Hirudin Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436339 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Hirudin Market Size

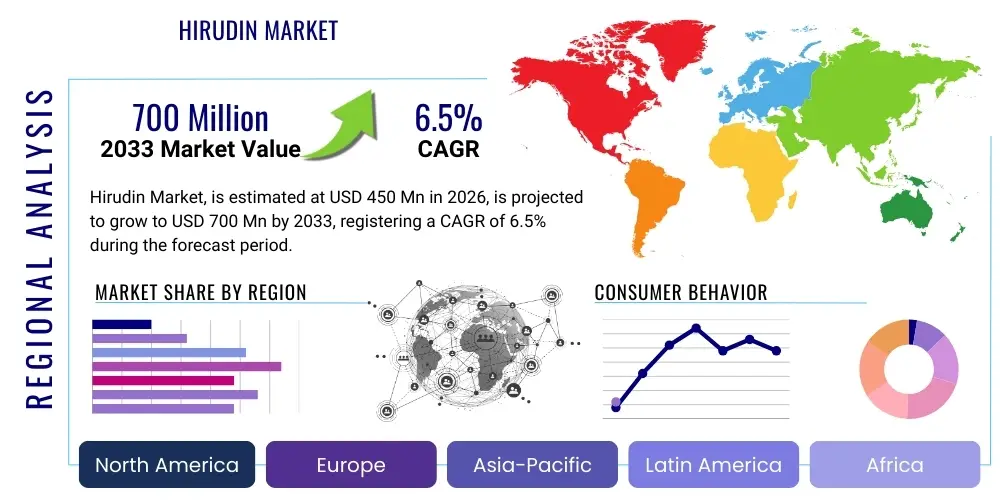

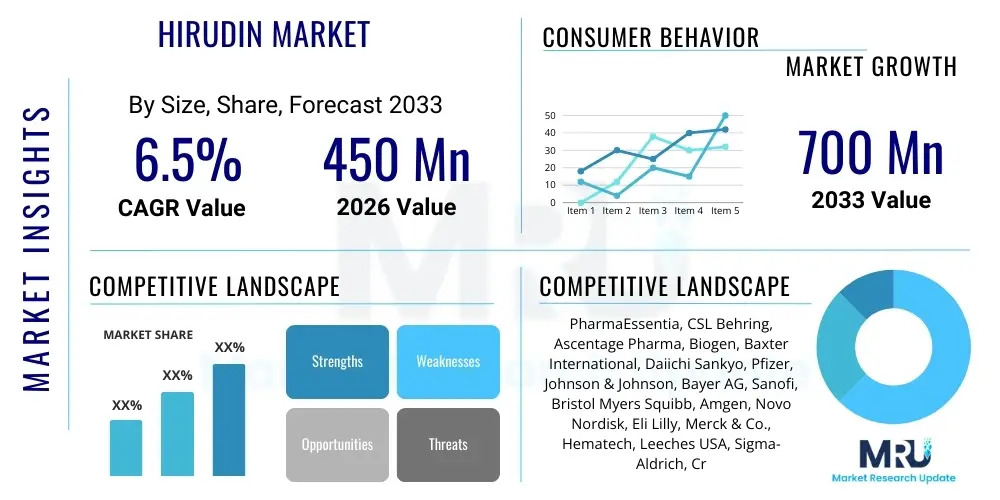

The Hirudin Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 700 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the escalating prevalence of cardiovascular diseases and venous thromboembolism (VTE) globally, necessitating highly effective and targeted anticoagulant therapies. Furthermore, advancements in recombinant DNA technology, which enables the large-scale, cost-effective production of highly pure hirudin, are critical factors fueling market expansion.

Hirudin Market introduction

Hirudin is a potent, naturally occurring anticoagulant peptide originally isolated from the salivary glands of medicinal leeches (Hirudo medicinalis). Structurally, it is a highly specific and direct thrombin inhibitor, distinguishing it from conventional anticoagulants like heparin, which act indirectly. This targeted mechanism prevents the conversion of fibrinogen to fibrin and inhibits thrombin's pro-inflammatory effects, making it invaluable in treating Heparin-Induced Thrombocytopenia (HIT) and various thrombotic disorders where other treatments are contraindicated or ineffective. The market scope encompasses both natural hirudin extracts and, increasingly, recombinant hirudin variants (like Lepirudin and Desirudin), which offer higher purity and standardized dosage forms for clinical use.

Major applications for hirudin extend across prophylactic and therapeutic intervention for venous and arterial thrombosis, particularly in patients undergoing coronary intervention procedures or those at high risk of VTE. Its primary benefit lies in its predictable dose-response, lack of requirement for antithrombin III, and minimal risk of cross-reactivity with platelet factors, offering a superior safety profile for specific patient groups. Market growth is significantly driven by the need for alternative anticoagulants in critical care settings, coupled with increasing R&D investments aimed at exploring novel formulations and delivery systems for this specialized biologic. The transition towards recombinant manufacturing minimizes reliance on natural sources, ensuring a stable supply chain and bolstering overall market confidence.

Hirudin Market Executive Summary

The Hirudin Market exhibits robust business trends characterized by a shift from naturally derived to recombinant production methods, optimizing scalability and reducing batch variability. Strategic alliances between biotechnology firms and established pharmaceutical companies are crucial for drug development and global distribution, particularly focusing on emerging markets where cardiovascular disease incidence is rising rapidly. Technologically, the focus is on enhancing expression systems—such as yeast or bacterial cultures—for superior recombinant hirudin yields, driving down production costs and making the drug more accessible for long-term therapeutic use. Furthermore, regulatory approvals for new indications, particularly in complex thrombotic events, are continually expanding the commercial potential of hirudin and its derivatives.

Regionally, North America and Europe maintain dominance due to advanced healthcare infrastructure, high incidence of VTE, and favorable reimbursement policies supporting expensive specialized therapies like hirudin. However, the Asia Pacific (APAC) region is projected to register the highest growth rate, fueled by improving healthcare expenditure, a large patient pool, and increasing domestic manufacturing capabilities, especially in countries like China and India, focusing on biosimilar development. Segment trends show a clear preference for the recombinant source segment due to quality assurance and supply consistency, while the application segment for Heparin-Induced Thrombocytopenia (HIT) continues to be the primary revenue generator, given hirudin's established efficacy in this critical niche market. The growing adoption in cardiovascular surgery settings also represents a significant avenue for future market penetration.

AI Impact Analysis on Hirudin Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Hirudin market frequently center on three critical themes: optimizing recombinant production yields, accelerating drug discovery for novel hirudin analogs, and improving patient specific dosing regimens. Users express concerns about the complexity of managing large-scale bioproduction data and the need for precision medicine in anticoagulation, where minor dosing errors can have severe consequences. Expectations are high regarding AI's ability to streamline the highly regulated and complex process of developing next-generation thrombin inhibitors, particularly through predictive modeling of molecular interactions and clinical trial outcomes. The core user concern is how AI can deliver cost efficiencies without compromising the stringent quality and purity requirements essential for injectable biological therapies.

AI is poised to revolutionize the Hirudin market by introducing unprecedented efficiencies in biomanufacturing and clinical application. Machine learning algorithms are being applied to analyze complex fermentation parameters in recombinant expression systems, predicting optimal nutrient media, temperature fluctuations, and harvesting times to maximize yield and purity of the peptide. This predictive analytics approach minimizes costly batch failures, directly addressing one of the major restraints of the market—high production costs. Furthermore, AI-driven structure prediction and virtual screening capabilities accelerate the identification of novel hirudin analogs with enhanced stability or targeted therapeutic indices, pushing the boundaries of current anticoagulant therapies. In clinical settings, AI facilitates personalized medicine by utilizing patient genetic data and real-time clotting factors to recommend precise, individualized dosing, significantly improving safety and efficacy, especially in vulnerable populations like those with renal impairment.

- AI optimizes fermentation and purification processes for recombinant hirudin, improving yield and reducing manufacturing costs.

- Machine learning algorithms enhance drug discovery by modeling new hirudin derivative structures with superior therapeutic profiles.

- Predictive analytics in clinical trials accelerates phase progression by identifying ideal patient cohorts and predicting adverse event risks.

- AI facilitates precision dosing of hirudin therapy, using patient-specific physiological data to minimize bleeding risk and optimize therapeutic efficacy.

- Automation powered by AI enhances quality control and impurity detection in large-scale bioproduction facilities, ensuring compliance with strict regulatory standards.

DRO & Impact Forces Of Hirudin Market

The Hirudin market's dynamics are shaped by powerful Drivers (D), systemic Restraints (R), and latent Opportunities (O), which collectively determine its growth trajectory and competitive landscape. The primary driver is the demonstrable clinical superiority of hirudin in specific high-risk indications, such as HIT, where standard therapies are ineffective or dangerous, positioning it as an essential life-saving drug. However, the market faces significant restraints, chiefly the elevated manufacturing expenses associated with biological production, particularly for recombinant variants, alongside intense competition from generic and novel oral anticoagulants (NOACs). Opportunities arise primarily through technological advancements, specifically in microbial or mammalian cell expression systems, which promise to deliver cost reductions and expand therapeutic applications beyond current indications, such as in oncology-related thrombosis, broadening the overall patient base.

Impact forces currently exert a moderate to high influence on the market. Supplier power is high, especially for essential raw materials and specialized microbial strains necessary for recombinant production, necessitating strong supply chain management by manufacturers. Buyer power is moderate; while end-users (hospitals) seek cost-effective treatments, the critical nature of hirudin in certain conditions limits price sensitivity for approved, high-quality products. The threat of substitutes is high, driven by the emergence of safer, more convenient oral anticoagulants that address a broader demographic, although these substitutes often lack the specific targeted action of hirudin against thrombin. The threat of new entrants remains low due to the substantial capital investment, technological expertise, and stringent regulatory hurdles required for developing and launching a specialized biologic anticoagulant, thereby protecting the market share of established players.

The long-term sustainability and growth of the Hirudin market depend heavily on mitigating the restraint of high cost through efficient recombinant scale-up and securing broader reimbursement coverage. Successful navigation of these impact forces requires focused R&D spending to demonstrate superior clinical outcomes over existing therapies and aggressive patent protection for novel delivery systems or formulations. Market participants must leverage global harmonization of regulatory standards to facilitate quicker market entry in high-potential regions like APAC and Latin America, thereby maximizing the utilization of existing production capacities and solidifying hirudin's role as a cornerstone therapy in specialized thrombotic management.

Segmentation Analysis

The Hirudin market is segmented based on the Source of the drug, its Application across therapeutic areas, and the key End-User institutions involved in its administration. This structure provides a clear framework for understanding market demand distribution and identifying high-growth sub-sectors. The segmentation highlights the transition away from resource-intensive natural extraction toward scalable biotechnology methods, which is pivotal for future market viability. The analysis reveals that the recombinant segment dominates, reflecting industry efforts to standardize purity and achieve higher volume production necessary to meet global clinical demands for specialized anticoagulation.

In terms of application, the market is primarily concentrated within complex hospital settings dealing with acute thrombotic events or surgical complications. Heparin-Induced Thrombocytopenia (HIT) remains the most critical and highest-value application segment, owing to the lack of effective alternatives for patients needing immediate, reliable anticoagulation. However, the usage in general thrombosis prevention and in specialized cardiovascular surgery is rapidly expanding, driven by new clinical evidence supporting hirudin’s efficacy in preventing arterial and venous clots during invasive procedures. Understanding these dynamics is crucial for strategic investment and targeting product development efforts toward the most lucrative and unmet clinical needs, ensuring alignment with the evolving standards of care in thrombotic management globally.

- By Source

- Natural Hirudin (Extracted)

- Recombinant Hirudin (r-Hirudin)

- Lepirudin

- Desirudin

- Bivalirudin (Synthetic peptide analog)

- By Application

- Heparin-Induced Thrombocytopenia (HIT)

- Venous Thromboembolism (VTE) Prophylaxis

- Deep Vein Thrombosis (DVT)

- Unstable Angina

- Coronary Intervention Procedures (PCI)

- Disseminated Intravascular Coagulation (DIC)

- By End-User

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers (ASCs)

- Research Institutes

- By Region

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, India, South Korea, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa (GCC Countries, South Africa, Rest of MEA)

Value Chain Analysis For Hirudin Market

The value chain for the Hirudin market begins with the upstream segment, primarily focused on sourcing and raw material preparation. For natural hirudin, this involves specialized leech farming and extraction techniques, which are high-cost and yield-limited. Conversely, for recombinant hirudin, the upstream process involves complex biotechnology steps: gene cloning, developing robust microbial or mammalian cell expression systems (e.g., yeast, E. coli), and initiating large-scale fermentation. Critical suppliers in this stage include specialized biochemical companies providing fermentation media, purification resins, and quality control reagents. Efficiency and intellectual property protection at this stage are paramount, as the chosen expression system dictates the final product's quality, scalability, and overall manufacturing cost.

The core midstream segment involves the highly technical purification and formulation of the active pharmaceutical ingredient (API). Purification is complex due to the peptide nature of hirudin, requiring multi-step chromatography to achieve the necessary pharmaceutical grade purity (>98%). Following purification, the API is formulated into stable injectable dosage forms (often lyophilized). This phase is capital-intensive, requiring adherence to Current Good Manufacturing Practices (cGMP) and rigorous validation protocols. Distribution channels, forming the downstream segment, are characterized by specialized logistics due to the temperature sensitivity of biological products. Direct distribution is common for high-volume hospital procurement, while indirect channels utilize specialized pharmaceutical distributors and wholesalers who maintain cold chain logistics, ensuring product integrity from the manufacturer to the point of care.

The final stage involves the clinical end-users, where the product reaches the patient. Direct channels involve manufacturers negotiating directly with large hospital systems, group purchasing organizations (GPOs), or national health services (NHS). Indirect channels, which are more prevalent, involve multi-tiered distribution networks reaching smaller clinics and specialty pharmacies. Given hirudin's high cost and specialized application, regulatory compliance and traceability throughout the distribution network are critical. Successful market penetration relies on effective physician education and strong reimbursement support, ensuring the drug is readily available when required for acute thrombotic interventions, thus connecting the complex biomanufacturing process directly to specialized patient needs.

Hirudin Market Potential Customers

The primary end-users and potential customers in the Hirudin Market are institutions requiring specialized, high-efficacy anticoagulation therapies for acute or life-threatening conditions, where traditional treatments are inadequate or contraindicated. Hospitals, particularly tertiary care centers with specialized departments for cardiology, cardiovascular surgery, and critical care medicine, represent the largest customer segment. These facilities manage the majority of Heparin-Induced Thrombocytopenia (HIT) cases and complex percutaneous coronary interventions (PCI), driving consistent demand for injectable thrombin inhibitors like hirudin and its derivatives. The acquisition patterns of these large institutions are often influenced by institutional formularies, cost-effectiveness analyses, and therapeutic guidelines issued by cardiology and hematology societies, making formulary inclusion a critical commercial objective for market players.

Specialty Clinics, including dedicated thrombosis centers and ambulatory surgical centers (ASCs) that perform minor cardiac procedures, also constitute a growing customer base. While their volume is generally lower than large hospitals, these centers require reliable supply chains for immediate use in procedural settings. Research Institutes and academic medical centers also serve as pivotal customers, driving demand for research-grade hirudin for both basic science investigation into coagulation pathways and for conducting clinical trials on new indications or formulations. Customer loyalty in this specialized market is strongly influenced by product purity, regulatory approval status (FDA, EMA), proven clinical track record, and the reliability of the cold chain logistics provided by the manufacturer or distributor.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 700 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | PharmaEssentia, CSL Behring, Ascentage Pharma, Biogen, Baxter International, Daiichi Sankyo, Pfizer, Johnson & Johnson, Bayer AG, Sanofi, Bristol Myers Squibb, Amgen, Novo Nordisk, Eli Lilly, Merck & Co., Hematech, Leeches USA, Sigma-Aldrich, Creative Peptides, Thermo Fisher Scientific |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hirudin Market Key Technology Landscape

The technological landscape of the Hirudin market is primarily defined by advanced bioprocessing techniques aimed at transitioning production from resource-limited natural extraction to scalable, high-purity recombinant methods. Recombinant DNA technology, utilizing host organisms like baker's yeast (Saccharomyces cerevisiae) or Escherichia coli, is the cornerstone technology. Manufacturers are constantly refining expression vectors and optimizing fermentation parameters—such as aeration, pH, and nutrient feeding strategies—to maximize the yield of functional, correctly folded hirudin peptide. Crucially, the technology must ensure that the recombinant product maintains the exact biological activity and immunological profile of the native peptide, minimizing potential adverse immune reactions in patients.

Further innovation focuses heavily on downstream processing technologies, which are essential for purifying the recombinant peptide from the complex fermentation broth. Advanced chromatography techniques, including ion-exchange, affinity, and size-exclusion chromatography, are utilized sequentially to achieve the required high levels of purity, removing host cell proteins, nucleic acids, and endotoxins. Continuous processing methodologies, such as continuous chromatography (e.g., Simulated Moving Bed, or SMB), are increasingly being adopted to reduce footprint, enhance throughput, and lower the overall cost of goods sold (COGS), addressing a major market restraint. The integration of advanced filtration technologies ensures sterility and removes viral contaminants, meeting stringent regulatory requirements for injectable biological products.

Looking forward, the technology landscape includes the development of novel delivery systems and formulations. Efforts are underway to improve the pharmacokinetics and half-life of hirudin derivatives, potentially reducing the frequency of intravenous administration. This involves investigating liposomal encapsulation, nanoparticle carriers, or even subcutaneous formulations, aiming to broaden the utility of hirudin beyond the critical care hospital setting. Furthermore, the application of computational biology and high-throughput screening technologies is vital for designing next-generation synthetic analogs (like Bivalirudin) that retain potent antithrombin activity while offering improved stability or fewer renal excretion dependencies, ultimately increasing the clinical utility and competitive edge of hirudin-based therapies.

Regional Highlights

Geographically, the global Hirudin market is segmented into North America, Europe, Asia Pacific (APAC), Latin America, and Middle East & Africa (MEA). North America, particularly the United States, commands the largest market share, driven by high per capita healthcare spending, the presence of major biopharmaceutical companies, and established guidelines supporting the use of specialized anticoagulants like hirudin for complex conditions such as HIT. High awareness among clinicians regarding advanced therapeutic options and favorable government policies regarding drug approval and reimbursement contribute significantly to this dominance. The region is also a hub for clinical trials and biotechnological advancements in recombinant manufacturing, ensuring a steady supply of high-quality products.

Europe represents the second-largest market, characterized by stringent quality standards enforced by the European Medicines Agency (EMA) and strong adoption in countries like Germany, France, and the UK, where specialized cardiac and vascular procedures are frequently performed. The integration of recombinant hirudin derivatives into standardized critical care protocols and the availability of advanced diagnostics for thrombosis accelerate market penetration. The regulatory environment in Europe encourages biosimilar competition, which, while potentially lowering prices, expands the overall market volume by increasing patient access to cost-effective alternatives, thereby stimulating demand in specific therapeutic segments requiring long-term anticoagulation.

The Asia Pacific region is anticipated to exhibit the fastest Compound Annual Growth Rate during the forecast period. This accelerated growth is attributed to the rapidly aging population in countries such as Japan and China, leading to a rising incidence of cardiovascular and peripheral vascular diseases. Furthermore, significant improvements in healthcare infrastructure, increased disposable incomes leading to higher healthcare expenditure, and governmental initiatives promoting domestic pharmaceutical and biotechnology sectors are driving forces. Local manufacturers in APAC are increasingly focusing on developing cost-effective recombinant hirudin products, often targeting regional unmet needs for affordable, specialized anticoagulant therapy, making it a critical growth frontier for global market players seeking to expand their operational footprints.

- North America: Dominant market due to high healthcare expenditure, sophisticated surgical intervention rates, and established protocols for managing HIT.

- Europe: Strong presence driven by advanced clinical adoption, stringent regulatory environment, and high prevalence of chronic cardiovascular conditions.

- Asia Pacific (APAC): Fastest growing region, fueled by expanding healthcare access, rising incidence of thrombosis, and increasing recombinant production capabilities, particularly in China and India.

- Latin America: Emerging market characterized by improving healthcare access and demand for advanced therapies, though constrained by pricing sensitivity and variable infrastructure.

- Middle East & Africa (MEA): Growth driven by medical tourism and investment in specialized treatment centers, focusing primarily on high-value, critical care applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hirudin Market.- PharmaEssentia

- CSL Behring

- Ascentage Pharma

- Biogen

- Baxter International

- Daiichi Sankyo

- Pfizer

- Johnson & Johnson

- Bayer AG

- Sanofi

- Bristol Myers Squibb

- Amgen

- Novo Nordisk

- Eli Lilly

- Merck & Co.

- Hematech

- Leeches USA

- Sigma-Aldrich

- Creative Peptides

- Thermo Fisher Scientific

Frequently Asked Questions

Analyze common user questions about the Hirudin market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary clinical advantage of Hirudin over traditional anticoagulants like Heparin?

Hirudin is a direct thrombin inhibitor that does not require the presence of Antithrombin III for activity, making it highly effective and predictable. Its key advantage is its safety profile in patients with Heparin-Induced Thrombocytopenia (HIT), as it does not cross-react with platelet factor 4, a major limitation of heparin-based therapies. This targeted mechanism provides a crucial therapeutic option for patients requiring immediate and reliable anticoagulation when heparin is contraindicated.

Which factors are restraining the global growth of the Hirudin market?

The primary restraints include the high cost associated with manufacturing pharmaceutical-grade recombinant hirudin, which requires complex bioprocessing and purification techniques. Additionally, intense competition from a growing range of established and novel oral anticoagulants (NOACs), which offer greater convenience and broader application scope for general thrombosis prevention, limits the overall patient pool for specialized injectable hirudin therapies.

How is recombinant technology impacting the future supply and pricing of Hirudin?

Recombinant technology is crucial for stabilizing the Hirudin supply chain by minimizing reliance on variable natural sources. By utilizing engineered microbial systems, manufacturers can achieve large-scale, standardized production of high-purity product. This technological shift is essential for reducing long-term manufacturing costs, which, in turn, is expected to make hirudin and its derivatives more accessible and competitively priced, facilitating broader use in clinical settings globally.

Which geographical region is projected to experience the fastest growth in the Hirudin market?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR). This acceleration is driven by significant improvements in regional healthcare infrastructure, increasing prevalence of cardiovascular diseases among aging populations, and rising investment in local biopharmaceutical manufacturing capabilities focused on developing biosimilar and generic versions of specialized anticoagulants.

In which specific medical application does Hirudin generate the most significant market revenue?

Hirudin generates the most significant market revenue in the treatment of Heparin-Induced Thrombocytopenia (HIT). Due to its unique mechanism as a potent, direct thrombin inhibitor, hirudin is often the preferred, and sometimes mandatory, therapeutic intervention for managing acute thrombosis in HIT patients, distinguishing it as a critical niche market where its value proposition is unmatched by alternatives.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Hirudin Market Size Report By Type (Natural Hirudin, Recombinant Hirudin), By Application (Thrombosis Disease, Tumor Disease, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Hirudin Market Statistics 2025 Analysis By Application (Thrombosis Disease, Tumor Disease), By Type (Natural Hirudin, Recombinant Hirudin), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager