HIT Battery Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436055 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

HIT Battery Market Size

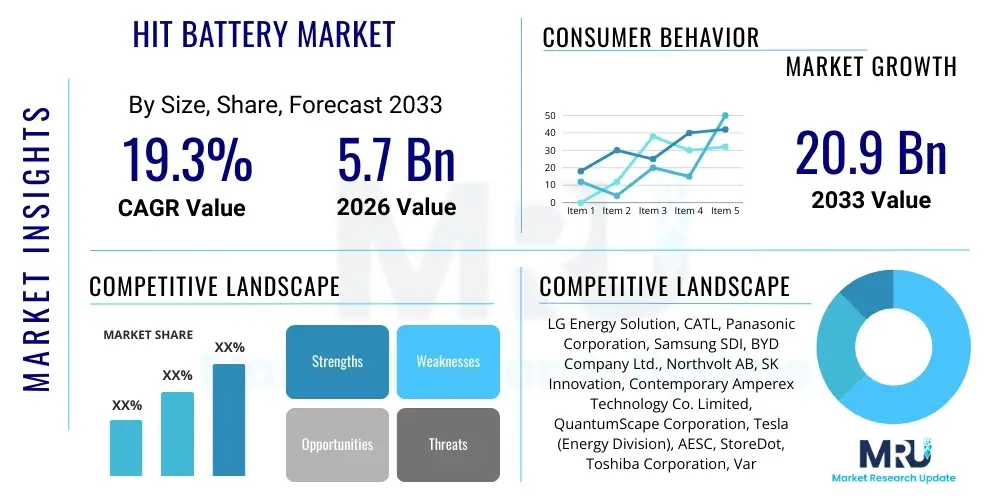

The HIT Battery Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 19.3% between 2026 and 2033. The market is estimated at USD 5.7 Billion in 2026 and is projected to reach USD 20.9 Billion by the end of the forecast period in 2033.

HIT Battery Market introduction

The High Integration Technology (HIT) Battery Market encompasses advanced energy storage solutions characterized by high energy density, superior thermal management capabilities, and deeply integrated battery management systems (BMS). These batteries move beyond traditional cell-level integration to incorporate sophisticated module and pack designs that maximize volumetric and gravimetric efficiency while ensuring stringent safety standards. The primary product offering involves modular lithium-ion architectures optimized for rapid charging and extended cycle life, often utilizing advanced cathode materials such as NMC 811 or solid-state electrolytes in developmental phases. This technological convergence addresses the critical demand for reliable, powerful, and compact power sources across various high-stakes applications.

Major applications of HIT batteries are predominantly concentrated in the electric mobility sector, including high-performance passenger electric vehicles (EVs), commercial electric fleets, and heavy-duty electric trucks, where weight reduction and range extension are paramount. Furthermore, the robust architecture of HIT batteries makes them ideal for grid-scale energy storage systems (ESS) requiring high throughput and long-duration cycling capabilities to stabilize renewable energy integration. Key benefits include significantly enhanced safety through integrated thermal runaway suppression, increased energy throughput per unit volume, and reduced overall system complexity due to streamlined integration processes, translating directly into lower total ownership costs for end-users.

The market is fundamentally driven by global mandates pushing for decarbonization, particularly the accelerated adoption of electric vehicles coupled with governmental incentives supporting charging infrastructure development. Concurrent technological advancements in material science, especially in anode and cathode composition, are continually improving battery performance metrics, thereby expanding the applicability and appeal of HIT solutions. Rapid industrial scaling of production facilities by major Asian and European manufacturers, coupled with aggressive R&D investments aimed at achieving solid-state breakthroughs, further solidify the market's explosive growth trajectory, positioning HIT batteries as a cornerstone technology for the 21st-century energy transition.

HIT Battery Market Executive Summary

The HIT Battery Market is experiencing rapid expansion, fueled by unprecedented demand from the electric vehicle sector and critical investment in grid modernization efforts globally. Business trends indicate a strong move toward vertical integration among key players, securing raw material supply chains (specifically lithium, cobalt, and nickel) and enhancing control over manufacturing quality and costs. Strategic partnerships between established automotive OEMs and dedicated battery manufacturers are accelerating the pace of technology deployment and standardization, pushing innovative thermal management systems and intelligent BMS solutions to the forefront. Furthermore, mergers and acquisitions targeting niche technology providers specializing in silicon anodes or solid-state elements highlight the industry's focus on future-proofing energy density and cycle life improvements, driving competitive differentiation in a rapidly consolidating market landscape.

Regionally, Asia Pacific maintains market dominance due to high manufacturing capacity and early adoption rates in China and South Korea, coupled with significant governmental support for large-scale ESS projects. North America and Europe are witnessing the fastest growth rates, driven by stringent emission regulations, ambitious EV mandates, and substantial public and private investments under initiatives focused on domestic battery production security. Segment trends reveal that the Electric Vehicle segment retains the largest market share, specifically the high-performance EV sub-segment which leverages the integration benefits of HIT solutions. However, the Stationary Energy Storage segment is projected to exhibit the highest CAGR, reflecting the essential role these high-integrity batteries play in buffering intermittent renewable power sources and ensuring grid reliability, necessitating robust, long-duration solutions.

In summary, the HIT Battery Market outlook remains highly positive, characterized by technological convergence, escalating production volumes, and strong regulatory tailwinds. While raw material volatility presents a short-term challenge, continuous innovation in battery chemistry and pack design, coupled with robust infrastructure development, ensures sustained market expansion. Stakeholders must prioritize supply chain resilience and investment in advanced manufacturing techniques to capitalize on the rapidly evolving requirements of the mobility and stationary storage industries, ensuring that integrated safety and efficiency remain the central pillars of product development.

AI Impact Analysis on HIT Battery Market

Common user questions regarding AI's influence on the HIT Battery market primarily revolve around three core themes: How AI enhances battery life and safety through predictive maintenance; what role machine learning plays in optimizing complex manufacturing processes; and the potential for AI-driven materials discovery to accelerate next-generation battery development. Users are specifically concerned with real-time diagnostics, performance degradation prediction, and automated quality control during production. The consensus expectation is that AI will transition HIT batteries from reactive management systems to highly proactive, self-optimizing energy storage units, significantly extending lifespan and ensuring thermal stability under extreme operational conditions, thereby mitigating primary consumer concerns regarding safety and longevity in high-energy-density packs.

AI's integration offers substantial operational benefits, particularly in managing the complexity inherent in High Integration Technology batteries. Sophisticated machine learning algorithms analyze vast streams of operational data—including temperature, voltage flux, charging patterns, and environmental conditions—to construct highly accurate State-of-Health (SOH) and State-of-Charge (SOC) models. These models enable intelligent charging and discharging protocols that minimize internal stress and degradation, maximizing the battery's lifespan beyond current conventional limits. Furthermore, AI facilitates advanced thermal management by predicting localized hotspots before they become critical, allowing the BMS to deploy active cooling strategies precisely and preemptively, drastically improving safety margins and preventing thermal runaway incidents critical for high-density applications like EVs.

In the manufacturing domain, AI-driven quality control and process optimization are revolutionizing HIT battery production efficiency. Computer vision systems combined with neural networks are used for high-speed, non-destructive inspection of electrodes, separators, and internal assembly integrity, identifying micro-defects invisible to human operators, thereby increasing yield and consistency. Concurrently, Generative AI and simulation tools are dramatically shortening the R&D cycle for new battery materials. AI can rapidly screen millions of theoretical chemical combinations and material structures, predicting performance characteristics like stability and conductivity, directing material scientists toward the most promising candidates for future solid-state or high-capacity anode development, ultimately accelerating the arrival of even higher energy density HIT battery generations.

- AI-Enhanced BMS: Utilizes deep learning to predict cell degradation and optimize charge/discharge cycles, extending battery lifespan (SOH and SOC prediction).

- Predictive Thermal Management: Machine learning models forecast thermal stress and activate cooling systems preemptively, substantially improving safety and preventing thermal runaway.

- Manufacturing Quality Control: Deploys computer vision and AI analytics for real-time, non-destructive inspection of internal components, increasing manufacturing yield and consistency.

- Raw Material Optimization: AI algorithms analyze electrode material consistency and purity, ensuring high-quality input for high-performance cell production.

- Accelerated R&D: Generative AI tools simulate novel battery chemistries and material structures, drastically speeding up the discovery and testing phase for next-generation HIT solutions.

DRO & Impact Forces Of HIT Battery Market

The dynamics of the HIT Battery Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities, which collectively constitute the primary impact forces. Market growth is overwhelmingly driven by the global imperative to transition toward sustainable energy and mobility, underpinned by aggressive EV adoption targets and significant investment in renewable energy infrastructure requiring robust grid storage. Opportunities arise from technological leaps, specifically the commercialization of solid-state technologies and silicon anode integration, promising breakthroughs in energy density that further enhance product appeal. Conversely, the market faces significant restraints, primarily stemming from high raw material price volatility, particularly for lithium and cobalt, and the complex logistical challenge of establishing globally resilient and ethical battery supply chains, alongside regulatory hurdles related to end-of-life recycling mandates for these complex integrated packs.

Primary drivers include supportive government policies, such as production tax credits and stricter vehicle emission standards, coupled with strong consumer acceptance driven by improving EV performance metrics like range and charging speed, which HIT batteries specifically address. The push for renewable energy storage necessitates highly efficient and durable batteries capable of managing rapid cycling and long-duration storage, a core capability of integrated HIT systems. Restraints are largely supply-side issues, including geographical concentration of mining and processing capabilities for critical minerals, leading to geopolitical risks and supply bottlenecks. Furthermore, the capital intensity required to build giga-factories capable of producing HIT batteries at scale acts as a barrier to entry for smaller players, leading to market consolidation and intense competitive pressure among the dominant manufacturers.

Opportunities are centered around innovation and market diversification. The development of advanced recycling technologies (closed-loop systems) offers a crucial opportunity to mitigate raw material supply risks and improve the sustainability profile of HIT batteries, potentially unlocking significant secondary markets. Geographic expansion into emerging markets, where electrification is gaining traction, provides substantial scope for deployment. Impact forces are overwhelmingly positive, driven by the exponential growth in both mobility and stationary storage sectors, pushing continuous technological enhancement and scaling of manufacturing processes, ensuring that innovation in battery integration remains a core competitive factor determining future market leadership.

Segmentation Analysis

The HIT Battery market is segmented based on critical factors including product type, application, and capacity. Segmentation by product type typically focuses on the cathode chemistry utilized, such as Lithium Nickel Manganese Cobalt Oxide (NMC), Lithium Iron Phosphate (LFP), and emerging Solid-State Batteries (SSB), reflecting varying performance characteristics, cost structures, and safety profiles critical for different applications. The application segmentation delineates the major end-use sectors, predominantly Electric Vehicles (EVs), encompassing passenger, commercial, and two-wheeler segments, and Stationary Energy Storage Systems (ESS), including utility-scale grid storage and commercial/industrial backups. Capacity segmentation helps differentiate between low-capacity batteries used in light mobility and high-capacity units designed for grid stabilization or heavy-duty trucks, providing a granular view of demand profiles across the value chain.

The dominance of the NMC segment within product type classification is maintained by its high energy density, making it the preferred choice for long-range, high-performance EVs, despite ongoing cost and ethical concerns related to cobalt usage. However, the LFP segment is rapidly gaining traction, particularly in the Chinese market and for entry-level EVs and stationary storage, driven by its inherent safety, lower cost, and longer cycle life, although its energy density remains lower than NMC variants. The application segment analysis clearly shows the EV sector as the largest consumer base, capitalizing on the high integration benefits of HIT solutions for thermal management and packaging efficiency. The fastest growth, however, is projected in the ESS segment, fueled by global renewable energy integration goals, which mandate highly reliable and scalable battery solutions, often favoring the robustness of LFP or specialized, integrated long-duration HIT systems.

- By Product Type:

- Lithium Nickel Manganese Cobalt Oxide (NMC)

- Lithium Iron Phosphate (LFP)

- Lithium Nickel Cobalt Aluminum Oxide (NCA)

- Solid-State Batteries (SSB)

- By Application:

- Electric Vehicles (EVs)

- Passenger EVs

- Commercial EVs (Buses, Trucks)

- Two-Wheelers & E-Bikes

- Stationary Energy Storage Systems (ESS)

- Utility-Scale Grid Storage

- Commercial & Industrial Storage (C&I)

- Residential Storage

- Consumer Electronics (High-Performance Devices)

- By Capacity:

- Low Capacity (0-50 kWh)

- Medium Capacity (50-200 kWh)

- High Capacity (Above 200 kWh)

Value Chain Analysis For HIT Battery Market

The HIT Battery value chain is complex and globalized, beginning with the upstream segment involving the extraction and refining of critical raw materials such as lithium, cobalt, nickel, manganese, and graphite. This phase is highly capital intensive and geopolitically sensitive due to concentrated resource locations, often leading to supply volatility. Following material refinement, the midstream processes include the manufacturing of active materials (cathode and anode), electrolytes, and separators, culminating in the highly technical assembly of individual battery cells. High Integration Technology demands stringent quality control at the cell manufacturing level to ensure uniformity and performance reliability, setting the foundation for the integrated pack systems.

The downstream segment involves the crucial steps of module and pack assembly, integrating the proprietary Battery Management Systems (BMS), sophisticated thermal management components, and structural housing. This is where the 'High Integration Technology' aspect is realized, customizing the pack design for specific end-user applications (e.g., specific volumetric requirements for an EV chassis or ruggedized casing for a utility-scale ESS). Distribution channels are predominantly indirect, leveraging established partnerships. For the EV segment, battery packs are supplied directly to Original Equipment Manufacturers (OEMs) via long-term contracts. For ESS, distribution often occurs through engineering, procurement, and construction (EPC) contractors or specialized system integrators who customize the deployment according to utility or commercial client specifications. Direct distribution, although less common, is utilized by manufacturers offering proprietary residential or small-scale commercial storage solutions.

The post-use value chain is increasingly critical, encompassing battery utilization in second-life applications (e.g., repurposing EV batteries for less demanding ESS roles) and eventual recycling. Regulations are driving major investments in closed-loop recycling facilities to recover valuable materials, thereby mitigating upstream supply risks and enhancing the sustainability footprint of HIT batteries. The overall value chain is characterized by increasing localization efforts in North America and Europe to reduce dependence on Asian manufacturing, shifting the balance of power and leading to new regional partnerships focusing on securing the entire supply line from mine to recycling facility.

HIT Battery Market Potential Customers

Potential customers for the High Integration Technology Battery Market are diverse yet focused primarily on sectors demanding high performance, reliability, and robust safety standards from their energy storage solutions. The largest segment of end-users comprises global Automotive Original Equipment Manufacturers (OEMs) who require mass quantities of custom-designed, highly integrated battery packs for their electric vehicle lineups, ranging from premium sedans and SUVs to high-volume commuter cars. These buyers prioritize gravimetric energy density, fast-charging capability, and guaranteed long-term warranties, making the HIT architecture essential for competitive EV offerings.

The second major cohort consists of Utility and Grid Operators, along with Independent Power Producers (IPPs). These customers purchase multi-megawatt-scale HIT ESS solutions for frequency regulation, peak shaving, renewable energy smoothing (solar and wind farm integration), and transmission asset deferral. Their key buying criteria include operational lifespan (cycle life), system reliability, thermal safety compliance (NFPA standards), and ease of integration with existing grid infrastructure. Furthermore, the burgeoning fleet operators, especially those managing electric commercial buses, delivery vans, and heavy-duty electric trucks, represent a rapidly expanding customer base. These buyers demand extremely durable batteries with minimized downtime and rapid charge turnaround, aligning perfectly with the advanced thermal and integration features of HIT batteries designed for intense daily cycling.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.7 Billion |

| Market Forecast in 2033 | USD 20.9 Billion |

| Growth Rate | 19.3% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | LG Energy Solution, CATL, Panasonic Corporation, Samsung SDI, BYD Company Ltd., Northvolt AB, SK Innovation, Contemporary Amperex Technology Co. Limited, QuantumScape Corporation, Tesla (Energy Division), AESC, StoreDot, Toshiba Corporation, Varta AG, Gotion High-Tech. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

HIT Battery Market Key Technology Landscape

The HIT Battery Market is defined by several intertwined technological innovations focused on maximizing energy density, enhancing safety, and improving overall system longevity. Central to the HIT concept is the integration of advanced cell chemistries. While traditional liquid-electrolyte lithium-ion batteries using NMC (Nickel Manganese Cobalt) dominate due to high energy density, the market is rapidly adopting next-generation variants like NMC 811 and high-silicon anodes. These new anode materials increase the specific capacity of the cell but require highly specialized and intelligent Battery Management Systems (BMS) to handle the greater volumetric expansion and contraction during cycling, which necessitates complex algorithms and real-time monitoring capabilities to prevent early degradation and ensure safety.

Furthermore, the physical integration at the module and pack level is undergoing radical transformation. Technologies such as Cell-to-Pack (CTP) and Cell-to-Chassis (CTC) designs eliminate unnecessary intermediate components, significantly increasing the volumetric energy density—a core attribute of HIT solutions. CTP/CTC designs require highly sophisticated structural engineering to maintain mechanical integrity and thermal isolation. This trend is inextricably linked to advancements in thermal management, moving from passive cooling systems to highly efficient active liquid cooling loops, often utilizing advanced materials and intelligent fluid distribution to maintain uniform cell temperatures, which is crucial for prolonging the life of high-performance integrated packs operating under stress.

Looking ahead, the development and commercialization of Solid-State Battery (SSB) technology represent the most disruptive future force. SSBs replace the flammable liquid electrolyte with a solid conductive material, promising a step-change increase in safety and energy density, which are the fundamental pillars of High Integration Technology. While full-scale commercialization is still navigating challenges related to electrode interface stability and high-volume manufacturing costs, significant investment is being channeled into this domain. Complementary technologies like advanced recycling processes (pyrometallurgy and hydrometallurgy) are also key, ensuring that the valuable components within these complex, integrated battery packs can be efficiently recovered, thereby supporting circular economy models and stabilizing long-term raw material supply for future generations of HIT batteries.

Regional Highlights

The global HIT Battery Market demonstrates distinct growth characteristics across major geographic regions, influenced by localized manufacturing capabilities, regulatory frameworks, and regional demand dynamics, particularly concerning electrification goals.

- Asia Pacific (APAC): APAC is the global hub for HIT battery manufacturing and consumption, led primarily by China, South Korea, and Japan. China dominates due to massive domestic EV sales, extensive manufacturing capacity (giga-factories operated by CATL and BYD), and significant governmental support for electric mobility and grid storage projects. South Korea and Japan are key centers for advanced battery R&D and high-quality cell production (LG Energy Solution, Samsung SDI, Panasonic). The region benefits from established supply chains and economies of scale, maintaining cost competitiveness and technological leadership in both NMC and LFP chemistries.

- North America: North America is poised for the highest growth rate, driven by the US Inflation Reduction Act (IRA), which provides substantial incentives for domestic battery production and EV adoption. This has resulted in a surge of investment in new gigafactories by both established foreign manufacturers and emerging domestic players. Demand is high, particularly for integrated, high-performance batteries suitable for long-range US vehicles and utility-scale ESS deployments necessary to modernize the grid infrastructure and integrate renewable sources effectively.

- Europe: Europe is rapidly catching up in establishing a localized battery value chain (Battery Passports, Green Deal Industrial Plan). Countries like Germany, Poland, and Sweden (Northvolt) are becoming major manufacturing hubs. The region focuses heavily on safety, sustainability, and ethical sourcing, often setting higher standards for the integration of recycling into the battery lifecycle. The primary driver is stringent EU emission standards and large-scale commitments to end the sale of internal combustion engine (ICE) vehicles, ensuring robust demand for high-integrity battery solutions for both passenger and commercial EVs.

- Latin America (LATAM): LATAM remains a nascent market for large-scale battery deployment, primarily focused on raw material extraction (lithium triangle: Chile, Argentina, Bolivia). While EV adoption is slower, emerging demand for stationary storage in off-grid and industrial applications, especially in countries investing in renewable energy like Brazil and Mexico, drives localized growth. The long-term regional importance lies in its role in securing the upstream supply chain for global manufacturers.

- Middle East and Africa (MEA): The MEA region is experiencing increasing demand driven by utility-scale solar projects and the need for reliable grid solutions in resource-rich but infrastructure-sparse areas. Countries like the UAE and Saudi Arabia are investing heavily in ESS to manage renewable energy variability and support smart city initiatives. EV adoption is growing but remains niche, whereas the need for integrated, robust battery systems for industrial and infrastructural applications is rapidly expanding.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the HIT Battery Market.- Contemporary Amperex Technology Co. Limited (CATL)

- LG Energy Solution (LGES)

- Panasonic Corporation

- Samsung SDI Co. Ltd.

- BYD Company Ltd.

- Northvolt AB

- SK Innovation (SK On)

- Tesla (Energy Division & Vehicle Integration)

- QuantumScape Corporation

- Gotion High-Tech Co., Ltd.

- Automotive Energy Supply Corporation (AESC)

- Toshiba Corporation

- Varta AG

- StoreDot

- Farasis Energy, Inc.

- Solid Power, Inc.

- EVE Energy Co., Ltd.

- Prime Planet Energy & Solutions, Inc. (PPES)

- SVOLT Energy Technology Co., Ltd.

- Envision AESC Group Ltd.

Frequently Asked Questions

Analyze common user questions about the HIT Battery market and generate a concise list of summarized FAQs reflecting key topics and concerns.What defines a High Integration Technology (HIT) Battery and how does it differ from standard Lithium-Ion batteries?

HIT batteries are characterized by superior volumetric energy density and advanced safety features, primarily achieved through highly integrated designs (Cell-to-Pack/Chassis) and sophisticated, AI-driven Battery Management Systems (BMS). They differ by minimizing non-cell components and optimizing thermal control proactively, delivering higher performance and safety margins compared to standard Li-ion modules.

Which application segment holds the greatest potential for HIT Battery Market growth?

While the Electric Vehicle (EV) segment currently holds the largest market share, the Stationary Energy Storage Systems (ESS) segment, encompassing utility-scale and commercial storage, is projected to exhibit the highest Compound Annual Growth Rate (CAGR) due to global mandates accelerating renewable energy integration and grid modernization projects.

How is raw material volatility impacting the cost and supply chain of HIT Batteries?

Raw material volatility, particularly concerning lithium, cobalt, and nickel, leads to unpredictable manufacturing costs and pricing instability. Manufacturers mitigate this by securing long-term supply agreements, diversifying chemistries (e.g., increased use of LFP), and investing in closed-loop recycling infrastructure to establish secure, circular supply chains and reduce geopolitical reliance.

What role do Solid-State Batteries (SSBs) play in the future development of HIT technology?

Solid-State Batteries are considered the next major technological leap for HIT systems. By replacing liquid electrolytes with solid materials, SSBs promise significantly enhanced safety (eliminating fire risk) and substantial gains in energy density, potentially doubling the performance metrics of current integrated lithium-ion packs once manufacturing challenges related to interface resistance and cost are overcome.

Which geographical region is leading in both manufacturing capacity and market adoption for HIT Batteries?

Asia Pacific (APAC), particularly driven by manufacturing powerhouses like China and South Korea, is currently leading the market in both production capacity and overall adoption, benefiting from established supply chain ecosystems, early industrial scaling, and robust governmental support for electrification initiatives across mobility and grid storage sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager