High Speed Elevator Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432533 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

High Speed Elevator Market Size

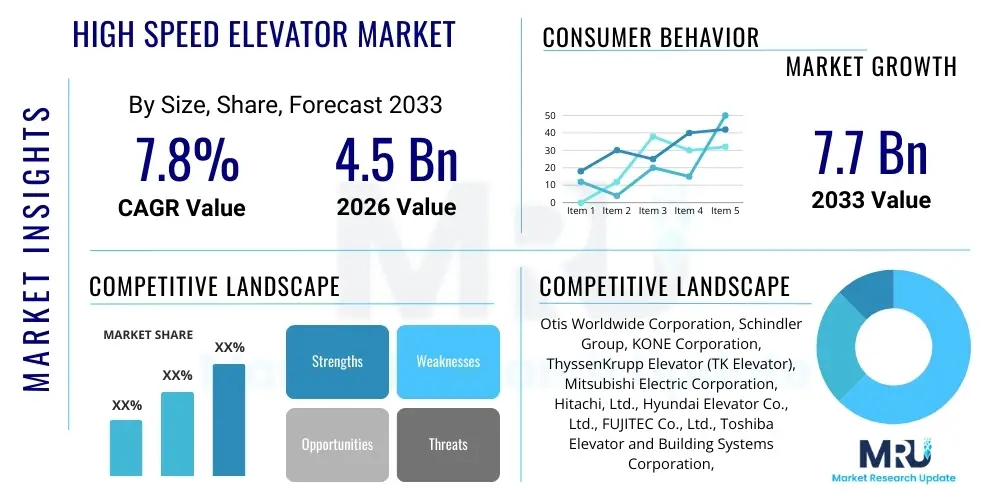

The High Speed Elevator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.7 Billion by the end of the forecast period in 2033. This substantial growth trajectory is underpinned by rapid global urbanization, particularly the proliferation of mega-tall structures (supertall and megatall skyscrapers) requiring sophisticated vertical transport systems capable of safely and efficiently moving large volumes of people at speeds often exceeding 6 meters per second (m/s). Investment in smart city infrastructure and high-rise commercial real estate development in emerging economies further fuels this expansion.

High Speed Elevator Market introduction

The High Speed Elevator Market encompasses the design, manufacture, installation, and maintenance of advanced vertical conveyance systems engineered for buildings where travel distances and passenger volume necessitate speeds significantly higher than standard elevators, typically defined as 4 m/s and above, often reaching 18-20 m/s in specialized applications. These systems are crucial components of modern infrastructure, primarily utilized in high-rise commercial buildings, luxury residential towers, and transit hubs. They integrate complex subsystems including highly resilient traction mechanisms, advanced control algorithms, stringent safety mechanisms (such as aerodynamic damping and emergency braking), and sophisticated energy recovery drive systems to ensure performance, safety, and energy efficiency across extreme heights.

The core product features of high speed elevators involve specialized materials—such as carbon fiber ropes replacing traditional steel cables to reduce dead weight and increase travel height—and machine room-less (MRL) configurations utilizing permanent magnet synchronous motors (PMSM) for enhanced power density and minimized noise. Major applications include Grade A office complexes where efficient inter-floor transit impacts business productivity, mixed-use high-rise developments, and iconic architectural landmarks globally. The market's growth is inherently linked to global construction cycles and architectural trends emphasizing vertical density and spatial optimization, demanding elevators that can handle greater dynamic loads and withstand operational stresses associated with rapid ascent and descent over hundreds of meters.

Key benefits derived from implementing high speed elevators involve maximizing the rentable space within tall buildings by minimizing the space required for elevator cores (a critical factor in skyscraper economics), significantly reducing passenger wait and travel times, and enhancing the overall user experience through reduced vibration and improved ride comfort facilitated by active roller guides and pressure control systems. Driving factors for market adoption include stringent governmental regulations concerning energy efficiency and seismic resilience in tall buildings, technological advancements in material science enabling lighter and stronger components, and intense competitive pressures in global urban centers to construct visually striking and functionally superior skyscrapers that define metropolitan skylines and attract premium tenants.

High Speed Elevator Market Executive Summary

The High Speed Elevator Market is experiencing robust expansion driven predominantly by architectural mega-projects in Asia Pacific and the Middle East, regions characterized by aggressive urban densification and investment in super-tall structures. Business trends indicate a strong move toward digitalization, with manufacturers integrating IoT sensors, predictive maintenance analytics, and cloud-based monitoring systems into new installations and modernization projects. This focus on smart elevator technology not only enhances operational reliability and safety compliance but also allows building managers to optimize traffic flow and minimize operational downtime, shifting the competitive advantage towards companies offering comprehensive, digitally-enabled lifecycle services rather than purely hardware sales. Furthermore, sustainability is becoming a key purchase criterion, pushing vendors to develop regenerative drive systems and lightweight, durable materials that reduce overall energy consumption.

Regionally, the Asia Pacific dominates the market share due to unparalleled high-rise construction activity, particularly in China, India, and Southeast Asia, where rapid population growth necessitates immediate vertical expansion of commercial and residential infrastructure. North America and Europe, while having mature high-speed markets, focus primarily on modernization, refurbishment, and adoption of advanced digital interfaces to extend the lifespan and improve the performance of existing high-rise installations, adhering to strict building codes and energy efficiency mandates like those in the EU Green Deal. The Middle East remains a critical market segment due to ongoing prestigious mega-projects, such as those associated with Saudi Vision 2030 and significant construction in the UAE, driving demand for the absolute fastest and most aesthetically integrated vertical transport solutions.

Segment trends reveal that the modernization and maintenance services segment is growing faster than new installations, reflecting the increasing age of high-rise building stock globally and the imperative to upgrade older hydraulic and traction systems to modern, energy-efficient high-speed gearless technology. By speed, the 6.0 m/s to 10.0 m/s range maintains the highest volume due to its optimal balance of speed and cost-effectiveness for buildings ranging from 40 to 80 floors. The end-user analysis highlights the commercial sector, encompassing corporate offices and hotels, as the primary consumer base, though high-end residential towers are rapidly increasing their market contribution, demanding bespoke, quiet, and seamlessly integrated elevator solutions.

AI Impact Analysis on High Speed Elevator Market

User queries regarding the impact of Artificial Intelligence (AI) on High Speed Elevators predominantly center on operational efficiency, predictive safety, and enhanced passenger experience. Key themes revolve around how AI can optimize elevator grouping and dispatching in complex high-rise traffic scenarios (destination control systems), whether AI can detect mechanical failures before they occur (predictive maintenance), and how autonomous systems might influence maintenance technician roles. Users are highly interested in understanding the algorithms that manage peak traffic flows in super-tall buildings and the security implications of integrated AI systems. The general expectation is that AI will move high-speed vertical transport systems from reactive maintenance models to proactive, highly personalized, and energy-efficient operations, addressing the critical challenge of minimizing downtime in buildings where elevators are lifeblood infrastructure.

The immediate influence of AI is most visible in advanced predictive analytics platforms. These platforms continuously analyze vast datasets collected from elevator sensors (vibration, temperature, door cycling counts, motor performance) to establish baseline operating norms and identify subtle anomalies indicative of impending failure, potentially reducing unexpected shutdowns by up to 50%. Furthermore, AI-driven destination control systems (DCS) utilize machine learning to predict passenger flow based on time of day, calendar events, and even real-time building occupancy data, minimizing the number of stops and optimizing the allocation of cars, thereby increasing the effective handling capacity of the elevator bank and saving significant amounts of energy by reducing unnecessary travel distances.

- AI-Enhanced Predictive Maintenance: Utilizes machine learning on sensor data to forecast component failure, transitioning maintenance from scheduled interventions to condition-based servicing, drastically reducing unplanned outages.

- Optimized Destination Control Systems (DCS): AI algorithms dynamically manage elevator dispatching, improving traffic flow, reducing waiting times, and minimizing energy consumption during peak hours by predicting demand.

- Acoustic Anomaly Detection: Machine learning models analyze elevator noise and vibration signatures in real-time to detect subtle operational defects, crucial for high-speed systems where component stresses are severe.

- Energy Optimization: AI controls regenerative drive systems and motor speeds based on predictive load management, ensuring that energy use is minimized while maintaining specified travel times.

- Enhanced Passenger Experience: Integration of facial recognition and personalized service profiles (via IoT/AI interfaces) allows seamless, touchless operation and route optimization based on individual needs or building access controls.

- Autonomous Monitoring and Adjustment: AI autonomously adjusts damping systems, cabin pressure controls, and active roller guides in ultra-high-speed scenarios to ensure smooth, stable rides despite external factors like wind load or building sway.

DRO & Impact Forces Of High Speed Elevator Market

The dynamics of the High Speed Elevator Market are shaped by a powerful interplay of technological advancements (Drivers), economic sensitivities (Restraints), and expansive new infrastructure needs (Opportunities), creating significant Impact Forces. Key drivers include accelerating global urbanization leading to an increased necessity for vertical city planning and the construction of supertall skyscrapers globally, particularly across Asian megacities. Simultaneously, the persistent demand for greater efficiency and reduced carbon footprints drives innovation in sustainable elevator technologies, such as advanced regenerative drives and ultra-lightweight materials, compelling manufacturers to continually upgrade product portfolios. Restraints, conversely, primarily involve the exceptionally high initial capital investment required for high-speed installations, compounded by intense regulatory scrutiny and strict safety standards mandated for these complex, high-stress systems. Economic downturns or geopolitical instability can rapidly slow down large-scale commercial real estate projects, directly impacting new sales volumes for high-speed systems.

The primary opportunities stem from the untapped potential of the high-speed elevator modernization segment, where older, less efficient systems in existing high-rise buildings across North America and Europe require substantial upgrades to comply with new safety and energy codes. Furthermore, the burgeoning demand for specialized, high-performance elevators in transit infrastructure—such as high-speed rail stations and deep-underground facilities—presents a niche but lucrative growth area. Impact forces are strong and directional, focusing heavily on safety technology advancements, specifically the development of non-metallic, high-strength ropes (e.g., carbon fiber belts) that eliminate hoistway compensation chains and significantly extend travel height limitations, thus enabling the next generation of mega-tall structures.

These forces collectively influence the competitive landscape, dictating that successful market players must not only provide cutting-edge hardware but also robust, long-term service contracts leveraging digital twins and remote diagnostics. Regulatory pressures, particularly concerning fire resistance, seismic stability, and passenger evacuation protocols in high-speed, high-rise environments, act as critical filters for market entry, ensuring that only highly capable global firms can compete effectively. The overall market momentum favors integration: seamless vertical transportation systems that communicate directly with building management systems (BMS) for optimized energy use and security management are now prerequisites for major construction contracts.

Segmentation Analysis

The High Speed Elevator Market is primarily segmented by Speed, Technology, Application, and End-Use, reflecting the diverse requirements of the vertical construction industry. Segmentation by speed, specifically systems exceeding 4.0 m/s, is crucial as performance requirements correlate directly with building height, material requirements, and overall system complexity and cost. Technology segmentation differentiates between high-speed geared, gearless (the dominant current standard utilizing PMSM), and emerging linear motor (or magnetic levitation) systems, which promise unlimited height capabilities and exceptional speed consistency but are still in the early stages of widespread commercialization. Application segmentation distinguishes between installations based on travel path (e.g., residential versus commercial) which impacts interior design specifications, noise reduction priorities, and operational duty cycles.

Further analysis of segmentation reveals that the gearless technology segment holds the majority share, driven by its energy efficiency, reduced maintenance needs, and capacity to deliver the necessary speeds (up to 12 m/s) required by most supertall buildings currently under construction. However, the ultra-high-speed segment (above 10.0 m/s) is projected to exhibit the highest Compound Annual Growth Rate (CAGR), reflecting the ongoing global competition to construct the world’s tallest buildings in Asia and the Middle East, requiring highly customized and technically demanding solutions. End-use segmentation clearly indicates that the commercial segment, comprising vast office spaces, luxury hotels, and convention centers, represents the largest revenue source due to the intense daily traffic demands and the emphasis on premium, reliable transport in high-value real estate.

- By Speed:

- 4.0 m/s to 6.0 m/s

- 6.0 m/s to 10.0 m/s

- Above 10.0 m/s (Ultra-High Speed)

- By Technology:

- Gearless Traction Elevators (Dominant)

- Linear Motor/Maglev Elevators (Emerging)

- Others (e.g., Advanced Hydraulic for specific applications)

- By Application:

- New Installation

- Modernization and Maintenance (Fastest growing service segment)

- By End-Use:

- Commercial (Offices, Hotels, Retail)

- Residential (Luxury High-Rise Apartments)

- Industrial and Institutional (Transportation Hubs, Hospitals)

Value Chain Analysis For High Speed Elevator Market

The value chain for the High Speed Elevator Market is intricate, spanning from raw material sourcing and specialized component manufacturing to system installation, commissioning, and exhaustive lifecycle maintenance. Upstream analysis focuses on suppliers of critical, high-tolerance materials and components, including high-strength steel alloys for structural guides, sophisticated carbon fiber composites for traction ropes, advanced electronics for control systems (e.g., variable voltage variable frequency or VVVF drives), and highly specialized Permanent Magnet Synchronous Motors (PMSM). These upstream suppliers often operate under stringent quality controls and long-term contracts with major elevator OEMs due to the bespoke nature and safety criticality of the components, creating high barriers to entry and moderate supplier bargaining power for specialized parts like active roller guides and damping systems.

Midstream activities are dominated by major global elevator Original Equipment Manufacturers (OEMs), who undertake the complex process of system design, manufacturing integration, and rigorous safety testing. Due to the requirement for site-specific customization, this stage involves extensive engineering input, optimizing car aerodynamics, hoistway pressures, and control logic for maximum speed and rider comfort in ultra-tall buildings. Downstream analysis focuses on installation, commissioning, and, most importantly, post-installation service and maintenance. Installation is executed by specialized, certified technicians, often employed directly by or highly trained by the OEMs, given the precision required for aligning high-speed rails across vast vertical distances. The long-term maintenance contracts represent the most stable and profitable portion of the value chain, ensuring recurring revenue and deep client engagement over the 20-40 year lifespan of a high-rise building.

Distribution channels for high speed elevators are predominantly direct, necessitated by the project-based nature of sales, which involve direct negotiation between the OEM and the building developer, construction firm (General Contractor), and architectural consultants early in the design phase. Indirect channels are rare but may involve regional distributors or agents for smaller, less complex projects, though high-speed systems almost always require direct OEM engagement to manage customization, regulatory compliance, and installation quality assurance. The reliance on direct sales ensures tight control over quality and intellectual property protection while allowing OEMs to offer bundled services encompassing installation, warranty, and long-term maintenance, essential for maintaining the high reliability standards demanded in premium commercial real estate.

High Speed Elevator Market Potential Customers

The primary end-users and buyers of high speed elevator systems are sophisticated entities involved in large-scale commercial and residential real estate development, requiring advanced vertical mobility solutions for supertall and megatall structures. These customers typically fall into categories such as private property developers specializing in Grade A office space and luxury residences, multinational hotel chains constructing flagship properties, and governmental or quasi-governmental entities funding major civic infrastructure projects, including high-speed rail hubs, airport control towers, and strategic governmental buildings. These buyers prioritize total cost of ownership (TCO) over initial cost, focusing heavily on proven safety track records, energy efficiency ratings, and the OEM’s capacity to provide rapid, global support and technologically advanced, often proprietary, destination control systems that integrate smoothly with building security and management platforms.

A significant segment of potential customers includes large, established real estate investment trusts (REITs) and institutional fund managers who manage extensive portfolios of aging high-rise commercial buildings. For this group, the demand is centered on modernization services—upgrading existing mid-speed systems to modern high-speed gearless technology to meet current tenant expectations for reduced wait times and improved energy performance, thereby maximizing asset value. These customers are highly sensitive to disruption and downtime during the modernization process, requiring partners who can execute complex upgrades efficiently and often in phases while the building remains partially operational. The decision-making unit for high-speed systems is often multidisciplinary, involving architects, mechanical and electrical consultants, building owners, and facility management personnel, leading to prolonged sales cycles focused on detailed performance specifications and custom engineering solutions.

Emerging potential customers are increasingly found in the specialized institutional sector, particularly in rapid urban transit organizations and utility providers constructing critical underground infrastructure, such as deep-level metro stations or data centers housed below ground, requiring high-speed, heavy-duty elevators with enhanced fire and seismic resistance features. Furthermore, specialized scientific or industrial applications, such as wind turbine testing facilities or vertical agricultural operations (vertical farms), are beginning to require custom high-speed lift systems for equipment and personnel transport across extreme heights. These niche buyers require bespoke engineering solutions that often challenge conventional elevator design parameters, offering high-margin opportunities for specialized high-speed elevator providers capable of complex customization and meeting extremely rigorous environmental and operational specifications, driving innovation in areas like remote monitoring and extreme environment operation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.7 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Otis Worldwide Corporation, Schindler Group, KONE Corporation, ThyssenKrupp Elevator (TK Elevator), Mitsubishi Electric Corporation, Hitachi, Ltd., Hyundai Elevator Co., Ltd., FUJITEC Co., Ltd., Toshiba Elevator and Building Systems Corporation, Canny Elevator Co., Ltd., Express Elevators, Guangri Elevator Industry Co., Ltd., Shenyang Brilliant Elevator Co., Ltd., IFE Elevators, Kleemann S.A., SJEC Corporation, Yungtay Engineering Co., Ltd., Volkslift Elevator, Ascent Elevator, Sigma Elevator. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Speed Elevator Market Key Technology Landscape

The technological landscape of the High Speed Elevator Market is defined by continuous innovation aimed at increasing travel speed, improving energy efficiency, and enhancing passenger safety and ride comfort over extremely long vertical distances. The most crucial foundational technology remains the Permanent Magnet Synchronous Motor (PMSM) gearless traction machine, which offers superior torque characteristics, greater efficiency than traditional geared systems, and a compact size essential for Machine Room-Less (MRL) designs, though ultra-high-speed systems often still utilize machine rooms for complex machinery. A paradigm shift is occurring with the adoption of non-metallic, high-strength composite ropes, particularly carbon fiber belts, which are dramatically lighter than steel cables. This weight reduction allows elevators to reach previously unattainable heights by eliminating the weight of compensating chains and significantly decreasing the power required to lift the system’s dead weight, fundamentally altering the height constraints for future skyscraper design and operation.

Furthermore, significant technological effort is directed towards managing the physics associated with high-speed travel. This includes the development of sophisticated aerodynamic car designs and hoistway pressure management systems that actively equalize cabin air pressure during rapid ascent and descent, preventing passenger discomfort and potential health issues linked to pressure fluctuations. Crucially, the deployment of active roller guides is standard in high-speed systems; these electronically controlled guides sense lateral vibration and actively adjust to minimize movement, ensuring a smooth ride experience even at speeds exceeding 15 m/s. These systems rely on high-precision sensors and microprocessors to execute real-time adjustments, making them a cornerstone of modern high-speed comfort and reliability.

In terms of digital integration, the technological emphasis is shifting towards AI-powered smart elevator systems. This includes advanced destination control systems (DCS) using machine learning to predict and manage traffic flow, optimizing car allocation and route planning in real-time. Additionally, IoT sensor integration is mandatory for comprehensive monitoring, fueling predictive maintenance programs that analyze vibration, temperature, and door usage patterns to anticipate faults. This digitalization minimizes costly downtime in critical infrastructure. Looking ahead, the potential adoption of multi-car systems (e.g., ThyssenKrupp’s MULTI) and linear motor technology promises to further revolutionize the market by allowing multiple cars to operate in a single shaft vertically and horizontally, significantly increasing handling capacity while reducing the required core space in skyscrapers, thus presenting a major technological frontier for urban density optimization.

Regional Highlights

The global demand for high-speed elevators is highly concentrated in regions experiencing intensive urban development and rapid construction of skyscrapers, leading to pronounced regional disparities in market growth and maturity.

- Asia Pacific (APAC): APAC is the epicenter of the High Speed Elevator Market, commanding the largest market share and the highest growth rate globally. This dominance is attributed directly to unprecedented urbanization and industrialization, particularly in China (which accounts for the majority of new global skyscraper construction), India, and Southeast Asian nations like Vietnam and Indonesia. Government initiatives supporting smart city infrastructure and massive investments in commercial real estate drive demand for new installations of both high-speed and ultra-high-speed systems. Key architectural trends in this region focus on height and capacity, demanding speeds often exceeding 10 m/s. Manufacturers heavily prioritize production and service capacity expansion across major APAC economies to capitalize on these development cycles.

- Middle East and Africa (MEA): The MEA region represents a high-value, albeit volatile, segment, primarily driven by large-scale, prestige architectural projects in the Gulf Cooperation Council (GCC) states, specifically Saudi Arabia and the UAE. Projects linked to national visions (e.g., Saudi Vision 2030) and global events continue to necessitate bespoke, ultra-high-speed vertical transport systems, often showcasing the pinnacle of elevator technology. While overall project volumes are lower than APAC, the average contract value is substantially higher due to the requirement for custom luxury finishes, extremely high speeds (often world-record attempts), and integration with sophisticated building security protocols. Africa's contribution is currently modest but is expected to accelerate in capital cities undergoing modernization.

- North America: North America presents a mature market characterized by slower growth in new, ultra-tall construction compared to APAC, but significant and sustained demand for modernization and refurbishment services. Key market activities focus on upgrading elevator systems in existing commercial towers in cities like New York, Chicago, and Toronto to comply with modern safety standards, energy efficiency mandates, and tenant experience expectations. The North American market is highly competitive and places a premium on long-term service contracts, sophisticated predictive maintenance capabilities, and compliance with strict local building codes, including accessibility (ADA) regulations, favoring robust, proven technology and service reliability.

- Europe: The European market, similar to North America, is characterized by maturity, with emphasis placed heavily on modernization and service rather than new supertall construction, constrained by stringent historical preservation laws and planning regulations. The market growth is largely driven by the European Union’s energy efficiency directives, compelling building owners to replace older, energy-intensive geared systems with high-efficiency gearless technology incorporating regenerative drives. Focus areas include integrating elevators with smart building energy management systems and enhancing digital connectivity, often through retrofit programs. Germany, the UK, and France are the largest consumers of high-speed elevator maintenance and modernization services.

- Latin America (LATAM): The LATAM market exhibits moderate growth, driven by localized high-rise development in major metropolitan hubs such as São Paulo, Mexico City, and Santiago. Economic stability challenges occasionally slow large project execution, but ongoing urbanization drives a consistent need for high-density residential and commercial towers. The market tends to favor reliable, cost-effective high-speed solutions (primarily in the 4.0 m/s to 6.0 m/s range) and is increasingly adopting global safety standards to enhance infrastructure quality and appeal to international investors. Competition is fierce, often involving regional distributors alongside major global OEMs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Speed Elevator Market.- Otis Worldwide Corporation

- Schindler Group

- KONE Corporation

- ThyssenKrupp Elevator (TK Elevator)

- Mitsubishi Electric Corporation

- Hitachi, Ltd.

- Hyundai Elevator Co., Ltd.

- FUJITEC Co., Ltd.

- Toshiba Elevator and Building Systems Corporation

- Canny Elevator Co., Ltd.

- Express Elevators

- Guangri Elevator Industry Co., Ltd.

- Shenyang Brilliant Elevator Co., Ltd.

- IFE Elevators

- Kleemann S.A.

- SJEC Corporation

- Yungtay Engineering Co., Ltd.

- Volkslift Elevator

- Ascent Elevator

- Sigma Elevator

Frequently Asked Questions

Analyze common user questions about the High Speed Elevator market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of ultra-high-speed elevators (above 10 m/s)?

The primary driver is the global construction trend focusing on supertall and megatall skyscrapers, particularly in Asia Pacific and the Middle East. These extreme heights necessitate ultra-fast vertical transit to manage significant passenger volumes efficiently and ensure acceptable journey times, maximizing the commercial viability of the upper floors.

How do high-speed elevators ensure passenger comfort and safety during rapid movement?

Comfort and safety are maintained through highly advanced systems including active roller guides that minimize vibration, specialized aerodynamic car designs, and automated hoistway pressure regulation systems that equalize cabin air pressure, preventing ear discomfort at high speeds. Safety relies on redundant braking systems, advanced non-contact monitoring, and carbon fiber ropes for increased strength and reduced weight.

What role does AI and IoT play in the operational efficiency of high-speed elevators?

AI and IoT enable real-time operational optimization through predictive maintenance, using sensors to forecast component failures before downtime occurs. AI-driven Destination Control Systems (DCS) utilize machine learning to manage complex traffic patterns, minimizing car stops, reducing waiting times, and optimizing overall energy use across high-rise installations.

Is the modernization segment more lucrative than new installations in mature markets like North America and Europe?

Yes, in mature markets, the modernization and maintenance segment is exceptionally strong and often more lucrative than new installations. Many existing high-rise buildings require upgrades to meet current energy efficiency standards and improve vertical throughput, driving demand for modern gearless, high-speed retrofit solutions and long-term service contracts.

What technological advancement is crucial for enabling elevators to reach record-breaking heights?

The most crucial advancement is the widespread adoption of non-metallic, high-strength materials, specifically carbon fiber reinforced polymer (CFRP) ropes or belts. These significantly lighter materials replace traditional steel cables, reducing the overall weight of the compensating systems and lifting mechanisms, thereby overcoming the long-standing height limitations imposed by heavy steel cable weight.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager