Home Water Filtration Systems Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439572 | Date : Jan, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Home Water Filtration Systems Market Size

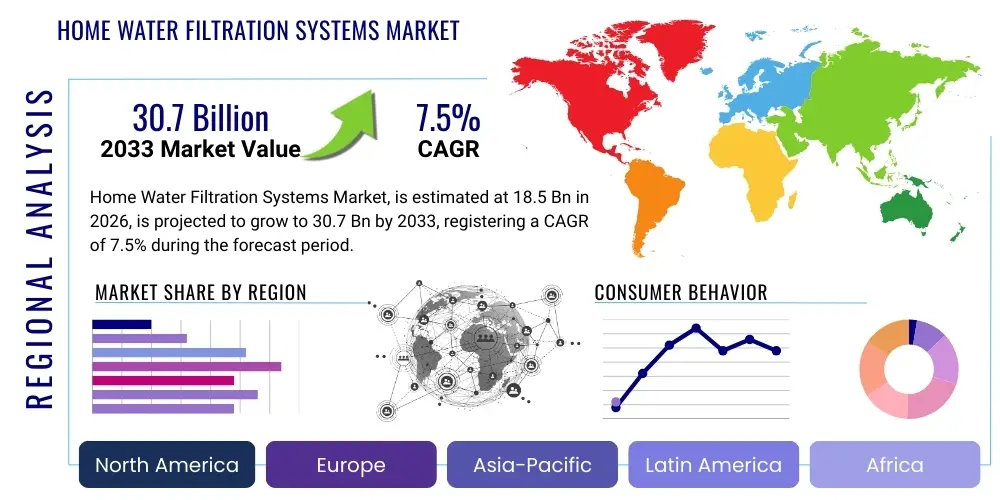

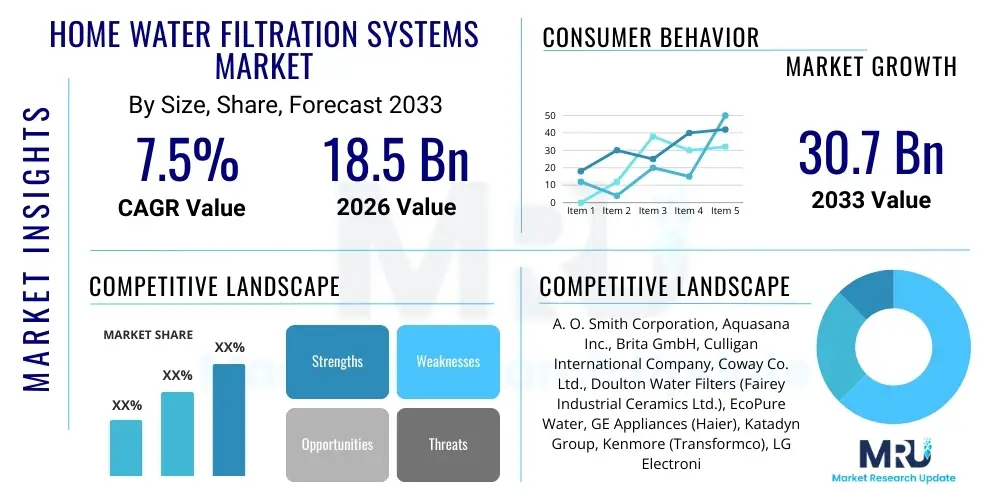

The Home Water Filtration Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 30.7 Billion by the end of the forecast period in 2033. This robust growth is attributed to increasing consumer awareness regarding water quality, growing concerns over contaminants, and technological advancements enhancing the efficiency and accessibility of home filtration solutions. The market’s expansion is further supported by stringent regulatory standards for drinking water and a growing inclination among households to invest in health and wellness products, positioning water filtration as a fundamental aspect of modern living.

Home Water Filtration Systems Market introduction

The Home Water Filtration Systems Market encompasses a wide array of devices and technologies designed to remove impurities, contaminants, and undesirable substances from tap water, making it safer and more palatable for household consumption. These systems range from simple pitcher filters and faucet-mounted units to advanced under-sink and whole-house filtration solutions, catering to diverse consumer needs and preferences. Major applications include improving drinking water quality, enhancing the taste of food and beverages prepared with filtered water, and extending the lifespan of appliances by reducing limescale buildup. The primary benefits derived from these systems are improved health outcomes due to reduced exposure to pollutants, cost savings compared to bottled water, and enhanced convenience. Key driving factors propelling market growth include escalating public concern over tap water safety, increasing prevalence of waterborne diseases, deteriorating municipal water infrastructure in many regions, and rising disposable incomes globally. Additionally, a growing environmental consciousness among consumers is fostering a shift away from single-use plastic bottles, further bolstering demand for sustainable in-home filtration options.

Home Water Filtration Systems Market Executive Summary

The Home Water Filtration Systems Market is currently experiencing dynamic growth, driven by pervasive health consciousness and increasing scrutiny of municipal water quality. Business trends indicate a strong emphasis on product innovation, with manufacturers investing heavily in smart features, advanced filtration technologies, and user-friendly designs that simplify installation and maintenance. Regional trends highlight North America and Europe as mature markets with high adoption rates, while Asia Pacific and Latin America are emerging as high-growth regions due to rapid urbanization, improving economic conditions, and expanding awareness regarding water contamination. Segment trends reveal a significant shift towards point-of-use (POU) systems like under-sink and countertop filters for immediate drinking water needs, alongside a steady demand for whole-house systems for comprehensive water treatment. The market is also characterized by intense competition, prompting companies to focus on brand differentiation, robust distribution networks, and strong customer service to maintain market share and attract new consumers.

AI Impact Analysis on Home Water Filtration Systems Market

The integration of Artificial Intelligence (AI) into the Home Water Filtration Systems market represents a significant paradigm shift, addressing common user questions about system efficiency, maintenance schedules, and overall water quality monitoring. Consumers are increasingly asking how AI can provide real-time insights into the performance of their filters, predict maintenance needs before issues arise, and even personalize filtration settings based on local water quality reports or individual health profiles. There is also a strong interest in understanding how AI can enhance the user experience through intuitive interfaces, remote monitoring capabilities, and automated ordering of replacement filters. Furthermore, users are keen to know if AI can help them optimize water usage, extend filter life, and identify potential contaminants proactively, moving beyond reactive solutions to a more predictive and preventive approach to water purification. These questions underscore a desire for smarter, more autonomous, and more reliable home water filtration solutions that leverage data and intelligence to deliver superior performance and peace of mind.

AI's influence extends deeply into the operational aspects of home water filtration, enabling a new generation of smart filtration devices. These intelligent systems are designed to continuously monitor water quality parameters, such as pH levels, total dissolved solids (TDS), and the presence of specific contaminants, adjusting filtration processes in real-time for optimal purification. This proactive monitoring ensures consistent water quality, addressing user concerns about fluctuating contaminant levels and the efficacy of their filtration setup. Moreover, AI algorithms can learn user consumption patterns and local water conditions, providing personalized recommendations for filter replacement, system upgrades, or even suggesting specific types of filtration technologies best suited for their household's unique needs, thereby transforming a generic product into a highly tailored solution.

Beyond individual device enhancement, AI plays a crucial role in improving the entire ecosystem surrounding home water filtration. From supply chain management, where AI can predict demand for specific filter types and optimize inventory, to customer support, where AI-powered chatbots can assist with troubleshooting and installation guides, the technology streamlines various touchpoints. The potential for AI to integrate with broader smart home ecosystems, allowing filtration systems to communicate with other appliances for holistic water management, is also a key area of development. This interconnectedness promises not only greater convenience but also enhanced efficiency and resource conservation, fulfilling user expectations for intelligent, integrated, and sustainable home solutions.

- Real-time water quality monitoring and analysis, providing immediate insights into contaminant levels.

- Predictive maintenance alerts for filter replacement, optimizing system performance and longevity.

- Personalized filtration settings based on user preferences, local water reports, and health data.

- Integration with smart home ecosystems for centralized control and automated water management.

- Enhanced user experience through intuitive apps, remote control, and voice assistant compatibility.

- Optimized supply chain and inventory management for manufacturers and retailers based on demand forecasting.

- Improved customer service through AI-powered chatbots and virtual assistants for troubleshooting and support.

- Development of self-diagnosing systems capable of identifying and reporting malfunctions proactively.

DRO & Impact Forces Of Home Water Filtration Systems Market

The Home Water Filtration Systems Market is propelled by a confluence of powerful drivers, tempered by specific restraints, and ripe with diverse opportunities, all shaped by significant impact forces. Key drivers include escalating global concerns over tap water safety due to aging infrastructure, industrial pollution, and emerging contaminants like microplastics and PFAS. A growing health consciousness among consumers, coupled with increased disposable incomes in developing economies, further fuels demand for reliable in-home water purification solutions. These drivers underscore the consumer's non-negotiable need for safe drinking water, transforming filtration systems from a luxury to a household necessity. Meanwhile, the robust growth is also significantly influenced by stringent governmental regulations and increasing public awareness campaigns regarding the adverse effects of contaminated water, pressuring both municipal bodies and individual households to adopt better water treatment practices. Innovations in filtration technology, such as more effective membranes and sustainable materials, also continuously enhance product appeal and expand market reach. The convenience and cost-effectiveness compared to prolonged reliance on bottled water also serve as a strong impetus for adoption.

Despite the strong tailwinds, the market faces notable restraints. The relatively high initial cost of advanced whole-house or reverse osmosis (RO) systems can be a significant barrier for price-sensitive consumers, particularly in emerging markets. Furthermore, the recurring expense and hassle associated with filter replacement and system maintenance can deter potential buyers or lead to discontinuation of use. Lack of comprehensive awareness about the specific benefits and appropriate filtration technologies for different types of contaminants in certain regions also limits market penetration. Competition from bottled water, though increasingly viewed as unsustainable, remains a formidable challenge, particularly where tap water quality perceptions are low, and bottled options are readily available and affordable. Moreover, the technical complexity of some advanced systems can intimidate average consumers, necessitating professional installation and specialized maintenance, adding to the overall cost and effort. The fragmented nature of regulations across different regions also creates complexity for manufacturers in developing universally compliant products.

Opportunities within the market are abundant and varied, particularly in emerging economies where awareness is growing and infrastructure development is accelerating. The rise of smart home technology presents a significant opportunity for integrated, AI-powered filtration systems that offer real-time monitoring, predictive maintenance, and seamless connectivity. The demand for eco-friendly and sustainable filtration solutions, reducing reliance on single-use plastics, is also creating a niche for innovative product development. Customization and personalization of filtration systems, tailored to specific regional water quality issues or individual health requirements, represent another growth avenue. Furthermore, expanding distribution channels, particularly through e-commerce platforms and strategic partnerships with home appliance retailers, can significantly broaden market reach. The impact forces shaping this market include evolving regulatory landscapes that mandate higher water quality standards, rapid urbanization leading to increased strain on municipal water supplies, and shifting consumer preferences towards health-centric and environmentally responsible products. Technological advancements, particularly in nanotechnology and membrane science, continue to revolutionize filtration efficiency and reduce system footprint, making advanced purification more accessible. The macroeconomic environment, including disposable income levels and consumer spending patterns, also exerts a powerful influence on market dynamics, determining the affordability and perceived value of home water filtration investments.

Segmentation Analysis

The Home Water Filtration Systems Market is meticulously segmented to cater to the diverse needs and preferences of consumers across various demographics and geographical locations. This comprehensive segmentation allows market players to identify specific niches, tailor product offerings, and develop targeted marketing strategies. Understanding these segments is crucial for analyzing market trends, competitive landscapes, and future growth opportunities, enabling stakeholders to make informed business decisions. The market can be broadly categorized based on factors such as the type of system, the underlying filtration technology employed, the specific application within a household, and the primary distribution channels through which these products reach consumers. Each segment presents unique characteristics in terms of market size, growth potential, consumer behavior, and competitive intensity, reflecting the dynamic nature of the industry.

By delving into each segment, it becomes evident how different consumer requirements drive product innovation and market penetration. For instance, the choice between point-of-use (POU) and point-of-entry (POE) systems often depends on whether the consumer seeks to purify water for specific taps (drinking, cooking) or for the entire household (bathing, laundry). Similarly, the selection of filtration technology, such as activated carbon for taste and odor removal or reverse osmosis for comprehensive contaminant reduction, is dictated by local water quality issues and desired purification levels. Distribution channels play a vital role in accessibility, with online retail gaining prominence for its convenience and wider product selection, while traditional brick-and-mortar stores offer immediate product availability and personalized consultation. This multi-faceted approach to segmentation highlights the complexity and breadth of the home water filtration market, emphasizing the need for flexible and adaptable business strategies.

- By Type:

- Whole House (Point-of-Entry) Filtration Systems

- Under-Sink Filtration Systems

- Countertop Filtration Systems

- Faucet-Mounted Filters

- Pitcher Filters

- Shower Head Filters

- By Technology:

- Activated Carbon Filters

- Reverse Osmosis (RO) Systems

- UV (Ultraviolet) Filters

- Sediment Filters

- Water Softeners (Ion Exchange)

- Ultrafiltration (UF) Systems

- Distillation Systems

- Alkaline/Water Ionizers

- By Application:

- Residential (Kitchen, Bathroom, Whole Home)

- Light Commercial (Small Offices, Cafes)

- By Distribution Channel:

- Online Retail (E-commerce Websites, Company Websites)

- Offline Retail (Supermarkets, Hypermarkets, Specialty Stores, Home Improvement Stores, Hardware Stores)

- Direct Sales

Value Chain Analysis For Home Water Filtration Systems Market

The value chain for the Home Water Filtration Systems Market is a complex network spanning from raw material sourcing to post-sale services, encompassing various stages that add value to the final product. Upstream analysis involves the procurement of essential raw materials such as plastics, specialized filter media (e.g., activated carbon, ceramic, resins, membranes for RO/UF), metals for housing and components, and electronic parts for smart systems. Key players in this stage include chemical suppliers, polymer manufacturers, and specialized media producers, whose quality and cost efficiency directly impact the final product's performance and pricing. Collaboration and strong relationships with reliable upstream suppliers are critical for ensuring consistent quality, managing costs, and enabling innovation in filter media and system components. This stage lays the foundational elements upon which the entire filtration system is built, emphasizing the importance of sustainable sourcing and ethical manufacturing practices.

The core manufacturing and assembly processes form the central part of the value chain. This stage involves the design, engineering, and production of various filtration components and the final assembly of complete filtration systems. Manufacturers often specialize in specific technologies (e.g., RO membrane production, carbon block molding) or integrate components from multiple suppliers. Quality control, adherence to industry standards, and efficient production lines are paramount here to ensure product reliability and competitive pricing. Once manufactured, the products move into the downstream analysis, focusing on distribution, marketing, and sales. Distribution channels are varied and include direct sales, which allow manufacturers to control the customer experience fully; offline retail channels such as large format retailers (e.g., Lowe's, Home Depot), supermarkets, and specialty appliance stores; and increasingly, online retail platforms (e.g., Amazon, company e-commerce sites). Each channel offers unique advantages in terms of reach, customer interaction, and logistical efficiency, with companies often employing a multi-channel strategy to maximize market penetration.

Marketing and sales strategies are crucial for informing consumers about product benefits, differentiating brands in a competitive landscape, and driving purchase decisions. This includes digital marketing, in-store promotions, and educational campaigns highlighting the importance of water quality. Post-sale services, including installation support, maintenance, filter replacement subscriptions, and customer service, complete the value chain, ensuring customer satisfaction and fostering brand loyalty. The efficiency of the entire value chain, from procurement to after-sales support, directly impacts the profitability and market position of companies within the Home Water Filtration Systems Market. The balance between direct and indirect distribution channels also plays a pivotal role, with direct sales offering higher margins but requiring significant investment in sales infrastructure, while indirect channels provide broader market access but involve shared margins and greater reliance on third-party performance. Optimizing these channels, leveraging digital platforms for both sales and customer engagement, and ensuring a seamless customer journey are key for sustained growth.

Home Water Filtration Systems Market Potential Customers

The Home Water Filtration Systems Market primarily targets residential end-users, encompassing a broad spectrum of households that are increasingly prioritizing health, wellness, and environmental sustainability. Potential customers include homeowners and renters across various socio-economic strata, ranging from single-person households to large families, who are concerned about the quality, safety, and taste of their tap water. This segment is driven by a desire to mitigate exposure to contaminants such as chlorine, lead, pesticides, bacteria, and emerging pollutants, ensuring a healthier living environment. Consumers with specific health conditions, young children, or elderly family members often exhibit a heightened sensitivity to water quality, making them prime candidates for advanced filtration solutions. Furthermore, individuals residing in areas with known water quality issues or aging municipal infrastructure represent a significant and immediate pool of potential buyers who are actively seeking reliable in-home water treatment options.

Beyond basic health and safety, the market also appeals to consumers who are environmentally conscious and seek to reduce their reliance on single-use plastic bottled water. This growing demographic views home water filtration systems as a sustainable and cost-effective alternative, aligning with broader lifestyle trends towards eco-friendly practices. Additionally, those who appreciate the enhanced taste of filtered water for drinking, cooking, and brewing coffee or tea constitute another significant customer base, as improved water quality can noticeably elevate culinary experiences. Property developers and real estate companies can also be considered indirect potential customers, as they may integrate whole-house filtration systems into new residential constructions to enhance property value and appeal to discerning buyers seeking modern, health-conscious homes. The diverse motivations, from critical health needs to lifestyle preferences and environmental responsibility, collectively define the expansive potential customer base for home water filtration systems, necessitating a segmented approach to marketing and product development.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 30.7 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | A. O. Smith Corporation, Aquasana Inc., Brita GmbH, Culligan International Company, Coway Co. Ltd., Doulton Water Filters (Fairey Industrial Ceramics Ltd.), EcoPure Water, GE Appliances (Haier), Katadyn Group, Kenmore (Transformco), LG Electronics Inc., Pentair plc, PUR (Kaz USA, Inc.), Samsung Electronics Co. Ltd., The 3M Company, Watts Water Technologies Inc., Whirlpool Corporation, Waterdrop Inc., ZeroWater, Apex Water Filters |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Home Water Filtration Systems Market Key Technology Landscape

The Home Water Filtration Systems Market is characterized by a dynamic and continuously evolving technology landscape, driven by ongoing research and development aimed at enhancing filtration efficiency, system longevity, and user convenience. Activated carbon remains a foundational technology, widely used for its effectiveness in removing chlorine, sediment, volatile organic compounds (VOCs), and improving taste and odor. However, advancements in carbon technology now include specialized activated carbon blocks that can target specific contaminants like lead or PFAS. Reverse Osmosis (RO) systems represent a more advanced purification method, utilizing a semi-permeable membrane to remove a broad spectrum of dissolved solids, heavy metals, bacteria, and viruses, offering highly purified water. Innovations in RO focus on improving recovery rates (reducing wastewater), decreasing system footprint, and integrating permeate pumps for enhanced efficiency, addressing previous limitations regarding water wastage and slow flow rates.

Beyond these established methods, Ultraviolet (UV) light sterilization is gaining traction, especially when paired with other filtration stages, to effectively neutralize bacteria, viruses, and other microorganisms without the use of chemicals. Sediment filters, though basic, are crucial pre-treatment stages to protect more sensitive filtration components from larger particles. Ion-exchange technology, commonly found in water softeners, removes hard water minerals like calcium and magnesium, preventing scale buildup in pipes and appliances, while also being adapted for targeted contaminant removal. Ultrafiltration (UF) systems provide a middle ground, effectively removing suspended solids, colloids, and high molecular-weight substances, including bacteria and viruses, without removing beneficial minerals, making them suitable for situations where RO might be overkill or when natural minerals are desired.

Emerging technologies and ongoing innovations are further shaping the market. Nanotechnology is being leveraged to develop advanced membranes and filter media with enhanced contaminant removal capabilities and reduced pore sizes, offering superior purification. Smart filtration systems, incorporating sensors, IoT connectivity, and artificial intelligence, are transforming the user experience by providing real-time water quality monitoring, predictive maintenance alerts, and remote control functionalities. These intelligent systems can also optimize filter usage and notify users about replacement needs automatically, simplifying upkeep. Additionally, efforts are underway to develop more sustainable and eco-friendly filtration materials, reducing the environmental impact of filter disposal. These technological advancements collectively contribute to more effective, efficient, and user-friendly home water filtration solutions, continuously pushing the boundaries of what is possible in home water purification and addressing increasingly complex water quality challenges.

Regional Highlights

The global Home Water Filtration Systems Market exhibits distinct growth patterns and maturity levels across different geographical regions, influenced by varying factors such as water quality issues, economic development, regulatory frameworks, and consumer awareness. Each region presents a unique set of drivers and opportunities, shaping local market dynamics and influencing the strategies of market players. Understanding these regional nuances is critical for businesses looking to expand their global footprint and tailor their product offerings to specific local demands. The market's geographical segmentation typically includes North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, each contributing uniquely to the overall market landscape.

North America and Europe represent mature markets characterized by high consumer awareness, established regulatory standards, and a strong preference for advanced filtration technologies. In these regions, growth is primarily driven by replacement demand, product upgrades, and the increasing adoption of whole-house systems and smart filtration solutions. Asia Pacific, on the other hand, stands out as the fastest-growing market, propelled by rapid urbanization, industrialization-induced water pollution, increasing disposable incomes, and a burgeoning middle class in countries like China and India. The demand here is often for basic to mid-range filtration solutions, with a rapidly growing appetite for more sophisticated systems as economic conditions improve. Latin America and the Middle East & Africa are emerging markets where awareness is steadily increasing, and infrastructure development, coupled with localized water quality challenges, is fostering significant growth opportunities for a variety of filtration products. Each region’s unique water quality concerns, cultural preferences, and economic capacity mandate a localized approach to product development, marketing, and distribution for sustained market success.

- North America: A mature market with high penetration, driven by health consciousness, aging infrastructure, and a strong emphasis on smart home integration. Key countries include the United States and Canada, showing demand for both point-of-use and whole-house systems.

- Europe: Characterized by stringent water quality regulations and high consumer expectations. Germany, the UK, France, and Italy are significant contributors, with a growing interest in sustainable and aesthetically pleasing designs.

- Asia Pacific (APAC): The fastest-growing region, fueled by rapid industrialization, urbanization, increasing water pollution, and rising disposable incomes. China, India, Japan, and Australia are key markets, with diverse demands ranging from basic pitchers to advanced RO systems.

- Latin America: An emerging market with increasing awareness of waterborne diseases and improving economic conditions. Brazil, Mexico, and Argentina are showing steady growth, particularly for affordable and reliable filtration solutions.

- Middle East and Africa (MEA): Growing due to water scarcity concerns, rising populations, and infrastructure development. The GCC countries and South Africa are key areas, with demand for robust and efficient filtration technologies suitable for challenging water conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Home Water Filtration Systems Market.- A. O. Smith Corporation

- Aquasana Inc.

- Brita GmbH

- Culligan International Company

- Coway Co. Ltd.

- Doulton Water Filters (Fairey Industrial Ceramics Ltd.)

- EcoPure Water

- GE Appliances (Haier)

- Katadyn Group

- Kenmore (Transformco)

- LG Electronics Inc.

- Pentair plc

- PUR (Kaz USA, Inc.)

- Samsung Electronics Co. Ltd.

- The 3M Company

- Watts Water Technologies Inc.

- Whirlpool Corporation

- Waterdrop Inc.

- ZeroWater

- Apex Water Filters

Frequently Asked Questions

Analyze common user questions about the Home Water Filtration Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary benefits of installing a home water filtration system?

Home water filtration systems provide safer, cleaner, and better-tasting drinking water by removing contaminants like chlorine, lead, sediment, and bacteria. They also reduce reliance on bottled water, save money, and extend the lifespan of appliances by preventing scale buildup.

How do I choose the right type of water filtration system for my home?

Selecting the right system depends on your specific needs, local water quality (test your water!), budget, and desired level of filtration. Consider factors like the types of contaminants you want to remove, whether you need point-of-use (for drinking) or whole-house filtration, and ease of installation and maintenance.

How often do I need to replace filters, and what are the maintenance requirements?

Filter replacement frequency varies significantly by system type, water quality, and usage. Pitcher filters might need changing monthly, while whole-house filters can last 6-12 months. Regular maintenance typically involves inspecting the system, cleaning housings, and ensuring proper filter seating.

Are home water filtration systems effective against all types of contaminants?

No single filtration system removes all contaminants. Different technologies target specific impurities. For example, activated carbon excels at taste and odor, while reverse osmosis systems are highly effective against dissolved solids and heavy metals. A multi-stage system or combination of technologies often provides the broadest protection.

What is the difference between point-of-use (POU) and point-of-entry (POE) water filtration systems?

Point-of-use (POU) systems filter water at a specific tap (e.g., under-sink, countertop) primarily for drinking and cooking. Point-of-entry (POE), or whole-house, systems filter all water entering your home, treating water for every faucet, shower, and appliance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager