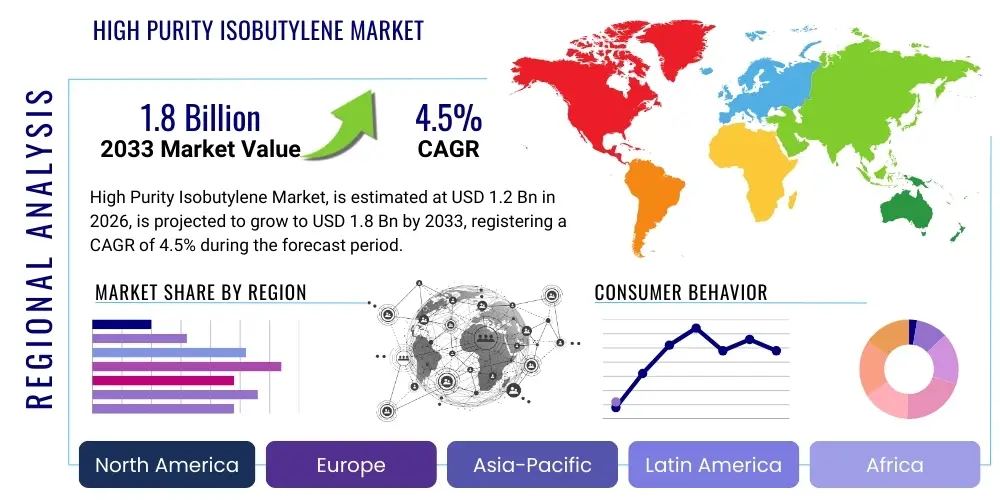

High Purity Isobutylene Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436560 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

High Purity Isobutylene Market Size

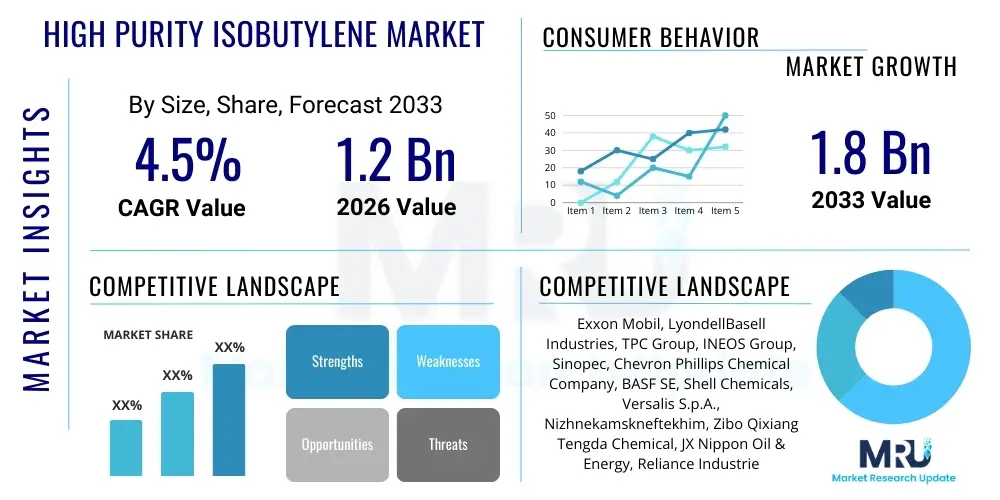

The High Purity Isobutylene Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.8 Billion by the end of the forecast period in 2033.

High Purity Isobutylene Market Introduction

High Purity Isobutylene (HPIB), a critical intermediate chemical derived typically from C4 streams in steam crackers or fluid catalytic cracking (FCC) units, is defined by its minimal contamination levels, usually above 99.9% purity. This stringent purity requirement makes HPIB indispensable in applications where contaminants could disrupt polymerization processes or degrade the final product performance, particularly in the production of high-performance polymers and specialty chemicals. Key industrial processes, such as the synthesis of butyl rubber, polyisobutylene (PIB), antioxidants (like BHT), and various chemical intermediates, rely heavily on a stable and high-quality supply of HPIB. The material's unique chemical structure, featuring a highly reactive tertiary carbon atom, is fundamental to its utility in advanced chemical synthesis.

HPIB purity specifications are crucial; even trace contaminants like C3 or C5 hydrocarbons can poison catalysts used in polymerization, leading to defective products or significant batch losses. Therefore, the production process must maintain extremely tight control over fractionation parameters. The distinction between commodity-grade isobutylene (often used directly in MTBE production) and High Purity Isobutylene (required for polymerization) defines the market segmentation and complexity of the supply chain. Global supply stability is often constrained not by the availability of raw C4 feedstock, but by the limited capacity of advanced purification facilities, which require high energy input and specialized operational expertise. The intrinsic linkage between HPIB supply and the global refining capacity ensures that geopolitical and operational shifts in the energy sector have immediate, observable impacts on HPIB pricing and availability for downstream polymer manufacturers worldwide.

The primary applications driving the demand for HPIB are centered around the automotive and construction sectors. Butyl rubber, synthesized using HPIB, is crucial for inner tubes, tire inner liners, and protective linings due to its superior impermeability to gases. Similarly, polyisobutylene is used extensively as an additive in lubricants, adhesives, sealants, and viscosity modifiers. The growing global focus on enhancing tire performance, particularly concerning fuel efficiency and longevity, directly translates into increased demand for high-quality butyl rubber, thereby strengthening the HPIB market trajectory. Furthermore, driving factors include the rapid industrialization across Asia Pacific, leading to surging automotive production and infrastructure development. Technological advancements in separation and purification processes are improving the efficiency and yield of HPIB production, addressing potential supply constraints and bolstering market growth.

High Purity Isobutylene Market Executive Summary

The High Purity Isobutylene market is poised for steady expansion, fueled primarily by the robust growth in the global automotive industry and sustained demand for specialty chemicals used in construction and packaging. Key business trends indicate a strategic shift among major petrochemical producers toward integrating HPIB production facilities with upstream cracking units to optimize feedstock costs and ensure purity control. Furthermore, there is an increasing emphasis on sustainable production methodologies, exploring alternative, bio-based feedstock sources for isobutylene to mitigate reliance on fossil fuels, although these processes are currently nascent and high-cost. Mergers and acquisitions focusing on securing C4 feedstock supply chains are notable, enhancing market consolidation and operational efficiencies across established industry leaders, positioning the industry for long-term stability despite feedstock volatility.

Regionally, Asia Pacific maintains its dominance in consumption, driven by China and India’s burgeoning manufacturing base and massive domestic demand for tires and polymers. This region is simultaneously becoming a hub for production capacity expansion, attracting significant foreign direct investment into integrated petrochemical complexes. North America and Europe, while mature markets, are experiencing demand growth driven by high-value applications such as advanced polyisobutylene lubricants and pharmaceutical-grade excipients. Regulatory actions, particularly the phase-out or restriction of MTBE in Western economies, have necessitated production shifts, compelling manufacturers to focus HPIB output predominantly toward butyl rubber and PIB sectors, diversifying their product portfolios away from traditional fuel applications.

The trend toward specialization also highlights the growing importance of circular economy initiatives within the petrochemical sector. Several leading companies are exploring methods to utilize waste streams or capture CO2 in HPIB production processes, although these concepts are primarily in pilot stages. Economically, the HPIB market is experiencing upward pricing pressure due to increasing environmental compliance costs, particularly in developed regions where tighter regulations govern effluent discharge and carbon footprint reporting. These compliance requirements necessitate continuous investment in cleaner technologies, which ultimately affects the final cost of HPIB derivatives. Segment trends reveal that Isobutylene-Isoprene Rubber (IIR) holds the largest share, while Polyisobutylene (PIB) is projected to exhibit the highest growth rate, propelled by increasing use in adhesives, sealants, and high-performance fuel and lube additives required by modern engine designs.

AI Impact Analysis on High Purity Isobutylene Market

Common user questions regarding AI's influence on the High Purity Isobutylene (HPIB) market typically revolve around optimizing complex separation processes, predicting feedstock volatility, and enhancing operational safety in petrochemical facilities. Users are highly interested in how machine learning algorithms can manage the intricate distillation and adsorption columns required for achieving 99.9%+ purity, questioning the reliability of AI models in handling real-time variability in C4 stream composition. Key concerns center on the capital investment required for AI implementation versus the resulting yield improvement, and the ability of predictive maintenance tools to minimize costly unplanned shutdowns specific to high-pressure chemical plants. The general expectation is that AI will dramatically improve resource efficiency and quality control, making HPIB production more consistent and cost-effective globally, leading to higher profitability margins for early adopters.

The utilization of sophisticated AI tools extends to optimizing the supply chain resilience, particularly for integrated producers managing complex internal logistics from the steam cracker output to the final butyl rubber synthesis unit. AI algorithms are designed to continuously adjust process variables—including pressure, temperature profiles in distillation columns, and flow rates through adsorbent beds—to dynamically counteract minor fluctuations in feedstock quality, ensuring uninterrupted achievement of the >99.9% purity threshold. This precision control significantly reduces off-spec production batches, minimizing waste and reprocessing costs inherent to high-purity chemical manufacturing processes.

Furthermore, AI platforms are being deployed to enhance safety protocols by predicting equipment failure scenarios and recommending preventative shut-down procedures, thereby mitigating the substantial risks associated with handling highly flammable C4 streams under high pressure. Ethical concerns related to intellectual property of process optimization models and data security in integrated operational environments are also emerging as discussion points among industry stakeholders, requiring robust frameworks for data governance. The predictive power of AI enables faster adaptation to external factors such as sudden feedstock price hikes or logistical bottlenecks, securing a competitive advantage for technologically advanced firms.

- AI optimizes C4 feedstock scheduling and blending ratios based on real-time market pricing and predicted operational performance.

- Predictive maintenance using AI minimizes downtime of critical HPIB synthesis reactors and purification units, improving overall asset utilization.

- Machine learning models enhance process control parameters in multi-stage separation columns (e.g., TAME splitting, extractive distillation) to maximize HPIB purity and yield.

- Advanced data analytics aids in forecasting demand volatility across major application segments like butyl rubber and PIB, optimizing inventory management and production sequencing.

- AI-driven simulation tools accelerate the development and scale-up of novel, sustainable HPIB production methods, such as those utilizing bio-based routes or advanced membrane separation techniques.

DRO & Impact Forces Of High Purity Isobutylene Market

The High Purity Isobutylene market is characterized by a strong interplay of positive drivers, structural restraints, and emerging opportunities, collectively shaped by complex internal dynamics and external macroeconomic factors. Primary drivers include the relentless expansion of the automotive sector, particularly in emerging economies, which necessitates high volumes of butyl rubber for tire production, a segment largely immune to substitution. Opportunities are concentrated in green chemistry and novel applications, such as the increasing use of HPIB derivatives in high-performance adhesives, lubricants essential for electric vehicles (EVs), and specialized chemical syntheses beyond traditional rubber and fuel additives. These opportunities provide avenues for diversification and margin enhancement, particularly for producers capable of achieving ultra-high purity grades.

However, the market faces significant structural restraints. The reliance on C4 fractions derived from crude oil refining and steam cracking exposes HPIB production to severe feedstock price volatility, which directly impacts operating margins. Furthermore, the stringent regulatory environment surrounding certain applications, notably the phase-out of MTBE in major economies due to groundwater contamination concerns, limits a historical major outlet for HPIB, requiring manufacturers to rapidly shift capacity utilization toward polymer grades. The high capital expenditure and energy intensity associated with purification processes necessary to achieve the requisite high purity levels also act as a substantial barrier to entry for new market participants, favoring established, large-scale integrated petrochemical giants.

Opportunities are further solidified by the increasing globalization of stringent product quality standards. As consumer expectations for durability and safety rise, particularly in the premium automotive segment (e.g., specialized sealing systems for electric vehicle batteries or high-durability infrastructure components), the reliance on ultra-pure feedstocks like HPIB grows. This provides niche market opportunities for suppliers focused on quality and regulatory compliance. However, a significant restraint is the availability of skilled technical personnel capable of operating and maintaining the increasingly complex HPIB purification plants and integrating them with advanced AI-driven control systems. The combination of forces dictates that market players must focus on efficiency, feedstock security, and differentiation through purity and service reliability to maintain competitive advantage.

Segmentation Analysis

The High Purity Isobutylene market is comprehensively segmented based on its source material, its final application, and the geography of consumption and production. Source segmentation, usually divided into C4 streams from crackers, refinery streams, and emerging on-purpose technologies like dehydration of tertiary butyl alcohol (TBA), is critical as it defines the purity achievable and the cost structure of the resulting product. Refinery streams are often less concentrated in isobutylene compared to cracker streams, necessitating more intensive purification processes. The choice of source stream dictates the feasibility of producing different purity grades, thereby influencing the competitive positioning of various manufacturers.

Application segmentation provides insights into end-use consumption patterns, dominated by the synthesis of butyl rubber and polyisobutylene, which serve diverse industrial requirements from automotive sealing to lubricant viscosity enhancement. The butyl rubber segment is relatively stable, correlated closely with global tire production volume, while the PIB segment shows greater potential for innovative growth in new adhesive and sealant formulations. Understanding these segments is vital for strategic capacity planning and investment decisions within the petrochemical value chain, allowing producers to anticipate shifts in demand based on macroeconomic trends in the automotive, construction, and specialized chemical sectors globally.

- Source

- Refinery C4 Stream: Typically requires TAME processing or selective adsorption due to higher contamination levels.

- Steam Cracker C4 Stream: Often contains higher isobutylene concentration, leading to lower purification costs.

- On-Purpose Technology (e.g., TBA Dehydration): Provides feedstock flexibility independent of cracking/refining operations, ensuring high purity.

- Application

- Isobutylene-Isoprene Rubber (IIR) Production (Butyl Rubber): Largest volume consumer, essential for gas impermeability in tires and medical stoppers.

- Polyisobutylene (PIB) Production: Used extensively as viscosity modifiers, sealants, and in chewing gum base.

- Methyl Tertiary Butyl Ether (MTBE) (where permitted): Still significant in developing markets for octane boosting.

- Tertiary Butyl Alcohol (TBA) and Derivatives: Intermediates used in various solvents and specialized chemicals.

- Antioxidants (e.g., BHT) and Specialty Chemicals: Lower volume but high-value applications for product preservation.

- Grade

- Standard Purity (99.5% - 99.9%): Suitable for MTBE and some standard polymer applications.

- Ultra-High Purity (>99.9%): Mandatory for high-performance butyl rubber, medical applications, and advanced electronics materials.

- Geography

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For High Purity Isobutylene Market

The value chain for High Purity Isobutylene begins with the upstream procurement of crude oil and natural gas, which are subsequently processed through steam cracking or refining to yield mixed C4 hydrocarbon streams. Upstream analysis focuses heavily on securing reliable and cost-effective C4 feedstock supply, a process characterized by intense competition and susceptibility to global energy market fluctuations. The availability and price stability of naphtha or LPG, the primary inputs for steam crackers, directly dictate the cost structure of the resulting isobutylene. Integrated producers who control both cracking and refining assets possess a significant cost advantage and greater resilience against price volatility compared to non-integrated chemical players who must purchase C4 streams on the open market.

The midstream process involves the actual chemical synthesis of HPIB, incorporating complex and energy-intensive separation techniques. These include TAME synthesis followed by cracking (the most common industrial route), or non-reactive methods like selective adsorption using sophisticated molecular sieves (SMB/PSA). The distribution channel for HPIB, given its volatile nature, relies heavily on direct logistics—specialized pipelines for local transport or dedicated ISO tanks and pressurized rail cars for regional shipments. This direct model ensures rigorous safety standards are met and minimizes handling risks. Indirect distribution through third-party chemical distributors is reserved for smaller, specialized orders or sales into markets lacking direct pipeline access, requiring meticulous documentation and adherence to stringent hazardous material transport regulations.

Downstream analysis highlights the transformative conversion of HPIB into high-value derivatives. The primary downstream consumers are producers of butyl rubber (IIR) for tire manufacturing and polyisobutylene (PIB) for sealants, adhesives, and lubricants. The profitability of the HPIB value chain is heavily dictated by the strength of these downstream markets. The shift toward higher-specification polymers and specialized additives increases the demand for ultra-high purity grades, driving innovation and demanding greater technical expertise throughout the purification stages. Successful players in the HPIB value chain often possess proprietary purification technology or strong backward integration into feedstock supply, enabling both cost leadership and product differentiation.

High Purity Isobutylene Market Potential Customers

Potential customers for High Purity Isobutylene are large-scale industrial consumers operating within specialized chemical synthesis, material manufacturing, and the automotive component supply chain. The primary buyer segments are globally diversified corporations specializing in synthetic rubber and polymer production, requiring guaranteed, continuous supplies of HPIB for their polymerization reactions. These entities act as foundational customers, driving demand through long-term supply contracts tied to global economic cycles, particularly those affecting vehicle production and infrastructure construction projects. Quality control and consistency in purity are paramount concerns for these buyers, as impurities can severely compromise the catalytic processes and the ultimate performance of their final products, such as high-end tires or specialized protective coatings.

The secondary customer segment includes lubricant and fuel additive manufacturers who utilize polyisobutylene derivatives synthesized from HPIB to enhance engine performance, viscosity, and cleanliness, a demand segment growing rapidly due to stricter fuel efficiency standards. Furthermore, specialty chemical producers who synthesize antioxidants like BHT, essential for preserving foods, fuels, and plastics, represent a stable, though smaller, customer base requiring consistent, high-specification feedstocks. Pharmaceutical companies also constitute a niche, high-value customer group, utilizing HPIB derivatives for medical stoppers and closures where extremely high purity and inertness are mandated by regulatory bodies like the FDA or EMA.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.8 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Exxon Mobil, LyondellBasell Industries, TPC Group, INEOS Group, Sinopec, Chevron Phillips Chemical Company, BASF SE, Shell Chemicals, Versalis S.p.A., Nizhnekamskneftekhim, Zibo Qixiang Tengda Chemical, JX Nippon Oil & Energy, Reliance Industries Limited, PTT Global Chemical, Formosa Plastics Corporation, Indian Oil Corporation Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Purity Isobutylene Market Key Technology Landscape

The technological landscape of the High Purity Isobutylene market is primarily defined by advanced separation and purification methodologies aimed at extracting HPIB from complex C4 mixtures efficiently and economically. Historically, the primary technology involved separating Isobutylene from n-butenes and butadiene, often utilizing highly selective catalysts and precise temperature control. Key established technologies include the use of sulfuric acid extraction, which is effective but poses environmental challenges due to corrosive byproducts, and the TAME process, where isobutylene is reacted with methanol to form MTBE or TAME, which is then thermally cracked back to recover high-purity isobutylene. The TAME route is popular due to its high selectivity and ease of integration with existing petrochemical infrastructure, but it is limited by the fluctuating global viability of MTBE/TAME derivatives.

Recent technological advancements focus heavily on non-reactive separation methods to avoid secondary reactions and increase yield purity, crucial for ultra-high purity applications. These include Pressure Swing Adsorption (PSA) and Simulated Moving Bed (SMB) technologies, utilizing highly specialized zeolites or molecular sieves tailored to selectively adsorb isobutylene based on molecular size and polarity. These advanced adsorption techniques offer superior energy efficiency, lower operational complexity, and lower environmental impact compared to older chemical reaction methods, positioning them as the preferred standard for new HPIB capacity, especially as environmental regulations tighten globally and demand for ultra-pure grades rises in high-tech sectors.

Furthermore, on-purpose technologies, specifically the catalytic dehydration of Tertiary Butyl Alcohol (TBA), are gaining significant traction. TBA is often a stable byproduct of propylene oxide production, making this route an important alternative, offering greater feedstock flexibility and enabling producers to bypass the price volatility associated with crude oil derived C4 streams entirely. Innovation is also occurring in bio-based isobutylene synthesis, leveraging fermentation or synthetic biology to produce isobutylene from renewable feedstocks like sugars, cellulosic biomass, or waste streams. While these bio-based technologies are currently characterized by higher production costs and lower scale, they represent a strategically vital, long-term technological shift addressing energy security concerns and offering a fully sustainable pathway independent of the traditional fossil fuel supply chain.

Regional Highlights

The dynamics of the High Purity Isobutylene market exhibit significant geographical divergence, driven by varying industrial growth rates, regulatory frameworks, and regional petrochemical capacity. These regional differences dictate production strategies, investment flow, and the specific application focus for HPIB derivatives, influencing global trade flows.

- Asia Pacific (APAC): APAC is the undisputed epicenter of global HPIB demand and production, primarily fueled by the massive automotive and infrastructure sectors in China, India, and South Korea. The region commands substantial market share due to its vast, integrated petrochemical complexes and lower manufacturing costs, supporting continuous, high-volume consumption of butyl rubber for tires and construction materials. Strategic expansion efforts are concentrated here, making it the fastest-growing and most competitive region globally.

- North America: Characterized by mature consumption patterns and robust domestic production capabilities, North America utilizes its competitive feedstock advantage derived from shale gas and refining operations. Demand is concentrated in high-specification, specialized polymer and elastomer manufacturing. The region has transitioned almost completely away from MTBE, forcing producers to innovate and focus exclusively on high-value polymerization-grade HPIB, often serving niche industries like pharmaceuticals and high-end automotive components.

- Europe: Europe maintains a strong focus on high-value, niche HPIB derivatives, catering to specialty polymers, advanced adhesives, and medical applications, strictly prioritizing ultra-high purity grades. Stringent environmental regulations in Europe accelerate the research, development, and commercial adoption of cleaner production technologies, including bio-based routes and high-efficiency non-reactive separation processes, cementing Europe's role as a leader in sustainable chemical innovation within the HPIB space.

- Latin America (LATAM): Market growth in LATAM is closely tied to fluctuating macroeconomic stability and specific infrastructure investment levels, particularly within the refining and automotive sectors in major economies like Brazil. While domestic consumption for tire production exists, the region often faces challenges in domestic HPIB production capacity, leading to significant reliance on imports of specialized grades from APAC and North America to fulfill industrial requirements.

- Middle East and Africa (MEA): The MEA region is emerging as a critical HPIB production hub, strategically utilizing abundant, low-cost hydrocarbon feedstock to build world-scale, export-oriented petrochemical facilities. Significant investments are channeled into establishing large-scale integrated refining and cracking complexes aimed primarily at supplying high volumes of HPIB and its derivatives to high-demand, deficit regions like Asia and parts of Europe, positioning MEA as a major future global supplier.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Purity Isobutylene Market.- Exxon Mobil Corporation

- LyondellBasell Industries N.V.

- TPC Group (Texas Petrochemicals Corporation)

- INEOS Group Holdings S.A.

- China Petrochemical Corporation (Sinopec)

- Chevron Phillips Chemical Company LLC

- BASF SE

- Shell Chemicals

- Versalis S.p.A. (ENI Subsidiary)

- Nizhnekamskneftekhim PJSC

- Zibo Qixiang Tengda Chemical Co., Ltd.

- JX Nippon Oil & Energy Corporation

- Reliance Industries Limited

- PTT Global Chemical Public Company Limited

- Formosa Plastics Corporation

- Indian Oil Corporation Ltd.

- Lotte Chemical Corporation

- Wanhua Chemical Group Co., Ltd.

- Dow Chemical Company

Frequently Asked Questions

Analyze common user questions about the High Purity Isobutylene market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications driving the demand for High Purity Isobutylene?

The demand for High Purity Isobutylene (HPIB) is predominantly driven by its use in synthesizing Isobutylene-Isoprene Rubber (Butyl Rubber) for tire inner liners and protective seals, and in producing Polyisobutylene (PIB) for advanced lubricants, adhesives, and sealants. The automotive sector's continuous need for high-performance, gas-impermeable elastomers is the core market driver.

How does the phase-out of MTBE impact the HPIB market?

The regulatory restrictions and phase-out of Methyl Tertiary Butyl Ether (MTBE) in major markets like North America and Europe necessitated that HPIB producers pivot their product streams primarily toward higher-margin polymer-grade applications (butyl rubber and PIB), shifting focus from commodity fuel additives to specialized elastomers and chemicals.

What is the role of on-purpose technologies in HPIB production?

On-purpose technologies, such as the catalytic dehydration of Tertiary Butyl Alcohol (TBA), are crucial for diversifying HPIB feedstock sources. They offer producers flexibility, reduce reliance on volatile C4 refinery streams, and help consistently meet the stringent purity requirements for ultra-high-grade polymers, improving overall supply stability.

Which geographical region holds the largest market share for High Purity Isobutylene?

The Asia Pacific (APAC) region holds the largest market share for HPIB consumption and is simultaneously the fastest-growing market globally. This dominance is attributed to robust industrial expansion, massive vehicle production volumes, and significant investment in domestic polymer and synthetic rubber manufacturing infrastructure, particularly in China.

What are the main technological challenges in achieving ultra-high purity Isobutylene?

The primary challenge is the highly complex and energy-intensive separation required to isolate isobutylene from chemically similar C4 isomers (like n-butenes and butadiene). Achieving ultra-high purity (above 99.9%) necessitates advanced, high-capital processes such as selective Pressure Swing Adsorption (PSA) or specialized TAME/cracking units to eliminate all trace impurities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager