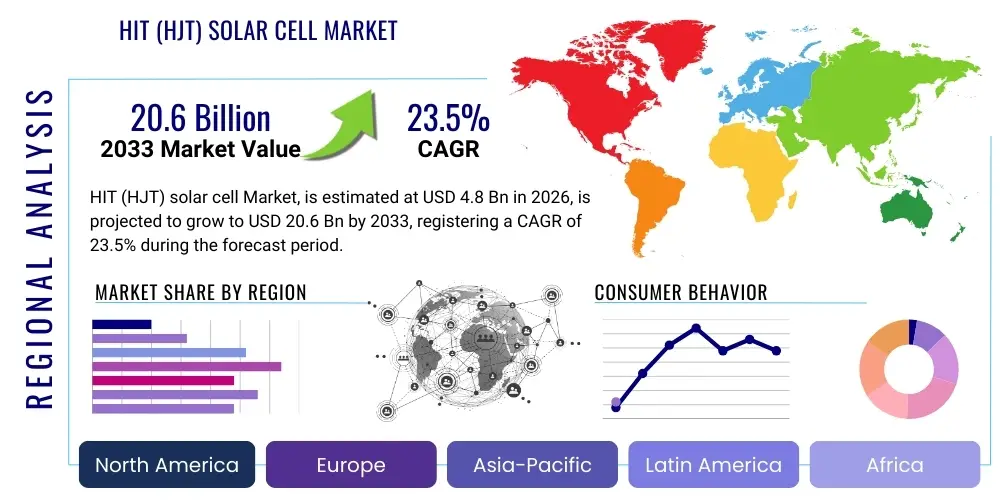

HIT (HJT) solar cell Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435525 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

HIT (HJT) solar cell Market Size

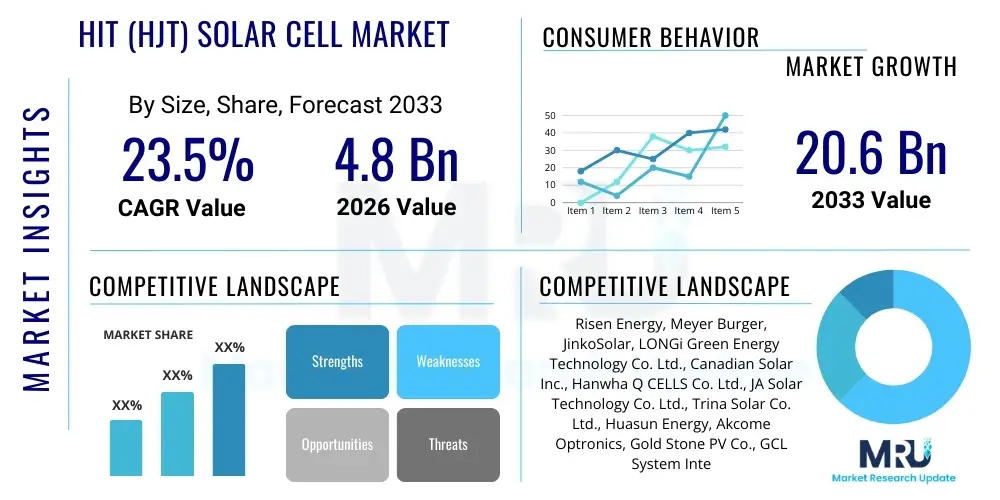

The HIT (HJT) solar cell Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 23.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 20.6 Billion by the end of the forecast period in 2033.

HIT (HJT) solar cell Market introduction

The Heterojunction Technology (HJT), often referred to as Heterojunction with Intrinsic Thin layer (HIT), solar cell market encompasses the manufacturing and deployment of photovoltaic cells utilizing an amorphous silicon (a-Si) layer deposited onto a crystalline silicon (c-Si) wafer. This structure effectively passivates the wafer surface, leading to significantly higher efficiencies and reduced recombination losses compared to conventional PERC (Passivated Emitter and Rear Cell) technologies. HJT cells inherently offer superior performance, including excellent temperature coefficients, leading to higher energy yield in hot climates, and easy integration into bifacial modules, capturing light from both sides.

Major applications driving market expansion include utility-scale solar farms, commercial and industrial (C&I) rooftop installations, and high-efficiency residential systems where space constraints necessitate maximum power density. The intrinsic benefits of HJT technology—such as enhanced efficiency beyond 24%, simpler processing steps post-wafering, and lower thermal budget requirements—are making it an increasingly attractive alternative to established technologies like PERC and emerging technologies like TOPCon (Tunnel Oxide Passivated Contact). The transition toward N-type silicon wafers, which form the foundation of most high-efficiency HJT processes, is accelerating this market shift.

Key driving factors include global mandates for renewable energy integration, substantial cost reductions achieved through mass production scaling (particularly concerning TCO, or Transparent Conductive Oxide, material usage and precious metal paste consumption), and increasing consumer demand for premium, durable photovoltaic modules. Government incentives and supportive regulatory frameworks, particularly in major solar markets like China, the European Union, and North America, further stimulate technological adoption and manufacturing capacity expansion, solidifying HJT's position as a next-generation standard.

HIT (HJT) solar cell Market Executive Summary

The HIT (HJT) solar cell market is characterized by robust investment in new manufacturing capacities, predominantly driven by Asia Pacific manufacturers seeking to capitalize on the technology's high-efficiency roadmap. Business trends indicate a rapid scale-up, moving HJT from niche high-performance applications to mainstream utility and C&I projects. Strategic mergers and acquisitions are observed as established PV manufacturers acquire specialized HJT technology providers or heavily invest in internal R&D to optimize amorphous silicon deposition and metallization processes, aiming to reduce dependence on silver paste through copper plating or alternative methods.

Regionally, Asia Pacific, led by China, dominates both production and consumption, functioning as the global hub for technological innovation and capacity deployment. Europe and North America exhibit strong demand growth, specifically for high-efficiency, bifacial HJT modules required for land-constrained installations or projects demanding higher long-term energy yields. Government policies focused on carbon neutrality and energy independence are instrumental in fostering strong regional market expansion outside of Asia, particularly where Feed-in Tariffs (FiTs) reward higher module efficiency and performance stability.

Segment trends highlight the growing dominance of N-type silicon wafers as the foundational substrate for HJT, accelerating the displacement of traditional P-type technologies. The utility-scale application segment remains the largest consumer, benefiting from the superior temperature stability and higher energy density of HJT modules. Furthermore, there is a distinct trend towards increasing production capacity thresholds, with numerous manufacturers projecting multi-gigawatt HJT lines, signifying the technological maturity and economic viability of this advanced cell architecture in global competitive bidding environments.

AI Impact Analysis on HIT (HJT) solar cell Market

Common user questions regarding AI's impact on HJT technology center around how intelligent systems can enhance manufacturing precision, improve yield rates, and accelerate materials discovery, particularly in optimizing thin-film deposition and minimizing costly silver consumption. Users are highly interested in predictive maintenance models for HJT manufacturing equipment, anticipating that AI can forecast failures and adjust plasma-enhanced chemical vapor deposition (PECVD) parameters in real-time to maintain ultra-precise layer thickness and uniformity essential for high cell efficiency. The primary concern revolves around the complexity and cost of integrating sophisticated AI algorithms into existing cleanroom fabrication facilities.

AI's role is transformative in accelerating the R&D cycle for HJT cells. Machine learning algorithms can analyze vast datasets generated during pilot runs, identifying optimal doping concentrations, intrinsic layer compositions (a-Si:H), and annealing protocols far faster than traditional experimental methods. This capability significantly reduces the time-to-market for higher efficiency HJT iterations, potentially pushing average commercial efficiencies towards 26%. Furthermore, AI-driven simulations allow researchers to model the interaction of light with the complex heterojunction interface, optimizing texturing and anti-reflection layers for maximum light harvesting.

In the production phase, AI facilitates closed-loop control systems. Vision systems powered by deep learning analyze minute defects on wafers post-processing, detecting subtle variations in surface passivation quality or metallization patterns that human operators might miss. Predictive quality control ensures that only cells meeting the highest performance specifications proceed, dramatically increasing overall production yield and reducing waste of expensive materials like TCOs and silver paste. This integration of AI addresses the critical manufacturing challenges associated with the precision required for high-performance HJT structures.

- AI optimizes PECVD processes for highly precise amorphous silicon layer deposition, maximizing surface passivation.

- Machine learning accelerates R&D for novel TCO materials and reduced silver consumption metallization techniques.

- Predictive maintenance models increase equipment uptime, particularly for high-cost vacuum deposition systems.

- Deep learning-based vision systems enable real-time, high-resolution defect detection during cell fabrication, enhancing quality control.

- AI algorithms forecast cell performance degradation over the module lifetime, improving long-term warranty reliability estimates.

DRO & Impact Forces Of HIT (HJT) solar cell Market

The HJT market is propelled by the critical need for high-efficiency solar cells to reduce Balance of System (BOS) costs and maximize energy density in solar installations. Key drivers include superior bifacial power generation capabilities and an excellent temperature coefficient, yielding higher energy outputs compared to mainstream technologies. However, the high capital expenditure required for specialized deposition equipment (PECVD) and the reliance on expensive silver paste for screen printing act as significant restraints. Opportunities lie in developing low-cost manufacturing routes, such as replacing silver with copper plating (LIP - Laser Induced Plating), and utilizing simplified, high-throughput processes that reduce overall module cost and compete effectively with TOPCon and PERC.

The primary driving force is the global energy transition mandate, which prioritizes performance and long-term yield over minimal upfront cost. HJT's capacity for high bifaciality (often exceeding 90%) means it generates more power per installed area, making it ideal for congested or challenging environments. Technological breakthroughs in reducing the intrinsic layer thickness while maintaining high passivation quality, coupled with advancements in non-vacuum or simplified TCO application methods, are further mitigating the initial cost disadvantages. The competitive dynamic, especially the rapid advancement of TOPCon technology, acts as a crucial impact force, pressuring HJT manufacturers to accelerate cost reduction and efficiency gains to maintain market share.

Restraints are primarily focused on the materials science and processing side. The requirement for specialized, high-vacuum equipment for PECVD of amorphous silicon layers constitutes a significant barrier to entry and increases CapEx. Furthermore, while silver consumption per watt has decreased, the overall volume of silver used across the industry remains a major cost factor. The key opportunity involves strategic material substitution and process simplification. The development of specialized conductive adhesive films and proprietary connection techniques (e.g., SmartWire Connection Technology) aims to bypass traditional screen printing completely, offering a viable pathway to mass-market cost parity, thereby increasing the overall market penetration of HJT technology.

Segmentation Analysis

The HIT (HJT) solar cell market segmentation provides a detailed framework for understanding the diverse applications, technology adoption rates, and regional manufacturing strategies employed across the global PV landscape. The market is primarily divided based on cell type, distinguishing between N-type and P-type based cells, though HJT predominantly utilizes N-type substrates for optimal performance. Further segmentation based on application highlights the distinct demands of utility-scale projects versus decentralized commercial and residential installations. The industry structure is also delineated by production capacity thresholds, reflecting the global shift toward standardized, multi-gigawatt fabrication facilities necessary to achieve economies of scale and drive down the Levelized Cost of Electricity (LCOE).

Analysis of these segments reveals that the N-type segment dominates the HJT market, driven by its superior carrier lifetime and immunity to light-induced degradation (LID), making it the optimal platform for heterojunction architectures. The utility-scale segment commands the largest market share, requiring modules with high reliability and long-term energy yield, attributes that HJT cells inherently possess due to their stable performance under varying temperature conditions. As costs decline, the C&I sector is exhibiting the fastest growth, as businesses increasingly prioritize maximum power output from limited rooftop space. This detailed segmentation is crucial for stakeholders to tailor their product offerings and manufacturing investments effectively.

- By Type

- N-type HJT Cell

- P-type HJT Cell (Less prevalent, mainly R&D)

- By Application

- Utility-Scale Power Plants

- Commercial and Industrial (C&I)

- Residential Systems

- By Production Capacity

- Less than 5 GW

- 5 GW to 10 GW

- Above 10 GW

- By Module Technology

- Bifacial HJT Modules

- Monofacial HJT Modules

Value Chain Analysis For HIT (HJT) solar cell Market

The value chain for the HIT (HJT) solar cell market is characterized by high technological specialization and capital intensity, starting with upstream silicon purification and N-type wafer preparation. Upstream activities involve specialized suppliers providing high-purity polysilicon and sophisticated manufacturers producing N-type monocrystalline wafers, which require stringent quality control to ensure the high carrier lifetime necessary for HJT architecture. The core value addition occurs during cell manufacturing, involving complex deposition equipment (PECVD for a-Si:H and PVD/Sputtering for TCO layers) and advanced metallization techniques. The capital cost of this specialized upstream equipment is a major determinant of overall manufacturing cost.

Downstream activities focus on module assembly, system integration, and project development. Module assembly for HJT requires specialized interconnection technologies, such as multi-busbar (MBB) or SmartWire, which are adapted to the unique characteristics of HJT cells. Distribution channels are varied, including direct sales to large Engineering, Procurement, and Construction (EPC) firms for utility projects, indirect distribution through specialized wholesale distributors for C&I installers, and partnerships with residential solar providers. The direct channel dominates large-scale procurement, emphasizing performance contracts and long-term supplier relationships based on verified energy yield data.

The high efficiency and low degradation profile of HJT cells allow manufacturers to command a premium price in the downstream market. Indirect distribution relies heavily on technical training and support provided to installers, ensuring proper handling and integration of delicate bifacial modules. The market is currently consolidating, with major integrated players controlling the entire value chain from wafer production to module sales, capitalizing on internal synergies and quality control to maintain a competitive edge over manufacturers focusing solely on single-stage production.

HIT (HJT) solar cell Market Potential Customers

Potential customers for HIT (HJT) solar cells and modules represent entities across the energy spectrum that prioritize high energy density, superior long-term performance, and excellent temperature stability. The primary buyers are utility companies and large independent power producers (IPPs) investing in extensive ground-mounted solar farms. These entities are driven by the Levelized Cost of Electricity (LCOE) and seek the highest annual energy yield possible, which HJT's bifacial capabilities and low temperature coefficient reliably provide, ensuring maximized return on investment over the 25-30 year project lifecycle.

A second major customer segment comprises developers and operators of commercial and industrial (C&I) rooftop solar projects. For C&I customers, space limitation is often the critical constraint; hence, modules offering the highest power output per square meter are highly valued. HJT modules fulfill this requirement, allowing businesses to maximize self-consumption and reduce electricity costs efficiently. This segment also benefits from HJT's aesthetically pleasing, uniform dark appearance, which is often preferred for high-visibility commercial installations.

Finally, residential solar installers and distributors represent a significant growing segment, particularly in markets such as North America, Germany, and Japan, where premium solar solutions are sought. Homeowners are increasingly willing to pay a premium for high-efficiency modules that reduce installation footprints and offer superior long-term reliability and high performance, even under extreme weather conditions. The easy integration of HJT modules with sophisticated residential energy storage systems further enhances their appeal to this demanding end-user market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 20.6 Billion |

| Growth Rate | CAGR 23.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Risen Energy, Meyer Burger, JinkoSolar, LONGi Green Energy Technology Co. Ltd., Canadian Solar Inc., Hanwha Q CELLS Co. Ltd., JA Solar Technology Co. Ltd., Trina Solar Co. Ltd., Huasun Energy, Akcome Optronics, Gold Stone PV Co., GCL System Integration Technology Co. Ltd., Tongwei Solar, Wuxi Suntech Power Co. Ltd., Maxeon Solar Technologies, China Energy Engineering Group Co. Ltd., Shanghai Aerospace Automobile Electromechanical Co. Ltd., Shunfeng International Clean Energy Limited. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

HIT (HJT) solar cell Market Key Technology Landscape

The core technology underpinning the HIT (HJT) market revolves around the precise deposition of ultra-thin layers of intrinsic and doped amorphous silicon films onto both sides of a crystalline silicon wafer, achieved primarily through Plasma Enhanced Chemical Vapor Deposition (PECVD). This low-temperature process is critical as it minimizes thermal damage to the highly sensitive crystalline structure, ensuring superior passivation and consequently, high open-circuit voltage ($V_{OC}$). The complexity lies in maintaining uniformity and purity across large wafer sizes, requiring highly sophisticated, high-throughput vacuum equipment that represents a significant portion of the initial capital investment.

A second critical technology is the application of Transparent Conductive Oxide (TCO) layers, typically Indium Tin Oxide (ITO), applied via physical vapor deposition (PVD) or magnetron sputtering. The TCO layer serves dual purposes: minimizing surface recombination and providing excellent lateral conductivity to the cell surface. Current innovation in this area focuses on reducing the reliance on increasingly expensive Indium by exploring alternative materials such as Aluminum-doped Zinc Oxide (AZO) and utilizing advanced sputtering techniques to achieve optimal film properties while reducing material consumption. The quality of the TCO interface directly impacts the cell's fill factor and overall performance.

The most rapidly evolving technological aspect is metallization. Traditionally, HJT cells relied on screen-printed silver paste, which is costly. The industry is rapidly adopting advanced techniques to reduce or eliminate silver usage. Key technologies include Light-Induced Plating (LIP) and Laser-Induced Plating (LIP) for copper deposition, which offer significantly lower material costs and narrower line widths, maximizing the active area of the cell. Furthermore, manufacturers are increasingly using Multi-Busbar (MBB) and proprietary foil-based interconnection methods like SmartWire Connection Technology (SWCT) to improve current collection efficiency and increase mechanical stability in the final module assembly, thereby enhancing the overall commercial viability of the HJT product.

Regional Highlights

Asia Pacific (APAC)

The APAC region, particularly China, dominates the global HIT (HJT) solar cell market, accounting for the vast majority of current manufacturing capacity and leading the curve in efficiency records and process cost reduction. China's dominance is supported by massive government backing, integrated supply chains spanning polysilicon to module assembly, and aggressive investments from major PV players like LONGi, JinkoSolar, and Risen Energy in GW-scale HJT fabrication lines. The region serves as the primary innovation hub for overcoming critical challenges such as silver consumption and improving TCO material substitution. India, Southeast Asia, and South Korea are also emerging as significant production and consumption markets, driven by favorable renewable energy targets and the increasing need for high-performance modules for dense solar projects.

Europe

Europe is characterized by strong demand for premium, high-efficiency modules, positioning it as a key consumer market for HJT technology, despite having comparatively smaller manufacturing capacity than APAC. Countries like Germany, Switzerland, and the Netherlands prioritize solar performance metrics, often rewarding higher efficiency with better Feed-in Tariffs or preferential regulatory treatment. The European market focuses heavily on innovation related to equipment and specialized materials, with companies like Meyer Burger playing a crucial role in pioneering HJT manufacturing outside of Asia. Demand is primarily driven by ambitious decarbonization goals and strong residential and C&I demand where rooftop space is at a premium.

North America

North America is experiencing accelerated adoption of HJT modules, fueled by the demand for domestic manufacturing and highly durable, high-yield solutions mandated by large-scale utility projects and increasingly severe weather conditions. Government policies such as the Inflation Reduction Act (IRA) in the United States are providing significant incentives for localized manufacturing of high-efficiency cells, leading to substantial planned investments in US-based HJT facilities. The market demands robust reliability and bifacial capabilities, making HJT highly competitive, particularly in sun-belt states where temperature stability is paramount for maximizing annual energy production.

Latin America (LATAM)

The LATAM market is growing steadily, with Brazil, Mexico, and Chile leading regional solar adoption. While cost sensitivity remains a factor, the excellent temperature coefficient of HJT cells provides a significant advantage in the high-irradiance, high-temperature environments prevalent across much of the continent. Demand is concentrated in utility-scale projects, where minimizing performance degradation due to heat is crucial for project profitability. The region relies heavily on imports from APAC but is beginning to see localized distribution and assembly operations focusing on high-performance modules.

Middle East and Africa (MEA)

The MEA region, particularly the GCC countries and South Africa, offers immense potential for HJT technology due to high solar irradiance and high ambient temperatures. HJT’s superior thermal performance means its efficiency drop-off at high temperatures is minimal compared to conventional silicon cells, translating into significantly higher power output during peak operational hours. Massive planned giga-projects in the UAE and Saudi Arabia are increasingly specifying high-efficiency bifacial technology, driving regional demand and favoring the technological attributes of HJT over traditional alternatives, making this a critical emerging market.

- China (APAC): Dominant manufacturing hub; focus on capacity scale-up (GW scale) and cost reduction via material substitution (copper plating).

- Germany and Netherlands (Europe): Premium consumption market; strong demand for residential and C&I high-efficiency modules.

- United States (North America): High-growth market supported by IRA incentives; focus on utility-scale projects requiring high bifaciality and domestic supply chains.

- Brazil and Chile (LATAM): Emerging utility markets where HJT’s superior temperature stability offers strong yield advantages.

- UAE and Saudi Arabia (MEA): Critical emerging demand due to extreme heat conditions favoring HJT's low temperature coefficient for giga-project deployment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the HIT (HJT) solar cell Market.- Risen Energy Co. Ltd.

- Meyer Burger Technology AG

- JinkoSolar Holding Co. Ltd.

- LONGi Green Energy Technology Co. Ltd.

- Canadian Solar Inc.

- Hanwha Q CELLS Co. Ltd.

- JA Solar Technology Co. Ltd.

- Trina Solar Co. Ltd.

- Huasun Energy Co. Ltd.

- Akcome Optronics Science & Technology Co. Ltd.

- Gold Stone PV Co. Ltd.

- GCL System Integration Technology Co. Ltd.

- Tongwei Solar Co. Ltd.

- Wuxi Suntech Power Co. Ltd.

- Maxeon Solar Technologies, Ltd.

- China Energy Engineering Group Co. Ltd.

- Shanghai Aerospace Automobile Electromechanical Co. Ltd.

- Shunfeng International Clean Energy Limited

Frequently Asked Questions

Analyze common user questions about the HIT (HJT) solar cell market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of HIT (HJT) solar cells over traditional PERC technology?

The primary advantage of HJT cells is the use of intrinsic amorphous silicon layers for superior surface passivation, resulting in a much higher open-circuit voltage ($V_{OC}$) and negligible power loss due to high temperatures (lower temperature coefficient). This structure also inherently allows for high bifaciality, meaning the cell generates significant power from light captured on its rear side, leading to greater overall energy yield in the field.

How does the manufacturing cost of HJT compare to established technologies like TOPCon and PERC?

Currently, HJT production involves higher capital expenditure (CapEx) primarily due to the specialized, high-vacuum equipment required for Plasma Enhanced Chemical Vapor Deposition (PECVD) of the intrinsic amorphous layers. However, operating expenses (OpEx) are decreasing rapidly due to process simplification and the adoption of lower-cost metallization techniques, such as copper plating, aiming for cost parity with emerging TOPCon technology by 2027.

Is silver consumption a limiting factor for the mass adoption of Heterojunction Technology?

Yes, silver consumption has historically been a significant limiting factor and cost driver for HJT, which traditionally uses silver paste for both front and rear side metallization. However, industry efforts are intensely focused on reducing silver usage through advanced techniques like Light-Induced Plating (LIP) and developing copper-based alternatives, which are critical for scaling HJT to multi-gigawatt levels while maintaining economic competitiveness.

Which geographical region is leading the capacity expansion and technological innovation in the HJT market?

Asia Pacific, specifically China, is overwhelmingly leading the global capacity expansion and technological innovation for HJT solar cells. Chinese manufacturers have deployed massive GW-scale production lines, benefitting from integrated supply chains and government support, setting the pace for efficiency records and driving down the manufacturing costs necessary for global market penetration.

What role does the bifacial capability play in driving the market demand for HJT modules?

Bifacial capability is a major demand driver, as HJT cells boast some of the highest bifacial factors (often >90%) in the market. This capability allows modules to capture reflected light (albedo) from the ground, significantly increasing the power generated per installed module area. This feature is particularly crucial for utility-scale projects and high-density installations where maximized energy output and reduced Balance of System (BOS) costs are paramount.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager