systems—will directly increase the demand for high-performance magnetic materials and thermal management components that rely heavily on HPI, ensuring sustained market expansion.

The implementation of AI and sophisticated analytical models offers transformative potential for HPI production, shifting processes from relying heavily on empirical knowledge and intermittent laboratory testing to continuous, data-driven optimization. AI algorithms can ingest multivariate data streams from sensors monitoring temperature, current density, flow rates, and spectral analysis during purification. By analyzing these complex datasets, the models can identify subtle correlations between process parameters and final impurity profiles, allowing operators to make proactive adjustments that stabilize the purity outcome, reducing variability between batches and decreasing the reliance on time-consuming post-production reprocessing. This enhancement in process precision is crucial, especially when aiming for 6N and 7N purity levels, where traditional control methods often struggle to maintain consistency.

Beyond direct manufacturing, AI indirectly influences the HPI market through its massive computational infrastructure requirements. High-performance computing (HPC) and data centers require millions of specialized components, including advanced magnetic storage media, highly efficient power delivery systems, and sophisticated shielding to protect sensitive electronic components from electromagnetic interference (EMI). Many of these components, particularly high-frequency transformers and inductors, utilize HPI-derived alloys for superior magnetic characteristics. As AI adoption accelerates globally, the necessary build-out of supporting hardware provides a long-term, high-volume demand driver for ultra-pure materials. Thus, AI serves as both a powerful tool for manufacturing efficiency and a fundamental accelerator of end-market consumption.

- AI-Driven Process Optimization: Utilizing machine learning models to analyze complex metallurgical process parameters (e.g., current, temperature, vacuum level) during electrolytic or vacuum melting to achieve higher purity yields consistently.

- Real-Time Quality Control: Implementation of computer vision and deep learning algorithms for automated, high-speed inspection and mapping of internal impurities or structural defects in HPI products.

- Predictive Maintenance: AI tools forecast equipment failures in high-cost purification equipment, minimizing unplanned downtime and ensuring continuous production of sensitive materials.

- Supply Chain Resilience: Use of predictive analytics to optimize inventory levels of specialty precursors and forecast potential material bottlenecks based on global demand signals.

- Demand Acceleration: The exponential growth of AI infrastructure (HPC, data centers, advanced chips) drives increased demand for high-performance magnetic materials and EMI shielding manufactured using HPI.

DRO & Impact Forces Of High Purity Iron Market

The dynamics of the High Purity Iron market are shaped by a complex interplay of Drivers (D), Restraints (R), and Opportunities (O), which are amplified or mitigated by pervasive Impact Forces. The primary driver is the accelerating global investment in semiconductor manufacturing and advanced electronic miniaturization, necessitating materials with superior magnetic properties and minimal electrical resistivity. Opportunities center around the development of ultra-high purity grades (7N and above) for emerging quantum computing and next-generation fusion energy applications, coupled with the optimization of sustainable, low-carbon purification processes. Conversely, the market faces significant restraints, including the exorbitant capital expenditure required to set up and operate high-specification purification facilities and the inherent volatility and complexity of the global supply chain for precursor materials. These elements collectively dictate market competitiveness, pricing structures, and strategic investment decisions across the value chain.

A major impact force shaping the HPI market is technological advancements, specifically in areas such as vacuum technology and plasma processing, which continuously push the boundaries of achievable purity levels, thereby redefining what constitutes a "high-purity" product and increasing the performance threshold expected by end-users. Geopolitical stability also exerts a high impact; since HPI is considered a strategic material due to its use in defense and advanced technology, trade regulations, export controls, and international tariffs significantly influence material flow and regional manufacturing investment. Furthermore, environmental, social, and governance (ESG) factors are becoming an increasingly powerful force, pressuring producers to adopt more energy-efficient and environmentally benign refining methods, often requiring substantial upfront investment but offering long-term brand differentiation and compliance benefits.

The market's sensitivity to macroeconomic cycles, particularly investment waves in capital-intensive sectors like semiconductors (Moore's Law implications) and infrastructure (EV adoption targets), also acts as a critical impact force. When global investment in these sectors surges, demand for HPI spikes dramatically, leading to potential supply bottlenecks and price inflation. Conversely, periods of reduced capital expenditure can lead to inventory build-up and pricing pressure. The inherent difficulty in achieving and certifying ultra-high purity grades acts as a structural barrier to entry, concentrating market control among a few highly specialized companies. Therefore, sustained growth relies heavily on technological breakthroughs that lower production costs and broaden the application scope beyond current niche markets into more commoditized, high-volume segments while maintaining rigorous quality control standards demanded by cutting-edge consumers.

Segmentation Analysis

The High Purity Iron market is critically segmented based on purity level, product form, and end-use application, reflecting the highly specialized nature of the material and its diverse technological requirements. Purity level serves as the most decisive factor, dictating both the achievable application and the final market price, with each incremental 'N' (nine) representing a significant jump in manufacturing complexity and value. Product forms like sputtering targets, ingots, and powders cater directly to specific manufacturing techniques used by downstream industries. Analyzing these segments provides a clear understanding of where current growth is concentrated, which is predominantly in the ultra-high purity grades demanded by the semiconductor and advanced research sectors, distinguishing this market from conventional ferrous material markets.

The segmentation based on application reveals the primary consumption centers for HPI. Magnetic materials, encompassing soft magnets for motors, sensors, and transformers, constitute the largest segment due to widespread adoption across consumer electronics and industrial machinery. However, the fastest evolution is seen within the sputtering targets segment, essential for depositing ultra-thin, contamination-free metal films onto silicon wafers and display panels. Understanding this distribution is crucial for manufacturers to align their production capacity and purity focus, ensuring compliance with the extremely tight specifications required for semiconductor manufacturing, which represents the highest barrier to entry but also the highest profit potential.

Geographical segmentation underscores the regional distribution of both production capacity and final consumption, highlighting the concentration of demand in Asia Pacific due to its semiconductor and electronics manufacturing dominance, versus the high-value, niche defense and aerospace applications prevalent in North America and Europe. This geographic skew mandates specialized logistics and regulatory expertise for global players. Overall, segmentation analysis confirms that market value is increasingly shifting towards materials that promise higher functional performance (i.e., higher purity), positioning HPI as a critical enabling material for future technological advancements.

- By Purity Level:

- 4N (99.99%)

- 5N (99.999%)

- 6N (99.9999%)

- Above 6N (Ultra-High Purity)

- By Product Form:

- Ingots/Billets

- Sputtering Targets

- Wires/Rods

- Powders

- Sheets/Plates

- By Application:

- Magnetic Materials

- Sputtering Targets (Semiconductors & Displays)

- Nuclear Applications

- Electronic Components (Shielding, Cores)

- Specialized Alloys (Aerospace & Defense)

- Catalysts and Medical Devices

- By End-Use Industry:

- Semiconductors and Electronics

- Aerospace and Defense

- Nuclear Energy

- Automotive (EV components)

- Healthcare and Medical

Value Chain Analysis For High Purity Iron Market

The value chain for High Purity Iron is complex, highly specialized, and significantly shorter than that for standard iron, characterized by intensive processing steps that add substantial value. The chain begins with the procurement of highly selected, often low-impurity raw material (upstream analysis), such as specialized pig iron, high-grade iron ore, or purified scrap, which must adhere to stringent initial chemical specifications to minimize the load on subsequent purification stages. This initial selection phase is critical as the cost and difficulty of removing impurities increase exponentially with the required final purity. Key upstream activities include chemical analysis, material pre-treatment, and initial melting operations, often requiring specialized knowledge in managing trace element content.

The core of the value chain is the purification process, involving high-cost, proprietary technologies like electrolytic refining, vacuum induction melting (VIM), electron beam refining (EBR), and zone melting. These sophisticated processes transform the input material into high-purity ingots or billets. Following purification, the material undergoes fabrication into specific product forms—most notably sputtering targets for the semiconductor industry or specialized powders. Quality control and certification, involving advanced analytical techniques like Glow Discharge Mass Spectrometry (GDMS), are paramount at this stage, representing a significant portion of the material's final cost and acting as a major competitive differentiator. The precision and consistency of this manufacturing phase define the market leaders.

The distribution channel involves both direct and indirect routes. Due to the highly customized nature and technical requirements of HPI, especially in the semiconductor sector, direct sales from manufacturers to end-users (downstream analysis) are prevalent, facilitating deep technical collaboration and security of supply. Indirect channels involve specialized materials distributors and trading houses that manage logistics, small-volume orders, and specific regional market needs, particularly in Europe and smaller APAC markets. The final consumption occurs within high-tech fabrication facilities (fabs), specialized alloy producers, and nuclear research centers. The high value and strategic importance of HPI mean that efficiency in processing, minimizing waste, and maintaining a secure, certified supply chain are the primary drivers of profitability throughout the value chain.

High Purity Iron Market Potential Customers

The customer base for the High Purity Iron market is highly concentrated within industries requiring materials with exceptional magnetic, thermal, and mechanical properties, primarily where impurities cannot be tolerated. The largest cohort of potential customers consists of semiconductor fabrication plants (fabs) and display panel manufacturers who utilize HPI sputtering targets to create critical thin films necessary for microprocessors, memory chips (DRAM, NAND), and flat panel displays. These customers demand 5N and 6N purity levels, focusing on minimizing defects and maximizing device performance yield. Their purchasing decisions are driven almost exclusively by material consistency, contamination control protocols, and the producer's proven track record of meeting rigid specification tolerances over long periods, making them demanding but highly lucrative long-term partners.

Another significant customer segment includes manufacturers of specialized magnetic components, particularly those supplying the automotive industry (specifically electric vehicles) and the industrial machinery sector. These customers use HPI-derived alloys to produce soft magnetic materials for high-efficiency motors, high-frequency power supplies, and advanced sensors. The need for reduced core losses and enhanced magnetic permeability in these components, which are crucial for improving EV range and industrial energy efficiency, drives their demand for HPI. Similarly, aerospace and defense contractors represent a high-value customer group, using HPI for specialized alloys in critical structural components, electromagnetic shielding, and instrumentation, where reliability under extreme conditions (high temperature, radiation) is non-negotiable.

Furthermore, research institutions, nuclear facilities, and specialized medical device manufacturers represent niche but vital customer segments. Nuclear energy customers use HPI for structural components in advanced reactor designs due to its known behavior under irradiation and controlled elemental composition. Medical device companies require ultra-pure iron for specific implants, diagnostic equipment, and specialized drug delivery systems, where biocompatibility and precise mechanical properties are essential. These customers often require custom batches and meticulous documentation, focusing on material traceability and regulatory compliance rather than purely on price, indicating a segment characterized by long qualification cycles and sustained, high-margin consumption.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.4 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nippon Steel Corporation, JFE Steel Corporation, Kobe Steel Ltd., Goodfellow Corporation, American Elements, S.C.I. Engineered Materials, ALB Materials Inc., Stanford Advanced Materials, Beijing Sinosource Technologies Co., Ltd., Luoyang JFE High Purity Materials Co., Ltd., GFE Materials Technology, Leshan Dongfeng Iron & Steel Co., Ltd., Advanced Materials Technology, Alfa Aesar (Thermo Fisher Scientific), Materion Corporation, Plansee Group, VACUUMSCHMELZE GmbH & Co. KG, Umicore N.V., Tosoh Corporation, Praxair (Linde plc) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Purity Iron Market Key Technology Landscape

The manufacturing of High Purity Iron relies on a highly specialized and evolving technological landscape centered on iterative purification processes and advanced analytical validation. The foundational technologies include various methods of melting and solidification control designed to segregate impurities. Key among these is Vacuum Induction Melting (VIM), which reduces gaseous and volatile impurities by melting the iron under a high vacuum. Electrolytic Refining stands out as a critical purification technology, involving the movement of iron ions in an electrolyte solution, effectively separating the desirable iron from most metallic and non-metallic contaminants. Furthermore, specialized techniques like Zone Melting are employed, particularly for achieving ultra-high purity grades (6N and above), where a narrow molten zone is slowly moved along an ingot, pushing impurities to the ends for subsequent removal, demanding highly precise temperature and movement control systems.

Beyond primary purification, the technological landscape is defined by advanced fabrication and post-processing methods tailored to end-user specifications. For semiconductor applications, the purified HPI ingots must be transformed into sputtering targets with extremely fine grain structures and uniform density, often achieved through specialized powder metallurgy and hot isostatic pressing (HIP). This ensures that the sputtering process yields homogeneous films without macro-particle defects. Furthermore, the handling and storage technology utilized post-purification is equally critical. Ultra-pure materials must be processed in cleanroom environments, often under inert gas atmospheres, to prevent re-contamination by oxygen, nitrogen, or particulate matter from the environment, necessitating sophisticated air filtration and material transfer systems.

Finally, the analytical technology supporting the HPI market is arguably as important as the purification technology itself. Producers must employ state-of-the-art analytical tools to confirm and certify the purity of every batch. Techniques such as Glow Discharge Mass Spectrometry (GDMS) and Inductively Coupled Plasma Mass Spectrometry (ICP-MS) are indispensable for detecting and quantifying trace impurities down to ppb levels, providing the necessary assurance to high-stakes customers like semiconductor and nuclear organizations. Continuous investment in faster, more sensitive, and non-destructive analytical methods is essential, driving innovation in sensor technology, automated sampling, and data processing. The integration of these advanced analytical and processing technologies ensures compliance with the exacting standards that differentiate commercial iron from strategic, high-purity iron materials.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant market for High Purity Iron, driven by the world's leading semiconductor manufacturing centers in Taiwan, South Korea, Japan, and mainland China. The region's robust electronics manufacturing ecosystem, coupled with massive investments in electric vehicle (EV) battery technology and related high-efficiency motors, ensures continuous, high-volume demand for HPI, particularly in the 5N and 6N purity segments for sputtering targets and specialized magnetic alloys. Governmental support for advanced materials research and substantial existing metallurgical infrastructure further solidify its market leadership.

- North America: North America represents a high-value, albeit volume-constrained, market. Demand here is characterized by stringent quality requirements emanating from the aerospace, defense, and specialized medical sectors, necessitating high-grade, often custom-specification HPI. Recent strategic investments under initiatives aimed at securing domestic semiconductor supply chains are fueling expansion in localized HPI production capacity, focusing on materials certification and supply chain integrity.

- Europe: The European market demonstrates steady growth, primarily driven by the advanced automotive sector (EV production), renewable energy infrastructure (wind turbines requiring specialized magnetic materials), and nuclear research facilities. Demand is concentrated in countries like Germany and France, which have strong traditions in advanced engineering and materials science, focusing on HPI utilization for high-performance sensors, soft magnetic components, and precise instrumentation.

- Latin America (LATAM): The LATAM market remains nascent but offers potential, primarily tied to local electronics assembly operations and resource extraction industries. Consumption is generally low volume and focused on standard HPI grades, often relying heavily on imports from APAC and North American suppliers. Future growth hinges on foreign direct investment in high-tech manufacturing or specialized industrial projects.

- Middle East & Africa (MEA): MEA is currently the smallest consumer segment, with demand generally concentrated in oil and gas infrastructure (for specific sensor and control applications) and nascent solar energy projects. The region relies entirely on imported HPI. However, diversification initiatives in countries like Saudi Arabia and the UAE into advanced manufacturing and research could slowly stimulate localized demand for specialized materials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Purity Iron Market.- Nippon Steel Corporation

- JFE Steel Corporation

- Kobe Steel Ltd.

- Goodfellow Corporation

- American Elements

- S.C.I. Engineered Materials

- ALB Materials Inc.

- Stanford Advanced Materials

- Beijing Sinosource Technologies Co., Ltd.

- Luoyang JFE High Purity Materials Co., Ltd.

- GFE Materials Technology

- Leshan Dongfeng Iron & Steel Co., Ltd.

- Advanced Materials Technology

- Alfa Aesar (Thermo Fisher Scientific)

- Materion Corporation

- Plansee Group

- VACUUMSCHMELZE GmbH & Co. KG

- Umicore N.V.

- Tosoh Corporation

- Praxair (Linde plc)

Frequently Asked Questions

Analyze common user questions about the High Purity Iron market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary purity grades in the High Purity Iron Market?

The market is categorized by metallic purity levels, primarily 4N (99.99%), 5N (99.999%), and 6N (99.9999%). Grades 5N and 6N are essential for advanced semiconductor applications, where trace elements must be minimized for optimal device performance and reliability.

Which purification technologies are used to manufacture Ultra-High Purity Iron?

The key purification methods include Electrolytic Refining, which uses electric current to separate iron ions; Vacuum Induction Melting (VIM) for volatile impurities removal; and Zone Melting, employed for achieving the highest purity levels (6N and above) by directional solidification.

What is the main driver of demand for High Purity Iron sputtering targets?

The dominant driver is the accelerating global investment in semiconductor manufacturing, particularly the production of advanced logic chips and memory devices (DRAM/NAND), which rely on HPI sputtering targets to deposit contamination-free thin films onto silicon wafers.

How does the use of High Purity Iron affect electric vehicle (EV) performance?

HPI is crucial for manufacturing soft magnetic materials utilized in high-efficiency electric motors and power electronics in EVs. Its superior magnetic permeability and low core loss significantly reduce energy waste, thereby enhancing the overall range and performance of the vehicle.

What are the major geographical constraints facing the HPI supply chain?

Geographical constraints include the high concentration of specialized production facilities in the APAC region and the strategic nature of the material, leading to geopolitical risks, trade controls, and the necessity for highly specialized, certified global logistics to prevent re-contamination during transport.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager