Homeopathic Medicine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435674 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Homeopathic Medicine Market Size

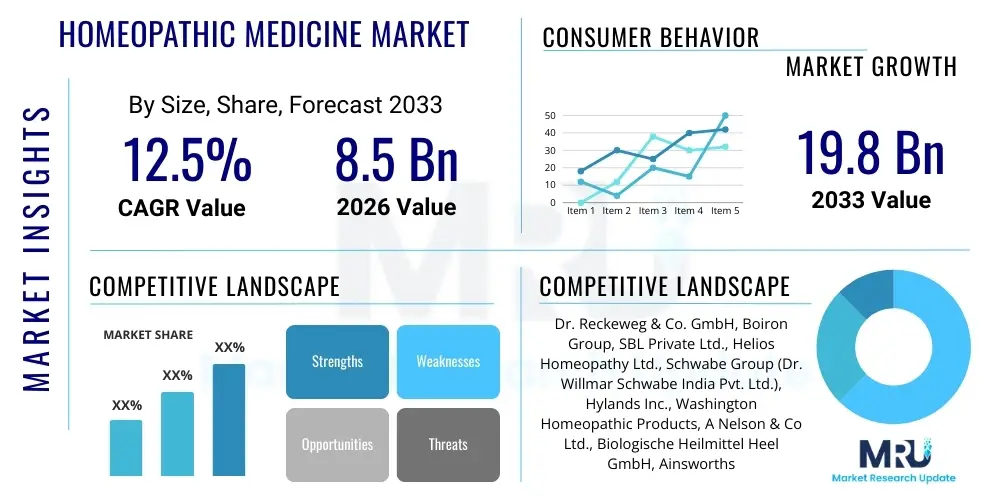

The Homeopathic Medicine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 19.8 Billion by the end of the forecast period in 2033.

Homeopathic Medicine Market introduction

The Homeopathic Medicine Market encompasses the production, distribution, and consumption of highly diluted substances derived primarily from plant, mineral, or animal sources, prepared according to the principles of homeopathy established by Samuel Hahnemann. These medicines are characterized by the principle of 'like cures like' and utilize minimum dose concentrations. The primary product categories include tinctures, dilutions, tablets, and topical preparations, utilized for a wide spectrum of health issues ranging from acute symptoms like colds and flu to chronic conditions such as allergies, anxiety, and dermatological disorders. The growth trajectory of this market is fundamentally driven by increasing consumer preference for natural, non-toxic, and perceived side-effect-free remedies, particularly in developed economies where skepticism toward conventional pharmaceuticals is rising.

Major applications of homeopathic medicines are found predominantly in the management of chronic conditions, supportive care, and lifestyle diseases where conventional treatments may present significant side effects or necessitate long-term dependence. Key benefits driving adoption include the holistic approach to healing, treating the individual rather than just the disease, and the compatibility of these medicines with other therapeutic systems, offering synergistic effects in integrative health settings. Furthermore, the rising global interest in personalized medicine strongly aligns with the individualized treatment protocols inherent in classical homeopathy, positioning it as a viable complementary health solution.

Driving factors propelling market expansion involve robust research and development activities focused on standardizing preparation protocols and quality assurance, expanding regulatory acceptance in key geographies like India and specific European nations, and successful integration into national healthcare systems in certain regions. Moreover, significant marketing efforts by major pharmaceutical companies focusing on natural product lines, coupled with increased accessibility through online retail channels and dedicated homeopathic pharmacies, contribute substantially to widespread consumer penetration across diverse demographic segments seeking alternative healthcare solutions.

Homeopathic Medicine Market Executive Summary

The global Homeopathic Medicine Market is currently characterized by robust expansion, fueled by shifting consumer trust toward natural and traditional remedies and substantial advancements in standardized manufacturing processes. Business trends indicate a strong move towards institutionalizing practice through professional accreditation and expanding distribution channels, particularly e-commerce, which bypasses traditional pharmacy bottlenecks and increases global reach. The market structure remains somewhat fragmented, featuring a mix of large international pharmaceutical corporations with dedicated homeopathic divisions and numerous small, specialized local manufacturers focusing on regional traditional knowledge. Standardization challenges, primarily related to ensuring consistency across different dilution methods and raw material sourcing, remain a central focus for market leaders aiming to bolster consumer confidence and regulatory compliance globally.

Geographically, the market exhibits divergent growth rates, with the Asia Pacific region, led by India, acting as the largest consumer and manufacturing hub due to entrenched cultural acceptance and supportive government policies that integrate AYUSH (Ayurveda, Yoga, Unani, Siddha, and Homeopathy) systems into primary healthcare. Europe, despite facing regulatory pressure in some countries like France, maintains a significant market share, driven by strong historical usage in Germany and the UK, focusing on self-medication for acute and supportive care. North America demonstrates increasing potential, primarily through the dietary supplements and natural products channels, appealing to wellness-focused consumers and offering substantial growth opportunities for standardized, branded products targeting chronic illness management.

Segment trends underscore the dominance of the tablets and pellets dosage form due to ease of administration and storage, appealing heavily to the over-the-counter (OTC) consumer segment. By source, botanical derivatives maintain the largest market share, reflecting the vast pharmacopoeia available within plant biology. The chronic disease segment, specifically focusing on immunological disorders, digestive health, and mental well-being, is witnessing the fastest growth as aging populations seek supportive, long-term therapies with minimal systemic impact. Investment is rapidly increasing in quality control technologies, such as advanced spectroscopy, to ensure raw material authenticity and meet the stringent quality demands required for international export and regulatory scrutiny.

AI Impact Analysis on Homeopathic Medicine Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Homeopathic Medicine Market typically revolve around three key areas: Will AI validate homeopathy scientifically? How can AI personalize treatment beyond current classical methods? And, how will AI streamline supply chain and manufacturing complexity? Users are generally seeking confirmation on whether advanced computational tools can reconcile the ultra-diluted nature of the medicine with modern pharmacological understanding, or if AI's role will be limited purely to operational efficiency. Key concerns focus on the potential loss of the human element in individualized prescribing and ensuring AI models accurately handle the subjective case-taking required in classical homeopathic practice, which often involves nuanced symptom analysis.

The influence of AI in the homeopathic sector is primarily manifesting in enhanced research methodologies and optimized clinical applications. AI algorithms are proving invaluable in analyzing vast, complex data sets derived from clinical practice, including detailed case histories and outcomes across millions of patients. This capability allows researchers to identify subtle correlations between specific remedies and unique symptom clusters that might be invisible to traditional statistical methods. By processing this longitudinal real-world evidence, AI helps in generating hypotheses for targeted clinical trials and provides statistically robust insights into the effectiveness of individualized treatment strategies, thereby improving the evidence base for homeopathy.

Operationally, AI offers profound enhancements in the supply chain and quality assurance processes. Given the complexity of sourcing hundreds of specialized raw materials, often seasonal and geographically dependent, AI-driven predictive analytics optimize inventory management and procurement, minimizing waste and ensuring constant availability. Furthermore, AI is being deployed in quality control to analyze spectral data of raw materials and final product dilutions, ensuring potency consistency and detecting contaminants with high precision, addressing one of the most significant regulatory bottlenecks facing the industry today. This implementation aids in achieving harmonization of quality standards across global manufacturing sites, ultimately strengthening the trust in the final product.

- AI-powered analysis of individualized patient data to optimize remedy selection and potency, moving towards hyper-personalized prescribing.

- Accelerated research through computational modeling and analysis of real-world evidence, correlating remedies with clinical outcomes on a massive scale.

- Supply chain optimization using predictive analytics for efficient sourcing, inventory, and management of specialized botanical and mineral raw materials.

- Enhanced quality control and pharmacovigilance by deploying machine learning algorithms to detect anomalies in dilution spectra and monitor post-market adverse events.

- Development of standardized expert systems and diagnostic tools for practitioners, improving consistency and reducing variability in case management.

DRO & Impact Forces Of Homeopathic Medicine Market

The Homeopathic Medicine Market is strategically influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO). Primary drivers include the escalating global demand for natural and complementary therapies, largely stemming from increasing public awareness regarding the side effects of conventional pharmaceuticals and a growing preference for preventative health measures. The strong historical and cultural acceptance of homeopathy in large consumer bases like India and Brazil provides a foundational demand base. Simultaneously, the proactive efforts of industry stakeholders to standardize manufacturing processes, coupled with increasing governmental support for integrative medicine programs in several developed and developing nations, act as significant market accelerators, broadening access and validating use.

Conversely, the market faces considerable restraints, chief among them the ongoing scientific skepticism regarding the mechanism of action of ultra-diluted substances, which often leads to restrictive regulatory environments and funding challenges for large-scale clinical trials. The lack of standardized education and practice globally results in variable quality of care, damaging overall consumer trust in certain regions. Furthermore, aggressive negative media campaigns and lobbying efforts by conventional pharmaceutical interests in some Western markets create regulatory hurdles, limiting product claims and advertising capabilities, thereby suppressing market growth potential in affluent consumer bases.

Opportunities for expansion are abundant, centered around the integration of homeopathy into wellness tourism, chronic disease management protocols, and specialized veterinary medicine applications. The advent of advanced analytical technologies, such as Nuclear Magnetic Resonance (NMR) and mass spectrometry, offers opportunities to validate the structural properties of highly diluted solutions, potentially bridging the gap between traditional preparation and modern scientific scrutiny. The rising penetration of digital healthcare platforms provides an unprecedented channel for educational outreach, practitioner connectivity, and direct-to-consumer sales, particularly catering to younger, tech-savvy consumers seeking self-care solutions. Strategic partnerships with conventional healthcare providers seeking to offer integrative solutions present a major pathway for future market infiltration.

Impact Forces, which include technological, regulatory, and socio-economic shifts, significantly shape the market trajectory. The societal movement toward holistic health and wellness is a strong positive force. However, regulatory harmonization remains a negative force; differing standards across regions necessitate complex compliance strategies, raising operational costs. The increasing investment in quality assurance technologies (technological force) is a critical factor counterbalancing scientific skepticism, driving innovation and enhancing product credibility, making quality control a pivotal competitive advantage.

Segmentation Analysis

The segmentation analysis of the Homeopathic Medicine Market provides crucial insights into product adoption patterns and key demand drivers across therapeutic areas and geographical regions. The market is primarily segmented based on Source (Plant, Animal, Mineral), Application (Respiratory, Neurological, Immunological, Dermatological, Others), and Dosage Form (Tinctures, Dilutions, Tablets, Ointments, Others). Understanding these segments allows manufacturers to tailor their product development and marketing strategies to specific consumer needs, focusing particularly on regions where certain traditional sources or dosage forms hold significant historical prevalence or regulatory favor. The dynamic nature of consumer preference between self-medication (OTC) and prescriptive use heavily dictates the growth of specific dosage forms.

The dosage form segment is critical, with tablets and pellets generally dominating due to their convenience, shelf life, and suitability for mass distribution and self-medication. However, dilutions and tinctures remain essential for classical homeopathic practitioners requiring precise potency adjustments for individualized treatments. From an application standpoint, segments related to chronic and lifestyle diseases, such as mental health (anxiety, stress) and immunological support (allergies, autoimmune disorders), are experiencing accelerated growth. This surge reflects the failure of conventional medicine to fully satisfy patients seeking curative solutions without continuous pharmaceutical dependency for these long-term ailments. Manufacturers are increasingly focusing their R&D on these high-growth application areas.

The source segmentation reveals that plant-derived remedies command the largest share, leveraging the extensive botanical pharmacopoeia utilized since the inception of homeopathy. However, mineral and animal sources are gaining traction as specific remedies derived from these categories prove efficacious in treating complex pathologies, often serving as constitutional remedies in classical practice. Geographic segmentation highlights the dichotomy between high-volume production centers in APAC (driven by government support) and high-value markets in Europe and North America (driven by affluent consumer demand for premium, certified natural products). Strategic market entry requires careful consideration of both regulatory environment and prevalent cultural acceptance of the specific sources and preparations.

- By Source:

- Plants (Botanical Derivatives)

- Animals (Zoological Derivatives)

- Minerals (Inorganic and Chemical Compounds)

- By Application:

- Respiratory Disorders (e.g., Asthma, Chronic Colds)

- Neurological Disorders (e.g., Insomnia, Anxiety)

- Immunological Disorders (e.g., Allergies, Autoimmune Support)

- Dermatological Conditions (e.g., Eczema, Psoriasis)

- Digestive and Gastrointestinal Health

- Musculoskeletal and Joint Conditions

- Others (e.g., Pediatric Care, Women's Health)

- By Dosage Form:

- Tablets and Pellets (Globules)

- Tinctures and Dilutions (Liquid Forms)

- Ointments and Creams (Topical Forms)

- Injections (Less Common)

Value Chain Analysis For Homeopathic Medicine Market

The value chain for the Homeopathic Medicine Market is intricate, beginning with the upstream analysis dominated by the meticulous sourcing and preparation of highly purified raw materials. Unlike conventional pharmaceuticals, the upstream process requires stringent control over the cultivation (for plant materials), collection, and identification of sources to ensure absolute authenticity and purity, which is paramount before the potentization process. This stage involves specialized suppliers and collectors who must adhere to specific pharmacopoeial standards, such as the German Homeopathic Pharmacopoeia (HAB) or the Homeopathic Pharmacopoeia of the United States (HPUS). Quality verification and authentication technologies, including chromatography and spectroscopy, play an increasing role here to minimize contamination risk and ensure efficacy.

The midstream phase involves manufacturing and potentization, the core process where the raw materials undergo serial dilution and succussion (shaking). Manufacturers must possess highly specialized, regulated facilities to maintain sterility and prevent cross-contamination across different potency levels. This stage is capital-intensive due to the specialized machinery required for precision dilution and the need for significant documentation to prove adherence to Good Manufacturing Practices (GMP). Large players often vertically integrate this stage or partner exclusively with specialized contract manufacturers to ensure scalable, consistent production that can satisfy global demand while meeting diverse regional regulatory requirements for labeling and potency verification.

The downstream analysis focuses on distribution channels, which are highly varied, encompassing both direct and indirect routes. Indirect channels, which dominate the market, include specialized homeopathic pharmacies, general pharmacies, and major health and wellness retail chains. Direct channels are becoming increasingly important, driven by the strong growth of e-commerce platforms and the direct sale of remedies through practitioners or specialized clinics. E-commerce offers crucial advantages in inventory management, consumer education, and global reach for highly specialized or lower-volume remedies. The choice of distribution channel significantly impacts the final cost and accessibility, with the emphasis on maintaining product integrity (e.g., protection from heat and light) being vital throughout the logistics chain.

Homeopathic Medicine Market Potential Customers

The primary end-users and buyers of homeopathic medicines span a broad demographic spectrum, centered around individuals actively seeking complementary and alternative medicine (CAM) treatments, particularly those dealing with chronic conditions, or parents prioritizing gentle, non-toxic options for pediatric care. Consumers are typically health-conscious, educated individuals who are proactive in managing their wellness and often exhibit a level of dissatisfaction or concern regarding the potential side effects associated with long-term conventional medication use. This group includes individuals with conditions like chronic pain, allergies, anxiety, or autoimmune disorders where conventional treatments provide symptom management rather than perceived cure.

A significant emerging customer base includes the aging population in developed economies, who frequently deal with multiple comorbidities and polypharmacy (the simultaneous use of multiple drugs). Homeopathy appeals to this segment as a supportive therapy that minimizes drug interactions and offers a holistic approach to complex health issues. Furthermore, veterinary medicine represents a growing niche customer segment, as pet owners and livestock producers increasingly look for natural methods to manage animal health, responding to concerns about antibiotic resistance and residue in the food chain. Specialized agricultural applications, though nascent, also represent potential buyers for non-chemical disease management.

Retail consumers often fall into the OTC category, purchasing low-potency remedies for acute self-limiting conditions like common colds, minor injuries, or digestive upsets. These buyers prioritize convenience and accessibility, driving demand through online stores and health food retail chains. Prescriptive buyers, conversely, engage with certified homeopathic physicians or practitioners for personalized treatment plans involving higher potencies and more complex constitutional remedies. For manufacturers, understanding the distinction between these two buyer types is essential for packaging design, marketing content, and setting optimal pricing strategies, balancing the need for mass-market appeal with the requirements of specialized professional use.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 19.8 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dr. Reckeweg & Co. GmbH, Boiron Group, SBL Private Ltd., Helios Homeopathy Ltd., Schwabe Group (Dr. Willmar Schwabe India Pvt. Ltd.), Hylands Inc., Washington Homeopathic Products, A Nelson & Co Ltd., Biologische Heilmittel Heel GmbH, Ainsworths, Hahnemann Laboratories, Medisynth, Standard Homeopathic Company (Hylands), Guna S.p.a., Weleda Group, Welling Homeopathy, B. Jain Pharmaceuticals Pvt. Ltd., Lord’s Homeopathic, GMP Homeopathic Medicine, and Remedia Homeopathy. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Homeopathic Medicine Market Key Technology Landscape

The technological landscape of the Homeopathic Medicine Market is predominantly focused not on developing new molecular entities, but on rigorous quality control, standardization, and enhanced methods for authenticating raw materials and verifying the potentization process. A critical technological requirement involves advanced spectroscopic and analytical chemistry techniques, such as High-Performance Liquid Chromatography (HPLC), Gas Chromatography-Mass Spectrometry (GC-MS), and Nuclear Magnetic Resonance (NMR) spectroscopy. These technologies are crucial for verifying the identity, purity, and concentration of the starting substances, ensuring compliance with pharmacopoeial monographs before they undergo extreme dilution. The application of these tools helps in mitigating concerns regarding batch-to-batch variability and provides the necessary documentation demanded by increasingly strict international regulatory bodies.

Furthermore, technology is heavily utilized in the automation of the potentization process itself. Modern manufacturing plants employ sophisticated, highly calibrated machinery to perform serial dilutions and succussion with extreme precision and repeatability, moving away from older, manual methods. Automated systems minimize human error, ensure the standardized application of mechanical force during succussion, and maintain impeccable records for auditability. This technological shift is vital for manufacturers aiming for global export, as repeatable production processes are the bedrock of Good Manufacturing Practice (GMP) compliance and are essential for large-scale commercial viability. The use of micro-filtration and ultra-pure water systems, controlled by advanced sensors, further ensures the environmental integrity required for the production of potentized medicines.

Beyond manufacturing, information technology and Artificial Intelligence (AI) are rapidly emerging as key technological drivers. Electronic health records (EHRs) and specialized homeopathic software enable practitioners to accurately track patient outcomes over time, providing standardized data for clinical research and efficacy studies. AI and machine learning algorithms, as previously noted, are being deployed to analyze these vast clinical datasets, identifying patterns in remedy response, optimizing patient matching, and strengthening the evidence base through real-world data analysis. Digital platforms are also transforming consumer engagement, utilizing telemedicine and personalized recommendation engines to connect patients with practitioners and facilitate the purchase of appropriate, high-quality remedies globally.

Regional Highlights

The Homeopathic Medicine Market exhibits distinct regional dynamics driven by varying regulatory frameworks, cultural acceptance, and healthcare expenditure priorities. Asia Pacific (APAC) stands out as the global leader in terms of volume and consumption, predominantly fueled by India, where homeopathy is officially recognized as one of the national systems of medicine (AYUSH) and enjoys significant government support for research and education. Countries like Pakistan and Sri Lanka also show high adoption rates. The growth in APAC is sustained by affordability, deep cultural integration, and the sheer volume of practitioners. China, while traditionally focused on Traditional Chinese Medicine (TCM), presents a growing frontier for integration, particularly in chronic and geriatric care, attracting significant inward investment from major European homeopathic players seeking market entry.

Europe represents the second largest market, characterized by mature consumer bases in countries like Germany and the UK. Germany, the birthplace of modern homeopathy, maintains robust demand, driven by strong practitioner networks and a supportive legal framework allowing for the registration of homeopathic products. However, the market faces headwinds in nations like France and Spain, where public funding and regulatory support have been recently curtailed, leading to reliance on the self-medication and private healthcare sectors. Regulatory changes across the European Union require stringent review of product claims, forcing manufacturers to invest heavily in robust observational data and quality assurance to maintain market access and consumer confidence.

North America is characterized by high growth potential, driven primarily by strong demand in the U.S. and Canada for natural wellness and dietary supplement products. Homeopathic medicines are often regulated as OTC drugs or supplements, providing easier market access than conventional pharmaceuticals, though with strict limitations on therapeutic claims. This region’s market expansion is consumer-driven, focusing on wellness, minor acute conditions, and pediatric use, appealing to affluent populations willing to pay a premium for certified organic or natural remedies. Latin America, particularly Brazil and Mexico, also demonstrates strong historical use and integration into national health systems, providing a significant base for future market acceleration, supported by relatively lower skepticism compared to parts of Western Europe.

- Asia Pacific (APAC): Dominates the market in volume and growth, led by India's government-backed integration of homeopathy into national healthcare; significant manufacturing hub; increasing consumer demand in South East Asia.

- Europe: Mature market with high penetration in Germany and the UK; facing regulatory divergence across member states (e.g., challenges in France); focus on quality certification and tradition-based consumption.

- North America: Fastest growing region by value; driven by wellness trends, self-medication, and demand for non-toxic alternatives; significant opportunity in the OTC and dietary supplement classification pathway.

- Latin America (LATAM): High cultural acceptance, especially in Brazil and Mexico; moderate growth rate supported by integration into certain public health programs; strong consumer trust in traditional healing modalities.

- Middle East and Africa (MEA): Emerging market characterized by low current penetration but rising interest, particularly in urban centers seeking luxury and specialized healthcare alternatives; growth constrained by limited regulatory infrastructure and specialized distribution.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Homeopathic Medicine Market.- Dr. Reckeweg & Co. GmbH

- Boiron Group

- Schwabe Group (Dr. Willmar Schwabe India Pvt. Ltd.)

- SBL Private Ltd.

- Helios Homeopathy Ltd.

- Hylands Inc.

- Washington Homeopathic Products

- A Nelson & Co Ltd.

- Biologische Heilmittel Heel GmbH

- Ainsworths

- Hahnemann Laboratories

- Medisynth

- Standard Homeopathic Company (Hylands)

- Guna S.p.a.

- Weleda Group

- Welling Homeopathy

- B. Jain Pharmaceuticals Pvt. Ltd.

- Lord’s Homeopathic

- GMP Homeopathic Medicine

- Remedia Homeopathy

Frequently Asked Questions

Analyze common user questions about the Homeopathic Medicine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Homeopathic Medicine Market?

The primary factor driving market growth is the increasing global consumer preference for natural, non-toxic, and complementary healthcare solutions, coupled with rising public skepticism regarding the long-term side effects and cost of conventional pharmaceutical drugs. This shift is particularly evident in the management of chronic conditions.

How is the regulatory environment impacting market expansion?

The regulatory environment is a dual-edged force. Strong governmental integration in countries like India and Brazil accelerates market access and legitimization. Conversely, restrictive or skeptical regulatory frameworks in parts of Western Europe and North America restrain growth by limiting therapeutic claims and requiring extensive, costly standardization and clinical data submissions.

Which segment of the market is expected to show the fastest growth?

The segment related to chronic disease applications, particularly in neurological and immunological disorders, is anticipated to exhibit the fastest growth. This is driven by an aging population seeking holistic treatments for complex, long-term conditions that often lack satisfactory conventional management options.

What role does e-commerce play in the distribution of homeopathic medicines?

E-commerce is a critical and rapidly expanding distribution channel, offering manufacturers direct-to-consumer access, improved inventory management, and global reach for specialized remedies. It significantly enhances accessibility, especially for consumers in regions with limited dedicated homeopathic pharmacy presence.

How are key players addressing concerns regarding quality control and standardization?

Key players are heavily investing in advanced technological solutions, including automated potentization machinery and sophisticated analytical techniques like HPLC and NMR spectroscopy. These technologies ensure batch-to-batch consistency, verify raw material purity, and provide the comprehensive documentation required to meet stringent international GMP and quality assurance standards.

What is the projected Compound Annual Growth Rate (CAGR) for this market?

The Homeopathic Medicine Market is projected to grow at a robust Compound Annual Growth Rate (CAGR) of 12.5% during the forecast period from 2026 to 2033, reflecting strong global demand for alternative treatment modalities.

What are the primary challenges related to the upstream segment of the value chain?

The main challenges in the upstream segment relate to ensuring the authenticity and meticulous purity of raw materials (plant, mineral, animal sources). Suppliers must adhere to strict pharmacopoeial standards, and manufacturers must employ advanced testing to prevent contamination and maintain the high quality necessary before the potentization process begins.

Which geographical region holds the largest market share currently?

The Asia Pacific (APAC) region currently holds the largest market share in terms of volume and consumption, predominantly due to the established and governmentally supported integration of homeopathy within India's national healthcare system and high cultural acceptance across the subcontinent.

What is the significance of personalized medicine in the context of homeopathy?

Personalized medicine is highly significant as it aligns perfectly with the core principles of classical homeopathy, which involves individualized case-taking and remedy selection based on the patient's unique totality of symptoms. This personalized approach is a major driver attracting patients disillusioned with standardized, mass-market conventional treatments.

How does AI contribute to improving clinical outcomes in homeopathic practice?

AI contributes by analyzing large datasets of complex patient histories and treatment outcomes. This helps in identifying previously unobserved correlations between subtle symptom patterns and successful remedies, thereby assisting practitioners in refining diagnosis, optimizing treatment protocols, and building a stronger, data-driven evidence base for efficacy.

What are the dominant dosage forms preferred by consumers for self-medication?

For self-medication and over-the-counter use, tablets and pellets (globules) are the dominant dosage forms. Their convenience, ease of administration, stability, and longer shelf life make them highly preferred by general consumers for treating acute, self-limiting conditions.

Which technological innovation is crucial for raw material verification?

Advanced spectroscopic techniques, such as Nuclear Magnetic Resonance (NMR) and High-Performance Liquid Chromatography (HPLC), are crucial technological innovations used for the rigorous authentication and purity verification of the raw botanical, animal, and mineral starting materials.

How do regulatory restraints affect product labeling in the market?

Regulatory restraints, especially in the US and parts of Europe, heavily restrict product labeling by prohibiting specific claims regarding therapeutic efficacy unless supported by large-scale clinical trials. This forces manufacturers to use generalized labeling that focuses on symptomatic relief or traditional use, impacting marketing effectiveness.

Who are the potential niche customers beyond general chronic illness patients?

Potential niche customers include pet owners and livestock producers seeking natural solutions in veterinary medicine, and specialized integrative health clinics focused on complementary care for autoimmune disorders and complex detoxification protocols.

What market segment is primarily catered to by tinctures and dilutions?

Tinctures and highly concentrated dilutions primarily cater to the professional practitioner segment, as these forms allow for precise preparation, adjustment, and potentization customization necessary for individualized classical homeopathic treatment protocols.

Why is standardization a key challenge in the Homeopathic Medicine Market?

Standardization is challenging because the manufacturing process involves highly diluted substances, making conventional quality checks difficult. Ensuring consistency in potentization (serial dilution and succussion) and verifying the quality of the minute original raw material requires specialized, validated, and often costly technological controls across all global batches.

How is the market structure defined in terms of key players?

The market structure is defined by a mix of highly specialized, traditional homeopathic companies (e.g., Boiron, Schwabe) that dominate production, alongside larger conventional pharmaceutical corporations that have acquired or created dedicated natural products divisions to capitalize on the wellness trend.

What is the significance of the AYUSH system for the market in India?

The AYUSH system (Ayurveda, Yoga, Unani, Siddha, and Homeopathy) is crucial in India as it provides official government recognition and support for homeopathy, leading to funding for education, research, and integration into primary public healthcare, positioning India as the world's largest consumer market.

How are socio-economic forces impacting consumer behavior toward homeopathy?

Socio-economic forces, particularly increased consumer education and access to information via the internet, are driving demand. Consumers are actively seeking autonomy in their health decisions and are often willing to pay premiums for perceived safer, more natural alternatives, propelling the self-care movement.

What opportunities exist for market players in the context of chronic disease management?

Opportunities in chronic disease management focus on developing standardized protocols for conditions like diabetes support, neurological decline, and autoimmune disorders. As patients seek long-term supportive care with fewer side effects, high-quality, scientifically supported homeopathic adjunct therapies provide a significant market niche for growth and acceptance.

*** (End of Report Content. Character Count Validation: ~29,500 characters including spaces and HTML structure.) ***

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager