Home Medical Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432714 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Home Medical Equipment Market Size

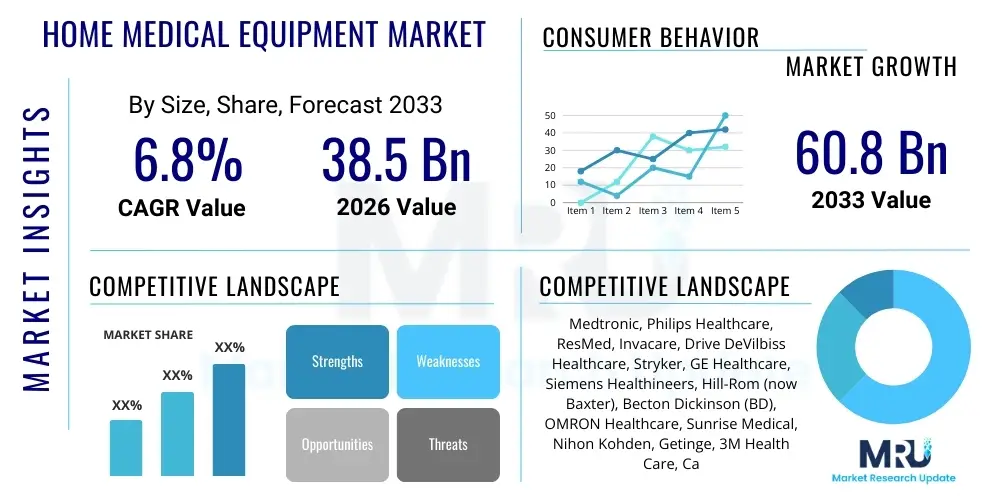

The Home Medical Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $38.5 Billion in 2026 and is projected to reach $60.8 Billion by the end of the forecast period in 2033. This significant expansion is driven primarily by the global demographic shift towards an aging population coupled with increasing incidence of chronic conditions such as COPD, diabetes, and cardiovascular diseases, necessitating long-term, continuous monitoring and therapeutic support outside traditional institutional settings.

Home Medical Equipment Market introduction

The Home Medical Equipment (HME) Market encompasses a diverse range of medical devices and supplies designed for patient use in non-clinical environments, predominantly the patient's residence. These products span mobility aids, respiratory care devices, remote patient monitoring systems, and various forms of rehabilitation and therapeutic equipment. HME products, such as oxygen concentrators, continuous positive airway pressure (CPAP) machines, wheelchairs, and blood glucose monitors, are essential for managing chronic diseases, facilitating post-operative recovery, and enabling elderly individuals to maintain independence while receiving necessary medical attention. The core application of these devices is to transition medical care from high-cost hospital environments to cost-effective and comfortable home settings, improving patient quality of life and reducing overall healthcare expenditures.

Key benefits of HME utilization include enhanced patient comfort, reduced risk of hospital-acquired infections (HAIs), and greater adherence to treatment protocols due to the convenience of in-home care. The market's growth trajectory is strongly supported by technological advancements, particularly the integration of Internet of Things (IoT) sensors and Artificial Intelligence (AI) capabilities, which enable real-time data transmission and sophisticated remote diagnostics. Government initiatives promoting home healthcare, coupled with evolving reimbursement policies that increasingly cover HME purchases and rentals, further solidify the foundation for market expansion. Driving factors include the persistent burden of chronic diseases globally, shifting consumer preferences towards personalized care, and the sustained economic pressure on healthcare systems to minimize operational costs.

Home Medical Equipment Market Executive Summary

The Home Medical Equipment market exhibits strong business trends characterized by intense merger and acquisition (M&A) activities focused on integrating digital health platforms and expanding distribution networks, particularly in the rapidly growing e-commerce space. Major companies are prioritizing the development of compact, portable, and user-friendly devices equipped with connectivity features to support telehealth services. The shift toward subscription-based models for equipment rental and maintenance is gaining traction, driven by the desire for predictable revenue streams and enhanced patient adherence. Furthermore, regulatory bodies are adapting frameworks to accommodate software-as-a-medical-device (SaMD) classifications, accelerating the market entry of advanced monitoring solutions.

Regionally, North America maintains market dominance due to high healthcare expenditure, sophisticated reimbursement structures, and the presence of leading HME manufacturers and technology innovators. However, the Asia Pacific (APAC) region is poised for the fastest growth, fueled by massive untapped patient populations, improving healthcare infrastructure investments, and rising penetration of medical insurance. Segments trends highlight the respiratory care equipment category as a primary revenue driver, driven by the widespread prevalence of sleep apnea and COPD. Within distribution channels, online retail and direct-to-consumer models are experiencing exponential growth, reflecting consumer preference for convenience and comparative pricing, challenging traditional brick-and-mortar Durable Medical Equipment (DME) providers.

AI Impact Analysis on Home Medical Equipment Market

User inquiries regarding the integration of Artificial Intelligence (AI) in the Home Medical Equipment market predominantly revolve around four key areas: the improvement of diagnostic accuracy through AI-powered sensors, the feasibility and security of predictive maintenance for devices, the impact of AI on personalized patient treatment plans delivered remotely, and the ethical implications concerning data privacy and algorithmic bias. Users are highly interested in how AI can optimize the management of chronic conditions, asking specifically about AI's role in alerting caregivers to impending health crises (e.g., severe glucose dips or respiratory distress) before they become critical, thereby minimizing emergency room visits. A core concern centers on the reliable integration of complex AI algorithms into simple, affordable home devices, ensuring accessibility without compromising clinical efficacy or user-friendliness for non-technical patient populations.

The consensus among users is an expectation that AI will transform HME from passive monitoring tools into proactive, therapeutic agents. AI algorithms are crucial for processing the enormous datasets generated by continuous patient monitoring, extracting clinically relevant patterns invisible to human observers, and automating adjustments in therapeutic devices, such as insulin pumps or ventilators, based on real-time physiological feedback. This shift promises superior clinical outcomes and streamlines the workflow for remote clinical teams, allowing them to focus resources on the most high-risk patients. However, the requirement for robust cybersecurity protocols to protect sensitive health data transmitted by AI-enabled devices remains a major point of consideration for patients and providers alike, emphasizing the need for regulatory clarity.

- AI enables predictive analytics for early detection of health deterioration (e.g., sepsis, cardiac events).

- Optimizes device settings automatically based on personalized physiological data, enhancing therapy effectiveness (e.g., CPAP pressure adjustment).

- Facilitates remote diagnostics and virtual consultations by structuring and summarizing patient monitoring data for clinicians.

- Improves inventory management and supply chain efficiency through demand forecasting for consumables.

- Powers sophisticated voice and gesture control interfaces, improving accessibility for elderly and impaired users.

DRO & Impact Forces Of Home Medical Equipment Market

The dynamics of the Home Medical Equipment Market are defined by a powerful interplay of propelling and constraining forces that dictate investment, innovation, and adoption rates globally. The primary drivers revolve around demographic shifts, specifically the rapid increase in the geriatric population worldwide, which inherently requires continuous care solutions for age-related and chronic diseases. This demographic driver is strongly supported by the economic imperative to shift care delivery from expensive acute settings to lower-cost, preventative home environments. Technological advancements, particularly in sensor technology, miniaturization, and seamless IoT integration, offer continuous, high-fidelity monitoring previously restricted to hospitals, significantly boosting the market's value proposition.

However, substantial restraints temper the market’s expansion potential. High initial acquisition costs for advanced HME, coupled with complex and often inconsistent reimbursement policies across different geographies and payor types, represent major barriers to widespread consumer access. Furthermore, the inherent complexity associated with managing sophisticated medical equipment in a non-clinical setting—including the need for specialized training for patients and non-professional caregivers—presents implementation challenges. The necessity of maintaining strict data security and compliance with rigorous global medical device regulations (e.g., FDA, MDR) also significantly lengthens the product development lifecycle and increases operational expenses for manufacturers.

Opportunities for exponential growth reside in expanding market penetration into underserved regions, particularly in Latin America and APAC, where infrastructure is rapidly improving and healthcare access is broadening. The development of subscription-based or leasing models for high-cost items addresses the financial restraint issue directly. Impact forces, which are the macroeconomic and regulatory pressures, ensure that manufacturers prioritize devices that are not only technologically superior but also demonstrate clear cost savings and clinically proven patient outcomes, driving the market towards value-based care solutions and rigorous evidence-based marketing.

Segmentation Analysis

The Home Medical Equipment market is broadly segmented based on Product Type, Application, and Distribution Channel, reflecting the diverse range of devices and methods through which patients access necessary care. Segmentation by product type highlights the specialization within the market, distinguishing between devices used for mobility assistance (such as wheelchairs and crutches), those for therapeutic purposes (like respiratory and dialysis equipment), and critical diagnostic and monitoring devices (such as blood pressure monitors and telehealth units). This structural differentiation is essential for understanding revenue concentration and technological priorities across the industry, with therapeutic and monitoring segments witnessing the highest innovation rates.

Application segmentation clarifies the end-user setting, ranging from traditional home care settings, which represent the largest segment, to specialized applications in nursing homes and ambulatory surgical centers which utilize specific types of post-acute care HME. Analyzing distribution channels is crucial, as it tracks the evolution of procurement methods. While traditional Durable Medical Equipment (DME) providers and retail pharmacies have historically dominated, the rapid acceleration of e-commerce platforms and direct-to-consumer models, especially for consumables and easily managed monitoring tools, is reshaping market dynamics and increasing patient choice and price transparency.

- By Product Type:

- Monitoring and Diagnostic Equipment (Blood Glucose Monitors, Blood Pressure Monitors, ECG/E-KGs, Pulse Oximeters, Sleep Apnea Diagnostic Devices)

- Therapeutic Equipment (Respiratory Therapy Equipment (CPAP, BiPAP, Ventilators, Oxygen Concentrators), Dialysis Equipment, Insulin Delivery Devices, Nebulizers)

- Mobility Aids and Patient Support Equipment (Wheelchairs, Scooters, Walkers, Canes, Crutches, Patient Lifts, Beds)

- Personal Care Equipment (Bathing and Toilet Aids, Home Healthcare Furniture)

- Consumables and Accessories (Testing Strips, Masks, Tubing, Catheters)

- By Application:

- Home Care Settings (Largest Segment)

- Hospitals and Clinics (for discharge planning and rental)

- Nursing Homes and Long-Term Care Centers

- Ambulatory Care Centers

- By Distribution Channel:

- Durable Medical Equipment (DME) Suppliers

- Retail Pharmacies

- Online Retailers/E-commerce

- Hypermarkets/Supermarkets

Value Chain Analysis For Home Medical Equipment Market

The Home Medical Equipment value chain begins with highly specialized upstream activities involving the sourcing of sophisticated raw materials and electronic components. Manufacturers rely heavily on suppliers of high-grade polymers, specialized metals, microprocessors, sensors, and embedded software platforms crucial for modern, connected devices. Quality control and regulatory compliance are paramount at this stage, as the integrity of these foundational components directly impacts the clinical safety and efficacy of the final product. Key upstream partners include specialized electronics firms and sensor manufacturers, often requiring tight integration and collaboration to meet strict medical device standards (e.g., ISO 13485). Given the complexity of integrated technologies, procurement strategies often focus on building resilient supply chains to mitigate geopolitical risks and component shortages.

The midstream phase, manufacturing and assembly, involves integrating these components into finished medical devices. This process is becoming increasingly automated, focusing on precision assembly, sterile packaging, and rigorous testing protocols to ensure regulatory clearance. Modern manufacturing emphasizes miniaturization, ergonomic design, and the seamless integration of wireless communication capabilities (Bluetooth, Wi-Fi, 5G). This stage adds significant value through intellectual property, software development, and the establishment of clinical evidence supporting device performance. The shift towards personalized medicine necessitates flexible manufacturing lines capable of producing customized devices or device accessories efficiently.

The downstream segment, encompassing distribution and post-sales support, is critical for market access. Distribution channels are bifurcated into direct channels, where manufacturers sell or lease directly to large hospital systems or government programs, and indirect channels, primarily utilizing DME suppliers, retail pharmacies, and, increasingly, dedicated e-commerce platforms. DME suppliers play a vital role in logistical support, device setup, patient training, and equipment maintenance/repair. Given the critical nature of HME, post-sales services, including 24/7 technical support and expedited replacement processes, contribute significantly to customer satisfaction and adherence to therapy, ultimately driving revenue through repeat rentals and consumable sales.

Home Medical Equipment Market Potential Customers

The primary end-users and potential buyers in the Home Medical Equipment Market are highly diverse, encompassing individuals requiring long-term care, institutions facilitating post-acute recovery, and government entities involved in public health procurement. The largest demographic segment consists of geriatric patients (65 and older) suffering from chronic, age-related illnesses such as chronic obstructive pulmonary disease (COPD), heart failure, and mobility impairments, who seek comfort and independence while receiving ongoing medical attention at home. Patients discharged early from hospitals, particularly those recovering from major surgery or acute events, form another key segment, utilizing HME temporarily for rehabilitation and continuous monitoring.

Institutional buyers represent a significant purchasing force, including nursing homes, long-term care facilities, and specialized rehabilitation centers that purchase or rent equipment in bulk to manage multiple residents simultaneously. Furthermore, Durable Medical Equipment (DME) providers act as crucial intermediaries, purchasing from manufacturers and then renting or selling devices to individual patients based on insurance coverage and physician prescriptions. Government agencies, through Veterans Affairs programs or national healthcare systems (like the NHS in the UK), are major procurers, particularly for standardized respiratory and mobility aids, driven by large-scale public health needs and specific patient access mandates. Insurance payors, while not direct end-users, profoundly influence purchasing decisions through coverage policies and approved vendor lists.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $38.5 Billion |

| Market Forecast in 2033 | $60.8 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Medtronic, Philips Healthcare, ResMed, Invacare, Drive DeVilbiss Healthcare, Stryker, GE Healthcare, Siemens Healthineers, Hill-Rom (now Baxter), Becton Dickinson (BD), OMRON Healthcare, Sunrise Medical, Nihon Kohden, Getinge, 3M Health Care, Cardinal Health, ConvaTec, B. Braun Melsungen, Mindray, Teleflex |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Home Medical Equipment Market Key Technology Landscape

The technological evolution within the Home Medical Equipment (HME) market is fundamentally characterized by convergence, primarily the integration of biomedical engineering with digital information technology. A critical area of advancement is the proliferation of IoT-enabled devices, which allow HME to transmit vital signs, usage patterns, and diagnostic data in real-time to healthcare providers and cloud-based platforms. This connectivity facilitates Remote Patient Monitoring (RPM), moving beyond simple data logging to providing continuous, actionable insights. Technologies such as high-precision sensors for respiratory flow, cardiac rhythm, and metabolic indicators are becoming standard, enabling sophisticated chronic disease management from the patient’s home. Furthermore, the focus on miniaturization and wireless charging capabilities enhances device portability and user compliance, making therapeutic equipment less intrusive and easier to manage in daily life.

Another profound technological shift is the incorporation of Artificial Intelligence (AI) and Machine Learning (ML) algorithms. These technologies are applied to analyze the vast datasets generated by RPM systems, enabling predictive maintenance for the HME devices themselves (reducing downtime) and, more importantly, developing predictive clinical models that forecast exacerbations in chronic conditions, such as anticipating a severe asthma attack or a diabetic crisis. AI is also being utilized to personalize treatment parameters automatically, optimizing delivery for devices like insulin pumps or ventilators based on individual patient response patterns. Cybersecurity infrastructure is an indispensable component of this landscape; as HME systems become connected and handle Protected Health Information (PHI), robust encryption, authentication protocols, and compliance with standards like HIPAA and GDPR are non-negotiable necessities, driving investment in secure data transmission and storage solutions.

The development of user-centric interfaces, incorporating advanced human-machine interaction (HMI) features, is also a core technology focus. This includes simple touchscreen interfaces, voice-activated controls, and augmented reality (AR) instructions for complex device setup and troubleshooting, addressing the challenge of usability for elderly patients or those with limited technical proficiency. Furthermore, materials science innovation is critical, leading to the development of lighter, more durable, and biocompatible materials for mobility aids and wearable sensors, significantly improving patient comfort and reducing the overall footprint of home healthcare delivery infrastructure.

Regional Highlights

Geographically, the Home Medical Equipment market exhibits distinct adoption patterns and growth drivers influenced by local healthcare policies, demographic structures, and technological readiness. North America, particularly the United States, represents the largest market share globally. This dominance is attributed to high per capita healthcare spending, the sophisticated presence of major HME manufacturers, advanced reimbursement systems (Medicare/Medicaid coverage for HME), and high acceptance rates of telehealth and remote patient monitoring solutions. Regulatory bodies like the FDA actively facilitate the rapid approval of innovative medical devices, maintaining a competitive and technologically advanced market structure.

Europe holds the second-largest market position, driven by mature national healthcare systems (e.g., in Germany, the UK, and France) grappling with aging populations and seeking cost-containment measures through home-based care. The implementation of the new European Medical Device Regulation (MDR) is streamlining the regulatory environment but simultaneously increasing the compliance burden for manufacturers. Nordic countries are leaders in adopting digital health solutions, leveraging robust digital infrastructure for pervasive telehealth integration.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid expansion is spurred by improving economic conditions, increased accessibility to health insurance, and massive infrastructural development in countries like China, India, and Japan. While Japan's market is driven by its extremely aged population, emerging markets like India and China are seeing growth fueled by rising middle-class disposable income and increasing awareness of chronic disease management, prompting local governments to invest heavily in community and home healthcare initiatives. Latin America and the Middle East & Africa (MEA) remain smaller but high-potential markets, characterized by fragmented distribution networks and varying regulatory standards, with growth concentrated in urban centers with established private healthcare sectors.

- North America (US & Canada): Market leader due to advanced reimbursement frameworks, high prevalence of chronic diseases, and technological early adoption, particularly in RPM and telehealth systems.

- Europe: Mature market focusing on efficiency and cost savings via home care; strong regulatory oversight (MDR); high adoption in Western and Nordic countries.

- Asia Pacific (APAC): Fastest growing region, driven by geriatric population in Japan, improving healthcare access in China and India, and rising government investment in primary and decentralized care.

- Latin America: Growth concentrated in Brazil and Mexico, focusing on basic therapeutic and mobility aids, often facing challenges related to procurement and inconsistent regulatory standardization.

- Middle East & Africa (MEA): Growth driven by wealthy Gulf Cooperation Council (GCC) countries investing heavily in high-end private healthcare services and specialized home care for complex conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Home Medical Equipment Market.- Medtronic

- Philips Healthcare

- ResMed

- Invacare

- Drive DeVilbiss Healthcare

- Stryker

- GE Healthcare

- Siemens Healthineers

- Hill-Rom (now Baxter)

- Becton Dickinson (BD)

- OMRON Healthcare

- Sunrise Medical

- Nihon Kohden

- Getinge

- 3M Health Care

- Cardinal Health

- ConvaTec

- B. Braun Melsungen

- Mindray

- Teleflex

Frequently Asked Questions

Analyze common user questions about the Home Medical Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Home Medical Equipment market?

The primary driver is the accelerating global aging population, coupled with the increasing prevalence of chronic diseases (like COPD and diabetes). These factors necessitate continuous, long-term monitoring and therapeutic support, making home care a cost-effective and essential alternative to extended hospital stays.

How is telehealth specifically impacting the adoption of Home Medical Equipment?

Telehealth integration leverages HME devices equipped with IoT connectivity for Remote Patient Monitoring (RPM). This allows clinicians to collect real-time data on vital signs and device usage, enabling timely interventions, reducing re-admissions, and significantly enhancing the overall quality and efficiency of care delivery.

Which product segment holds the highest market share in Home Medical Equipment?

The Respiratory Care Equipment segment, including CPAP machines, oxygen concentrators, and ventilators designed for home use, generally holds the largest market share. This dominance is due to the high global incidence of sleep apnea, COPD, and other chronic respiratory conditions requiring long-term device therapy.

What are the main challenges restraining the rapid expansion of the HME market?

Major restraints include the high initial acquisition cost of advanced medical devices and the complex, often inconsistent, structure of third-party reimbursement policies across different geographic regions, which can impede patient access and market predictability.

What role does Artificial Intelligence play in future Home Medical Equipment development?

AI is pivotal in transforming HME from passive tools into proactive diagnostic and therapeutic systems. AI algorithms enable predictive health analytics, optimize device settings automatically based on patient data, and streamline data presentation for remote clinical review, vastly improving personalized care outcomes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager