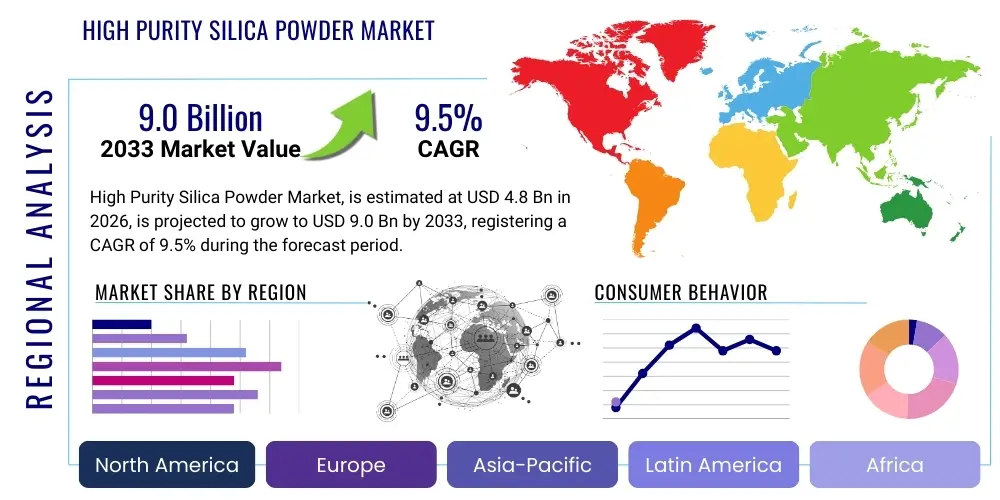

High Purity Silica Powder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436039 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

High Purity Silica Powder Market Size

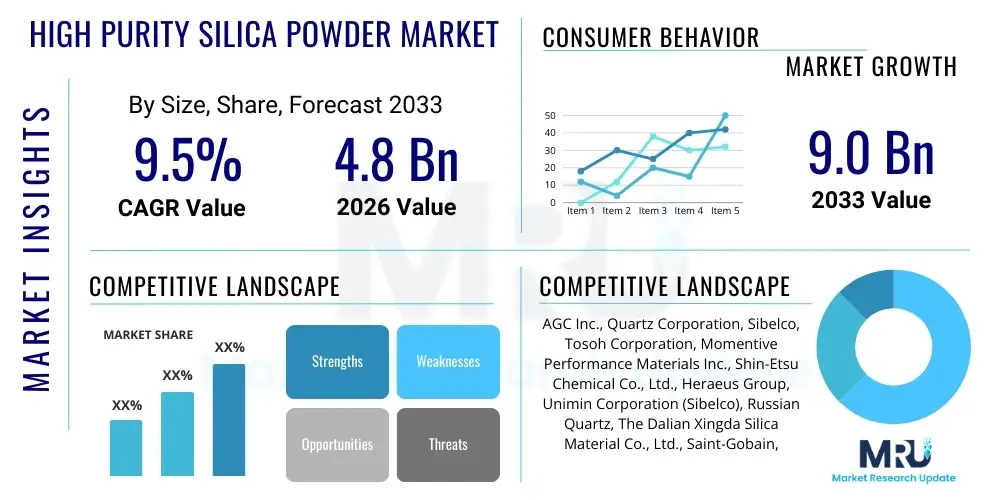

The High Purity Silica Powder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 9.0 Billion by the end of the forecast period in 2033.

High Purity Silica Powder Market introduction

High Purity Silica Powder (HPSP), primarily composed of silicon dioxide (SiO2) with extremely low levels of metallic and non-metallic impurities (often less than 50 parts per million), is a critical material across numerous high-technology sectors. The material's exceptional characteristics, including low thermal expansion, high chemical inertness, superior dielectric strength, and high melting point, make it indispensable for demanding applications. HPSP is typically derived from natural quartz through intensive purification processes such as acid leaching, flotation, heat treatment, and specialized grinding, ensuring the resulting powder meets stringent purity standards required by industries like electronics and solar energy.

The primary product forms of High Purity Silica Powder include fused silica, crystalline silica, and precipitated silica, with varying purity levels tailored to specific end-user requirements, particularly in the semiconductor industry where trace impurities can severely compromise device performance and yield. Fused silica, created by melting high-grade quartz, is particularly valued for its amorphous structure and outstanding thermal stability, making it the preferred material for quartz glassware used in high-temperature semiconductor processing, such as diffusion and oxidation furnaces, and in manufacturing photovoltaic components. The increasing demand for miniaturization and enhanced performance in electronic devices directly correlates with the need for higher volumes and incrementally purer grades of silica powder.

Major applications of HPSP span across electronics, particularly for encapsulation materials and crucibles; optics, including manufacturing specialized lenses and optical fibers; solar energy, specifically for producing photovoltaic cells and high-performance quartz tubes used in crystal pulling; and niche chemical sectors requiring highly inert fillers. The fundamental driving factors for market growth include the relentless expansion of the global semiconductor industry, fueled by 5G deployment, IoT devices, and advanced computing needs, alongside governmental incentives supporting renewable energy infrastructure expansion globally. The unique benefits of HPSP—thermal shock resistance, consistent quality, and chemical stability—establish it as an irreplaceable component in the modern technology supply chain, underpinning its robust market trajectory.

High Purity Silica Powder Market Executive Summary

The High Purity Silica Powder Market is experiencing robust growth driven predominantly by the escalating demand from the global semiconductor and photovoltaic industries. Key business trends indicate a strong focus on capacity expansion and vertical integration among leading producers to control raw material quality and ensure purity standards vital for next-generation microelectronics. Strategic alliances and long-term supply contracts between silica producers and major semiconductor fabrication plants (fabs) are becoming common practice to secure the supply chain. Technological innovation centers around ultra-purification methods, aiming to achieve 6N (99.9999%) or higher purity levels necessary for advanced lithography applications and high-end memory chips. Furthermore, sustainability is becoming a key business metric, influencing processes toward energy-efficient production and responsible sourcing of raw quartz, ensuring compliance with evolving environmental, social, and governance (ESG) standards across the value chain, which impacts investment decisions and market positioning.

Regionally, Asia Pacific (APAC) stands as the dominant market, propelled by massive investments in semiconductor manufacturing facilities, particularly in China, Taiwan, South Korea, and Japan, which together host the majority of the world's leading foundries and solar panel manufacturers. North America and Europe, while smaller in volume, represent critical markets for advanced research, development, and high-value applications, including aerospace optics and high-frequency communication components, often focusing on niche, ultra-high purity grades. Regional trends are also influenced by geopolitical considerations, leading to efforts in North America and Europe to bolster domestic production capacity for critical materials like HPSP to mitigate reliance on Asian supply chains, catalyzed by legislation such as the U.S. CHIPS and Science Act and similar European initiatives.

Segmentation analysis reveals that the Fused Silica segment maintains the largest market share due to its wide usage in semiconductor processing equipment and lighting applications requiring excellent thermal performance. However, the Synthetic Silica segment is projected to exhibit the fastest growth, primarily driven by its superior and highly controllable purity profile, making it ideal for the most stringent electronics applications, including chemical mechanical planarization (CMP) slurry abrasives and advanced packaging. Application-wise, the Electronics and Semiconductors sector remains the primary revenue generator, but the Optical Fiber and Telecommunications segment is witnessing accelerated demand growth, driven by the global rollout of high-speed internet infrastructure and data center expansion, creating new opportunities for specific particle size distributions of HPSP.

AI Impact Analysis on High Purity Silica Powder Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the High Purity Silica Powder market frequently center on two main themes: first, how AI-driven manufacturing processes can enhance the quality and yield of HPSP production (process optimization); and second, how the exponential growth in demand for AI hardware (specifically advanced CPUs, GPUs, and memory) translates into increased demand for ultra-high purity silica used in semiconductor fabrication and advanced packaging. Users are keenly interested in predictive maintenance models for large-scale purification reactors and grinding equipment, seeking to minimize costly downtime and maintain consistent particle size distribution. Concerns also revolve around the potential for AI-powered material discovery platforms to identify or optimize alternative low-impurity raw quartz sources, reducing dependency on a few high-quality mines globally. The consensus expectation is that AI will be a double-edged sword: optimizing HPSP supply chains while simultaneously driving unprecedented demand for the material itself due to its foundational role in the chips that power AI infrastructure.

- AI-Driven Process Optimization: Utilizing machine learning algorithms to fine-tune purification parameters (e.g., acid concentration, temperature, residence time) to maximize purity yield and minimize impurity levels in the final powder product, leading to significant cost savings.

- Predictive Quality Control: Implementing AI visual inspection systems to analyze particle morphology, size distribution, and surface defects in real-time, ensuring stringent quality specifications are met for sensitive applications like CMP slurries.

- Semiconductor Demand Surge: AI hardware acceleration, particularly for deep learning training and inference, necessitates high-volume production of advanced microchips, translating directly to higher consumption of HPSP in quartzware, crucibles, and specialized encapsulation materials.

- Supply Chain Resilience: AI predictive analytics used to forecast demand fluctuations based on global technology trends (e.g., shifts in memory or logic chip design cycles), enabling HPSP manufacturers to optimize inventory levels and raw material procurement strategies.

- Automation in Mining and Processing: Deployment of AI and robotics in harsh mining environments and subsequent processing steps (such as crushing and milling) to enhance worker safety, improve energy efficiency, and ensure highly consistent particle size distribution before purification.

- Material Informatics: Application of AI to screen thousands of material combinations and purification recipes virtually, potentially accelerating the development of novel or more cost-effective methods for achieving 6N and 7N purity grades necessary for future semiconductor nodes.

DRO & Impact Forces Of High Purity Silica Powder Market

The market dynamics for High Purity Silica Powder are shaped by a complex interplay of robust demand drivers, stringent quality restraints, and significant opportunities arising from technological advancements. The primary driver is the pervasive digitization across all sectors, necessitating increasing volumes of advanced semiconductors and display technologies, which are intrinsically reliant on high-purity silica products for their manufacturing infrastructure. This consistent demand ensures market stability and projected revenue growth. Conversely, the market faces considerable restraints, most notably the extremely high capital expenditure required for setting up and operating ultra-purification facilities, coupled with the inherent difficulty and high cost associated with maintaining consistent, ultra-low impurity levels (parts per billion) across large production batches. Furthermore, reliance on limited, high-quality natural quartz reserves presents a potential bottleneck and supply security risk for manufacturers.

Opportunities for growth are heavily concentrated in emerging technologies. The development of advanced lithography techniques, particularly Extreme Ultraviolet (EUV) lithography, mandates materials with zero defect tolerance and exceptional purity, offering a high-margin niche for specialized HPSP producers. Additionally, the proliferation of large-scale renewable energy projects, particularly solar farms, drives sustained demand for HPSP in photovoltaic components, creating a diversified revenue stream away from solely relying on the often-cyclical semiconductor industry. The synthesis of artificial quartz glass that can match or exceed the quality of natural fused silica provides a pathway to mitigate raw material supply constraints and achieve higher process control over the material's properties, representing a substantial long-term strategic opportunity for technologically advanced players.

The impact forces within this market are significant and interconnected. Technological progression acts as a critical force, where advancements in semiconductor fabrication processes (shrinking node sizes) dictate ever-higher purity standards for the silica used in consumables and equipment. This mandates continuous investment in R&D and process improvement. Economic factors, such as global GDP growth and cyclical investment in capital equipment by electronics manufacturers, directly impact HPSP consumption volumes. Regulatory constraints, particularly concerning environmental discharge from acid leaching processes and worker safety related to crystalline silica exposure, exert pressure on operational costs and regulatory compliance, shaping the competitive landscape. Finally, the strategic importance of HPSP as a foundational material makes it subject to geopolitical trade policies and supply chain security imperatives, significantly influencing market distribution and regional investment strategies.

Segmentation Analysis

The High Purity Silica Powder market is extensively segmented based on the type of material, particle size, application, and end-use industry. Understanding these segments is crucial for manufacturers to target specific, high-growth, and high-margin niches, particularly within the electronics and specialized optics sectors. The fundamental differentiation between synthetic and natural silica powders determines both cost structure and application scope, with synthetic grades commanding premium pricing due to superior, tailored purity. Further analysis by particle size allows producers to cater to specific processing requirements, such as the ultra-fine powders needed for advanced polishing slurries or the coarser grades used in refractory applications. Segmentation provides a clear roadmap for market penetration strategies, highlighting the fastest-growing application areas such as 5G infrastructure components and advanced display technology substrates, which require bespoke material specifications. The inherent complexity of purity requirements across different end-use domains necessitates this multi-faceted segmentation approach to accurately gauge market value.

- Product Type:

- Fused Silica Powder

- Crystalline Silica Powder

- Synthetic Silica Powder (including Precipitated Silica and Colloidal Silica based on application)

- Other Specialty Grades

- Application:

- Semiconductors and Electronics (Quartzware, Encapsulation, Filters, CMP Slurries)

- Solar Energy/Photovoltaics (PV Cells, Quartz Tubes for Crystal Pulling)

- Optics and Lighting (Optical Fiber Preforms, High-Performance Lenses, Specialty Lamps)

- Refractories and Ceramics (High-Temperature Crucibles, Insulators)

- Chemicals and Fillers (High-Performance Coatings, Composites)

- End-Use Industry:

- Consumer Electronics

- Telecommunications and IT

- Aerospace and Defense

- Energy (Solar and Nuclear)

- Industrial Manufacturing

- Purity Level:

- Standard Purity (99.5% - 99.9%)

- High Purity (99.99% - 99.999%)

- Ultra-High Purity (UHP) (99.9999% and above - 6N, 7N)

Value Chain Analysis For High Purity Silica Powder Market

The value chain for High Purity Silica Powder is highly concentrated and technologically demanding, starting with the upstream phase of mining and refinement. Upstream activities involve the extraction of high-grade quartz, which is a specialized geological resource found in specific locations globally, characterized by low natural impurity levels. This initial raw material sourcing is crucial, as the quality of the raw quartz dictates the efficiency and ultimate achievable purity of the final powder. Following extraction, initial mechanical processing—crushing, milling, and classification—prepares the material for the intensive purification stage. The control over raw material access and consistency is a key competitive advantage in this upstream segment, influencing pricing and long-term supply stability for downstream processors.

The core midstream process involves advanced chemical and thermal purification, primarily using acid leaching and high-temperature fusion to remove metallic contaminants (such as aluminum, iron, and titanium) down to parts per million (ppm) or parts per billion (ppb) levels. This step requires specialized, capital-intensive infrastructure and highly skilled operational expertise, forming the major barrier to entry. Distribution channels for HPSP are typically direct or through highly specialized distributors due to the material's sensitivity and the need for stringent handling protocols (e.g., contamination-free packaging). Direct sales are predominant for major clients like semiconductor fabs, which require custom specifications and long-term, audited supply agreements, ensuring traceability and quality control throughout the logistics process.

Downstream activities center on the end-use applications, where HPSP is processed into finished products such as quartz glass crucibles, transparent tubes, optical fiber preforms, or integrated as a filler into epoxy molding compounds for semiconductor encapsulation. The indirect channel involves material suppliers providing HPSP to intermediate manufacturers (e.g., quartzware producers or CMP slurry formulators), who then sell their finished components to the ultimate end-users (semiconductor or solar companies). The entire chain is characterized by severe quality demands imposed by the electronics industry, meaning any failure in purity or consistency at the upstream or midstream level can lead to significant yield losses for the high-value downstream manufacturers, emphasizing the necessity of integrated quality management.

High Purity Silica Powder Market Potential Customers

The primary consumers of High Purity Silica Powder are sophisticated manufacturing entities operating in technology-intensive industries where material performance directly impacts product quality and operational yield. The largest customer base resides within the semiconductor manufacturing industry, encompassing leading integrated device manufacturers (IDMs) and pure-play foundries. These entities utilize HPSP extensively in their cleanroom environments for fabricating quartz glass components critical to high-temperature processes (such as diffusion, oxidation, and etching), as well as in the formulation of specialized abrasive slurries (Chemical Mechanical Planarization - CMP) essential for wafer surface finishing. The rigorous demands of these customers for ultra-high purity grades (UHP) necessitate close collaboration with HPSP suppliers to meet ever-tightening specifications related to particle size, surface area, and trace impurity concentration.

Another rapidly expanding customer segment is the photovoltaic (PV) industry, including crystalline silicon solar cell manufacturers and specialized equipment providers for solar ingot production. These customers require high-quality silica for quartz tubes used in crystal growth furnaces and for manufacturing the crucial encapsulant layers in solar modules. The focus here is on thermal stability and optical transparency. Furthermore, the global telecommunications sector, driven by the rollout of 5G and high-capacity data networks, represents a significant customer base through its demand for optical fiber preforms, where HPSP is the foundational material. These customers prioritize refractive index consistency and homogeneity, requiring highly specialized, often synthetic, silica powders.

Niche but high-value customer groups include advanced optics manufacturers (producing specialized lenses for lithography and high-power lasers), aerospace and defense contractors (requiring thermally resistant, stable materials), and producers of high-performance technical ceramics and refractories. These end-users typically require smaller volumes but demand extremely specialized characteristics and often proprietary formulations. The common thread across all potential customer segments is the absolute necessity for certified, consistent quality, making the procurement decision highly dependent on supplier reputation, quality control systems, and the ability to maintain long-term supply security in a technologically demanding environment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 9.0 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AGC Inc., Quartz Corporation, Sibelco, Tosoh Corporation, Momentive Performance Materials Inc., Shin-Etsu Chemical Co., Ltd., Heraeus Group, Unimin Corporation (Sibelco), Russian Quartz, The Dalian Xingda Silica Material Co., Ltd., Saint-Gobain, Jiangsu Pacific Quartz Co., Ltd., Kyshtym Mining, I-Sheng Chemical Industry Co., Ltd., NOVACEL, China Silicon Corporation Ltd., High Purity Quarz, HPQ Silicon Inc., Jiangsu Changfeng Advanced Material Co., Ltd., Denka Company Limited. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Purity Silica Powder Market Key Technology Landscape

The technological landscape of the High Purity Silica Powder market is dominated by purification science and advanced particle engineering, aiming to meet the exacting standards of sub-micron electronic components. Key technologies center around achieving ultra-high purity levels, typically 6N (99.9999%) or greater, through sophisticated chemical and thermal processes. The primary technological processes include enhanced acid leaching techniques, often involving multi-stage treatment with highly corrosive acids (such as hydrofluoric or hydrochloric acid) at controlled temperatures and pressures to effectively dissolve and remove metallic impurities bound within the quartz lattice. This is complemented by high-temperature fusion technology, where raw quartz is melted at temperatures exceeding 1,700°C and then rapidly cooled to produce amorphous fused silica, valued for its low coefficient of thermal expansion and structural homogeneity, which are critical properties for semiconductor quartzware.

Furthermore, particle size and shape control are vital technological differentiators, particularly for applications like Chemical Mechanical Planarization (CMP) slurries, which demand perfectly spherical and narrowly distributed particle sizes to ensure effective and defect-free wafer polishing. Advanced milling and classification technologies, including specialized jet mills and air classifiers, are employed to achieve the required sub-micron precision. In the realm of synthetic silica, technologies such as the flame hydrolysis process (used primarily for optical fiber preforms) or the wet chemical process (for precipitated silica) offer superior control over purity and morphology compared to natural quartz derivatives. These synthetic methods allow manufacturers to essentially build the silica structure from precursor chemicals, bypassing many of the inherent impurity challenges associated with mined quartz.

Another crucial technological frontier involves the development of in-situ quality assurance systems. Manufacturers are increasingly integrating advanced spectroscopic and analytical techniques, such as Inductively Coupled Plasma Mass Spectrometry (ICP-MS) and Atomic Absorption Spectroscopy (AAS), directly into the production lines. These systems provide real-time monitoring of trace element concentrations, enabling immediate process adjustments to maintain purity consistency, a necessity for serving high-volume, zero-defect industries. The integration of advanced computational fluid dynamics (CFD) modeling is also being leveraged to optimize reactor design for acid leaching and improve thermal profiles in fusion furnaces, reducing energy consumption and increasing batch consistency, thereby solidifying the technological competitiveness of leading market players focused on continuous innovation in purity control.

Regional Highlights

The regional market landscape for High Purity Silica Powder is highly concentrated, mirroring the global distribution of key technology manufacturing hubs. Asia Pacific (APAC) stands out as the undisputed global leader in both consumption and production, driven primarily by the colossal manufacturing output of semiconductor wafers, memory chips, photovoltaic cells, and advanced display panels across China, Taiwan, South Korea, and Japan. The region benefits from significant governmental investments in infrastructure and the presence of the world's largest contract chip manufacturers and solar technology providers, generating an intense and sustained demand for ultra-high purity grades of silica for quartzware and processing equipment. Growth in APAC is further accelerated by the localization of supply chains, with countries like China actively seeking to enhance domestic HPSP purification capabilities to ensure material security.

North America holds a substantial share, characterized by high-value consumption in specialized sectors, particularly in the production of cutting-edge microprocessors, advanced telecommunications components, and specialized aerospace optics. While not the largest volume market, North America maintains technological leadership in synthetic silica production and high-end application development, emphasizing R&D and ultra-high purity applications. The recent push for semiconductor manufacturing self-sufficiency, spurred by government policies, is expected to drive substantial greenfield investment in HPSP consumption facilities within the region, creating a strong trajectory for market expansion over the forecast period, specifically targeting 7N purity grades.

Europe represents a mature market focusing on high-specification optics, advanced materials research, and specialized industrial applications. Key demand centers are in Germany, France, and the UK, utilizing HPSP in precision optics, lighting, and certain automotive electronics applications. The European market places a strong emphasis on sustainability and traceability, influencing procurement decisions toward suppliers with robust ESG credentials. Although facing competition from high-volume Asian suppliers, European manufacturers maintain a strong foothold in niche, highly engineered silica components that require deep technical expertise and customization, focusing on quality rather than sheer volume dominance.

- Asia Pacific (APAC): Dominates consumption driven by robust semiconductor (Taiwan, South Korea) and solar manufacturing (China, India). High demand for fused silica quartzware and UHP grades for wafer fabrication. Significant capacity expansion occurring across the region.

- North America: Key market for technological innovation, synthetic silica development, and high-specification end-uses (Aerospace, advanced logic chips). Growth stimulated by recent governmental initiatives to localize critical semiconductor supply chain elements.

- Europe: Focuses on niche, high-margin applications, including precision optics, specialized industrial quartz glass, and telecommunications infrastructure development. Emphasis on sustainable production methods and high-quality synthetic quartz.

- Latin America (LATAM) and Middle East & Africa (MEA): Emerging markets with nascent demand primarily driven by local infrastructure projects, solar energy installations, and minor electronics assembly. Growth potential tied to urbanization and expansion of regional energy grids.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Purity Silica Powder Market.- AGC Inc.

- Quartz Corporation

- Sibelco

- Tosoh Corporation

- Momentive Performance Materials Inc.

- Shin-Etsu Chemical Co., Ltd.

- Heraeus Group

- Unimin Corporation (Sibelco)

- Russian Quartz

- The Dalian Xingda Silica Material Co., Ltd.

- Saint-Gobain

- Jiangsu Pacific Quartz Co., Ltd.

- Kyshtym Mining

- I-Sheng Chemical Industry Co., Ltd.

- NOVACEL

- China Silicon Corporation Ltd.

- High Purity Quarz

- HPQ Silicon Inc.

- Jiangsu Changfeng Advanced Material Co., Ltd.

- Denka Company Limited

Frequently Asked Questions

Analyze common user questions about the High Purity Silica Powder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What purity levels are required for semiconductor manufacturing and why are they critical?

Semiconductor manufacturing demands Ultra-High Purity (UHP) grades, typically 99.9999% (6N) or higher, with some advanced applications targeting 7N or 8N purity. These high levels are critical because trace metallic impurities (even in ppb concentration) can severely contaminate silicon wafers, leading to crystal defects, device failure, and significant yield losses in microchip fabrication processes.

How does the type of raw material (natural vs. synthetic) influence the HPSP market?

Natural HPSP is derived from mined quartz, offering high volume and cost efficiency, primarily used in photovoltaics and standard electronics. Synthetic HPSP is chemically manufactured, offering superior, tailor-made purity and morphology, essential for highly sensitive applications like advanced lithography optics and specialized CMP slurries, commanding a significant price premium.

What is the primary driving force behind the High Purity Silica Powder Market growth?

The primary driving force is the global expansion and technological advancements within the semiconductor industry, specifically the increasing production of chips for 5G devices, artificial intelligence hardware, data centers, and the persistent trend of miniaturization requiring higher grade, zero-defect processing materials.

Which geographical region dominates the consumption of High Purity Silica Powder?

The Asia Pacific (APAC) region dominates the consumption of High Purity Silica Powder due to its massive concentration of semiconductor fabrication facilities (fabs) in countries like Taiwan, South Korea, and China, coupled with its leading role in global photovoltaic panel manufacturing.

What are the main technical challenges in manufacturing Ultra-High Purity Silica Powder?

The main technical challenges involve effectively and consistently removing trace metallic impurities (down to parts per billion levels) from the raw quartz lattice, controlling the exact particle size distribution and morphology during milling, and managing the extremely high capital and operating costs associated with advanced acid leaching and high-temperature fusion purification processes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager