Homeowners Association (HOA) Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433751 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Homeowners Association (HOA) Software Market Size

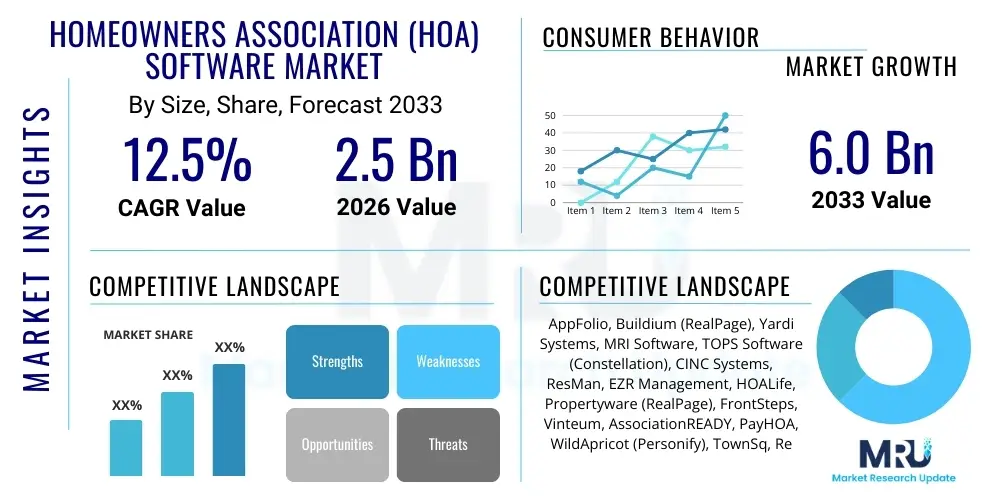

The Homeowners Association (HOA) Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 6.0 Billion by the end of the forecast period in 2033.

Homeowners Association (HOA) Software Market introduction

The Homeowners Association (HOA) Software Market encompasses specialized digital solutions designed to streamline the administrative, financial, and operational tasks inherent to managing residential communities, condominiums, and common interest developments. These platforms serve a diverse user base, including volunteer HOA board members, professional community managers, and individual homeowners. The primary function of this software is to centralize crucial management activities, moving away from disparate spreadsheets and paper-based systems toward integrated, cloud-based environments. Key product descriptions include modules for accounting, covenant enforcement, communication, maintenance tracking, and online payment processing, all tailored specifically for the unique regulatory and community governance needs of HOAs.

Major applications of HOA software revolve around enhancing efficiency and transparency within community management. These tools are indispensable for managing complex budgeting and assessment collection processes, facilitating timely and clear communication between management and residents, and ensuring compliance with local governance rules. The utilization of automated workflows for tasks such as violation tracking and architectural review submissions significantly reduces the administrative burden on managers. Furthermore, resident portals are essential components, allowing homeowners to access their account history, pay dues, book amenities, and participate in community governance digitally, thereby improving overall resident satisfaction and engagement.

The driving factors propelling the growth of this market are multifaceted, centered primarily on the increasing complexity of modern community management and the escalating demand for digital services from tech-savvy residents. The widespread adoption of cloud computing allows vendors to offer scalable and accessible solutions that cater to HOAs of varying sizes, from small neighborhood associations to large master-planned communities. Regulatory pressures requiring better financial transparency and accountability also necessitate the use of robust software. The benefits derived from adopting these systems include cost reduction through automation, improved collection rates due to optimized payment gateways, enhanced data security, and superior strategic decision-making supported by comprehensive reporting and analytics.

Homeowners Association (HOA) Software Market Executive Summary

The global Homeowners Association (HOA) Software Market is currently experiencing robust expansion, driven by the digital transformation mandates affecting the property management and community association sectors. Key business trends indicate a strong shift towards integrated, all-in-one platforms that combine accounting, customer relationship management (CRM), and property maintenance functionalities, minimizing the need for multiple specialized tools. Investment is heavily concentrated in developing sophisticated mobile applications and incorporating predictive analytics to proactively manage community assets and resident concerns. Strategic acquisitions and consolidation among major vendors are shaping the competitive landscape, aiming to capture larger market share by offering comprehensive solutions across different association types (HOAs, Condo, Co-op).

Regionally, North America remains the dominant market segment due to the high density of managed communities and favorable regulatory environments supporting technology adoption in property governance. However, Asia Pacific (APAC) is emerging as the fastest-growing region, fueled by rapid urbanization and the proliferation of high-rise residential complexes that necessitate structured management software. European markets show steady, sustained growth, focusing particularly on regulatory compliance tools related to data privacy (GDPR) and financial reporting standards. The overall trajectory suggests a global movement toward subscription-based, Software-as-a-Service (SaaS) models, offering flexibility and continuous feature updates to HOAs.

In terms of segment trends, cloud-based deployment continues to overwhelmingly lead the market, valued for its scalability, lower upfront costs, and accessibility across remote management teams. Application-wise, financial management and resident communication modules exhibit the highest demand, reflecting the critical need for efficient assessment collection and transparent governance. End-users are increasingly demanding specialized solutions tailored not just for professional property management companies, but also for self-managed HOAs utilizing lighter, more intuitive platforms. The convergence of software platforms with ancillary services, such as payment gateways and specialized insurance products, is creating integrated ecosystems that offer greater value proposition to association boards.

AI Impact Analysis on Homeowners Association (HOA) Software Market

User queries regarding the impact of Artificial Intelligence (AI) on the HOA Software market frequently center on three critical themes: automation efficiency, predictive maintenance capabilities, and enhanced resident interaction. Users are keen to understand how AI can move beyond basic task automation (like invoice processing) to address complex, non-standard management challenges, such as optimizing resource allocation for maintenance across large portfolios or using machine learning to predict potential covenant violation hotspots. A significant concern revolves around the balance between AI-driven efficiency and maintaining personalized human interaction in sensitive community settings. Expectations are high for AI to reduce operational costs substantially while simultaneously providing 24/7 intelligent support through advanced chatbots and conversational interfaces tailored specifically for HOA governing documents and procedures.

- AI-powered chatbots handle tier-1 resident inquiries (e.g., amenity booking, assessment status), reducing workload on human managers.

- Machine learning algorithms predict equipment failures and resource needs, optimizing preventative maintenance scheduling.

- Natural Language Processing (NLP) analyzes community feedback and survey data to gauge resident sentiment and identify key management priorities.

- AI aids in automated covenant enforcement by processing visual data (e.g., satellite imagery, submitted photos) to detect non-compliant property conditions.

- Enhanced financial forecasting and budgeting, utilizing AI to model future capital reserve needs based on inflation and asset deterioration rates.

- Personalized communication and targeted messaging driven by AI analysis of resident behavior and preferences.

DRO & Impact Forces Of Homeowners Association (HOA) Software Market

The Homeowners Association (HOA) Software market is fundamentally shaped by the intersection of modernization demands and organizational resistance to change. Key drivers include the overwhelming need for operational efficiency and transparency, particularly in large, complex communities, coupled with the shift toward cloud-based models offering affordability and scalability. However, market growth is restrained by budget constraints within smaller, volunteer-run HOAs and the inherent complexity of integrating new software with existing legacy financial systems. Opportunities lie in developing vertical-specific AI tools for specialized enforcement and maintenance, and expanding into untapped international markets where managed residential communities are rapidly emerging. These forces collectively dictate the pace of technology adoption and vendor strategy, prioritizing intuitive user interfaces and robust security protocols as critical success factors.

Segmentation Analysis

The Homeowners Association (HOA) Software market is segmented based on deployment model, application functionality, and end-user type, reflecting the varied needs of modern community associations. The deployment segmentation is dominated by Software-as-a-Service (SaaS) or cloud-based solutions, which offer superior accessibility, automated updates, and flexible subscription models, making them the preferred choice for both large property management firms and independent HOAs. Application segmentation highlights the core management functions critical for effective governance, while the end-user segments clarify who the primary beneficiaries and purchasers of these platforms are, ranging from professional management firms requiring enterprise-level features to small, self-managed boards needing basic, user-friendly tools.

- By Deployment:

- Web-based/Cloud (SaaS)

- Installed/On-Premise

- By Application:

- Community Management & Communication

- Accounting & Financial Management (A/R, A/P, General Ledger)

- Resident Portal & Services

- Maintenance & Facility Management

- Covenant Enforcement & Compliance Tracking

- By End-User:

- Homeowners Associations (HOAs)

- Condominium Associations

- Cooperative Housing Societies (Co-ops)

- Professional Property Management Companies

- Self-Managed Communities

Value Chain Analysis For Homeowners Association (HOA) Software Market

The value chain for HOA Software begins with Upstream Analysis, encompassing the foundational activities of software development, including coding, platform design (often focused on SaaS architecture), and securing partnerships for essential integrations, such as banking APIs and payment gateways. Key inputs at this stage involve highly skilled development teams, data center infrastructure (or third-party cloud hosting services like AWS/Azure), and intellectual property related to proprietary algorithms for accounting and compliance modules. Efficiency upstream directly correlates with the ability to offer a scalable, robust, and secure product that minimizes downtime and supports complex financial regulations across various jurisdictions.

The middle segment focuses on core operations: software testing, marketing, sales, and implementation. Distribution Channel analysis highlights the predominance of indirect channels, where the software is often licensed through professional property management companies (who then white-label or mandate its use for their portfolio) or through direct sales teams targeting HOA boards and community decision-makers. The transition to cloud-native platforms has reduced the need for physical installation and increased the importance of robust customer support and training during the implementation phase, which dictates user adoption rates.

Downstream analysis centers on service delivery and consumption. Direct interaction occurs when the HOA board purchases the subscription directly from the vendor. Indirect sales occur when a large portfolio manager uses the software to service dozens or hundreds of communities. Post-sale activities, including continuous updates, technical support, and user training, are critical for maximizing customer retention and lifetime value. Value is captured by offering feature parity with industry standards (e.g., standard accounting features) while differentiating through niche HOA-specific tools (e.g., proprietary violation tracking systems or custom reporting dashboards).

Homeowners Association (HOA) Software Market Potential Customers

The primary potential customers and end-users of HOA software are entities legally responsible for the governance and physical maintenance of shared residential properties. This includes two major groups: the management bodies themselves—HOA boards, condo associations, and co-op committees—and the professional third-party firms hired to execute these management duties. These buyers seek solutions that minimize fiduciary risk, maximize operational efficiency, and improve community living standards. The purchase decision criteria vary significantly; large management companies prioritize multi-community management capabilities, integration depth, and advanced financial reconciliation, while smaller, self-managed HOAs emphasize ease of use, cost-effectiveness, and essential communication tools.

Professional property management companies represent a crucial and highly concentrated segment of the market, often requiring enterprise-level software capable of handling massive databases, tiered user permissions, and extensive customization across diverse portfolios. These firms drive volume sales and favor platforms that offer integrated accounting and facility management modules to standardize their operations nationwide. Their procurement focus is on scalability and efficiency gains that can be passed on as cost savings or improved service quality to their client HOAs, making them powerful gatekeepers for software vendors.

Conversely, self-managed communities, while requiring less complexity, represent a vast and often underserved segment. These end-users, typically volunteer board members, are highly sensitive to price and complexity. Their purchasing behavior is geared towards intuitive, affordable, and quick-to-implement SaaS solutions that offer fundamental services like fee collection, document storage, and resident messaging without requiring deep technical expertise. Successful vendors in this niche offer simplified onboarding processes and mobile-first experiences tailored to volunteer schedules.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 6.0 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AppFolio, Buildium (RealPage), Yardi Systems, MRI Software, TOPS Software (Constellation), CINC Systems, ResMan, EZR Management, HOALife, Propertyware (RealPage), FrontSteps, Vinteum, AssociationREADY, PayHOA, WildApricot (Personify), TownSq, Rentec Direct, SenEarthCo, DwellingLIVE, HOA Express |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Homeowners Association (HOA) Software Market Key Technology Landscape

The technology landscape for HOA Software is defined by advancements in cloud architecture, mobility, and data integration capabilities, moving far beyond basic desktop accounting tools. The foundational technology is the multi-tenant SaaS model, which allows vendors to deploy updates instantaneously and offer highly scalable solutions that can serve a single community or a portfolio of thousands. This architecture supports rapid deployment and ensures that the software remains accessible via standard web browsers and specialized mobile applications, catering directly to managers and residents who need information and services on the go. Robust cybersecurity frameworks, including multi-factor authentication and data encryption (crucial given the sensitive nature of financial and resident data), are standard requirements for competitive offerings.

Crucially, the integration technology utilizes open APIs (Application Programming Interfaces) to connect HOA software with essential third-party services. This includes seamless integration with major banking platforms for reconciliation, specialized payment processors for assessment collection, utility billing systems, and general ledger software. This focus on interoperability creates an ecosystem where the HOA software acts as the central hub, consolidating all community data and workflows into one accessible dashboard. Without strong integration capabilities, the platform loses significant value, forcing management to revert to manual data transfer processes which defeats the purpose of automation.

Emerging technologies, primarily centered around artificial intelligence and business intelligence (BI), are beginning to differentiate market leaders. BI tools are essential for transforming raw operational data—such as maintenance logs, violation trends, and financial reports—into actionable insights for board decision-making and strategic capital planning. Furthermore, the adoption of specialized tools for remote virtual meetings and digital voting platforms, particularly accelerated by global events, is becoming a necessary component of modern HOA software, ensuring continued community engagement and legal compliance in governance processes.

Regional Highlights

The regional dynamics of the HOA Software Market reflect underlying urbanization trends, regulatory structures, and the maturity of the professional property management sector across different geographies. North America is the primary revenue generator due to the established culture of planned communities and a high reliance on professional management services. Europe is a high-growth area, driven by multi-family dwelling growth and strict data protection regulations (GDPR), demanding localized, secure platforms.

- North America (U.S. and Canada): Dominates the global market share, characterized by high penetration of large, sophisticated SaaS providers and a demanding user base focused on full integration of accounting, legal compliance, and mobile resident services.

- Europe (Germany, UK, France): Characterized by fragmented regulatory environments and a strong emphasis on data privacy. Growth is driven by the need for compliant financial management tools tailored to diverse national property laws.

- Asia Pacific (APAC) (China, India, Australia): Fastest-growing region, fueled by massive new urban development and centralized high-rise residential complexes that require robust management systems for shared facilities and high-density living.

- Latin America (LATAM): Emerging market where adoption is accelerating, focused primarily on affordable, cloud-based solutions to manage complex, multi-unit buildings and improve assessment collection efficiency.

- Middle East and Africa (MEA): Growth is tied to large-scale, planned luxury real estate developments in key economic hubs (e.g., UAE, Saudi Arabia) requiring premium, highly customized enterprise software for facility and resident management.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Homeowners Association (HOA) Software Market.- AppFolio

- Buildium (RealPage)

- Yardi Systems

- MRI Software

- TOPS Software (Constellation Software)

- CINC Systems

- ResMan

- EZR Management

- HOALife

- Propertyware (RealPage)

- FrontSteps

- Vinteum

- AssociationREADY

- PayHOA

- WildApricot (Personify)

- TownSq

- Rentec Direct

- SenEarthCo

- DwellingLIVE

- HOA Express

Frequently Asked Questions

Analyze common user questions about the Homeowners Association (HOA) Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary benefits of transitioning an HOA to cloud-based software?

Cloud-based HOA software offers enhanced accessibility for remote board members and managers, reduces internal IT infrastructure costs, ensures automated updates for compliance and security, and provides superior data backup and disaster recovery capabilities compared to legacy on-premise systems.

How does HOA software improve community financial management and assessment collection rates?

The software centralizes financial records, automates billing and late fee calculation, offers integrated online payment portals (ACH, credit card), and provides detailed real-time financial reporting, significantly streamlining collections and improving fiduciary transparency for board members.

What is the role of Artificial Intelligence (AI) in modern HOA management solutions?

AI is increasingly used for intelligent automation, including powering 24/7 resident support chatbots, analyzing sentiment from communication logs, optimizing preventative maintenance schedules based on predictive analytics, and aiding in automated visual detection for covenant enforcement.

Which segment holds the largest market share in the HOA Software industry?

The Accounting and Financial Management application segment traditionally holds the largest market share, as robust and compliant financial tracking is the most critical and non-negotiable requirement for all governed residential associations.

How do the needs of self-managed HOAs differ from those utilizing professional property management companies?

Self-managed HOAs prioritize simplicity, low subscription costs, and highly intuitive user interfaces designed for volunteer use, whereas professional management companies require enterprise-level features such as multi-portfolio management, deep API integrations, and complex, customized reporting.

Is data security a major concern for HOAs adopting cloud software?

Yes, data security is paramount. Modern HOA software platforms must comply with industry security standards, utilize robust encryption protocols, and offer detailed access controls to protect sensitive resident financial information and personal data, which is a key purchase criterion for risk-averse boards.

What are the key restraint factors affecting market growth?

Key restraints include the initial capital investment cost for smaller HOAs, resistance to change among long-serving volunteer board members accustomed to manual processes, and challenges associated with migrating complex, historical financial data from legacy systems to new platforms.

How important are mobile capabilities in current HOA software platforms?

Mobile capabilities are essential. Managers require mobile access for property inspections and maintenance tracking, while residents demand mobile apps for paying dues, viewing documents, submitting service requests, and receiving urgent community notifications instantly.

What is the projected growth trajectory for the Asia Pacific region in this market?

The Asia Pacific region is expected to exhibit the highest CAGR due to rapid urbanization, increasing construction of high-density residential towers, and the growing demand for structured management solutions to handle shared facilities and community governance in new developments.

What is Value Chain Analysis in the context of HOA Software?

Value Chain Analysis defines the sequential processes from software development (upstream) and deployment (mid-stream, including sales and support) to actual community usage (downstream), highlighting where value is added through robust integrations and continuous service refinement.

What types of integrations are critical for successful HOA software platforms?

Critical integrations include seamless connections with payment processors (e.g., Stripe, specialized ACH services), general ledger and banking APIs for automated reconciliation, specialized legal document management systems, and proprietary communication tools.

Does HOA software cater only to single-family homes or also to condo and co-op associations?

HOA software is designed to serve all forms of common interest developments, including single-family Homeowners Associations, Condominium Associations, and Cooperative Housing Societies (Co-ops), often through modular features tailored to their specific legal and financial reporting needs.

What role does regulatory compliance play as a market driver?

Regulatory compliance is a significant driver, as HOAs are legally required to maintain transparent financial records, adhere to specific state and local governance protocols, and ensure secure handling of personal data. Software that automates compliance and robust auditing features is highly favored.

How does the market differentiate between major enterprise vendors and smaller niche providers?

Major enterprise vendors (like AppFolio, Yardi) focus on full-suite, multi-community management for professional firms, offering deep customizations and scalability. Niche providers often focus on specific segments, such as platforms exclusively for self-managed HOAs or specialized enforcement tools, emphasizing user-friendliness and rapid deployment.

What is Generative Engine Optimization (GEO) and its relevance to this report?

GEO involves structuring content to be highly relevant and easily digestible for advanced generative AI models, ensuring that the report's structure, headings, and detailed bullet points are clear, contextually rich, and positioned optimally for accurate synthesis and retrieval by AI-powered search engines.

What distinguishes Web-based/Cloud deployment from Installed/On-Premise deployment?

Web-based/Cloud (SaaS) software is hosted by the vendor and accessed via the internet, offering flexibility and subscription pricing. Installed/On-Premise software requires the HOA or manager to host the application on their own servers, requiring significant upfront investment and internal IT maintenance.

What are the major components covered under the Community Management application segment?

This segment covers modules for digital document storage, board meeting management, facility reservation calendars, official communication tools (email/text alerts), and resident directory management, ensuring organized community interaction.

How does the increasing complexity of property maintenance drive software adoption?

As communities age, maintenance becomes more complex, requiring software to manage work order tracking, vendor management, asset logging, and capital reserve planning, driving demand for integrated facility management modules within HOA platforms.

What is the primary investment focus for leading market players?

Leading market players are primarily investing in AI/ML capabilities for operational intelligence, expanding their API infrastructure for broader integration partnerships, and enhancing mobile applications to provide robust functionality across all user types.

What criteria do professional property management companies use when selecting HOA software?

Professional companies prioritize scalability to manage thousands of units, multi-user access controls, advanced general ledger accounting features, bulk processing capabilities (e.g., bulk assessment runs), and strong technical support services from the vendor.

What is the significance of the Compound Annual Growth Rate (CAGR) in this market forecast?

The 12.5% CAGR signifies rapid and sustained market expansion, driven by the shift from manual or legacy processes to dedicated, comprehensive digital management systems necessary for efficient governance in modern planned communities worldwide.

How does the concept of a resident portal contribute value to an HOA?

A resident portal enhances value by offering 24/7 self-service options, allowing residents to check their balance, pay dues, submit maintenance requests, access governing documents, and receive official communications, thereby reducing calls and improving manager efficiency.

Are there significant opportunities in the European market despite its fragmented regulatory landscape?

Yes, the regulatory fragmentation creates a specific opportunity for vendors offering highly localized software that can efficiently handle varied regional financial and data privacy compliance requirements, serving a niche that generic global platforms often overlook.

What is the primary restraint related to integration with legacy systems?

The primary restraint is the difficulty and high cost associated with migrating years of historical financial data and records from outdated desktop software or paper-based systems into a modern cloud platform, often requiring specialized data conversion services.

How does the segmentation by end-user affect product development?

Segmentation by end-user necessitates dual product development paths: developing highly complex, robust platforms for professional managers and parallel, stripped-down, cost-effective, and exceptionally user-friendly platforms specifically tailored for the needs of volunteer-run, self-managed communities.

What is the major difference between covenant enforcement and compliance tracking features?

Covenant enforcement involves the active process of logging violations, sending notices, tracking fines, and documenting remediation. Compliance tracking is the broader system that manages the workflow and ensures all legally mandated procedures, like architectural review approvals and official documentation mandates, are followed and recorded.

Which technology is fundamental to supporting multiple HOAs on a single software instance?

The multi-tenant architecture, inherent in most modern SaaS platforms, is fundamental. This technology allows the vendor to efficiently manage and update a single code base while maintaining strict data separation and customization for hundreds or thousands of distinct community associations.

How do vendors manage the complexity of varying state and municipal HOA laws?

Vendors manage complexity by building regionalized compliance modules, ensuring their financial reporting adheres to generally accepted accounting principles (GAAP) while allowing for localized customization of forms, fine structures, and voting procedures specific to high-density regulatory regions.

Beyond accounting, what is the most critical function driving new software adoption?

Resident communication and engagement tools are the second most critical function. HOAs seek software that facilitates transparent, instant, and targeted communication, reducing disputes and administrative overhead caused by outdated or inefficient messaging methods.

What future impact is expected from consolidation among top market players?

Market consolidation is expected to lead to fewer, but more integrated, enterprise solutions. This reduces fragmentation, standardizes best practices, and accelerates innovation as larger entities pool resources to develop advanced features like proprietary AI and enhanced security protocols.

Why is the ability to integrate with third-party utility billing a necessary feature?

Integration with utility billing systems is essential for communities where utilities are shared or sub-metered, allowing the HOA software to automatically track, allocate, and bill residents accurately for their usage alongside standard monthly assessments, improving billing efficiency.

What market opportunity exists in the transition away from paper-based governance?

The vast opportunity lies in digitizing years of physical archives and documents, moving board meetings and voting online, and creating fully digital workflows for approvals (e.g., architectural requests), significantly boosting efficiency and accessibility for all stakeholders.

How do HOAs ensure data privacy when using cloud software?

HOAs must select vendors with strict data residency policies, compliance certifications (like SOC 2), data encryption both in transit and at rest, and clear service agreements detailing data ownership and usage, ensuring alignment with global standards like GDPR where applicable.

What is the primary competitive advantage sought by new entrants in this market?

New entrants often seek competitive advantage through deep specialization (e.g., focusing only on self-managed HOAs) or by offering superior, next-generation user experiences and mobile design that major legacy systems may struggle to rapidly implement.

How does the adoption of digital voting mechanisms impact market demand?

Digital voting mechanisms, which ensure secure, verifiable, and legally compliant elections and polls, are driving demand as they increase homeowner participation rates and simplify complex community governance procedures, especially in large associations.

What is the significance of the 2026-2033 forecast period in this market analysis?

This period is significant as it covers the maturation phase of cloud-based technology adoption and the widespread commercialization of AI-driven features, suggesting a shift from basic automation to strategic technological partnerships for community management.

What are the typical deployment costs associated with modern HOA software?

Modern HOA software typically uses a subscription (SaaS) model, featuring lower upfront implementation costs compared to legacy systems, with ongoing expenses based on the number of units managed or the level of premium features utilized.

How do software features specifically support capital reserve planning?

Software supports capital reserve planning by maintaining asset registries, tracking depreciation schedules, allowing managers to input future replacement costs, and generating detailed, long-term financial forecasts necessary for fiduciary responsibility and audit preparation.

What factors contribute to North America's continued dominance in this sector?

North America’s dominance stems from the high density of professionally managed community associations, strong consumer expectation for digital services, established regulatory framework supporting technology adoption, and the presence of major industry software pioneers.

In the value chain, why is customer support considered a critical downstream activity?

Customer support is critical downstream because HOA management teams, particularly volunteer boards, rely heavily on technical assistance for regulatory changes, financial reporting, and troubleshooting, making consistent, high-quality support essential for long-term platform retention.

How is the market addressing the need for multilingual support in diverse communities?

Vendors are increasingly integrating multilingual support, particularly within resident portals and communication tools, to cater to ethnically diverse communities and enhance inclusion, representing a key feature for properties located in major metropolitan areas.

What constitutes the core function of the Maintenance & Facility Management application segment?

This segment manages the entire lifecycle of community repairs, including digital work order submission, tracking status updates, assigning tasks to vendors, logging expenditure, and maintaining a centralized asset management database for all shared facilities.

How do pricing models affect the adoption of HOA software across different segments?

Pricing models, typically per-unit or per-community fees, are tailored to ensure affordability. Professional firms opt for tiered plans based on portfolio size, while self-managed HOAs gravitate towards fixed, low-cost starter plans focusing on core features to align with limited volunteer budgets.

What opportunities exist for vendors in the Middle East and Africa (MEA) region?

The opportunity in MEA is concentrated around supporting large-scale, planned, high-end residential and mixed-use developments, which require sophisticated, often customized, software for complex facilities and premium concierge-style resident service portals.

How does specialized software aid in managing architectural review processes?

Specialized modules automate the architectural review process by allowing residents to submit applications digitally, facilitating digital routing to the board/committee members, tracking approval timelines, and archiving documentation for audit compliance.

What is the primary trend observed in the deployment segment?

The primary trend is the near-total migration towards Web-based/Cloud (SaaS) deployment, driven by the need for remote accessibility, reduced infrastructure maintenance, and the continuous innovation capabilities offered by the subscription service model.

How do leading software providers ensure data integrity during system migrations?

Leading providers employ specialized data migration teams, utilize proprietary data mapping tools, and conduct extensive testing and parallel runs to ensure that all historical financial and owner data is accurately and securely transferred to the new platform without corruption or loss.

What are the most common restraints related to user adoption?

Common restraints include a steep learning curve for non-technical users, resistance to change among established board members, and difficulty in achieving full resident participation in online portals, necessitating robust training and change management protocols.

In the context of the supply chain, what are crucial upstream components?

Crucial upstream components include securing reliable and scalable cloud hosting infrastructure, developing proprietary accounting logic compliant with industry standards, and ensuring robust API licensing for essential third-party financial and legal integrations.

What differentiates modern HOA communication tools from standard email?

Modern tools offer targeted communication based on location or owner status, provide verifiable receipt logs for legal compliance, integrate urgent text/SMS alerts for emergencies, and centralize all correspondence within the management platform, unlike generic email.

How is the market addressing the demand for real-time reporting?

The market is addressing this demand through integrated Business Intelligence (BI) dashboards that refresh instantaneously, providing board members and managers with up-to-the-minute metrics on cash flow, assessment delinquency rates, and active maintenance work orders.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager