High Security Locks Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435267 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

High Security Locks Market Size

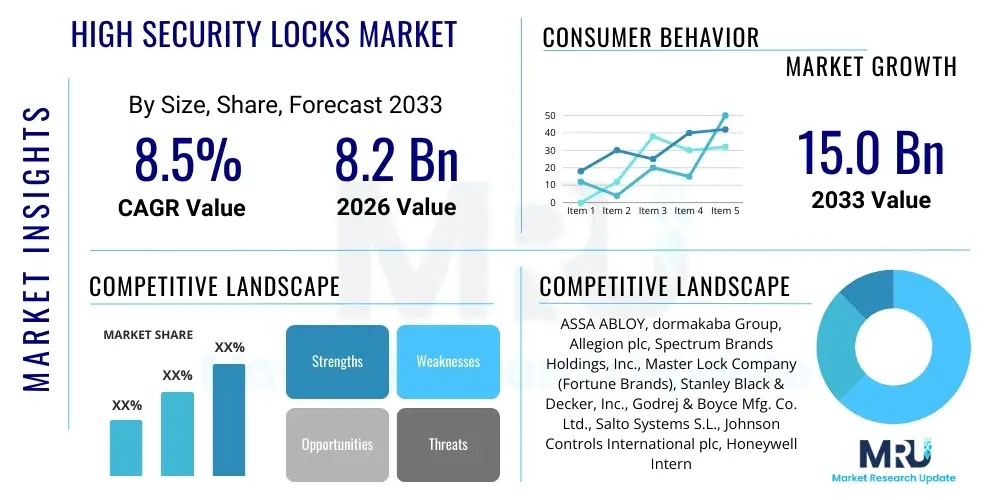

The High Security Locks Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 8.2 Billion in 2026 and is projected to reach USD 15.0 Billion by the end of the forecast period in 2033.

High Security Locks Market introduction

The High Security Locks Market encompasses advanced locking mechanisms designed to offer superior resistance against unauthorized entry, manipulation, forced attacks, and sophisticated bypass techniques. These systems go beyond standard commercial or residential locks by incorporating complex mechanical designs, advanced electronic components, biometric verification, or a combination thereof, catering primarily to environments where the protection of high-value assets, critical infrastructure, or sensitive data is paramount. Key products range from certified high-security padlocks and robust cylinder locks to complex electronic access control systems and vault locking mechanisms, all adhering to stringent international standards such as UL (Underwriters Laboratories) or CEN (European Committee for Standardization) classifications, ensuring robust performance against drilling, picking, bumping, and cutting.

Major applications of high security locks span across critical infrastructure, banking and finance (vaults, ATMs, safe deposit boxes), governmental facilities, military installations, luxury residential properties, and commercial sectors requiring robust asset protection, such as data centers and pharmaceuticals. The inherent benefits include significantly enhanced deterrence against professional criminals, compliance with increasingly strict insurance requirements, reduced risk of insider threats through sophisticated audit trails, and seamless integration with broader security management systems, offering multi-layered defense. These systems are essential tools in modern proactive security strategies, moving beyond simple perimeter protection to integrated access management.

The market is primarily driven by the escalating global threat landscape, characterized by rising organized crime rates, sophisticated burglary methods, and the necessity for robust regulatory compliance, particularly in sectors handling sensitive information or valuable goods. Furthermore, rapid urbanization, coupled with the growing adoption of smart home technologies and IoT integration in security systems, is propelling demand for advanced, remotely manageable high-security solutions. Technological advancements, especially in biometric identification, encrypted communication protocols, and miniaturization of electronic components, continue to redefine the market, shifting the focus from purely mechanical resilience to intelligent, integrated security ecosystems capable of real-time monitoring and threat response.

High Security Locks Market Executive Summary

The High Security Locks Market is experiencing significant dynamic shifts driven by convergence between traditional mechanical robustness and cutting-edge electronic intelligence. Business trends indicate a strong move toward subscription-based models for electronic and smart locking solutions, emphasizing recurring revenue streams derived from software updates, maintenance, and cloud-based access management services. Key manufacturers are focusing heavily on strategic acquisitions and partnerships to integrate specialized biometric and cryptographic technologies, broadening their product portfolios to include integrated security platforms rather than standalone locking devices. Demand remains robust across critical verticals like defense, finance, and logistics, where certified security standards dictate procurement choices, favoring vendors who can provide auditable and tamper-proof solutions alongside enhanced connectivity features.

Regionally, North America and Europe maintain dominance, characterized by early adoption of advanced electronic access control systems and stringent regulatory frameworks mandating high levels of physical security, particularly in critical infrastructure protection (CIP). However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate, fueled by rapid commercialization, massive infrastructure development, increasing urbanization, and a rising awareness regarding asset protection in emerging economies like China and India. The Middle East and Africa (MEA) region shows accelerating uptake, particularly in government projects and oil and gas facilities, seeking advanced physical barriers against physical intrusion and unauthorized access, thus demanding bespoke, heavy-duty locking solutions tailored for extreme environmental conditions.

Segment trends highlight the substantial growth of the Electromechanical and Electronic High Security Locks segments over purely Mechanical systems, reflecting end-user preference for features such as remote monitoring, access logging, and dynamic key management. Within the Application segment, the Commercial and Industrial sectors are the leading consumers, driven by the need to secure warehouses, server rooms, and supply chain assets. Conversely, the Residential segment is seeing rapid penetration of smart, high-security smart locks that offer convenience without compromising on certified security standards, leveraging fingerprint recognition, facial recognition, and secure mobile application control, democratizing previously niche high-security features for mass market adoption.

AI Impact Analysis on High Security Locks Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the High Security Locks Market frequently revolve around how AI can enhance predictive threat detection, manage complex access authorization profiles dynamically, and mitigate evolving cyber vulnerabilities in electronic lock systems. Users are concerned about the shift from reactive security to proactive, AI-driven deterrence, asking if AI algorithms can recognize unusual patterns of attempted forced entry or unauthorized access attempts in real-time, thereby generating preemptive alerts or triggering automated defensive mechanisms. Key expectations focus on AI's potential to revolutionize biometric authentication accuracy, minimize false positives, and ensure seamless, yet highly secure, user experience through continuous behavioral analytics, leading to inquiries about the long-term reliability and cost implications of integrating such sophisticated learning systems into physical security hardware.

- AI-powered predictive analytics enhance the detection of anomalous access behavior, identifying potential intrusion attempts before physical breach occurs.

- Machine learning algorithms optimize biometric security systems by improving facial and fingerprint recognition accuracy across varying conditions and reducing false rejection rates significantly.

- AI facilitates dynamic access control by learning user patterns and automatically adjusting permission levels based on contextual data (e.g., time, location, previous access history).

- Integration of AI enables sophisticated audit trail analysis, quickly pinpointing irregularities or suspicious activities within large access logs for investigation.

- AI aids in system health monitoring, predicting potential mechanical or electronic failures in high-security locks, ensuring proactive maintenance and reducing downtime.

- Enhanced cybersecurity for electronic locks is achieved through AI-driven threat intelligence, continuously monitoring and patching vulnerabilities exploited by sophisticated cyber-physical attacks.

- AI supports personalized security profiles, allowing locks to adapt based on individual user behavior and recognized threat levels, thereby increasing both security and user convenience.

- Optimization of energy consumption in battery-operated smart locks is achieved through AI management of power cycles based on predicted access frequency.

DRO & Impact Forces Of High Security Locks Market

The High Security Locks Market is significantly shaped by a confluence of accelerating drivers (D), persistent restraints (R), and compelling opportunities (O), which collectively dictate the trajectory and competitive dynamics of the industry, manifesting as potent impact forces. Key drivers include the global increase in professional theft and criminal activities targeting commercial assets, the mandatory requirement for certified locking standards in regulated industries such as finance and pharmaceuticals, and technological advancements focusing on integrated electronic and biometric authentication systems that offer superior control and traceability. These driving forces compel end-users to upgrade from standard locking mechanisms to certified, high-resistance security solutions, directly increasing market velocity and average product expenditure across all geographical regions, particularly those undergoing rapid infrastructure modernization.

Despite strong market impetus, several restraining factors dampen growth potential, notably the high initial investment cost associated with purchasing and installing sophisticated high-security systems, which often acts as a significant barrier for Small and Medium-sized Enterprises (SMEs) and budget-conscious residential customers. Furthermore, the increasing complexity of electronic locks introduces vulnerabilities related to cyberattacks, data privacy breaches, and reliance on network connectivity, demanding constant software maintenance and updates, which presents a challenge for deployment in remote or infrastructure-poor locations. Lack of standardized global regulatory frameworks concerning biometric data handling and cross-border security standards also introduces friction for international vendors and users.

Opportunities for expansion are abundant, centered around the proliferation of the Internet of Things (IoT) in security, enabling remote diagnostics, real-time alerts, and seamless integration with broader smart building management systems (BMS). The development of highly specialized locks for niche markets—such as logistics container security, critical data center physical access, and secure mobile storage units—presents profitable avenues for innovation and market penetration. The burgeoning requirement for tamper-proof auditing and compliance in supply chain security also offers substantial growth potential for locks equipped with advanced encryption and reporting capabilities, especially as global trade complexity increases and regulatory oversight tightens, demanding end-to-end security solutions for high-value cargo.

Segmentation Analysis

The High Security Locks Market segmentation provides a crucial framework for understanding the diverse needs of end-users and the specific technological solutions offered by manufacturers. The market is primarily divided based on Product Type (Mechanical, Electronic, Electromechanical, Biometric), Application (Commercial, Residential, Industrial, Government/Military), and End-Use Industry, reflecting the varied requirements for resilience, access control sophistication, and integration capabilities across different operational environments. Analyzing these segments helps stakeholders identify high-growth areas, allocate resources efficiently, and tailor product development to address sector-specific security challenges, ranging from securing a personal residence to safeguarding a high-security government vault.

- Product Type

- Mechanical Locks (e.g., High-security Cylinders, Deadbolts, Padlocks, Vault Locks)

- Electronic Locks (e.g., Keypad Locks, RFID Locks, Smart Locks)

- Electromechanical Locks (Combining mechanical robustness with electronic control)

- Biometric Locks (e.g., Fingerprint Recognition, Iris Recognition, Facial Recognition)

- Application

- Commercial (e.g., Retail, Offices, Data Centers, Logistics)

- Residential (Luxury Homes, Multi-Family Units)

- Industrial (e.g., Manufacturing Plants, Warehouses, Energy Facilities)

- Government and Military (e.g., Defense Bases, Critical Infrastructure)

- Technology Standard (e.g., UL 437, CEN Grade 6, VdS Certified)

- Mechanism (e.g., Combination, Key-based, Keyless)

Value Chain Analysis For High Security Locks Market

The value chain for the High Security Locks Market is complex, beginning with sophisticated raw material sourcing and precision manufacturing, extending through stringent testing and certification, and culminating in specialized installation and long-term maintenance services. Upstream analysis involves the procurement of high-grade, resilient materials such as specialized alloys (e.g., hardened steel, tungsten carbide inserts) for enhanced drill resistance, and advanced electronic components like encrypted microprocessors, sensors, and robust power supplies for smart locks. Key activities in this stage include specialized metallurgy, component design, and assembly, requiring high capital investment in precision engineering machinery and quality control systems to meet rigorous security standards enforced by third-party certifiers like UL, EN, or VdS.

Midstream activities focus on the physical manufacturing, assembly, and integration of mechanical and electronic parts, followed by mandatory third-party security certifications that validate the lock’s resistance capabilities against various forms of attack (e.g., lock picking, bumping, core pulling, brute force). This certification process is critical as it establishes the product's market credibility and determines its suitability for high-risk applications. Distribution channels are highly specialized; direct channels often cater to large government or financial institutions requiring bespoke security installations and ongoing service contracts, ensuring direct control over installation integrity and data security protocols, essential for maintaining chain of custody.

Downstream analysis involves distribution, professional installation, and after-sales support. Indirect channels, including specialized security distributors, system integrators, and authorized security dealers, handle the bulk of commercial and residential sales, providing localized expertise in system integration (e.g., connecting locks to surveillance or alarm systems). Aftermarket services, including system programming, key management software updates, periodic maintenance, and emergency lockout services, are increasingly becoming a vital revenue stream, particularly for complex electronic and biometric systems. The value proposition at the downstream stage heavily relies on the quality of installation and the reliability of ongoing technical support to ensure the system’s continuous operational security and longevity in challenging environments.

High Security Locks Market Potential Customers

Potential customers for high security locks represent a diverse but security-conscious demographic spanning both public and private sectors, united by the necessity to protect assets, personnel, and sensitive information from sophisticated threats. The largest consumer base resides in the Financial Sector, including commercial banks, credit unions, data storage vaults, and ATM operators, which require certified locks for securing physical currency, safe deposit boxes, and server rooms. Another crucial segment is Government and Defense, encompassing military installations, federal buildings, secure document storage facilities, prisons, and critical infrastructure (e.g., power grids, water treatment plants), where security compliance and multi-layered access control are strictly regulated and non-negotiable requirements for operational continuity and national security.

The Commercial and Industrial sector constitutes a rapidly growing customer base, driven by the need to secure valuable inventory, intellectual property, and critical operational areas. This includes pharmaceutical companies (securing controlled substances), high-value logistics and warehousing operations (securing cargo containers and distribution centers), and especially data centers, which require stringent physical security to complement their cyber defenses, often utilizing biometric and multi-factor authentication locks on server cabinet doors and access points. These commercial customers prioritize features such as auditability, remote management, and seamless integration with existing building management and surveillance systems, favoring electronic and networked solutions that provide real-time status updates.

Finally, the high-end Residential market represents a lucrative segment, particularly luxury homes and multi-family high-rise buildings where residents demand advanced security combined with smart home connectivity and aesthetic integration. These customers often seek biometric or high-end mechanical locks (Grade 1/CEN Grade 6) for perimeter doors and internal safe rooms, prioritizing convenience features like keyless entry and remote access control without compromising the physical resistance capabilities required to deter skilled burglars. Furthermore, institutions like universities and hospitals, holding valuable equipment and sensitive personal data, are increasingly adopting centralized high-security locking systems for specialized labs, pharmacies, and record-keeping offices, driving consistent demand for customized access solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.2 Billion |

| Market Forecast in 2033 | USD 15.0 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ASSA ABLOY, dormakaba Group, Allegion plc, Spectrum Brands Holdings, Inc., Master Lock Company (Fortune Brands), Stanley Black & Decker, Inc., Godrej & Boyce Mfg. Co. Ltd., Salto Systems S.L., Johnson Controls International plc, Honeywell International Inc., Ingersoll Rand, Serrature Meroni SpA, Mul-T-Lock (ASSA ABLOY subsidiary), SimonsVoss Technologies AG, Paxton Access Ltd., GANTNER Electronic GmbH, Gunnebo AB, Hanwha Techwin Co., Ltd., ADT Inc., Panasonic Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Security Locks Market Key Technology Landscape

The technological landscape of the High Security Locks Market is characterized by a significant shift towards integration, intelligence, and interoperability, moving beyond simple mechanical resistance to holistic access management ecosystems. Biometric technology, encompassing fingerprint, iris, and facial recognition, remains a cornerstone, with continuous advancements focusing on liveness detection and multispectral imaging to defeat spoofing attempts, ensuring only verified biological characteristics grant access. Encryption protocols, particularly highly secure AES 256-bit encryption, are foundational for electronic communication between the lock mechanism, access credentials (e.g., secure RFID cards, mobile devices), and centralized servers, mitigating risks associated with unauthorized interception and manipulation of control signals and stored data across the network.

The deployment of Secure Element (SE) hardware within electronic locks is a critical development, providing a tamper-resistant environment for storing cryptographic keys and access credentials, thus safeguarding against firmware manipulation and side-channel attacks that target memory or processing units. Furthermore, the adoption of specialized communication standards tailored for high-security applications, such as Open Supervised Device Protocol (OSDP), ensures secure and bidirectional communication between the access control panel and readers, offering enhanced supervision capabilities and real-time fault reporting. This technological focus enables high security locks to operate reliably within complex, distributed access control architectures required by large commercial and governmental organizations.

The growing role of mobile credentials—using NFC (Near Field Communication) and BLE (Bluetooth Low Energy) technologies secured by Public Key Infrastructure (PKI)—is rapidly replacing traditional physical keys and access cards. This evolution requires robust backend cloud platforms and mobile application security to manage digital key issuance, revocation, and audit trails globally and instantaneously. Integrating AI and Machine Learning (ML) for behavioral analytics is also emerging, allowing locks to recognize and flag deviations from normal access patterns, dynamically adjust security posture based on threat level, and contribute to proactive security strategies, thereby defining the cutting edge of physical security intelligence and minimizing dependence on static security measures.

Regional Highlights

- North America: This region maintains a leadership position due to stringent regulatory demands, particularly in defense, finance, and data protection sectors, requiring UL-certified Grade 1/CEN Grade 6 locks. High adoption rates of advanced electronic access control systems and biometric technologies, coupled with high consumer spending on smart home security, drive continuous market innovation and penetration of integrated security solutions and professional monitoring services.

- Europe: Characterized by highly standardized and rigorous testing requirements (CEN, VdS), European markets prioritize certified mechanical and electromechanical resilience. Driven by high levels of urbanization and the presence of major security manufacturers (e.g., ASSA ABLOY, dormakaba), the region is a strong adopter of smart locking systems, particularly in commercial and public infrastructure, with an emphasis on GDPR compliance concerning biometric data handling.

- Asia Pacific (APAC): Positioned as the fastest-growing region, APAC benefits from massive urbanization projects, rapid commercial infrastructure development (e.g., smart cities, data centers), and increasing awareness of security threats in emerging economies like China, India, and Southeast Asia. Growth is fueled by government investment in CIP and rising middle-class disposable incomes driving demand for smart, secure residential solutions.

- Latin America (LATAM): Market growth in LATAM is primarily driven by high perceived security risks, leading to strong demand for robust, mechanical, and heavy-duty locks in commercial and high-end residential segments. Adoption of electronic solutions is accelerating, particularly in metropolitan areas, though market maturity trails North America and Europe, focusing on essential access control and basic surveillance integration.

- Middle East and Africa (MEA): Significant investment in large-scale infrastructure projects, coupled with stringent security needs in the oil, gas, and governmental sectors, drives demand for specialized, high-temperature, and robust mechanical and electromechanical locks. High-security vault solutions for the banking sector and critical infrastructure protection are major revenue generators, requiring certified, tamper-proof hardware that meets international standards for resilience and durability in demanding climates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Security Locks Market.- ASSA ABLOY

- dormakaba Group

- Allegion plc

- Spectrum Brands Holdings, Inc.

- Master Lock Company (Fortune Brands)

- Stanley Black & Decker, Inc.

- Godrej & Boyce Mfg. Co. Ltd.

- Salto Systems S.L.

- Johnson Controls International plc

- Honeywell International Inc.

- Ingersoll Rand

- Serrature Meroni SpA

- Mul-T-Lock (ASSA ABLOY subsidiary)

- SimonsVoss Technologies AG

- Paxton Access Ltd.

- GANTNER Electronic GmbH

- Gunnebo AB

- Hanwha Techwin Co., Ltd.

- ADT Inc.

- Panasonic Corporation

Frequently Asked Questions

Analyze common user questions about the High Security Locks market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between Mechanical, Electronic, and Biometric High Security Locks?

Mechanical high security locks rely purely on complex physical designs (e.g., multiple locking mechanisms, intricate keyways) to resist picking and drilling, prioritizing physical durability. Electronic locks use keypads, RFID cards, or remote controls, offering audit trails and programmable access but requiring power. Biometric locks utilize unique biological identifiers (fingerprints, iris scans) for authentication, providing the highest level of personal identification security and dynamic access control capabilities.

What role does third-party certification (like UL or CEN) play in the High Security Locks Market?

Third-party certification, such as UL (Underwriters Laboratories) or CEN (European Committee for Standardization), is crucial as it validates the lock’s resistance against specific attack methods and durations (e.g., UL 437 for key integrity; CEN Grade 6 for forced entry resilience). Certification is often mandatory for insurance compliance, governmental contracts, and securing high-value assets, ensuring the product meets rigorous, independently verified security performance benchmarks.

How is the adoption of IoT and smart technology impacting the security level of high security locks?

IoT and smart technology enhance high security locks by enabling remote monitoring, real-time alerts, dynamic access management, and integration with broader security ecosystems. While connectivity offers convenience and control, it also introduces cybersecurity risks. Manufacturers mitigate this through advanced encryption (AES 256-bit), secure hardware elements, and continuous over-the-air firmware updates, ensuring that enhanced functionality does not compromise core security integrity against digital threats.

Which industry segments are the largest consumers of high security locking solutions globally?

The largest consumer segments globally are the Financial Sector (banks, vaults, ATMs) and the Government/Defense sector (military installations, critical infrastructure), both requiring non-negotiable, certified security standards due to the high value or criticality of protected assets. The Commercial sector, particularly data centers and high-value logistics, is also a rapidly accelerating consumer, prioritizing integrated electronic systems for detailed auditability and supply chain security compliance.

What are the main market restraints affecting the widespread growth of high security locks, especially in emerging economies?

The primary restraints are the significantly high initial capital expenditure required for sophisticated, certified high-security systems, making them cost-prohibitive for many small and medium enterprises (SMEs) and basic residential applications. Additionally, the technical complexity of installing and maintaining networked electronic and biometric systems, coupled with potential cybersecurity vulnerabilities and the requirement for stable power and network infrastructure, hinders adoption in regions with limited technical support or infrastructure reliability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager