High Temperature Polyamides Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439402 | Date : Jan, 2026 | Pages : 242 | Region : Global | Publisher : MRU

High Temperature Polyamides Market Size

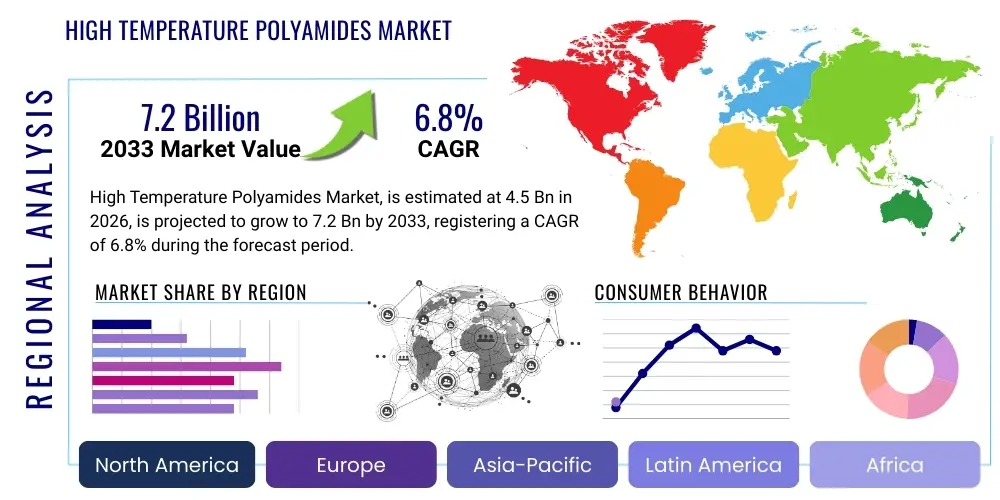

The High Temperature Polyamides Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033.

High Temperature Polyamides Market introduction

High Temperature Polyamides (HTPAs) represent a specialized class of engineering thermoplastics renowned for their superior performance under extreme thermal and mechanical conditions. These advanced polymers are designed to withstand temperatures exceeding 150°C for prolonged periods, offering a significant advantage over conventional polyamides like PA6 and PA66. Their robust molecular structure imbues them with excellent mechanical strength, chemical resistance, and dimensional stability, making them indispensable in demanding applications across various industries.

The primary applications of HTPAs span the automotive, electrical and electronics, industrial, and aerospace sectors. In automotive, they are crucial for under-the-hood components, engine covers, and structural parts due to their lightweight properties and resistance to fuels and high temperatures. The electrical and electronics industry utilizes HTPAs for connectors, circuit breakers, and insulation, leveraging their dielectric strength and heat resistance. Benefits include enhanced operational safety, extended product lifespan, reduced component weight, and improved energy efficiency. The market is primarily driven by the automotive industry's continuous push for lightweighting and thermal management solutions, the escalating demand for high-performance materials in consumer electronics, and the need for durable components in industrial machinery.

High Temperature Polyamides Market Executive Summary

The High Temperature Polyamides market is experiencing dynamic growth, propelled by the increasing demand for advanced materials capable of enduring harsh operating environments. Key business trends indicate a strong focus on innovation in polymer chemistry, with manufacturers investing heavily in research and development to introduce new grades offering enhanced properties such as improved heat deflection temperature, better processability, and reduced moisture absorption. There is also a notable trend towards sustainability, with some players exploring bio-based or recycled content HTPAs to meet environmental regulations and consumer preferences. Strategic collaborations and mergers and acquisitions are frequently observed as companies aim to expand their product portfolios and geographical reach, consolidating market positions and fostering competitive growth.

Regional trends highlight Asia Pacific as the leading and fastest-growing market for High Temperature Polyamides, driven by robust industrialization, burgeoning automotive production, and expanding electronics manufacturing bases in countries like China, India, and Japan. North America and Europe, while mature markets, continue to demonstrate steady demand, particularly from the automotive and aerospace sectors, fueled by stringent regulatory standards for vehicle efficiency and safety. These regions are also hubs for advanced material innovation, contributing significantly to the development of next-generation HTPA solutions. Latin America, the Middle East, and Africa are emerging as promising markets, albeit with smaller market shares, as industrial development and infrastructure projects increase the adoption of high-performance polymers.

Segmentation trends reveal significant growth across various HTPA types, including PA4T, PA6T, PA9T, PPA (Polyphthalamide), and others, each offering distinct property profiles tailored for specific application requirements. The automotive application segment is projected to maintain its dominance due to the electric vehicle (EV) revolution and the persistent need for lighter, more fuel-efficient internal combustion engine (ICE) vehicles. The electrical and electronics segment is also experiencing substantial growth, spurred by the miniaturization of devices and the increased complexity of electronic components that require materials with superior thermal management capabilities. Industrial and aerospace applications continue to demand high-performance HTPAs for critical components, driving innovation in material resilience and longevity.

AI Impact Analysis on High Temperature Polyamides Market

User inquiries concerning AI's influence on the High Temperature Polyamides market often revolve around its potential to revolutionize material discovery, optimize manufacturing processes, and enhance product performance. Common themes include how AI can accelerate the development of novel HTPA formulations with tailored properties, improve predictive maintenance in production facilities, and streamline supply chain logistics for raw materials and finished goods. Users are keen to understand if AI can reduce the time and cost associated with experimental R&D, leading to faster market introduction of innovative HTPA solutions. Furthermore, there is interest in AI's role in quality control, process parameter optimization for compounding and molding, and the potential for AI-driven simulations to predict material behavior under extreme conditions, thereby minimizing physical prototyping and testing requirements. The overarching expectation is for AI to drive efficiency, innovation, and cost-effectiveness across the entire HTPA value chain.

- AI accelerates new HTPA material discovery and formulation development by simulating molecular structures and predicting performance characteristics, significantly reducing R&D cycles.

- Predictive analytics powered by AI optimizes manufacturing processes, leading to improved yield, reduced waste, and enhanced product consistency in HTPA production.

- AI-driven supply chain management improves raw material sourcing, inventory control, and logistics efficiency, ensuring timely availability and cost-effectiveness for HTPA manufacturers.

- Machine learning algorithms enhance quality control by identifying defects and variations in HTPA components more accurately and rapidly than traditional methods.

- AI supports advanced simulation and modeling for HTPA component design, predicting real-world performance under stress and temperature, thereby enabling optimized applications and reducing design iterations.

DRO & Impact Forces Of High Temperature Polyamides Market

The High Temperature Polyamides market is significantly shaped by a confluence of driving factors, restraints, and opportunities. A primary driver is the burgeoning demand from the automotive sector, particularly with the rapid electrification of vehicles. Electric vehicles require high-performance polymers for lightweighting, thermal management of battery systems, and electronic components, where HTPAs excel due to their heat resistance, mechanical strength, and electrical insulation properties. The general trend towards lightweighting across various industries to improve fuel efficiency and reduce emissions further fuels HTPA adoption. Additionally, the increasing complexity and miniaturization of electronic devices necessitate materials with superior dielectric properties and thermal stability, creating a robust demand for HTPAs in the electrical and electronics sector.

Despite the strong demand, the market faces several notable restraints. The high cost of High Temperature Polyamides compared to conventional engineering plastics poses a significant barrier to wider adoption, especially in cost-sensitive applications. The complex processing requirements of certain HTPA grades, which often necessitate specialized equipment and precise temperature control, can also limit their use for manufacturers lacking the necessary expertise or infrastructure. Furthermore, intense competition from other high-performance polymers, such as PEEK (Polyetheretherketone), PPS (Polyphenylene Sulfide), and LCP (Liquid Crystal Polymer), which offer comparable or sometimes superior properties for specific niche applications, presents a constant challenge to market share.

However, the market is also rich with opportunities. Emerging applications in areas such as 5G telecommunication infrastructure, hydrogen fuel cell technology, and advanced industrial equipment present new avenues for HTPA growth. The development of bio-based or partially bio-based HTPAs offers a sustainable alternative, appealing to environmentally conscious consumers and industries, and aligning with global sustainability goals. Ongoing research into novel polymerization techniques and compounding technologies is expected to enhance material properties and reduce production costs, making HTPAs more accessible and versatile. The continuous innovation in additive manufacturing (3D printing) for high-performance polymers also opens up new design possibilities and rapid prototyping capabilities for HTPA components.

Segmentation Analysis

The High Temperature Polyamides market is meticulously segmented to provide a detailed understanding of its diverse landscape, considering various types, applications, end-use industries, and geographic regions. This comprehensive segmentation allows for precise market analysis, identifying key growth areas and niche opportunities across the value chain. Each segment exhibits unique characteristics and growth trajectories, influenced by technological advancements, regulatory frameworks, and specific industrial demands.

- By Type:

- PA4T

- PA6T

- PA9T

- PPA (Polyphthalamide)

- PA MXD6

- Others (e.g., PA10T, PA12T)

- By Application:

- Automotive Components (e.g., under-the-hood parts, engine covers, sensor housings, connectors, motor components)

- Electrical and Electronics (e.g., connectors, switches, circuit breakers, LED components, semiconductor packaging)

- Industrial (e.g., gears, bearings, pumps, valves, power tools, industrial machinery components)

- Aerospace and Defense (e.g., interior components, structural elements, fuel system parts)

- Consumer Goods (e.g., appliances, sports equipment)

- Others (e.g., medical devices, oil & gas)

- By End-Use Industry:

- Automotive

- Electrical and Electronics

- Industrial

- Aerospace

- Consumer Goods

- Medical

- Others

- By Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Value Chain Analysis For High Temperature Polyamides Market

The value chain for the High Temperature Polyamides market is complex, beginning with the upstream sourcing of specialized monomers and culminating in the delivery of high-performance components to diverse end-use industries. The upstream segment involves chemical manufacturers who produce critical raw materials such as terephthalic acid, isophthalic acid, various diamines, and other specialized monomers required for the polymerization of different HTPA types. This stage is crucial as the quality and availability of these unique chemical precursors directly impact the properties and cost of the final polymer. Suppliers in this segment often operate globally, leveraging economies of scale and specialized chemical synthesis capabilities.

Moving downstream, these raw materials are supplied to polymer producers, who undertake the polymerization process to create HTPA resins in various forms like pellets or powders. These resins are then often acquired by compounders, who blend them with additives such as glass fibers, carbon fibers, mineral fillers, flame retardants, and stabilizers to enhance mechanical strength, thermal stability, processability, or other specific performance characteristics tailored for particular applications. This compounding step is vital for customizing HTPAs to meet the stringent requirements of different end-use sectors. Subsequently, these compounded materials are processed by component manufacturers using techniques like injection molding, extrusion, or additive manufacturing to produce final parts for automotive, electronics, industrial, and aerospace applications.

The distribution channel plays a critical role in connecting manufacturers with end-users. Direct distribution involves HTPA producers or compounders selling directly to large-scale industrial customers, often for custom formulations or high-volume orders. This approach allows for direct technical support and closer collaboration. Indirect distribution channels involve a network of distributors, agents, and resellers who provide materials to smaller manufacturers, offer localized support, and manage inventory. These intermediaries are essential for market penetration and reaching a broader customer base, particularly in geographically diverse markets. The effectiveness of both direct and indirect channels is critical for market reach, customer service, and efficient delivery of specialized HTPA materials across the globe.

High Temperature Polyamides Market Potential Customers

The High Temperature Polyamides market primarily serves a diverse array of industrial end-users and buyers who require materials capable of performing reliably under demanding conditions. The automotive industry represents a cornerstone of the customer base, encompassing original equipment manufacturers (OEMs) and their Tier 1 and Tier 2 suppliers. These customers seek HTPAs for critical under-the-hood components such as engine covers, intake manifolds, charge air ducts, sensor housings, and various connectors that must withstand high temperatures, aggressive chemicals, and mechanical stresses. The increasing focus on electric vehicles also drives demand for HTPAs in battery enclosures, power electronics, and motor components due to their electrical insulation and thermal management properties.

Another significant customer segment is the electrical and electronics industry, including manufacturers of consumer electronics, telecommunication equipment, and industrial electronics. Here, HTPAs are vital for producing high-performance connectors, switches, circuit breakers, LED components, and semiconductor packaging, where properties like high dielectric strength, thermal stability, and flame retardancy are paramount. The miniaturization trend and the demand for higher operating frequencies in electronic devices amplify the need for materials that can dissipate heat efficiently and maintain structural integrity under elevated temperatures. These customers prioritize reliability, long-term performance, and compliance with stringent industry standards.

Beyond automotive and electronics, the industrial machinery and equipment sector, aerospace and defense, and even specialized consumer goods manufacturers constitute important customer segments. Industrial customers utilize HTPAs for components in gears, bearings, pumps, valves, and power tools, where abrasion resistance, chemical inertness, and durability are crucial. Aerospace companies employ HTPAs for lightweight interior components, structural elements, and parts within fuel systems, valuing their high strength-to-weight ratio and fire resistance. Medical device manufacturers also represent a niche but growing customer base, using HTPAs for sterilisable and biocompatible components. These diverse end-users are driven by the need for materials that deliver superior performance, reduce overall system weight, enhance operational efficiency, and extend product lifecycles in their respective applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Solvay S.A., Arkema S.A., BASF SE, Evonik Industries AG, EMS-CHEMIE HOLDING AG, DuPont de Nemours, Inc., Mitsubishi Engineering-Plastics Corporation, UBE Corporation, DSM Engineering Materials, Ascend Performance Materials, Kuraray Co., Ltd., Polyplastics Co., Ltd., Sumitomo Chemical Co., Ltd., Celanese Corporation, Lanxess AG, SABIC, RadiciGroup, Kingfa Sci. & Tech. Co., Ltd., RTP Company, LG Chem |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Temperature Polyamides Market Key Technology Landscape

The technological landscape of the High Temperature Polyamides market is continuously evolving, driven by the need for enhanced performance, improved processability, and sustainable solutions. Key technologies center around advanced polymerization techniques that enable the synthesis of specific monomer combinations, yielding HTPAs with tailored thermal, mechanical, and chemical resistance properties. For instance, controlled polymerization processes are crucial for achieving precise molecular weights and narrow molecular weight distributions, which directly impact the material's processability and end-use performance. Innovations in co-polymerization also allow for the creation of new HTPA grades that blend the characteristics of different polyamide chemistries, offering optimized property sets for niche applications.

Compounding technology represents another critical area of innovation. This involves blending HTPA resins with various additives, fillers, and reinforcements to create highly customized materials. Advanced compounding techniques, such as twin-screw extrusion, enable uniform dispersion of high-performance fibers (e.g., glass fibers, carbon fibers) and mineral fillers, significantly boosting the material's stiffness, strength, and heat deflection temperature. The development of specialized coupling agents and impact modifiers is also vital for improving the interfacial adhesion between the polymer matrix and fillers, enhancing overall composite performance. Furthermore, research into novel flame retardant systems and heat stabilizers allows HTPAs to meet increasingly stringent safety standards while maintaining their high-temperature capabilities.

Additive manufacturing (3D printing) is an emerging technology gaining traction for HTPAs. While historically challenging due to their high melting points and processing complexity, advancements in selective laser sintering (SLS), fused deposition modeling (FDM), and material jetting technologies are enabling the creation of complex HTPA components with intricate geometries. This technology offers rapid prototyping, customized production, and the ability to manufacture parts with optimized designs for thermal management or lightweighting. Furthermore, the development of bio-based monomers and the integration of recycled content into HTPA formulations are key aspects of the sustainability technology landscape, aiming to reduce the environmental footprint of these high-performance materials without compromising their critical properties.

Regional Highlights

- Asia Pacific (APAC): Dominates the HTPA market due to robust growth in automotive manufacturing, particularly in China and India, driven by increasing vehicle production and the rapid expansion of the electric vehicle (EV) sector. The region is also a global hub for electronics manufacturing, demanding high-performance polymers for miniaturized and thermally stable electronic components. Significant investments in infrastructure and industrialization further fuel demand for durable materials.

- North America: A mature market characterized by strong demand from the automotive industry, especially for lightweighting and thermal management solutions in both traditional and electric vehicles. The aerospace and defense sector is a key consumer, requiring high-strength, high-temperature resistant materials. Innovation in advanced materials and stringent regulatory standards for vehicle efficiency and safety also drive market growth.

- Europe: A significant market for HTPAs, largely influenced by the stringent environmental regulations and the strong presence of premium automotive manufacturers. The region is a leader in advanced engineering and boasts a robust industrial base that requires high-performance polymers for various applications. Focus on sustainability also drives the adoption of advanced, eco-friendlier HTPA solutions.

- Latin America: An emerging market experiencing gradual growth, primarily driven by expanding automotive production and industrial development. Countries like Brazil and Mexico are seeing increased adoption of HTPAs as their manufacturing capabilities and demand for higher-performance materials evolve.

- Middle East and Africa (MEA): A developing market with increasing demand for HTPAs, particularly in industrial applications related to oil and gas, and infrastructure development. Economic diversification initiatives and growing automotive assembly plants in certain countries are contributing to the regional market expansion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Temperature Polyamides Market.- Solvay S.A.

- Arkema S.A.

- BASF SE

- Evonik Industries AG

- EMS-CHEMIE HOLDING AG

- DuPont de Nemours, Inc.

- Mitsubishi Engineering-Plastics Corporation

- UBE Corporation

- DSM Engineering Materials

- Ascend Performance Materials

- Kuraray Co., Ltd.

- Polyplastics Co., Ltd.

- Sumitomo Chemical Co., Ltd.

- Celanese Corporation

- Lanxess AG

- SABIC

- RadiciGroup

- Kingfa Sci. & Tech. Co., Ltd.

- RTP Company

- LG Chem

Frequently Asked Questions

Analyze common user questions about the High Temperature Polyamides market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are High Temperature Polyamides (HTPAs) and their primary characteristics?

High Temperature Polyamides (HTPAs) are specialized engineering thermoplastics designed to withstand continuous operating temperatures above 150°C. Key characteristics include superior thermal stability, excellent mechanical strength, high chemical resistance, good dimensional stability, and improved electrical properties compared to conventional polyamides.

Which industries are the major consumers of High Temperature Polyamides?

The major consumer industries for HTPAs are automotive (for under-the-hood, structural, and EV components), electrical and electronics (for connectors, switches, and insulation), industrial (for gears, bearings, and pumps), and aerospace (for lightweight and fire-resistant parts).

What are the key drivers propelling the growth of the HTPA market?

Key drivers include the increasing demand for lightweight and thermally stable materials in the automotive sector (especially for electric vehicles), the miniaturization and complexity trends in the electronics industry, and the general push for energy efficiency and durable components across various industrial applications.

What challenges does the High Temperature Polyamides market face?

The HTPA market faces challenges such as the relatively high cost of these specialized polymers, their complex processing requirements which necessitate specific equipment, and intense competition from other high-performance polymers offering comparable property sets for certain applications.

What are the emerging opportunities in the High Temperature Polyamides market?

Emerging opportunities include new applications in 5G telecommunication infrastructure, hydrogen fuel cell technology, and additive manufacturing (3D printing). Additionally, the development of bio-based and sustainable HTPA formulations presents a significant growth avenue.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager