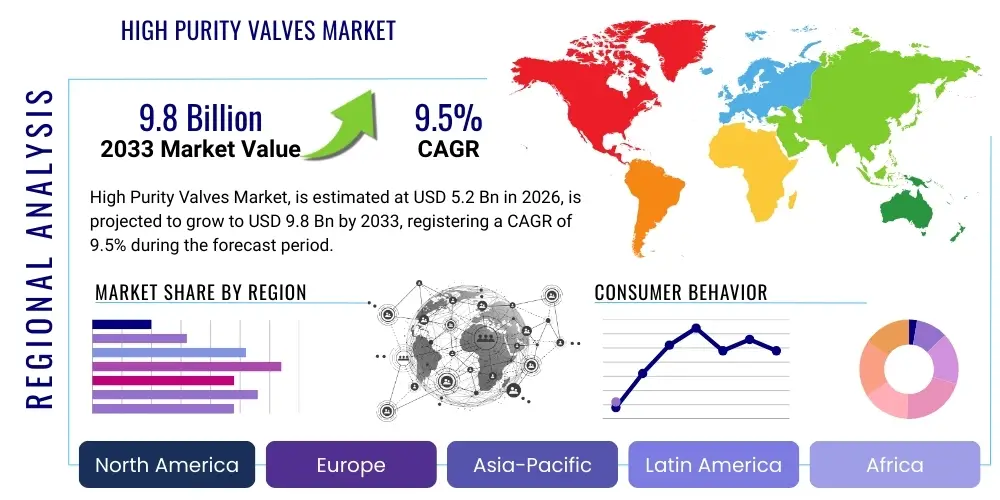

High Purity Valves Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434713 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

High Purity Valves Market Size

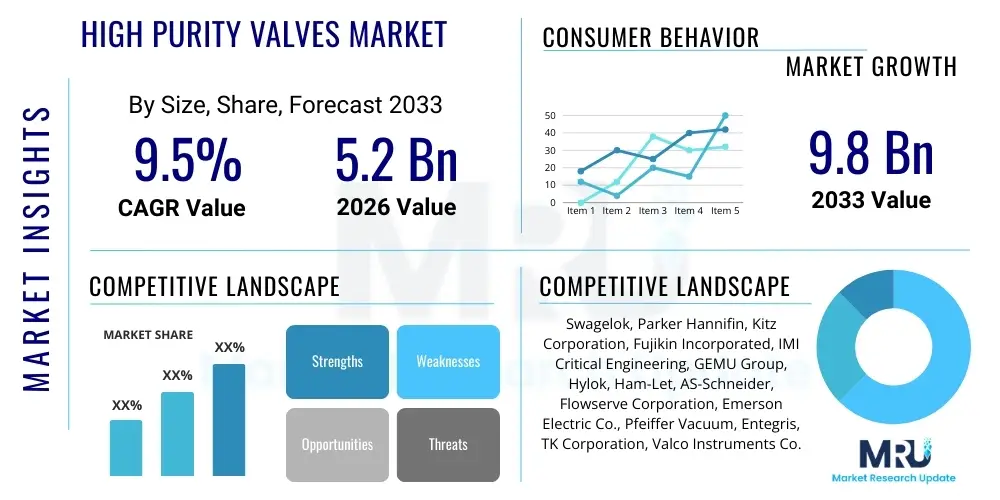

The High Purity Valves Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at $5.2 Billion in 2026 and is projected to reach $9.8 Billion by the end of the forecast period in 2033. This robust growth is primarily driven by the escalating demand from the semiconductor industry for Ultra-High Purity (UHP) gas delivery systems and stringent regulatory standards in the pharmaceutical and biotechnology sectors concerning contamination control and sterile processing.

High Purity Valves Market introduction

The High Purity Valves Market encompasses specialized fluid control components designed and manufactured to meet extremely demanding standards regarding surface finish, leakage rates, and chemical inertness. These valves are critical for maintaining the integrity of highly sensitive media, such as high-purity gases, aggressive chemicals, and sterile pharmaceuticals, ensuring that processing streams remain free from particulate contamination, leaching, or biological residues. Key product characteristics include materials like 316L stainless steel with electropolished internal surfaces, PFA/PTFE linings, and specialized sealing technologies like metallic bellows or advanced diaphragms, which eliminate potential entrapment areas where impurities could harbor.

Major applications for high purity valves span several high-tech industries. In the semiconductor industry, they are indispensable components of gas cabinets and bulk chemical delivery systems, where the purity of specialty gases directly impacts wafer yields and device performance. Similarly, in the pharmaceutical and biotechnology sectors, these valves are utilized in upstream and downstream processing, including bioreactors, chromatography skids, and Clean-in-Place (CIP) or Steam-in-Place (SIP) systems, guaranteeing compliance with cGMP (current Good Manufacturing Practices). Furthermore, their use extends to food and beverage processing for sterile filling and mixing, as well as critical applications in high-performance labs and aerospace fuel handling where zero leakage is mandatory.

The principal driving factors accelerating market expansion include rapid technological advancements in semiconductor manufacturing, particularly the transition to smaller node sizes (below 7nm) which necessitate absolute purity in processing environments. The global expansion of biopharmaceutical production, especially the growth of biologics and vaccine manufacturing, also mandates the adoption of certified high-purity components to prevent cross-contamination. Benefits derived from utilizing these specialized valves include enhanced product quality and consistency, reduced operational downtime due to fewer contamination incidents, compliance with international regulatory bodies (like the FDA and EMA), and improved safety for handling hazardous or volatile media under precise control conditions.

High Purity Valves Market Executive Summary

The High Purity Valves Market is characterized by intense focus on material science and precision engineering, driven by increasing globalization of advanced manufacturing sectors. Business trends show a strategic shift toward smart, automated valve solutions integrated with Industrial Internet of Things (IIoT) platforms, enabling predictive maintenance and remote diagnostics, particularly among Tier 1 suppliers aiming for holistic fluid control system offerings. Furthermore, the market is experiencing consolidation, with major players acquiring niche technology providers specializing in unique sealing mechanisms or exotic materials tailored for corrosive media, thus broadening their application scope and addressing complex UHP requirements in cutting-edge fabs and bioprocessing facilities.

Regionally, Asia Pacific, specifically Taiwan, South Korea, China, and Japan, dominates the market due largely to the concentration of global semiconductor foundries and significant investment in large-scale biomanufacturing capacities. North America and Europe maintain strong market positions, driven by mature pharmaceutical R&D, stringent quality controls, and pioneering adoption of new biotechnologies, such as cell and gene therapy manufacturing, which demand the highest level of material and process purity. Emerging markets in Southeast Asia and Latin America are showing accelerating growth as multinational corporations expand manufacturing footprints, leading to localized demand for compliant high-purity infrastructure components.

In terms of segmentation, diaphragm valves remain the largest segment due to their robust design, lack of dead space, and suitability for aseptic processing, particularly in biotech. However, the bellows-sealed valve segment is demonstrating the highest growth rate, fueled by its unmatched leakage integrity and superior performance in extreme pressure and temperature UHP gas applications within the semiconductor sector. Material trends indicate a growing preference for specialty alloys and advanced polymer linings (like PFA) over traditional stainless steel in applications involving highly corrosive or sticky media, ensuring extended valve life and reduced maintenance cycles, which aligns with industry demands for enhanced total cost of ownership (TCO).

AI Impact Analysis on High Purity Valves Market

Common user questions regarding AI’s impact on the High Purity Valves Market center around how artificial intelligence and machine learning can enhance reliability, optimize maintenance schedules, and improve quality assurance during manufacturing. Users frequently ask if AI-driven predictive maintenance models can reduce the catastrophic failure rates associated with valve leakage or contamination in UHP systems, and how AI can be utilized in the highly controlled environments of semiconductor fabs or biopharma cleanrooms. Based on this analysis, the key themes include leveraging AI for real-time diagnostics of pneumatic actuators and positioners, optimizing complex fluid routing using machine learning algorithms to minimize dead legs and pressure fluctuations, and employing computer vision systems for automated, ultra-precise inspection of valve surface finishes, weld quality, and internal component alignment, thereby exceeding traditional human inspection capabilities and ensuring adherence to nanometer-level purity standards.

- AI-driven Predictive Maintenance: Utilizing sensor data from valve actuators (pressure, vibration, temperature) to forecast potential seal degradation or mechanical failure before it impacts process purity or system uptime.

- Optimized Manufacturing Quality Control: Implementing machine learning models and computer vision systems for automated, high-resolution inspection of internal surface finishes (Ra value verification) and weld integrity, critical for UHP compliance.

- Automated Process Optimization: Using AI algorithms to manage complex valve arrays in batch processes (e.g., bioreactor sequencing or chromatography separation), minimizing cycle times while maintaining sterility and fluid purity.

- Supply Chain and Inventory Management: AI assisting in forecasting the lifespan and replacement frequency of high-wear components (diaphragms, seals), ensuring critical inventory is available without excessive capital lockup.

- Design Optimization: Generative design based on AI simulations to optimize valve flow paths, reducing internal shear stress, minimizing dead volume, and improving flushability for CIP/SIP operations.

DRO & Impact Forces Of High Purity Valves Market

The High Purity Valves Market operates under a dynamic set of Drivers, Restraints, and Opportunities (DRO), collectively forming significant impact forces on market trajectory. The primary driver remains the unrelenting technological roadmap of the semiconductor industry, demanding incrementally cleaner environments and superior material compatibility as feature sizes shrink. Simultaneously, the global expansion and complexity of biologics manufacturing, requiring single-use and highly aseptic fluid handling systems, provide continuous demand. These forces accelerate innovation in material science and surface treatment technologies, driving the replacement cycle of older, less compliant valve installations in mature industries.

Restraints primarily revolve around the exceptionally high cost of manufacturing and testing high-purity components. The requirement for electropolishing, cleanroom assembly, and specialized testing (such as Helium Leak Detection) significantly inflates product costs, posing a barrier for adoption in non-critical applications or in developing markets. Furthermore, the market faces complex regulatory hurdles; maintaining compliance with varying international standards (e.g., ASME BPE, SEMI F-series, FDA validation) necessitates extensive documentation and validation protocols, which can slow down product introduction and standardization across global supply chains.

Opportunities are abundant, particularly in the integration of smart technologies. The convergence of UHP requirements with IIoT offers a significant growth pathway through smart valves equipped with advanced diagnostics and communication capabilities. Furthermore, the emerging fields of advanced materials, such such as specialized ceramics and new polymers, present opportunities to develop valves capable of handling extreme temperatures or highly aggressive new precursor chemicals used in 3D NAND and EUV lithography. The shift towards modular and skid-mounted bioprocessing systems also favors suppliers who can offer pre-validated, integrated valve manifolds.

The combined impact forces dictate that innovation must focus on reducing the total cost of ownership (TCO) through enhanced reliability and extended lifecycles, rather than simply competing on initial price. The necessity for absolute purity acts as a powerful barrier to entry for conventional valve manufacturers, solidifying the position of specialized high-purity vendors. Regulatory pressure, especially in pharmaceuticals, acts as a continuous upward force, ensuring that quality and compliance remain non-negotiable prerequisites for market participation and growth.

Segmentation Analysis

The High Purity Valves Market is comprehensively segmented based on material composition, valve type, operational mechanism, and end-user application, reflecting the diverse and stringent requirements across various high-tech sectors. This granular segmentation allows manufacturers to tailor design and material selection—such as choosing between advanced stainless steel alloys, PTFE, or PFA linings—to match specific process media characteristics, pressure ratings, temperature stability, and required cleanliness levels. Understanding these segments is crucial for market stakeholders to accurately target investment and product development efforts toward the fastest-growing application areas, particularly those tied to the expansion of 5G infrastructure and personalized medicine manufacturing.

- By Material:

- Stainless Steel (316L, 304, Specialty Grades)

- Specialty Alloys (Hastelloy, Monel, Titanium)

- Plastics/Polymers (PTFE, PFA, PVDF)

- By Type:

- Diaphragm Valves

- Bellows Sealed Valves

- Ball Valves (High Purity grades)

- Check Valves

- Needle Valves

- Globe Valves

- By Operation:

- Manual

- Pneumatic

- Motorized/Electric

- By End-User Industry:

- Semiconductor and Electronics

- Pharmaceutical and Biotechnology

- Food and Beverage (Aseptic Processing)

- Chemical Processing

- Aerospace and Defense

- Research Laboratories

Value Chain Analysis For High Purity Valves Market

The value chain for the High Purity Valves Market begins with the upstream sourcing of highly specialized raw materials. This includes high-grade, traceable stainless steel (often certified 316L VIM/VAR for ultra-clean applications) and high-performance polymers like PFA and PTFE, where purity and lot consistency are paramount. Suppliers of these raw materials must meet strict certifications, ensuring low impurity levels and consistent mechanical properties necessary for precision machining and orbital welding. Upstream activities also involve the manufacturing of specialized components such as polished diaphragms, metallic bellows, and custom seal kits, which require dedicated cleanroom facilities and stringent material handling protocols to prevent pre-assembly contamination.

The core manufacturing stage involves precision machining, followed by specialized surface treatments like electropolishing, which achieves ultra-low surface roughness (Ra values typically below 0.25 µm) to minimize particulate adhesion and microbial growth. Assembly of these components must occur in certified cleanrooms (e.g., ISO Class 4 or higher). The distribution channel relies significantly on highly knowledgeable specialist distributors or direct sales teams capable of providing extensive technical support and system integration expertise. Given the critical nature of the applications, indirect channels, while utilized for general components, often require specialized training to handle the complexity and validation needs of high-purity systems.

Downstream analysis focuses on system integrators, EPC (Engineering, Procurement, and Construction) firms, and specialized OEM (Original Equipment Manufacturer) partners who design and build the complex UHP gas delivery systems, chromatography skids, and bioprocessing modules. The direct relationship between valve manufacturers and these downstream integrators is crucial for customizing solutions and ensuring rapid deployment. End-users, such as semiconductor fabs or biopharma plants, demand extensive validation packages and long-term support, emphasizing the service component of the value proposition. The successful completion of the value chain is measured by the flawless operation and compliance of the integrated fluid control systems, highlighting the low tolerance for failure inherent in this market.

High Purity Valves Market Potential Customers

The potential customers for the High Purity Valves Market are concentrated in sectors where fluid purity is directly proportional to product quality, yield, and safety compliance. The largest buyer segment is the semiconductor industry, including large-scale wafer fabrication plants (fabs) and integrated device manufacturers (IDMs) like Samsung, TSMC, Intel, and Micron. These buyers utilize high purity valves across all stages of production, from gas delivery cabinets and precursor chemical systems to clean utility distribution. Their purchasing decisions are driven by factors like leakage rates (measured in He leak rates), material compatibility with exotic gases (e.g., silane, ammonia), and the longevity of bellows/diaphragms under high cycle duty, prioritizing UHP certified suppliers exclusively.

The pharmaceutical and biotechnology sectors constitute the second major customer base, encompassing large pharmaceutical corporations, Contract Manufacturing Organizations (CMOs), and specialized biotechs involved in vaccine and monoclonal antibody production. These customers require valves adhering to ASME BPE standards, specifically demanding features like drainability, minimal dead legs, and surfaces suitable for sterilization (CIP/SIP). Buying criteria focus heavily on validation documentation, material traceability, and suitability for aseptic processing, often favoring diaphragm valves for their ease of maintenance and verifiable sealing integrity in sterile applications.

Other significant end-users include specialty chemical manufacturers that handle corrosive or highly toxic substances requiring impeccable seal integrity, ensuring worker safety and preventing environmental contamination. Furthermore, high-performance research laboratories, particularly those involved in analytical chemistry or specialized material science, represent a niche but highly demanding customer group. These buyers seek miniature, highly precise flow control valves (like high purity needle valves or miniature bellows valves) for sampling, analysis, and managing extremely small volumes of expensive or sensitive media, where precision and repeatability are the ultimate buying factors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.2 Billion |

| Market Forecast in 2033 | $9.8 Billion |

| Growth Rate | CAGR 9.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Swagelok, Parker Hannifin, Kitz Corporation, Fujikin Incorporated, IMI Critical Engineering, GEMU Group, Hylok, Ham-Let, AS-Schneider, Flowserve Corporation, Emerson Electric Co., Pfeiffer Vacuum, Entegris, TK Corporation, Valco Instruments Co. Inc., Maric Controls, V-Tex, Shanghai Fushun Flow Systems, Dockweiler AG, MKS Instruments. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Purity Valves Market Key Technology Landscape

The technology landscape of the High Purity Valves Market is primarily defined by innovations aimed at enhancing seal integrity, minimizing contamination, and improving automation capabilities. A cornerstone technology is the development of advanced sealing mechanisms, particularly high-cycle metallic bellows and multi-layered PTFE/elastomer diaphragms, engineered to withstand millions of cycles under high pressure or corrosive conditions without particle shedding or leakage. Furthermore, electropolishing technology remains critical, evolving toward achieving superior surface finishes (sub-0.1 Ra µm) through plasma treatment and advanced electrochemical processes, which is essential for handling low vapor pressure materials and UHP gases in EUV lithography environments where surface chemistry is crucial.

Automation and sensor integration represent the fastest-growing technological area. Modern high-purity valves are increasingly integrated with smart positioners, leveraging magnetic sensing and non-contact monitoring to provide highly accurate, real-time feedback on valve status and stroke position. This facilitates precise flow control and enables predictive maintenance strategies through continuous data collection on cycle counts, temperature excursions, and operational anomalies. The adoption of EtherNet/IP and other industrial communication protocols ensures seamless integration into centralized Distributed Control Systems (DCS) and SCADA systems, essential for complex, automated bioprocessing skids and fully autonomous fabs.

Moreover, the industry is witnessing significant advancements in material science. There is a growing focus on high-performance polymers (e.g., PFA variants with improved chemical resistance and reduced extractables) and specialized alloys that offer superior corrosion resistance and thermal stability compared to standard 316L stainless steel, particularly for highly aggressive chemical vapor deposition (CVD) precursors. The emergence of modular manifold technology, which uses compact, block-style designs to eliminate external piping and potential leak paths, also represents a critical technology shift, providing compact, high-reliability fluid transfer solutions for both gas and liquid applications in space-constrained, high-purity environments.

Regional Highlights

- Asia Pacific (APAC): Dominates the global market, primarily driven by massive investments in semiconductor fabrication facilities (Fabs) in Taiwan (TSMC), South Korea (Samsung, SK Hynix), and China. Rapid expansion of pharmaceutical and vaccine production capacity, coupled with government initiatives to localize advanced manufacturing, solidifies APAC's position as both the largest consumer and a growing hub for high-ppurity valve manufacturing.

- North America: A mature market characterized by stringent regulatory environments (FDA) and high adoption rates in the biotechnology and pharmaceutical sectors. Growth is fueled by cell and gene therapy manufacturing, which requires the highest standards of aseptic fluid handling, and renewed domestic investment in semiconductor manufacturing driven by geopolitical supply chain concerns.

- Europe: Characterized by strong demand from the premium pharmaceutical, specialty chemical, and food & beverage industries. European manufacturers are leaders in stainless steel processing and adherence to standards like ASME BPE, emphasizing the quality and traceability necessary for critical applications. Germany and Switzerland are key hubs for precision valve engineering and bioprocessing equipment manufacturing.

- Latin America (LATAM): Exhibits moderate growth, driven mainly by the expansion of multinational pharmaceutical companies establishing regional production sites and modernization of existing chemical processing plants, requiring upgrades to modern high-purity standards.

- Middle East and Africa (MEA): Currently a smaller market, but showing increasing demand from petrochemical industries refining specialized chemical products and nascent pharmaceutical manufacturing initiatives focused on regional supply security, necessitating initial investment in reliable high-purity infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Purity Valves Market.- Swagelok Company

- Parker Hannifin Corporation

- Kitz Corporation

- Fujikin Incorporated

- IMI Critical Engineering (IMI Purity)

- GEMU Group

- Hylok Corporation

- Ham-Let Group

- AS-Schneider

- Flowserve Corporation

- Emerson Electric Co.

- Pfeiffer Vacuum GmbH

- Entegris Inc.

- TK Corporation

- Valco Instruments Co. Inc. (VICI)

- Maric Controls

- V-Tex

- Dockweiler AG

- MKS Instruments, Inc.

- Hitachi High-Tech Corporation

Frequently Asked Questions

Analyze common user questions about the High Purity Valves market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between standard valves and high purity valves?

High purity valves are engineered with superior internal surface finishes (often electropolished to sub-0.25 µm Ra), manufactured from traceable materials (e.g., 316L VIM/VAR), and assembled in certified cleanroom environments. They eliminate dead legs and entrapment areas to prevent contamination, which is critical for UHP and aseptic applications.

Which end-user industry drives the highest demand for bellows sealed valves?

The Semiconductor and Electronics industry drives the highest demand for bellows sealed valves. These valves offer superior leak integrity (zero external leakage) necessary for managing highly toxic or flammable Ultra-High Purity (UHP) specialty gases required for advanced wafer fabrication processes like etching and deposition.

What role does ASME BPE certification play in the High Purity Valves Market?

ASME Bioprocessing Equipment (BPE) certification is essential for high purity valves used in the pharmaceutical and biotechnology sectors. It ensures the valves meet design standards for cleanability, sterilizability (CIP/SIP), drainability, and material compatibility necessary for aseptic manufacturing and preventing biological contamination.

How does cleanroom assembly affect the cost and performance of these valves?

Cleanroom assembly (typically ISO Class 4 or higher) is mandatory to prevent particulate contamination before installation. This specialized environment significantly increases manufacturing cost but is critical for performance, as microscopic contaminants can ruin sensitive processes (like semiconductor yields) or compromise sterile drug production.

Are smart high purity valves capable of supporting Industry 4.0 initiatives?

Yes, smart high purity valves, equipped with integrated sensors, positioners, and fieldbus communication capabilities (e.g., IO-Link, EtherNet/IP), are fundamental to Industry 4.0. They provide real-time diagnostic data for predictive maintenance, remote condition monitoring, and enhanced process control optimization in automated UHP systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager