Hog Production and Pork Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434272 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Hog Production and Pork Market Size

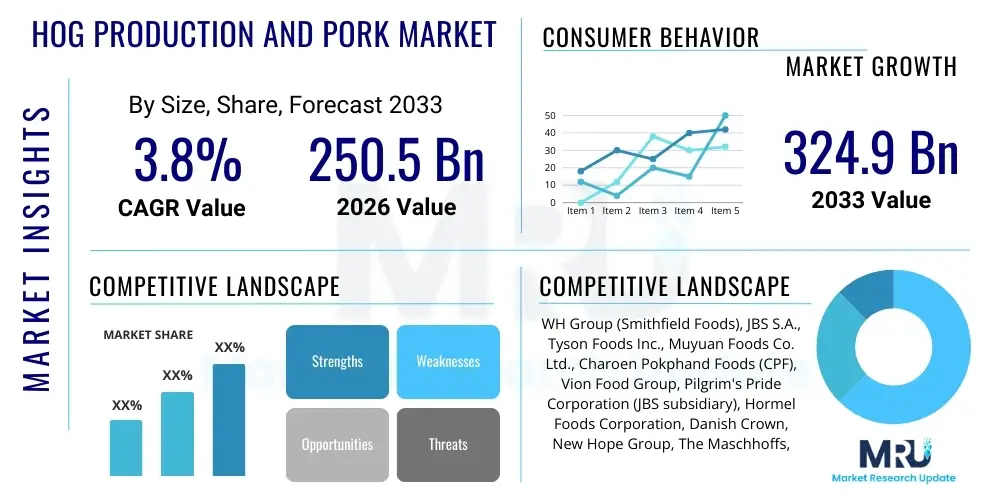

The Hog Production and Pork Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 3.8% between 2026 and 2033. The market is estimated at USD 250.5 Billion in 2026 and is projected to reach USD 324.9 Billion by the end of the forecast period in 2033.

Hog Production and Pork Market introduction

The Hog Production and Pork Market encompasses the entire lifecycle from breeding and rearing swine to the processing, distribution, and consumption of finished pork products. This vast global industry is fundamentally driven by continuously rising global meat demand, particularly from densely populated and rapidly developing regions in Asia Pacific. Pork remains the most widely consumed meat globally, necessitating sophisticated production systems that balance high yield with stringent quality and safety standards. Key market dynamics are centered on maximizing feed conversion efficiency, managing prevalent swine diseases such as African Swine Fever (ASF), and adopting sustainable farming practices to meet regulatory and consumer pressures regarding animal welfare and environmental impact. The market includes both fresh cuts distributed through retail channels and a wide array of processed products, including bacon, ham, sausages, and specialty deli meats.

Product description within this market spans across various classifications, including fresh pork cuts (loins, shoulders, bellies), which form the staple, and value-added processed pork items. The quality of the pork is increasingly differentiated based on production methods—conventional, organic, and free-range systems—catering to diverse consumer preferences regarding taste, fat content, and ethical sourcing. Major applications of pork span across retail sales (supermarkets, hypermarkets), food service (restaurants, catering, institutional feeding), and industrial processing (used in packaged foods and ingredients). The versatility and relatively lower cost of production compared to other meats often solidify its position as a primary protein source globally.

The primary driving factors sustaining market growth involve population expansion, rising disposable incomes in emerging economies, and the increasing trend of urbanization leading to higher consumption of processed and readily available meat products. Technological advancements in genetic selection, precision feeding, and disease management are crucial benefits that allow producers to scale operations while minimizing losses and ensuring consistent supply. However, the market faces structural challenges related to market volatility stemming from fluctuating feed costs, the cyclical nature of hog prices, and the ever-present threat of high-impact epizootic diseases, which necessitate significant investment in biosecurity protocols and regulatory compliance.

Hog Production and Pork Market Executive Summary

The global Hog Production and Pork Market is experiencing significant transformation, driven primarily by efforts to rebuild swine populations in regions previously devastated by African Swine Fever (ASF) and a robust structural shift toward industrialized, highly biosecure production models. Business trends emphasize vertical integration, where large corporations control genetics, feeding, processing, and distribution, thereby maximizing supply chain efficiency and mitigating risk exposure. Furthermore, consumer demand for traceable, antibiotic-free, and ethically raised pork is compelling producers to invest in auditing systems and specialized certifications, influencing premium pricing segments. Financial strategies across leading market players focus on acquiring smaller, technologically advanced farms or processing facilities to secure geographical footholds and enhance processing capacity, especially in high-demand Asian markets. Technological adoption, particularly in real-time monitoring and data analytics for herd health and feed efficiency, is paramount to maintaining competitive advantage in an increasingly capital-intensive sector.

Regional trends highlight the continued dominance of Asia Pacific, driven by China, which remains both the largest producer and consumer, defining global price benchmarks and trade flows. China's efforts to modernize its swine industry post-ASF have led to massive capital expenditure on advanced, climate-controlled mega-farms, favoring international suppliers of genetic material and farming technology. North America and Europe continue to be critical exporters, prioritizing sustainability and complex processing capabilities to cater to high-value international markets. Europe, particularly the European Union, faces heightened regulatory scrutiny regarding welfare standards and environmental emissions, compelling innovation in manure management and reducing the reliance on conventional confinement systems. Latin America, specifically Brazil, leverages abundant feed resources and geographical advantages to emerge as a rapidly growing, low-cost exporter, challenging established trade patterns.

Segment trends underscore the accelerated growth in the processed pork segment, particularly ready-to-eat and convenience meat products, mirroring broader consumer shifts toward prepared foods globally. While fresh pork remains foundational, the high margin potential of processed products, such as packaged bacon, gourmet sausages, and prepared deli slices, attracts significant investment in processing technologies and product development. Additionally, the premiumization trend is manifesting in niche segments like certified organic and heritage pork, although these segments represent a smaller volume of the overall market. Genetic advancements are steering production toward breeds optimized not just for yield but also for specific meat quality characteristics (marbling, texture) demanded by discerning food service operators and high-end retail chains, further fragmenting and specializing the market based on quality and consumer perception.

AI Impact Analysis on Hog Production and Pork Market

User inquiries concerning AI in the Hog Production and Pork Market primarily revolve around operational efficiency, disease prediction, and labor management challenges. Common questions address how AI-powered visual recognition systems can monitor individual hog behavior and health indicators, the efficacy of machine learning models in optimizing complex feed formulations based on real-time growth data, and the role of predictive analytics in forecasting disease outbreaks like ASF or PRRS within large herds. There is also keen interest in understanding the Return on Investment (ROI) for implementing costly AI infrastructure versus traditional management practices, particularly regarding labor cost reduction and sustainability improvements. Users seek concise summaries of AI’s capability to move the industry towards true precision livestock farming (PLF) and enhance biosecurity through automated monitoring and early anomaly detection.

AI adoption is transforming hog production from a traditional agricultural practice into a data-intensive manufacturing process. Machine learning algorithms are crucial for analyzing vast datasets generated by sensors, cameras, and biometric trackers installed throughout production facilities. This data analysis allows farmers and managers to move beyond reactive management to proactive intervention. For example, AI can analyze vocalizations, gait patterns, and consumption rates to identify subtle signs of illness or stress long before clinical symptoms appear, drastically improving treatment outcomes and reducing mortality rates. This enhanced predictive capability is vital for biosecurity, acting as a critical early warning system against widespread infections, thereby minimizing massive economic losses that characterize the market.

Furthermore, AI is instrumental in optimizing resource utilization, a critical factor given the market’s exposure to volatile feed and energy prices. Algorithms precisely calculate and adjust environmental controls (ventilation, temperature) and feeding schedules, ensuring peak feed conversion ratios (FCR) and minimizing waste. In the processing stage, AI-driven sorting and grading systems utilize computer vision to assess carcass quality, fat distribution, and primal cut yield with unparalleled accuracy, maximizing processor profitability and standardizing product quality for downstream applications. This integrated application of AI across the value chain, from farrowing to fabrication, ultimately enhances efficiency, traceability, and compliance with increasingly complex global food safety standards.

- AI-powered Predictive Health Monitoring: Real-time analysis of behavior, temperature, and movement patterns to forecast disease outbreaks (e.g., ASF, PRRS) and initiate rapid isolation protocols.

- Precision Nutrition Optimization: Machine learning models adjust feed ingredient ratios dynamically based on genetic strain, growth phase, and real-time environmental conditions to maximize Feed Conversion Ratio (FCR).

- Automated Farrowing and Nursery Management: Computer vision systems monitor sow welfare during farrowing and identify critical needs of newborn piglets, reducing labor intensity and increasing survivability.

- Environmental Control Automation: Intelligent climate control systems optimize barn temperature, humidity, and air quality using predictive algorithms, leading to reduced energy consumption and improved animal comfort.

- Enhanced Processing Efficiency: AI imaging and robotics used in processing plants for accurate carcass grading, cutting optimization, and quality control inspection, minimizing human error and maximizing yield.

- Supply Chain Traceability: Integration of blockchain and AI analytics to track pork products from farm to fork, ensuring integrity and rapid recall capabilities in case of contamination or outbreak.

DRO & Impact Forces Of Hog Production and Pork Market

The Hog Production and Pork Market is influenced by a powerful combination of driving factors, structural restraints, and emerging opportunities, all shaped by significant external impact forces. Key drivers include sustained global population growth, urbanization, and rising per capita meat consumption, particularly in developing Asian nations, coupled with continuous technological advancements in genetics and feeding systems that increase efficiency and yield. Conversely, the market is severely restrained by high levels of operational risk, primarily the endemic threat of transboundary diseases like African Swine Fever (ASF), volatile feed commodity prices (corn and soybean), and increasingly restrictive environmental and animal welfare regulations, particularly in Western markets. Opportunities lie in the expansion of export markets, especially for high-value cuts, the development of sustainable and alternative protein feeds, and the effective deployment of precision livestock farming (PLF) technologies to mitigate labor shortages and enhance biosecurity. These internal dynamics are continuously shaped by overarching impact forces, including global trade policies, climate change effects on feed production, and shifting consumer perceptions regarding meat consumption ethics and health.

Segmentation Analysis

The Hog Production and Pork Market is systematically segmented based on various factors crucial for understanding consumption patterns, production methodologies, and processing requirements. Primary segmentation includes Product Type (Fresh Pork, Processed Pork), Application (Retail, Food Service, Industrial Processing), and Production System (Conventional, Organic, Free-Range). This segmentation allows producers and processors to tailor their offerings to specific consumer demographics and distribution channels, enabling targeted marketing and optimization of supply chain logistics. The growth rate within these segments often reflects shifting global dietary preferences, with processed and value-added segments showing robust expansion due to convenience, while sustainable and organic systems cater to niche, premium markets focused on ethical sourcing and perceived health benefits.

- Product Type

- Fresh Pork (Loin, Shoulder, Belly, Ribs, Ham)

- Processed Pork (Bacon, Ham, Sausage, Deli Meats, Canned Pork, Prepared Meals)

- Application

- Retail (Supermarkets, Hypermarkets, Convenience Stores)

- Food Service (Restaurants, QSRs, Institutional Catering)

- Industrial Processing (Ingredient Manufacturing, Further Processing)

- Production System

- Conventional Farming

- Organic Farming

- Free-Range/Pasture-Raised Farming

- Distribution Channel

- Direct Sales (Farm to Consumer)

- Indirect Sales (Wholesale, Retail Chains)

Value Chain Analysis For Hog Production and Pork Market

The value chain for the Hog Production and Pork Market is characterized by highly complex linkages spanning genetic development, primary production, processing, and final distribution. Upstream analysis focuses on key input providers: genetic companies supply high-performance breeding stock, feed manufacturers provide scientifically formulated rations (often the single largest input cost), and pharmaceutical/veterinary companies supply health products and biosecurity solutions. Efficiency in this upstream segment is vital, as improvements in feed conversion ratio (FCR) through superior genetics and nutrition directly translate into lower production costs, offering a substantial competitive advantage to vertically integrated operations. Strategic sourcing of key feed ingredients, particularly corn and soy, and managing price volatility are central challenges at this stage.

Midstream activities involve primary production (hog farming) and processing (slaughtering, cutting, fabrication). Primary production is increasingly industrialized, utilizing climate-controlled facilities and precision technology to maximize throughput while adhering to strict biosecurity protocols, especially post-ASF. The processing stage is capital-intensive and requires high levels of automation for efficient disassembly, grading, and packaging of meat cuts. Downstream analysis focuses on connecting processed pork to consumers through various distribution channels. Major distributors, wholesalers, and food service providers act as intermediaries, managing cold chains and inventory. The effectiveness of the cold chain is paramount to maintaining product quality and safety, requiring sophisticated logistics and monitoring systems to minimize spoilage and ensure regulatory compliance.

Distribution channels are broadly categorized into direct and indirect sales. Direct channels, while less common for large volumes, include farm stands or specialized butcher shops, focusing primarily on high-end or heritage pork products where traceability and farm transparency are premium selling points. Indirect channels dominate the market, utilizing wholesalers and large retail networks (supermarkets and hypermarkets) for mass distribution of both fresh and processed products. Furthermore, the industrial channel supplies large manufacturers that use pork as an ingredient in consumer-packaged goods. The rise of e-commerce and specialized meat subscription services is creating new, highly efficient indirect pathways, enabling processors to bypass some traditional intermediaries, provided they can ensure reliable, high-quality cold chain delivery directly to consumers.

Hog Production and Pork Market Potential Customers

Potential customers and end-users of the Hog Production and Pork Market are highly diversified, ranging from global retail giants demanding consistent quality and large volumes to niche, independent food service operators requiring specialized cuts and certifications. Retail consumers, accessed via supermarkets and hypermarkets, constitute the largest volume segment, driven by price sensitivity for standard cuts and increasing willingness to pay a premium for organic, certified welfare-friendly, or regional specialty pork. These buyers demand robust supply chain visibility and adherence to private label quality standards. Effective inventory management and minimizing stock-outs are primary concerns for retail buyers, necessitating reliable long-term supply agreements with major processors.

The Food Service sector represents a significant portion of demand, spanning Quick Service Restaurants (QSRs), full-service dining, and institutional catering (schools, hospitals). QSRs and large chain restaurants require highly standardized, often pre-cooked or portioned pork products (e.g., bacon, ham for sandwiches) to ensure consistency across multiple locations, making them key buyers of processed and value-added pork. Fine dining and independent restaurants often seek specific cuts, heritage breeds, or high-quality specialty pork products that align with contemporary culinary trends and specific menu requirements. These buyers value consistent quality, specific fat profiles, and robust flavor characteristics, often forming closer relationships with smaller, specialized processors.

Industrial processors form the third critical customer base, purchasing large quantities of pork raw materials for further processing into derived products such as soups, ready meals, pet foods, and flavorings. These industrial buyers prioritize price, volume, and consistent component composition (e.g., lean-to-fat ratio). Their procurement strategies are highly sensitive to global commodity market fluctuations. The emerging customer base includes manufacturers focusing on novel food formats, such as meat analogs or hybrid meat products, which require specific pork components (fats or proteins) to enhance texture and flavor. Meeting the diverse specifications of these three major customer groups—volume, quality, or specialization—requires flexibility and technical precision throughout the entire hog production and processing chain.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 250.5 Billion |

| Market Forecast in 2033 | USD 324.9 Billion |

| Growth Rate | CAGR 3.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | WH Group (Smithfield Foods), JBS S.A., Tyson Foods Inc., Muyuan Foods Co. Ltd., Charoen Pokphand Foods (CPF), Vion Food Group, Pilgrim's Pride Corporation (JBS subsidiary), Hormel Foods Corporation, Danish Crown, New Hope Group, The Maschhoffs, Triumph Foods, Clemens Food Group, LDC (Cooperl Arc Atlantique), Foster Farms, Cranswick plc, BRF S.A., Norsvin, PIC (Pig Improvement Company), Genus plc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hog Production and Pork Market Key Technology Landscape

The technological landscape of the Hog Production and Pork Market is rapidly evolving, driven by the need for increased efficiency, enhanced biosecurity, and compliance with welfare standards. Central to this evolution is the broad application of Precision Livestock Farming (PLF). PLF technologies utilize interconnected sensors, cameras, and data analysis platforms (often leveraging AI and IoT) to monitor environmental conditions, individual animal health, and feeding behavior in real-time. This real-time data allows farmers to move from batch management to individual animal management, significantly improving resource utilization, reducing waste, and facilitating early intervention for health issues, which is crucial for managing the threat of high-contagion diseases. Furthermore, automated feeding systems controlled by algorithms ensure that each animal receives a precisely calculated ration, maximizing the Feed Conversion Ratio (FCR), which is the most critical operational metric in the industry.

Beyond the farm, advanced genetics and breeding technologies form the bedrock of productivity improvements. Genomic selection techniques utilize DNA markers to rapidly identify and select breeding stock that exhibit superior traits, such as disease resistance, higher lean meat yield, and improved mothering ability in sows. Companies specializing in swine genetics employ sophisticated sequencing and bioinformatics tools to accelerate the development of robust, high-performing breeds tailored for specific market demands, such as faster growth rates or pork quality optimized for specific processed products like high-quality bacon. Simultaneously, significant investment is being channeled into vaccine technology development, particularly to combat complex viral diseases like PRRS (Porcine Reproductive and Respiratory Syndrome) and to enhance protection against emerging ASF threats, although the latter still lacks a commercially viable, widely accepted vaccine.

The processing segment is heavily reliant on automation and robotics. High-throughput processing plants use sophisticated robotic cutting systems and 3D imaging technology to maximize yield from each carcass by optimizing cutting patterns based on real-time fat and muscle measurements, reducing manual labor dependency and improving consistency. Furthermore, food safety technologies, including advanced rapid pathogen testing systems and integrated traceability platforms (often involving blockchain), are becoming standard requirements, ensuring transparency and enabling immediate product recall management. These technological advancements collectively reduce operational risks, optimize economic outputs, and meet the growing global demand for safe, reliable, and ethically produced pork products.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the global Hog Production and Pork Market, driven overwhelmingly by consumption and production in China. Despite severe setbacks due to African Swine Fever (ASF) since 2018, the region is investing massively in rebuilding its swine herd, shifting from traditional backyard farming to large-scale, vertically integrated, and technologically advanced production facilities. This modernization drive has created significant demand for genetics, feed technologies, and biosecurity solutions. Southeast Asian nations such as Vietnam and the Philippines are also large consumers and producers, focused on domestic market self-sufficiency and managing disease risks. The large, affluent middle class in countries like Japan and South Korea drives strong import demand for premium, high-quality pork products, particularly from North America and Europe, emphasizing specific textural and flavor profiles for prepared cuisine.

- North America: North America, led by the United States, is a primary global exporter, characterized by highly industrialized and efficient production systems, often based on vertically integrated models. The region benefits from abundant, low-cost feed inputs (corn and soy) and advanced genetic research. U.S. producers prioritize scale and competitive cost structures, enabling them to dominate global trade flows. The focus here is on maximizing throughput, maintaining rigorous biosecurity measures, and addressing domestic consumer trends leaning towards antibiotic-free and crate-free pork options. Canada maintains a strong export orientation, focusing on high-quality pork demanded by Japanese and Korean markets, with strict adherence to quality and safety standards.

- Europe: The European market is highly regulated, distinguished by stringent animal welfare and environmental standards mandated by the European Union. These regulations, while increasing production costs, often lead to a focus on premium, traceable, and sustainable pork products, appealing to health-conscious consumers. Major producers like Germany, Spain, and Denmark are leaders in export, leveraging advanced processing technology and certifications. Spain, in particular, maintains a significant competitive edge due to its extensive production and export capabilities, particularly for specialized products like Iberian ham. Innovation in Europe centers on alternative housing systems (group housing for sows) and reducing reliance on antibiotics, necessitating technological solutions for enhanced herd health monitoring.

- Latin America: Latin America, particularly Brazil, is emerging as a powerful, cost-competitive force in the global pork export market. Brazil benefits from favorable climate, vast land resources, and large-scale domestic production of feed commodities. The region's primary competitive advantage lies in its ability to produce pork at lower costs compared to North American and European counterparts, making it highly attractive to import-dependent nations in Asia and the Middle East. Argentina and Chile are also expanding their roles as exporters, focusing on diversifying their markets and improving processing infrastructure to meet international quality standards. The growth trajectory in this region is primarily export-driven, capitalizing on global supply shortfalls caused by disease outbreaks elsewhere.

- Middle East and Africa (MEA): The MEA region is generally characterized by lower pork consumption due to religious demographics, but there are growing niche markets serving expatriate populations and non-Muslim communities, particularly in South Africa and specific Gulf urban centers. South Africa holds the largest and most developed pork industry within the continent. Overall, the region is highly import-reliant for pork products, focusing on frozen and highly processed meats that can withstand long distribution chains. The primary regional relevance is as a growing import destination for established exporters from Europe and Latin America, driven by general population growth and urbanization in non-pork sensitive areas.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hog Production and Pork Market.- WH Group (Smithfield Foods)

- JBS S.A.

- Tyson Foods Inc.

- Muyuan Foods Co. Ltd.

- Charoen Pokphand Foods (CPF)

- Vion Food Group

- Pilgrim's Pride Corporation (JBS subsidiary)

- Hormel Foods Corporation

- Danish Crown

- New Hope Group

- The Maschhoffs

- Triumph Foods

- Clemens Food Group

- LDC (Cooperl Arc Atlantique)

- Foster Farms

- Cranswick plc

- BRF S.A.

- Norsvin

- PIC (Pig Improvement Company - Genus plc subsidiary)

- Wens Foodstuff Group Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Hog Production and Pork market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the global Hog Production and Pork Market?

The primary driver is the sustained increase in global protein demand, particularly from rapidly urbanizing populations and rising middle-class disposable incomes in the Asia Pacific region, coupled with the inherent cost-efficiency of pork production compared to other major meats.

How does African Swine Fever (ASF) continue to impact global pork supply?

ASF continues to impose significant structural volatility. While production in affected regions (primarily Asia) is stabilizing through large-scale modernization and biosecurity investment, the risk of recurrence mandates high capital expenditure, drives market consolidation, and fuels major shifts in international trade dependence on key exporting nations like the U.S. and Brazil.

What role does Precision Livestock Farming (PLF) technology play in modern hog production?

PLF, incorporating AI, sensors, and IoT, is critical for optimizing operational efficiency by ensuring precision feeding (maximizing Feed Conversion Ratio), automating environmental control, and providing real-time predictive health monitoring to rapidly detect and manage disease outbreaks, thereby mitigating economic risks.

Which segmentation of the pork market is experiencing the fastest growth?

The Processed Pork segment, including ready-to-eat and value-added products like packaged bacon, ham, and prepared meals, is showing the fastest growth rate globally, driven by consumer demand for convenience, long shelf life, and variety, particularly in urban retail environments.

Why are sustainability and animal welfare standards major restraints in the European pork market?

European Union regulations impose some of the world's most stringent standards regarding animal welfare (e.g., sow housing restrictions) and environmental protection (e.g., manure management and GHG emissions). While these regulations satisfy consumer ethical demands, they necessitate substantial capital investment, increasing operational costs and acting as a restraint on rapid market expansion compared to less regulated regions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager