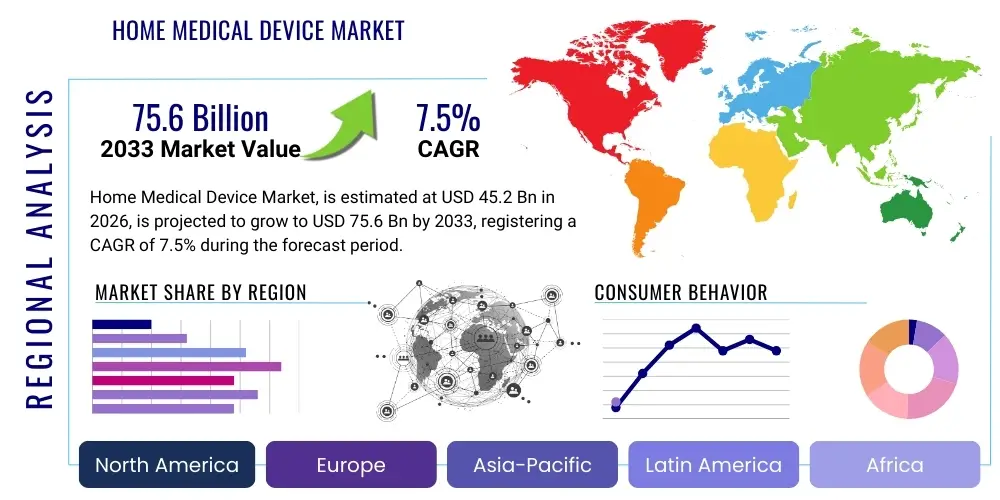

Home Medical Device Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436317 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Home Medical Device Market Size

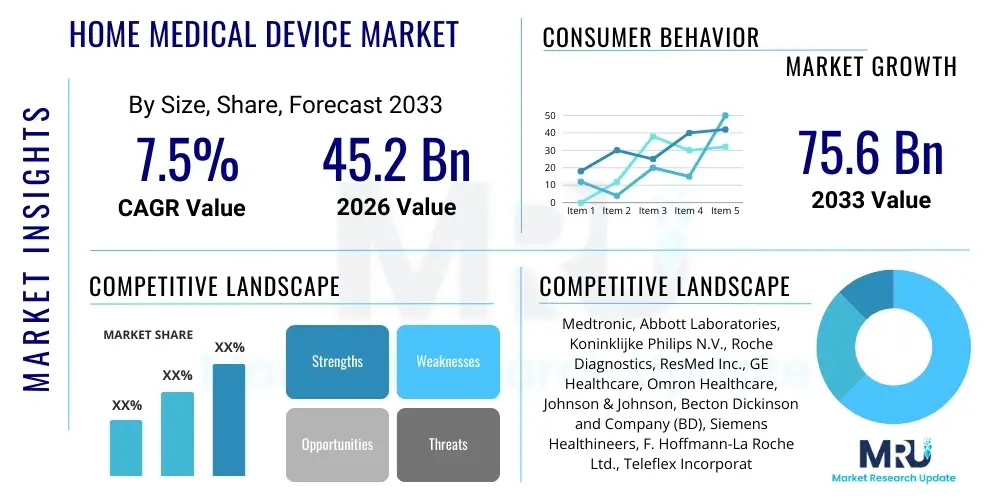

The Home Medical Device Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at $45.2 Billion in 2026 and is projected to reach $75.6 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily fueled by the accelerating trend of decentralization in healthcare, shifting patient care from acute institutional settings to more cost-effective and comfortable home environments. The rising global prevalence of chronic diseases, particularly among the aging population, necessitates continuous monitoring and management solutions that home medical devices efficiently provide, thus sustaining strong demand.

The valuation reflects increased investment in remote patient monitoring (RPM) technologies and the integration of sophisticated features such as connectivity (IoT), artificial intelligence (AI), and enhanced data analytics capabilities into standard home-use equipment. Furthermore, favorable reimbursement policies in developed economies and increasing patient compliance with self-care protocols contribute significantly to market expansion. The shift towards proactive and preventive health management, empowered by readily available and user-friendly devices, solidifies the market's substantial potential throughout the projection period.

Home Medical Device Market introduction

The Home Medical Device Market encompasses a diverse range of medical equipment, instruments, and software utilized by patients or caregivers outside traditional clinical settings, primarily within residential environments. These devices are crucial for monitoring, diagnosis, therapy, and mobility support, enabling chronic disease management, post-operative care, rehabilitation, and general wellness tracking at home. Key products span vital signs monitors (blood pressure, glucose), therapeutic devices (nebulizers, oxygen concentrators, insulin pumps), and mobility aids, all designed for ease of use, safety, and connectivity. The core benefit of these products lies in enhancing quality of life, reducing healthcare expenditure by avoiding unnecessary hospital readmissions, and providing personalized, real-time health data to patients and clinicians.

Major applications of home medical devices include diabetes management, cardiovascular monitoring, respiratory care for conditions like COPD and asthma, and pain management. The driving factors behind market expansion are multifaceted, including the demographic shift towards an older population requiring continuous care, technological advancements making devices smaller and more intuitive, and the growing preference among patients for receiving care in a familiar setting. Additionally, the increasing burden on hospital resources necessitates the adoption of home-based solutions to manage patient overflow and improve overall healthcare system efficiency. The COVID-19 pandemic significantly accelerated the adoption curve for these technologies, establishing home care as a fundamental component of modern healthcare delivery.

Home Medical Device Market Executive Summary

The Home Medical Device Market is undergoing transformative growth, propelled by strong business trends centered around digital health integration and patient-centric care models. Business trends indicate a robust competitive landscape characterized by strategic partnerships between traditional medical device manufacturers and technology firms to embed IoT, AI, and cloud computing capabilities into their product offerings, driving innovation in remote patient monitoring (RPM). The focus has shifted from simple monitoring to predictive analytics and intervention alerts, enhancing device utility and clinical outcomes. Furthermore, consolidation activities, including mergers and acquisitions, are common strategies employed by market leaders to capture specialized technology or expand geographical footprint, particularly in emerging markets.

Regional trends reveal that North America holds the largest market share due to advanced healthcare infrastructure, high awareness regarding preventive care, and favorable reimbursement structures supporting home healthcare services. However, Asia Pacific (APAC) is projected to exhibit the highest Compound Annual Growth Rate (CAGR), driven by rapid economic development, increasing disposable incomes, and substantial government initiatives aimed at improving primary healthcare access and managing the continent's massive aging population, notably in China and Japan. Europe maintains a steady growth rate, supported by universal healthcare systems that prioritize cost containment through home care solutions.

Segmentation trends highlight that the Monitoring Devices segment, particularly continuous glucose monitors (CGMs) and pulse oximeters, dominates the market due to the high global incidence of diabetes and respiratory disorders. However, the Therapeutic Devices segment, led by smart insulin pumps and portable respiratory support systems, is expected to show accelerated growth fueled by technological miniaturization and enhanced user experience. The fastest growing segment within services is remote patient monitoring services, reflecting the shift from product sales to integrated healthcare solutions that provide continuous support and data interpretation.

AI Impact Analysis on Home Medical Device Market

Analysis of common user questions reveals significant interest and high expectations concerning the integration of Artificial Intelligence (AI) into home medical devices. Users frequently inquire about AI's role in improving the accuracy of diagnoses conducted at home, specifically asking whether AI algorithms can detect subtle health deteriorations or predict acute events (like hypoglycemic episodes or cardiac issues) before they become critical. A major thematic concern revolves around data security and privacy, particularly how personal health data collected by AI-enabled devices are protected and whether this data is shared securely with healthcare providers. Furthermore, users are keen to understand if AI can personalize treatment protocols—for instance, adjusting insulin doses based on real-time glucose and activity data—thereby minimizing the reliance on manual intervention and human error. The core expectation is that AI will transform reactive care into highly accurate, proactive, and personalized home health management, making complex devices easier to use and more effective.

AI's influence is profound, transforming device capabilities from simple data collection to advanced analytical and predictive engines. In monitoring devices, AI algorithms analyze patterns in continuous vital signs data to detect anomalies that are imperceptible to human observation, providing early warning signals for conditions such as sepsis or heart failure exacerbation. This capability significantly elevates the clinical value of home data. In therapeutic devices, such as automated insulin delivery systems (artificial pancreas), AI acts as a smart controller, calculating and adjusting medication delivery based on sophisticated predictive modeling, thereby maintaining optimal physiological parameters with minimal user input.

Beyond diagnostics and therapy, AI enhances the overall patient experience by optimizing device interfaces, providing conversational AI support for adherence and troubleshooting, and automating data synchronization with Electronic Health Records (EHRs). This simplification of device management reduces the technological barrier for elderly users and improves adherence rates, which is a critical factor for successful chronic disease management at home. The future market will be defined by devices that not only monitor but also learn and adapt to the individual patient’s unique health profile, leveraging machine learning to continually refine diagnostic accuracy and therapeutic efficacy.

- Predictive Analytics: AI algorithms analyze longitudinal patient data to predict acute health crises, enabling timely intervention and potentially reducing emergency room visits.

- Personalized Therapy: Machine learning optimizes drug delivery (e.g., insulin pumps) and adjusts therapy settings in real-time based on individual physiological responses and environmental factors.

- Diagnostic Augmentation: AI enhances the accuracy of home diagnostic tools (e.g., portable ECGs, imaging) by identifying subtle patterns indicative of disease progression.

- Remote Monitoring Efficiency: AI filters vast amounts of RPM data, prioritizing critical alerts for clinicians, reducing data fatigue, and improving response times.

- Enhanced User Interface: AI enables intuitive voice commands and adaptive interfaces, making complex medical devices accessible to older adults and non-technical caregivers.

- Adherence Monitoring: Utilizing behavioral data to identify risks of non-adherence and generate personalized reminders or motivational feedback.

DRO & Impact Forces Of Home Medical Device Market

The dynamics of the Home Medical Device Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming the Impact Forces that dictate market evolution. Key drivers include the global aging population, the rising incidence of chronic lifestyle diseases such as diabetes and hypertension, and the fundamental shift towards cost-effective healthcare delivery. Conversely, the market faces significant restraints, notably regulatory hurdles that slow down product approval, concerns regarding the security and privacy of highly sensitive health data collected by connected devices, and the high initial cost of sophisticated remote monitoring systems, which can limit adoption in price-sensitive markets. The core opportunities lie in the expansion of telehealth services, the development of miniaturized and highly integrated sensor technologies, and the untapped potential of emerging economies where healthcare infrastructure is rapidly developing and demand for accessible care is soaring. These forces create a high-impact environment where innovation and regulatory compliance are paramount for success.

The impact forces heavily favor market growth driven by macroeconomic pressures to manage chronic conditions outside the hospital setting. The technological convergence—specifically the blending of medical technology with consumer electronics principles (wearables, smartphones)—has significantly lowered the entry barrier for new, innovative solutions, driving fierce competition and rapid price erosion in mature segments like basic monitors. However, the requirement for robust cybersecurity protocols acts as a constant check on rapid deployment, necessitating substantial investment in data protection frameworks, which influences the development lifecycle of connected devices. The ongoing transition towards value-based care models globally intrinsically supports the use of home monitoring, as these devices provide the necessary data transparency and outcomes measurement required for reimbursement under these new models.

Furthermore, external factors like public health crises, as demonstrated by the lasting effects of the recent pandemic, instantaneously accelerate device adoption, normalizing the use of complex medical technology in the home. This shift is irreversible, creating a sustained demand floor. Legislative efforts supporting digital health infrastructure and increasing insurance coverage for RPM services in countries like the United States (Medicare/Medicaid) serve as powerful market catalysts, mitigating the initial restraint posed by high equipment costs. The primary challenge remains educating end-users and healthcare professionals on the proper utilization and clinical interpretation of the vast amount of data generated by modern home medical devices, ensuring that data availability translates effectively into improved patient outcomes.

Segmentation Analysis

The Home Medical Device Market is segmented primarily based on Device Type, Application, and Distribution Channel. This segmentation reflects the diverse needs of patients managing various conditions at home, ranging from basic daily monitoring to complex therapeutic interventions. The Device Type category is crucial, differentiating between monitoring devices that collect data (e.g., blood glucose meters, pulse oximeters), therapeutic devices that deliver treatment (e.g., ventilators, dialysis equipment), and mobility aids that assist daily living. Application segmentation provides insights into which chronic diseases drive demand, with cardiology, respiratory care, and diabetes care being the most prominent and high-growth areas. Understanding these segments is vital for manufacturers to tailor their R&D investments and marketing strategies to areas offering the highest return, specifically focusing on integrated solutions that address co-morbidities often experienced by the target demographic—the elderly population.

The distribution channel analysis further delineates market flow, distinguishing between channels such as pharmacies, online retail, and home care service providers. The rapid growth of e-commerce platforms has significantly democratized access to non-prescription and over-the-counter home medical devices, influencing consumer purchasing behaviors and bypassing traditional clinical recommendation pathways. Conversely, high-value, complex therapeutic devices (like sleep apnea machines or sophisticated infusion pumps) still rely heavily on specialized hospital channels or certified home healthcare agencies for rental, setup, and maintenance. The trend toward subscription-based models for certain connected devices and associated data services is also emerging, blurring the lines between product sales and service provision across all distribution categories.

- By Device Type:

- Blood Glucose Monitoring Devices

- Blood Pressure Monitors

- Temperature Monitoring Devices

- Sleep Apnea Devices

- Pacing Devices (e.g., external pacemakers)

- Oxygen Delivery Equipment (e.g., Concentrators, Cylinders)

- Nebulizers

- Mobility Assistance Devices (e.g., Wheelchairs, Walkers, Scooters)

- Drug Delivery Systems (e.g., Wearable Injectors, Infusion Pumps)

- By Application:

- Diagnostics and Monitoring (e.g., Cardiac, Respiratory, Neurological)

- Therapeutics (e.g., Respiratory Therapy, Dialysis, Pain Management)

- Rehabilitation and Wellness

- Wound Care

- By Distribution Channel:

- Retail Pharmacies

- E-commerce Platforms/Online Channels

- Home Care Providers

- Hospital-Based Pharmacies and Retail Outlets

Value Chain Analysis For Home Medical Device Market

The value chain for the Home Medical Device Market begins with upstream activities focused heavily on R&D, material sourcing, and component manufacturing, particularly for advanced sensors, microprocessors, and secure connectivity modules. Upstream profitability is often tied to intellectual property protection and economies of scale in component sourcing, as manufacturers frequently rely on specialized external suppliers for high-precision components like microfluidic chips or biocompatible materials. The core manufacturing stage involves strict quality control and adherence to global regulatory standards (FDA, CE Mark) due to the critical nature of these devices. Design innovation is focused on miniaturization, power efficiency, and user-friendliness, ensuring devices are suitable for non-professional home use. Suppliers of secure cloud storage and data analytics platforms are increasingly vital partners at this stage, integrating digital capabilities directly into the physical product.

The downstream segment is dominated by distribution and sales activities, characterized by a complex network involving wholesale distributors, specialized medical equipment retailers, pharmacies, and increasingly, direct-to-consumer (D2C) online channels. The distribution channel selection depends heavily on device complexity; high-end therapeutic equipment usually requires direct involvement from specialized home healthcare agencies for setup, training, and maintenance, often involving insurance verification and coordination. Direct distribution channels, particularly through e-commerce, have gained traction for simpler, over-the-counter monitoring devices, offering convenience and often lower prices to the end-user. Effective post-sales service, including technical support, calibration, and consumable supply management, forms a crucial part of maintaining customer satisfaction and ensuring device efficacy in the home environment.

The value generated within the home medical device ecosystem is increasingly shifting towards the service layer, particularly remote data monitoring and interpretation. Direct channels allow manufacturers to capture richer customer data, enabling personalized marketing and product improvements. Indirect channels, relying on distributors and retailers, leverage existing logistical networks and established patient relationships. The integration of telehealth services acts as a potent value multiplier, connecting the collected data with clinical expertise, thus enhancing the perceived and actual value of the physical device by offering continuous, guided care. Therefore, securing strong partnerships across the downstream segment, especially with major pharmacy chains and technology-enabled service providers, is critical for achieving market penetration and sustained revenue streams.

Home Medical Device Market Potential Customers

The primary potential customers and end-users of the Home Medical Device Market are segmented into four main categories: the Elderly Population, Chronic Disease Patients, Individuals focused on Wellness and Preventive Care, and Professional Home Healthcare Providers/Caregivers. The Elderly Population represents the largest and most critical demographic due to age-related health decline and the high prevalence of co-morbidities requiring continuous monitoring and mobility assistance. Chronic disease patients, particularly those managing diabetes (requiring CGMs and pumps), cardiovascular conditions (requiring BP monitors and remote ECGs), and respiratory illnesses (requiring oxygen therapy and nebulizers), form the core user base for therapeutic and diagnostic devices, driven by long-term treatment protocols that must be managed outside the hospital setting.

Individuals actively seeking Wellness and Preventive Care are an expanding customer base, purchasing smart wearables, high-accuracy consumer-grade diagnostic tools, and fitness trackers that increasingly integrate medical-grade sensor technology. These users are typically younger, technologically savvy, and proactive about managing lifestyle health metrics. Finally, Professional Home Healthcare Providers and informal caregivers (family members) act as both buyers and primary operators of more complex medical devices installed in the home. They require user-friendly, highly reliable, and network-enabled equipment that simplifies data transmission and facilitates efficient, multi-patient management. The purchasing decisions for the first three groups are often heavily influenced by insurance coverage and physician recommendations, while the last group prioritizes clinical efficacy, ease of maintenance, and interoperability with existing digital health systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $45.2 Billion |

| Market Forecast in 2033 | $75.6 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Medtronic, Abbott Laboratories, Koninklijke Philips N.V., Roche Diagnostics, ResMed Inc., GE Healthcare, Omron Healthcare, Johnson & Johnson, Becton Dickinson and Company (BD), Siemens Healthineers, F. Hoffmann-La Roche Ltd., Teleflex Incorporated, 3M Company, Masimo Corporation, Baxter International Inc., Boston Scientific Corporation, Stryker Corporation, Invacare Corporation, Nipro Corporation, Terumo Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Home Medical Device Market Key Technology Landscape

The technological landscape of the Home Medical Device Market is defined by the rapid convergence of medical-grade sensing technology with consumer electronics and robust communication platforms. A critical technological foundation is the Internet of Medical Things (IoMT), which enables seamless, real-time data transmission from personal health devices to cloud servers and Electronic Health Records (EHRs). This IoMT infrastructure relies heavily on energy-efficient communication protocols, such as Bluetooth Low Energy (BLE) and cellular connectivity (5G), ensuring continuous and reliable monitoring without rapidly draining battery life. Furthermore, advanced sensor technology—including micro-electro-mechanical systems (MEMS) sensors used for motion tracking and miniaturized electrochemical sensors for point-of-care diagnostics—is essential for creating small, wearable, and highly accurate devices.

The second major technological thrust is in data processing and analysis, dominated by Artificial Intelligence (AI) and Machine Learning (ML). These capabilities are embedded both directly into the device (edge computing) and within the cloud ecosystem, providing sophisticated pattern recognition for predictive health alerts and personalized treatment algorithms. Cybersecurity technologies, including end-to-end encryption, secure data transmission tunnels, and robust authentication mechanisms, are now mandatory technological features, responding directly to stringent regulatory requirements like HIPAA and GDPR concerning protected health information (PHI). The use of virtual reality (VR) and augmented reality (AR) is also emerging, particularly in home-based physical therapy and rehabilitation programs, offering engaging, guided exercise routines monitored remotely by clinicians.

Finally, material science advancements play a crucial, though less visible, role. The development of flexible, biocompatible, and non-invasive materials is driving the creation of comfortable and aesthetically pleasing wearable devices that encourage long-term user adherence. This includes hydrogels for sophisticated skin interface sensors and flexible circuit boards that allow devices to conform seamlessly to the body. These technological pillars collectively enable the transition from single-function devices to integrated, multi-parameter health management systems that form the backbone of modern remote patient monitoring (RPM) platforms, ensuring the reliability, intelligence, and safety required for clinical acceptance in the home setting.

Regional Highlights

The market dynamics show distinct regional maturity and growth patterns, reflecting varying healthcare policies, technological adoption rates, and demographic structures globally. North America, encompassing the United States and Canada, currently holds the largest revenue share. This dominance is attributed to high patient awareness, advanced reimbursement mechanisms for remote patient monitoring (RPM) and home healthcare services (especially through Medicare), and the presence of numerous key market players and technological innovators. The high prevalence of chronic diseases and significant investments in digital health infrastructure further solidify its leading position, with a strong focus on advanced therapeutic devices like automated insulin delivery systems.

- North America: Market leader driven by robust reimbursement policies for RPM, high incidence of chronic lifestyle diseases, and early adoption of AI-enabled diagnostic and therapeutic devices. The U.S. remains the core revenue generator.

- Europe: Characterized by established universal healthcare systems prioritizing cost-efficiency. Growth is steady, focused on managing aging populations through integrated care models and strong uptake of respiratory and mobility aids. Germany, the UK, and France are critical markets.

- Asia Pacific (APAC): Fastest-growing region, projected to outperform others due to rapid modernization of healthcare infrastructure, increasing disposable incomes, and the massive scale of aging populations in Japan and China. Government initiatives promoting domestic manufacturing and affordable care solutions drive significant market expansion, particularly for basic monitoring and diabetes management devices.

- Latin America (LATAM): Emerging market with increasing penetration, primarily driven by rising private healthcare expenditure and efforts to expand basic care access. Adoption remains slow compared to developed regions due to economic instability and fragmented distribution channels.

- Middle East and Africa (MEA): Growth is concentrated in the Gulf Cooperation Council (GCC) countries, fueled by high government investment in specialized healthcare facilities and addressing high rates of non-communicable diseases. Telehealth adoption is accelerating, though infrastructure challenges persist in sub-Saharan Africa.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Home Medical Device Market.- Medtronic plc

- Abbott Laboratories

- Koninklijke Philips N.V.

- Roche Diagnostics (A segment of F. Hoffmann-La Roche Ltd.)

- ResMed Inc.

- GE Healthcare

- Omron Healthcare, Inc.

- Johnson & Johnson

- Becton Dickinson and Company (BD)

- Siemens Healthineers AG

- Teleflex Incorporated

- 3M Company

- Masimo Corporation

- Baxter International Inc.

- Boston Scientific Corporation

- Stryker Corporation

- Invacare Corporation

- Nipro Corporation

- Terumo Corporation

- Tunstall Group

Frequently Asked Questions

Analyze common user questions about the Home Medical Device market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growth of the Home Medical Device Market?

The primary drivers are the rapid aging of the global population, the increasing prevalence of chronic diseases (like diabetes and cardiovascular conditions) requiring continuous management, and the strong push towards cost-effective remote patient monitoring (RPM) solutions over expensive hospital stays.

How does technological innovation impact home medical devices?

Technological innovation, specifically the integration of the Internet of Medical Things (IoMT), AI, and miniaturized sensors, is transforming devices into intelligent, interconnected systems capable of real-time predictive analytics, enhancing accuracy, and simplifying data transmission for remote clinical review.

Which geographical region holds the largest market share for home medical devices?

North America currently holds the largest market share, driven by favorable government reimbursement policies supporting home healthcare, advanced digital health infrastructure, and high consumer acceptance of connected health technologies.

What are the main regulatory challenges faced by manufacturers?

Key regulatory challenges include navigating complex and fragmented global approval processes (FDA, CE Mark), ensuring stringent data privacy compliance (HIPAA, GDPR) for connected devices, and validating the clinical efficacy and security of software-as-a-medical-device (SaMD) components.

What are the key benefits of using therapeutic home medical devices?

Therapeutic home devices (such as oxygen concentrators and insulin pumps) offer significant benefits, including improved patient comfort and quality of life, greater independence, reduced risk of hospital-acquired infections, and potential reduction in overall healthcare costs through prevention of readmissions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager