Hispanic Foods Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431895 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Hispanic Foods Market Size

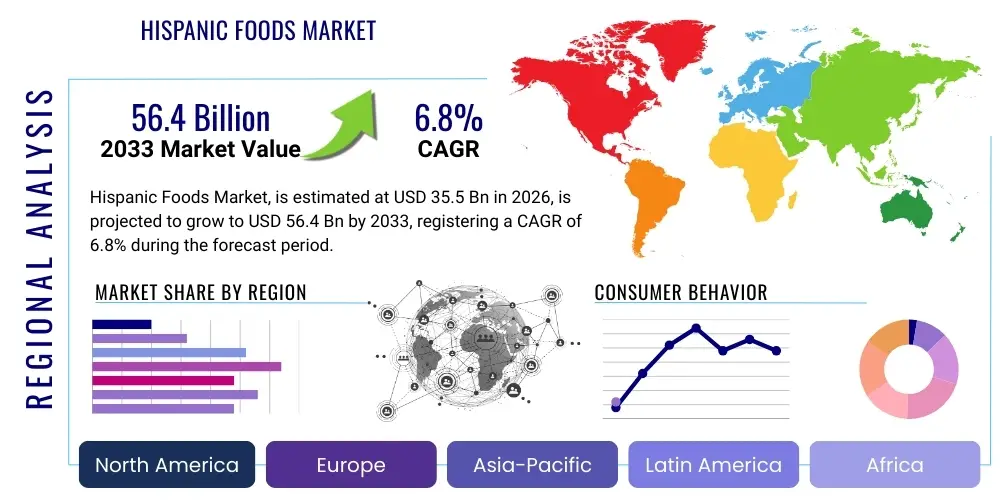

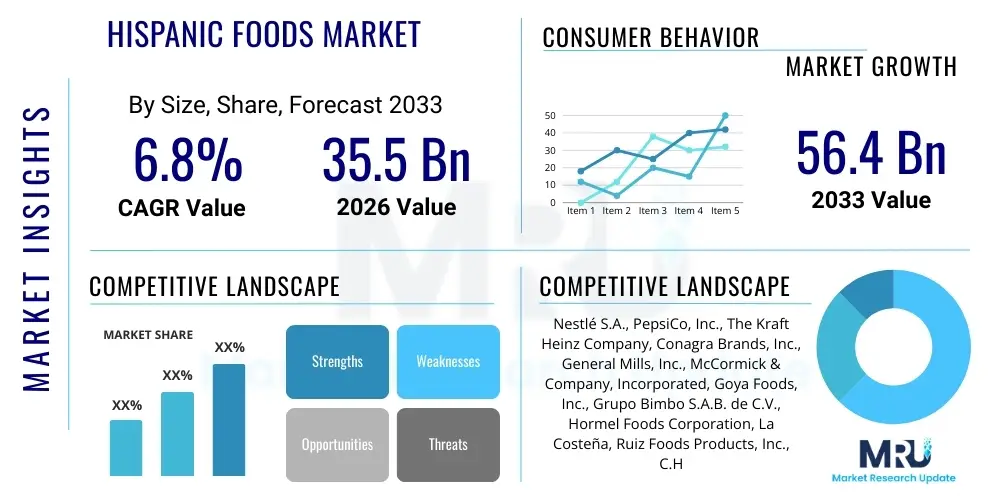

The Hispanic Foods Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 35.5 Billion in 2026 and is projected to reach USD 56.4 Billion by the end of the forecast period in 2033.

Hispanic Foods Market introduction

The Hispanic Foods Market encompasses a diverse range of food products and beverages originating from or heavily influenced by Latin American culinary traditions, including Mexican, Central American, South American, and Caribbean cuisines. These products span staples such as rice, beans, tortillas, ethnic cheeses (like Queso Fresco), spices, sauces (salsa, mole), and prepared meals. The primary applications of these products are found in both retail environments, catering to household consumption, and in the foodservice sector, including restaurants, fast-casual chains, and institutional catering. The increasing cultural integration and the substantial growth of the Hispanic population globally, particularly in North America, are the fundamental demographic drivers fueling this market expansion. Furthermore, non-Hispanic consumers are increasingly adopting these flavorful and versatile ingredients, seeking out authenticity and variety in their daily diets.

The market benefits significantly from its inherent authenticity and perceived health advantages associated with certain traditional preparations, such as plant-based meals utilizing legumes and whole grains. Key driving factors include robust immigration patterns, effective cross-cultural marketing campaigns that normalize ethnic foods, and technological advancements in food processing that enhance the shelf life and convenience of perishable ethnic staples. Products often cater to specific consumer needs, offering gluten-free options (like corn tortillas) or natural, minimally processed ingredients, aligning well with broader trends toward clean labeling and functional foods. The introduction of refrigerated and frozen Hispanic prepared meals has also dramatically boosted market accessibility for busy modern consumers who prioritize convenience without sacrificing flavor or cultural fidelity.

The product portfolio within the Hispanic Foods market is highly dynamic, constantly integrating traditional recipes with modern flavor profiles and preparation methods. This adaptability allows major food manufacturers and smaller, specialized ethnic brands to co-exist and thrive. Growth is particularly strong in categories like ready-to-eat salsas, specialized peppers, and authentic baking mixes, which offer consumers simple ways to recreate complex cultural dishes at home. As global food distribution networks improve, the availability of highly regionalized products—which previously had limited geographic reach—is increasing, further stimulating both consumer interest and competitive intensity within the domestic and international Hispanic food sectors.

Hispanic Foods Market Executive Summary

The Hispanic Foods Market is characterized by robust resilience and consistent expansion, primarily driven by shifting demographic landscapes and the pervasive influence of globalized culinary trends. Business trends emphasize strategic mergers and acquisitions among large food conglomerates targeting established regional Hispanic brands to rapidly acquire market share and distribution channels. There is a noticeable shift towards premiumization within certain segments, where consumers are willing to pay more for organic, locally sourced, or highly authentic imported ingredients, challenging the traditional focus solely on cost-efficiency. Innovation in packaging, particularly flexible and sustainable materials, is also a key competitive factor, addressing consumer demand for environmentally responsible product choices and extended freshness for ingredients like fresh produce and refrigerated doughs.

Regionally, North America, spearheaded by the United States, remains the undisputed epicenter of market demand due to its large and growing Hispanic population base, coupled with high levels of disposable income and significant mainstream adoption of Mexican and Tex-Mex cuisines. However, Europe, specifically Spain, the UK, and Germany, is showing accelerating growth as Latin American immigration increases and major retailers dedicate more shelf space to international food aisles, moving beyond generic "world food" labels to focus on specific regional cuisines. Asia Pacific, while a smaller market share currently, presents substantial future opportunity, driven by increasing global travel exposure and the rising popularity of international cuisine concepts in urban centers.

Segmentation trends highlight the dominance of the Prepared Foods and Ready-to-Eat (RTE) category, which continues to capture time-pressed consumers seeking convenient meal solutions, ranging from frozen burritos to chilled empanadas. Within the core product segment, the demand for specialty ingredients such as unique chile peppers (e.g., Aji Amarillo, Guajillo) and specific regional cheeses is outpacing the growth of more commoditized items like standard yellow corn tortillas, indicating a deeper level of consumer engagement and sophistication in their culinary pursuits. Furthermore, the E-commerce channel is becoming critical for specialized or niche ethnic products, allowing smaller brands to bypass conventional retail hurdles and reach specific, dispersed ethnic communities directly, significantly impacting overall market distribution dynamics.

AI Impact Analysis on Hispanic Foods Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the Hispanic Foods Market center predominantly on themes of supply chain efficiency, personalized marketing targeted at specific Hispanic sub-groups, and enhancing product quality assurance. Users frequently ask how AI can predict regional demand fluctuations for specific ingredients like plantains or specific types of beans, minimizing waste and optimizing inventory management. There is also significant user curiosity regarding how machine learning algorithms can analyze vast datasets of consumer preferences and social media trends to help manufacturers innovate new products, potentially fusion dishes that blend traditional Hispanic flavors with contemporary dietary trends (e.g., keto or vegan versions of classic recipes). Furthermore, questions often arise about using AI-driven vision systems in manufacturing lines to ensure the consistent quality and authenticity of processed foods, verifying ingredient sourcing and preventing contamination while maintaining cultural fidelity.

The application of AI in this culturally rich sector offers substantial operational advantages, moving beyond simple automation to deep, data-driven cultural insights. By employing predictive analytics, companies can forecast localized demand patterns, which vary significantly based on the national origin of local Hispanic communities (e.g., Cuban vs. Puerto Rican vs. Salvadoran). This precision stocking ensures that retailers can maintain optimal inventory levels of culturally relevant products, preventing both stockouts during peak cultural holidays and unnecessary spoilage. Moreover, AI facilitates hyper-segmentation in marketing, allowing brands to deliver tailored content that resonates specifically with the linguistic nuances and regional traditions of distinct demographic groups within the larger Hispanic umbrella, thereby maximizing advertising effectiveness and brand loyalty.

AI's influence also extends into the realm of sustainable sourcing and food safety. AI-powered tracking systems enhance transparency across the agricultural supply chain, verifying the origin and ethical compliance of key imported ingredients, a growing concern for conscious consumers. In the manufacturing environment, sophisticated AI models are used for real-time quality control, monitoring parameters like texture, color, and spice level in batches of sauces or prepared meals, ensuring consistent flavor profiles that meet stringent consumer expectations for authenticity. This technological integration transforms the supply chain from reactive management to proactive, predictive orchestration, significantly reducing costs and enhancing overall consumer trust in ethnic food brands.

- AI-driven Predictive Demand Forecasting: Optimizes inventory for highly regionalized products (e.g., specific masa types, unique chiles) based on localized demographic data and cultural calendar events.

- Hyper-Personalized Marketing Campaigns: Uses machine learning to target distinct Hispanic sub-segments with culturally relevant language, imagery, and product recommendations, maximizing conversion rates.

- Supply Chain Transparency and Traceability: Implements blockchain-linked AI systems to verify the ethical sourcing and authenticity of imported ingredients from Latin American origins.

- Automated Quality Control (QC) in Production: Utilizes computer vision and sensors to monitor and maintain consistent texture, flavor, and appearance in processed foods like salsas, tortillas, and frozen entrees.

- New Product Development Acceleration: Analyzes consumer trends, social media sentiment, and flavor combinations to rapidly prototype and test culturally relevant food innovations (e.g., veganizing traditional recipes).

- Optimized Shelf Space Management: AI tools analyze sales data to recommend optimal shelf placement and planogram configurations for Hispanic food aisles in mainstream grocery stores.

DRO & Impact Forces Of Hispanic Foods Market

The dynamics of the Hispanic Foods Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the impact forces dictating market direction. Key drivers include the exponential growth of the global Hispanic population, which ensures a continuously expanding, loyal consumer base, coupled with the increasing trend of culinary globalization, where non-Hispanic consumers actively seek out authentic ethnic flavors. Opportunities arise from the lack of penetration of authentic, regionalized Hispanic products in European and Asian markets, offering substantial greenfield expansion potential. However, the market faces significant restraints, primarily stemming from challenges in maintaining consistent ingredient quality across complex international supply chains and managing the high import duties and logistical costs associated with specialized agricultural products, which can limit competitive pricing.

The primary driving force remains demographic change, particularly the spending power of the second and third generations of Hispanic immigrants who simultaneously demand convenience and cultural authenticity in their food choices. This dual demand pushes manufacturers to invest in both traditional production methods and modern packaging technology. The opportunity landscape is further broadened by the growing demand for healthier, plant-based alternatives, allowing brands to reposition traditional staples like beans and corn products as naturally healthy superfoods. Brands leveraging sustainable sourcing practices and offering transparent ingredient traceability gain a competitive edge, responding to an overall increase in conscious consumerism that transcends ethnic lines.

Restraints, particularly those related to intellectual property and cultural appropriation, also influence market conduct; authentic brands must navigate a landscape where flavor profiles are easily copied, necessitating continuous innovation. Furthermore, the perishable nature of many fresh Hispanic ingredients (e.g., specialized produce, dairy products) poses significant logistical hurdles, requiring investment in refrigerated or modified atmosphere packaging technology. The overall impact forces favor continued, strong expansion, provided manufacturers successfully navigate supply chain complexities and capitalize on digital distribution channels (e-commerce) to overcome traditional retail space constraints for niche products, thereby securing long-term dominance in the global ethnic food sector.

Segmentation Analysis

The Hispanic Foods Market is broadly segmented based on Product Type, Distribution Channel, and Geographic Region, reflecting the diverse origins and consumption patterns inherent to this category. Product segmentation is crucial as it differentiates core ingredients (e.g., rice, beans, tortillas, spices) from processed items (e.g., prepared meals, sauces, canned goods). Analyzing these segments helps in understanding consumer migration patterns, such as the shift from buying raw ingredients to purchasing value-added, convenient forms of the same staple items. The dominance of certain product types, like Mexican cuisine components, often overshadows smaller, yet rapidly growing, sub-segments such as specific Caribbean or South American staples.

Distribution channel analysis reveals the market's heavy reliance on supermarkets and hypermarkets, which dedicate significant space to ethnic aisles, particularly in areas with high Hispanic concentration. However, the rapidly expanding role of specialty ethnic stores and online platforms cannot be overstated; these channels are vital for providing the deep regional authenticity and niche products that mainstream retailers often overlook. Understanding the balance between mass-market retail and specialized distribution is essential for market penetration strategies, especially for new entrants focusing on highly specific regional products that require targeted outreach.

Overall, segmentation serves as a roadmap for investment, highlighting categories with the highest growth potential, such as frozen and refrigerated ready-to-eat meals which cater to busy lifestyles, and functional Hispanic beverages, which blend traditional ingredients with modern wellness trends. Successful market strategies must employ a granular approach, recognizing that the "Hispanic consumer" is not monolithic and demands specific product offerings based on national origin, regional culinary traditions, and evolving dietary preferences, such as veganism or keto adherence. This detailed segmentation ensures effective inventory management and precise marketing resource allocation.

- By Product Type:

- Staple Foods (Rice, Beans, Corn/Masa Products)

- Spices and Seasonings

- Sauces and Condiments (Salsa, Mole, Adobo)

- Dairy Products (Queso Fresco, Crema)

- Prepared/Processed Foods (Frozen Meals, Canned Goods, Ready-to-Eat)

- Beverages (Aguas Frescas, Horchata, Nectars)

- By Cuisine Type:

- Mexican

- Tex-Mex

- Caribbean (Cuban, Puerto Rican, Dominican)

- Central American

- South American (Peruvian, Colombian, Argentinian)

- By Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty/Ethnic Stores

- Online Retail (E-commerce)

- Foodservice (Restaurants, Cafeterias)

- By Geography:

- North America (U.S., Canada, Mexico)

- Europe (Spain, UK, Germany)

- Asia Pacific

- Latin America (Excluding Mexico)

- Middle East and Africa (MEA)

Value Chain Analysis For Hispanic Foods Market

The value chain for the Hispanic Foods Market begins significantly upstream with raw material sourcing, often involving complex agricultural supply chains spanning multiple Latin American nations for key, specialized ingredients like specific chile peppers, high-quality coffee beans, and authentic varieties of corn and beans. This upstream analysis focuses heavily on ethical sourcing, sustainability certifications, and maintaining strict quality control over imported perishable goods, which often dictates the final cost and authenticity of the product. Manufacturers must establish strong, transparent relationships with local farmers and co-operatives to ensure a consistent supply of culturally specific ingredients that meet international food safety standards. The subsequent processing and manufacturing stage involves specialized equipment for tasks like masa production, high-volume salsa creation, and ethnic cheese production, often requiring significant capital investment to achieve necessary economies of scale while preserving traditional flavor profiles.

The midstream segment involves packaging and branding, where innovation is focused on preserving freshness for long-distance transport and utilizing culturally appealing visual elements. Distribution forms the critical downstream component, which is bifurcated into direct and indirect channels. Direct distribution includes manufacturers selling directly to large foodservice clients or through proprietary brand stores/e-commerce platforms. Indirect distribution, which dominates the market, involves utilizing third-party logistics providers (3PLs) and wholesalers specializing in ethnic foods to reach retail outlets. These wholesalers often play a crucial role in aggregating niche products and managing the complexities of temperature-controlled logistics for refrigerated and frozen items destined for supermarkets and smaller bodegas.

The distribution channel, spanning from large-scale supermarkets and hypermarkets to specialized ethnic grocers, is fundamentally important for market penetration. While mainstream retailers provide high volume sales for ubiquitous items like tortillas and standardized salsas, specialty stores are the crucial gatekeepers for highly regional and authentic products, often serving specific ethnic enclaves. E-commerce acts as a disruptive channel, allowing brands to overcome geographical barriers and reach dispersed consumers seeking rare or imported ingredients, bypassing traditional retail intermediaries. Effective management of this value chain requires deep logistical expertise, robust cold chain management capabilities, and strategic partnership alignment across all stages, ensuring authenticity is maintained from farm to consumer plate while optimizing cost efficiency.

Hispanic Foods Market Potential Customers

The potential customer base for the Hispanic Foods Market is highly stratified but can be broadly categorized into three primary segments: the core Hispanic population, the growing segment of non-Hispanic consumers seeking culinary exploration, and the global foodservice industry. The core end-user consists of individuals of Latin American descent, particularly those who maintain strong cultural ties to traditional foods and preparation methods. This segment acts as the foundational demand driver, requiring authenticity, quality, and a diverse range of products specific to their national origin (e.g., Mexican, Salvadoran, Peruvian). Manufacturers must cater to both first-generation immigrants who demand highly traditional flavors and subsequent generations who seek convenient, modern interpretations of those classics.

The second major segment, non-Hispanic consumers (often referred to as 'culinary tourists' or 'food explorers'), represents the highest growth opportunity. These buyers are motivated by flavor novelty, culinary versatility, and the perceived health benefits of ingredients like beans, corn, and specific vegetables. Their purchases often center around easily adaptable items such as specialty salsas, seasonings, ready-to-eat taco kits, and frozen entrees, representing the "mainstreaming" of Hispanic cuisine. Marketing efforts aimed at this group focus on ease of use, recipe integration, and highlighting the inherent flavor depth and complexity of the food.

Finally, the Foodservice/Institutional buyers—including restaurants (from small taquerias to major fast-casual chains), schools, and corporate cafeterias—constitute a massive business-to-business (B2B) market. These customers require bulk packaging, consistent quality, and reliable supply chains for staple products like pre-cut meats, high-volume sauces, standardized tortillas, and foodservice-grade cheeses. Their purchasing decisions are primarily influenced by cost-effectiveness, scalability, and adherence to rigorous food safety standards. Catering effectively to this diverse range of end-users necessitates highly customized product formats and distribution strategies tailored to specific buyer requirements.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 35.5 Billion |

| Market Forecast in 2033 | USD 56.4 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nestlé S.A., PepsiCo, Inc., The Kraft Heinz Company, Conagra Brands, Inc., General Mills, Inc., McCormick & Company, Incorporated, Goya Foods, Inc., Grupo Bimbo S.A.B. de C.V., Hormel Foods Corporation, La Costeña, Ruiz Foods Products, Inc., C.H. Guenther & Son LLC, Cacique, Inc., Del Monte Foods, Inc., Mission Foods (Gruma S.A.B. de C.V.), Frito-Lay (PepsiCo), Herdez Group, Iberia Foods Corp., El Monterey (Ruiz Foods), Sabor Latino Foods. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hispanic Foods Market Key Technology Landscape

The technological landscape in the Hispanic Foods Market is primarily focused on enhancing product authenticity, extending shelf life, and ensuring food safety across international supply chains. Crucial technologies include advanced Modified Atmosphere Packaging (MAP) and aseptic processing techniques, particularly vital for perishable items like fresh tortillas, specialty cheeses (queso fresco), and refrigerated ready-to-eat meals, allowing them to maintain quality and flavor consistency during long-haul distribution. Furthermore, sophisticated thermal processing and flash-freezing technologies are increasingly employed for frozen tamales, burritos, and other prepared entrees, minimizing nutritional degradation while meeting consumer demand for high-quality, convenient meal solutions. Investment in high-speed, automated production lines, specifically tailored for traditional processes like masa sheeting and ingredient mixing, allows manufacturers to achieve economies of scale without sacrificing the textural or structural integrity of culturally sensitive products.

Beyond manufacturing, digital technologies are fundamentally transforming market interaction and supply chain visibility. The adoption of robust Enterprise Resource Planning (ERP) systems is critical for managing the complexities associated with sourcing raw materials from diverse international locations, tracking multiple customs requirements, and ensuring compliance with varied local food regulations. Furthermore, the integration of sensors and Internet of Things (IoT) devices throughout the cold chain provides real-time monitoring of temperature and humidity conditions for sensitive ingredients like imported tropical produce or seafood used in ceviche kits. This proactive monitoring drastically reduces spoilage rates and enhances overall supply chain reliability, a major competitive differentiator in the ethnic foods sector.

The future technology landscape is heavily invested in consumer-facing digital tools and flavor replication science. Advanced data analytics and Artificial Intelligence (AI) are being used to analyze consumer sensory feedback and optimize recipes for maximum market appeal, allowing manufacturers to fine-tune spice levels, texture, and ingredient ratios based on regional preferences. Additionally, leveraging e-commerce platforms requires robust logistics software optimized for direct-to-consumer (DTC) delivery of specialized ingredients that might not be available in local stores. These technologies collectively enable the market to scale authentic traditional food production efficiently while catering precisely to the nuanced tastes of a globally dispersed consumer base.

Regional Highlights

The Hispanic Foods Market exhibits pronounced regional variations in consumption, production, and culinary preferences, making geographical segmentation essential for effective market strategy. North America, especially the United States, represents the largest and most dynamic market, driven by its expansive and culturally diverse Hispanic population. This region is characterized by high consumption rates of Tex-Mex and mainstream Mexican products, coupled with accelerating demand for specific Central American and Caribbean foods in localized metropolitan areas like New York, Miami, and Los Angeles. Market penetration here is high, but competition is fierce, compelling brands to focus on innovation, health-conscious alternatives, and premiumization to capture market share. Canada also contributes significant growth, following similar demographic trends, though on a smaller scale, favoring easy-to-prepare meal kits and staple ingredients.

Europe stands out as the fastest-growing region outside of North America. Spain, due to historical and cultural ties, acts as a primary entry point, but the UK, France, and Germany are rapidly expanding their consumption, fueled by increasing Latin American migration and the overall growth of global cuisine in mainstream retail. The European demand leans toward authentic, imported ingredients for home cooking, as well as the popularity of Latin American street food concepts in urban centers. European regulatory complexities regarding food additives and ingredient sourcing, however, necessitate specialized compliance strategies for exporting companies. Latin America, while the source of these culinary traditions, is analyzed separately (excluding Mexico, often grouped with North America for trade purposes) and primarily serves as a production hub, though domestic consumption patterns often involve highly localized, fresh, and often non-packaged food items, making the packaged goods market less dominant than in developed regions.

The Asia Pacific (APAC) region offers long-term, high-potential growth, albeit from a lower base. Market expansion is driven by globalized urban consumers, high discretionary spending in countries like Japan and South Korea, and the rise of international dining trends. Consumption here often involves premium, imported packaged goods, and the expansion of international restaurant chains featuring Mexican or Peruvian cuisine. The Middle East and Africa (MEA) remain smaller markets, largely reliant on expatriate populations and high-end niche retail, but offer opportunities for high-margin, specialized product sales focusing on gourmet and premium positioning. Overall, successful regional strategy requires recognizing and adapting to the specific cultural and logistical constraints inherent in each geographic market.

- North America: Dominant market share due to large Hispanic population, high purchasing power, and extensive mainstream adoption of Mexican and Tex-Mex cuisines. Focus on convenience, health, and premium packaged goods.

- Europe: Fastest growth trajectory, driven by immigration and increasing culinary openness. Key markets include Spain, UK, and Germany, focusing on authentic imported staples and specialty sauces.

- Asia Pacific (APAC): Emerging high-potential market characterized by urban centers adopting international culinary trends. Demand focuses on premium, high-quality imported items and foodservice applications.

- Latin America (Excluding Mexico): Primarily a production and sourcing region. Domestic markets emphasize fresh, traditional, and less-packaged staples, with growing adoption of local branded processed goods.

- Middle East and Africa (MEA): Niche market, driven primarily by expatriate communities and high-end retail sectors, demanding specialized and sometimes Halal-certified ethnic products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hispanic Foods Market.- Nestlé S.A.

- PepsiCo, Inc.

- The Kraft Heinz Company

- Conagra Brands, Inc.

- General Mills, Inc.

- McCormick & Company, Incorporated

- Goya Foods, Inc.

- Grupo Bimbo S.A.B. de C.V.

- Hormel Foods Corporation

- La Costeña

- Ruiz Foods Products, Inc.

- C.H. Guenther & Son LLC

- Cacique, Inc.

- Del Monte Foods, Inc.

- Mission Foods (Gruma S.A.B. de C.V.)

- Frito-Lay (PepsiCo)

- Herdez Group

- Iberia Foods Corp.

- El Monterey (Ruiz Foods)

- Sabor Latino Foods

Frequently Asked Questions

What is driving the growth of the Hispanic Foods Market in North America?

Growth is fundamentally driven by the significant demographic expansion and increasing purchasing power of the Hispanic population. Additionally, widespread cultural adoption of Mexican and Latin American flavors by non-Hispanic consumers, seeking convenient and exciting culinary variety, substantially fuels demand across staple and prepared food categories.

How do manufacturers ensure the authenticity of Hispanic foods for a diverse consumer base?

Authenticity is maintained through meticulous sourcing of specialized, traditional ingredients directly from Latin American regions and employing traditional preparation techniques integrated with modern manufacturing processes. Quality control focuses heavily on sensory attributes like flavor profiles and textures that resonate with regional cultural expectations.

Which product segment holds the largest share of the Hispanic Foods Market?

The Prepared and Processed Foods segment, encompassing items like frozen entrees, canned beans, and ready-to-eat salsas, currently holds the largest market share. This dominance is attributed to the growing consumer preference for convenience and time-saving meal solutions suitable for modern, fast-paced lifestyles.

What role does e-commerce play in the distribution of Hispanic foods?

E-commerce is increasingly vital, especially for niche and specialty products that are difficult to stock in conventional supermarkets. Online platforms allow smaller, specialized ethnic brands to bypass traditional retail limitations, connecting directly with dispersed ethnic communities seeking highly specific or regionalized imported ingredients.

What are the primary logistical challenges facing the Hispanic Foods supply chain?

Key challenges include managing the complex international sourcing of agricultural products, dealing with high import tariffs, and maintaining robust cold chain integrity for perishable items like fresh dairy, produce, and refrigerated doughs across extensive distribution networks to prevent spoilage and ensure freshness.

How is sustainability impacting product development in the Hispanic Foods sector?

Sustainability is influencing development by prioritizing ethical sourcing of ingredients like coffee and cacao, reducing reliance on artificial additives, and improving packaging recyclability. Consumers increasingly prefer brands that offer transparency regarding the origin and environmental impact of their Latin American-sourced raw materials.

What competitive advantage do specialized Hispanic food retailers offer over major supermarkets?

Specialized retailers offer a competitive edge through deeper inventory breadth, focusing on highly regionalized and authentic imported products (e.g., specific masa flours, unique chile varieties) that mass-market supermarkets often cannot justify stocking, catering effectively to specific cultural consumer needs.

Are plant-based alternatives a growing trend within the market?

Yes, the market is seeing a strong trend toward plant-based alternatives. Many traditional Hispanic staples, such as beans, rice, and corn products, are naturally plant-based, allowing manufacturers to easily introduce vegan and vegetarian ready-to-eat meals, capitalizing on global health and dietary movements.

Which technological application is most critical for quality control in large-scale production?

Advanced sensor technology and AI-driven computer vision systems are critical for real-time quality control. These technologies monitor consistency in texture, color, and ingredient distribution for products like sauces and tortillas, ensuring high standards of uniformity across massive production batches.

How does the definition of 'Hispanic food' vary regionally?

The definition varies significantly; in the US, it is often dominated by Mexican and Tex-Mex cuisines. Conversely, in the US Southeast, Caribbean and Cuban influences are stronger, while certain parts of Europe might feature more South American (Peruvian or Argentinian) product lines due to varied migratory patterns and historical ties.

What is the projected growth trajectory for the Hispanic dairy segment?

The Hispanic dairy segment, focused on products like Queso Fresco, Cotija, and Crema, is projected for substantial growth, driven by increasing demand for authentic and artisanal cheeses. Innovation in packaging to extend the limited shelf life of these fresh products is a key factor enabling wider distribution.

How are changing demographics, specifically second and third-generation consumers, affecting product innovation?

Second and third-generation consumers seek a blend of convenience and cultural nostalgia. This drives innovation towards hybrid products, such as fusion foods or traditional recipes presented in highly convenient, modern formats like microwavable pouches or frozen, single-serving meals, preserving flavor while minimizing preparation time.

What impact do macroeconomic factors, such as inflation, have on the market?

Inflation significantly impacts the market by increasing the cost of key imported staples, which can lead to price sensitivity among consumers. Companies mitigate this by optimizing supply chain efficiencies or focusing on value-added products that justify higher price points through convenience and premium ingredients.

Beyond food, what related product categories are seeing growth?

Growth is strong in related categories such as specialized non-alcoholic Hispanic beverages (including ready-to-drink Aguas Frescas and pre-mixed Horchata) and authentic Latin American confectionery items, driven by consumer exploration and the desire for cultural beverage experiences.

What is the importance of language and cultural nuance in marketing Hispanic food products?

Language and cultural nuance are critical for building brand loyalty. Marketing must resonate authentically with specific sub-groups (e.g., using regional Spanish dialects or incorporating relevant cultural holidays) to demonstrate genuine understanding and respect for diverse heritage, moving beyond generic Latin American branding.

How does the foodservice sector influence overall market demand?

The foodservice sector significantly influences demand by driving bulk purchases of staple ingredients (tortillas, rice, beans, specialty meats) and popularizing new flavors. Restaurant popularity often introduces non-Hispanic consumers to specific ingredients, subsequently driving retail demand for those items for home consumption.

What regulatory challenges exist for imported Hispanic foods?

Imported Hispanic foods face challenges related to varied national food safety standards, labeling requirements (including allergen declarations and nutritional information that must comply with local laws), and complex customs procedures, particularly concerning fresh or minimally processed ingredients.

In which European countries is the demand for authentic Mexican food strongest?

In Europe, the strongest demand for authentic Mexican food is observed in the United Kingdom and Spain. Spain benefits from cultural proximity, while the UK's diverse major cities drive high demand for both packaged goods and specialized Mexican restaurants and street food vendors.

How is the packaging technology evolving to support the market?

Packaging technology is evolving towards sustainable and functional materials, including fully recyclable flexible pouches and biodegradable options for refrigerated items. MAP technology is crucial for extending the shelf life of highly perishable foods like fresh cheeses and tortillas, minimizing food waste.

What is the definition of "Tex-Mex" within the context of the global Hispanic Foods Market?

Tex-Mex represents a distinct culinary fusion developed in Texas, combining traditional Mexican components with Americanized ingredients and preparation methods (e.g., heavy use of yellow cheese, beef, and wheat flour). While popular, it is often segmented separately from traditional, regional Mexican cuisine within market analysis due to its unique flavor profile.

How are ethical sourcing requirements impacting raw material procurement?

Ethical sourcing is becoming mandatory, compelling manufacturers to invest in auditing and certification programs (like Fair Trade) for high-value raw materials such as coffee, cacao, and specialized herbs. This ensures that the supply chain aligns with corporate social responsibility mandates and consumer expectations regarding labor practices and environmental stewardship.

What is the significance of the shift from dry goods to refrigerated/frozen categories?

The shift signifies increasing consumer prioritization of convenience. While dry goods remain staples, the expansion of refrigerated and frozen Hispanic foods (like prepared tamales, pupusas, or fresh masa) offers consumers high-quality, time-saving options that maintain a better texture and flavor profile than many canned alternatives.

Which Latin American cuisine types show the highest potential for future mainstreaming?

Peruvian and Colombian cuisines show exceptionally high potential for mainstreaming globally. Peruvian cuisine, recognized internationally for its fusion techniques and unique ingredients (e.g., aji peppers, ceviche), is already gaining significant traction in metropolitan foodservice sectors across North America and Europe.

How does AI contribute to reducing waste in the Hispanic Foods Market supply chain?

AI reduces waste by providing highly accurate, real-time demand forecasts localized to specific retail locations. This precision stocking minimizes over-ordering of highly perishable products, such as fresh produce or refrigerated dairy, thereby lowering inventory write-offs and optimizing fresh product availability.

What investment trends are observed among major non-ethnic food conglomerates?

Major non-ethnic food conglomerates are increasingly focused on acquiring or establishing strategic partnerships with well-known, authentic Hispanic food brands. This strategy allows them to quickly enter the high-growth ethnic segment, leverage established distribution networks, and diversify their product portfolios.

What is the role of food tourism in shaping consumer preferences for Hispanic foods?

Food tourism plays a significant role by exposing consumers to authentic regional flavors and dishes they seek to recreate at home. This exposure drives demand for specific, often obscure, ingredients or pre-mixed spice blends that mimic the complex tastes experienced during international travel.

How are food safety standards being enforced across highly decentralized supply chains?

Enforcement relies on establishing mandatory third-party audits (e.g., GFSI certifications), implementing advanced traceability systems (sometimes blockchain-enabled) to track origin, and rigorously monitoring cold chain logistics from the point of harvest to the manufacturing facility.

What is the market expectation for specialty sauces and marinades?

Specialty sauces and marinades, particularly those offering regional authenticity (e.g., distinct moles, recados, or specific chili pastes), are expected to outperform commoditized sauces. Consumers value high flavor intensity and the convenience of using ready-made authentic bases for complex traditional dishes.

How does the seasonality of certain Latin American ingredients affect production scheduling?

Seasonality mandates sophisticated inventory management and long-term procurement planning. Manufacturers must rely on advanced dehydration, freezing, or canning techniques during peak harvest times to ensure a consistent year-round supply of seasonal staples like specific tropical fruits or peppers.

What is the biggest challenge for new, small ethnic brands entering mainstream retail?

The biggest challenge for new, small ethnic brands is securing limited shelf space in major supermarkets. This typically requires substantial marketing investment, competitive pricing, and demonstrating reliable, scalable supply chain logistics that can meet the high volume demands of large retail chains.

What specific packaging innovation is crucial for fresh tortillas?

For fresh tortillas, the most critical packaging innovation involves high-barrier films combined with Modified Atmosphere Packaging (MAP) technology. This system limits oxygen exposure, significantly inhibiting mold growth and extending the product's natural shelf life without reliance on harsh chemical preservatives.

How are traditional Hispanic baking products adapting to modern demands?

Traditional baking products are adapting by offering smaller portion sizes, integrating whole grains, reducing sugar content, and offering gluten-free alternatives using ingredients like specialized corn flours or cassava, thereby aligning classic flavors with contemporary dietary wellness trends.

What is the relative market position of Hispanic non-alcoholic beverages?

Hispanic non-alcoholic beverages, including fruit nectars and specialty waters (like sparkling flavored mineral water), occupy a high-growth niche. They are often positioned as healthier, more natural alternatives to traditional sodas, capitalizing on the appeal of exotic fruit flavors like guava, mango, and passionfruit.

How does the market differentiate between 'Mexican' and 'Tex-Mex' products for consumers?

Differentiation is achieved primarily through branding and ingredient labeling. Authentic Mexican products emphasize traditional ingredients and regional preparation methods, often using non-processed or heritage ingredients, whereas Tex-Mex products are generally marketed emphasizing speed, convenience, and a more generalized, familiar Americanized flavor profile.

What regional differences exist in pricing strategies across the North American market?

Pricing strategies in North America are typically higher on the coasts (e.g., California, New York) due to higher operational and logistics costs and greater demand for imported goods. In contrast, in the border states and certain parts of the Midwest, higher market saturation and local competition often necessitate more competitive, value-oriented pricing.

How are technological advancements in farming (AgriTech) impacting the raw material quality?

AgriTech impacts quality by utilizing precision farming techniques, including sensor networks and climate-controlled greenhouses, to optimize the yield and flavor profile of specialized ingredients like specific chile peppers or tropical produce, ensuring superior raw material consistency regardless of weather variables.

What is the significance of the "clean label" trend for Hispanic food manufacturers?

The clean label trend is highly significant, pushing manufacturers to reduce artificial colors, flavors, and preservatives. Consumers increasingly value transparency, preferring products that list simple, recognizable ingredients, often aligning naturally with traditional, minimally processed Hispanic staples.

In the Foodservice segment, what are the primary demands from chain restaurants?

Chain restaurants demand consistency, scalability, and labor-saving pre-prepared ingredients. This includes bulk-packaged, standardized sauces, pre-cooked proteins, and uniformly sized tortillas or dough portions to ensure rapid and identical product delivery across hundreds of locations.

What is the market outlook for Latin American coffee and chocolate products?

The outlook is highly positive, especially in the specialty and gourmet segments. Demand is driven by consumer focus on single-origin beans, sustainable sourcing, and complex flavor profiles, positioning these traditional products as premium items in global food and beverage markets.

How do cultural holidays and traditions influence short-term sales spikes?

Cultural holidays such as Cinco de Mayo, Dia de Muertos, and Christmas significantly influence short-term sales spikes for specific, traditional products (e.g., large-scale masa sales for tamales, specialty spices, and certain holiday-specific baked goods). Retailers must strategically overstock these items in the weeks leading up to the events.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager