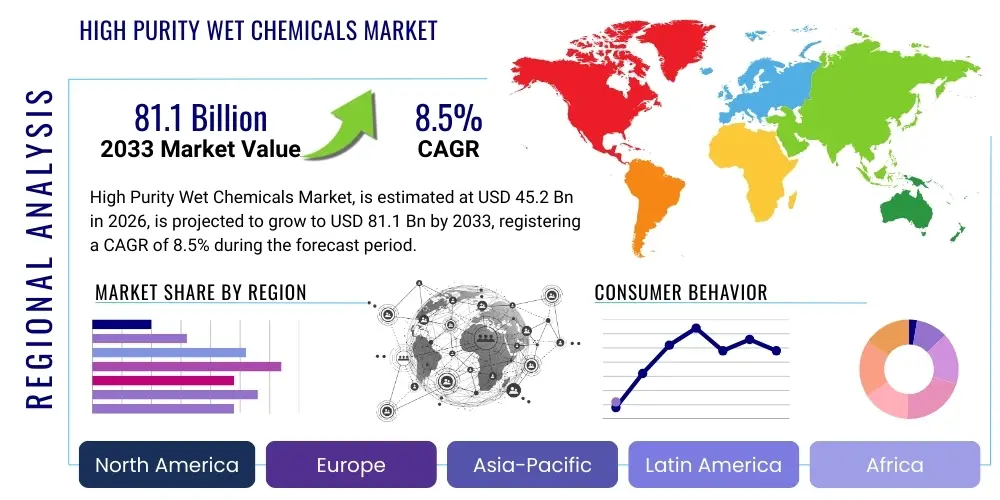

High Purity Wet Chemicals Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436390 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

High Purity Wet Chemicals Market Size

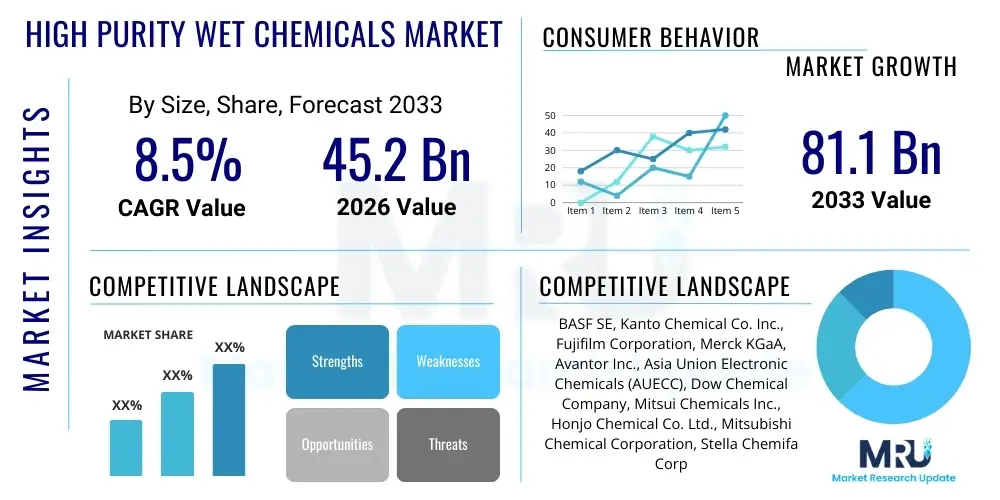

The High Purity Wet Chemicals Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 45.2 Billion in 2026 and is projected to reach USD 81.1 Billion by the end of the forecast period in 2033.

High Purity Wet Chemicals Market introduction

High Purity Wet Chemicals (HPWCs) are critical materials defined by extremely low levels of metallic impurities, particles, and organic contaminants. These specialty chemicals, including high-purity acids (e.g., sulfuric acid, hydrochloric acid, hydrofluoric acid), solvents (e.g., isopropyl alcohol, acetone), and specialized etchants, are indispensable for sophisticated manufacturing processes, particularly within the electronics and life sciences sectors. Their unparalleled purity levels—often measured in parts per trillion (ppt) or parts per billion (ppb)—are mandatory to prevent defects and ensure the high yield of microelectronic components and the integrity of pharmaceutical products.

The primary application driving the demand for HPWCs is the semiconductor industry, where they are utilized extensively in wafer cleaning, etching, photolithography, and deposition processes. As semiconductor manufacturing transitions to smaller nodes (5nm, 3nm, and below) and adopts advanced packaging technologies (e.g., 3D stacking, chiplets), the tolerance for chemical impurities drastically shrinks, compelling manufacturers to demand increasingly higher grades of wet chemicals (G5 and G6). The performance, reliability, and lifespan of electronic devices are directly proportional to the purity of the chemicals used during their fabrication.

Beyond semiconductors, HPWCs find significant applications in the production of high-resolution flat panel displays (OLED, LCD), photovoltaic cells, and in the preparation of specialized reagents and solvents required for high-end pharmaceutical manufacturing and stringent laboratory analysis. Key benefits include enhanced device performance, reduced manufacturing waste due to higher yield rates, and compliance with stringent industry standards like SEMI specifications. Driving factors include relentless miniaturization in electronics, massive investment in new fab construction globally, and the expanding need for advanced materials in biotechnology.

High Purity Wet Chemicals Market Executive Summary

The global High Purity Wet Chemicals market is characterized by intense technological competition and regional consolidation, primarily driven by the exponential growth of the semiconductor foundry capacity in Asia Pacific. Business trends indicate a strong push toward vertical integration among major chemical suppliers to secure critical raw materials and maintain strict control over the purification process, addressing concerns related to supply chain volatility exacerbated by geopolitical tensions. Furthermore, sustainable manufacturing practices are gaining traction, with increasing investment in recycling and regeneration technologies for spent process chemicals, aiming to reduce operational costs and environmental impact, particularly concerning high-volume acids and solvents used in cleaning stages.

Regional trends unequivocally highlight Asia Pacific (APAC), particularly China, South Korea, Taiwan, and Japan, as the dominant and fastest-growing hub for HPWCs consumption. This dominance is directly attributable to the concentration of global semiconductor manufacturing and advanced electronics assembly in the region. North America and Europe, while slower in capacity expansion, remain crucial markets focused on advanced R&D, specialized chemicals for pharmaceutical applications, and developing next-generation purification technologies. The ongoing semiconductor self-sufficiency initiatives in the US and Europe (e.g., CHIPS Act, European Chips Act) are poised to stimulate significant domestic growth and diversify the manufacturing landscape during the latter half of the forecast period.

In terms of segment trends, the market is observing a significant shift towards ultra-high purity grades (G5/G6), particularly for chemicals like electronic-grade sulfuric acid and hydrofluoric acid, critical for deep cleaning and etching sub-10nm logic and memory devices. By application, the semiconductor segment maintains the largest market share and is expected to exhibit the highest CAGR, propelled by the massive capital expenditure in new memory (DRAM, NAND) and logic foundries. The solvent segment is also showing robust growth, linked to increasing requirements for low-residue cleaning in sophisticated packaging processes and the growing use of advanced photoresist strippers.

AI Impact Analysis on High Purity Wet Chemicals Market

Common user questions regarding AI's influence center on optimizing the complex purification stages, ensuring real-time quality assurance of ppt-level purity, and mitigating supply chain risks associated with highly sensitive materials. Users are particularly concerned about how AI can improve batch consistency, reduce reliance on manual laboratory testing, and accelerate the development of novel chemical formulations required for emerging fabrication nodes. The analysis indicates a strong user expectation that AI, leveraged through advanced sensor technology and big data analytics, will revolutionize quality control by offering predictive insights into contamination risks and optimizing operational parameters in purification plants, thereby significantly enhancing yield rates and reducing waste in high-cost chemical manufacturing.

- AI-driven real-time contamination monitoring within purification lines, ensuring G5/G6 compliance.

- Predictive maintenance schedules for chemical handling and delivery systems, minimizing unexpected downtime.

- Optimization of complex chemical blending and mixing ratios using machine learning algorithms to achieve precise stoichiometry.

- Enhanced supply chain resilience through AI-based forecasting of raw material demand and logistical risk assessment.

- Accelerated R&D for novel HPWC formulations required for extreme ultraviolet (EUV) lithography and advanced packaging.

- Automated root cause analysis of purity deviations during the manufacturing process, improving process stability.

- Implementation of digital twins for simulating purification parameters and optimizing energy consumption.

DRO & Impact Forces Of High Purity Wet Chemicals Market

The High Purity Wet Chemicals market is powerfully influenced by the exponential advancements in microelectronics (Driver) which necessitate increasingly purer chemicals to prevent device failure at atomic scales. However, this growth is tempered by the exceptionally high capital expenditure required for building and maintaining ultra-clean manufacturing facilities (Restraint), coupled with stringent environmental regulations governing the handling and disposal of corrosive and toxic materials (Restraint). The opportunity lies in developing closed-loop recycling systems and achieving circularity for major acids and solvents, which not only addresses environmental concerns but also offers significant cost savings and enhances material security. The primary impact forces include the technological obsolescence rate in semiconductors, dictating demand for next-generation purity, and geopolitical instability, which stresses localized supply chain development.

Segmentation Analysis

The High Purity Wet Chemicals market is highly fragmented based on chemical type, application, and purity grade, reflecting the diverse and demanding nature of its end-user industries. Segmentation by product type highlights the dominance of high-purity acids, which are the backbone of etching and cleaning processes across the semiconductor landscape. By application, the market is overwhelmingly driven by the semiconductor sector, but specialized chemicals tailored for advanced pharmaceutical synthesis and rigorous laboratory testing represent crucial, high-value niches. Analyzing purity grade reveals a critical trend: the shift from lower grades (G1-G4) towards ultra-pure grades (G5 and G6), driven by the move to sub-10 nm technology nodes requiring ppt-level control of contaminants, fundamentally shaping R&D investment across the industry.

- By Product Type:

- Acids (Sulfuric Acid, Hydrochloric Acid, Hydrofluoric Acid, Nitric Acid, Phosphoric Acid)

- Solvents (Isopropyl Alcohol, Acetone, Methanol, N-Methyl-2-pyrrolidone (NMP))

- Etchants & Strippers (Ammonium Hydroxide, Potassium Hydroxide, Specialized Mixtures)

- Others (Buffers, Dyes, Photoresist Ancillaries)

- By Application:

- Semiconductors (Wafer Cleaning, Etching, Deposition, Photolithography)

- Pharmaceuticals & Biotechnology (Reagent Preparation, Synthesis, Analysis)

- Flat Panel Displays (Cleaning, Thin Film Transistors (TFT) manufacturing)

- Laboratory Reagents & Analytical Testing

- Photovoltaics (Solar Cell Manufacturing)

- By Purity Grade:

- G1 (Purity Grade 1)

- G2 (Purity Grade 2)

- G3 (Purity Grade 3)

- G4 (Purity Grade 4)

- G5 (Purity Grade 5 - Ultra-High Purity)

- G6 (Purity Grade 6 - Advanced Purity)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For High Purity Wet Chemicals Market

The value chain for High Purity Wet Chemicals is characterized by rigorous quality control and high capital intensity, starting with the upstream sourcing and initial purification of industrial-grade raw materials. The upstream segment involves complex chemical processes such as distillation, ion exchange, and membrane separation to reduce bulk impurities to preliminary levels. This stage is crucial and highly concentrated among a few global suppliers who can manage the environmental and safety challenges associated with handling corrosive base chemicals. The strategic significance of upstream control is rising as end-users demand greater transparency regarding trace elements.

The midstream phase, dominated by specialized chemical manufacturers, focuses on ultra-purification, custom blending, and quality validation to achieve G5 or G6 standards. Manufacturers must operate in highly controlled cleanroom environments, using advanced analytical tools like ICP-MS and particle counters to verify purity levels down to ppt. The transition from bulk chemical production to specialized electronic-grade material conversion represents the highest value-add stage. Downstream activities involve sophisticated packaging (using specialized fluoropolymer or high-density polyethylene containers), transportation, and just-in-time delivery to end-user fabrication facilities (fabs).

Distribution channels are highly specialized, often relying on direct relationships between the HPWC manufacturer and the end-user, particularly in the semiconductor segment, where technical support and application expertise are mandatory. Indirect channels, involving local distributors, are more common for lower-volume laboratory reagents and non-critical applications. The trend towards long-term supply agreements and localized manufacturing hubs (Direct distribution) is intensifying, driven by the need for enhanced security of supply and rapid response to purity issues within highly sensitive manufacturing processes like photolithography and wafer cleaning.

High Purity Wet Chemicals Market Potential Customers

The primary consumers of High Purity Wet Chemicals are entities operating highly controlled manufacturing environments where contamination must be minimized to ensure product performance and manufacturing yield. Semiconductor fabrication plants (fabs) represent the largest and most demanding customer segment, requiring massive volumes of ultra-pure acids and solvents for wafer processing. These customers prioritize consistency, supplier reliability, and the chemical’s ability to meet exacting SEMI specifications for emerging technology nodes.

Another major customer segment is the Flat Panel Display (FPD) industry, which requires high-purity materials for cleaning substrates and etching circuits in the manufacturing of sophisticated OLED and LCD screens. While the purity requirements are slightly less stringent than for advanced semiconductors, the volume demand, particularly in Asia, is substantial. Furthermore, large pharmaceutical and biotechnology companies constitute a high-value niche market. They utilize HPWCs as essential reagents and solvents in critical synthesis steps, drug formulation, and quality control analysis, where the absence of impurities is vital for regulatory compliance and drug efficacy.

R&D laboratories, academic institutions, and specialized analytical testing services also form a consistent customer base, often requiring diverse chemicals in smaller, customized volumes for trace analysis and material science research. The common characteristic among all these potential customers is the absolute necessity for assured quality and traceability, leading them to partner with certified suppliers capable of demonstrating rigorous quality assurance protocols.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.2 Billion |

| Market Forecast in 2033 | USD 81.1 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Kanto Chemical Co. Inc., Fujifilm Corporation, Merck KGaA, Avantor Inc., Asia Union Electronic Chemicals (AUECC), Dow Chemical Company, Mitsui Chemicals Inc., Honjo Chemical Co. Ltd., Mitsubishi Chemical Corporation, Stella Chemifa Corporation, Transene Company Inc., Daejung Chemicals & Metals Co. Ltd., Linde PLC, Air Liquide S.A., Central Glass Co. Ltd., CWK Chemiewerk Gmbh, Solvay S.A., Technic Inc., PVS Chemicals. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Purity Wet Chemicals Market Key Technology Landscape

The technological landscape in the High Purity Wet Chemicals market is defined by continuous innovation aimed at achieving lower detection limits for impurities and enhancing manufacturing efficiency. Traditional purification methods, such as fractional distillation and multiple-stage filtering, are being augmented by cutting-edge separation techniques. Ion exchange resins and proprietary membrane filtration systems are now central to removing metallic ions and particulates at the ultra-trace level. Achieving G5 and G6 purity demands closed-loop production environments and sophisticated material handling systems to prevent re-contamination during packaging and transport, necessitating constant investment in inert materials and cleanroom infrastructure.

Crucially, the analytical technology used for quality assurance is evolving rapidly. Inductively Coupled Plasma Mass Spectrometry (ICP-MS) remains the gold standard for measuring trace metal contamination, but its sensitivity is constantly being pushed to accurately detect impurities at ppt and even sub-ppt levels. Furthermore, particle counting technology, including liquid-borne particle counters, is essential to ensure chemicals meet stringent particulate cleanliness requirements, especially for critical process steps like immersion lithography. These advanced analytical technologies are not just testing tools; they are integrated into the manufacturing line to enable real-time process monitoring and adjustment.

A burgeoning technological area involves the development of chemical regeneration and recycling technologies. Given the high volume consumption of acids (like Sulfuric Acid, H2SO4) in wafer cleaning and the cost/environmental burden of disposal, advanced acid recovery systems—including proprietary crystallization and rectification units—are becoming essential competitive advantages. These technologies allow manufacturers to recover and repurify spent chemicals to a level acceptable for less critical, or even primary, semiconductor processes, driving down operational costs and promoting market sustainability, thereby influencing the long-term supply dynamics of HPWCs.

Regional Highlights

The High Purity Wet Chemicals market exhibits distinct regional dynamics, heavily mirroring the global footprint of advanced electronics manufacturing.

- Asia Pacific (APAC): APAC is the epicenter of global HPWC consumption, driven by colossal semiconductor manufacturing investments in Taiwan, South Korea, China, and Japan. The presence of major foundry operators (TSMC, Samsung, SK Hynix) and extensive assembly, test, and packaging (ATP) facilities ensures sustained, high-volume demand for ultra-high purity grades. China, in particular, is experiencing aggressive growth due to national strategies aimed at achieving self-sufficiency in semiconductor production, significantly boosting domestic demand for G4 and G5 grades.

- North America: This region maintains a strong position driven by leading-edge R&D, specialized chemical production, and renewed investment spurred by government incentives (e.g., the CHIPS Act). North America focuses heavily on supplying critical, high-value, low-volume specialty chemicals required for next-generation lithography and advanced materials science research, alongside maintaining a strong presence in the pharmaceutical and analytical reagent segments.

- Europe: Europe is characterized by a mature market with high demand from pharmaceutical/biotech industries and established automotive electronics manufacturing. While the region is implementing initiatives to enhance domestic semiconductor fabrication (e.g., European Chips Act), the immediate focus remains on high-quality specialized chemicals and developing robust environmental sustainability practices, particularly in chemical recycling and waste reduction technologies.

- Latin America (LATAM) & Middle East and Africa (MEA): These regions represent emerging markets for HPWCs. Demand is primarily generated by increasing industrialization, expanding electronics assembly operations, and growing pharmaceutical sectors. While volumes are currently smaller compared to APAC, infrastructure investments and growing regional R&D activity are projected to foster moderate growth, particularly for standard-to-high purity grades used in local manufacturing and scientific research centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Purity Wet Chemicals Market.- BASF SE

- Kanto Chemical Co. Inc.

- Fujifilm Corporation

- Merck KGaA

- Avantor Inc.

- Asia Union Electronic Chemicals (AUECC)

- Dow Chemical Company

- Mitsui Chemicals Inc.

- Honjo Chemical Co. Ltd.

- Mitsubishi Chemical Corporation

- Stella Chemifa Corporation

- Transene Company Inc.

- Daejung Chemicals & Metals Co. Ltd.

- Linde PLC

- Air Liquide S.A.

- Central Glass Co. Ltd.

- CWK Chemiewerk Gmbh

- Solvay S.A.

- Technic Inc.

- PVS Chemicals

Frequently Asked Questions

Analyze common user questions about the High Purity Wet Chemicals market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for High Purity Wet Chemicals?

The predominant driver is the relentless miniaturization and technological advancement in the semiconductor industry, specifically the transition to smaller manufacturing nodes (e.g., 5nm and 3nm), which necessitates ultra-high purity chemicals (G5 and G6 grades) to maintain high wafer yield and performance.

Which purity grade is currently setting the industry standard for advanced semiconductor manufacturing?

Purity Grade 5 (G5) and the emerging Purity Grade 6 (G6) are setting the highest standards. These grades require metallic impurities, particles, and organic contaminants to be controlled at parts per trillion (ppt) levels, crucial for preventing defects in next-generation microchips.

How does the volatile supply chain affect the High Purity Wet Chemicals market?

Supply chain volatility, often driven by geopolitical tensions or industrial accidents, poses a significant risk because many critical raw materials and specialized purification capabilities are geographically concentrated, leading companies to invest heavily in regional localization and dual-sourcing strategies.

What role does recycling play in the future of the HPWC market?

Chemical recycling and regeneration technologies are critical for sustainability and cost reduction. They allow manufacturers to purify spent high-volume process chemicals, like sulfuric acid, back to an electronic-grade standard, thereby reducing reliance on new raw materials and mitigating environmental disposal challenges.

Which geographical region holds the largest market share for High Purity Wet Chemicals?

The Asia Pacific (APAC) region currently holds the largest market share, predominantly due to its massive concentration of semiconductor fabrication plants (fabs) and advanced electronics assembly operations in countries such as Taiwan, South Korea, China, and Japan.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager