Hiking & Trail Footwear Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436609 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Hiking & Trail Footwear Market Size

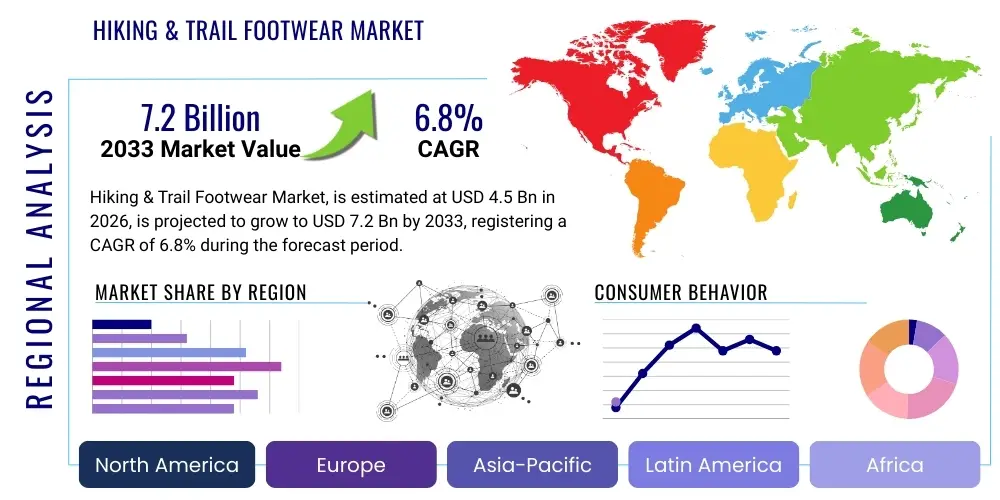

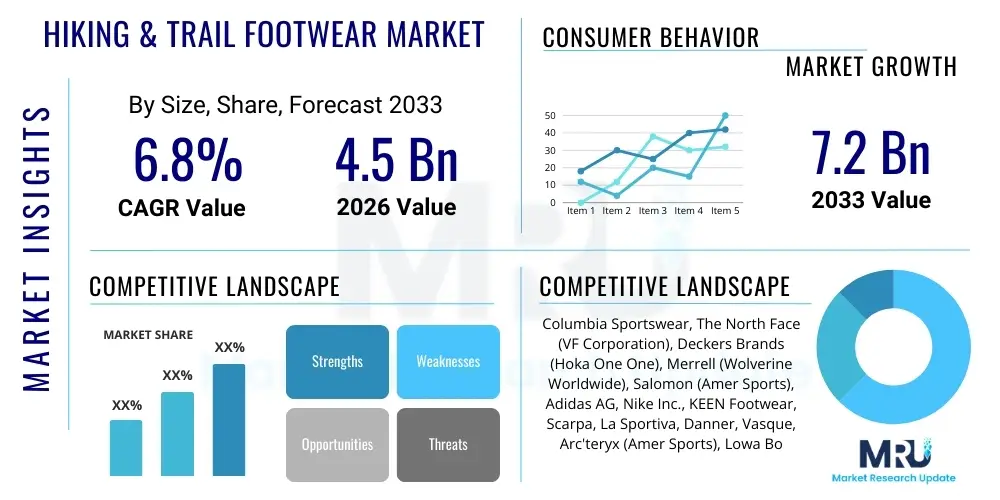

The Hiking & Trail Footwear Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.2 Billion by the end of the forecast period in 2033.

Hiking & Trail Footwear Market introduction

The Hiking & Trail Footwear Market encompasses specialized athletic and protective footwear designed for movement across varied and rugged terrains, ranging from established trails to challenging mountainous environments. These products are engineered to provide superior traction, ankle support, durability, and weather resistance, typically integrating advanced material technologies such as Gore-Tex for waterproofing and proprietary rubber compounds for enhanced grip. The core product categories include lightweight trail runners, mid-cut day hiking boots, heavy-duty backpacking boots, and specialized approach shoes, catering to diverse consumer needs based on activity intensity and load carried. The increasing global emphasis on health, wellness, and outdoor recreational activities, significantly accelerated by shifting lifestyle preferences post-pandemic, serves as the primary catalyst driving sustained market expansion across all major geographic regions.

Major applications of hiking and trail footwear extend beyond traditional trekking to include adventure tourism, rock scrambling, ultra-trail running, and general outdoor pursuits. The functional benefits are paramount, offering protection against abrasions, superior cushioning to reduce fatigue over long distances, and stability crucial for navigating uneven surfaces, thus minimizing the risk of injury. Furthermore, manufacturers are continually innovating to balance these protective features with sustainable production practices and aesthetic appeal, attracting a broader consumer base that values both performance and environmental responsibility. This focus on performance segmentation, driven by specialized material sciences and ergonomic design, ensures that products are highly differentiated and priced according to their technological complexity and intended use case.

Key driving factors underpinning the market’s robust growth trajectory include the rising participation rates in outdoor sports, particularly among younger demographics who prioritize experiential consumption. The continuous advancements in material technology, leading to lighter, more durable, and increasingly comfortable footwear options, further stimulate consumer replacement cycles. Moreover, effective digital marketing strategies leveraging social media platforms and influencer partnerships are successfully highlighting the accessibility and appeal of trail activities, thereby expanding the potential customer pool. The confluence of these factors—technological innovation, demographic shifts toward outdoor lifestyles, and enhanced product performance—cement the strong fundamentals supporting market growth through 2033.

Hiking & Trail Footwear Market Executive Summary

The Hiking & Trail Footwear Market is experiencing strong momentum, primarily driven by evolving consumer preference for high-performance outdoor gear and a sustained increase in global recreational hiking participation. Business trends emphasize product diversification, moving beyond traditional heavy leather boots towards lightweight, hybrid footwear that blends running shoe comfort with hiking boot durability. This strategic shift is being supported by significant investment in sustainable material research, focusing on recycled content, biodegradable components, and reduced manufacturing waste, establishing sustainability as a critical competitive differentiator. Furthermore, the expansion of direct-to-consumer (D2C) channels and enhanced e-commerce capabilities are optimizing supply chain efficiency and allowing brands to capture higher margins while offering personalized customer experiences, reshaping traditional retail distribution models across the outdoor industry landscape.

Geographically, North America and Europe remain the dominant regions, characterized by deeply entrenched hiking cultures, extensive trail networks, and high disposable incomes facilitating premium product purchases. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate, fueled by rapid urbanization leading to increased interest in nature escapes, the proliferation of adventure tourism, and rising middle-class disposable income, particularly in countries like China and India. Regional trends also highlight a micro-segmentation approach, with brands tailoring product lines to specific climate conditions—for instance, developing highly breathable footwear for tropical climates and insulated, waterproof options for alpine environments, ensuring relevance and penetration across varied global markets.

Segmentation trends reveal strong growth in the Trail Running Footwear segment, reflecting the increasing popularity of fast-and-light approaches to the outdoors and ultra-marathons. The Men’s segment currently holds the largest market share in terms of volume, but the Women’s segment is demonstrating faster growth, driven by better product fitting, targeted marketing, and increased female participation in outdoor adventure sports. Material-wise, synthetic materials are rapidly gaining ground over traditional leather due to advantages in weight reduction, quick-drying properties, and often, lower environmental impact (when sustainably sourced), although premium leather options maintain their stronghold in the high-durability backpacking boot sub-segment. Overall, the market remains highly competitive, necessitating continuous innovation in aesthetics, functionality, and ethical sourcing to secure sustained profitability.

AI Impact Analysis on Hiking & Trail Footwear Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Hiking & Trail Footwear Market primarily revolve around four key themes: personalized fitting and sizing solutions, optimization of supply chain and inventory management, the development of smart footwear features, and how AI-driven market analysis informs design innovation. Users are keen to understand if AI can virtually map their foot structure to ensure perfect fit, drastically reducing return rates associated with poor sizing, a pervasive pain point in online footwear purchasing. Furthermore, significant concerns are voiced about the ethical implications of using AI in tracking personal fitness data collected by 'smart' hiking boots. Expectations are high for AI to forecast demand accurately, particularly for highly seasonal products, and to guide the selection of materials (e.g., predicting the optimal blend of rubber and polymer based on expected trail conditions and wear patterns) to enhance product performance and accelerate the design-to-market cycle, thereby maintaining competitive relevance in a fast-paced retail environment.

AI is already beginning to revolutionize product development and consumer interaction within the outdoor footwear sector. Machine learning algorithms analyze vast datasets of consumer biomechanics, terrain types, and environmental factors to guide the creation of next-generation soles, midsoles, and upper designs. This data-driven approach moves beyond traditional subjective testing, allowing engineers to simulate real-world stress and durability under varying conditions, leading to faster iteration cycles and superior product launches. Additionally, sophisticated inventory management systems powered by AI are crucial for navigating complex global supply chains, optimizing stock levels across multiple regional warehouses, and minimizing obsolescence, directly improving operational efficiency and profitability margins for major brands operating internationally.

Beyond design and logistics, AI profoundly influences the consumer journey. Interactive online tools leverage AI to analyze user-uploaded photos or utilize 3D scanning technologies via smartphones, providing highly accurate sizing recommendations tailored to the specific anatomical needs of the hiker, significantly enhancing the e-commerce conversion rate and lowering logistics costs related to product exchanges. This personalized service extends to AI-driven marketing campaigns, segmenting customers based on past purchases, preferred trail difficulty, and climate, ensuring that promotional content for specialized footwear—such as ultra-light trail runners versus rugged alpine boots—is precisely targeted, maximizing marketing ROI and fostering deeper brand loyalty among niche customer segments.

- AI-driven personalized sizing and fit recommendations reduce e-commerce return rates.

- Predictive analytics optimize inventory, demand forecasting, and material procurement cycles.

- Machine learning algorithms inform advanced footwear design for optimal cushioning and traction patterns.

- Smart hiking boots integrate AI for real-time terrain analysis and performance tracking (e.g., fatigue detection).

- Automated quality control systems use computer vision to ensure consistency in manufacturing processes.

- Enhanced supply chain resilience through AI mapping of global logistics networks and risk assessment.

DRO & Impact Forces Of Hiking & Trail Footwear Market

The Hiking & Trail Footwear Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces dictating market trajectory. Key drivers include the global prioritization of health and wellness, leading to widespread adoption of outdoor activities, and technological advancements focusing on reducing weight without compromising structural integrity or protective features, particularly through innovations in foam compounds and synthetic weaves. The major restraint is the high initial cost associated with premium, technical hiking boots, which can deter price-sensitive consumers, coupled with significant concerns regarding the environmental footprint of non-biodegradable synthetic materials used in high volumes. However, these restraints create distinct opportunities, notably the growing consumer demand for genuinely sustainable and ethically sourced footwear, presenting a pathway for brands to develop differentiated product lines using bio-based polymers and circular design principles. This ongoing dynamic between performance demands and sustainability pressures defines the market's evolving competitive landscape.

Impact forces currently driving change include the rapid shift towards lighter, multi-functional footwear (Trail Runners and Hybrid Hikers), diminishing the market share of traditional heavy boots for general use. The acceleration of e-commerce penetration allows niche specialized brands to reach global audiences without reliance on traditional brick-and-mortar retail networks, intensifying competition across all price points. Furthermore, geopolitical instability affecting key manufacturing hubs in Asia presents a volatile force, compelling companies to diversify their sourcing and manufacturing capabilities, leading to investment in automated and regional production facilities. Consumer expectations for durability and waterproofing remain non-negotiable standards, forcing continuous material science research and development to maintain competitive standards against environmental wear and tear.

The primary opportunities center around emerging markets in Asia and Latin America where outdoor activity participation is scaling rapidly from a smaller base, offering immense untapped potential for mid-range product expansion. Secondly, the integration of smart technology (sensors, GPS trackers) into footwear represents a high-value niche segment for tech-savvy consumers willing to pay a premium for data-enhanced experiences. Successfully navigating the sustainability imperative—by achieving industry benchmarks like PFC-free waterproofing and verifiable supply chain traceability—will not only mitigate restraints but also serve as a powerful marketing tool, attracting the environmentally conscious millennial and Gen Z consumer base, who increasingly align their purchasing decisions with corporate environmental policies. Strategic focus on these opportunities will be crucial for long-term market leadership.

Segmentation Analysis

The Hiking & Trail Footwear Market is intricately segmented based on product type, material, distribution channel, gender, and end-user, providing a granular view of consumer preferences and market dynamics. The segmentation reflects the diverse range of activities covered under 'hiking,' from casual day walks to multi-day alpine expeditions, demanding highly specialized footwear characteristics. Product type segmentation is critical, separating heavy-duty backpacking boots requiring maximum support and rigidity from agile trail running shoes prioritizing lightweight construction and responsiveness. This diversification is essential for manufacturers aiming to capture specific demographic or activity-based market niches, allowing for targeted product development and optimized pricing strategies across the portfolio.

Further analysis of segmentation by material highlights the ongoing competition between traditional full-grain leather and advanced synthetic materials, each offering distinct advantages in durability, weight, and environmental tolerance. While leather maintains its position for extreme durability and water resistance in classic hiking boots, synthetic materials dominate the faster-growing trail running and light hiking segments due to inherent attributes such as reduced break-in time, superior breathability, and lighter construction. Understanding the material preferences across different consumer geographies and activity levels is paramount for managing supply chains and R&D pipelines efficiently, ensuring that innovation aligns directly with end-user needs and sustainability targets.

Distribution channel segmentation underlines the accelerating shift towards online sales, driven by convenience and the ability to compare technical specifications easily. However, specialized outdoor retail stores retain high importance, acting as crucial touchpoints for professional fitting services and expert advice, particularly for high-value technical boots where sizing and functional appropriateness are critical purchase factors. The market's complexity necessitates a robust omnichannel strategy, blending the expansive reach and data capture capabilities of e-commerce with the personalized service and physical product trial provided by specialized retail locations, optimizing the overall customer experience and brand touchpoints.

- By Product Type:

- Hiking Shoes (Low-Cut)

- Hiking Boots (Mid-Cut and High-Cut)

- Trail Running Shoes

- Approach Shoes

- Mountaineering Boots (Specialized)

- By Material:

- Leather (Full-Grain, Nubuck, Suede)

- Synthetic Materials (Nylon Mesh, Polyester, TPU)

- Hybrid Materials

- By Distribution Channel:

- Online Retail (E-commerce Platforms, Brand Websites)

- Specialty Stores (Outdoor Gear Retailers)

- Department Stores and Hypermarkets

- Sports Goods Stores

- By Gender:

- Men

- Women

- Unisex

- By End-User:

- Professional Hikers/Mountaineers

- Casual Hikers/Recreational Users

Value Chain Analysis For Hiking & Trail Footwear Market

The value chain for the Hiking & Trail Footwear Market begins with critical upstream activities encompassing raw material sourcing and initial component manufacturing. This stage involves the procurement of highly specialized materials such as waterproof membranes (e.g., Gore-Tex, eVent), durable rubber compounds for outsoles (e.g., Vibram), lightweight foams for midsoles (e.g., EVA, PU), and high-tenacity fabrics and leather. Upstream competitiveness is increasingly defined by sustainable sourcing policies, traceability, and secure supply agreements, as material shortages or ethical lapses can severely impact brand reputation and production timelines. Leading brands often collaborate directly with chemical and textile innovators to secure exclusive rights to proprietary technologies, establishing a crucial technological barrier to entry and optimizing material cost structures.

The subsequent key stage involves manufacturing and assembly, predominantly concentrated in specialized production facilities in Asia (Vietnam, China, Indonesia) and, to a lesser extent, in Europe and North America for high-end or specialized custom products. This phase is characterized by labor-intensive operations combined with advanced machinery for tasks like injection molding, lasting, and bonding. Efficiency in this stage relies on lean manufacturing principles, stringent quality control to ensure product performance specifications (waterproofing, adhesion strength), and skilled labor management. Distribution channel management then takes over, defining how products move from the factory floor to the consumer. Direct channels, through brand-owned e-commerce sites, offer maximum margin control and direct customer data collection, whereas indirect channels, utilizing distributors, wholesalers, and specialized retailers, ensure broader geographic market penetration and access to vital in-person fitting expertise.

Downstream analysis focuses on marketing, sales, and post-sales support. Marketing activities are heavily weighted toward digital platforms, outdoor influencer endorsements, and strategic partnerships with hiking organizations or events to build brand credibility and engagement within the target community. Retailers, whether online or physical, provide the final interface, where merchandising, customer service, and product warranties become decisive factors in the consumer's purchasing decision. The entire value chain is currently being scrutinized for opportunities to implement circular economy models, particularly concerning end-of-life product recycling and take-back programs, shifting the downstream focus from pure sales volume to lifecycle management and cementing long-term customer loyalty through shared sustainability values.

Hiking & Trail Footwear Market Potential Customers

Potential customers for the Hiking & Trail Footwear Market span a broad demographic, categorized primarily by their activity level, geographic location, and specific footwear requirement (e.g., lightweight agility versus heavy-duty protection). The largest segment comprises Recreational Day Hikers and Casual Outdoor Enthusiasts, who seek comfortable, multi-purpose footwear suitable for light trails and everyday casual wear. These consumers are typically sensitive to price but highly responsive to branding that emphasizes comfort, moderate durability, and versatility. They represent the high-volume segment, often purchasing through mainstream distribution channels and being influenced by aesthetic trends and social media recommendations showcasing accessible outdoor experiences.

A second, highly valuable customer segment consists of Professional Backpackers, Mountaineers, and Ultra-Trail Runners. These end-users demand highly technical, specialized, and durable footwear engineered for extreme conditions, heavy loads, and prolonged use. Their purchasing decisions are entirely performance-driven, often prioritizing features like proprietary waterproofing, advanced sole technology, and precise fit over price. This segment relies heavily on expert reviews, specialized outdoor retailer advice, and direct engagement with technical brand representatives, representing the primary market for premium-priced, high-margin products requiring substantial R&D investment. Brands often use the endorsement and feedback from this professional cohort to validate and market technologies trickling down to mass-market products.

A burgeoning and critical potential customer group includes Adventure Tourists and Eco-Travelers, particularly those residing in urban areas globally but participating in guided outdoor trips and nature-based vacations. This segment is characterized by relatively high disposable income and a strong preference for sustainable and ethically produced gear. They typically purchase mid-to-high range products that offer a blend of technical performance and contemporary styling. Furthermore, governmental and paramilitary agencies requiring durable, reliable footwear for fieldwork or training represent institutional buyers. Focusing marketing efforts on the specific needs of these varied customer groups—from the weekend warrior needing comfortable stability to the mountain guide requiring unparalleled durability—is essential for comprehensive market penetration and optimized product mix management.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.2 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Columbia Sportswear, The North Face (VF Corporation), Deckers Brands (Hoka One One), Merrell (Wolverine Worldwide), Salomon (Amer Sports), Adidas AG, Nike Inc., KEEN Footwear, Scarpa, La Sportiva, Danner, Vasque, Arc'teryx (Amer Sports), Lowa Boots, Mammut, Oboz Footwear, Tecnica Group, Zamberlan, Asics Corporation, Under Armour. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hiking & Trail Footwear Market Key Technology Landscape

The technology landscape in the Hiking & Trail Footwear Market is characterized by intense research and development focused on optimizing the three core components of footwear: the outsole, the midsole, and the upper. Outsole technology centers on advanced rubber compounds, specifically engineered by companies like Vibram and proprietary brand divisions, designed to maximize grip (traction) and reduce abrasion resistance across diverse terrains ranging from slippery rock to loose scree. Innovations include multi-directional lug patterns, sticky rubber formulations for scrambling, and strategically zoned rubber densities to enhance stability and longevity. Furthermore, the integration of rock plates and specialized shanks ensures protection and torsional rigidity, crucial for carrying heavy loads over uneven ground, blending sophisticated material engineering with biomechanical principles to enhance performance.

Midsole technology is rapidly evolving, moving away from standard EVA toward more responsive and durable materials, such as proprietary polyurethane blends and advanced injection-molded EVA (IMEVA). The goal is to provide superior energy return, lightweight cushioning, and sustained shock absorption over hundreds of miles without the foam breaking down or "packing out." Crucially, many brands are adopting rocker sole geometries, particularly in trail running and fast hiking models, which promote a more efficient and natural gait cycle, reducing muscle fatigue and improving overall pace. This focus on biomechanical efficiency is complemented by the pervasive use of advanced waterproofing and breathability technologies, primarily relying on highly technical membranes like Gore-Tex, which are continuously refined to improve moisture vapor transmission rates while maintaining absolute water resistance under hydrostatic pressure.

The technologies applied to the upper construction concentrate on achieving a perfect balance between durability, weight, and climate control. Modern uppers frequently utilize seamless construction techniques, often incorporating heat-pressed thermoplastic polyurethane (TPU) overlays instead of traditional stitching, significantly reducing potential failure points and overall weight while enhancing the modern aesthetic. Knitting technology, originally popular in athletic shoes, is being adapted for trail use, offering sock-like comfort and superior breathability, protected by durable external coatings or integrated woven components. Future technological integration is heavily leaning toward smart materials and embedded electronics, including pressure sensors for optimizing lacing systems, temperature regulation elements, and micro-GPS units, positioning hiking footwear as a functional piece of wearable technology capable of delivering real-time performance and safety data to the user.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand, product preferences, and competitive strategies within the Hiking & Trail Footwear Market. North America, encompassing the United States and Canada, represents a mature but highly profitable market segment, characterized by a well-established culture of outdoor recreation, high disposable income, and a strong preference for premium, technically advanced, and specialized products. The demand here is largely driven by the popularity of long-distance trails (like the Appalachian and Pacific Crest Trails) and a strong consumer base for both traditional hiking boots and the booming trail running segment. Key market players often launch their flagship technical innovations in this region first, leveraging the demanding consumer feedback loop and high media visibility.

Europe stands as another powerhouse, with countries like Germany, France, Italy, and the UK maintaining robust hiking and mountaineering traditions. The market is highly fragmented, with strong regional brands holding significant market share, particularly in alpine and specialized segments (e.g., Lowa in Germany, La Sportiva in Italy). European consumers demonstrate a heightened focus on sustainability, ethical production, and material sourcing, placing significant pressure on manufacturers to adhere to stringent environmental certifications and transparency standards. Product demand is often polarized, balancing the need for highly durable mountaineering boots in the Alps with lightweight, eco-friendly options for lower-level European trails.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market globally. This surge is attributed to burgeoning middle-class populations, increasing urbanization leading to a desire for nature excursions, and governmental investment in outdoor tourism infrastructure across South Korea, Japan, China, and Australia. While the market is price-sensitive in many sub-regions, the demand for high-quality, international brands is escalating, particularly among younger, affluent consumers. The specific climate conditions—high humidity in Southeast Asia and extreme temperature variations elsewhere—drive demand for highly specialized breathable and quick-drying footwear, presenting significant opportunities for technical differentiation and aggressive market entry strategies utilizing strong e-commerce platforms.

- North America (US, Canada): Dominant in terms of market value; strong demand for technical and trail running footwear; focus on premium, lightweight gear.

- Europe (Germany, UK, France): Mature market with strong regional brand loyalty; high emphasis on sustainability, ethical sourcing, and specialized alpine boots.

- Asia Pacific (APAC, China, Japan, Australia): Highest growth rate projected; driven by increasing disposable income and adventure tourism; demand for breathable and versatile products.

- Latin America (Brazil, Mexico): Emerging market characterized by increasing interest in ecotourism; greater price sensitivity, driving demand for mid-range durable footwear.

- Middle East & Africa (MEA): Niche market focused on desert hiking and occasional mountainous terrain; growth linked to expanding tourism sectors and specific demands for heat-resistant materials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hiking & Trail Footwear Market.- The North Face (VF Corporation)

- Merrell (Wolverine Worldwide)

- Salomon (Amer Sports)

- Columbia Sportswear Company

- KEEN Footwear

- Arc'teryx (Amer Sports)

- Hoka One One (Deckers Brands)

- Adidas AG (Terrex line)

- Nike Inc. (ACG line)

- Scarpa

- La Sportiva

- Lowa Boots

- Danner

- Vasque

- Mammut

- Oboz Footwear

- Zamberlan

- Tecnica Group

- Montrail (Columbia Sportswear)

- Under Armour (Outdoor range)

Frequently Asked Questions

Analyze common user questions about the Hiking & Trail Footwear market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Trail Running Footwear segment?

The Trail Running segment is primarily driven by the 'fast and light' movement in the outdoors, increased participation in ultra-marathons, and continuous technological advancements creating lighter, more cushioned, and highly durable shoes that appeal to both runners and casual hikers seeking versatile performance footwear.

How is sustainability impacting material choices in hiking boots?

Sustainability is profoundly shifting material choices, with manufacturers increasingly adopting recycled plastics for synthetic uppers, utilizing PFC-free Durable Water Repellent (DWR) treatments, incorporating bio-based and responsibly sourced leathers, and investing in closed-loop recycling programs to minimize environmental footprint.

Which geographic region presents the highest growth potential for the Hiking & Trail Footwear Market?

The Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR), fueled by rising urbanization, increasing disposable incomes, and the rapid expansion of adventure tourism and recreational outdoor activities across key emerging economies like China and India.

What is the main difference between Hiking Boots and Approach Shoes?

Hiking Boots are designed for maximum ankle support, load bearing, and long-distance comfort, featuring stiffer midsoles. Approach Shoes, conversely, are optimized for technical rocky terrain and scrambling, featuring sticky rubber outsoles similar to climbing shoes and a lower profile for precise foot placement, sacrificing some long-distance cushioning.

How does e-commerce influence the pricing and distribution strategy of hiking footwear?

E-commerce channels allow brands to implement D2C (Direct-to-Consumer) strategies, offering greater control over pricing and allowing them to capture higher margins. Online platforms also facilitate personalized marketing and real-time inventory management, crucial for efficiently distributing highly segmented, technical product lines globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager