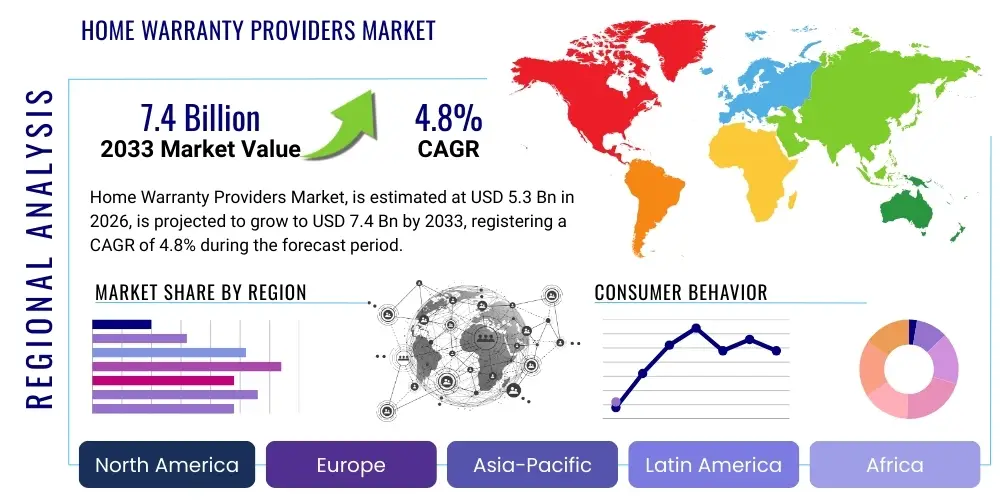

Home Warranty Providers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436944 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Home Warranty Providers Market Size

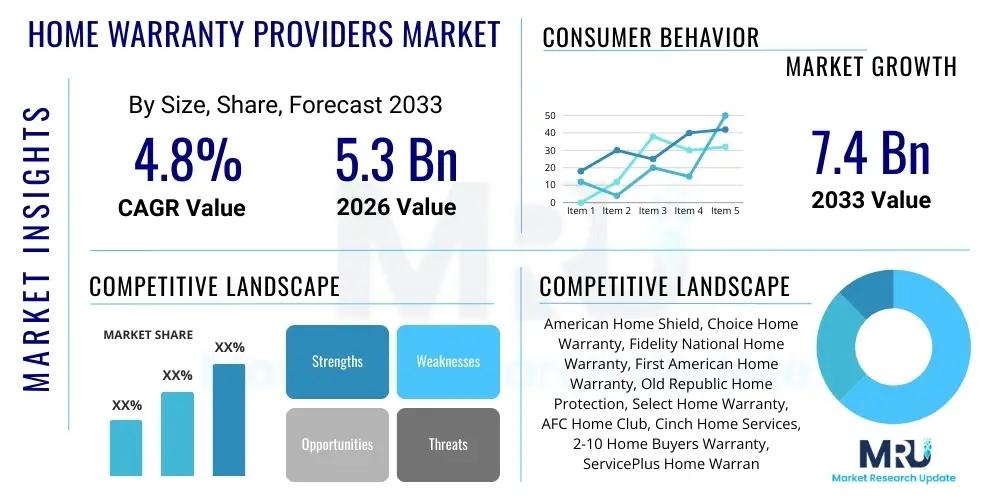

The Home Warranty Providers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $5.3 Billion in 2026 and is projected to reach $7.4 Billion by the end of the forecast period in 2033.

Home Warranty Providers Market introduction

The Home Warranty Providers Market encompasses services designed to protect homeowners against the unexpected costs of repairing or replacing major home systems and appliances that fail due to normal wear and tear. This differs fundamentally from homeowners insurance, which typically covers damage from sudden, catastrophic events. The core product is a service contract offering financial predictability and peace of mind to property owners. Major applications span residential real estate transactions, where warranties serve as a crucial negotiation tool, and existing home ownership, where they mitigate risks associated with aging infrastructure. The primary benefits include budget protection, access to vetted repair technicians, and streamlined claims processes. Key driving factors accelerating market expansion include the continually rising median age of housing stock globally, increasing consumer awareness regarding repair costs, and sustained growth in the resale housing sector.

The service model relies heavily on network management, actuarial precision, and customer retention strategies. Home warranty plans usually cover essential components such as HVAC systems, plumbing, electrical wiring, and standard kitchen appliances. The introduction of optional add-ons, covering items like pools, septic systems, or well pumps, has diversified product offerings and enhanced provider revenue streams. The value proposition is particularly strong for first-time buyers and those less financially prepared for large, intermittent home maintenance expenses. Market maturity varies geographically, with North America demonstrating high penetration rates, while regions in Europe and Asia Pacific are experiencing rapid adoption driven by urbanization and rising middle-class disposable incomes. The standardization of contract terms and improvement in claims transparency remain central themes influencing consumer trust and overall market performance.

Home Warranty Providers Market Executive Summary

The Home Warranty Providers Market exhibits robust growth, primarily fueled by sustained demand in the residential real estate sector and the aging population of residential homes across developed economies. Current business trends indicate a strong pivot towards digital transformation, focusing on optimizing the claims lifecycle through mobile applications and integrated vendor management systems to enhance operational efficiency and improve customer satisfaction metrics. Competition is intensifying, leading providers to differentiate through enhanced service networks, flexible customization of coverage plans, and the integration of preventative maintenance resources alongside traditional warranty services. Financial stability remains critical, as regulatory scrutiny increases concerning claims processing fairness and contract clarity, compelling smaller players to consolidate or invest heavily in compliance infrastructure.

Regional trends highlight North America as the dominant market, characterized by high consumer awareness and mature distribution channels, particularly through real estate professionals. However, the Asia Pacific (APAC) region is poised for the highest growth rate, driven by accelerated housing development, increasing urbanization, and a growing consumer appetite for bundled financial protection services. European markets show steady, moderate growth, often tailored to specific national regulations regarding consumer contracts and warranty protection. Segment trends reveal that Combination Plans, covering both systems and appliances, command the largest market share due to their comprehensive risk mitigation offering. Furthermore, the End-User segment shows substantial growth among existing homeowners seeking renewal, indicating high long-term retention rates for providers who deliver reliable service.

AI Impact Analysis on Home Warranty Providers Market

Users frequently inquire about how Artificial Intelligence (AI) can revolutionize the historically manual and often opaque claims process in the home warranty sector, focusing heavily on automation, speed, and fairness. Common questions center on AI's ability to instantly adjudicate simple claims, detect fraudulent activity, and personalize pricing based on property risk factors and historical performance data. There is significant expectation that AI-powered customer service, via intelligent chatbots and virtual assistants, will drastically reduce wait times and improve the initial user experience during failure reporting. Key concerns often revolve around data privacy, the potential for algorithmic bias in claims denial, and the displacement of human agents. Overall, the consensus theme is that AI will drive efficiency and profitability for providers, but consumers demand that these technologies enhance transparency and service quality rather than solely focusing on cost reduction.

- AI-driven claims adjudication: Utilizing machine learning algorithms to rapidly assess claim validity based on contract terms, historical repair data, and reported failure types, significantly reducing processing time.

- Predictive maintenance modeling: Employing AI to analyze sensor data from smart homes and historical system lifespan data to proactively flag potential component failures, shifting the model from reactive repair to preventative service.

- Enhanced fraud detection: Using advanced pattern recognition to identify anomalies in repair costs, technician reporting, and repeated claims, thereby minimizing financial losses due to fraudulent activity.

- Personalized premium pricing: Implementing AI models to calculate risk scores for individual properties based on geographical location, home age, system types, and usage patterns, allowing for more granular and personalized pricing structures.

- Intelligent customer support: Deployment of Natural Language Processing (NLP) powered chatbots and virtual assistants for 24/7 self-service support, handling initial inquiries, scheduling service calls, and updating claim statuses.

- Optimized technician dispatch: Utilizing AI to match claims with the most qualified and geographically proximate service vendors, minimizing travel time and improving first-time fix rates.

DRO & Impact Forces Of Home Warranty Providers Market

The dynamics of the Home Warranty Providers Market are shaped by a complex interplay of demand-side drivers, operational restraints, and technological opportunities, all mediated by critical impact forces related to consumer trust and regulatory oversight. The increasing age of residential infrastructure globally serves as a foundational driver, compelling homeowners to seek financial insulation against inevitable systems breakdown. Opportunities are largely concentrated in integrating warranty services with smart home ecosystems (IoT), enabling proactive diagnostics and offering enhanced, value-added services beyond basic repair. Restraints predominantly involve the public perception issues stemming from complex contract language, coverage exclusions, and disputes over claim denial rates, which necessitate greater transparency to build consumer confidence. These factors summarize the core market environment, influencing strategic decisions across pricing, product development, and operational scaling.

Key drivers include the steady rise in home sales (both new and resale), the escalating cost of specialized labor and replacement parts, and the growing complexity of modern home systems (such as high-efficiency HVAC units), which makes DIY repairs impractical. The market benefits significantly from the role of real estate agents who frequently bundle warranties as incentives during property transactions. Conversely, the market faces significant headwinds from regulatory challenges, particularly in states attempting to define warranty contracts as insurance products, which imposes stricter capital reserve requirements and compliance burdens. Furthermore, high customer acquisition costs, often related to commission structures paid to realtors, present an ongoing financial restraint for market players attempting rapid scale.

The most compelling opportunities lie in market segment diversification, specifically targeting rental property owners, small commercial entities, and utilizing subscription model innovations to offer tiered, highly flexible coverage. Impact forces are dominated by the need for digital transformation, where companies leveraging advanced data analytics for risk modeling and highly efficient claims processing gain a competitive edge. Consumer advocacy groups also exert significant pressure, forcing providers to simplify contract language and improve the fairness of the vendor network, driving the overall quality and trustworthiness of the service offering higher across the industry landscape.

Segmentation Analysis

Segmentation within the Home Warranty Providers Market is crucial for targeted marketing, product development, and accurate risk assessment. The market is primarily segmented based on the type of coverage offered, the specific end-user category, and the distribution channel utilized to reach customers. Analyzing these segments helps providers tailor their risk pool management and adjust pricing strategies to optimize profitability while ensuring competitive positioning. The heterogeneity of housing stock (age, location, system type) necessitates highly customizable segment offerings, moving away from monolithic, one-size-fits-all contracts.

The three main segmentation axes reflect the core functional differences in service delivery and customer needs. Coverage type dictates the scope of financial liability for the provider, with combination plans representing the highest perceived value for consumers. End-user classification differentiates between the immediate needs of a party involved in a real estate transaction versus the long-term maintenance requirements of an established homeowner. Distribution channel analysis reveals the varying costs associated with customer acquisition, highlighting the efficiency of direct-to-consumer digital channels versus the traditional, commission-heavy real estate referral network, shaping overall market strategies.

- Coverage Type:

- Appliance Coverage

- Systems Coverage (HVAC, Electrical, Plumbing)

- Combination Plans (Appliance and Systems)

- Add-Ons/Optional Coverage (Pool, Septic, Well Pump)

- End-User:

- Residential (Existing Homeowners)

- Residential (New Homeowners/Real Estate Transactions)

- Real Estate Professionals (Realtors, Brokers)

- Rental Property Owners

- Distribution Channel:

- Direct Sales (Online, Telemarketing)

- Real Estate Channel (Referrals)

- Affinity Programs (Partnerships with Financial Institutions)

Value Chain Analysis For Home Warranty Providers Market

The Home Warranty Providers value chain is defined by core activities ranging from upstream contract underwriting and product design to downstream service delivery and claims fulfillment. Upstream analysis focuses on actuarial science and risk management, where providers determine pricing, set coverage limits, and secure reinsurance (if applicable) to mitigate large-scale financial exposure. Key activities here include data modeling of system failure rates and the development of contract terms that legally define coverage parameters. Effective upstream operations ensure financial solvency and competitive pricing.

Downstream analysis centers heavily on operational logistics and customer experience, specifically the management of the vendor network, which includes thousands of independent service contractors (plumbers, electricians, HVAC technicians). The efficiency of the distribution channel is crucial; direct channels, such as online sales and internal call centers, offer high control over customer messaging but require significant marketing investment. Conversely, the real estate channel, reliant on realtor commissions, provides a steady stream of new business but entails higher acquisition costs. Managing this heterogeneous network efficiently is vital for claims fulfillment, customer satisfaction, and reputation management, as poor service from a third-party vendor directly impacts the provider's brand integrity.

In terms of distribution, the balance between direct and indirect channels is a strategic differentiator. Direct channels emphasize brand loyalty and lifetime customer value, allowing providers to control the entire communication process and rapidly integrate digital tools for enrollment and claims submission. Indirect channels, particularly the reliance on realtors, facilitate immediate market access and volume during high-turnover housing periods. Successful market participants leverage a hybrid model, using the high volume generated by indirect sales to feed a funnel that is subsequently managed and retained via superior direct digital service, ensuring a robust and resilient operational structure across the entire value chain.

Home Warranty Providers Market Potential Customers

The primary customer base for the Home Warranty Providers Market encompasses a broad spectrum of residential property owners and key facilitators in real estate transactions. End-users fall mainly into two categories: individuals purchasing or selling a home, where the warranty acts as a sales differentiator or protection during the initial ownership period, and existing long-term homeowners who purchase annual renewal contracts specifically to manage unpredictable maintenance budgets. The latter group, characterized by high retention rates, seeks convenience and financial stability against the wear and tear associated with aging appliances and home systems.

A rapidly growing segment includes rental property investors and landlords. These buyers utilize home warranties to manage maintenance across multiple properties efficiently, offloading the administrative burden of vetting and scheduling individual technicians for repairs. This allows property management companies to maintain operational leverage and standardize tenant service levels while stabilizing their expenditure on property upkeep. The increasing institutional investment in single-family rentals is further accelerating demand from this commercialized segment of end-users.

Beyond the property owners, real estate professionals, including realtors, brokers, and title companies, act as crucial gatekeepers and indirect buyers. While they do not use the service personally, they recommend or mandate warranties as a standard part of their transaction service offering. Their satisfaction is based on the reliability of the warranty provider’s service network and the ease of the claim process, as any service failure reflects poorly on the realtor who made the recommendation. Consequently, providers focus heavily on partnership programs and professional training aimed at this influential group to secure consistent lead generation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.3 Billion |

| Market Forecast in 2033 | $7.4 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | American Home Shield, Choice Home Warranty, Fidelity National Home Warranty, First American Home Warranty, Old Republic Home Protection, Select Home Warranty, AFC Home Club, Cinch Home Services, 2-10 Home Buyers Warranty, ServicePlus Home Warranty, Home Warranty of America, Landmark Home Warranty, OneGuard Home Warranties, Super Home Warranty, Global Home Protection, Secure Home Warranty, TotalProtect Home Warranty, Liberty Home Guard, Essential Home Warranty, Elite Home Warranty |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Home Warranty Providers Market Key Technology Landscape

The Home Warranty Providers market is undergoing a profound technological transformation driven by the need for efficiency, risk mitigation, and superior customer experience. The foundational technologies include robust Customer Relationship Management (CRM) systems integrated with sophisticated Enterprise Resource Planning (ERP) platforms, essential for managing vast numbers of contracts, billing cycles, and customer interactions across multiple channels. These systems enable comprehensive data capture necessary for actuarial analysis and compliance reporting. Furthermore, the reliance on third-party service networks necessitates the use of specialized Vendor Management Software (VMS) to track technician credentials, service performance metrics, dispatch efficiency, and payment processing, ensuring consistent quality control and timely service delivery across geographically dispersed operations.

A critical emerging area is the deployment of advanced analytics and Artificial Intelligence (AI). Data science teams are utilizing machine learning models for detailed risk profiling, helping to predict the likelihood of system failure based on property characteristics and historical claim frequency, thereby informing dynamic pricing strategies and optimizing reserves management. AI is also deeply integrated into the customer interface, utilizing Natural Language Processing (NLP) for claims intake via chatbots and virtual assistants, speeding up the initial reporting phase and reducing reliance on traditional call centers. This technological layer allows providers to handle increased claim volume without a proportional increase in human administrative overhead.

The proliferation of the Internet of Things (IoT) devices in residential homes presents both a technological challenge and a massive opportunity. Providers are beginning to explore partnerships and integrations that allow them to receive real-time diagnostic data from connected appliances (e.g., smart thermostats, water heaters). This capability enables the transition towards a predictive maintenance model, allowing the warranty provider to dispatch a technician before a catastrophic failure occurs, significantly improving customer satisfaction and potentially reducing the overall cost of repair, as early intervention is often cheaper than full replacement. Mobile application development is also paramount, providing homeowners with self-service tools for contract management, claim submission, and real-time technician tracking, solidifying the digital engagement strategy.

Regional Highlights

- North America: North America, particularly the United States, holds the largest market share due to high consumer awareness, widespread acceptance of home warranty services within the established real estate transaction process, and a mature competitive landscape. The market benefits from high rates of homeownership and the continuous aging of the housing stock. Regulatory environments, though varied by state, have largely accommodated the growth of this sector. Key growth vectors include the integration of digital platforms for claims management and aggressive marketing campaigns targeting Millennials and Gen Z first-time buyers who prioritize predictable monthly expenses over unexpected large capital outlays.

- Europe: The European market demonstrates moderate, steady growth, driven primarily by increasing consumer protection regulations and rising interest in managing property maintenance costs, particularly in the UK, Germany, and France. Penetration rates remain lower than in North America, largely due to diverse national insurance frameworks and stricter consumer contract laws. The opportunity lies in providers tailoring coverage to specific local building standards and system types (e.g., boilers versus central HVAC). The focus is often on systems coverage rather than appliance coverage, reflecting regional consumer priorities and home infrastructure differences.

- Asia Pacific (APAC): The APAC region is forecast to experience the highest Compound Annual Growth Rate (CAGR), driven by rapid urbanization, substantial growth in middle-class incomes, and massive residential construction booms in countries like China, India, and Southeast Asia. The market here is nascent but highly receptive to western service models that promise convenience and risk mitigation. Providers focus heavily on establishing trust and educating new homeowners about the differences between mandatory developer warranties and optional, ongoing home warranties. Digital adoption is crucial, with mobile-first engagement strategies essential for market penetration.

- Latin America: This region is characterized by fragmented market penetration and varying degrees of economic stability. Growth is primarily observed in high-density urban areas in countries like Brazil and Mexico, where there is a noticeable rise in formal real estate transactions and increasing demand for ancillary financial protection products. The challenge remains in developing robust, reliable vendor networks and navigating complex local legal frameworks regarding service contracts and consumer rights.

- Middle East and Africa (MEA): Growth in the MEA region is concentrated within the Gulf Cooperation Council (GCC) states, driven by high-value, modern residential developments and expatriate populations accustomed to comprehensive protection services. In many parts of Africa, the market is severely underdeveloped, though opportunities exist in commercialized rental housing sectors where institutional investors seek standardized maintenance solutions. Political and economic volatility remains a constraint, demanding highly conservative risk management practices from providers entering these markets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Home Warranty Providers Market.- American Home Shield

- Choice Home Warranty

- Fidelity National Home Warranty

- First American Home Warranty

- Old Republic Home Protection

- Select Home Warranty

- AFC Home Club

- Cinch Home Services

- 2-10 Home Buyers Warranty

- ServicePlus Home Warranty

- Home Warranty of America

- Landmark Home Warranty

- OneGuard Home Warranties

- Super Home Warranty

- Global Home Protection

- Secure Home Warranty

- TotalProtect Home Warranty

- Liberty Home Guard

- Essential Home Warranty

- Elite Home Warranty

Frequently Asked Questions

Analyze common user questions about the Home Warranty Providers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between a home warranty and homeowners insurance?

Home insurance covers sudden, accidental damage from events like fire or theft, whereas a home warranty is a service contract covering the repair or replacement of systems and appliances that fail due to normal wear and tear over time.

Are home warranties worth the annual premium cost?

For properties with aging systems or appliances, the warranty provides essential financial predictability. It is highly valuable for risk-averse homeowners seeking protection from the high, unexpected costs associated with major system failures, typically offsetting the premium if a single large claim is filed.

How are home warranty claims typically processed?

A homeowner reports a system failure, the provider verifies coverage, assigns a qualified technician from their network, and the homeowner pays a service call fee (deductible). The provider then authorizes and covers the remaining repair or replacement costs up to the contract limits.

What are the primary factors driving growth in the Home Warranty Market?

The primary growth drivers include the increasing average age of residential housing stock globally, escalating costs of specialized home repairs, and the active integration of home warranties into the real estate transaction process by agents.

Does coverage extend to pre-existing conditions or unknown failures?

Most standard home warranty contracts explicitly exclude failures resulting from pre-existing conditions or lack of maintenance. Coverage usually begins after a waiting period and only covers malfunctions that occur during the contract term due to normal operational wear and tear.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager