Hollow Silica Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437647 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Hollow Silica Market Size

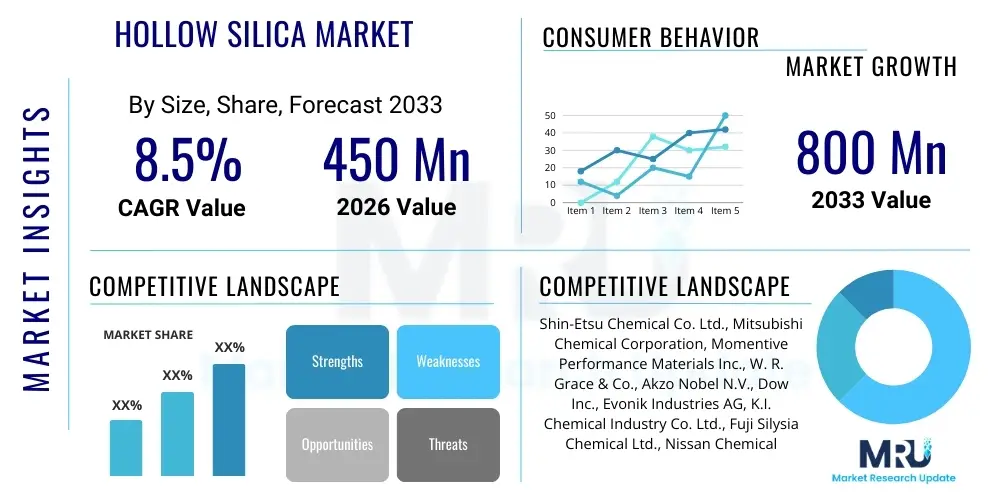

The Hollow Silica Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 800 Million by the end of the forecast period in 2033.

Hollow Silica Market introduction

The Hollow Silica Market encompasses the production, distribution, and application of silica-based particles characterized by a hollow core and porous shell structure. These unique physical attributes, including low density, high specific surface area, excellent thermal stability, and superior insulation properties, make hollow silica highly valuable across a multitude of high-technology sectors. The core product, typically synthesized through templating, sol-gel, or emulsion methods, finds critical application as fillers, drug delivery vehicles, thermal insulators, and cosmetic additives. The growing recognition of its lightweight properties in high-performance materials is significantly driving its adoption. Key application segments include coatings, where it enhances optical properties and reduces density; medical diagnostics, owing to its biocompatibility and controlled release capabilities; and electronics, where it acts as a low-dielectric constant material. The versatility derived from controlling shell thickness and core void size allows manufacturers to tailor the material precisely to specific industrial demands, ensuring sustained market expansion throughout the forecast period.

Hollow silica particles, chemically stable and environmentally benign, offer distinct advantages over traditional solid fillers, particularly in areas demanding material lightness and high porosity. In the field of advanced composites and plastics, the incorporation of hollow silica reduces the overall weight of the final product without compromising mechanical integrity, a crucial factor for the automotive and aerospace industries striving for fuel efficiency and reduced emissions. Furthermore, the material’s capacity to encapsulate active ingredients is a cornerstone of its success in pharmaceutical and cosmetic formulations, enabling sustained release of therapeutic agents or fragrance components, thereby improving product efficacy and user experience. The global push toward sustainable and energy-efficient materials also strongly favors hollow silica, as its insulating properties are utilized effectively in building materials and specialized thermal barriers, contributing directly to energy savings. These inherent benefits solidify hollow silica's position as a critical material science innovation poised for robust commercialization.

Major driving factors fueling the expansion of the Hollow Silica Market include the escalating demand for high-performance lightweight fillers in the paints and coatings industry, especially in marine and protective coating segments where resistance to corrosion and reduced density are paramount. Secondly, the rapid advancements in drug delivery systems and biomedical imaging techniques heavily rely on the precise encapsulation capabilities of hollow silica spheres, driving consumption within the pharmaceutical and biotechnology sectors. Regulatory pressures encouraging the use of safer, non-toxic materials, coupled with increasing investments in nanobiotechnology research and development, further accelerate market growth. Additionally, the proliferation of specialized electronic components requiring ultra-low dielectric constant insulators necessitates the specialized properties offered by hollow silica, making it indispensable in modern semiconductor manufacturing and advanced circuitry. The confluence of these technological drivers and application demands establishes a strong foundation for substantial market growth.

Hollow Silica Market Executive Summary

The global Hollow Silica Market is experiencing dynamic growth driven by crucial business trends focusing on material science innovation and supply chain efficiency. A key trend involves strategic collaborations between academic research institutions and industrial manufacturers aimed at developing scalable and cost-effective synthesis methods, moving away from high-cost batch processing toward continuous flow production. This focus on manufacturing optimization is essential for meeting the escalating bulk demand from high-volume industries like construction and automotive. Furthermore, companies are increasingly investing in developing functionalized hollow silica—particles surface-modified with specific chemical groups to enhance compatibility with diverse matrix materials (polymers, resins, etc.). This functionalization broadens application scope, particularly in specialized composite materials and active smart coatings. The competitive landscape is characterized by moderate consolidation, with major chemical producers acquiring smaller, specialized nanotechnology firms to gain access to proprietary synthesis technologies and intellectual property related to particle morphology control, ultimately streamlining the product portfolio and accelerating market penetration in niche, high-margin sectors.

Regional trends indicate that the Asia Pacific (APAC) region dominates the market, primarily due to the rapid industrialization and expansion of end-user sectors such as electronics manufacturing, automotive production, and infrastructure development, particularly in China, Japan, and South Korea. These nations exhibit significant consumption of hollow silica in electronic encapsulation and lightweight automotive parts. Europe, driven by stringent environmental regulations and a strong emphasis on sustainable materials, shows robust growth, focusing on pharmaceutical applications, advanced composites for renewable energy infrastructure (wind turbine blades), and high-efficiency thermal insulation. North America maintains a mature but steady growth rate, largely fueled by substantial research and development expenditure in advanced drug delivery systems and specialized aerospace coatings, where high-performance materials justify premium pricing. These regional dynamics highlight a market split between high-volume, cost-sensitive industrial applications prevalent in APAC and high-value, R&D-intensive applications dominating Western markets.

Segment trends reveal that the application segment of Paints and Coatings holds a dominant market share, attributed to the tangible benefits of reduced volatile organic compounds (VOCs), enhanced durability, and improved thermal insulation properties offered by hollow silica additives. However, the Biomedical and Pharmaceutical segment is poised for the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This accelerated growth is primarily propelled by the breakthrough success of hollow silica spheres as versatile nano-carriers for targeted drug delivery, gene therapy, and advanced diagnostic imaging agents, capitalizing on their superior loading capacity and biocompatibility. Regarding synthesis method, the Sol-Gel technique remains the most widely adopted due to its relative simplicity and ability to control particle size distribution, though emerging techniques like spray drying and templating are gaining traction for achieving highly uniform and tailored shell structures essential for specialized electronic and optical applications. The shift towards specialized, high-purity grades required by medical applications is expected to drive value growth disproportionately compared to volume growth in the later years of the forecast period.

AI Impact Analysis on Hollow Silica Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Hollow Silica Market predominantly center on optimizing material synthesis, predicting performance characteristics, and streamlining supply chain operations. Common questions include: "How can AI reduce the time taken for new hollow silica formulation development?", "Can machine learning accurately predict the optimal shell thickness for specific thermal insulation requirements?", and "What is the role of AI in quality control and defect detection during large-scale manufacturing?". The key themes emerging from this analysis are the expectation that AI will revolutionize the high-throughput screening of synthesis parameters, minimize experimental trial-and-error costs, and significantly accelerate the discovery of novel hollow silica morphologies tailored for highly specific industrial functions, such as high-efficiency catalysis or ultra-stable drug encapsulation. Users anticipate AI acting as a critical enabler for predictive material science, shifting the industry from empirical formulation to data-driven design, thereby ensuring higher purity, uniformity, and reduced time-to-market for specialized products.

The integration of AI, particularly machine learning (ML) and deep learning algorithms, is beginning to fundamentally alter the R&D cycle within the hollow silica domain. By analyzing vast datasets generated from high-throughput experimentation (HTE)—including precursor concentration, temperature profiles, stirring rates, and resulting particle size distribution—AI models can predict the synthesis conditions required to produce hollow silica with targeted properties (e.g., specific pore volume or mechanical strength). This predictive modeling capability drastically reduces the reliance on traditional, time-consuming laboratory optimization methods, enabling manufacturers to rapidly iterate on formulations tailored for emerging applications in electronics and medical technology. Furthermore, AI-powered tools are crucial for simulating particle behavior within complex matrices, such as polymer coatings or concrete mixtures, allowing developers to anticipate performance under real-world stress conditions and ensuring that material properties translate reliably from the lab bench to industrial scale production environments.

Beyond research and development, AI’s impact extends deeply into the manufacturing and commercialization stages of hollow silica. In manufacturing, computer vision systems, powered by deep learning, are being deployed for real-time quality control during synthesis and purification, identifying subtle morphological defects or variations in shell integrity that are imperceptible to human operators. This ensures consistently high product quality, which is paramount for sensitive applications like pharmaceuticals. Strategically, AI assists in demand forecasting and supply chain optimization, predicting shifts in regional market needs (e.g., increased demand for low-density fillers in Asian automotive production) and adjusting production schedules and raw material procurement (e.g., silica precursors, templates) accordingly. This optimization minimizes inventory holding costs, enhances logistical efficiency, and allows producers to maintain competitive pricing, thereby cementing AI's role as a transformative tool across the entire hollow silica value chain.

- AI-driven optimization of synthesis parameters, reducing formulation time by up to 40%.

- Machine learning models predict targeted particle morphology and performance characteristics (e.g., thermal conductivity, drug release kinetics).

- Computer vision systems enhance real-time quality control and defect detection during large-scale production runs.

- Predictive analytics streamline supply chain and inventory management of raw silica precursors and stabilizing agents.

- Accelerated discovery of novel functionalized hollow silica structures for catalysis and sensor applications.

DRO & Impact Forces Of Hollow Silica Market

The Hollow Silica Market dynamics are governed by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and powerful external Impact Forces. The primary drivers revolve around the indispensable need for lightweight materials across major industries, particularly in automotive and aerospace sectors focused on fuel efficiency and emission reduction, making hollow silica's low density and high strength-to-weight ratio highly appealing. Simultaneously, the burgeoning demand from the pharmaceutical sector for advanced encapsulation and targeted drug delivery systems, leveraging the material’s controllable porosity and biocompatibility, is a significant market impetus. Opportunities are strongly linked to expanding applications in energy storage, specifically as anode materials in high-capacity lithium-ion batteries, where the porous structure can accommodate volume expansion, thereby extending battery lifespan and performance. The synergy between these factors creates a robust positive market momentum, despite technical hurdles and cost considerations.

However, the market faces significant restraints that temper its growth trajectory. The most critical restraint is the relatively high manufacturing cost associated with producing hollow silica, especially high-purity, uniform particles required for electronic and medical grades, which limits widespread adoption in cost-sensitive, high-volume industries like traditional construction materials. Furthermore, achieving precise control over particle size, shell thickness, and monodispersity at commercial scale remains a technical challenge, requiring specialized equipment and rigorous quality control protocols. The regulatory landscape surrounding the use of nanomaterials in consumer products and pharmaceuticals presents another restraint; although generally considered safe, the long-term environmental and health impacts of inhaled or ingested nanosilica require ongoing monitoring and may necessitate costly regulatory compliance measures, particularly in European and North American markets, demanding comprehensive toxicological data.

The combined impact forces—economic, technological, and regulatory—exert considerable influence on the market's direction. Technological advancements in synthesis methods, such as continuous hydrothermal flow synthesis and improved templating techniques, are acting as a strong mitigating force against high production costs, promising to enhance scalability and reduce price points over the forecast period, thereby unlocking new market opportunities. Economically, fluctuations in the price of precursor chemicals, notably tetraethyl orthosilicate (TEOS), affect production profitability, yet the premium performance characteristics often justify the higher input costs. Regulatory pressures mandating lower volatile organic compound (VOC) emissions in coatings and strict performance standards in medical implants indirectly favor hollow silica, pushing end-users toward high-performance, safer additive solutions. The overall assessment suggests that the positive impact of technological advancements and expanding high-value applications will outweigh the current cost and scaling restraints, driving sustained moderate to high growth.

Segmentation Analysis

The Hollow Silica Market is strategically segmented across three primary dimensions: Application, Synthesis Method, and End-Use Industry, allowing for a precise understanding of market dynamics and targeted strategic investment. The segmentation by Application details where the material is physically utilized, ranging from simple fillers in paints to complex components in advanced electronics. This analysis helps identify high-growth value segments, particularly those requiring highly customized particle properties. Segmentation by Synthesis Method (e.g., Sol-Gel, Templating, Emulsion) is crucial for manufacturers, as it dictates the cost structure, scalability potential, and the achievable control over morphological characteristics such as shell porosity and uniformity, directly influencing product quality and suitability for specific high-performance applications. The third segmentation, End-Use Industry, groups consumers based on their overarching economic sector, providing clarity on demand stability, regulatory impact, and procurement volumes, with industries like Automotive, Biomedical, and Construction exhibiting unique purchasing patterns and quality requirements.

The granular analysis within the Application segment reveals a crucial divergence between high-volume, low-margin applications and specialized, high-margin uses. High-volume applications, such as coatings and composites, prioritize cost-effectiveness and bulk availability, often utilizing less complex synthesis methods. Conversely, biomedical applications, including drug delivery and diagnostics, demand ultra-high purity, stringent particle size distribution control, and surface functionalization capabilities, requiring advanced synthesis techniques and commanding significantly higher average selling prices. This dichotomy mandates that manufacturers adopt diversified production strategies, allocating capacity for both bulk industrial grades and meticulously controlled specialty grades. Understanding these application-specific requirements is key to market success, driving product differentiation and intellectual property development around synthesis patents aimed at optimizing specific properties like acoustic dampening or optical clarity.

Geographic segmentation is also integral, with regions demonstrating distinct segmentation preferences. For instance, North American and European markets exhibit a stronger preference for specialized hollow silica products used in advanced medical diagnostics and high-end aerospace components, capitalizing on stringent regulatory environments that favor high-quality materials. Conversely, the Asia Pacific market shows robust volume growth driven by the massive consumer electronics and infrastructure development sectors, consuming bulk quantities of hollow silica for fire retardant additives and low-density filler applications. This regional specialization dictates global investment strategies, focusing R&D hubs near pharmaceutical clusters in the West and scaling up manufacturing facilities near high-volume industrial centers in the East, ensuring a balanced global supply chain capable of responding efficiently to diverse demand signals across the segmented product portfolio.

- By Application:

- Paints & Coatings (Thermal Insulation, Density Reduction, Optical Properties)

- Plastics & Composites (Lightweight Filler, Mechanical Reinforcement)

- Biomedical & Pharmaceutical (Drug Delivery, Diagnostics, Gene Therapy)

- Electronics (Low Dielectric Constant Materials, Encapsulation)

- Construction (Thermal Insulation, Lightweight Concrete Additives)

- Cosmetics & Personal Care (Texturizing Agents, UV Protection)

- By Synthesis Method:

- Sol-Gel Process (Most common, high purity potential)

- Templating Method (Hard Templating, Soft Templating)

- Emulsion/Microemulsion Methods (Controls droplet size)

- Spray Drying

- By End-Use Industry:

- Automotive & Transportation

- Aerospace & Defense

- Healthcare & Biotechnology

- Building & Construction

- Chemical & Materials

- Consumer Goods

Value Chain Analysis For Hollow Silica Market

The value chain for the Hollow Silica Market starts with the Upstream Analysis, dominated by the procurement and processing of raw materials. The primary precursors are silicon alkoxides, such as tetraethyl orthosilicate (TEOS) or tetramethyl orthosilicate (TMOS), alongside various surfactants, stabilizers, and templating agents (e.g., polymer beads, carbon spheres) essential for creating the hollow structure. The cost and purity of these chemical precursors are critical factors influencing the final product price and quality. Key upstream suppliers include major chemical companies specializing in silicon derivatives. Efficient sourcing, purification, and just-in-time inventory management of these precursors are vital for maintaining competitive advantage, as precursor price volatility can significantly impact profit margins for hollow silica producers. Furthermore, advancements in green chemistry are pushing for the development of alternative, less toxic, and more sustainably sourced silicon precursors, influencing the long-term structure of the upstream segment.

The Midstream segment involves the core manufacturing process, where hollow silica particles are synthesized, purified, dried, and often functionalized. This stage adds the highest value due to the technical complexity of controlling particle morphology, shell thickness, and porosity—factors crucial for end-user performance. Major hollow silica producers employ various proprietary technologies (Sol-Gel, Templating) to achieve required specifications. Effective process control and high-yield manufacturing are prerequisites for profitability. Following synthesis, extensive downstream processing involves surface modification (functionalization) to ensure compatibility with different host matrices (e.g., making the particle hydrophobic or hydrophilic) and specialized packaging to maintain integrity before distribution. Research and development efforts at this stage focus heavily on scaling up laboratory techniques to industrial production volumes while maintaining strict quality control, particularly for biomedical and high-tech electronic grades which demand exceptional uniformity.

Downstream analysis focuses on distribution channels and end-user engagement, encompassing direct sales, specialized distributors, and indirect sales through compounders and formulators. For high-volume industrial applications (Paints, Construction), indirect sales through large chemical distributors or specialized compounding houses are common, providing broad market reach and localized technical support. Conversely, for highly specialized applications like drug delivery or aerospace composites, Direct and indirect sales models are utilized, often involving direct engagement between the manufacturer’s technical team and the end-user R&D department to tailor the product specification precisely. This direct engagement ensures optimal integration and allows manufacturers to capture valuable market feedback crucial for continuous product refinement. Efficient logistical networks capable of handling fine, lightweight powders are essential for minimizing freight costs and ensuring timely global delivery across all major distribution pathways.

Hollow Silica Market Potential Customers

The primary potential customers and end-users of hollow silica products span a diverse range of high-value and high-volume industries, driven by the materials' unique combination of lightweight properties, thermal insulation capabilities, and porous structure. Major end-users include large multinational chemical companies specializing in architectural and industrial coatings (e.g., marine, aerospace protective coatings), which utilize hollow silica to reduce the weight of paint formulations, improve scrub resistance, and enhance thermal barrier performance. Automotive manufacturers and specialized compounders constitute another significant customer base, integrating hollow silica into lightweight polymer composites for interior and exterior parts to meet stringent efficiency standards. These customers prioritize bulk supply capability, consistency in particle size, and compatibility with standard injection molding or extrusion processes.

Another rapidly expanding customer segment is the Healthcare and Biotechnology sector, encompassing pharmaceutical manufacturers, medical device companies, and advanced diagnostics laboratories. These customers are primarily interested in ultra-high purity hollow silica spheres for sophisticated applications such as targeted drug delivery systems, where the hollow core acts as a protective reservoir for therapeutic agents, ensuring controlled and sustained release at the desired biological location. They demand rigorous validation, biocompatibility testing documentation, and adherence to Good Manufacturing Practice (GMP) standards. This segment is characterized by low volume but extremely high value, prioritizing quality and functional performance over unit cost, making them a premium target market for manufacturers capable of producing biomedical-grade nanostructures.

Furthermore, specialized Electronics and Building & Construction companies represent key strategic customer groups. In electronics, customers include semiconductor manufacturers requiring low-dielectric constant fillers to minimize signal loss in high-frequency circuits and enhance the performance of encapsulation materials. For the construction industry, customers are typically concrete admixture suppliers and insulation panel manufacturers who incorporate hollow silica to produce high-strength, lightweight concrete and superior fire-retardant, insulating panels. These end-users value the material's contribution to energy efficiency and structural integrity. Targeting these diverse customer needs requires specialized sales teams and customized product offerings that address industry-specific regulatory compliance and performance metrics.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 800 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Shin-Etsu Chemical Co. Ltd., Mitsubishi Chemical Corporation, Momentive Performance Materials Inc., W. R. Grace & Co., Akzo Nobel N.V., Dow Inc., Evonik Industries AG, K.I. Chemical Industry Co. Ltd., Fuji Silysia Chemical Ltd., Nissan Chemical Corporation, PPG Industries Inc., 3M Company, Imerys S.A., Microlite Co., Cospheric LLC, PQ Corporation, Tosoh Corporation, Applied Sciences, Inc., Silicium S.A., Spherex Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Hollow Silica Market Key Technology Landscape

The technological landscape of the Hollow Silica Market is primarily defined by the evolution of synthesis methods aimed at achieving precise control over particle morphology, crucial for optimizing performance in demanding applications. The Sol-Gel process remains a foundational technology, favored for its versatility and ability to produce high-purity silica from liquid precursors like TEOS. Continuous advancements in Sol-Gel involve optimizing catalyst systems and reaction conditions (pH, temperature) to minimize particle aggregation and improve structural stability, particularly for creating monodispersed spheres essential for optical and electronic uses. However, the limitation of Sol-Gel often lies in achieving a perfect hollow structure with a uniform, non-collapsing shell at high yields, prompting research into hybrid techniques that combine Sol-Gel chemistry with other methods to enhance structural integrity and control over internal void size.

The Templating Method represents another crucial technological pillar, offering superior control over the size and shape of the resulting hollow sphere. This involves using sacrificial templates—such as polymer spheres, carbon nanotubes, or emulsion droplets—around which the silica shell is grown, followed by the removal of the template via calcination or chemical dissolution. Hard Templating (using solid spheres) yields highly defined structures, while Soft Templating (using micelles or liquid droplets) is increasingly preferred for its cost-effectiveness and scalability, particularly in producing mesoporous shells that are vital for high-loading drug delivery carriers. Current technological breakthroughs focus on developing recyclable and environmentally friendly template materials and refining the template removal process to reduce energy consumption and maintain the delicate shell integrity, thereby lowering the overall production cost of high-quality mesoporous hollow silica.

Emerging technologies, such as microfluidic synthesis and advanced spray drying techniques, are gaining prominence due to their potential for large-scale, continuous manufacturing with exceptional particle uniformity. Microfluidic reactors allow for highly precise mixing and reaction timing, enabling the synthesis of highly monodispersed hollow silica particles tailored for biomedical imaging agents and specialized electronic encapsulation. Meanwhile, enhanced spray drying techniques, combined with specialized nozzles and thermal profiles, are being adapted to create micron-sized hollow spheres efficiently for use as lightweight fillers in high-volume industrial composites and coatings. The future technological trajectory is centered on integrating AI and machine learning into these processes, enabling real-time optimization and quality assurance, thereby pushing the limits of scalable production for highly specialized, nano-sized hollow silica structures required by next-generation applications in battery technology and personalized medicine.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market for hollow silica, primarily driven by massive industrial growth in China, India, and Southeast Asian nations. The region's dominance is attributed to the booming electronics manufacturing sector, which requires low-dielectric constant materials for advanced circuitry, and the extensive automotive production aiming to integrate lightweight fillers for improved vehicle performance and fuel efficiency. Furthermore, rapid urbanization and infrastructure development boost demand for insulating and lightweight additives in the construction sector, particularly in high-rise buildings and energy-efficient materials. Regional companies are actively investing in local synthesis facilities to meet this escalating, cost-competitive demand, often focusing on high-volume industrial grades used in paints, coatings, and structural composites, securing the region's position as a global manufacturing hub and major consumer.

- North America: North America holds a significant market share, characterized by its focus on high-value, R&D-intensive applications, particularly within the biomedical, aerospace, and defense sectors. The stringent regulatory environment and high investment in biotechnology propel the use of specialized hollow silica spheres for advanced drug delivery, targeted cancer therapies, and sophisticated medical diagnostics. The aerospace industry utilizes high-performance, functionalized hollow silica in specialized composite materials and thermal protective coatings, valuing stability and lightweight characteristics above cost. Market growth is stable and driven by innovation rather than sheer volume, with leading research universities and pharmaceutical companies forming strategic partnerships with hollow silica manufacturers to develop custom, proprietary materials.

- Europe: The European market demonstrates steady growth, strongly influenced by the European Union’s focus on sustainability, energy efficiency, and stringent environmental regulations (e.g., REACH). Demand is robust in the construction sector for high-efficiency thermal insulation materials, where hollow silica drastically improves the performance of insulating plasters and panels, aligning with net-zero carbon goals. The automotive sector in Germany and France utilizes hollow silica in polymer matrix composites to achieve lighter vehicle structures, complying with CO2 reduction mandates. Additionally, Europe's mature pharmaceutical industry provides a strong demand base for specialized, high-purity nanosilica carriers, ensuring sustained investment in advanced synthesis capabilities across the region, especially in countries like Germany and Switzerland.

- Latin America (LATAM): The LATAM market is emerging, with growth concentrated in Brazil and Mexico, fueled by expanding construction and automotive industries. While the current market size is smaller compared to APAC or North America, industrialization and increasing foreign direct investment are gradually driving the adoption of high-performance materials. Demand is primarily centered on utilizing hollow silica as a cost-effective lightweight filler in paints and coatings for general industrial use and infrastructure projects. Market penetration is expected to accelerate as local industries mature and regulatory standards for construction quality and material performance improve across the region, necessitating the efficiency benefits provided by hollow silica additives.

- Middle East and Africa (MEA): The MEA market shows potential, largely driven by significant investment in large-scale construction projects and diversification away from oil dependence, especially in Gulf Cooperation Council (GCC) countries. The high ambient temperatures in the region create a substantial need for superior thermal insulation materials in residential and commercial buildings, making hollow silica additives highly desirable for energy conservation. Demand is also rising from the protective coatings sector for applications in the oil and gas infrastructure, where materials must withstand extreme corrosion and temperature variations. Growth, though localized and often tied to major governmental infrastructure spending cycles, is projected to be consistent, focusing on robust, high-performance industrial applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Hollow Silica Market.- Shin-Etsu Chemical Co. Ltd.

- Mitsubishi Chemical Corporation

- Momentive Performance Materials Inc.

- W. R. Grace & Co.

- Akzo Nobel N.V.

- Dow Inc.

- Evonik Industries AG

- K.I. Chemical Industry Co. Ltd.

- Fuji Silysia Chemical Ltd.

- Nissan Chemical Corporation

- PPG Industries Inc.

- 3M Company

- Imerys S.A.

- Microlite Co.

- Cospheric LLC

- PQ Corporation

- Tosoh Corporation

- Applied Sciences, Inc.

- Silicium S.A.

- Spherex Inc.

Frequently Asked Questions

Analyze common user questions about the Hollow Silica market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of hollow silica over traditional solid fillers?

Hollow silica offers significantly reduced density, resulting in lighter final products (crucial for automotive/aerospace), superior thermal insulation properties due to its internal void space, and a high surface area suitable for encapsulation and controlled release applications. This unique structure provides both lightweighting and functional benefits unmatched by traditional solid fillers.

Which synthesis method is most commercially viable for high-volume hollow silica production?

The Sol-Gel process is currently the most commercially viable method for high-volume production due to its relatively low precursor cost and scalability, despite requiring careful control to ensure structural uniformity. However, advanced spray drying techniques are rapidly gaining viability for large-scale, cost-effective manufacturing of micron-sized particles used in construction and basic coatings.

How is the Hollow Silica Market affected by sustainability and environmental regulations?

The market is positively affected, as hollow silica helps reduce the density of materials, contributing to fuel efficiency in transportation and improving thermal insulation in buildings, thus lowering overall energy consumption. Furthermore, the use of hollow silica in coatings helps reduce the reliance on volatile organic compounds (VOCs), aligning with stricter environmental regulations worldwide.

What is the main driver of growth in the biomedical application segment?

The main driver is the material's unique capability to function as a highly efficient nano-carrier for targeted drug delivery. The hollow core allows for high loading capacity of therapeutic agents, while the porous shell enables precise, controlled release kinetics, significantly enhancing the efficacy and reducing the systemic toxicity of pharmaceutical treatments, driving high-value demand.

What are the key challenges related to the manufacturing and cost of hollow silica?

The primary challenge is the high cost associated with producing ultra-pure, monodispersed hollow silica spheres required for electronic and medical applications. Maintaining consistent particle morphology and precise shell thickness during scalable production remains technically demanding, contributing to higher unit costs compared to standard industrial fillers, thereby restricting adoption in price-sensitive markets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager