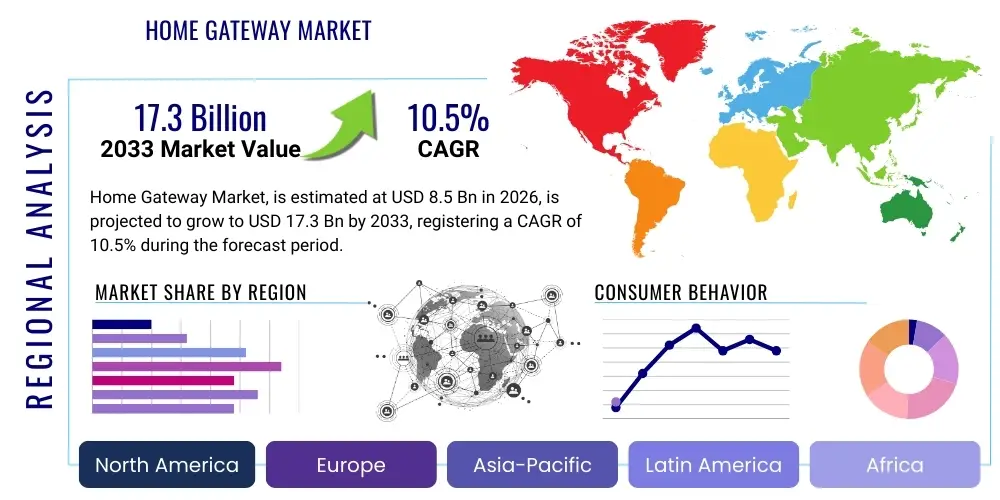

Home Gateway Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436402 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Home Gateway Market Size

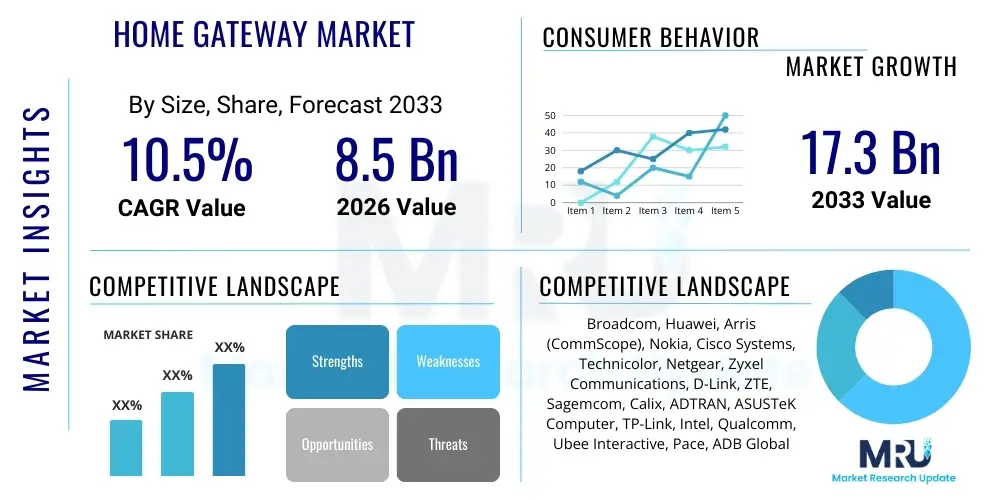

The Home Gateway Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at $8.5 Billion in 2026 and is projected to reach $17.3 Billion by the end of the forecast period in 2033.

Home Gateway Market introduction

The Home Gateway Market encompasses devices that function as central hubs connecting the residential local area network (LAN) to the wide area network (WAN), typically provided by Internet Service Providers (ISPs) or Multiple System Operators (MSOs). These sophisticated devices consolidate functionalities such as routing, switching, modem capabilities (DSL, cable, fiber), and often integrate advanced wireless networking (Wi-Fi 6/7) and security features. The primary function is to manage and distribute high-speed internet access across multiple devices within the home, supporting diverse applications ranging from basic web browsing and streaming to bandwidth-intensive activities like 4K video conferencing and high-definition gaming, fundamentally acting as the critical infrastructure for the modern connected home ecosystem.

The core product description revolves around multifunctional hardware that seamlessly bridges disparate communication protocols and network technologies. Modern home gateways are increasingly characterized by enhanced processing power, supporting virtualization technologies, and featuring modular designs that allow for upgrades and integration of new standards, such as Matter or Thread for IoT connectivity. Major applications extend beyond basic internet access to sophisticated home automation, enabling voice over IP (VoIP) services, providing robust parental controls, and forming the backbone for comprehensive smart home systems including security cameras, smart lighting, and energy management solutions. This integration is crucial for maintaining high Quality of Service (QoS) across heterogeneous network loads.

Key benefits derived from advanced home gateways include superior network performance, enhanced security layers protecting against external cyber threats, simplified network management through user-friendly interfaces, and optimized bandwidth allocation ensuring smooth operation for latency-sensitive applications. Driving factors propelling market growth are intrinsically linked to the global acceleration of fiber and 5G network rollouts, the exponential proliferation of Internet of Things (IoT) devices in residential settings, and the sustained consumer demand for ultra-high-definition content streaming and complex multi-user digital lifestyles. Furthermore, governmental initiatives promoting universal broadband access in developed and emerging economies significantly contribute to the expanding adoption landscape.

Home Gateway Market Executive Summary

The Home Gateway Market is experiencing significant dynamic shifts driven by the transition from legacy copper-based networks (DSL/DOCSIS 3.0) to advanced fiber-optic and 5G Fixed Wireless Access (FWA) architectures, necessitating substantial hardware upgrades across consumer premises. Business trends are dominated by strategic partnerships between original equipment manufacturers (OEMs) and major telecom operators, focusing on developing highly customized, software-defined networking (SDN)-enabled gateways capable of remote management and automated troubleshooting. This emphasis on managed services and predictive maintenance is creating new revenue streams for ISPs and ensuring higher customer satisfaction, minimizing truck rolls and operational expenditures. Competition is intensifying around delivering superior Wi-Fi performance (Wi-Fi 6E and Wi-Fi 7 readiness) and embedded cybersecurity features, transforming the gateway from a simple modem/router combination into a complex security appliance and IoT orchestrator.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, primarily fueled by massive government investment in large-scale fiber-to-the-home (FTTH) infrastructure deployment, particularly in China, South Korea, and India, catering to densely populated urban centers. North America and Europe, while mature, exhibit strong growth in the high-end segment, driven by the rapid adoption of gigabit and multi-gigabit broadband tiers and the subsequent demand for sophisticated gateways supporting low latency and high throughput for professional and gaming applications. Regulatory pressure in various regions, particularly concerning data privacy and equipment energy efficiency, is also shaping product development cycles, pushing manufacturers toward more sustainable and secure hardware solutions, thereby accelerating the replacement cycle of older, less efficient devices.

Segment trends highlight the increasing dominance of fiber-optic technology, specifically GPON (Gigabit Passive Optical Network) and the emerging XGS-PON/10G EPON standards, which necessitate purpose-built Optical Network Terminal (ONT) integrated gateways. The smart home application segment is witnessing the most rapid innovation, where gateways are evolving to include built-in AI processing capabilities for local data analysis, reducing reliance on cloud computing and enhancing responsiveness for crucial home automation tasks. Furthermore, the Fixed Wireless Access (FWA) segment, leveraging 5G infrastructure, is gaining traction, particularly in underserved rural areas or competitive urban environments, requiring gateways optimized for millimeter wave (mmWave) and sub-6 GHz spectrum aggregation, offering a compelling alternative to traditional wired broadband connections.

AI Impact Analysis on Home Gateway Market

Common user questions regarding AI’s impact on home gateways frequently center on how AI can enhance network performance, whether it can truly bolster cybersecurity against evolving threats, and what tangible user experience improvements, such as automated QoS management or personalized network settings, will materialize. Users often express concerns about data privacy given AI's need for extensive network traffic analysis and are curious about the computational demands and energy efficiency of AI-enabled edge processing within the residential device itself. The overarching theme is the expectation that AI should move the gateway from a passive hardware device to an active, predictive network manager that can anticipate and resolve connectivity issues before they affect the end-user experience.

The analysis reveals key themes where AI integration is becoming indispensable: predictive maintenance, automated security, and dynamic resource allocation. AI algorithms are crucial for analyzing vast streams of network telemetry data—identifying abnormal usage patterns, detecting potential intrusions, and prioritizing traffic flows based on real-time application needs (e.g., boosting bandwidth for a critical video conference during peak usage). This shift enables the gateway to proactively optimize Wi-Fi channel selection, mitigate interference, and provide personalized network advice, reducing the burden on customer support centers and dramatically improving the perceived reliability and speed of the broadband connection, which is a key differentiator for ISPs.

The key concerns revolve around standardizing AI models for cross-vendor compatibility and establishing robust privacy frameworks. While AI offers immense potential for advanced threat detection (identifying zero-day attacks or sophisticated phishing attempts locally), it requires continuous updates and model refinement. User expectations are high regarding seamless integration with existing smart home ecosystems, requiring the AI within the gateway to act as an effective central coordinator for protocols like Matter and HomeKit, ensuring interoperability and high-speed local control without excessive lag. This push toward edge intelligence positions the gateway as the foundational computational node for the smart home infrastructure, preparing it for future high-demand applications like immersive augmented reality and widespread telehealth services.

- AI-driven Quality of Service (QoS): Dynamic prioritization of bandwidth for latency-sensitive applications (gaming, VoIP).

- Predictive Maintenance: Algorithms identify component degradation or network anomalies before service interruption occurs.

- Enhanced Cybersecurity: Real-time anomaly detection, threat signature updates, and behavioral analysis for intrusion prevention.

- Self-Optimizing Wi-Fi: Automated channel optimization, power adjustment, and interference mitigation using machine learning.

- Personalized Experience: AI-based network profiles and access controls based on learned user activity and device requirements.

- Edge Computing Facilitation: Local processing of smart home data, minimizing reliance on cloud infrastructure for faster response times.

DRO & Impact Forces Of Home Gateway Market

The Home Gateway Market is fundamentally shaped by the powerful interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming the impact forces that dictate investment decisions and technological roadmap execution. The primary driver is the accelerating global deployment of next-generation broadband infrastructure, including FTTH and 5G FWA, which necessitates a complete overhaul and upgrade of customer premises equipment (CPE) to support multi-gigabit speeds. Concurrently, the exponential growth in the average number of connected IoT devices per household, coupled with the rising demand for high-bandwidth applications such as 4K/8K streaming and cloud gaming, places continuous pressure on manufacturers to innovate robust, high-throughput gateway solutions capable of managing complex, high-density network environments effectively and reliably.

However, market expansion is constrained by several critical restraints. The most significant is the escalating complexity and frequency of cybersecurity threats targeting residential networks, compelling manufacturers to invest heavily in robust security hardware and software, which often increases the final retail cost. Furthermore, the inherent technological lifecycle presents a challenge; the extended operational lifespan of existing, older generation gateways in emerging markets slows down the adoption of newer standards like Wi-Fi 6E/7. Supply chain volatility, particularly concerning semiconductor components, also imposes limitations on production capacity and influences competitive pricing strategies, creating friction in meeting the high demand generated by widespread fiber deployment initiatives.

Opportunities in the market center around the integration of advanced networking paradigms such as Software-Defined Networking (SDN) and Network Function Virtualization (NFV) within the gateway hardware, allowing service providers unprecedented remote control, customization, and deployment of new services (e.g., smart home security or telehealth monitoring) post-installation. The push toward edge computing presents a significant opportunity for gateways to evolve into crucial local processing nodes, enabling low-latency application delivery and fostering partnerships with independent software vendors (ISVs). Finally, the burgeoning market for managed Wi-Fi services, where the gateway is supplied, managed, and upgraded by the ISP as a subscription service, promises stable, recurring revenue and higher customer stickiness, mitigating risks associated with outright hardware purchase cycles and technological obsolescence.

Segmentation Analysis

The Home Gateway Market is critically segmented based on the underlying access technology, product type, integrated features, and the target application environment, reflecting the diverse requirements of modern broadband consumers and service providers globally. Analysis across these segments is essential for understanding market dynamics, guiding product development, and tailoring strategic marketing efforts. The segmentation by technology—including DSL/VDSL, Cable (DOCSIS), Fiber (GPON/XGS-PON), and Fixed Wireless Access (FWA)—provides a clear view of where capital expenditure and infrastructure rollouts are concentrated, with Fiber and FWA exhibiting the highest current growth rates due to their capacity to deliver multi-gigabit services demanded by the modern digital household. Understanding these technological shifts is paramount for manufacturers to allocate R&D resources effectively.

Further granularity is achieved through segmentation based on integrated functionality, differentiating between basic modem-router combinations and advanced smart home gateways that feature embedded IoT communication protocols (Zigbee, Z-Wave, Thread) and advanced local processing capabilities. The product type split, often categorized into Integrated Gateways (combining modem and router functions into a single CPE unit) and Standalone Gateways (requiring a separate modem or ONT), demonstrates differing installation preferences; service providers typically favor integrated solutions for simplified deployment and management, while high-end prosumers may prefer modular, standalone components for flexibility. This segmentation highlights the continuing bifurcation of the market based on end-user technical aptitude and service tier subscription levels.

Segmentation by application environment reveals the growing importance of the smart home ecosystem, where the gateway acts as the central orchestrator, versus traditional applications like pure data connectivity or Voice over IP (VoIP) delivery. The fastest-growing sub-segment is related to IoT and security management, where gateways are now expected to host virtualized security functions and manage hundreds of connected devices efficiently and securely. Strategic positioning within these application segments requires manufacturers to move beyond basic network parameters and focus heavily on user experience, platform integration, and robust data protection capabilities to capture market share within the competitive residential CPE landscape.

- By Technology:

- Fiber (GPON, XGS-PON, 10G EPON)

- Cable (DOCSIS 3.1, DOCSIS 4.0)

- DSL (VDSL, G.fast)

- Fixed Wireless Access (5G FWA, 4G LTE)

- By Product Type:

- Integrated Home Gateway

- Standalone Home Gateway (Router functionality)

- By Application:

- Data and Internet Access

- Smart Home Management and IoT

- Voice over IP (VoIP)

- Video Streaming and IPTV

- By Component:

- Hardware

- Software/Firmware

- By Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Value Chain Analysis For Home Gateway Market

The Value Chain for the Home Gateway Market is a complex structure involving distinct stages, commencing with upstream component manufacturing, moving through equipment production, distribution via service providers, and concluding with end-user installation and ongoing support. The upstream analysis is dominated by major semiconductor manufacturers supplying highly specialized chipsets (SoCs) for networking, Wi-Fi radio components, memory modules, and power management integrated circuits. These suppliers hold significant leverage as their component roadmaps and production capacities directly influence the technological capabilities and cost structure of the final gateway product. Access to leading-edge components, such as Wi-Fi 7 chipsets or specialized 10G PHY layers, is critical for OEMs to maintain a competitive advantage in performance metrics, driving fierce negotiation and long-term partnership strategies with top-tier semiconductor vendors.

Midstream activities primarily involve Original Equipment Manufacturers (OEMs) and Original Design Manufacturers (ODMs) who design, assemble, and test the gateways. This stage is highly competitive and concentrated, with major players relying on economies of scale and efficient supply chain management to reduce manufacturing costs. Crucially, the trend towards Software-Defined Networking (SDN) necessitates substantial software development investment at this stage, focusing on robust, secure firmware that allows remote configuration and integration with ISP management platforms (OSS/BSS systems). The primary distribution channel is highly centralized and dominated by indirect routes through Internet Service Providers (ISPs), Multiple System Operators (MSOs), and Telcos, which often procure gateways in massive volumes under long-term contracts, making channel loyalty a defining characteristic of market entry and success.

Downstream analysis focuses on deployment, installation, and post-sales support. While some specialized, high-end gateways are sold directly to consumers via retail channels, the overwhelming majority reach the end-user as part of a managed broadband service package provided by the telecom operator. This distribution model ensures quality control and minimizes end-user complexity but grants significant purchasing power to the ISPs. The final stage involves ongoing technical support, firmware updates, and maintenance, often managed remotely via the gateway’s embedded TR-069 or subsequent protocols. This emphasis on remote lifecycle management transforms the hardware device into a managed service asset, creating opportunities for recurring software and security subscription revenues for the service provider, effectively linking hardware procurement closely with service delivery models.

Home Gateway Market Potential Customers

The primary purchasers and key end-users of home gateway devices are categorized broadly into three groups: large-scale telecommunication companies (Telcos and ISPs), cable operators (MSOs), and the residential consumer segment, particularly high-end technology enthusiasts and smart home adopters. Telecommunication companies constitute the largest volume customers, purchasing millions of units annually to facilitate the massive rollout of broadband services, specifically fiber-to-the-home (FTTH) and 5G Fixed Wireless Access (FWA) infrastructure. These customers prioritize high reliability, scalability, seamless integration with existing network management systems, and competitive pricing, often demanding custom branding and highly tailored software features to differentiate their service offerings in highly competitive urban markets. Their purchasing decisions are driven by infrastructure investment cycles and the need to support progressively higher bandwidth tiers, making them the cornerstone clients for major gateway manufacturers.

Cable operators, or MSOs, represent another massive segment, currently driving demand for advanced DOCSIS 3.1 and next-generation DOCSIS 4.0 gateways to support multi-gigabit internet speeds over hybrid fiber-coaxial (HFC) networks. MSOs require highly integrated devices capable of handling video, voice (VoIP), and data transmission simultaneously, often necessitating specific regulatory compliance for emergency services and quality assurance for their bundled offerings. These operators are increasingly looking for gateways that incorporate mesh Wi-Fi capabilities directly into the CPE design to ensure whole-home coverage and reduce customer churn caused by poor indoor wireless performance, focusing heavily on total cost of ownership (TCO) over the device's operational life, typically favoring devices with long upgrade cycles and proven durability in various home environments.

The residential end-user market, particularly the 'Prosumer' and early adopter segments, forms a distinct, high-value customer base for specialized, often standalone, high-performance gateways sold through retail channels. These customers are driven by performance metrics, demanding the latest Wi-Fi standards (Wi-Fi 7), robust security features, advanced parental controls, and compatibility with open-source firmware or specialized networking software (e.g., VPN servers). While smaller in volume compared to ISP purchases, this segment commands high average selling prices (ASPs) and acts as a leading indicator for future technology trends that eventually migrate into the mass-market ISP-provided hardware. They are the driving force behind the demand for aesthetic design, ease of use, and integration with diverse and constantly evolving third-party smart home platforms.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $8.5 Billion |

| Market Forecast in 2033 | $17.3 Billion |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Broadcom, Huawei, Arris (CommScope), Nokia, Cisco Systems, Technicolor, Netgear, Zyxel Communications, D-Link, ZTE, Sagemcom, Calix, ADTRAN, ASUSTeK Computer, TP-Link, Intel, Qualcomm, Ubee Interactive, Pace, ADB Global |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Home Gateway Market Key Technology Landscape

The technological landscape of the Home Gateway Market is defined by the rapid adoption of next-generation physical layer standards and increasingly sophisticated software frameworks designed for network flexibility and centralized control. Crucially, the transition from legacy Wi-Fi 5 and Wi-Fi 6 to Wi-Fi 6E and the emerging Wi-Fi 7 (IEEE 802.11be) standard represents the single largest technological accelerator, enabling gateways to deliver multi-gigabit wireless throughput, extremely low latency, and robust coverage across the 6 GHz spectrum band. This technological advancement is necessary to meet the bandwidth requirements of concurrent 4K/8K video streams and latency-sensitive applications like cloud gaming and professional teleconferencing. Simultaneously, the underlying access technologies are migrating toward XGS-PON for fiber networks (supporting 10 Gbps symmetrical speeds) and DOCSIS 4.0 for cable networks, ensuring that the WAN capacity matches the robust capabilities of the internal Wi-Fi distribution system.

Software-Defined Networking (SDN) and Network Function Virtualization (NFV) are transforming the operational model of home gateways, shifting complex functions from dedicated hardware to flexible software. SDN allows service providers to manage network traffic flows and configurations remotely and centrally, dramatically improving service provisioning, troubleshooting, and delivering customized network security or parental control features as virtualized services running directly on the gateway. This approach minimizes the need for specialized hardware appliances and allows for rapid service deployment, creating a platform for monetization beyond basic connectivity. The integration of advanced mesh networking technologies, which utilize intelligent routing and standardized communication protocols (e.g., EasyMesh), is now standard, ensuring seamless, high-performance coverage throughout large or complex residential structures, which is a key driver for customer satisfaction and service quality perception.

A significant trend involves the integration of edge computing capabilities and dedicated security processing. Modern gateways are incorporating specialized neural processing units (NPUs) or higher core count CPUs to run localized AI/ML models for tasks such as identifying malware signatures, performing deep packet inspection (DPI), and optimizing network performance without transmitting sensitive data to the cloud. Furthermore, the adoption of standardized IoT protocols such as Matter and Thread is becoming critical, positioning the gateway as the foundational interoperability hub for all smart home devices, moving away from fragmented proprietary ecosystems. This technological convergence ensures that the home gateway remains the most essential, multifunctional piece of residential network equipment, capable of adapting to both current and future consumer digital demands while maintaining a high level of security and operational efficiency for the service provider.

Regional Highlights

The Home Gateway Market exhibits distinct regional dynamics heavily influenced by infrastructure development, regulatory policies, and consumer willingness to adopt high-speed services. North America remains a highly lucrative market characterized by intense competition between cable operators and fiber providers, driving rapid innovation in multi-gigabit service tiers. The push for DOCSIS 4.0 upgrades by MSOs and extensive FTTH expansion by Telcos ensures high demand for advanced, multi-standard gateways supporting Wi-Fi 6E/7. Government initiatives aimed at closing the digital divide and deploying 5G FWA in rural areas further stimulate market growth, particularly for gateways optimized for high-frequency spectrum use. Consumers in this region prioritize security, reliability, and advanced features like parental controls and integrated mesh Wi-Fi systems.

Asia Pacific (APAC) dominates the market in terms of volume and boasts the fastest growth rate globally. This explosive expansion is primarily attributed to large-scale, government-backed fiber deployments, especially in China, South Korea, Japan, and Southeast Asia, where extremely dense urbanization facilitates rapid infrastructure rollout. These markets are heavily concentrated on mass deployment of cost-effective GPON and XGS-PON ONTs and integrated gateways. Price sensitivity is higher in many parts of APAC, leading to strong competition among regional manufacturers, although the demand for high-performance devices supporting the region’s massive online gaming and streaming populations is steadily increasing. The sheer scale of broadband subscription growth dictates that APAC will remain the central hub for Home Gateway manufacturing and consumption throughout the forecast period.

Europe presents a fragmented but technologically advanced landscape, marked by varied regulatory environments and a mixture of strong fiber presence (particularly in Nordic countries and Spain) and older copper/VDSL infrastructures in countries like Germany and the UK, necessitating hybrid solutions. Regulatory mandates, such as the German Router Freedom law, influence procurement strategies by limiting the ability of ISPs to dictate the supplied CPE, thus creating a vibrant retail market for high-quality, open-standard gateways. European consumers and regulators place high importance on data privacy and energy efficiency, pushing manufacturers toward developing highly secure and sustainable gateway devices. The deployment of advanced 5G networks across major European cities is also creating a growing niche for FWA gateways as a competitive alternative to entrenched wired providers, diversifying the market portfolio substantially.

- North America: Focus on multi-gigabit services (DOCSIS 4.0, XGS-PON), strong FWA adoption, and leading demand for Wi-Fi 7 integrated devices.

- Asia Pacific (APAC): Highest volume and growth, driven by massive FTTH rollout (GPON/XGS-PON), government subsidy programs, and high market share concentration in China and India.

- Europe: Market diversification due to "Router Freedom" regulations, high emphasis on data privacy, and significant investment in both fiber and urban 5G infrastructure.

- Latin America (LATAM): Emerging market characterized by accelerating FTTH adoption, moving quickly from legacy DSL/cable to fiber, focusing on affordable, robust gateways to support burgeoning digital populations.

- Middle East & Africa (MEA): Rapid infrastructure modernization driven by smart city initiatives and increasing broadband penetration rates, particularly in the GCC states, favoring high-performance fiber solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Home Gateway Market.- Broadcom

- Huawei

- CommScope (Arris)

- Nokia

- Cisco Systems

- Technicolor (Vantiva)

- Netgear

- Zyxel Communications

- D-Link

- ZTE

- Sagemcom

- Calix

- ADTRAN

- ASUSTeK Computer

- TP-Link

- Intel

- Qualcomm

- Ubee Interactive

- Pace (Acquired by ARRIS/CommScope)

- ADB Global

Frequently Asked Questions

Analyze common user questions about the Home Gateway market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current upgrade cycle in the Home Gateway Market?

The primary factor is the global transition to multi-gigabit internet services, specifically the widespread deployment of Fiber-to-the-Home (FTTH) using XGS-PON and the adoption of 5G Fixed Wireless Access (FWA). These infrastructure upgrades necessitate new gateways capable of processing 10 Gbps speeds and supporting advanced wireless standards like Wi-Fi 6E and Wi-Fi 7 to manage high-density traffic within the home effectively.

How is Artificial Intelligence (AI) being utilized within modern Home Gateways?

AI is increasingly utilized for network optimization, predictive maintenance, and enhanced security. AI algorithms dynamically adjust Quality of Service (QoS) based on application demand, automatically select the best Wi-Fi channels to minimize interference, and perform real-time behavioral analysis to detect and mitigate potential cybersecurity threats directly at the edge of the network.

Which technology segment holds the largest potential growth in the forecast period?

The Fiber-optic technology segment, particularly the XGS-PON and 10G EPON standards, holds the largest potential growth. This is driven by aggressive government and private sector investments in FTTH infrastructure globally, especially in high-growth regions like Asia Pacific, where population density and high bandwidth demand strongly favor fiber deployment over legacy technologies.

What is the main challenge faced by manufacturers in the Home Gateway market?

The main challenge is balancing the integration of advanced features—such as robust cybersecurity measures, complex AI processing, and cutting-edge Wi-Fi standards—with maintaining competitive pricing and navigating persistent supply chain volatilities, especially concerning high-performance networking chipsets.

Why are ISPs prioritizing gateways with integrated mesh networking capabilities?

ISPs prioritize integrated mesh networking capabilities because poor whole-home Wi-Fi coverage is a leading cause of customer dissatisfaction and churn. By integrating mesh technology into the gateway, service providers can ensure seamless, high-performance wireless connectivity throughout the residence, significantly improving customer experience, reducing support calls, and enabling the reliable delivery of high-tier services.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager