High Purity Organo Silica Sol Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436429 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

High Purity Organo Silica Sol Market Size

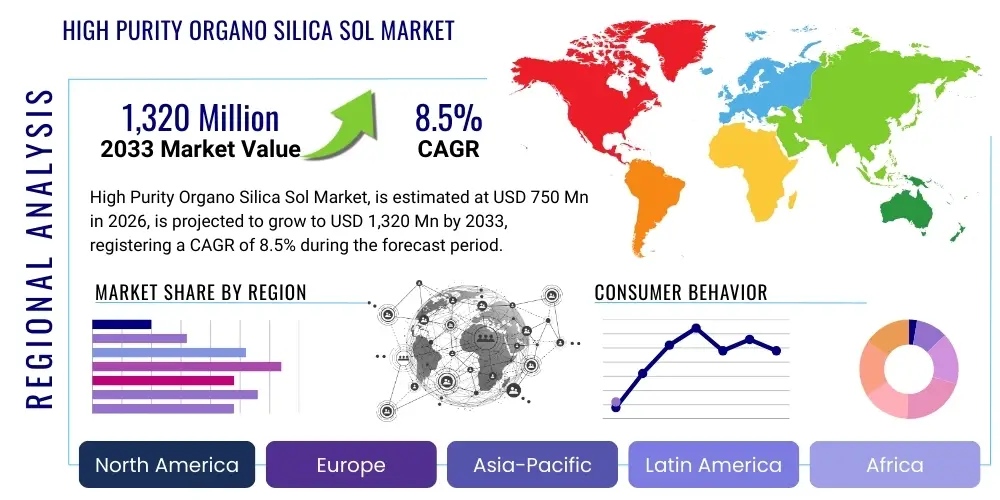

The High Purity Organo Silica Sol Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $750 Million in 2026 and is projected to reach $1,320 Million by the end of the forecast period in 2033.

High Purity Organo Silica Sol Market introduction

High Purity Organo Silica Sol refers to stable colloidal dispersions of amorphous silica particles that are chemically modified with organic functional groups. The defining characteristic is the extremely low level of metallic impurities, making these materials indispensable in high-tech applications where contaminants can severely impair performance, particularly in electronics and optics. These sols typically possess particle sizes in the nanometer range, offering unique advantages such as high surface area, enhanced thermal stability, and superior compatibility with various organic matrices. They function primarily as advanced functional additives, binders, or precursors for synthesizing composite materials, leveraging the combined benefits of inorganic silica’s robustness and organic components’ flexibility.

The principal product types include methyl silica sol, phenyl silica sol, and hybrid variations, each tailored by the specific organic ligand attached to the silica core, dictating its solubility and reactivity. Major applications span high-performance coatings, advanced electronic encapsulation materials, precision optics, chemical mechanical polishing (CMP) slurries in semiconductor manufacturing, and specialized composite reinforcements. The market is driven by the relentless demand for miniaturization in the semiconductor industry, the development of high-refractive-index display materials, and the necessity for durable, scratch-resistant coatings in automotive and aerospace sectors. The high purity prerequisite dictates rigorous manufacturing and quality control, contributing to the premium pricing and niche focus of this specialized chemicals segment.

Key benefits derived from using these sols include improved mechanical strength, enhanced dielectric properties, customizable refractive indices, and superior thermal resistance compared to traditional polymer systems. The organo-functionalization allows for excellent integration into polymer matrices, preventing phase separation and ensuring homogenous composite formation. These attributes are critical for next- generation technologies, where material performance is pushed to its limits. Factors such as increasing investment in semiconductor fabrication facilities (fabs), particularly in Asia Pacific, and the global shift towards advanced display technologies (OLED, microLED) further fuel the necessity for these specialized, ultra-pure materials, positioning the market for sustained, high-value growth.

High Purity Organo Silica Sol Market Executive Summary

The High Purity Organo Silica Sol market is characterized by robust growth, primarily propelled by burgeoning demands from the advanced electronics and optical sectors, which require materials with ultra-low impurity levels to maintain device functionality and longevity. Business trends indicate a strong focus on strategic mergers and acquisitions among specialized chemical manufacturers to consolidate intellectual property related to controlled particle synthesis and surface modification techniques, ensuring stable supply chains for high-volume customers in the semiconductor industry. Furthermore, manufacturers are increasingly investing in sophisticated purification technologies, such as advanced filtration and ion-exchange processes, to meet the stringent specifications required for applications like chemical mechanical planarization (CMP) and photoresist formulations, thereby maintaining a high barrier to entry and favoring established players with proven quality assurance systems.

Regionally, the Asia Pacific (APAC) continues to dominate the market landscape, driven by the massive presence of semiconductor foundries, flat panel display manufacturers, and consumer electronics assembly hubs in countries like South Korea, Taiwan, China, and Japan. This region exhibits the highest consumption rates and is projected to maintain the fastest growth rate throughout the forecast period due to continued government initiatives supporting domestic high-tech manufacturing and extensive R&D spending focused on next-generation displays and flexible electronics. North America and Europe, while possessing mature markets, demonstrate significant growth in niche, high-value segments, particularly aerospace coatings, biomedical devices, and specialized optical fiber production, emphasizing quality and customization over sheer volume.

Segment-wise, the Application segmentation reveals that the Electronic Materials segment, encompassing CMP slurries, dielectric films, and low-k materials, holds the largest market share and is expected to witness the most rapid expansion, directly correlating with the scaling challenges and increasing wafer complexity in semiconductor manufacturing (e.g., 5G and AI hardware requiring advanced packaging solutions). In terms of Type, Methyl Organo Silica Sols represent a dominant segment due to their widespread use in hydrophobic coatings and composite materials, offering excellent compatibility and thermal stability. However, Phenyl Organo Silica Sols are gaining traction due to their enhanced refractive index properties, making them critical in advanced optical adhesives and specialized lens coatings, indicating a future shift towards materials optimized for light management and transmission.

AI Impact Analysis on High Purity Organo Silica Sol Market

Users frequently inquire about how Artificial Intelligence and advanced machine learning (ML) models can be leveraged to address the critical manufacturing challenges inherent in the High Purity Organo Silica Sol market, specifically focusing on achieving batch-to-batch consistency and minimizing contamination risks. Key concerns revolve around optimizing complex synthesis parameters, such as pH control, temperature profiles, and precursor addition rates, which currently rely heavily on empirical knowledge and skilled operator intervention. Users also express strong expectations regarding AI’s ability to significantly enhance quality control (QC) by analyzing real-time spectral data, automatically detecting minute impurities, and predicting potential product deviations before they occur, thereby reducing waste and ensuring compliance with stringent electronic grade specifications (parts per billion impurity levels). The primary theme unifying these inquiries is the desire to utilize AI for accelerating R&D cycles—specifically, simulating and optimizing new organo-functionalization chemistries to quickly develop customized sols for emerging applications like flexible OLED displays or extreme UV (EUV) photoresists, ultimately transitioning manufacturing from a semi-batch process to a highly automated, predictive, and continuous operation.

- AI-driven optimization of reaction kinetics and particle size distribution during sol-gel synthesis, ensuring tighter quality control.

- Machine learning algorithms enhance contamination monitoring by analyzing spectroscopic data for trace metallic impurities (ppb level detection).

- Predictive maintenance schedules for high-purity processing equipment, minimizing downtime and cross-contamination risks.

- Automated quality assurance systems replacing manual inspections, leading to faster release times for high-grade electronic materials.

- Accelerated discovery of novel organo-silica formulations tailored for specific refractive indices or thermal expansion characteristics through computational chemistry simulations.

- Supply chain management optimization, leveraging AI to forecast demand variability from semiconductor and display fabricators.

DRO & Impact Forces Of High Purity Organo Silica Sol Market

The High Purity Organo Silica Sol market is powerfully shaped by a dynamic interplay of inherent market drivers, stringent limiting factors, compelling growth opportunities, and complex external impact forces. The core driver is the exponential growth and increasing complexity within the global semiconductor industry, particularly the transition to smaller nodes (e.g., 3nm, 2nm) which necessitates higher precision chemical mechanical polishing (CMP) slurries and advanced low-dielectric constant (low-k) materials where organo silica sols are essential components. Concurrently, the proliferation of advanced display technologies, including high-resolution 8K TVs and flexible/rollable OLED screens, demands superior optical coatings and encapsulation layers that benefit immensely from the thermal stability and tuneable refractive indices provided by these high-purity materials, ensuring vibrant color quality and device longevity.

However, the market faces significant restraints, primarily centered on the demanding synthesis complexity and the exceptionally high cost associated with achieving and maintaining ultra-high purity levels. The requirement to eliminate metallic and alkaline impurities to levels below 10 parts per billion (ppb) necessitates specialized, costly cleanroom manufacturing environments, premium raw materials (ultra-pure alkoxysilanes), and rigorous post-synthesis purification steps, limiting the number of qualified suppliers and driving up end-product prices. Furthermore, the limited shelf life and storage sensitivity of certain high concentration sols, which are prone to irreversible aggregation or gelation, pose logistical challenges for global distribution and inventory management, complicating just-in-time supply chains necessary for continuous manufacturing processes.

Despite these challenges, substantial opportunities exist, particularly in the development of next-generation photoresist formulations critical for Extreme Ultraviolet (EUV) lithography, where the high purity and structural characteristics of these sols offer superior performance in patterning fine features. Furthermore, the emerging use of these sols in biomedical applications, such as controlled drug delivery systems and advanced diagnostics requiring non-toxic, highly stable nanoparticles, opens new, high-margin market avenues. The dominant impact forces shaping this market include stringent environmental regulations concerning the use of solvents and hazardous chemicals (pushing demand towards water-based sols), rapid technological obsolescence in the electronics sector (demanding continuous material innovation), and geopolitical factors influencing global semiconductor supply chain stability, which encourages regionalization of specialized chemical production to mitigate risk.

Segmentation Analysis

The High Purity Organo Silica Sol market is comprehensively segmented based on three primary dimensions: Product Type, Application, and geographic Region, providing granular insights into market dynamics and consumption patterns. The segmentation by Product Type reflects the different organic ligands used for surface modification, which dictate the final physical and chemical characteristics, particularly hydrophobicity, dispersibility, and reactivity with polymer matrices. Understanding the interplay between the silica core size and the organo-functional group is crucial for tailoring the sol for specific end-use environments, whether it’s a non-polar solvent for high-performance composites or an aqueous system for environmentally friendly coatings.

The segmentation by Application is vital as it directly illustrates the value proposition of high purity sols. The Electronic Materials segment consistently demands the most stringent purity standards, influencing pricing power and technological focus across the industry, while the Coatings and Composites segments rely more on volume and customized material integration properties like scratch resistance or enhanced mechanical stiffness. The differential requirements across applications mean that manufacturers must maintain a diverse product portfolio and flexible synthesis capabilities to effectively serve distinct market needs. Geographic segmentation highlights the significant concentration of demand in Asia Pacific, driven by semiconductor and display manufacturing, contrasting with the specialized, innovation-focused consumption patterns observed in North America and Europe.

- By Type:

- Methyl Organo Silica Sol (Most common, high thermal stability)

- Phenyl Organo Silica Sol (High refractive index, optical applications)

- Vinyl Organo Silica Sol (Enhanced UV curing capabilities)

- Amino Organo Silica Sol (Improved adhesion properties)

- Others (Epoxy, Methacrylate functionalized sols)

- By Application:

- Electronic Materials (CMP slurries, low-k dielectrics, photoresists)

- High-Performance Coatings (Anti-scratch, thermal barrier coatings)

- Composites and Adhesives (Aerospace components, specialized binders)

- Optics and Display Materials (High refractive index coatings, antireflection films)

- Others (Catalyst supports, Biomedical applications)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For High Purity Organo Silica Sol Market

The value chain for the High Purity Organo Silica Sol market is complex and highly specialized, beginning with the upstream sourcing of extremely pure raw materials. The primary precursors are high-purity alkoxysilanes (e.g., tetraethyl orthosilicate (TEOS) or methyltrimethoxysilane (MTMS)) and specialized organo-functionalizing agents. Upstream analysis focuses heavily on supplier qualification and purification processes, as even trace impurities in the raw materials can propagate through the synthesis process, compromising the final product’s high-purity electronic grade designation. Due to the limited global suppliers of ultra-pure precursors, strong, long-term relationships with qualified chemical feedstock providers are crucial for maintaining consistent quality and mitigating supply chain risks, often involving vertical integration or exclusive procurement contracts to secure highly purified chemical intermediates.

The midstream phase involves the sophisticated manufacturing process, typically employing variations of the Stöber or modified sol-gel methods under rigorously controlled cleanroom conditions to ensure precise particle nucleation and growth, followed by the critical organo-functionalization step via surface modification techniques. This stage is characterized by high intellectual property barriers, revolving around proprietary methods for stabilizing the nano-particles, controlling polydispersity, and executing high-efficiency purification (e.g., dialysis, ultrafiltration, ion exchange) to remove ionic impurities, metallic residues, and unreacted precursors. Operational excellence and yield optimization are key competitive factors in this manufacturing segment, as the energy and resource consumption required for ultra-purification are substantial.

Downstream analysis involves distribution channels and end-user application. Due to the high value and often sensitive nature of the sols (requiring temperature control or specific inert atmosphere packaging), distribution is typically direct or through highly specialized chemical distributors who possess expertise in handling and storage for the electronics industry. Direct distribution is favored for major consumers like large semiconductor fabricators and multinational display manufacturers, allowing for customized specifications and technical support. Potential customers leverage these materials as critical components (binders, fillers, surface modifiers) in high-value products, where the cost of the sol is minor compared to the total cost of the final device, but its performance is paramount, cementing its status as an enabling technology.

High Purity Organo Silica Sol Market Potential Customers

The primary consumers of High Purity Organo Silica Sol are organizations operating within the highly demanding sectors of microelectronics, advanced materials engineering, and specialized manufacturing where material consistency and impurity control are non-negotiable performance prerequisites. Semiconductor fabrication plants, or Fabs, represent the largest and most stringent customer base, utilizing these sols extensively in chemical mechanical planarization (CMP) slurries, which are vital for smoothing wafer surfaces during intricate chip manufacturing processes. These customers require sols with highly uniform particle size distribution and virtually zero metallic contaminants (often less than 1 ppb) to prevent defects that could ruin complex, multi-billion transistor chips, driving the market toward hyper-specialized, application-specific formulations.

Another significant group of potential customers includes manufacturers of high-performance flat panel displays (FPDs), encompassing OLED and LCD producers. These companies use high purity organo silica sols in various thin-film coating applications, such as improving the scratch resistance of cover glass, developing high-refractive-index layers for enhanced light extraction, and integrating the sol into encapsulation barriers to protect moisture-sensitive components. The need for materials that can withstand rigorous operational conditions, while maintaining optical clarity and stability, positions these display manufacturers as continuous, high-volume buyers seeking customized optical properties tailored to specific display stacks.

Furthermore, specialized chemical compounders and material processors serving the aerospace and medical device industries constitute high-value niche customers. In aerospace, the sols are integrated into thermally stable, lightweight composite matrices and durable anti-corrosion coatings designed to operate in extreme environments. For medical applications, the non-toxic nature and small, controllable particle size of the organo sols make them suitable for sophisticated tasks such as enhancing the biocompatibility of implants or acting as carriers in targeted drug delivery systems, where regulatory compliance and absolute material integrity are paramount, translating into premium pricing for specialized, certified products.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $750 Million |

| Market Forecast in 2033 | $1,320 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nissan Chemical Corporation, Fuso Chemical Co., Ltd., AkzoNobel N.V., Wacker Chemie AG, Cabot Corporation, Evonik Industries AG, Merck KGaA, Reade Advanced Materials, Chem-materials, Specialty Materials Inc., Sumitomo Osaka Cement Co., Ltd., Shin-Etsu Chemical Co., Ltd., ADEKA CORPORATION, Gelest, Inc., Momentive Performance Materials Inc., Advanced Nanotech Lab, PPG Industries Inc., DuPont de Nemours, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Purity Organo Silica Sol Market Key Technology Landscape

The technological backbone of the High Purity Organo Silica Sol market centers on achieving atomic-level precision during synthesis and ensuring absolute purity throughout the production lifecycle. The primary technology involves highly controlled variations of the sol-gel process, specifically focusing on hydrothermal or microemulsion techniques to achieve monodisperse nanoparticles—meaning particles of extremely uniform size—which is crucial for applications like CMP where particle consistency dictates surface finish quality. Innovation in this area focuses heavily on reaction parameter control, including precise metering of precursors, rapid aging stabilization to prevent uncontrolled growth, and utilizing closed-loop feedback systems to maintain optimal conditions for nucleation, thereby minimizing defects and maximizing yield efficiency in high-volume production environments.

A second critical technological focus is advanced surface functionalization and modification. Once the high-purity silica core is formed, technologies must be employed to chemically graft organic functional groups (e.g., methyl, phenyl, amino) onto the particle surface, which allows the inorganic particle to be stably dispersed in various organic solvents or polymer resins. Key advancements here involve solvent-exchange techniques and specialized reactor designs that facilitate efficient, reproducible coupling reactions while minimizing residual impurities. The ability to tailor the functional group allows manufacturers to fine-tune properties such as the refractive index, compatibility with specific polymer hosts, and overall hydrophobicity, leading to niche, high-performance product offerings essential for the optical and display industries.

Finally, purification and quality assurance technologies are indispensable and form a significant competitive edge for market leaders. Achieving electronic grade purity requires sophisticated downstream processing, including multiple stages of ultrafiltration, proprietary ion exchange resins, and specialized chromatography techniques designed to strip out metallic ions and residual salts below ppb detection limits. Furthermore, the technology landscape is being enhanced by advanced analytical tools, such as Inductively Coupled Plasma Mass Spectrometry (ICP-MS) and dynamic light scattering (DLS), which provide real-time, ultra-sensitive feedback on impurity levels and particle size, respectively. These technologies collectively ensure that the final product meets the extreme specifications demanded by leading semiconductor manufacturers, sustaining the high-value nature of the market.

Regional Highlights

The regional distribution of the High Purity Organo Silica Sol market is highly asymmetrical, reflecting the global concentration of advanced manufacturing capabilities, particularly in electronics and displays.

- Asia Pacific (APAC): APAC is the unequivocally dominant region, accounting for the largest share of market consumption and exhibiting the highest projected growth rate. This dominance is driven by the massive presence of the world’s leading semiconductor fabrication facilities (e.g., TSMC, Samsung, SK Hynix) in countries such as Taiwan, South Korea, China, and Japan, which consume vast quantities of high purity sols for CMP, photoresists, and encapsulation. Government initiatives in China and South Korea focusing on supply chain localization and increased domestic chip production further solidify APAC’s status as the core manufacturing and consumption hub.

- North America: North America represents a mature, high-value market characterized by innovation and specialized material demand, particularly in aerospace, advanced defense systems, and high-end specialty chemicals. The region focuses heavily on research and development, demanding customized, cutting-edge formulations for new low-k dielectric materials and specialized optical coatings. While volume consumption is lower than APAC, the average selling price (ASP) of products sold in North America is typically higher due to stringent regulatory standards and highly complex application requirements.

- Europe: The European market demonstrates steady growth, driven by the strong presence of the automotive industry (requiring durable anti-scratch coatings), specialty chemical producers (focusing on binder systems and paints), and niche optics manufacturing. Germany, in particular, is a key consumer, leveraging high purity sols in advanced material engineering and the development of energy-efficient glazing and thermal insulation solutions. European growth is often dictated by stringent environmental regulations, favoring suppliers capable of providing high-performance, water-based or low-VOC solvent systems.

- Latin America and Middle East & Africa (MEA): These regions currently represent smaller market shares, primarily serving localized coating industries and general industrial applications. Growth is expected to be gradual, contingent upon future investments in local electronics assembly and expansion of infrastructure projects that necessitate high-performance, protective coatings, although the ultra-high purity segment catering to semiconductors remains relatively nascent in these geographies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Purity Organo Silica Sol Market.- Nissan Chemical Corporation

- Fuso Chemical Co., Ltd.

- AkzoNobel N.V.

- Wacker Chemie AG

- Cabot Corporation

- Evonik Industries AG

- Merck KGaA

- Reade Advanced Materials

- Chem-materials

- Specialty Materials Inc.

- Sumitomo Osaka Cement Co., Ltd.

- Shin-Etsu Chemical Co., Ltd.

- ADEKA CORPORATION

- Gelest, Inc.

- Momentive Performance Materials Inc.

- Advanced Nanotech Lab

- PPG Industries Inc.

- DuPont de Nemours, Inc.

- Colloidal Dynamics Inc.

- Cotronics Corporation

Frequently Asked Questions

Analyze common user questions about the High Purity Organo Silica Sol market and generate a concise list of summarized FAQs reflecting key topics and concerns.What defines high purity in Organo Silica Sol, and why is it crucial for electronics?

High purity is defined by extremely low concentrations of metallic and ionic contaminants, typically measured in parts per billion (ppb). This purity is crucial for electronics, particularly in semiconductor manufacturing (e.g., CMP slurries and dielectrics), because trace impurities can cause device failures, leakage currents, or long-term reliability issues in complex integrated circuits.

What are the primary applications driving the growth of Methyl Organo Silica Sol?

Methyl Organo Silica Sol growth is primarily driven by its use in high-performance hydrophobic and anti-fouling coatings, and as an additive in composite materials. Its excellent thermal stability and superior compatibility with organic polymer systems make it ideal for durable, weatherproof surface treatments and lightweight structural components in automotive and aerospace sectors.

How does the use of Organo Silica Sol benefit advanced display technologies like OLED?

In advanced displays, these sols are used to create high-refractive-index (HRI) coatings and encapsulation layers. They enhance light extraction efficiency, improve screen clarity, and provide robust moisture and oxygen barriers, thereby significantly extending the lifespan and performance of sensitive components like OLED emitters.

Which region currently dominates the consumption of high purity Organo Silica Sol?

Asia Pacific (APAC), specifically led by countries such as South Korea, Taiwan, and China, dominates the consumption. This is due to the high concentration of global semiconductor fabrication facilities (Fabs) and major flat panel display manufacturing hubs located within the region, driving demand for electronic-grade materials.

What are the major technological challenges in synthesizing high-purity sols?

Major technological challenges include achieving precise control over nanoparticle size and narrow size distribution (monodispersity), preventing aggregation during synthesis and storage, and implementing highly effective, multi-stage purification techniques (such as specialized ion exchange) to remove trace metallic contaminants to ppb levels.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager