High Speed Tool Steel Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431807 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

High Speed Tool Steel Market Size

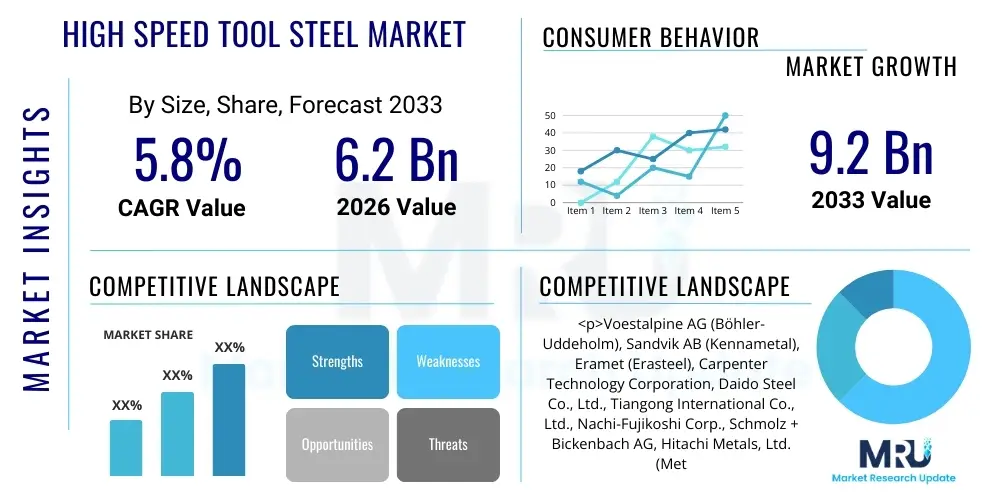

The High Speed Tool Steel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 6.2 Billion in 2026 and is projected to reach USD 9.2 Billion by the end of the forecast period in 2033. This consistent growth trajectory is fundamentally supported by increasing automation and industrial expansion across global manufacturing sectors, particularly in automotive, aerospace, and defense industries, which require cutting tools capable of maintaining peak performance under severe thermal and mechanical stresses. The ongoing technological advancements in metallurgy, leading to the commercialization of superior powder metallurgy (PM) grades, further contribute to market value expansion by enabling higher efficiency and longer tool life in demanding applications.

High Speed Tool Steel Market introduction

High Speed Tool Steel (HSS) constitutes an indispensable category of iron-based alloys specifically engineered for fabricating cutting, drilling, and shaping tools used in high-throughput industrial machining operations. The material’s defining characteristic is its 'red hardness'—the exceptional ability to retain hardness and a sharp cutting edge even when temperatures rise significantly, often exceeding 600°C, during rapid material removal processes. This vital property is achieved through the meticulous incorporation of substantial amounts of carbide-forming elements such, including tungsten, molybdenum, vanadium, and chromium. These alloying additions, coupled with precise heat treatment processes involving austenitizing and multiple tempering cycles, lead to the formation of complex, highly stable secondary carbides (such as M6C and M2C) that provide the necessary wear resistance and hardness stability at elevated operating temperatures, distinguishing HSS from conventional low-alloy tool steels.

The product portfolio within the HSS market is broadly segmented into the T-series (Tungsten-rich steels) and M-series (Molybdenum-rich steels), with the M-series, particularly M2 and M42, dominating volume sales due to their excellent balance of cost-effectiveness, toughness, and performance. HSS is predominantly utilized in the manufacturing of complex tools such as twist drills, taps, milling cutters, reamers, gear cutters, broaches, and specific types of knives and dies where the operational environment involves high impact or intermittent cutting action. The material is chosen over ultra-hard alternatives like cemented carbides in applications where toughness and resistance to chipping are paramount. Furthermore, the material’s inherent capacity to be reground and recoated multiple times significantly contributes to its economic viability and sustainable use in heavy industrial settings, maintaining its relevance despite the rise of alternative tooling materials.

The primary driving factors propelling the expansion of the HSS market include the robust global demand from the automotive sector, driven by the need for intricate tooling for lightweighting materials and the tooling requirements for specialized components in the burgeoning electric vehicle (EV) market. Benefits derived from using HSS tools encompass significant improvements in machining precision, superior surface finishes on complex workpieces, and notably reduced downtime due to premature tool failure compared to lower-grade alternatives. Additionally, continuous innovation in coatings technology, which is applied to HSS substrates, further extends the tool’s functional envelope, allowing HSS tools to compete effectively in increasingly rigorous high-speed machining environments. The interplay between raw material availability, process refinement, and application specific demands solidifies the strategic importance of HSS within the global supply chain for capital goods and industrial production machinery, mandating consistent investment in metallurgical research and production capacity across leading market participants globally.

High Speed Tool Steel Market Executive Summary

The High Speed Tool Steel market exhibits strong business trends characterized by a dual focus on cost optimization in conventional HSS production and premiumization within the specialized segments. Major manufacturers are consolidating production capabilities and leveraging digitalization (Industry 4.0) to achieve tighter process control, especially in the critical heat treatment stage, reducing manufacturing variability and enhancing product consistency. A notable trend is the strategic geographical diversification of production, moving capacity closer to high-growth demand centers in Southeast Asia, aimed at mitigating supply chain volatility and reducing logistical overheads associated with the transport of heavy steel products. Furthermore, strategic partnerships between HSS producers and specialized coating service providers are becoming commonplace to deliver integrated, high-performance tool solutions directly to sophisticated end-users, ensuring that the HSS substrate is perfectly matched with an application-appropriate surface enhancement.

Regionally, the market structure remains highly asymmetrical. The Asia Pacific (APAC) region continues its dominance, accounting for the largest share of market volume due to the high density of automotive, general machinery, and consumer electronics manufacturing in countries like China, India, and Vietnam. This region primarily dictates global pricing dynamics for standard HSS grades. Conversely, North America and Europe, while possessing slower volume growth, drive the value segment of the market. These mature regions emphasize performance and are rapid adopters of premium, high-vanadium, and Powder Metallurgy (PM) HSS grades, particularly for aerospace and high-precision mold manufacturing. Regulatory frameworks in Europe concerning sustainable manufacturing and resource efficiency also mandate that HSS suppliers offer products with high recyclability and optimized energy input, influencing local material selection and process innovation.

Segmentation trends highlight the increasing disparity between conventional HSS and PM HSS. While Molybdenum-based HSS (M-series) maintains its market leadership in terms of tonnage, the Powder Metallurgy HSS segment is forecasted to achieve the highest Compound Annual Growth Rate (CAGR). This accelerated growth is attributed to the superior mechanical properties offered by PM HSS, including improved toughness and minimal internal residual stress, making them ideal for high-risk applications where tool failure is costly. Across end-use sectors, the Automotive industry remains the foundational segment; however, the burgeoning requirements from the Medical and Aerospace sectors for machining biocompatible alloys (like titanium and stainless steel) and superalloys necessitate extremely hard and tough HSS materials, providing premium opportunities for specialized alloy producers. This overall trajectory suggests a future market driven by high-specification materials rather than purely high-volume output.

AI Impact Analysis on High Speed Tool Steel Market

The convergence of Artificial Intelligence and High Speed Tool Steel manufacturing is largely driven by the imperative to overcome the inherent complexities of metallurgy and processing. User inquiries commonly focus on how AI can streamline the complex alloying process, particularly in predicting the precise microstructural outcomes of variable cooling rates and tempering cycles—critical steps that determine the final hardness and toughness of HSS. There is significant interest in utilizing machine learning for material informatics, where vast chemical composition and property data sets are analyzed to virtually screen novel HSS compositions, thereby drastically reducing the time and cost associated with traditional trial-and-error R&D cycles. Users are also highly interested in how AI integration, coupled with advanced sensing technology, can enable true 'closed-loop' control in high-temperature processes like austenitizing, ensuring that every batch meets stringent specifications consistently.

AI's influence is profoundly shaping the production efficiency landscape by addressing variability. The traditional HSS manufacturing process involves numerous human-dependent decision points, from furnace temperature regulation to forging control, which introduce variability. Machine learning algorithms are now being deployed to analyze real-time sensor data—including infrared temperature readings, acoustic emissions during forging, and eddy current signals post-treatment—to identify anomalies and autonomously adjust parameters within milliseconds. This level of optimization minimizes energy consumption, reduces the prevalence of internal defects such as carbide banding or grain boundary segregation, and ultimately elevates the yield of high-quality HSS product. Such systems move HSS fabrication toward a predictive, rather than reactive, quality control model, thereby cutting operational costs and improving material reliability for downstream toolmakers.

In the application phase, AI is fundamentally transforming tool management. By analyzing operational data streams from CNC machines—including spindle load, cutting fluid pressure, vibration spectroscopy, and acoustic signature analysis—AI systems can construct highly accurate digital twin models of the HSS tool in action. These models enable sophisticated Predictive Maintenance (PdM) strategies. Instead of relying on fixed schedules or reactive failure analysis, manufacturers can receive precise forecasts of a tool's Remaining Useful Life (RUL). This capability is particularly critical for high-value HSS tools like large broaches or complex gear cutters. Optimized tool use leads to significant savings through maximized material removal rates, reduced scrap component generation, and minimized unplanned machine downtime, further cementing HSS's value proposition in modern, high-precision manufacturing environments that prioritize maximum asset utilization.

- AI drives material informatics to accelerate discovery of novel HSS alloys and specialized coatings by optimizing composition screening.

- Machine learning algorithms precisely optimize complex HSS heat treatment cycles for maximum hardness consistency and minimized internal stress.

- Predictive maintenance platforms integrate multi-sensor data to monitor tool wear in real-time, maximizing machine uptime and reducing unexpected tool failure rates.

- AI systems enhance process control in forging and rolling, ensuring microstructure uniformity and significantly improving yield rates in HSS production.

- Robotic systems integrated with computer vision utilize AI for high-speed, non-destructive surface inspection and automated defect classification, revolutionizing HSS quality assurance.

DRO & Impact Forces Of High Speed Tool Steel Market

The High Speed Tool Steel market dynamics are shaped by potent drivers such as the relentless global focus on industrial productivity and the manufacturing of intricate components for next-generation technologies. The expansion of the global middle class, particularly in Asian economies, stimulates infrastructure development and automotive production, creating sustained baseline demand for HSS cutting and forming tools. A significant driver is the increasing use of difficult-to-machine, high-strength materials (like hardened steels, stainless alloys, and titanium superalloys) in aerospace and power generation, which strictly require HSS tools with superior hot hardness and toughness that cheaper alternatives cannot reliably deliver. Conversely, significant restraints include the acute volatility of raw material costs—specifically Molybdenum and Vanadium, which are often sourced from politically sensitive regions—leading to unpredictable production costs. Furthermore, the market faces intense competition from advanced ceramic tools and CBN (Cubic Boron Nitride), which outperform HSS in certain very high-speed, continuous machining applications, thereby capping HSS growth potential in specific high-volume segments.

Opportunities for market growth are abundant within technological niches. The burgeoning field of Additive Manufacturing (AM), utilizing HSS powders, presents a substantial opportunity to create tools with internal cooling channels and complex lattice structures that are impossible to produce via traditional forging, offering vastly improved performance and efficiency. Furthermore, the global environmental push presents opportunities for HSS producers focusing on 'green steel' initiatives—reducing energy consumption during melting and refining, and developing HSS grades optimized for dry machining or minimum quantity lubrication (MQL), aligning with strict European and North American environmental regulations. The rise of complex precision machining in the medical and dental sectors for intricate implants and surgical instruments also provides a high-margin opportunity for specialized, ultra-clean PM HSS grades that require stringent certification and quality standards.

The key impact forces dictating the market's trajectory include the cyclical nature of capital expenditure in the global machinery sector, where economic downturns immediately depress demand for new tooling, and the constant pressure for innovation. Technological inertia poses a threat; manufacturers failing to adopt PM techniques or invest in advanced coating capabilities risk losing premium customers to competitors offering superior tool life and higher performance-to-cost ratios. Furthermore, the geopolitical stability of resource-rich countries heavily influences the supply chain reliability for critical alloying elements. To maintain competitiveness, market players must proactively manage these impact forces through vertical integration, sophisticated supply chain hedging strategies, and continuous, rapid metallurgical research to offer incrementally improved HSS solutions that consistently address end-user demands for faster, more reliable, and more durable cutting tools in increasingly challenging operating environments.

Segmentation Analysis

The High Speed Tool Steel market segmentation provides a comprehensive framework for understanding the diverse applications and material requirements across industrial landscapes. This analysis dissects the market based on intrinsic material properties (Product Type) and extrinsic operational contexts (Application and End-Use Industry). The market complexity stems from the fact that tool steel selection is rarely based on a single factor, instead requiring a careful balancing act between cost, required toughness, achievable hot hardness, and machinability of the workpiece material. For instance, the demand for large, impact-resistant tools (like shears for scrap metal) drives consumption of standard, conventional HSS, while micro-milling cutters for electronics necessitate ultra-fine-grained PM HSS to ensure minimal chipping and superior edge retention.

The segmentation by Product Type reveals that M-series HSS, characterized by its substantial Molybdenum content, dominates the market due to its versatility and established manufacturing economics. However, the rapidly expanding segment of Powder Metallurgy HSS, although commanding a higher price premium, is capturing market share in high-stakes applications like specialty taps and hobs, where its superior homogeneity guarantees performance predictability and extended tool life. Geographical segmentation underscores that while production might be centralized in a few regions, consumption is highly correlated with global GDP and industrial output metrics. Tailoring product grades and distribution strategies to meet localized regulatory requirements (e.g., REACH compliance in Europe) and industrial preferences (e.g., preference for specific surface treatments in the Asian market) is critical for sustained market growth across all regional clusters.

- By Product Type:

- Molybdenum High Speed Tool Steel (M-Series): M1, M2, M7, M42 (Highest volume consumption due to cost-performance balance)

- Tungsten High Speed Tool Steel (T-Series): T1, T4, T15 (Preferred in highly thermal-stressed applications, less volume)

- Powder Metallurgy High Speed Tool Steel (PM HSS): CPM REX 76, PM M4, PM T15 (Fastest growing segment, utilized for premium, high-toughness tooling)

- By Application:

- Cutting Tools: Drills, End Mills, Taps, Reamers, Broaches (Largest sub-segment)

- Molds and Dies: Hot work and cold work applications requiring high compressive strength

- Wear Parts and Components: Bushings, rollers, valve seats (Demand for extreme abrasion resistance)

- Knives and Blades: Industrial sheer blades and high-speed rotary slitter knives

- By End-Use Industry:

- Automotive and Transportation (Primary consumer, includes powertrain and chassis tooling)

- Aerospace and Defense (High demand for PM grades for superalloy machining)

- Industrial Machinery and Equipment (General tooling, high maintenance and replacement cycle)

- Construction and Mining (Heavy-duty drilling and excavation tooling)

- Medical and Dental Devices (Precision micro-tools and surgical instruments)

- Energy and Power Generation (Turbine component machining and oilfield drilling tools)

Value Chain Analysis For High Speed Tool Steel Market

The High Speed Tool Steel value chain commences with the upstream extraction and processing of ferroalloys, which include critical strategic metals such as ferrotungsten, ferromolybdenum, ferrovanadium, and chromium ore. The reliability and cost structure of the entire HSS market are intrinsically linked to the supply stability and geopolitical risks associated with these primary input materials. Specialized chemical and metallurgical processors convert these ores into ferroalloys suitable for steelmaking. This stage is followed by the core manufacturing process carried out by specialized HSS producers. These manufacturers employ either conventional ingot casting and hot working processes or the advanced Powder Metallurgy route, involving highly controlled atomization and consolidation (HIP). Quality control at this stage is intensive, focusing on ensuring precise chemical composition within tight tolerances and verifying that the internal microstructure is free from damaging segregation patterns, which requires substantial capital investment in advanced laboratory and inspection equipment.

Midstream activities involve the crucial steps of heat treatment and surface enhancement. While many large HSS producers offer comprehensive heat treatment services, specialized, independent vacuum heat treating companies often perform the intricate hardening, tempering, and cryo-treatment cycles necessary to achieve the final, specified mechanical properties. Tool fabrication houses then purchase the HSS stock (in bars, rods, or billets) and machine it into finished tools using sophisticated CNC and grinding equipment. A rapidly growing element of the midstream value proposition is the application of advanced Physical Vapor Deposition (PVD) or Chemical Vapor Deposition (CVD) coatings, such as TiAlN or AlCrN, often provided by third-party coating specialists. These coatings significantly augment the HSS tool's performance, enabling operations at much higher feeds and speeds, thus increasing the total value of the finished product well beyond the base material cost.

Distribution channels for finished HSS products exhibit a dual structure. Major, highly customized tooling (e.g., large broaches or complex hobs for Tier 1 automotive suppliers) often utilizes a direct distribution model, involving technical sales teams and close collaboration between the toolmaker and the end-user to ensure precise specification fulfillment. Conversely, standard HSS products (e.g., standard twist drills and taps) are efficiently moved through a robust indirect channel comprising industrial distributors, wholesalers, and specialized tool supply houses. These intermediaries provide critical localized inventory management, technical support, and vital logistical services, enabling just-in-time delivery to thousands of smaller machine shops globally. The efficiency of the distribution network, particularly the ability to handle rapid stock turnover and provide expert technical application advice, is a key determinant of market competitiveness, necessitating sophisticated warehousing and inventory optimization technologies throughout the entire downstream ecosystem.

High Speed Tool Steel Market Potential Customers

The core potential customer base for High Speed Tool Steel is comprised of companies engaged in precision manufacturing and material processing where the removal of high volumes of material or intricate shaping is required under high-stress conditions. The Automotive sector remains the single largest consumer, spanning OEMs (Original Equipment Manufacturers) and their vast network of Tier 1 and Tier 2 suppliers. These companies utilize HSS extensively for machining engine blocks, gear components, brake systems, and increasingly, the complex cooling plates and battery housing components required for next-generation electric vehicles. Tool steel procurement decisions in this sector are driven by consistent batch quality, high throughput capability, and maximizing tool life to minimize unit costs, establishing HSS as a key material input for high-volume metalworking operations worldwide, often requiring stringent certifications such as IATF 16949 compliance from material suppliers.

A high-value, high-specification customer segment includes the Aerospace and Defense industries, whose suppliers demand premium HSS grades, primarily PM HSS, for machining difficult superalloys like Inconel and titanium used in jet engines and airframe components. These customers prioritize absolute reliability and performance predictability over cost, due to the extremely high cost associated with component scrap and the critical nature of the parts being manufactured. Similarly, the specialized manufacturers of high-precision molds and dies, used in plastics, metal forming, and casting, are heavy consumers of HSS, requiring materials that offer a balance of hardness and exceptional polishability. These mold and die makers are looking for HSS that minimizes distortion during heat treatment and offers resistance to thermal fatigue during cyclical operation, often necessitating specific alloying compositions for hot work applications.

Furthermore, the broad Industrial Machinery and Equipment manufacturing sector represents a foundational market segment, encompassing everything from heavy construction equipment manufacturers to machine tool builders themselves. This diverse group relies on HSS for general maintenance operations, fabricating replacement parts, and the production of their own specialized machinery components, demanding a wide range of HSS grades from general-purpose M2 to more specialized high-vanadium alloys. The medical device and dental industries are emerging as critical high-growth potential customers, requiring micro-tools and intricate surgical instruments made from specialized, contamination-free HSS powders to meet stringent biocompatibility and precision requirements. Targeting these varied customer profiles requires HSS suppliers to maintain a flexible product portfolio and possess deep application engineering expertise to solve highly specific industrial challenges across global manufacturing hubs.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.2 Billion |

| Market Forecast in 2033 | USD 9.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Voestalpine AG (Böhler-Uddeholm), Sandvik AB (Kennametal), Eramet (Erasteel), Carpenter Technology Corporation, Daido Steel Co., Ltd., Tiangong International Co., Ltd., Nachi-Fujikoshi Corp., Schmolz + Bickenbach AG, Hitachi Metals, Ltd. (Metals Division), Crucible Industries LLC, Sanyo Special Steel Co., Ltd., Kind & Co. Edelstahlwerke GmbH & Co. KG, Aichi Steel Corporation, Finkl Steel, Söderfors Steel, Jiangsu Feida Steel Co., Ltd., Samuel, Son & Co. (Metaltech Division), Kalyani Steels Limited, ThyssenKrupp AG (Materials Services), Shanghai Tool Works, Allegheny Technologies Incorporated, Shanghai No. 1 Tool Works, SFS Group AG, Shandong Weida Machinery Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Speed Tool Steel Market Key Technology Landscape

The technological landscape driving innovation in the High Speed Tool Steel market is heavily focused on achieving superior metallurgical purity and structural homogeneity to maximize mechanical performance. The dominant transformative technology is Powder Metallurgy (PM), which addresses the fundamental limitation of conventionally cast HSS—macrosegregation of alloying elements and coarse carbide formation. The PM process, often involving Gas Atomization followed by Hot Isostatic Pressing (HIP), results in ultra-fine, uniformly distributed carbides and a finer grain size. This structure dramatically improves the steel’s resistance to chipping, enhances toughness, and ensures near-net-shape production capability for complex blanks, minimizing expensive subsequent machining and grinding operations. Manufacturers are continuously refining atomization techniques to produce finer, cleaner powders, enabling the development of new PM HSS grades with even higher vanadium and cobalt content without compromising processibility or toughness.

Surface engineering represents the second critical technological frontier. While HSS provides the essential bulk properties (toughness and core hardness), the interface between the tool and the workpiece dictates performance and longevity. Modern HSS tools rely extensively on advanced PVD and CVD coatings, utilizing sophisticated materials such as super-hard nanocomposite layers, multilayer architectures, and specific elements like Aluminum Chromium Nitride (AlCrN) and specialized diamond-like carbon (DLC) coatings. The key innovation here lies not only in the coating material itself but also in optimizing the coating adhesion and thickness to the HSS substrate, often requiring specialized surface preparation and low-temperature deposition processes to prevent the HSS core from losing its critical temper during coating application. These technological enhancements allow HSS tools to effectively handle materials (like titanium) and operating temperatures previously reserved for monolithic carbide tools.

Furthermore, the manufacturing and usage phases are increasingly benefiting from digital technologies, embedding the HSS sector within the broader Industry 4.0 movement. Advanced computational metallurgy, often leveraging AI and thermodynamic modeling software (like CALPHAD), is enabling rapid prototyping and testing of new alloy formulations before physical melting is necessary, dramatically cutting R&D timelines. On the shop floor, non-destructive testing (NDT) techniques, including advanced ultrasonic and magnetic particle inspection, are being integrated with real-time process monitoring to ensure 100% material quality traceability. This digital integration across the value chain, from predicting material behavior to monitoring tool wear via smart sensors, ensures that HSS remains a viable, highly optimized material choice for the most demanding modern industrial applications, guaranteeing predictable performance and maximizing total operational efficiency for the end-user.

Regional Highlights

The global demand and production of High Speed Tool Steel are heavily influenced by region-specific industrial characteristics and economic policies.

- Asia Pacific (APAC): APAC is the engine of HSS market growth, primarily driven by its overwhelming dominance in global manufacturing output. China, India, and ASEAN nations fuel massive demand for tooling used in high-volume production of vehicles, machinery, and consumer goods. The region focuses on balancing cost efficiency with performance, leading to high consumption of both standard M2 HSS and locally produced specialty alloys. Government initiatives supporting domestic infrastructure and electric vehicle production further solidify APAC’s role as the primary market volume driver.

- Europe: The European market is characterized by a strong emphasis on high-quality, high-performance HSS grades, often mandated by the sophisticated aerospace and precision machining sectors (e.g., medical devices, specialized defense). Germany, Austria, and Sweden are key technology hubs, driving demand for premium PM HSS and advanced coated tools. The region leads in adopting sustainable manufacturing practices, influencing HSS producers to reduce their environmental footprint and enhance material recycling efficiency.

- North America: North America, particularly the U.S., maintains high demand driven by the robust Aerospace and Defense sectors, as well as significant oil & gas activity. The market here values reliability and uptime, leading to substantial adoption of the most technologically advanced and expensive PM HSS grades, often sourced from highly qualified global suppliers. Demand elasticity is closely tied to capital investment cycles in heavy machinery and domestic infrastructure projects.

- Latin America (LATAM): The LATAM market, with key centers in Brazil and Mexico, is largely dependent on the automotive and mining industries. Consumption patterns tend towards proven, robust HSS grades that balance cost and durability, necessary for challenging mining and general industrial maintenance applications. Market growth is sensitive to commodity price fluctuations and regional economic stability influencing industrial investment.

- Middle East and Africa (MEA): Demand in MEA is highly concentrated within the energy (oil and gas exploration and refining) and infrastructure development sectors. This necessitates HSS tools that are resistant to harsh environments and capable of machining tough materials often found in pipelines and specialized drilling equipment. Investment in localized manufacturing capabilities, although growing, means the market relies heavily on imported, high-specification HSS products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Speed Tool Steel Market.- Voestalpine AG (Böhler-Uddeholm)

- Sandvik AB (Kennametal)

- Eramet (Erasteel)

- Carpenter Technology Corporation

- Daido Steel Co., Ltd.

- Tiangong International Co., Ltd.

- Nachi-Fujikoshi Corp.

- Schmolz + Bickenbach AG

- Hitachi Metals, Ltd. (Metals Division)

- Crucible Industries LLC

- Sanyo Special Steel Co., Ltd.

- Kind & Co. Edelstahlwerke GmbH & Co. KG

- Aichi Steel Corporation

- Finkl Steel

- Söderfors Steel

- Jiangsu Feida Steel Co., Ltd.

- Samuel, Son & Co. (Metaltech Division)

- Kalyani Steels Limited

- ThyssenKrupp AG (Materials Services)

- Shanghai Tool Works

Frequently Asked Questions

Analyze common user questions about the High Speed Tool Steel market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between M-series and T-series High Speed Tool Steel?

M-series (Molybdenum-based) HSS accounts for the majority of market consumption due to its superior toughness and lower raw material cost compared to T-series (Tungsten-based). T-series HSS, while more expensive, typically offers marginally higher hot hardness and heat resistance, making it essential for applications involving high sustained thermal loads or specialized cutting operations in extreme heat environments.

How does Powder Metallurgy (PM) enhance the performance of High Speed Tool Steel?

PM processes utilize ultra-fine powders consolidated under high pressure (HIP) to create a homogenous microstructure free from carbide segregation, a common flaw in conventionally cast HSS. This homogeneity significantly improves the HSS tool's grindability, toughness, and wear resistance, allowing for the use of highly alloyed compositions that would otherwise be brittle, thereby extending tool life in high-demand operations.

Which end-use industry drives the largest volume demand for HSS globally?

The Automotive and Transportation industry drives the largest volume demand for High Speed Tool Steel. HSS is indispensable for the production of drills, reamers, taps, and specialized dies used in machining ferrous alloys, casting components, and shaping high-strength steels essential for vehicle chassis, powertrain, and increasingly, complex battery enclosures in the burgeoning EV manufacturing sector globally.

Are cemented carbides expected to fully replace High Speed Tool Steel in manufacturing?

No, cemented carbides are not expected to fully replace HSS. While carbides offer superior performance at extremely high cutting speeds and in continuous operations, HSS retains a distinct advantage in applications requiring high ductility, resistance to mechanical shock, complex geometry tools (like broaches and intricate hobs), and low-speed intermittent cutting where the risk of chipping is high, confirming HSS's enduring utility.

What are the key raw material risks affecting the High Speed Tool Steel Market?

The most significant raw material risks stem from the price volatility and geopolitical supply concentration of critical strategic alloying elements, specifically Tungsten, Molybdenum, and Vanadium. These metals are subject to supply chain disruptions and highly variable costs, forcing HSS manufacturers to adopt sophisticated hedging strategies, explore substitution options, and ensure diversified global sourcing to maintain cost stability and competitive pricing for finished products.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- High Speed Tool Steel Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Tungsten Steels, Molybdenum High Speed Steels (HSS), Cobalt High Speed Steels (HSS)), By Application (Automotive, Shipbuilding, Machinery, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Automotive High Speed Tool Steel Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (General, Special Purpose), By Application (Passenger Vehicle, Light Commercial Vehicle, Heavy Commercial Vehicle), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager