High Voltage Motors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435609 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

High Voltage Motors Market Size

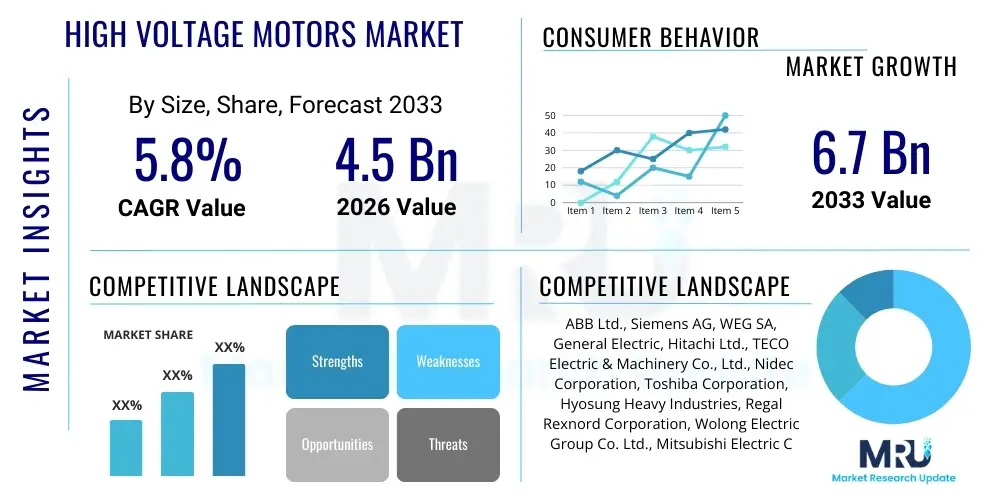

The High Voltage Motors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by robust global industrialization, particularly in emerging economies, coupled with increased investments in large-scale infrastructure projects such as power generation, oil and gas exploration, and chemical processing facilities, all of which rely heavily on high-power machinery.

High Voltage Motors Market introduction

High Voltage (HV) motors are electromechanical devices typically operating at voltages above 1,000 volts (1kV) used to convert electrical energy into mechanical energy for heavy-duty industrial applications. These motors are essential for driving large mechanical equipment suchances as compressors, pumps, fans, mills, and generators where reliability, high power output, and continuous operation are critical requirements. The market encompasses a range of technologies including synchronous motors, induction motors (asynchronous), and specialized configurations designed for specific harsh operating environments or high-efficiency mandates.

The primary applications of HV motors span critical infrastructure sectors including power generation (driving boiler feed pumps and cooling water pumps), oil and gas (operating compressors and pipeline pumps), metals and mining (driving large conveyors, crushers, and rolling mills), and water/wastewater management. Their inherent capability to handle high power ratings (typically ranging from 1 MW up to 100 MW or more) while maintaining excellent energy efficiency makes them indispensable assets in industrial processes globally. Furthermore, the robust construction of HV motors ensures longevity and reduced maintenance downtime, translating directly into lower total cost of ownership (TCO) for end-users operating demanding production cycles.

Key benefits driving the adoption of HV motors include superior energy efficiency compared to their low-voltage counterparts in high-power applications, reduced current draw, which minimizes conductor size requirements, and enhanced torque capabilities necessary for starting and running heavy loads. Driving factors for market expansion include escalating global energy demand necessitating the expansion of power generation capacities, the resurgence in capital expenditure within the petrochemical and chemical sectors, and stringent regulatory push for implementing energy-efficient industrial equipment, such as mandatory efficiency standards established by various international bodies.

High Voltage Motors Market Executive Summary

The High Voltage Motors Market is experiencing significant upward momentum, underpinned by favorable macroeconomic trends centered on global infrastructure development and industrial modernization. Business trends indicate a strong focus on incorporating smart capabilities, such as integrated sensors and digital twin technology, into HV motor systems to facilitate predictive maintenance and optimize operational longevity. Manufacturers are strategically shifting towards modular designs and standardized interfaces to streamline production and installation processes, addressing the custom nature historically associated with these capital goods. This strategic pivot enhances responsiveness to diverse industrial requirements while simultaneously focusing on compliance with ever-tightening energy efficiency regulations, making advanced permanent magnet synchronous motors (PMSM) highly attractive for specific high-performance applications.

Regionally, the Asia Pacific (APAC) stands as the primary growth engine, fueled by massive industrial expansion, rapid urbanization, and extensive government investments in power grid infrastructure, particularly in countries like China, India, and Southeast Asian nations. North America and Europe, while mature, exhibit substantial demand driven by replacement cycles, refurbishment projects, and the critical need to upgrade existing motor fleets to meet stringent energy efficiency standards (e.g., IE4 and potentially IE5 compliance). The Middle East and Africa (MEA) contribute steadily, primarily due to large ongoing oil, gas, and petrochemical projects requiring substantial pumping and compression power, ensuring consistent demand for high-reliability HV motors in challenging climates.

Segment trends reveal that the asynchronous (induction) motor segment continues to hold the largest market share due to its proven reliability, lower initial cost, and relative ease of maintenance, making it the default choice for general industrial use. However, the synchronous motor segment is projected to witness the fastest growth, propelled by their inherent higher efficiency and power factor correction capabilities, which are highly valued in critical, continuous operations like large compressors and grinding mills. Furthermore, the market is highly segmented by end-use application, with the oil and gas sector maintaining dominance, although the power generation segment, especially tied to renewable integration projects and grid stabilization requirements, is showing accelerated demand for specialized HV motor applications.

AI Impact Analysis on High Voltage Motors Market

User queries regarding the impact of Artificial Intelligence (AI) on the High Voltage Motors Market frequently revolve around how AI can enhance reliability, predict failures, and optimize motor performance across industrial installations. Common concerns include the cost-effectiveness of implementing AI-driven monitoring systems, the security implications of transmitting sensitive operational data, and the tangible return on investment (ROI) derived from AI-enhanced predictive maintenance programs. Users are keenly interested in moving beyond traditional time-based maintenance schedules toward condition-based monitoring, anticipating that AI can significantly extend motor lifecycles and minimize unplanned downtime, which is exceptionally costly in capital-intensive industries.

The integration of AI technologies, particularly machine learning (ML) algorithms, is fundamentally transforming the lifecycle management and operational efficiency of high voltage motors. These algorithms analyze massive datasets generated by integrated sensors (vibration, temperature, current, voltage) to detect subtle anomalies that precursors to critical failures long before they become apparent through conventional diagnostics. This capability allows industrial operators to schedule maintenance precisely when necessary, maximizing operational uptime and reducing unnecessary preventative servicing. Furthermore, AI is being deployed in the motor design phase, optimizing winding configurations and cooling mechanisms through generative design, leading to motors with superior efficiency (IE5 targets) and reduced material consumption.

Additionally, AI facilitates real-time optimization of motor operations within complex system contexts. For instance, in power generation plants or large pumping stations, AI can dynamically adjust motor speed and torque based on immediate load demands, energy pricing signals, and overall system efficiency goals. This level of granular control, coupled with the ability to forecast future performance degradations, solidifies AI's role not just as a maintenance tool, but as a central component of high-efficiency, sustainable industrial operations, driving substantial operational savings for companies operating large fleets of HV motors across multiple facilities.

- Enhanced Predictive Maintenance: AI algorithms analyze vibration and thermal signatures to anticipate bearing failure, insulation degradation, and winding faults with high accuracy.

- Optimized Energy Management: Machine learning models adjust motor control parameters (VFDs) in real-time to minimize energy consumption relative to fluctuating load profiles.

- Improved Design and Simulation: AI-driven generative design optimizes motor topology and material use, leading to higher power density and efficiency (IE5 standards).

- Digital Twin Development: AI integrates data from physical motors into high-fidelity digital models for advanced simulation, testing, and lifecycle management.

- Fault Diagnosis Automation: Automated root cause analysis using AI reduces human error and shortens the time required for diagnostics and repair after an operational anomaly.

DRO & Impact Forces Of High Voltage Motors Market

The High Voltage Motors Market is influenced by a powerful combination of drivers stemming from global energy demands and industrial policy, tempered by significant restraints related to capital expenditure and technical complexity, yet poised for substantial growth through strategic opportunities in new energy sectors. The primary driver is the accelerating pace of global electrification and industrial expansion, necessitating reliable, high-power drivers for core industrial processes, particularly in rapidly industrializing regions like APAC. This demand is further amplified by stringent global regulatory mandates promoting energy efficiency, such as the International Efficiency (IE) standards, forcing end-users to upgrade or replace legacy motor installations with highly efficient HV variants. Conversely, the market faces constraints primarily due to the high initial capital investment required for HV motor systems, including associated costs for specialized power electronics and installation infrastructure, alongside persistent challenges related to complex maintenance procedures and the scarcity of skilled technicians capable of servicing these specialized machines. Opportunities abound in the burgeoning renewable energy sector, where HV motors are crucial components in large-scale solar and wind turbine gearboxes, and in the modernization of aging industrial infrastructure in developed economies through smart grid integration and digitalization initiatives.

The key driving forces include significant investment in oil and gas infrastructure, particularly upstream and midstream operations requiring robust compression and pumping systems, and the ongoing modernization of the global power grid, which demands high-power motors for large pumps, fans, and utility-scale compressors. Furthermore, the mining and metals industry continues to be a crucial consumer, driven by the need for high-torque motors to run heavy machinery like crushers and grinding mills under extreme operating conditions. These drivers collectively ensure a foundational level of persistent demand that is relatively inelastic to minor economic fluctuations, positioning HV motors as essential capital expenditure items.

Restraints center on the cyclical nature of capital expenditure in heavy industries; economic downturns often lead to delayed large-scale industrial projects, impacting demand for new installations. Moreover, the technical barrier to entry for maintenance and repair remains high; HV motor failure often necessitates highly specialized winding and insulation expertise, leading to extended downtime and significant repair costs. Opportunities for market expansion are strongly linked to the integration of HV motors into Variable Frequency Drive (VFD) systems, which enhances control and energy savings, and the rapid expansion of utility-scale energy storage solutions and associated infrastructure, creating new avenues for high-power motor deployment in dynamic grid environments. The cumulative impact of these forces dictates a steady but technically challenging growth path for the market.

Segmentation Analysis

The High Voltage Motors Market is meticulously segmented based on product type, power output, end-user industry, and region, allowing for granular analysis of market dynamics and targeted strategic planning. Segmentation by product type primarily distinguishes between asynchronous (induction) and synchronous motors; while asynchronous motors dominate the volume due to their robustness and lower cost, synchronous motors are gaining traction due to superior efficiency and precise control capabilities required in specialized, high-criticality applications. The output power segmentation is critical, ranging from 1,000V to 3,300V, 3,300V to 6,600V, and above 6,600V, reflecting the increasing requirements for driving progressively larger machinery across various industries.

Segmentation by end-user industry reveals the key consumers of HV motors, with Oil & Gas, Power Generation, and Metals & Mining being the dominant sectors, representing the highest concentration of heavy-duty, continuous operation environments. The Oil & Gas sector utilizes these motors extensively for compressors in pipelines and liquefied natural gas (LNG) facilities, while the Power Generation sector relies on them for critical utility components such as large cooling pumps and turbine auxiliary systems. Furthermore, geographical segmentation provides essential insights into regional demand drivers, distinguishing between mature markets like North America and Europe, which focus on replacement and efficiency upgrades, and high-growth markets like Asia Pacific, driven by new infrastructure deployment.

Understanding these segments is crucial for market participants as it dictates product development focus and market entry strategies. For instance, manufacturers targeting the European market must prioritize energy efficiency compliance (IE4/IE5), whereas those focusing on the Middle East often emphasize robustness and reliable performance under high temperatures. The complexity of HV motor applications requires manufacturers to offer highly customizable solutions, making segment-specific specialization a key competitive differentiator across the diverse landscape of industrial heavy machinery use.

- By Product Type:

- Asynchronous (Induction) Motors

- Synchronous Motors

- By Power Output:

- 1,000V – 3,300V

- 3,300V – 6,600V

- Above 6,600V

- By End-User Industry:

- Oil & Gas (Upstream, Midstream, Downstream)

- Power Generation (Thermal, Nuclear, Renewable)

- Metals & Mining (Crushers, Mills, Conveyors)

- Chemicals & Petrochemicals

- Water & Wastewater Management

- Pulp & Paper

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For High Voltage Motors Market

The value chain for the High Voltage Motors Market begins with the highly specialized procurement of critical raw materials, primarily high-grade electrical steel (silicon steel laminations), copper for windings, and specialized insulation materials designed to withstand high operational voltages and thermal stress. The upstream segment is characterized by reliance on a few key global suppliers for these materials, making price fluctuations in commodities such as copper a significant cost driver for manufacturers. Manufacturers must engage in rigorous quality control to ensure the integrity of magnetic circuits and winding insulation, as these factors directly dictate the motor’s efficiency and lifespan, which are paramount in HV applications.

The manufacturing phase involves highly technical processes, including precision machining of large motor frames, complex winding procedures, and extensive testing to meet required performance specifications (torque, efficiency, vibration levels). Distribution channels are predominantly indirect, leveraging specialized industrial distributors, system integrators, and engineering, procurement, and construction (EPC) firms who manage large-scale industrial projects. Direct sales typically occur only for highly customized, extremely large motor units sold directly to major utilities or oil and gas companies. System integrators play a vital role in integrating the motor seamlessly with control systems (like VFDs) and the mechanical load (pumps or compressors).

Downstream activities include installation, commissioning, and long-term after-sales service. Given the high criticality and capital investment associated with HV motors, maintenance, repair, and overhaul (MRO) services are a substantial and highly profitable part of the value chain. Manufacturers or their certified service partners provide specialized field services, condition monitoring, and spare parts management. The complexity of these assets ensures that the downstream support services segment maintains high margins and offers sustained revenue streams, making robust service networks a crucial competitive advantage.

High Voltage Motors Market Potential Customers

The potential customers for High Voltage Motors are large industrial operators and utility entities whose core processes require significant, continuous mechanical power. These end-users are characterized by high capital expenditures, long-term asset planning, and an intense focus on operational reliability and energy efficiency. Primary buyers include state-owned and private power generation companies requiring motors for boiler feed pumps, condensate pumps, and cooling tower fans, ensuring the continuous operation of thermal, nuclear, and increasingly, renewable energy facilities. Their purchasing decisions are heavily influenced by mean time between failures (MTBF), total cost of ownership (TCO), and compliance with environmental and efficiency mandates.

Another major buyer segment is the oil and gas industry, encompassing upstream drilling and extraction, midstream transportation (pipeline compressors and pumps), and downstream processing (refineries and petrochemical plants). These operations necessitate extremely robust and reliable motors for high-pressure compression and liquid transfer, often in hazardous and remote environments. The procurement cycle in this sector is usually tied to major greenfield projects or large-scale expansion/modernization initiatives, where motors are typically purchased as part of an integrated package from system integrators or EPC contractors, emphasizing adherence to rigorous industry standards (e.g., API specifications).

Furthermore, the metals and mining industry constitutes a significant customer base, relying on HV motors to drive high-inertia equipment such as large grinding mills, crushers, and bulk material handling conveyors that operate under tremendous mechanical stress. These buyers prioritize high starting torque and robust mechanical design capable of handling continuous duty cycles. Other key buyers include major water utilities for massive pumping stations and large chemical manufacturers where precision and safety are paramount. The purchasing decisions across all these segments are increasingly influenced by the availability of sophisticated diagnostic and predictive maintenance features, making digital readiness a key differentiator among motor suppliers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Siemens AG, WEG SA, General Electric, Hitachi Ltd., TECO Electric & Machinery Co., Ltd., Nidec Corporation, Toshiba Corporation, Hyosung Heavy Industries, Regal Rexnord Corporation, Wolong Electric Group Co. Ltd., Mitsubishi Electric Corporation, Kirloskar Electric Company, Shandong Huali Electric Motor Group Co., Ltd., Bharat Heavy Electricals Limited (BHEL), Marathon Electric, VEM motors GmbH, Lafert S.p.A., H2W Technologies, Inc., Rotor Technology |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

High Voltage Motors Market Key Technology Landscape

The technological landscape of the High Voltage Motors Market is rapidly evolving, driven by the dual pressures of optimizing energy efficiency and enhancing operational intelligence through digitalization. A critical focus is placed on advanced magnetic materials and design methodologies to achieve International Efficiency (IE) class standards, particularly IE4 and the emerging IE5 (Ultra Premium Efficiency). Key advancements include the increasing adoption of Permanent Magnet Synchronous Motors (PMSMs) in applications demanding exceptional efficiency and power density, primarily through the use of rare-earth magnets. While expensive, PMSMs offer significant energy savings over the motor's lifecycle, justifying the higher initial cost in continuous operations. Furthermore, manufacturers are heavily investing in improved insulation systems, such as Vacuum Pressure Impregnation (VPI) techniques and advanced resin formulations, to enhance dielectric strength and thermal endurance, thus prolonging the motor lifespan under harsh voltage conditions.

Digitalization forms the second major technological pillar. The integration of Internet of Things (IoT) sensors and connectivity into HV motors is becoming standard practice. These sensors continuously monitor parameters such as winding temperature, bearing vibration, stator current, and partial discharge activity. This extensive data collection fuels sophisticated condition monitoring systems, allowing operators to transition from time-based maintenance to predictive maintenance strategies. The development of Digital Twin technology is central to this effort, creating a virtual replica of the physical motor that can be used for real-time performance simulation, failure prediction, and optimization of maintenance scheduling, significantly reducing unplanned downtime and associated maintenance expenses across critical industrial assets.

Another significant area of advancement is the synergy between HV motors and their control systems, specifically Variable Frequency Drives (VFDs). Modern medium-voltage VFDs utilize advanced power electronics, such as Silicon Carbide (SiC) or Gallium Nitride (GaN) devices, to achieve higher switching frequencies, reduce harmonic distortion, and improve overall system efficiency. This allows HV motors to operate optimally across a wide speed range, providing precise process control and substantial energy savings compared to fixed-speed operation. The technological push is towards a fully integrated motor-drive system that maximizes efficiency, optimizes asset utilization, and simplifies the overall system integration process for end-users.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market for High Voltage Motors, driven primarily by massive investments in new power generation infrastructure, including coal, gas, and utility-scale renewable energy projects, alongside rapid industrial expansion in chemicals, metals, and cement sectors across China, India, and Southeast Asia. The region’s demand is centered on new installations rather than replacements, necessitating large volumes of motors for heavy machinery. Government initiatives promoting domestic manufacturing and infrastructure connectivity further stimulate this market, although local price competition is intense.

- North America: This region is characterized by steady demand predominantly fueled by the replacement and refurbishment of an aging installed base of industrial infrastructure, particularly in the oil and gas (shale and LNG terminals) and power utility sectors. Demand is highly focused on premium efficiency motors (IE4 compliance) and integrated smart systems (IoT/AI) that enhance asset management and energy conservation, reflecting a mature market prioritizing TCO and operational reliability over initial purchase price.

- Europe: Europe is defined by extremely strict energy efficiency regulations and a strong commitment to decarbonization and renewable energy integration. The market growth here is driven by mandatory upgrades to meet high efficiency standards, the integration of HV motors into wind and hydro power generation systems, and modernization efforts in manufacturing and water utilities. Demand for specialized, highly engineered synchronous motors with superior power factors is prominent, reflecting the region's focus on sustainable industrial practices and grid stability.

- Middle East & Africa (MEA): Growth in MEA is highly concentrated in the petrochemical, oil and gas, and water desalination sectors, driven by government initiatives to expand processing and export capabilities. These regions require robust motors engineered to withstand high temperatures and harsh operating environments, emphasizing reliability and explosion-proof (ATEX/IECEx) certifications for hazardous areas. Large-scale infrastructure projects, often backed by sovereign wealth funds, ensure consistent demand for high-power, customized HV units.

- Latin America (LATAM): The LATAM market, while smaller, is significantly influenced by the mining sector (Chile, Peru) and oil exploration (Brazil, Mexico). Market fluctuations are often tied to global commodity prices, but sustained investment in mineral extraction and power distribution infrastructure supports a baseline demand for rugged, high-performance HV motors capable of operating reliably in remote and challenging terrains.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the High Voltage Motors Market.- ABB Ltd.

- Siemens AG

- WEG SA

- General Electric

- Hitachi Ltd.

- TECO Electric & Machinery Co., Ltd.

- Nidec Corporation

- Toshiba Corporation

- Hyosung Heavy Industries

- Regal Rexnord Corporation

- Wolong Electric Group Co. Ltd.

- Mitsubishi Electric Corporation

- Kirloskar Electric Company

- Shandong Huali Electric Motor Group Co., Ltd.

- Bharat Heavy Electrical Limited (BHEL)

- Marathon Electric

- VEM motors GmbH

- Lafert S.p.A.

- H2W Technologies, Inc.

- Rotor Technology

Frequently Asked Questions

Analyze common user questions about the High Voltage Motors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary voltage ranges defining a High Voltage Motor?

High Voltage (HV) motors are generally defined as operating above 1,000 Volts (1kV). Common industrial operating ranges include 2.3kV, 3.3kV, 4.16kV, 6.6kV, and 13.8kV. The specific range dictates the motor's insulation class and design complexity.

How does AI contribute to the life extension and maintenance of HV Motors?

AI utilizes machine learning to analyze real-time operational data (vibration, temperature, current) collected via IoT sensors. This analysis identifies subtle deviations indicative of impending failure (e.g., winding insulation breakdown or bearing wear), allowing for proactive, predictive maintenance before critical motor failure occurs, significantly extending asset life and reducing costly unplanned downtime.

What is the main driver for the adoption of synchronous motors over asynchronous motors?

Synchronous motors are primarily adopted for their superior energy efficiency, precise speed control, and ability to improve the power factor of the entire electrical system. While asynchronous motors are cheaper and simpler, synchronous motors are preferred for highly critical, continuous, high-power applications such as large air compressors and complex grinding mills where efficiency yields high lifecycle savings.

Which industry holds the largest share in the High Voltage Motors Market?

The Oil and Gas industry consistently holds the largest market share. This sector requires high-reliability, high-power motors for critical functions such as pipeline transportation (pumps and compressors) and processing at refineries and LNG terminals, where operational stability is non-negotiable.

What impact do global energy efficiency mandates (like IE standards) have on the HV motor market?

Global energy efficiency mandates, such as the IE4 (Super Premium Efficiency) standards prevalent in Europe and North America, compel industrial operators to replace older, less efficient motors with modern HV units. This regulatory pressure drives innovation in motor design (e.g., VFD compatibility and PMSM technology) and fuels the demand for high-efficiency models, contributing significantly to market growth in mature economies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Industrial High Voltage Motors Market Statistics 2025 Analysis By Application (Oil & Gas and Chemicals, Power and Energy, Water & Wastewater Treatment, Mining, Cement Industry, Metallurgical Industry), By Type (Synchronous Motor, Asynchronous Motor), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- High Voltage Motors Market Statistics 2025 Analysis By Application (Oil & Gas and Chemicals, Power and Energy, Water & Wastewater Treatment, Mining, Cement Industry, Metallurgical Industry), By Type (Synchronous Motor, Asynchronous Motor), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager