High Purity Synthetic Quartz Glass Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433518 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

High Purity Synthetic Quartz Glass Market Size

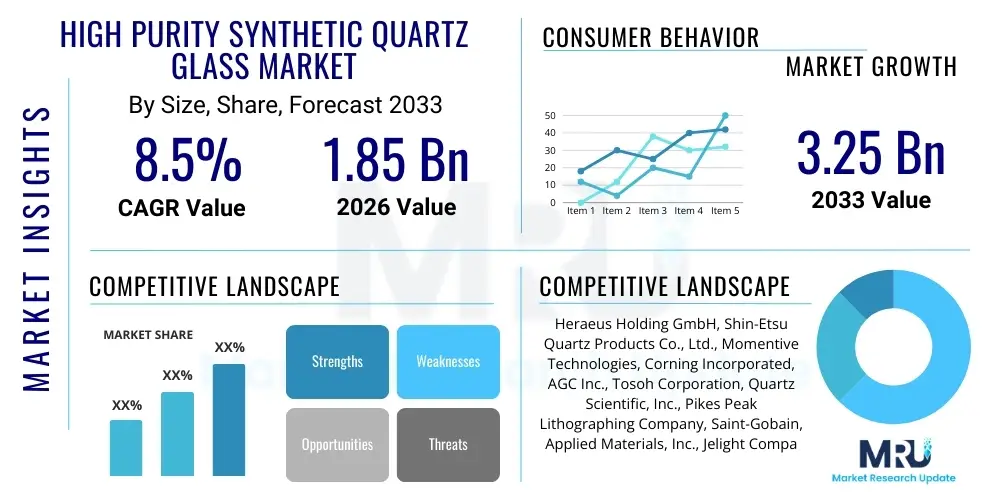

The High Purity Synthetic Quartz Glass Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $1.85 Billion in 2026 and is projected to reach $3.25 Billion by the end of the forecast period in 2033.

High Purity Synthetic Quartz Glass Market introduction

High Purity Synthetic Quartz Glass is a highly specialized material characterized by exceptional transparency across the deep UV (DUV) to infrared spectrum, unparalleled thermal resistance, and extremely low coefficient of thermal expansion. It is manufactured artificially, typically through methods like flame hydrolysis (Vapor Axial Deposition – VAD) or chemical vapor deposition (CVD), using high-purity silicon tetrachloride (SiCl4) as the primary precursor. This synthetic process ensures the removal of virtually all metallic impurities and structural defects present in natural quartz, which are detrimental to performance in advanced applications. The resultant material exhibits superior optical homogeneity and resistance to radiation damage (solarization), making it indispensable for complex lithography systems and precision optics. The material’s ability to withstand high temperatures and rapid thermal cycling without structural failure is critical for semiconductor manufacturing processes such as etching and deposition.

The primary applications driving the robust demand for high purity synthetic quartz glass are rooted in the semiconductor and optical industries. In semiconductors, it is crucial for photomasks, lens elements in advanced deep ultraviolet (DUV) and extreme ultraviolet (EUV) lithography equipment, and high-temperature wafer processing components (e.g., tubes, boats, pedestals). The continuous push towards miniaturization and higher transistor density in integrated circuits mandates quartz materials with defect concentrations measured in parts per billion (ppb) or even parts per trillion (ppt). Furthermore, the burgeoning demand for large-format displays, high-power lasers, and complex telecommunication infrastructure (especially 5G and fiber optics) relies heavily on the optical clarity and mechanical stability provided exclusively by synthetic quartz glass.

Key driving factors accelerating market expansion include the massive global investment in advanced semiconductor fabrication facilities (Fabs), particularly in East Asia and the US/Europe, aimed at securing domestic chip supply chains. The transition to EUV lithography, which requires highly damage-resistant, ultra-pure quartz glass components, significantly elevates the value and demand for this material. The benefits of using synthetic quartz glass over fused natural quartz are quantifiable in terms of reduced defectivity, improved transmission efficiency at shorter wavelengths, and prolonged component lifespan in harsh operational environments, ultimately reducing the total cost of ownership for high-tech manufacturers. The high chemical inertness of the material also makes it invaluable for handling corrosive chemicals and plasma environments encountered in microelectronic etching processes.

High Purity Synthetic Quartz Glass Market Executive Summary

The High Purity Synthetic Quartz Glass market is experiencing dynamic growth, fundamentally underpinned by the global semiconductor supercycle and relentless technological advancements in lithography and optical systems. Business trends indicate a strong focus on capacity expansion, particularly among Japanese and German manufacturers who dominate the high-end, zero-defect segments required for EUV and advanced DUV systems. Consolidation activities and strategic long-term supply agreements between quartz manufacturers and major equipment makers (like ASML, Nikon, and Canon) are becoming standard practice to ensure supply stability and collaborative R&D for next-generation material specifications. Furthermore, manufacturers are heavily investing in proprietary purification and fabrication techniques, such as laser-based machining and advanced annealing processes, to address emerging challenges like inherent structural defects (e.g., striae, bubbles) that become critical at 7nm and 5nm node processing. The shift toward larger wafer sizes (300mm and potential 450mm) also necessitates larger synthetic quartz components, increasing overall material demand.

Regional trends clearly highlight the dominance of the Asia Pacific (APAC) region, driven primarily by the colossal manufacturing footprint in Taiwan, South Korea, China, and Japan, which host the majority of global semiconductor foundries. This region not only consumes the largest share of high purity quartz glass but is also rapidly developing domestic manufacturing capabilities, particularly in China, challenging the traditional dominance of Western and Japanese suppliers in lower to mid-range purity segments. North America and Europe, while smaller consumers in volume, remain crucial centers for cutting-edge R&D and host major equipment manufacturers, ensuring sustained, high-value demand for the most sophisticated grades of synthetic quartz used in pilot lines and system assembly. Geopolitical factors, specifically trade tensions affecting semiconductor supply chains, are prompting regional governments to incentivize localized production of both chips and critical upstream materials like high purity quartz glass, thereby diversifying the global production map.

Segment trends underscore the supremacy of the semiconductor application segment, which accounts for the lion’s share of market revenue due to the high cost and volume required for lithography and wafer processing. Within the type segmentation, ozone-free synthetic quartz is gaining traction, particularly for DUV applications where managing the generation of ozone gas is critical for cleanroom environments and process control. The lighting segment, historically significant, is transitioning towards high-efficiency, specialized applications (e.g., high-intensity discharge lamps, UV sterilization) rather than general illumination, maintaining a steady but slower growth rate compared to microelectronics. Crucially, the demand for ultra-high purity (>99.999% purity) materials is escalating much faster than standard grades, reflecting the accelerating technological complexity and performance requirements dictated by Moore's Law, leading to premium pricing and higher margins for suppliers capable of achieving these stringent purity levels.

AI Impact Analysis on High Purity Synthetic Quartz Glass Market

Common user questions regarding AI's impact on the High Purity Synthetic Quartz Glass Market often center on whether AI-driven manufacturing processes can reduce defect rates, how AI adoption in data centers influences component demand, and the role of AI in quality control and yield optimization for quartz fabrication. Users are highly interested in the quantification of material demand driven by AI accelerators and high-performance computing (HPC) infrastructure. The analysis reveals that AI exerts a profound, primarily indirect, influence by drastically increasing the demand for advanced semiconductors (AI chips, GPUs) that require complex lithography. This drives the need for more sophisticated, zero-defect synthetic quartz used in EUV and DUV systems. Furthermore, AI is increasingly being deployed within the quartz manufacturing process itself, notably in automated inspection systems for detecting micro-defects (like inclusions or bubbles), improving furnace control for material homogenization, and predicting equipment failure, thus ensuring superior material consistency and yield crucial for meeting stringent microelectronic specifications. The proliferation of AI-driven data centers also necessitates advanced optical components made from synthetic quartz for high-speed fiber optic connectivity and highly precise thermal management systems.

- Increased Demand for Advanced Lithography: AI acceleration drives massive growth in high-end chip production (3nm, 5nm nodes), requiring more EUV and DUV quartz components (reticle blanks, lens elements).

- Enhanced Quality Control and Inspection: AI-powered machine vision systems are used to detect sub-micron defects in quartz substrates, ensuring required optical homogeneity and reducing scrap rates during manufacturing.

- Optimized Manufacturing Processes: Machine learning algorithms fine-tune VAD and CVD synthesis parameters (temperature, gas flow) to achieve ultra-high purity levels and minimize structural defects (striae).

- Growth in Data Center Optics: Synthetic quartz is essential for high-speed fiber optic connectors and specialized beam splitters used in vast, AI-driven data centers, demanding high-throughput optical materials.

- Faster Material Innovation: AI simulations accelerate the discovery and testing of new doping agents or fabrication techniques needed to enhance quartz performance against solarization and laser damage in high-power applications.

DRO & Impact Forces Of High Purity Synthetic Quartz Glass Market

The High Purity Synthetic Quartz Glass market is highly influenced by a critical balance of stimulating drivers, supply chain constraints, and emerging technological opportunities. The primary driver is the accelerating pace of semiconductor technology scaling (Moore's Law), particularly the widespread adoption of EUV lithography, which demands quartz components with extreme purity and virtually zero intrinsic defects to maintain acceptable yields. Complementing this is the pervasive deployment of 5G networks, IoT devices, and cloud computing infrastructure, all of which require exponential increases in chip production, thereby heightening the baseline demand for quartz processing components. These macro-drivers ensure long-term demand stability, but the highly specialized nature of the material limits the number of qualified suppliers, leading to tight market conditions and extended lead times, especially for the largest format substrates. This limited supplier base represents a significant impact force, making the market vulnerable to production halts or geopolitical friction.

Restraints primarily revolve around the exceptionally high capital expenditure required for VAD/CVD manufacturing facilities and the long qualification cycles (often several years) needed to certify new quartz products for use in highly sensitive semiconductor equipment. The process involves handling highly corrosive precursors (SiCl4) and operating at extreme temperatures, posing environmental and safety challenges. Furthermore, the market faces constraints related to the availability and cost volatility of ultra-high purity raw materials, impacting production costs. Another critical restraint is the technical difficulty of scaling up production while maintaining sub-ppb impurity levels, as any increase in batch size can lead to quality degradation, which is unacceptable for advanced lithography applications. Geopolitical tensions, particularly concerning access to critical technological exports and imports between major powers, also introduce significant market uncertainty and can disrupt supply chain predictability.

Opportunities for growth are concentrated in the development of next-generation optical materials, such as doped quartz glasses tailored for specific wavelength management and improved resistance to plasma erosion. The expansion of the global solar (photovoltaic) industry, requiring high-quality quartz for reactor tubes and processing equipment, presents a steady, high-volume ancillary market. Moreover, manufacturers are exploring opportunities to integrate sophisticated metrology and in-situ monitoring during fabrication, leveraging AI and advanced sensor technology to achieve zero-defect manufacturing goals, unlocking premium price points. The intense global focus on localized and diversified semiconductor supply chains following the pandemic provides a clear opportunity for second-tier regional players to capture market share, provided they can successfully navigate the stringent qualification requirements set by Tier 1 equipment manufacturers. The impact forces are characterized by high barriers to entry, intense R&D competition focused on purity and thermal stability, and strong forward integration by key component suppliers seeking to secure material access.

Segmentation Analysis

The High Purity Synthetic Quartz Glass Market segmentation provides a clear insight into the diverse requirements and technological demands across various end-use industries, with the classification primarily based on manufacturing process, resultant properties (type), and application. The Type segmentation often differentiates between Ozone-Free Quartz, intended mainly for deep UV exposure systems, and other specialized grades, such as fused silica doped with titanium (TiO2) or other elements to manage thermal expansion or improve transmission characteristics at specific wavelengths. The overarching trend across all segments is the increasing demand for ultra-low inclusion and bubble density, regardless of application, driven by the need for enhanced reliability and performance in precision environments. The complexity of synthetic quartz segmentation reflects its role as a core enabling material, where even minor variations in material specification can have profound impacts on the yield of the final semiconductor chip or the fidelity of an optical system.

The Application segmentation is the most critical determinant of market dynamics, revealing the heavy reliance on the semiconductor sector. Within semiconductors, the use spans from projection lens elements and reticle blanks (high-value, low-volume) to furnace components and chamber parts (lower-value, high-volume). The optics sector is vital, encompassing applications in telecommunication optics, high-power industrial lasers, and aerospace instrumentation, where purity and thermal stability are non-negotiable. The Lighting segment, though mature, continues to demand high purity synthetic quartz for high-intensity UV lamps used in water purification, air sterilization, and industrial curing processes, capitalizing on the material's excellent UV transmittance and heat resistance. The Solar industry (photovoltaics) represents a growing segment, utilizing quartz glass for specialized crucibles and tubing required in silicon crystallization and high-temperature processing, linking the market’s growth closely to global renewable energy policies.

- By Type:

- High Purity Fused Silica (Non-Doped)

- Doped Quartz Glass (e.g., TiO2 Doped for low CTE)

- Ozone-Free Quartz Glass

- IR-Grade Synthetic Quartz

- By Application:

- Semiconductors (Lithography Systems, Wafer Processing Equipment, Reticle Blanks)

- Optical Instruments (Prisms, Lenses, Filters, Gratings)

- Lighting (High-Intensity Discharge Lamps, UV Lamps)

- Solar/Photovoltaics (Crucibles, Tubes)

- Telecommunications/Fiber Optics

- Aerospace and Defense

Value Chain Analysis For High Purity Synthetic Quartz Glass Market

The value chain for High Purity Synthetic Quartz Glass is characterized by intensive upstream R&D and manufacturing complexity, culminating in highly specialized, direct sales channels to Tier 1 equipment manufacturers. The chain begins upstream with the procurement and purification of chemical precursors, primarily Silicon Tetrachloride (SiCl4), which must meet rigorous purity standards (often 9N to 11N purity). This initial stage is capital-intensive and concentrated among a few global chemical suppliers. The core manufacturing stage involves complex processes like VAD or CVD, where precision engineering dictates the quality and applicability of the final product. Manufacturers invest heavily in proprietary furnace designs and annealing techniques to minimize inherent defects and internal stresses. The concentration of technological expertise in this midstream segment creates high barriers to entry, solidifying the market leadership of incumbent players like Heraeus and Shin-Etsu.

Following the synthesis, the quartz glass undergoes rigorous processing, including grinding, polishing, and cutting, often involving advanced laser and CNC machining to achieve the nanoscale precision required for lithography optics. Quality assurance and defect inspection, increasingly reliant on AI-enhanced metrology, are critical intermediate steps, as failure to meet specifications results in extremely expensive scrap. The distribution channel is predominantly indirect for standard components (through specialized material distributors or component fabricators) but highly direct for mission-critical parts like EUV optics. For EUV lens blanks or critical furnace tubes, manufacturers establish direct supply relationships with OEMs (Original Equipment Manufacturers) such as ASML, Applied Materials, and Lam Research, often under exclusive or preferred supplier agreements to ensure material specifications are perfectly integrated into the overall equipment design.

Downstream analysis focuses on the end-users, where the synthetic quartz glass is integrated into final products. Semiconductor fabs (e.g., TSMC, Samsung) represent the ultimate consumer, utilizing the material within their production tools for etching, deposition, and lithography. This customer base demands reliability, consistency, and traceability. The indirect distribution network serves smaller optical manufacturers, research laboratories, and specialized lighting companies. The strategic importance of high purity synthetic quartz glass in enabling advanced nodes means that price sensitivity is often secondary to performance and reliability, reinforcing the vertically integrated nature of the supply chain and maintaining high profitability margins for market leaders who control the most advanced synthesis technology.

High Purity Synthetic Quartz Glass Market Potential Customers

The core customer base for High Purity Synthetic Quartz Glass consists of enterprises operating at the pinnacle of technological manufacturing, demanding materials that offer extreme performance characteristics under highly controlled conditions. The most lucrative and quality-demanding customers are the global leaders in semiconductor fabrication and equipment manufacturing. These customers require materials for both front-end processing (lithography components, reticle substrates) and back-end process equipment (furnace tubes, boat carriers, pedestals). Their procurement cycles are long, involving extensive qualification and volume testing, but once qualified, they provide stable, high-volume, long-term contracts. The shift towards multi-patterning and EUV lithography has amplified the stringency of their requirements, making materials qualified for 3nm and 5nm nodes extremely valuable.

A secondary, yet highly critical, group of potential customers comprises manufacturers of advanced optical systems and high-power lasers. This includes companies producing metrology tools for inspection, high-power industrial cutting lasers, and specialized optics for aerospace and defense applications. These customers are driven by the material's superior optical transmission, particularly in the UV range, and its exceptional thermal stability, crucial for maintaining beam quality and system precision over long operational periods. For instance, manufacturers of advanced deep UV spectrophotometers and high-energy laser guidance systems are reliant on the high refractive index homogeneity achievable only with synthetic quartz glass.

Furthermore, the market includes customers in the environmental and industrial processing sectors. This segment encompasses major utilities and industrial firms utilizing high-intensity UV lamps for purification (water treatment, HVAC sterilization), as well as companies involved in photovoltaic (solar) component production. While these customers may utilize slightly lower purity grades than those required for EUV lithography, their volume requirements are substantial and predictable, offering a stable revenue base. Key decision-makers across all segments prioritize material consistency, thermal shock resistance, and the supplier's ability to maintain strict quality control and traceability throughout the manufacturing process, viewing the material as a core enabler of their proprietary processes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.85 Billion |

| Market Forecast in 2033 | $3.25 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Heraeus Holding GmbH, Shin-Etsu Quartz Products Co., Ltd., Momentive Technologies, Corning Incorporated, AGC Inc., Tosoh Corporation, Quartz Scientific, Inc., Pikes Peak Lithographing Company, Saint-Gobain, Applied Materials, Inc., Jelight Company, Inc., Atlantic Ultraviolet Corporation, Technical Glass Products, Inc., Guangbo Quartz, Beijing Kaide Quartz, Jiangsu Pacific Quartz, Jiangsu Donghai Quartz Products, QSIL, RusQuartz. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Purity Synthetic Quartz Glass Market Key Technology Landscape

The technological landscape of the High Purity Synthetic Quartz Glass market is dominated by proprietary, high-temperature synthesis methods engineered to achieve defect-free material structures and ultra-low impurity levels necessary for cutting-edge semiconductor applications. The primary manufacturing techniques include Vapor Axial Deposition (VAD), typically utilized by Japanese manufacturers, and Chemical Vapor Deposition (CVD), often favored in Western processes. VAD involves forming porous silica soot on a rotating substrate using flame hydrolysis (SiCl4 and H2/O2), followed by high-temperature consolidation in a controlled atmosphere. This process allows for precise control over the refractive index profile and minimizes water content (OH groups), which is critical for DUV transparency. Ongoing R&D focuses on refining these methods to produce larger ingots with consistently low striae (internal stress lines) and bubble content, pushing the boundaries of material size and homogeneity.

A critical technological focus area is the development of ultra-low thermal expansion (ULE) synthetic quartz glass, achieved through precise doping, commonly with titanium dioxide (TiO2). These doped materials are essential for EUV lithography mask substrates and demanding mirror applications where any thermal deformation can significantly degrade pattern accuracy at the nanometer scale. Achieving homogeneous doping across large blanks remains a substantial challenge and a key area of competitive differentiation. Furthermore, technological innovation is heavily concentrated in post-synthesis processing, particularly advanced annealing techniques (thermal treatments) designed to relieve residual internal stress induced during cooling and consolidation, thereby improving the material’s resistance to laser-induced damage (LID) and prolonging component life within aggressive photolithography environments.

The future technology landscape is centered on achieving "zero-defect" specifications, driven by the shift towards 3nm and 2nm nodes, where even atomic-scale imperfections can cause catastrophic chip failures. This requires integrating advanced in-situ monitoring technologies during the synthesis phase, utilizing spectral analysis and high-resolution imaging to detect and mitigate defect formation in real-time. Additionally, plasma fusion techniques are being explored for surface treatment and repair of existing components, extending the utility of high-value quartz parts. The successful development and commercialization of these technologies are crucial for sustaining the semiconductor industry's advancement, making the technological landscape highly specialized, IP-driven, and subject to continuous, iterative improvements in material science and process control.

Regional Highlights

- North America: Characterized by high-value consumption tied to advanced research, development, and the headquarters of major semiconductor equipment manufacturers (OEMs). The region prioritizes ultra-high purity grades for EUV prototype development and defense/aerospace optics. Recent governmental incentives (like the CHIPS Act) are expected to drive significant domestic demand for high-purity quartz processing components as new fabrication facilities become operational.

- Europe: A critical center for the design and manufacture of world-leading lithography systems, particularly in Germany and the Netherlands. Consumption is highly focused on optical components (lenses, mirrors) for DUV and EUV systems manufactured by European giants. The market demands exceptionally tight specifications and relies on established long-term supplier relationships with Japanese and US firms specializing in EUV-grade materials.

- Asia Pacific (APAC): The dominant regional market, representing the largest volume consumer driven by concentrated semiconductor production in Taiwan, South Korea, China, and Japan. Japan and China are leading synthetic quartz producers, while Taiwan and South Korea are the largest consumers due to the presence of TSMC, Samsung, and SK Hynix. Rapid expansion of Chinese domestic foundry capacity is fueling strong growth in mid-to-high purity grades for domestic applications and export.

- Latin America: Currently a smaller consumer market, with demand primarily concentrated in specialized academic research and niche industrial applications, such as high-power laser facilities and limited specialized optics manufacturing. Growth is steady but dependent on industrial modernization and regional investment in microelectronics assembly and basic fabrication facilities.

- Middle East and Africa (MEA): This region accounts for the smallest market share, with consumption focused primarily on environmental applications (UV sterilization for water treatment) and oil/gas industry sensors and monitoring systems requiring high-temperature, chemically inert materials. Future growth potential is linked to regional diversification efforts into technology and solar energy infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Purity Synthetic Quartz Glass Market.- Heraeus Holding GmbH

- Shin-Etsu Quartz Products Co., Ltd.

- Momentive Technologies

- Corning Incorporated

- AGC Inc.

- Tosoh Corporation

- Quartz Scientific, Inc.

- Saint-Gobain

- Pikes Peak Lithographing Company

- Applied Materials, Inc. (Component Division)

- Jelight Company, Inc.

- Technical Glass Products, Inc.

- Guangbo Quartz

- Beijing Kaide Quartz

- Jiangsu Pacific Quartz Co., Ltd.

- Jiangsu Donghai Quartz Products Co., Ltd.

- QSIL (Quartzwerke Group)

- RusQuartz

- The Glass-Fab Company

- Furuya Metal Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the High Purity Synthetic Quartz Glass market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between synthetic quartz glass and natural fused quartz?

Synthetic quartz glass is manufactured from highly purified chemical precursors (like SiCl4), resulting in ultra-low metallic impurity levels (ppb or ppt), significantly lower hydroxyl content, and superior optical homogeneity. Natural fused quartz, derived from naturally occurring silica, contains higher levels of impurities and structural defects, making synthetic quartz essential for DUV/EUV lithography and high-precision optics requiring transmission below 250 nm.

How does the shift to EUV lithography impact the demand for synthetic quartz glass?

EUV lithography dramatically increases the demand for specialized, ultra-high purity synthetic quartz substrates, particularly for defect-free mask blanks and highly stable optical system components (mirrors). These materials must exhibit exceptional resistance to high-energy radiation and maintain near-zero thermal expansion (ULE), pushing manufacturers to invest in more advanced, expensive fabrication processes.

Which application segment holds the largest market share for High Purity Synthetic Quartz Glass?

The Semiconductor application segment dominates the market share due to the intensive and highly valuable use of synthetic quartz in front-end wafer processing equipment, including lithography projection systems, etching chambers, and high-temperature furnace components necessary for manufacturing advanced microchips at nodes below 10nm.

What are the main technical challenges faced by synthetic quartz manufacturers?

Key technical challenges include scaling up ingot size while maintaining sub-ppb impurity levels and optical homogeneity, eliminating internal defects such as striae and micro-bubbles, and developing materials that offer enhanced resistance to laser-induced damage (LID) and plasma erosion required in modern fabrication processes.

What role does the Asia Pacific region play in the global synthetic quartz market?

APAC is the largest consumption region globally, driven by its concentration of major semiconductor foundries (e.g., in Taiwan, South Korea, China). While Western and Japanese firms dominate high-end production technology, APAC, especially China, is rapidly increasing capacity for mid-range purity synthetic quartz used in supporting industries and domestic applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager