Home Air Purifier Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434072 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Home Air Purifier Market Size

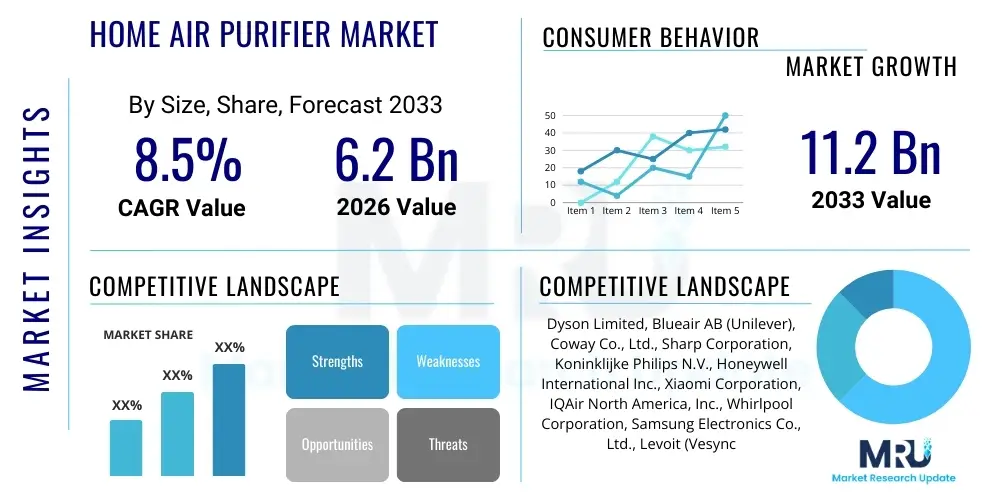

The Home Air Purifier Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 6.2 Billion in 2026 and is projected to reach USD 11.2 Billion by the end of the forecast period in 2033.

Home Air Purifier Market introduction

The Home Air Purifier Market encompasses devices designed to eliminate contaminants, allergens, and pollutants from the air within residential spaces, thereby improving indoor air quality (IAQ). These devices utilize various filtration and purification technologies, including High-Efficiency Particulate Air (HEPA) filters, activated carbon, ionization, and UV-C light, addressing particulate matter (PM2.5, PM10), volatile organic compounds (VOCs), pet dander, mold spores, and airborne viruses. The product spectrum ranges from small, portable units suitable for single rooms to whole-house purification systems integrated into HVAC infrastructure.

Major applications for home air purifiers revolve around health and wellness, driven significantly by increasing rates of respiratory illnesses, particularly asthma and allergies, coupled with rising consumer awareness regarding the detrimental effects of poor IAQ. Furthermore, the global prevalence of wildfire smoke events and sustained high pollution levels in urbanized areas necessitate the adoption of robust in-home filtration solutions. These purifiers offer substantial benefits, including the reduction of asthma triggers, minimization of odors, and protection against airborne infectious diseases, making them essential household appliances rather than luxury items in high-pollution environments.

Key driving factors propelling the market include stringent regulatory standards imposed on indoor air quality, rapid urbanization leading to higher pollution concentration in metropolitan areas, and continuous technological advancements resulting in quieter, more energy-efficient, and smarter (IoT-enabled) devices. The convergence of smart home technology with air purification systems, offering real-time monitoring and automated pollution response, is further accelerating market penetration across developed and developing economies. Consumer willingness to invest in preventative health measures remains a critical underlying driver for sustained market growth throughout the forecast period.

Home Air Purifier Market Executive Summary

The Home Air Purifier Market is characterized by robust growth, primarily fueled by global health concerns related to airborne pathogens and chronic respiratory conditions. Business trends indicate a strong shift towards premiumization, where consumers increasingly prioritize devices incorporating multiple stages of filtration (e.g., pre-filter, HEPA, activated carbon, and UV-C sterilization) and integrated AI for optimal performance modulation. Strategic mergers, acquisitions, and technological partnerships focused on sensor technology and predictive maintenance are defining the competitive landscape, pushing established appliance manufacturers to innovate rapidly to maintain market share against specialized IAQ technology firms.

Regional trends demonstrate that Asia Pacific (APAC) holds the largest market share, driven by severe ambient air pollution levels in countries like China and India, high population density, and rapidly growing middle-class purchasing power. However, North America and Europe are exhibiting the fastest growth rates, spurred by high penetration of smart home ecosystems and heightened consumer sensitivity regarding mold, VOCs from household chemicals, and wildfire smoke impacts. Governments in these regions are also initiating programs promoting IAQ awareness, indirectly supporting market expansion.

Segmentation trends highlight the dominance of HEPA technology due to its proven efficacy against PM2.5 particles, while activated carbon is rapidly gaining traction due to increasing concerns about VOCs and odors. Furthermore, the segment concerning whole-house air purifiers, which integrate directly into central heating, ventilation, and air conditioning (HVAC) systems, is projected to witness superior CAGR, reflecting a consumer preference for comprehensive, invisible, and automated air purification solutions across entire dwelling units.

AI Impact Analysis on Home Air Purifier Market

Common user questions regarding AI in the home air purifier market typically revolve around performance efficiency, automation capabilities, data privacy concerns, and cost-effectiveness. Users frequently ask: "How does AI make air purifiers smarter?" "Can AI predict pollution spikes before they happen?" and "Is the increased cost of an AI-enabled purifier justified by better air quality?" These inquiries highlight a collective expectation for air purifiers to transition from reactive devices—filtering air only after it becomes contaminated—to proactive, predictive systems that optimize energy consumption while guaranteeing superior air quality. Consumers expect AI to deliver highly personalized filtration protocols tailored to specific household needs, allergen cycles, and energy tariffs, moving beyond simple automatic modes based purely on immediate sensor readings.

- AI-Powered Predictive Maintenance: Utilizing machine learning algorithms to analyze usage patterns and contamination loads, predicting filter replacement timing with greater accuracy than traditional timers, thereby optimizing performance and reducing unnecessary consumables expenditure.

- Intelligent Air Quality Mapping: Employing neural networks to analyze data from multiple sensors (PM, VOC, temperature, humidity) and correlating this data with external environmental feeds (weather, local pollution reports) to create a dynamic, holistic air quality profile of the home.

- Real-time Efficiency Optimization: AI algorithms modulate fan speed and purification intensity in real-time, focusing filtration efforts geographically within the home (when integrated with smart zoning systems) and temporally based on occupancy and expected environmental triggers (e.g., cooking or seasonal pollen spikes).

- Noise and Energy Management: Machine learning models optimize fan noise profiles against desired air changes per hour (ACH), ensuring effective purification during sleeping hours while minimizing acoustic disruption and managing energy consumption to align with peak/off-peak utility rates.

- Enhanced User Experience (UX): AI facilitates seamless integration with broader smart home ecosystems (e.g., Google Home, Alexa), enabling complex voice commands, automated scenarios, and highly personalized alerts about environmental changes or operational status.

- Advanced VOC Recognition: Using sophisticated algorithms to differentiate and identify specific types of volatile organic compounds (such as formaldehyde vs. general cooking odors), allowing the system to engage specific filtering mechanisms (e.g., enhanced activated carbon usage) more precisely.

- Self-Diagnosis and Troubleshooting: AI enables purifiers to identify internal hardware failures or sensor malfunctions, autonomously initiating troubleshooting steps or notifying the user with detailed, actionable repair advice, reducing service calls.

- Personalized Health Protocols: Integrating user health data (via wearable devices or health apps, with consent) to prioritize the removal of specific pollutants that trigger their respiratory conditions (e.g., aggressively targeting mold spores for asthmatic users), tailoring IAQ beyond general standards.

DRO & Impact Forces Of Home Air Purifier Market

The trajectory of the Home Air Purifier Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming the primary Impact Forces. Primary drivers stem from heightened global awareness regarding the necessity of clean indoor air, accelerated by global health crises and rising chronic respiratory illness rates. The main restraints involve the high initial investment cost, especially for high-end, multi-stage filtration systems, and the recurring cost associated with mandatory filter replacements, often leading to consumer resistance in price-sensitive markets. Significant opportunities reside in the rapid expansion of IoT infrastructure, allowing manufacturers to offer subscription-based filter replacement services and advanced data-driven maintenance models, thereby overcoming cost restraints through long-term value creation. The market is also heavily influenced by regulatory pressures in developed economies concerning IAQ standards in newly constructed residential buildings.

Segmentation Analysis

The Home Air Purifier Market segmentation provides a granular view of market dynamics across various dimensions including product type, technology, application, and distribution channel. Understanding these segments is crucial for strategic planning, as consumer preferences vary significantly based on living conditions, budget, and specific purification needs (e.g., allergy relief versus general odor removal). The technology segment is highly dynamic, with HEPA and Activated Carbon combinations dominating due to their dual effectiveness against particles and gases, while emerging technologies like UV-C and PCO (Photocatalytic Oxidation) are expanding their niche in pathogen control.

- By Technology:

- HEPA Technology: Highly effective filtration, capturing 99.97% of airborne particles 0.3 micrometers in size. Dominates the market due to proven efficiency against common allergens, dust, and PM2.5.

- Activated Carbon: Essential for adsorbing volatile organic compounds (VOCs), odors, smoke, and chemical pollutants. Often paired with HEPA for comprehensive purification, growing rapidly due to rising awareness of indoor chemical off-gassing.

- Ionic Filters/Ionizers: Utilizes electrical charge to attract particles, causing them to settle out of the air. Popular for low maintenance requirements but faces scrutiny regarding potential ozone generation, though modern designs mitigate this risk significantly.

- UV-C Technology: Primarily used for germicidal irradiation, targeting airborne pathogens, viruses, and bacteria. Gaining importance post-pandemic as consumers seek enhanced defense against infectious diseases.

- Photocatalytic Oxidation (PCO): Uses UV light and a catalyst (like titanium dioxide) to break down gaseous pollutants and VOCs into harmless compounds. Highly effective against chemical contaminants but must be carefully engineered to prevent ozone generation.

- By Product Type:

- Portable/Room Air Purifiers: Designed for use in specific rooms (small, medium, or large coverage). Accounts for the largest market share due to affordability, ease of installation, and flexibility for renters or apartment dwellers.

- Whole-House Air Purifiers (In-Duct): Integrated directly into the existing HVAC system, providing filtration and purification for the entire dwelling simultaneously. Witnessing superior CAGR driven by new construction trends and luxury residential developments demanding seamless IAQ solutions.

- By Coverage Area:

- Less than 250 Sq. Ft.: Typically used for bedrooms, small offices, or dorm rooms. Focuses on quiet operation and compact design.

- 250 Sq. Ft. to 450 Sq. Ft.: Mid-sized purifiers suitable for living rooms and standard apartments. Represents a major sweet spot for balancing coverage and cost.

- Greater than 450 Sq. Ft.: High-capacity units, often required for open-plan homes or large commercial-grade residential spaces. Focuses heavily on high Clean Air Delivery Rate (CADR).

- By Application/End-Use:

- Residential (General Use): General dust, pollen, and odor removal, essential for maintaining baseline comfort and health in standard households.

- Health & Allergy Specific: Targeted filtration for households with asthma sufferers, severe allergies, or compromised immune systems. Demands higher filtration grades (e.g., H13 or H14 medical-grade HEPA).

- Pet-Specific: Focuses on capturing pet dander and neutralizing pet odors, often requiring enhanced pre-filtration and robust activated carbon filters.

- By Distribution Channel:

- Online Retail: The fastest-growing channel, offering price comparison, direct-to-consumer models, and a wide variety of brands. Dominates in markets with high e-commerce penetration.

- Offline Retail (Supermarkets, Specialty Stores): Crucial for consumers who prefer physical inspection, immediate purchase, and expert advice on technical specifications like CADR and room coverage.

- Direct Sales/HVAC Contractors: Primary channel for whole-house, in-duct systems, requiring professional installation and consultation.

Value Chain Analysis For Home Air Purifier Market

The value chain for the Home Air Purifier Market begins with upstream activities focused on raw material procurement, encompassing specialized filtration media (like fiberglass for HEPA, coconut shells for activated carbon), plastics, and electronic components (motors, sensors, and microcontrollers). Innovation at this stage is critical, particularly in developing sustainable, biodegradable, or washable filter media to address environmental concerns and reduce recurring consumer costs. Strong partnerships between purifier manufacturers and specialized sensor technology providers are essential, as the accuracy and reliability of air quality monitoring sensors directly influence the product's market acceptance and AI-driven capabilities.

Midstream activities involve core manufacturing, assembly, and quality control. This stage is marked by significant outsourcing to contract manufacturers, particularly in APAC, to leverage lower labor costs and established supply chains. Optimization of motor efficiency, reduction of noise levels, and ensuring compliance with stringent certification standards (such as AHAM Verified CADR ratings and Energy Star) are paramount manufacturing objectives. The transition to lean manufacturing principles and the adoption of automation are key to maintaining competitiveness in a rapidly evolving consumer electronics segment.

Downstream analysis focuses on distribution channels, including both direct and indirect routes. Indirect distribution dominates, leveraging large e-commerce platforms (Amazon, Alibaba), big-box retailers (Walmart, Target), and specialized appliance retailers, which provide wide market reach. Direct distribution, primarily through manufacturer websites or dedicated sales teams for whole-house systems, allows for higher margin control and direct customer engagement, crucial for managing filter subscription services and warranty claims. Effective post-sales service, including proactive filter replacement alerts and technical support, solidifies brand loyalty and ensures long-term revenue streams through consumables.

Home Air Purifier Market Potential Customers

The primary end-users and buyers of home air purifiers fall into several distinct categories, ranging from health-driven consumers seeking relief from respiratory conditions to general wellness seekers prioritizing clean living environments. The core demographic includes households with young children, elderly residents, or individuals diagnosed with asthma, chronic obstructive pulmonary disease (COPD), or severe allergies. These customers are highly sensitive to product performance metrics (CADR, filter grade) and are often willing to pay a premium for certified medical-grade filtration systems (H13/H14 HEPA). Their purchasing decisions are heavily influenced by recommendations from healthcare professionals and allergy specialists.

A rapidly expanding customer segment comprises urban dwellers living in high-density metropolitan areas globally, particularly in regions prone to heavy traffic emissions, industrial pollutants, or seasonal smog. These consumers are primarily motivated by protection against ambient pollution (PM2.5) that infiltrates their homes. They often prioritize high-capacity purifiers with robust activated carbon filtration to tackle external fumes and odors, valuing smart features that integrate with local air quality index (AQI) reports for automated adjustments. This segment often purchases through online channels due to ease of access to product specifications and reviews.

Furthermore, the market benefits significantly from the growth in the smart home ecosystem user base. These tech-savvy customers view air purification as another integrated layer of home automation, demanding Wi-Fi connectivity, app control, seamless integration with voice assistants, and energy efficiency. While IAQ improvement is the goal, the decision-making process for this group is often influenced by design aesthetics, low noise levels, and the device’s ability to communicate with other smart devices, positioning purifiers as integral parts of a sophisticated, connected dwelling.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.2 Billion |

| Market Forecast in 2033 | USD 11.2 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dyson Limited, Blueair AB (Unilever), Coway Co., Ltd., Sharp Corporation, Koninklijke Philips N.V., Honeywell International Inc., Xiaomi Corporation, IQAir North America, Inc., Whirlpool Corporation, Samsung Electronics Co., Ltd., Levoit (Vesync Co., Ltd.), Airpura Industries Inc., RGF Environmental Group Inc., Austin Air Systems Ltd., Carrier Global Corporation, LG Electronics, Daikin Industries, Ltd., Winix America Inc., Molekule, Inc., Alen Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Home Air Purifier Market Key Technology Landscape

The technological landscape of the Home Air Purifier Market is highly competitive and centered on achieving higher Clean Air Delivery Rates (CADR) with minimal energy consumption and acoustic output. Traditional mechanical filtration, centered around HEPA (H11 to H14 grades), remains the foundation, but innovation is now focused on optimizing the filter structure—for instance, developing filters with lower pressure drop to allow for quieter fan operation while maintaining high air throughput. Furthermore, the integration of specialized antimicrobial coatings and structural design enhancements that minimize the risk of secondary microbial growth on the filter media itself represents a significant technological advancement.

Beyond mechanical filtration, sensor technology is undergoing rapid evolution. Modern purifiers are shifting from basic PM2.5 and PM10 sensors to highly precise, multi-gas sensors capable of differentiating between various volatile organic compounds (VOCs), including formaldehyde and toluene. This enhanced sensing capability is crucial for the deployment of advanced AI and machine learning algorithms that tailor purification schedules based on the specific type of indoor pollutant detected. Connectivity standards, primarily leveraging Wi-Fi and Bluetooth Low Energy (BLE), ensure seamless integration into the growing ecosystem of smart home devices, allowing for remote monitoring and centralized control via mobile applications.

Emerging technologies, while holding smaller market shares currently, are driving significant long-term disruptive potential. These include advanced plasma and hydroxyl radical generation systems, and specialized PCO (Photocatalytic Oxidation) units designed to neutralize pollutants rather than just capture them. The future direction is clearly moving towards filter-less technologies and maintenance-free systems to address the high replacement cost restraint. However, achieving comparable purification efficacy to certified HEPA remains the primary challenge for widespread consumer adoption of these novel, non-traditional methods.

Regional Highlights

- Asia Pacific (APAC) Dominance: APAC maintains market dominance due to persistently high ambient air pollution, rapid urbanization, and massive population density. Countries like China, India, and South Korea face acute environmental challenges, translating directly into high demand for household air purification solutions. The strong manufacturing base in this region also contributes to lower production costs and higher supply volumes. The region is characterized by high price sensitivity, leading to strong growth in the mid-range portable purifier segment, though the premium market is also expanding among affluent urban consumers seeking advanced features.

- North America (Rapid Growth): North America is defined by high consumer awareness, strong smart home adoption, and increasing concerns over climate-related events such as seasonal wildfires. This has driven demand for high-capacity, robust air purifiers capable of handling fine smoke particles and prolonged usage. The high average household income enables consumers to invest heavily in premium, connected, and whole-house systems, making it a key region for revenue growth and technological innovation testing. Regulatory emphasis on IAQ in modern housing further supports market expansion.

- Europe (Sustainability Focus): The European market is mature and characterized by a focus on energy efficiency and sustainable design. Demand is driven by allergy concerns, adherence to strict EU energy consumption standards, and a preference for aesthetically pleasing, minimalist devices. Germany, the UK, and France are key markets. The penetration of whole-house ventilation systems (like MVHR) with integrated high-grade filtration is significant, complementing standalone purifier sales, with purchasing decisions heavily influenced by independent certifications and environmental impact scores.

- Latin America (Emerging Potential): Latin America represents an emerging market with significant growth potential, although market penetration remains relatively low. Growth is spurred by expanding middle classes, increasing air quality concerns in major cities (São Paulo, Mexico City), and growing retail infrastructure. The market is primarily driven by portable, entry-level models, with premium product adoption limited to high-net-worth individuals and expatriate communities. Economic volatility can pose a short-term restraint on large-scale consumer electronics purchases.

- Middle East and Africa (MEA - Niche Demand): Demand in MEA is highly localized. In the Middle East, factors such as frequent sandstorms, construction dust, and high air conditioning usage necessitate powerful air purification, particularly in affluent Gulf Cooperation Council (GCC) countries. In Africa, growth is restricted by infrastructure and disposable income, yet specific demands exist in regions dealing with indoor biomass fuel smoke or highly concentrated urban pollution corridors. The luxury segment focused on integrated systems for high-end residential complexes shows robust activity in urban centers like Dubai and Riyadh.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Home Air Purifier Market.- Dyson Limited

- Blueair AB (Unilever)

- Coway Co., Ltd.

- Sharp Corporation

- Koninklijke Philips N.V.

- Honeywell International Inc.

- Xiaomi Corporation

- IQAir North America, Inc.

- Whirlpool Corporation

- Samsung Electronics Co., Ltd.

- Levoit (Vesync Co., Ltd.)

- Airpura Industries Inc.

- RGF Environmental Group Inc.

- Austin Air Systems Ltd.

- Carrier Global Corporation

- LG Electronics

- Daikin Industries, Ltd.

- Winix America Inc.

- Molekule, Inc.

- Alen Corporation

Frequently Asked Questions

Analyze common user questions about the Home Air Purifier market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most effective technology for removing airborne viruses and pathogens in the home?

The most effective strategy involves a combination of highly efficient HEPA filtration (H13 or H14 medical grade) and supplemental sterilization technologies. While HEPA filters physically capture the majority of aerosols that may carry viruses (like PM0.3), technologies such as internal UV-C light are employed to neutralize trapped organisms, preventing their reproduction. Consumers seeking maximum protection should prioritize purifiers that integrate certified multi-stage filtration processes, often referred to as 'hospital-grade' systems, and ensure the device has a high Clean Air Delivery Rate (CADR) appropriate for the room size to maximize air exchanges per hour.

How frequently must air purifier filters be replaced, and what is the typical annual maintenance cost?

Filter replacement frequency varies significantly based on the filtration type, usage intensity, and local air quality conditions. Standard HEPA filters typically require replacement every 6 to 12 months, while activated carbon filters, due to saturation limits with VOCs, often need changing every 3 to 6 months. Pre-filters are generally washable. Annual maintenance costs can range widely, generally falling between USD 50 and USD 300, depending on the number of filter stages and the purifier model. Advanced AI-enabled purifiers provide superior value by monitoring contaminant build-up precisely, signaling replacement only when efficiency drops, thereby extending filter lifespan compared to purifiers relying on simple time-based reminders.

Are air purifiers truly necessary if my home already has an HVAC system with filtration?

Yes, standalone air purifiers are generally necessary to supplement standard HVAC systems, especially if robust indoor air quality is a priority. Standard HVAC filters (like MERV 8–10) are primarily designed to protect the HVAC equipment itself, not necessarily to purify indoor air to a high degree. While higher-grade MERV filters can be installed in HVAC systems, they often restrict airflow and may damage residential units not designed for the increased static pressure. Room air purifiers, particularly those with high CADR and HEPA filtration, specifically target the room environment, capturing localized pollutants, pet dander, and odors more effectively than whole-house ventilation alone, providing localized, immediate purification where it is needed most.

What criteria should consumers use to evaluate the performance of an air purifier before purchasing?

Consumers should prioritize the Clean Air Delivery Rate (CADR), which is an independently verified metric indicating how quickly a purifier removes particles (smoke, dust, pollen) from the air, preferably certified by organizations like AHAM (Association of Home Appliance Manufacturers). Secondly, assess the room coverage capacity, ensuring the purifier provides at least four to five air changes per hour (ACH) for the specific room dimensions. Finally, evaluate the Total Cost of Ownership (TCO), factoring in both the initial purchase price and the recurring annual costs of filter replacement and energy consumption, particularly looking for Energy Star certified models to ensure efficiency.

How is the integration of smart technology influencing consumer preference and purifier functionality?

Smart technology fundamentally transforms the purifier from a static appliance into a responsive, data-driven IAQ management system. Key functionalities driven by smart integration include remote monitoring and control via mobile applications, allowing users to adjust settings or check air quality from anywhere. Crucially, smart purifiers incorporate AI and advanced sensors to automate purification cycles based on detected pollution spikes, occupancy, and external environmental data, ensuring energy efficiency by running only when necessary. Furthermore, connectivity enables seamless interaction with voice assistants and home automation routines, enhancing overall user convenience and preventative health management.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager