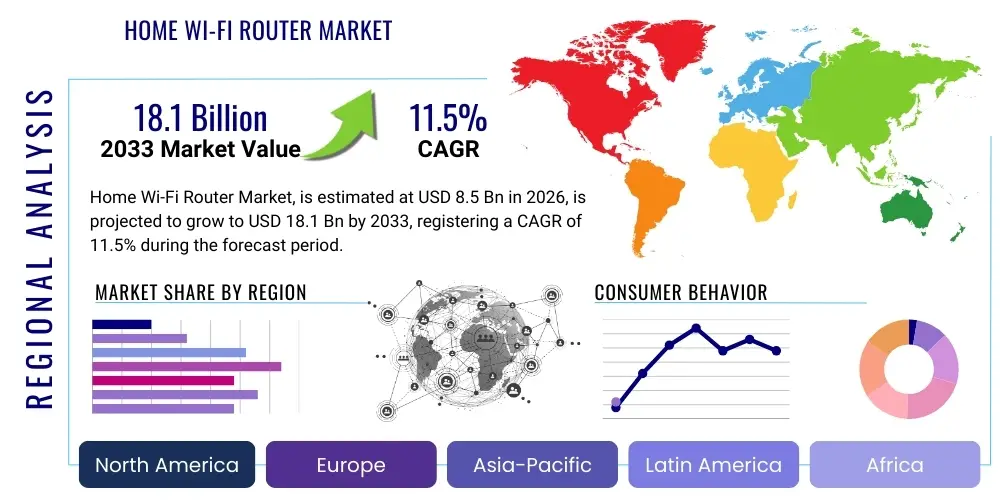

Home Wi-Fi Router Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437393 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Home Wi-Fi Router Market Size

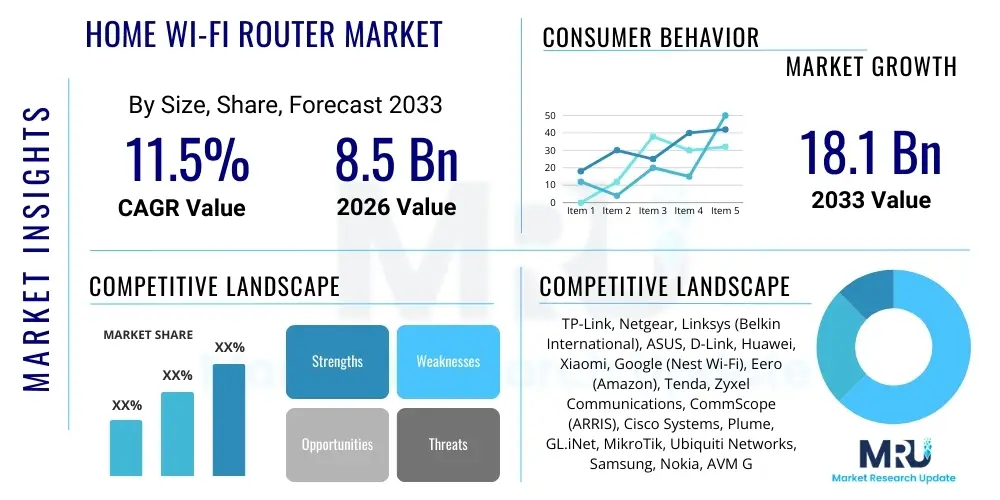

The Home Wi-Fi Router Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 18.1 Billion by the end of the forecast period in 2033.

Home Wi-Fi Router Market introduction

The Home Wi-Fi Router Market encompasses devices essential for connecting residential devices to the Internet Service Provider (ISP) network, facilitating seamless communication across local area networks (LANs). These devices have evolved significantly, transitioning from basic single-band gateways to advanced tri-band Mesh systems compliant with the latest Wi-Fi 6 (802.11ax) and Wi-Fi 6E standards, driven primarily by the escalating demand for high-speed connectivity and low latency required for 4K/8K streaming, competitive online gaming, and extensive smart home ecosystems. Product descriptions now emphasize security features, ease of management via mobile applications, and coverage capacity, moving beyond mere speed metrics.

Major applications for home Wi-Fi routers include enabling remote work and hybrid learning environments, supporting multiple simultaneous data-intensive applications such as video conferencing and cloud storage, and managing the proliferation of Internet of Things (IoT) devices like smart security cameras, thermostats, and lighting systems. The primary benefit derived from modern routers is the assurance of consistent, high-throughput coverage throughout the entire dwelling, eliminating dead zones often associated with older, centralized router architectures. Furthermore, advanced routers offer robust parental controls and sophisticated Quality of Service (QoS) management to prioritize critical data traffic.

Key driving factors fueling market expansion include the global surge in household broadband penetration, the increasing adoption of fiber-to-the-home (FTTH) services necessitating high-capacity networking equipment, and the widespread consumer transition towards bandwidth-hungry applications. The continuous evolution of wireless standards, guaranteeing better spectral efficiency and device capacity, acts as a pivotal driver compelling consumers to upgrade their existing infrastructure. Additionally, the rising prevalence of smart city initiatives and the reliance on cloud-based services further solidify the router's role as the central digital hub of the modern connected home.

Home Wi-Fi Router Market Executive Summary

The Home Wi-Fi Router Market is characterized by robust technological shifts, primarily dominated by the rapid uptake of Wi-Fi 6/6E standards and the transition toward sophisticated Mesh networking solutions. Business trends indicate a strong focus among manufacturers on integrating advanced cybersecurity features, such as built-in VPNs and threat detection, directly into the router firmware, transforming the device from a simple access point into a primary security gateway. Competition is intensifying, driven by Original Equipment Manufacturers (OEMs) and traditional networking giants focusing on delivering user-friendly, high-performance systems accessible to both technical and general consumer bases, alongside increased collaboration with ISPs for bundled offerings.

Regionally, North America and Europe currently maintain the largest market share, attributed to high average disposable income, early technology adoption, and extensive penetration of high-speed internet infrastructure. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This accelerated growth is primarily propelled by mass urbanization, massive governmental investments in digital infrastructure expansion, and the burgeoning middle class in countries like China and India transitioning to high-speed broadband and investing in smart home technologies, thus demanding advanced networking hardware capable of supporting these digital lifestyles.

Segment trends reveal that the Mesh Wi-Fi Systems segment is experiencing explosive growth, significantly outpacing traditional standalone routers, due to their superior coverage capabilities and simplified installation process. Based on technology, the migration from 802.11ac (Wi-Fi 5) to 802.11ax (Wi-Fi 6) and 802.11axe (Wi-Fi 6E, utilizing the 6 GHz band) is definitive. Furthermore, the dual-band router segment remains popular for cost-sensitive markets, while tri-band routers are becoming standard for high-density smart homes and power users requiring dedicated backhaul communication paths, signaling a polarization in consumer spending based on networking demands and complexity.

AI Impact Analysis on Home Wi-Fi Router Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the Home Wi-Fi Router Market frequently revolve around self-healing networks, enhanced security protocols, and intelligent traffic management. Users are primarily concerned with whether AI can eliminate manual troubleshooting, automatically optimize network performance based on real-time usage patterns, and provide proactive defense against sophisticated cyber threats without requiring constant user intervention. There is a high expectation that AI integration will lead to a truly 'set-it-and-forget-it' network experience, where optimal latency for gaming and seamless video conferencing are guaranteed automatically, irrespective of network congestion or device load. The key themes summarized across user concerns focus on autonomous network efficiency, superior cybersecurity, and personalized Quality of Service (QoS) delivery.

The integration of AI and Machine Learning (ML) is fundamentally redefining the performance and operational efficiency of modern home Wi-Fi routers. AI algorithms are now deployed to continuously monitor network traffic, detect anomalies, and dynamically allocate bandwidth to ensure optimal performance for latency-sensitive applications. For instance, ML can learn the typical usage patterns of a household—identifying peak hours, recognizing specific device needs (e.g., separating IoT devices from high-demand gaming consoles)—and then adjust settings like beamforming and channel allocation in real-time, thereby maximizing throughput and coverage reliability.

Furthermore, AI significantly enhances network security by enabling behavioral analysis. Instead of relying solely on signature-based detection, AI-powered routers can identify unusual device behavior—such as an unexpected port scan or an excessive data upload from an IoT sensor—and quarantine the suspicious device automatically, preventing potential malware spread or data breaches. This adaptive, predictive security layer is becoming a crucial differentiator, positioning the router as the first line of defense in an increasingly complex smart home ecosystem where many devices lack inherent security capabilities. This shift towards AI-driven management is crucial for maintaining network stability as device density within homes continues to climb.

- AI-Driven Adaptive QoS: Optimizing bandwidth allocation and prioritizing traffic based on real-time application demands (e.g., ensuring high priority for video calls).

- Intelligent Mesh Optimization: Automatically selecting the best wireless backhaul path and channel frequency to minimize interference and maximize coverage reliability.

- Anomaly Detection and Cybersecurity: Utilizing ML to learn baseline network behavior and instantly flag or block devices exhibiting malicious or unusual activity.

- Predictive Network Maintenance: Identifying potential hardware faults or impending performance bottlenecks before they impact the user experience.

- Simplified Setup and Configuration: AI guiding initial setup and automating complex settings adjustments, lowering the technical barrier for consumers.

DRO & Impact Forces Of Home Wi-Fi Router Market

The dynamics of the Home Wi-Fi Router Market are dictated by a confluence of powerful Drivers (D), inherent Restraints (R), and compelling Opportunities (O), which collectively define the Impact Forces on market growth trajectory. The predominant drivers include the ubiquitous adoption of high-bandwidth digital services, such as high-definition streaming and cloud gaming, coupled with the accelerating penetration of interconnected smart home devices, which necessitates robust, stable, and high-capacity wireless infrastructure. This demand is further amplified by the societal shift towards permanent remote and hybrid work models, placing unprecedented reliability and latency requirements on residential networks, thereby pushing consumers toward premium router upgrades.

Conversely, the market faces significant restraints that temper growth, most notably the high initial cost associated with advanced networking hardware, especially high-end Mesh systems utilizing Wi-Fi 6E or proprietary technologies. Consumer confusion regarding the rapidly changing technical standards (Wi-Fi 5, 6, 6E, 7) and complex feature sets often leads to delayed purchasing decisions or opting for cheaper, less future-proof solutions. Furthermore, increasing concerns over data privacy and network security vulnerabilities, particularly in IoT ecosystems managed by the router, require continuous manufacturer investment and generate consumer hesitation regarding the trustworthiness of connected devices.

Opportunities for market players are substantial, stemming particularly from the convergence of 5G and fixed wireless access (FWA) technologies, positioning the home router as a primary gateway for these high-speed services. The rising prevalence of managed Wi-Fi services offered by ISPs and the increasing consumer preference for easily manageable Mesh systems present opportunities for service-oriented business models. Furthermore, focusing research and development on enhanced cybersecurity features, particularly those leveraging AI/ML for proactive threat intelligence, offers a strong competitive advantage and addresses core consumer pain points, fueling premium segment growth and future product differentiation.

Segmentation Analysis

The Home Wi-Fi Router Market is comprehensively segmented across several key dimensions, providing clarity on consumer preferences and technological adoption trends. The primary segmentation criteria involve product type, differentiating between traditional standalone routers and the rapidly growing Mesh Wi-Fi systems, which are favored for large homes and demanding coverage requirements. Further breakdown occurs based on the wireless standard employed, encompassing legacy standards like Wi-Fi 5 (802.11ac) and cutting-edge technologies like Wi-Fi 6 (802.11ax) and Wi-Fi 6E, which define the spectral efficiency and maximum throughput capabilities available to the end-user.

Another crucial dimension is the operating frequency, categorized into dual-band (2.4 GHz and 5 GHz) and tri-band (adding a second 5 GHz band or the 6 GHz band in 6E models), reflecting the router's ability to handle high device density and minimize network congestion. Distribution channel segmentation is also vital, distinguishing between retail channels (online and physical stores), which cater to self-service consumers, and direct channels, often involving Internet Service Providers (ISPs) who bundle routers with their connectivity packages, offering managed services and simplifying customer setup and support processes.

Finally, the market is often segmented by application or end-user category, recognizing distinct needs between general home users, specialized gamers requiring extremely low latency, and smart home enthusiasts needing high capacity and reliability for numerous interconnected devices. Understanding these segmented demands allows manufacturers to tailor product specifications, ranging from routers optimized for basic internet browsing to high-performance gaming routers with advanced proprietary features and accelerated processing power for high-intensity, concurrent network usage scenarios.

- By Product Type:

- Standalone Routers (Single Unit)

- Mesh Wi-Fi Systems (Multi-Unit Systems)

- By Technology Standard:

- Wi-Fi 5 (802.11ac)

- Wi-Fi 6 (802.11ax)

- Wi-Fi 6E (802.11ax/6 GHz)

- Wi-Fi 7 (802.11be - Emerging)

- By Operating Frequency:

- Dual-Band

- Tri-Band

- By Distribution Channel:

- Online Retail

- Offline Retail (Physical Stores)

- ISP/Telecom Service Providers (Bundled Services)

- Other Direct Channels

- By End User/Application:

- General Households

- Gaming and High-Performance Applications

- Smart Home Ecosystems

Value Chain Analysis For Home Wi-Fi Router Market

The value chain for the Home Wi-Fi Router Market begins with the upstream segment, dominated by highly specialized component and chipset manufacturers such as Broadcom, Qualcomm, and MediaTek. These companies invest heavily in R&D to develop the core processors, wireless radio chips, and associated firmware that define the router's performance standards, including compliance with new standards like Wi-Fi 7 and integration of advanced features like AI-based QoS. Chipset providers hold significant leverage due to the complexity and high intellectual property required to produce these sophisticated components, determining the overall cost structure and technological capabilities available to downstream manufacturers.

The midstream involves Original Design Manufacturers (ODMs) and Original Equipment Manufacturers (OEMs), who design, assemble, and brand the final router units. Major players like TP-Link, Netgear, and D-Link manage manufacturing, quality control, and firmware development, translating the chipset capabilities into consumer-ready products. This stage also includes integrating proprietary software for network management, security, and mobile application control. Effective supply chain management, ensuring the availability of components and efficient assembly, is critical in this phase, particularly given recent global semiconductor shortages which have impacted production timelines.

Downstream activities focus heavily on distribution channels. The market utilizes both direct and indirect channels. Indirect distribution through online retail giants (e.g., Amazon, specialized electronics sites) and large physical retailers (e.g., Best Buy, specialized tech stores) allows consumers to select and purchase routers independently. Direct channels involve partnerships with Internet Service Providers (ISPs) who often white-label or bundle branded routers with their subscription packages. The ISP channel provides guaranteed volume and facilitates managed Wi-Fi services, offering a significant and stable revenue stream for router manufacturers, particularly as consumers increasingly prioritize simplicity and integrated support over independent hardware selection.

Home Wi-Fi Router Market Potential Customers

The potential customer base for the Home Wi-Fi Router Market is broadly segmented into several distinct demographics, each driven by specific connectivity needs and technological readiness. A large segment comprises general households replacing aging legacy equipment (Wi-Fi 4 or 5) due to increased device density, poor coverage, or mandatory upgrades required by higher-speed ISP plans (Gigabit or multi-Gigabit). These customers prioritize ease of installation, basic security features, and reliability, often opting for entry-to-mid-level dual-band or simple Mesh systems marketed for simple whole-home coverage and dependable performance.

A second crucial segment consists of "Power Users" and "Tech Enthusiasts," including competitive gamers, content creators, and professionals utilizing large file transfers or continuous video conferencing. These customers are highly sensitive to latency, demand the highest throughput, and typically purchase premium, tri-band routers or advanced Mesh systems compliant with the latest Wi-Fi standards (Wi-Fi 6E/7). Their purchasing decisions are often based on processor speed, advanced QoS controls, dedicated gaming acceleration features, and comprehensive network customization options, representing the highest-margin segment for manufacturers.

The fastest-growing customer group is the "Smart Home Ecosystem Integrators," individuals or families who own a significant number of connected IoT devices, smart appliances, and sophisticated security systems. These customers require routers that can manage high device counts reliably, ensure interoperability across various protocols, and offer robust, integrated cybersecurity features to protect vulnerable IoT endpoints. For this group, the router acts as the centralized brain of the digital home, requiring high-capacity bandwidth and often leveraging AI-driven management capabilities to maintain stability under continuous high-density device load.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 18.1 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | TP-Link, Netgear, Linksys (Belkin International), ASUS, D-Link, Huawei, Xiaomi, Google (Nest Wi-Fi), Eero (Amazon), Tenda, Zyxel Communications, CommScope (ARRIS), Cisco Systems, Plume, GL.iNet, MikroTik, Ubiquiti Networks, Samsung, Nokia, AVM GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Home Wi-Fi Router Market Key Technology Landscape

The technological landscape of the Home Wi-Fi Router Market is currently defined by three critical advancements: the widespread adoption of the Wi-Fi 6/6E standard, the dominance of Mesh networking architecture, and the increasing incorporation of Software-Defined Networking (SDN) and cloud-managed capabilities. Wi-Fi 6 (802.11ax) significantly improves efficiency through technologies like Orthogonal Frequency-Division Multiple Access (OFDMA) and Target Wake Time (TWT), dramatically boosting capacity and reducing battery consumption for connected devices, making it essential for high-density environments. Wi-Fi 6E further leverages this by accessing the clean, uncrowded 6 GHz band, providing wider channels and virtually eliminating interference, which is particularly beneficial for high-bandwidth applications like VR/AR and 8K streaming.

Mesh Wi-Fi networking represents a fundamental architectural shift from the traditional centralized router model. Instead of relying on a single powerful hub, Mesh systems deploy multiple satellite nodes distributed throughout the home, creating a single, unified network. This technology is optimized to dynamically manage node handover and ensure signal strength consistency, thereby eliminating dead zones and providing seamless roaming for mobile devices. The key technological components enabling Mesh excellence include dedicated wireless backhaul (often a tri-band feature) and intelligent routing algorithms that automatically determine the fastest path for data transmission between nodes and the central gateway, simplifying network expansion and maintenance for average users.

Furthermore, cloud management and Software-Defined Networking (SDN) principles are becoming increasingly embedded in router operations. These technologies allow manufacturers and ISPs to remotely manage, update, and optimize the router network, often leveraging AI/ML in the cloud infrastructure to analyze aggregated network data and push predictive performance improvements down to the residential gateway. This facilitates advanced features such as zero-touch provisioning, automated firmware updates, and cloud-based parental and security controls, shifting the complexity of network management away from the end-user and ensuring the network remains secure and performing optimally without manual intervention.

Regional Highlights

- North America (NA): This region is characterized by high rates of early technology adoption and significant consumer willingness to invest in premium networking solutions, maintaining its position as the largest revenue contributor. The market here is driven by the rapid deployment of multi-gigabit fiber broadband services and a dense concentration of high-bandwidth consuming households (remote workers, gamers). Mesh systems and Wi-Fi 6E/7 routers are experiencing accelerated uptake, often fueled by competitive pricing and bundling from major ISPs and telecom operators, making it the benchmark region for observing cutting-edge feature adoption and high Average Selling Prices (ASPs).

- Europe: The European market shows steady growth, propelled by strict regulatory frameworks encouraging digital infrastructure investment and a strong focus on cybersecurity features in router hardware. Western European countries exhibit high demand for energy-efficient and secure routers, often driven by government initiatives related to smart energy and home automation. The diversity of broadband infrastructure (VDSL, FTTH, Cable) across countries necessitates a flexible product range, though the overall trend is a significant shift towards high-performance Mesh networks to reliably cover larger, often older, residential structures.

- Asia Pacific (APAC): APAC is poised to be the fastest-growing region, driven by explosive growth in internet penetration, particularly in developing economies like India and Southeast Asia, and the maturity of digital economies in countries like China, South Korea, and Japan. Massive urbanization, coupled with rising disposable incomes, is driving mass market adoption of affordable yet advanced Wi-Fi 6 routers. Government investments in 5G and fiber rollout are creating immense demand for compatible, high-throughput terminal equipment. The market here is volume-driven, with strong competition from local OEMs focusing on value proposition and rapid deployment.

- Latin America (LATAM): Growth in LATAM is gradually accelerating, supported by improving fixed broadband infrastructure in key markets like Brazil and Mexico. The market is primarily moving from older legacy systems to modern Wi-Fi 5 and entry-level Wi-Fi 6 dual-band routers. Price sensitivity remains a key factor, often making ISP bundled offerings the preferred distribution method. Market penetration is steadily increasing, focusing on enhancing basic coverage and reliability for growing smartphone and streaming device usage.

- Middle East and Africa (MEA): This region is characterized by heterogeneous market development. Gulf Cooperation Council (GCC) countries show high demand for premium, smart-home-compatible routers, mirroring Western market trends due to significant FTTH deployment. Conversely, parts of Africa are rapidly adopting fixed wireless access (FWA) and relying on cost-effective, basic Wi-Fi 5 or entry-level Wi-Fi 6 solutions. The overall trajectory is positive, supported by large-scale infrastructure projects and increasing mobile broadband adoption driving the need for reliable local distribution points.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Home Wi-Fi Router Market.- TP-Link Corporation Limited

- Netgear Inc.

- Linksys (Belkin International, Inc.)

- ASUSTeK Computer Inc.

- D-Link Corporation

- Huawei Technologies Co., Ltd.

- Xiaomi Corporation

- Google LLC (Nest Wi-Fi)

- Eero LLC (Amazon)

- Tenda Technology Inc.

- Zyxel Communications Corp.

- CommScope Holding Company, Inc. (ARRIS)

- Cisco Systems, Inc.

- Ubiquiti Networks, Inc.

- AVM GmbH

- PLUME DESIGN, INC.

- Samsung Electronics Co., Ltd.

- Nokia Corporation

- Amped Wireless

- GL.iNet

Frequently Asked Questions

Analyze common user questions about the Home Wi-Fi Router market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Wi-Fi 6 and Wi-Fi 6E, and which standard is best for future-proofing a home network?

Wi-Fi 6 (802.11ax) introduced significant efficiency improvements (OFDMA, TWT) for congested networks utilizing the standard 2.4 GHz and 5 GHz bands. Wi-Fi 6E is an extension of Wi-Fi 6 that enables operation on the newly available 6 GHz frequency band. This 6 GHz band offers wider, uncongested channels, dramatically reducing interference and latency, making Wi-Fi 6E (or the upcoming Wi-Fi 7) the superior choice for future-proofing, especially for high-speed internet plans and virtual reality applications.

Are Mesh Wi-Fi systems necessary, or can a single high-end router provide sufficient coverage for a large home?

For large or structurally complex homes (over 2,500 sq ft or with multiple floors/thick walls), Mesh Wi-Fi systems are generally necessary to ensure consistent, reliable whole-home coverage and eliminate dead zones. While a single high-end router offers superior peak performance near the unit, its signal degradation over distance or through barriers is substantial. Mesh systems use multiple access points to blanket the area with a unified network, providing consistent speeds and seamless device roaming throughout the entire property.

How does the integration of AI improve the performance and security of modern home routers?

AI improves router performance by enabling Adaptive Quality of Service (QoS), allowing the router to automatically identify high-priority traffic (like video calls or gaming) and dynamically allocate bandwidth to prevent buffering or lag. In terms of security, AI uses Machine Learning (ML) to monitor network behavior, detect sophisticated anomalies indicative of malware or intrusion attempts in real-time, and proactively quarantine compromised devices, providing a robust layer of defense against modern cyber threats that signature-based methods often miss.

Which distribution channel is expected to dominate the Home Wi-Fi Router Market, and why?

While online retail remains strong for tech-savvy consumers, the Internet Service Provider (ISP) channel is expected to significantly increase its dominance, particularly in the Mesh and Managed Wi-Fi segments. ISPs are increasingly bundling advanced routers (often white-labeled) with high-speed internet subscriptions. This approach appeals to mass-market consumers seeking simplified setup, integrated technical support, and the assurance of hardware compatibility, making the router a service-driven component rather than a standalone hardware purchase.

What are the key considerations for consumers upgrading their routers to support IoT and smart home ecosystems?

Consumers upgrading for smart home support must prioritize routers that offer high device capacity, robust throughput on the 2.4 GHz band (where many IoT devices operate), and integrated cybersecurity features. Mesh systems are often recommended due to their ability to distribute connectivity evenly across a large number of endpoints. Furthermore, looking for routers with dedicated IoT security segmentation or excellent parental/access control features is crucial for protecting vulnerable smart devices from external threats and ensuring network stability under high device load.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager