High Temperature Battery Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432366 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

High Temperature Battery Market Size

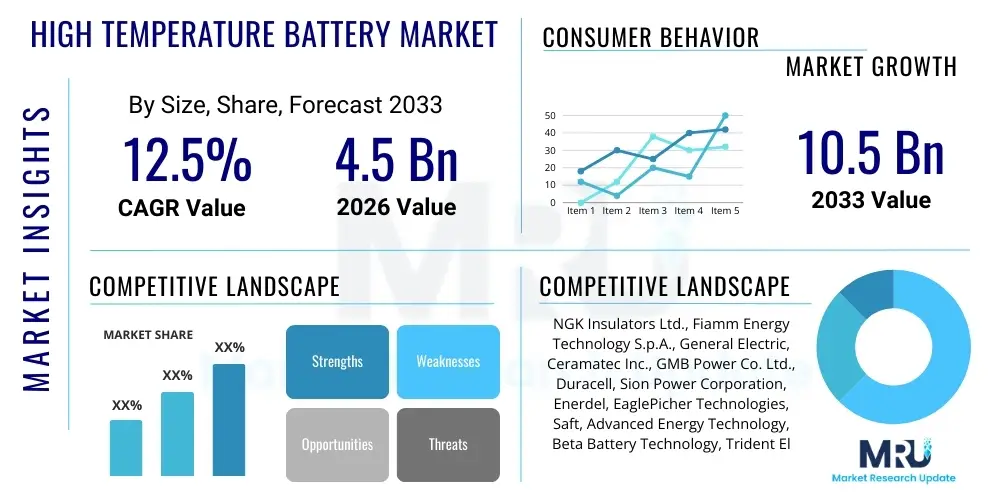

The High Temperature Battery Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 10.5 Billion by the end of the forecast period in 2033.

High Temperature Battery Market introduction

The High Temperature Battery Market encompasses specialized electrochemical energy storage systems designed to operate optimally and reliably in environments exceeding 60 degrees Celsius, often extending up to 350-500 degrees Celsius, without requiring extensive external cooling mechanisms. These batteries, typically based on advanced chemistries such as Sodium-Sulfur (NaS), Molten Salt Batteries (e.g., ZEBRA/Na-NiCl2), or specialized high-temperature Lithium-ion variants, are critical for applications where conventional battery chemistries exhibit performance degradation, rapid capacity fade, or safety risks due to thermal runaway in high-heat conditions. Their core product description emphasizes robust thermal stability, extended cycle life, and high energy density suitable for harsh operating environments, distinguishing them fundamentally from standard commercial battery technologies.

Major applications driving the demand for high temperature batteries include large-scale renewable energy integration, particularly utility-scale grid storage where consistent performance in varying ambient temperatures is mandatory, and industrial power management within manufacturing facilities or remote infrastructure subject to intense heat. Furthermore, the defense and aerospace sectors utilize these batteries for specialized power delivery systems in hostile environments and subterranean drilling operations (Oil & Gas), where temperature control is impractical or prohibitively expensive. The inherent thermal resilience and safety characteristics of chemistries like NaS and molten salt systems offer significant advantages over lower-temperature alternatives, particularly concerning fire mitigation risks.

The primary benefit of adopting high temperature battery solutions is their unparalleled durability and operational stability in challenging thermal conditions, leading to significantly lower maintenance costs and longer operational lifetimes compared to conventional batteries that require complex and energy-intensive cooling infrastructure. Key driving factors include the global shift toward decarbonization, which necessitates highly reliable, long-duration energy storage (LDES) solutions for intermittent renewable sources, and increasing capital investment in remote, high-temperature industrial sites. Furthermore, regulatory pushes for enhanced safety standards in energy storage installations are favoring non-flammable or inherently safer high-temperature chemistries, accelerating market penetration across diverse geographic and industrial segments.

High Temperature Battery Market Executive Summary

The High Temperature Battery Market is experiencing robust growth fueled by increasing global demand for long-duration energy storage (LDES) solutions and enhanced reliability in mission-critical applications across industrial and grid infrastructure. Current business trends indicate a significant technological pivot towards Sodium-Ion and Molten Salt chemistries, which offer lower raw material costs and superior safety profiles compared to high-temperature adapted lithium-ion variants. Strategic collaborations between utilities and battery manufacturers, particularly in mature electricity markets, are streamlining the deployment of NaS battery systems for peak shaving and frequency regulation, establishing them as the preferred technology for large-scale fixed installations requiring minimal thermal management complexity.

Regionally, the Asia Pacific (APAC) market is dominating the growth trajectory, primarily driven by massive infrastructure investments in China and India aimed at integrating variable renewable energy sources (solar and wind) into dense population centers. The high ambient temperatures common across parts of APAC and the Middle East make high temperature batteries an inherently efficient choice, minimizing energy losses associated with cooling. North America and Europe, while slower in deployment volume, lead in technological innovation and regulatory support, focusing heavily on enhancing cycle life and achieving greater energy density in next-generation sodium-based systems. Regulatory incentives promoting grid modernization and resilience are key catalysts in these Western markets.

Segmentation trends highlight that the Grid Storage segment remains the primary revenue generator, demanding capacities in the megawatt-hour range, with a critical focus on long-term capital expenditure efficiency (CAPEX). Within chemistry, the Sodium-Sulfur (NaS) segment holds the largest market share due to its proven track record in utility applications, though Sodium-Nickel Chloride (ZEBRA) batteries are gaining traction in specialized mobile and high-power industrial applications requiring slightly lower operating temperatures. Furthermore, there is a pronounced trend toward modular and containerized solutions that simplify installation and scale-up, addressing the diverse needs of both decentralized microgrids and large centralized utility projects, optimizing deployment timelines across varying geographical locations.

AI Impact Analysis on High Temperature Battery Market

User inquiries regarding AI's influence on the High Temperature Battery Market frequently center on themes such as predictive maintenance, optimization of extreme operating cycles, and accelerated materials discovery for new thermally stable chemistries. Users are particularly concerned with how AI can mitigate the inherent complexity and high cost associated with monitoring battery performance under continuous high heat stress, asking whether AI-driven battery management systems (BMS) can extend the practical life of current NaS and Molten Salt systems. Key expectations revolve around using machine learning algorithms to predict thermal runaway events before they occur and to simulate optimal charge/discharge protocols that minimize degradation under fluctuating thermal loads, ultimately lowering the total cost of ownership (TCO) for critical infrastructure deployments.

The integration of Artificial Intelligence is fundamentally transforming the operational lifecycle of high temperature batteries, moving maintenance strategies from reactive to predictive and enabling tighter control over performance parameters in volatile thermal environments. Advanced AI models, utilizing vast datasets generated by high-fidelity sensors within battery enclosures, are instrumental in detecting subtle shifts in internal resistance, voltage deviation, and thermal gradients indicative of impending failure or suboptimal performance. This predictive capability is vital for expensive, large-scale storage installations where unexpected downtime translates to significant financial losses and compromised grid stability. Furthermore, AI facilitates real-time adjustment of charging schedules based on weather forecasts, utility demands, and expected ambient temperatures, ensuring maximal efficiency and longevity.

Beyond operational optimization, AI is critically influencing the R&D pipeline for next-generation high temperature chemistries. Machine learning models are now routinely employed to screen millions of potential material combinations, accelerating the discovery of electrodes and electrolytes that exhibit superior ionic conductivity and thermal resilience at elevated temperatures, far outpacing traditional trial-and-error methods. This application speeds up the transition from lab-scale prototypes to commercially viable, safer, and more energy-dense batteries, addressing the market's need for solutions that can operate reliably above 400°C. The efficiency gains in materials informatics and manufacturing process optimization achieved through AI ensure that the market can rapidly scale production to meet the intensifying global demand for thermally robust storage systems.

- AI-driven Predictive Maintenance: Utilizing sensor data to forecast component failure and optimize maintenance schedules in high-heat industrial and grid environments, significantly reducing unexpected downtime and operational costs.

- Thermal Management Optimization: Machine learning algorithms fine-tuning internal heating/cooling requirements and charge/discharge curves to maintain the optimal operating temperature (e.g., 300°C for NaS) with minimal auxiliary energy consumption.

- Accelerated Materials Discovery: Employing Generative AI and ML to simulate and identify novel electrolyte and electrode materials exhibiting inherent high-temperature stability, accelerating the development of post-lithium high-temperature chemistries.

- Enhanced Safety Protocols: Real-time analysis of thermal signatures to immediately detect and isolate precursors to thermal runaway or internal short circuits, increasing the safety profile of utility-scale high temperature installations.

- Optimized Grid Integration: AI systems managing the charge and dispatch of large battery banks based on real-time grid conditions, temperature fluctuations, and renewable energy intermittency for maximum economic return and stability.

DRO & Impact Forces Of High Temperature Battery Market

The dynamics of the High Temperature Battery Market are predominantly shaped by powerful driving forces centered around global energy transition mandates, coupled with inherent restraints regarding technology complexity and initial capital investment, creating significant opportunities in specialized application niches. The necessity for long-duration energy storage (LDES) to manage increasing renewable penetration is the primary driver, demanding technologies capable of sustained, high-efficiency operation irrespective of external thermal conditions. However, the high operating temperatures (often requiring the battery to be constantly heated, even when idle) contribute to parasitic energy consumption, acting as a crucial restraint. The key opportunity lies in deploying these systems in geographically challenging locations (desert regions, deep-sea exploration, or geothermal power plants) where their thermal resilience offers a unique competitive edge.

The core Drivers include stringent government mandates for grid modernization and energy security, especially in regions prone to extreme weather events, alongside decreasing manufacturing costs spurred by economies of scale in sodium-based chemistry production. The environmental appeal of non-toxic, abundant raw materials (sodium, sulfur) further accelerates adoption compared to geopolitical risks associated with lithium or cobalt supply chains. Nevertheless, the Restraints are formidable: the initial high installation cost (CAPEX) for molten salt battery systems, the complexity of thermal management during manufacturing, and the need for specialized infrastructure to maintain operational temperatures present barriers to widespread adoption outside of utility-scale projects. Furthermore, the perceived safety risk associated with handling molten materials, though technically manageable, requires extensive safety certifications and public education efforts.

Impact forces indicate a strong market momentum driven by technological advancements focused on reducing operational temperature thresholds and improving energy density, which are collectively enhancing the viability of high temperature batteries across a wider range of industrial applications. The key Opportunities include the lucrative market for electric vehicle (EV) battery swapping stations in hot climates, requiring robust storage that handles rapid charging cycles without degradation, and the defense sector's demand for rugged, high-power batteries in extreme environments. The interplay between increasing renewable integration (Driver) and the need for reliable storage technology that can operate efficiently year-round (Impact Force) suggests a continued high growth trajectory, provided manufacturers successfully address the restraints related to CAPEX reduction and energy efficiency improvement during quiescent periods.

Segmentation Analysis

The High Temperature Battery Market is comprehensively segmented across several critical axes, primarily defined by the specific electrochemical chemistry utilized, the operational end-user application, and the functional voltage range required for specific industrial tasks. This detailed segmentation allows stakeholders to accurately target development efforts and market penetration strategies toward the most lucrative and technically feasible niches. The segmentation by chemistry is particularly crucial, differentiating established utility-scale solutions like Sodium-Sulfur (NaS) from emerging alternatives such as Sodium-Nickel Chloride (ZEBRA) and high-temperature adapted Lithium-ion chemistries, each possessing distinct advantages regarding energy density, cycle life, and optimal operating temperature. Understanding these fundamental differences is key to project matching and cost optimization.

Segmentation by application highlights the distinct demands of various end-user sectors. Grid Storage dominates the market, requiring massive, stationary installations focused on long-duration discharge capabilities and robust cycling stability over decades. In contrast, specialized segments such as Military & Defense demand extreme ruggedness and power density for short-burst applications in highly volatile conditions, while the industrial sector (including telecommunications and remote monitoring) prioritizes extended maintenance-free operation in challenging remote locations. The market structure reflects a bifurcated demand: high-volume, long-duration utility needs driving standardization, and low-volume, high-specification industrial/defense needs driving customization and niche technology development.

Further segmentations, such as those based on component type (e.g., cell, module, system) or voltage range, assist in defining the supply chain structure and regulatory requirements. As the market matures, there is an observable trend toward standardized modular systems, simplifying logistics and installation across diverse geographical deployment sites. This transition is essential for making high temperature batteries a plug-and-play solution for remote microgrids and decentralized energy systems, accelerating their adoption velocity and moving them beyond complex, custom-engineered utility projects toward broader commercial and industrial viability, solidifying their role in global energy infrastructure resilience.

- By Chemistry:

- Sodium-Sulfur (NaS) Batteries

- Sodium-Nickel Chloride (ZEBRA) Batteries

- High-Temperature Lithium-ion Batteries

- Molten Salt Batteries (Other Chemistries)

- By Application:

- Grid Storage (Utility-scale Energy Storage Systems - ESS)

- Industrial (Power backup, Telecommunications, Mining)

- Military & Defense

- Oil & Gas (Downhole drilling and exploration)

- Automotive (Specialized high-temperature hybrid/electric vehicles)

- By Voltage Range:

- Low Voltage (< 400V)

- Medium Voltage (400V – 800V)

- High Voltage (> 800V)

- By Component:

- Cell

- Module

- Battery System/Pack

Value Chain Analysis For High Temperature Battery Market

The value chain for the High Temperature Battery Market begins with the upstream sourcing and processing of raw materials, which are notably advantageous due to the reliance on abundant and low-cost elements like sodium, sulfur, nickel, and chloride, especially compared to the volatile supply chains of traditional lithium-ion systems. Upstream analysis focuses heavily on the procurement and refinement of high-purity electrolytes and separator materials capable of withstanding extreme thermal stress, often requiring specialized manufacturing processes distinct from conventional battery production. Key strategic activities at this stage involve establishing secure, long-term supply agreements for non-critical minerals and developing proprietary ceramic or glass solid electrolytes that ensure both ionic conductivity and mechanical integrity at operating temperatures often exceeding 300°C. Manufacturing efficiency in cell assembly and hermetic sealing to prevent reaction with air or moisture is paramount in this early stage.

The midstream process involves the intricate manufacturing and integration of individual cells into robust, thermally managed modules and complete system enclosures (Packs). Due to the elevated operating temperatures, system integration requires advanced thermal management systems, typically relying on highly efficient insulation and internal heaters to maintain the required molten state, rather than external cooling. Manufacturers must adhere to rigorous safety standards during this phase, ensuring that the high-temperature environment is contained and managed safely within the battery system. This phase is characterized by significant capital expenditure on specialized fabrication equipment and sophisticated quality control measures to guarantee the durability and reliability of the final product under continuous thermal cycling.

Downstream analysis focuses on distribution channels and end-user installation, which are dominated by direct engagement with utility companies and large industrial customers. The distribution channel is often direct (manufacturer to utility/EPC contractor) rather than relying on standard retail or wholesale networks, given the scale and complexity of deployment. Indirect channels, such as specialized engineering, procurement, and construction (EPC) firms, play a crucial role in integrating these systems into existing grid infrastructure or industrial facilities. Post-sales services, including long-term maintenance contracts, performance monitoring, and eventual decommissioning, represent a critical segment of the downstream value chain, owing to the highly technical nature and long lifespan expectations (20+ years) of high temperature battery systems.

High Temperature Battery Market Potential Customers

Potential customers for High Temperature Batteries primarily consist of entities requiring extremely reliable, long-duration energy storage capable of performing efficiently in high ambient temperatures or demanding specialized industrial environments where cooling is impractical. The most significant customer base comprises utility companies and Independent Power Producers (IPPs) focused on grid modernization and the integration of large-scale renewable energy farms, particularly in desert or equatorial regions. These entities require batteries for functions such as peak shaving, load shifting, and ancillary services, viewing high temperature batteries like NaS as a reliable, non-flammable alternative that minimizes dependence on external thermal management infrastructure, thereby reducing operational expenditures over the battery's lifespan.

A secondary, yet rapidly growing, customer segment includes heavy industrial users, specifically those in the telecommunications, mining, and remote data center sectors. These customers require robust power backup and primary power sources for off-grid or remote operations where ambient temperatures frequently exceed 40°C, making conventional lithium-ion batteries thermally challenged. For instance, telecommunication companies deploying base stations in remote areas seek maintenance-free, highly durable battery systems to ensure continuous operation, viewing the thermal stability of molten salt batteries as a crucial feature for minimizing site visits and maximizing uptime in hostile thermal environments.

Furthermore, specialized segments such as the defense industry and the oil & gas sector represent critical, high-value end-users. Defense applications utilize these batteries for specialized mobile units and stationary power requiring rapid charge/discharge cycles in extreme conditions, prioritizing ruggedness and safety over initial cost. The oil & gas sector uses high temperature batteries for downhole drilling and exploration tools, where temperatures can exceed 150°C and thermal stability is non-negotiable for sensor operation and power delivery deep underground. These customers focus on technological performance and reliability under stress, cementing high temperature batteries as niche, high-performance power solutions for mission-critical tasks.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 10.5 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | NGK Insulators Ltd., Fiamm Energy Technology S.p.A., General Electric, Ceramatec Inc., GMB Power Co. Ltd., Duracell, Sion Power Corporation, Enerdel, EaglePicher Technologies, Saft, Advanced Energy Technology, Beta Battery Technology, Trident Electro-Chemical Pvt. Ltd., FIAMM, Toshiba Corporation, HBL Power Systems Ltd., K&W Battery, Varta AG, Hitachi, CALB. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Temperature Battery Market Key Technology Landscape

The technological landscape of the High Temperature Battery Market is currently dominated by two primary molten salt chemistries: Sodium-Sulfur (NaS) and Sodium-Nickel Chloride (Na-NiCl2), often referred to as ZEBRA batteries. NaS batteries operate at the highest temperatures, typically between 300°C and 350°C, utilizing a solid beta-alumina ceramic electrolyte to separate molten sodium and sulfur electrodes. This configuration allows for high energy efficiency and exceptionally long cycle life (often exceeding 4,500 cycles), making them highly suitable for utility-scale applications requiring sustained, multi-hour discharge capabilities. The technological focus here is on improving the mechanical durability of the ceramic electrolyte and reducing the overall footprint and weight of the required high-efficiency insulation system to minimize heat loss and parasitic energy drain during operation.

In parallel, Sodium-Nickel Chloride (ZEBRA) batteries operate at a slightly lower temperature range (around 270°C to 300°C) and utilize a similar ceramic electrolyte but offer advantages in safety due to the use of a secondary electrolyte, molten chloroaluminate, which prevents the direct contact of sodium and sulfur. ZEBRA technology is favored in specialized mobile applications, such as heavy-duty transport or high-power industrial backup, where slightly faster charging rates and a marginally lower thermal threshold are beneficial. Ongoing innovation in ZEBRA systems centers on optimizing the cathode material composition to enhance specific energy and power density, while simultaneously exploring non-corrosive alternatives to the traditional chloroaluminate salt to further simplify manufacturing and extend cell lifespan under extreme thermal cycling.

Emerging technology trends also include the adaptation of conventional Lithium-ion systems for high-temperature use, primarily by incorporating novel electrolytes (such as solid-state or ionic liquid electrolytes) and advanced separator materials that prevent thermal runaway up to 80-100°C, bridging the gap between standard batteries and true molten salt systems. Furthermore, research is intensifying into alternative high-temperature chemistries, including liquid metal batteries (utilizing metals like sodium, antimony, or lead) and flow battery architectures specifically designed to operate efficiently at elevated temperatures. These advanced research pathways aim to eliminate the solid electrolyte failure mode and further decrease dependency on external insulation and heating, ultimately striving for a combination of the low cost of sodium-based systems with the high energy density often associated with cutting-edge lithium chemistry, pushing the boundaries of reliable high-temperature energy storage.

Regional Highlights

The global deployment and market penetration of high temperature batteries exhibit significant regional variation, primarily influenced by local energy policies, climate conditions, and the pace of renewable energy infrastructure development. Each region presents unique drivers and challenges that shape technology adoption and market share distribution.

- Asia Pacific (APAC): APAC is projected to maintain its dominance in the High Temperature Battery Market, driven primarily by China’s aggressive energy transition goals and massive investment in large-scale solar and wind projects, requiring corresponding gigawatts of reliable energy storage capacity. Countries like Australia, with high solar penetration and vast, arid internal regions experiencing extreme heat, are ideal testing grounds for NaS technology where thermal management is inherently challenging. India’s burgeoning industrial sector and focus on microgrids in remote, often hot, areas further accelerate demand. The region benefits from substantial government subsidies and state-owned utility procurement mandates favoring long-duration, high-efficiency storage solutions to manage grid stability in rapidly expanding energy networks.

- North America: North America, particularly the US, is characterized by high R&D spending and supportive regulatory frameworks, driving the market through utility-scale pilot projects and defense applications. The Department of Energy (DOE) initiatives focusing on Long-Duration Energy Storage (LDES) have created a strong impetus for the commercialization of ZEBRA and next-generation molten salt technologies. While deployment volume is currently lower than APAC, the market focuses on high-specification, reliable systems for grid resiliency and integration into sensitive infrastructure in regions experiencing high ambient temperatures, such as the Southwestern US. Canada also contributes through specialized applications in remote northern regions requiring robust, low-maintenance power solutions capable of handling extreme, though sometimes intermittent, temperature fluctuations.

- Europe: The European market is characterized by a strong emphasis on decarbonization and achieving net-zero goals, with a focus on integrating high-temperature batteries into smart grids and virtual power plants (VPPs). European utilities prioritize solutions that offer superior environmental footprints, favoring sodium-based chemistries over those with complex raw material extraction. Germany, the UK, and Italy are key adopters, leveraging these systems for frequency regulation and managing distributed renewable sources. The continent's high population density necessitates extreme safety standards, aligning well with the non-flammable characteristics of molten salt batteries, supporting their deployment in dense industrial zones and near urban centers.

- Middle East and Africa (MEA): This region is emerging as a critical growth area due to consistently high ambient temperatures, making conventional battery cooling energy-intensive and economically unviable. MEA countries, particularly Saudi Arabia and the UAE, are investing heavily in massive solar energy projects, creating an inherent demand for high temperature battery storage systems that can operate efficiently without active cooling in desert climates. The primary focus here is on durability, thermal resilience, and minimal maintenance, positioning high temperature batteries as the most logical, technically appropriate choice for utility-scale energy storage integration across the region’s expansive and hot terrains.

- Latin America: The market in Latin America is driven by the need for reliable energy access in geographically isolated and highly diverse thermal zones. Countries like Brazil and Mexico, experiencing rapid industrialization and expansion of renewable energy capacity (hydro and solar), are exploring high temperature batteries for grid stabilization and industrial power backup. Deployment efforts are often focused on remote mining operations and off-grid communities where infrastructure limitations require robust, self-sustaining power solutions capable of withstanding extreme environmental conditions with limited maintenance access.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Temperature Battery Market.- NGK Insulators Ltd.

- Fiamm Energy Technology S.p.A.

- General Electric

- Ceramatec Inc.

- GMB Power Co. Ltd.

- Duracell

- Sion Power Corporation

- Enerdel

- EaglePicher Technologies

- Saft

- Advanced Energy Technology

- Beta Battery Technology

- Trident Electro-Chemical Pvt. Ltd.

- FIAMM

- Toshiba Corporation

- HBL Power Systems Ltd.

- K&W Battery

- Varta AG

- Hitachi

- CALB

Frequently Asked Questions

Analyze common user questions about the High Temperature Battery market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of High Temperature Batteries (HTBs) over standard lithium-ion for utility storage?

The primary advantage of HTBs, such as Sodium-Sulfur (NaS) and ZEBRA, is their inherent thermal stability and safety, allowing them to operate efficiently at high ambient temperatures (up to 350°C) without requiring energy-intensive active cooling systems. This resilience translates directly to lower operational expenditure (OPEX) and higher reliability for long-duration grid storage in hot climates, coupled with a typically longer cycle life and the use of cheaper, abundant raw materials (sodium and sulfur).

What are the main restraints impacting the rapid adoption of Sodium-Sulfur (NaS) battery systems?

The main restraints are the high initial Capital Expenditure (CAPEX) associated with complex manufacturing processes and specialized thermal insulation required to maintain the molten state. Additionally, NaS batteries incur a parasitic heating load, meaning energy must be continuously supplied to keep the battery at its operational temperature (typically 300°C), which slightly reduces overall system efficiency when the battery is idle for long periods.

In which industrial applications are High Temperature Batteries most economically viable?

HTBs are most economically viable in applications requiring long-duration discharge (4+ hours) and those situated in challenging thermal environments, such as utility-scale grid stabilization in arid regions, remote telecommunication tower backup systems, and power delivery systems for subterranean drilling (Oil & Gas). Their low maintenance requirements and thermal robustness justify the initial investment in these mission-critical sectors.

How does the operating temperature of ZEBRA batteries compare to Sodium-Sulfur batteries, and what are their respective use cases?

ZEBRA (Sodium-Nickel Chloride) batteries operate at a slightly lower temperature range (270°C to 300°C) compared to NaS batteries (300°C to 350°C). NaS batteries are primarily used for large, stationary utility-scale grid storage due to their high energy efficiency. ZEBRA batteries, offering better power density and safety characteristics, are often favored for specialized mobile applications, high-power industrial backup, and niche defense applications.

What role does Artificial Intelligence (AI) play in improving the lifecycle and performance of High Temperature Batteries?

AI is crucial for enhancing HTB performance through predictive maintenance and optimizing thermal management. Machine learning analyzes sensor data in real-time to forecast potential failures, optimize charge/discharge cycles based on ambient temperature fluctuations, and minimize parasitic heating load, thereby extending the battery’s lifespan and ensuring stable, highly efficient operation under continuous high-heat stress.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager