Hitter based hand tools Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439978 | Date : Jan, 2026 | Pages : 245 | Region : Global | Publisher : MRU

Hitter based hand tools Market Size

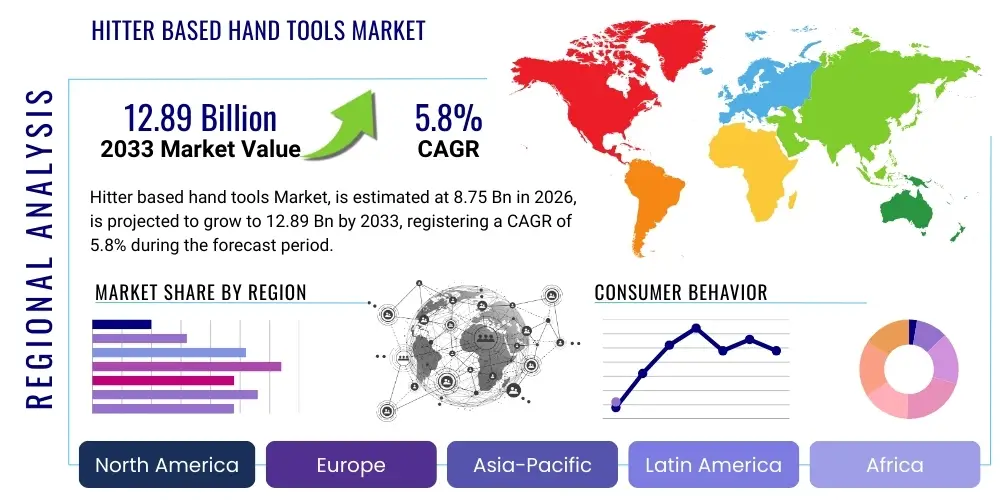

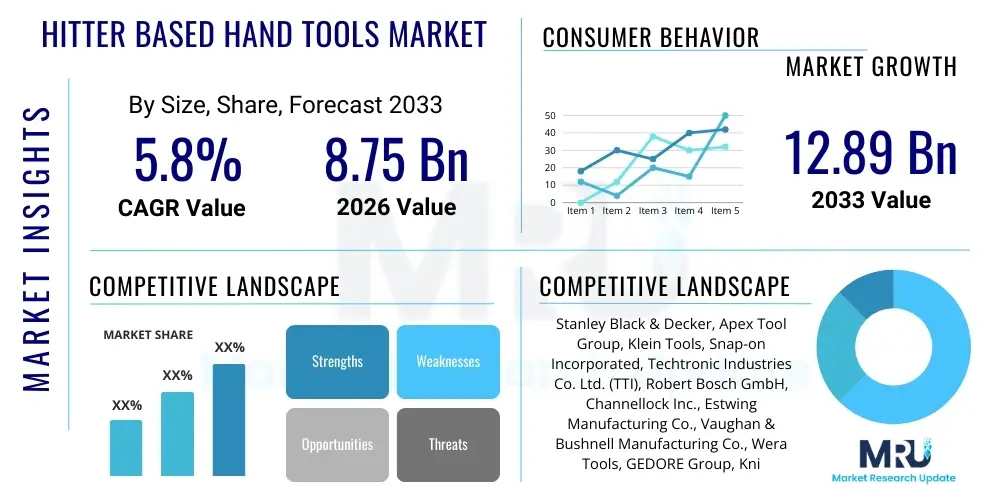

The Hitter based hand tools Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 8.75 Billion in 2026 and is projected to reach USD 12.89 Billion by the end of the forecast period in 2033.

Hitter based hand tools Market introduction

The hitter-based hand tools market encompasses a diverse range of implements designed for striking, impacting, prying, and cutting tasks, primarily relying on manual force or leverage rather than power. This category includes fundamental tools such as various types of hammers, mallets, chisels, axes, crowbars, and punches, all essential for a multitude of applications across industries and household uses. These tools are characterized by their robust construction, often featuring heads made from hardened steel or specialized alloys, combined with handles crafted from wood, fiberglass, or composite materials to ensure durability, shock absorption, and user comfort. Their design is inherently simple yet highly effective, built to withstand repetitive forceful actions.

The primary applications for hitter-based hand tools span a broad spectrum, from heavy-duty construction and demolition to intricate carpentry, automotive repair, masonry, and general DIY projects. In construction, tools like sledgehammers and crowbars are indispensable for breaking down structures or prying materials, while claw hammers are central to framing and finishing work. Carpenters rely on chisels for shaping wood and various hammers for precise fastening. Automotive mechanics utilize specific hammers and punches for assembly and disassembly tasks, showcasing the versatility and necessity of these tools in demanding professional environments. The enduring demand for these tools is a testament to their fundamental utility and reliability.

The inherent benefits of hitter-based hand tools contribute significantly to their continued market relevance. They offer unparalleled reliability, often functioning without external power, making them ideal for remote locations or situations where electricity is unavailable or unsafe. Their simplicity translates to ease of maintenance and a longer lifespan, often outlasting more complex power tools under comparable conditions. Furthermore, these tools are generally cost-effective to acquire and replace, presenting an economical solution for both professional tradespeople and individual consumers. The market's growth is predominantly driven by global infrastructure development, a sustained boom in residential and commercial construction, the widespread popularity of DIY culture, and consistent demand for industrial maintenance and repair operations.

Hitter based hand tools Market Executive Summary

The hitter-based hand tools market is experiencing steady growth, propelled by robust global construction activities, a persistent rise in do-it-yourself (DIY) culture, and the continuous need for maintenance across various industrial sectors. Key business trends indicate a strong emphasis on ergonomic design, material innovation to enhance durability and reduce weight, and a significant shift towards e-commerce platforms for distribution, which expands market reach and offers consumers greater product variety and competitive pricing. Manufacturers are increasingly investing in research and development to produce tools that minimize user fatigue and maximize efficiency, recognizing the importance of user experience in a competitive landscape. Consolidation among major players is also a notable trend, aiming for economies of scale and broader product portfolios.

Regionally, the market exhibits diverse growth dynamics. Asia Pacific stands out as a high-growth region, driven by rapid urbanization, extensive infrastructure projects, and a burgeoning middle class that fuels both professional and DIY segments. North America and Europe represent mature markets characterized by stable demand, an emphasis on quality and brand loyalty, and a strong preference for tools that adhere to stringent safety and ergonomic standards. These regions also demonstrate a significant uptake of specialized tools for niche applications. Latin America and the Middle East & Africa are emerging as promising markets, benefiting from developing economies, increasing industrialization, and substantial investments in construction and resource extraction industries, leading to a rising demand for reliable hand tools.

Segmentation trends reveal particular dynamism in several areas. The professional segment continues to demand high-performance, robust, and specialized tools capable of enduring rigorous daily use, often prioritizing brand reputation and warranty. Concurrently, the DIY/household segment is witnessing considerable expansion, driven by affordability, ease of use, and a wider availability of tools suitable for general home maintenance and hobby projects. Material advancements, such as the adoption of advanced composites for handles to reduce vibration and enhance grip, are also shaping product development. The online distribution channel is particularly impacting consumer buying habits, offering convenience and access to a global inventory, which in turn influences pricing strategies and market competition.

AI Impact Analysis on Hitter based hand tools Market

User inquiries regarding Artificial Intelligence's impact on the hitter-based hand tools market primarily revolve around concerns about automation replacing manual labor, the potential for smarter, more efficient tool designs, and how AI might optimize manufacturing and supply chains for these traditional products. There is an underlying curiosity about whether AI could lead to the development of 'smart' versions of these seemingly simple tools, enhancing their functionality or providing predictive maintenance insights. Additionally, users are keen to understand how AI-driven analytics could influence market forecasting, inventory management, and personalized marketing strategies within this established industry, ultimately improving the availability and relevance of these essential tools to various consumer segments.

- AI-powered predictive maintenance for manufacturing equipment ensures higher uptime and efficiency in producing hitter-based tools.

- Optimized supply chain management through AI algorithms predicts demand fluctuations, reducing inventory costs and improving delivery times for raw materials and finished products.

- AI-driven design optimization software assists in developing ergonomically superior and more durable tool geometries, reducing vibration and enhancing user comfort.

- Quality control enhanced by AI vision systems detects manufacturing defects in tool heads and handles with greater precision and speed, ensuring consistent product standards.

- Market trend analysis using AI analytics helps manufacturers identify emerging consumer preferences and regional demands, guiding product development and marketing strategies.

- Robotics integrated with AI can automate certain repetitive or hazardous stages of the manufacturing process, such as forging, grinding, or assembly, increasing production efficiency and safety.

- Personalized marketing and sales strategies, informed by AI, can better target specific end-user segments with relevant hitter-based tool offerings.

DRO & Impact Forces Of Hitter based hand tools Market

The hitter-based hand tools market is significantly shaped by a confluence of driving factors, restrictive elements, and burgeoning opportunities, all under the influence of various impact forces. Key drivers include the consistent growth in the global construction sector, spanning both residential and commercial infrastructure projects, which inherently necessitates a wide array of basic and specialized hand tools. The expanding popularity of DIY culture, fueled by rising homeownership and accessible online tutorials, further stimulates demand for versatile and user-friendly tools. Additionally, the continuous need for maintenance, repair, and overhaul (MRO) activities across diverse industries, from manufacturing to automotive, ensures a steady baseline demand for these durable implements. Innovations in ergonomic design, aimed at reducing user fatigue and improving safety, also act as a driver, encouraging upgrades and new purchases.

Conversely, several restraints impede faster market expansion. The primary challenge comes from the increasing adoption of power tools, which often offer higher efficiency and reduced physical effort for many tasks previously performed manually. While power tools do not fully replace hitter-based tools, they can sometimes act as substitutes, particularly for repetitive or large-scale operations. Furthermore, the market's maturity in developed economies means that growth often relies on replacement cycles rather than new market penetration. Volatility in the prices of raw materials such such as steel, wood, and plastics, which are essential components for tool manufacturing, can impact production costs and profit margins. Intense competition within the fragmented market can also lead to price pressures, affecting smaller manufacturers.

Despite these restraints, significant opportunities exist for market players. Emerging economies, especially in Asia Pacific and Latin America, present vast untapped potential due to rapid urbanization, industrial growth, and increasing disposable incomes. The development of specialized tools for niche applications, such as professional-grade ergonomic tools or tools designed for specific materials, offers avenues for premiumization and market differentiation. Expansion through e-commerce platforms represents a substantial opportunity to reach a broader customer base, reduce distribution costs, and offer a more diverse product catalog. Moreover, a growing focus on sustainable materials and manufacturing processes could open new segments for eco-conscious consumers, aligning with global environmental trends. Addressing these opportunities strategically can unlock substantial growth.

Segmentation Analysis

The hitter-based hand tools market is extensively segmented to reflect the diverse applications, end-users, product types, and distribution channels that characterize this foundational industry. Understanding these segments is crucial for market participants to identify niche opportunities, tailor product development, and optimize marketing and distribution strategies. Each segment addresses specific needs and preferences within the broader market, ranging from high-durability professional tools to versatile and affordable options for the casual DIY enthusiast. The granular segmentation allows for a detailed analysis of market dynamics and competitive landscapes across different functional and demographic categories, providing a comprehensive view of market structure and growth potential.

- By Product Type:

- Hammers (Claw Hammers, Ball-Peen Hammers, Sledgehammers, Mallets)

- Chisels

- Axes

- Crowbars

- Punches

- Picks

- Pry Bars

- Hand Saws (Non-Powered)

- Other Striking Tools (e.g., Brick Hammers, Scaling Hammers)

- By Application:

- Construction

- Automotive

- Carpentry

- DIY/Household

- Industrial Maintenance

- Masonry

- Demolition

- Mining

- General Repair

- By End-User:

- Professional (Contractors, Tradespeople, Industrial Workers)

- Residential/DIY (Homeowners, Hobbyists)

- By Material:

- Steel (Carbon Steel, Alloy Steel)

- Wood (Hickory, Ash, Oak)

- Fiberglass

- Composite Materials

- Rubber/Plastic (for mallets, handles)

- By Distribution Channel:

- Online Retail (E-commerce websites, Manufacturer's online stores)

- Offline Retail (Hardware Stores, Specialty Stores, Hypermarkets, Building Material Suppliers)

Value Chain Analysis For Hitter based hand tools Market

The value chain for the hitter-based hand tools market is a structured process involving several distinct stages, from the sourcing of raw materials to the final delivery to the end-user. This chain begins with upstream analysis, focusing on the procurement of essential raw materials such as various grades of steel (carbon steel, alloy steel for heads), wood (hickory, ash, oak for handles), fiberglass, rubber, and plastics (for composite handles and grips). Key suppliers in this segment are commodity producers and specialized material processors, whose pricing and quality significantly impact the manufacturing cost and final product performance. Efficient upstream management, including strategic sourcing and long-term contracts, is crucial for maintaining cost stability and ensuring consistent supply of high-quality inputs, directly influencing the overall value proposition of the finished tools.

Following raw material acquisition, the manufacturing stage involves complex processes such as forging, casting, machining, heat treatment, assembly, and finishing. Tool manufacturers invest heavily in advanced machinery and skilled labor to ensure precision, durability, and safety standards are met. This stage adds substantial value through design, engineering, and quality control. Once manufactured, the tools move into the downstream segment, which primarily deals with distribution and sales. The distribution channels are multifaceted, comprising both direct and indirect routes. Direct distribution typically involves manufacturers selling directly to large industrial clients, government agencies, or major construction companies, allowing for closer customer relationships and tailored service. This channel is often characterized by bulk orders and specific contractual agreements, where efficiency and logistical capabilities are paramount.

Indirect distribution, which forms a larger part of the market, involves a network of intermediaries. This includes wholesalers, distributors, hardware stores, specialty tool shops, large format retailers (hypermarkets and DIY superstores), and increasingly, online retail platforms. These channels play a critical role in inventory management, market reach, and customer service. Online distribution, in particular, has seen exponential growth, offering manufacturers and retailers the ability to reach a global customer base with reduced overheads, while providing consumers with convenience, extensive product choices, and competitive pricing. The efficiency of these distribution channels, coupled with effective marketing and after-sales support, significantly influences the product's availability, brand perception, and ultimate market success. Optimizing this entire value chain, from raw material to final consumer, is essential for profitability and sustainable growth in the hitter-based hand tools market.

Hitter based hand tools Market Potential Customers

The potential customer base for hitter-based hand tools is exceptionally broad and diverse, reflecting the universal utility and fundamental necessity of these implements across numerous sectors and personal applications. At a macro level, the construction industry stands as a primary end-user, encompassing commercial, residential, and infrastructure projects. Construction companies, general contractors, specialized trade contractors (e.g., carpenters, masons, roofers, demolition crews), and civil engineering firms are constant purchasers of tools like hammers, chisels, axes, and crowbars for tasks ranging from framing and finishing to heavy-duty demolition and material shaping. The sheer scale and ongoing nature of global construction activities ensure a sustained, high-volume demand from this segment, often prioritizing durability, brand reputation, and ergonomic design to withstand rigorous daily use.

Beyond construction, the automotive industry represents another significant customer segment. Mechanics, auto repair shops, body shops, and vehicle assembly plants regularly utilize hitter-based tools such as ball-peen hammers, mallets, and punches for various tasks, including component installation, removal, and bodywork. Industrial maintenance and repair operations (MRO) across manufacturing plants, energy facilities, and transportation sectors also constitute a vital customer group, relying on these tools for equipment upkeep, assembly, and general facility management. These professional segments often seek high-quality, specialized tools that offer precision, reliability, and meet specific industry standards, making purchasing decisions based on performance, safety, and brand trust.

On the consumer side, the rapidly expanding DIY (Do-It-Yourself) and household segment forms a substantial and growing customer base. Homeowners, hobbyists, and individuals undertaking home improvement projects are frequent buyers of a wide range of hitter-based tools for tasks such as hanging pictures, assembling furniture, minor repairs, and gardening. This segment is driven by factors like affordability, ease of use, convenience, and the increasing availability of tools through online and local hardware stores. Educational institutions, vocational training centers, and artisan workshops also represent niche but consistent customer groups, purchasing tools for teaching, learning, and crafting purposes. Understanding the distinct needs and purchasing behaviors of each of these diverse customer groups is key for manufacturers and retailers to effectively penetrate and serve the hitter-based hand tools market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.75 Billion |

| Market Forecast in 2033 | USD 12.89 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Stanley Black & Decker, Apex Tool Group, Klein Tools, Snap-on Incorporated, Techtronic Industries Co. Ltd. (TTI), Robert Bosch GmbH, Channellock Inc., Estwing Manufacturing Co., Vaughan & Bushnell Manufacturing Co., Wera Tools, GEDORE Group, Knipex-Werk C. Gustav Putsch KG, Facom, Hultafors Group, Irwin Tools, Fisco Tools, Makita Corporation, DeWalt, Milwaukee Tool, Proto. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hitter based hand tools Market Key Technology Landscape

The technology landscape for the hitter-based hand tools market, while rooted in traditional craftsmanship, continuously evolves through advancements in materials science, manufacturing processes, and ergonomic design principles. A significant area of innovation lies in the development and application of advanced materials. This includes higher-grade alloy steels for tool heads, offering superior hardness, impact resistance, and edge retention, which directly translates to enhanced durability and longevity of products like hammers, chisels, and axes. Furthermore, the selection of handle materials has seen substantial technological improvements, with fiberglass, advanced composites, and multi-component plastics increasingly replacing traditional wood. These modern materials provide better shock absorption, reduced vibration transfer to the user, and improved grip, significantly enhancing user comfort and reducing the risk of fatigue or injury during prolonged use.

Manufacturing processes have also undergone continuous refinement, driven by automation and precision engineering. Techniques such as advanced forging, precision machining, and specialized heat treatment processes are crucial for creating tools with optimal strength-to-weight ratios and consistent quality. Forging, in particular, refines the grain structure of steel, imparting superior strength and resilience to tool heads. Robotic welding and assembly technologies contribute to higher production efficiency and accuracy, ensuring consistency across product lines. Surface treatments, including corrosion-resistant coatings and polished finishes, not only enhance the aesthetic appeal but also extend the lifespan of tools by protecting them from environmental degradation, which is particularly important for tools used in harsh conditions.

Ergonomics and design engineering represent another critical technological frontier, directly influencing user experience and market competitiveness. Manufacturers employ sophisticated CAD/CAM software and biomechanical analysis to design tools that fit naturally in the hand, distribute weight effectively, and minimize strain. This includes optimizing handle shapes, grip textures, and overall balance to improve control and reduce the risk of repetitive strain injuries. Innovations like anti-vibration technologies, often incorporating specialized materials or internal dampening systems within handles, are becoming standard in premium tools. The integration of data-driven design approaches, while perhaps not 'AI' in the traditional sense, uses computational methods to simulate tool performance and user interaction, leading to more efficient and comfortable designs that push the boundaries of traditional hand tool utility and appeal.

Regional Highlights

- North America: This region represents a mature and stable market for hitter-based hand tools, characterized by strong consumer demand driven by robust construction sectors, a deeply embedded DIY culture, and a high emphasis on product quality, durability, and ergonomic design. The presence of major global players and established distribution networks ensures a competitive landscape.

- Europe: The European market demonstrates consistent demand, fueled by steady construction activities, stringent safety standards, and a preference for high-quality, specialized tools, particularly in countries like Germany and the UK. Sustainability and ergonomic advancements are key drivers, with a focus on tools that meet professional trade requirements.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, propelled by rapid urbanization, significant infrastructure development projects, and a burgeoning middle class in countries such as China, India, and Southeast Asia. Both professional and DIY segments are expanding, creating immense opportunities for market players.

- Latin America: This region exhibits emerging market characteristics with increasing industrialization and developing construction sectors. Economic growth in countries like Brazil and Mexico is driving demand, although market penetration and distribution infrastructure are still evolving.

- Middle East and Africa (MEA): The MEA region is witnessing substantial demand due to large-scale infrastructure investments, particularly in the Gulf Cooperation Council (GCC) countries, and growth in mining and oil & gas industries. The demand for durable and robust tools is high, supporting a steady market expansion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hitter based hand tools Market.- Stanley Black & Decker

- Apex Tool Group

- Klein Tools

- Snap-on Incorporated

- Techtronic Industries Co. Ltd. (TTI)

- Robert Bosch GmbH

- Channellock Inc.

- Estwing Manufacturing Co.

- Vaughan & Bushnell Manufacturing Co.

- Wera Tools

- GEDORE Group

- Knipex-Werk C. Gustav Putsch KG

- Facom

- Hultafors Group

- Irwin Tools

- Fisco Tools

- Makita Corporation

- DeWalt

- Milwaukee Tool

- Proto

Frequently Asked Questions

Analyze common user questions about the Hitter based hand tools market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the current estimated size of the Hitter based hand tools Market?

The Hitter based hand tools Market is estimated at USD 8.75 Billion in 2026, showcasing its significant global economic footprint.

What are the primary factors driving the growth of the Hitter based hand tools Market?

Key drivers include robust global construction activities, the expanding popularity of DIY projects, and ongoing demands for industrial maintenance and repair operations.

How is the Hitter based hand tools Market segmented?

The market is segmented by product type (e.g., hammers, chisels, axes), application (e.g., construction, automotive, DIY), end-user (professional, residential), material, and distribution channel (online, offline).

What are the main challenges facing the Hitter based hand tools Market?

Challenges include intense competition from power tools, volatility in raw material prices, and market maturity in developed regions which often limits growth to replacement cycles.

Who are the leading companies in the Hitter based hand tools Market?

Top players include Stanley Black & Decker, Apex Tool Group, Klein Tools, Snap-on Incorporated, and Techtronic Industries Co. Ltd., among others, driving innovation and market competition.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager