Home Improvement Retail Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434774 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Home Improvement Retail Market Size

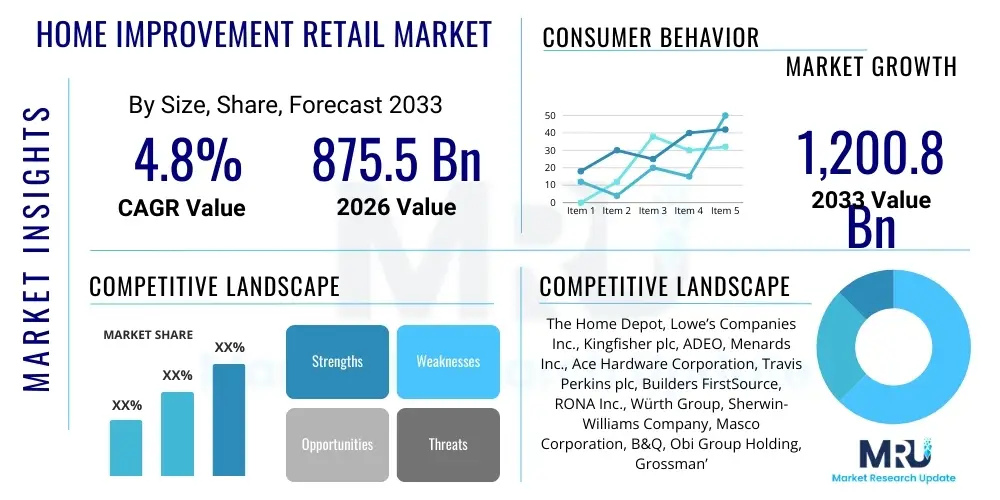

The Home Improvement Retail Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 875.5 Billion in 2026 and is projected to reach USD 1,200.8 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by sustained consumer focus on residential property value enhancement, accelerated by hybrid work models necessitating functional and aesthetically upgraded home environments, coupled with strong underlying trends in repairs, maintenance, and remodeling activities across mature economies.

Home Improvement Retail Market introduction

The Home Improvement Retail Market encompasses the sale of products and services designed for repairing, renovating, maintaining, and upgrading residential and commercial properties. This vast ecosystem includes everything from basic hardware and tools to complex building materials, décor items, plumbing, electrical supplies, and gardening equipment. The market serves two primary consumer bases: the Do-It-Yourself (DIY) consumers, who execute projects themselves, and the professional segment (Do-It-For-Me or DIFM), consisting of contractors, builders, and specialized tradespeople. Product categories are highly diverse, spanning structural components like lumber and roofing, functional systems like HVAC and electrical, and aesthetic elements such as paint, flooring, and furniture.

Major applications driving market vitality include routine home maintenance required due to aging infrastructure, large-scale remodeling projects aimed at increasing property resale value or accommodating changing family structures, and minor cosmetic upgrades driven by trends in interior design and sustainability. Key benefits derived by end-users involve enhancing living comfort, improving energy efficiency through the adoption of smart home technologies and insulation products, and ultimately increasing the long-term asset value of the property. The accessibility of products through varied channels, combined with enhanced digital tools for project planning and visualization, has democratized the ability of consumers to undertake complex renovation tasks.

Driving factors underpinning the consistent growth trajectory include historically low interest rates (though volatile, leading to refinancing and renovation rather than moving), the sustained increase in disposable personal income in major economies, and a growing trend of urbanization coupled with limited new housing supply, pushing consumers to invest heavily in existing structures. Furthermore, the rising adoption of sustainable and eco-friendly building materials, driven by stringent governmental regulations and consumer preference for lower utility costs, is creating new demand pathways, particularly within the energy efficiency segment. The resilience of the repair and maintenance segment ensures market stability even during periods of economic contraction.

Home Improvement Retail Market Executive Summary

The Home Improvement Retail Market displays robust business trends characterized by an accelerating shift towards omnichannel retailing, integrating seamless digital storefronts with traditional brick-and-mortar operations, maximizing both convenience and product expertise access for consumers. A dominant trend is the polarization of the customer base, with retailers increasingly tailoring services and product assortments to cater distinctly to the high-volume, complexity-focused professional segment and the value-seeking, guidance-dependent DIY homeowner. Supply chain resilience and localization efforts, spurred by recent global disruptions, are becoming paramount, influencing inventory strategies and partnerships with regional manufacturers. Investment in automation, specifically within warehouse management and last-mile delivery, remains a critical area for competitive differentiation.

Regionally, North America continues its dominance, fueled by a high homeownership rate, large average home sizes, and a deeply ingrained culture of DIY projects, although the Asia Pacific (APAC) region is demonstrating the highest growth velocity due to rapid urbanization, increasing middle-class income, and expanding residential construction activities in countries like China and India. Europe maintains steady growth, heavily regulated by sustainability mandates that drive demand for energy-efficient products, particularly in insulation and heating systems. Latin America and MEA present emerging opportunities, often characterized by fragmented markets and a faster adoption rate of modern retail formats as local economies mature and construction standards standardize.

Segment trends highlight the exceptional performance of the E-commerce channel, particularly for small- to medium-sized projects and specialized tools, driven by superior logistical capabilities and detailed product information readily available online. By product category, the segment dedicated to building materials (lumber, drywalls, structural components) and the home décor segment (paint, flooring, smart lighting) are experiencing rapid evolution. The service component, including installation and design consultation, is increasingly bundled with product sales, distinguishing full-service retailers from pure product suppliers and addressing the growing complexity of modern home technologies, especially those related to smart home integration and complex mechanical systems.

AI Impact Analysis on Home Improvement Retail Market

User inquiries regarding AI's influence in the Home Improvement Retail Market predominantly center on how Artificial Intelligence can personalize the shopping journey, streamline complex project management, and optimize supply chain operations. Key themes revolve around the feasibility of AI-driven design visualization tools (e.g., virtual room planners), the reliability of automated inventory forecasting to mitigate stockouts, and the ethical implications of using customer data collected through smart home devices for targeted marketing. Users also express strong interest in AI-powered chatbots and virtual assistants that can provide expert project advice, reducing reliance on in-store personnel and improving the first-time fix rate for DIY customers. The overarching expectation is that AI will transform the traditionally manual and guidance-heavy retail experience into a highly efficient, predictive, and personalized ecosystem, enhancing both customer satisfaction and operational margins.

- AI-Powered Personalized Product Recommendations: Utilizing purchase history and browsing behavior to suggest relevant tools, materials, and complementary products for specific projects.

- Advanced Inventory Forecasting: Employing machine learning models to predict demand spikes caused by weather patterns or localized housing market activity, optimizing stock levels.

- Generative Design and Visualization: Offering consumers AI tools that create 3D models or virtual reality walkthroughs of proposed renovations based on input constraints and current room photos.

- Optimized Supply Chain Logistics: Implementing AI for route optimization, real-time tracking of high-value construction materials, and identifying bottlenecks in regional distribution networks.

- Enhanced Customer Service Chatbots: Providing instant, expert-level technical support and troubleshooting guidance for common installation or repair issues, available 24/7.

- Dynamic Pricing Strategies: Adjusting pricing in real-time based on local competitor analysis, inventory levels, and consumer demand elasticity captured through AI algorithms.

DRO & Impact Forces Of Home Improvement Retail Market

The market dynamics are defined by a crucial interplay between significant growth drivers, structural constraints, and emerging opportunities, all subjected to various impactful forces that shape strategic decisions and investment priorities within the retail sector. Key drivers include rising consumer expenditure on housing, accelerated digitalization of the shopping experience making specialized products more accessible, and mandatory regulatory shifts towards energy efficiency standards, compelling homeowners to upgrade outdated systems like HVAC and insulation. These drivers collectively establish a robust environment for sustained revenue growth, particularly focusing on technology integration and service provision rather than merely product sales.

Restraints primarily involve the volatility in global commodity pricing, particularly for essential building materials such as lumber, steel, and plastics, which directly impacts retail margins and project costs, often leading to project postponements. Furthermore, the persistent shortage of skilled labor in the professional contracting segment (DIFM) in developed economies limits the capacity for complex renovation project execution, thus capping potential spending on high-end materials. High competition from specialized online retailers and large general e-commerce platforms also necessitates continuous investment in competitive pricing and unique service offerings to maintain market share.

Opportunities are strongly concentrated in the rapidly expanding smart home integration sector, offering retailers a lucrative pathway to transition from selling basic hardware to providing full home technology solutions, requiring high-margin installation and maintenance services. The increasing focus on sustainability presents a vast opportunity for specialized product lines, including rainwater harvesting systems, solar installation kits, and recycled building materials. Impact forces, such as rapid technological disruption (AI, AR/VR) and geopolitical instability affecting raw material sourcing, mandate flexible business models and substantial capital investment in R&D and digital infrastructure to ensure long-term competitive advantage and supply chain resilience.

Segmentation Analysis

The Home Improvement Retail Market is intricately segmented based on product type, distribution channel, and customer type, reflecting the diverse needs and purchasing behaviors of end-users. Analyzing these segments is essential for retailers to tailor their inventory, marketing efforts, and logistical networks. Product segmentation generally includes functional categories like lumber and building materials, tools and hardware, electrical systems, plumbing, garden and outdoor, and paint and décor, with modern emphasis on energy-efficient and smart home products spanning across several of these categories. The fastest-growing segment often revolves around services, illustrating a market shift where consumers increasingly purchase expertise alongside materials.

- Product Type:

- Lumber and Building Materials (Structural components, roofing, drywall)

- Hardware and Tools (Hand tools, power tools, accessories)

- Plumbing and Electrical (Fixtures, wiring, smart home devices)

- Paint and Wallpaper (Interior and exterior coatings, finishing)

- Flooring (Hardwood, laminate, carpet, tile)

- Garden and Outdoor (Landscaping, lawn care, patio furniture)

- Distribution Channel:

- Home Centers and Hardware Stores (Large format physical stores)

- Specialty Stores (Focus on specific products like paint or flooring)

- E-commerce (Online retail platforms, direct-to-consumer)

- Other Channels (Wholesalers, catalogue sales)

- Customer Type:

- DIY (Do-It-Yourself Consumers)

- Professional (Contractors, builders, trade professionals)

Value Chain Analysis For Home Improvement Retail Market

The Home Improvement Retail Market value chain is complex, starting with the upstream production of raw materials and ending with the final sale and, increasingly, the installation service. Upstream activities involve resource extraction (mining, forestry) and primary manufacturing (steel mills, chemical plants), where costs and sustainability practices heavily influence the entire chain. Midstream activities are dominated by secondary manufacturers who process raw materials into finished retail products—such as specialized tools, paint, plumbing fixtures, and pre-fabricated construction elements. Efficient sourcing, quality control, and compliance with building standards are crucial at this stage, requiring strong contractual relationships and transparency, often involving international supply networks.

Downstream analysis focuses on logistics, distribution, and the final point of sale. Distribution channels are bifurcated into direct channels, where manufacturers supply large professional builders or sell directly to consumers via proprietary websites, and indirect channels, which involve large home centers, regional distributors, and independent hardware stores. The importance of logistics cannot be overstated; managing the efficient transport of bulky, heavy, and diverse inventory from global sourcing locations to thousands of retail outlets and customer doorsteps is a core competence. This segment utilizes advanced warehouse management systems and specialized freight carriers.

The retail component, whether physical or digital, acts as the primary interface with the end consumer. Direct distribution, especially through E-commerce platforms operated by major retailers, allows for greater control over customer data and personalized marketing, optimizing the sales experience for high-margin products. Indirect distribution, leveraging local hardware stores, maintains relevance by offering hyper-local inventory, personalized advice, and serving rural or niche markets that are less viable for large-format centers. The growing service layer—including consultation, design, financing, and professional installation—is rapidly integrating into the downstream value chain, increasing the complexity and profitability of the retail offering by transforming simple product sales into project solutions.

Home Improvement Retail Market Potential Customers

The potential customer base for the Home Improvement Retail Market is broadly categorized into two major groups: the DIY consumer and the Professional (Pro) contractor/trade segment, each presenting distinct purchasing patterns, needs, and revenue streams. DIY customers are homeowners motivated by cost savings, personal fulfillment, or necessary repairs, typically focusing on smaller, less complex projects like painting, minor repairs, or aesthetic upgrades. This segment relies heavily on accessible product information, clear instructions, retail store staff guidance, and highly effective product visualization tools (e.g., augmented reality apps). Their purchase decisions are often influenced by promotional pricing, convenience, and trend relevance.

The Professional segment, comprising licensed contractors, remodelers, electricians, plumbers, and small-to-mid-sized construction firms, represents the highest volume and frequency purchasers. Their needs are centered on reliability, bulk discounts, professional credit services, specialized inventory availability, dedicated service desks, and rapid, often site-specific, delivery options. The relationship with Pro customers is usually long-term and relies on consistent quality, supply chain predictability, and robust contractor loyalty programs that provide financial and logistical advantages. This segment is highly sensitive to material availability and project timelines, making efficient supply chain management a non-negotiable requirement for retailers.

A third, rapidly emerging customer segment includes institutional buyers, such as property management companies, landlords, and large commercial real estate holders, who require products and services for maintaining or renovating large portfolios of rental properties or office spaces. These institutional buyers prioritize durability, volume purchasing capabilities, long-term warranties, and standardized product lines across multiple locations. Serving this segment often requires specialized B2B sales teams and tailored contracts focusing on large orders of consumables, maintenance supplies, and safety equipment, representing a stable and predictable revenue channel for major market participants.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 875.5 Billion |

| Market Forecast in 2033 | USD 1,200.8 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | The Home Depot, Lowe’s Companies Inc., Kingfisher plc, ADEO, Menards Inc., Ace Hardware Corporation, Travis Perkins plc, Builders FirstSource, RONA Inc., Würth Group, Sherwin-Williams Company, Masco Corporation, B&Q, Obi Group Holding, Grossman’s Bargain Outlet, True Value Company, IKEA (select home furnishings and DIY lines), HD Supply, Beacon Roofing Supply, Fastenal Company |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Home Improvement Retail Market Key Technology Landscape

The technological landscape of the Home Improvement Retail Market is rapidly evolving, driven by the need for superior customer experience, supply chain efficiency, and competitive differentiation in the digital age. A critical technology involves the deployment of Augmented Reality (AR) and Virtual Reality (VR) tools, enabling consumers to visualize products, such as paint colors, tile patterns, and furniture layouts, directly within their homes before purchase, significantly reducing returns and improving sales conversion rates, particularly for design-centric items. Furthermore, the integration of 3D scanning technology and digital measurement tools aids in accurate material estimation for complex projects, minimizing material waste and streamlining the quotation process for professional customers.

In the operational domain, the market relies heavily on advanced Enterprise Resource Planning (ERP) systems and sophisticated Warehouse Management Systems (WMS) utilizing robotics and automation for inventory handling, specifically addressing the logistical challenges associated with diverse product sizes and weights common in building supplies. E-commerce platforms are adopting headless commerce architectures to ensure scalable, personalized shopping experiences across various devices, backed by robust data analytics frameworks that track consumer behavior and forecast future renovation trends. Blockchain technology is also being explored, primarily to enhance transparency and traceability within the supply chain for materials like certified lumber or conflict-free minerals, addressing consumer demands for ethical sourcing and sustainability.

Finally, the proliferation of smart home technology—including integrated security systems, smart thermostats, and energy management hubs—is transforming the product mix sold by retailers. These systems require not only the sale of the physical hardware but also the backend infrastructure, connectivity, and potentially proprietary software platforms managed by the retailer or affiliated service providers. This shift mandates that retailers invest heavily in training their staff on IoT (Internet of Things) integration and cybersecurity protocols, positioning them not just as product sellers but as technology solution providers, thereby securing recurring revenue streams through associated installation and subscription services.

Regional Highlights

- North America: This region holds the largest market share, predominantly driven by the United States, characterized by high consumer confidence, large residential stock requiring constant maintenance, and a robust culture of DIY projects. The professional segment is highly mature, relying on sophisticated supply chain logistics and dedicated contractor services offered by major retailers like The Home Depot and Lowe’s. Current growth is focused on digitalization and the adoption of energy-efficient products in response to state-level climate initiatives.

- Europe: The European market is mature but highly fragmented, with strong growth stemming from mandatory energy renovation programs (e.g., insulation, heat pumps) enforced by the EU’s green deal initiatives. Countries like Germany and the UK lead in environmental product standards. The distribution is balanced between large international chains (Kingfisher, ADEO) and strong regional specialty retailers. Demand is shifting towards sustainable and smart home solutions, driven by high utility costs and regulatory compliance.

- Asia Pacific (APAC): APAC is the fastest-growing region, fueled by rapid urbanization and the massive expansion of the middle class in China, India, and Southeast Asia. The market is transitioning from traditional, independent small shops to modern, organized retail formats. While new construction dominates in certain areas, renovation and remodeling activities are accelerating in established urban centers, creating significant opportunities for international retailers offering modern, high-quality building materials and design-centric products.

- Latin America: This region exhibits high volatility but strong long-term potential, particularly in Brazil and Mexico, where expanding economies are supporting increased residential investment. The market remains highly price-sensitive, with local retailers often focusing on basic necessities and high-volume commodities. Organized retail is gaining traction, leveraging private label brands and offering specialized financing options to appeal to budget-conscious consumers undertaking incremental home improvements.

- Middle East and Africa (MEA): Growth in MEA is largely tied to infrastructure spending and residential development projects, particularly in the GCC countries (UAE, Saudi Arabia). The region presents opportunities for premium, high-specification products due to affluent consumers and complex construction demands (e.g., climate control systems). Africa shows immense potential driven by population growth and nascent formal retail structures, demanding scalable and affordable solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Home Improvement Retail Market.- The Home Depot

- Lowe’s Companies Inc.

- Kingfisher plc

- ADEO

- Menards Inc.

- Ace Hardware Corporation

- Travis Perkins plc

- Builders FirstSource

- RONA Inc.

- Würth Group

- Sherwin-Williams Company

- Masco Corporation

- B&Q

- Obi Group Holding

- Grossman’s Bargain Outlet

- True Value Company

- IKEA

- HD Supply

- Beacon Roofing Supply

- Fastenal Company

Frequently Asked Questions

Analyze common user questions about the Home Improvement Retail market and generate a concise list of summarized FAQs reflecting key topics and concerns.What major trends are shaping the Home Improvement Retail Market growth?

The market growth is primarily shaped by the shift toward comprehensive omnichannel retailing, sustained consumer investment in property value enhancement (especially post-pandemic), and the accelerating demand for energy-efficient products, including smart home technology and high-performance insulation materials, driven by sustainability mandates.

How significant is the professional contractor segment (Pro/DIFM) versus the DIY consumer segment?

While the DIY segment drives volume in unit sales and store traffic, the Professional (Pro) segment generates higher average transaction values and consistent, predictable revenue streams. Retailers are increasingly customizing logistics, credit options, and dedicated service platforms to cater specifically to the high-demand, specialized needs of professional contractors, acknowledging their critical role in market profitability.

What impact does supply chain volatility have on Home Improvement Retailers?

Supply chain volatility, particularly in the cost and availability of lumber, steel, and plastics, directly compresses retailer margins and leads to fluctuating project costs for consumers and contractors. Retailers mitigate this risk by diversifying sourcing geographically, increasing inventory holding levels, and establishing closer long-term relationships with domestic or regional material suppliers to enhance resilience.

Which technology is most disruptive to the customer experience in home improvement?

Augmented Reality (AR) and Virtual Reality (VR) visualization tools are the most disruptive technologies, fundamentally changing how consumers plan and purchase design-related products like paint, flooring, and décor. These tools significantly reduce purchase uncertainty, boost consumer confidence in complex decisions, and dramatically decrease product returns, integrating the design phase directly into the retail purchasing journey.

Which geographic region is expected to show the fastest growth rate?

The Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR) due to rapid infrastructure development, escalating urbanization, and the expanding disposable income of the emerging middle class, leading to a substantial increase in residential construction and subsequent demand for modern, organized retail home improvement products.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager