Homogeneous Flooring Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432091 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Homogeneous Flooring Market Size

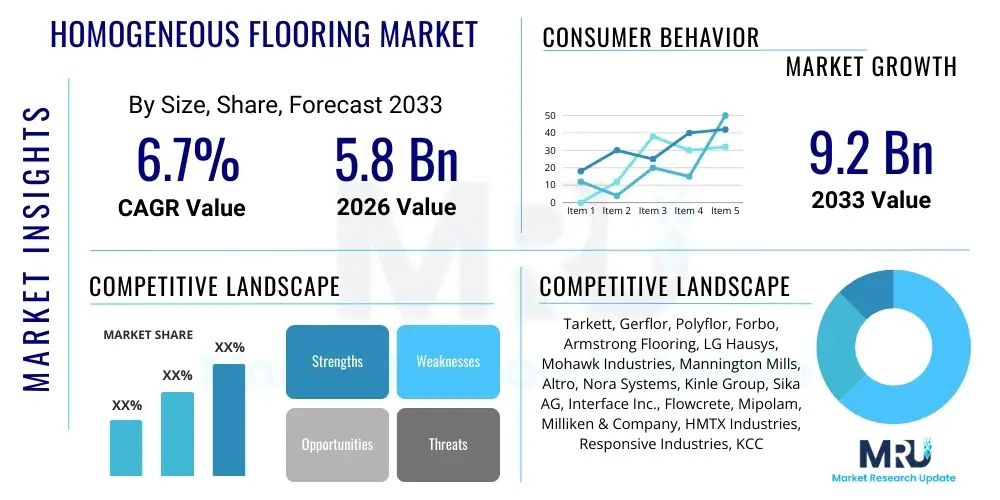

The Homogeneous Flooring Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.7% between 2026 and 2033. The market is estimated at $5.8 Billion USD in 2026 and is projected to reach $9.2 Billion USD by the end of the forecast period in 2033. This growth trajectory is primarily fueled by increasing demand from institutional sectors, particularly healthcare and education, which require durable, easy-to-maintain, and highly hygienic floor coverings. Furthermore, advancements in manufacturing technology allowing for complex color schemes and enhanced performance characteristics, such as better slip resistance and reduced volatile organic compound (VOC) emissions, are contributing significantly to market expansion.

Homogeneous Flooring Market introduction

Homogeneous flooring refers to resilient floor coverings, typically composed of polyvinyl chloride (PVC) or rubber, manufactured in a single layer throughout its thickness. Unlike heterogeneous flooring, which utilizes multiple stacked layers (wear layer, printed layer, backing), homogeneous products feature a uniform composition and pattern from top to bottom. This structural uniformity ensures that the material retains its appearance even after extensive wear and repeated polishing or refinishing processes, making it ideal for high-traffic environments where longevity and low maintenance are paramount concerns. Key characteristics include superior durability, excellent indentation resistance, and inherent hygiene properties due to their seamless installation capabilities.

Major applications of homogeneous flooring span critical institutional and commercial sectors. Healthcare facilities utilize these floors extensively in patient rooms, operating theaters, and corridors due to their ability to withstand heavy rolling loads, resistance to chemical spills, and the ease of achieving aseptic conditions. Similarly, the education sector relies on these materials for classrooms, libraries, and hallways, benefiting from their acoustic properties and extreme longevity under sustained student traffic. Furthermore, advancements in sustainable formulations, including the incorporation of recycled content and bio-plasticizers, are enhancing the market appeal, aligning with global trends toward greener building materials and contributing significantly to the widespread adoption of these solutions across various geographies.

The primary driving factors supporting market growth include stringent regulatory standards concerning hygiene and indoor air quality in public buildings, particularly in developed economies. The versatility of homogeneous flooring, offering a robust balance between cost-effectiveness and performance over its extensive lifecycle, positions it favorably against alternatives like ceramic tiles or certain types of linoleum. Market players are continually innovating, introducing specialized variants designed for specific needs, such as conductive flooring for sensitive data centers or static dissipative options for laboratories, further solidifying the material’s relevance across a diverse range of high-specification commercial and industrial settings worldwide.

Homogeneous Flooring Market Executive Summary

The Homogeneous Flooring Market is experiencing robust expansion driven by global infrastructure development in healthcare and educational sectors, necessitating flooring solutions that offer superior wear resistance and hygiene standards. Key business trends indicate a strong focus on sustainability, pushing manufacturers to invest heavily in circular economy principles, optimizing production processes for reduced waste, and developing low-VOC or completely phthalate-free product lines. Regional trends show Asia Pacific emerging as the fastest-growing market, primarily fueled by rapid urbanization, significant investments in new public infrastructure projects in countries like China and India, and increasing awareness regarding the long-term cost benefits associated with resilient flooring materials, especially compared to short-lived alternatives.

Segment trends highlight the dominance of the PVC-based segment due to its superior cost-to-performance ratio and established manufacturing base, although non-PVC alternatives, such as rubber homogeneous flooring, are gaining traction in niche applications requiring high ergonomic properties and specific chemical resistances. The Application segment analysis reveals that Healthcare remains the largest end-user, demanding specialized antibacterial and antiviral properties in flooring systems, while the Education segment shows consistent growth owing to large-scale renovation and new school construction programs globally. Furthermore, aesthetic preferences are shifting towards subtle, sophisticated designs and solid colors, moving away from heavily speckled patterns, reflecting contemporary architectural trends emphasizing minimalism and clean lines in commercial interiors.

The competitive landscape is characterized by established multinational corporations vying with regional players through strategic acquisitions and intense product differentiation focusing on digital printing technologies for enhanced design versatility and improved surface treatments for easier cleaning and maintenance. Pricing strategies are becoming increasingly competitive, particularly in emerging economies, where localized manufacturing is gaining prominence to mitigate logistical costs and reduce lead times. Overall, the market remains moderately consolidated, but innovation in material science, focusing on enhanced environmental certifications and improved installation methods (such as loose-lay systems), is a crucial determinant of market leadership and sustained profitability throughout the forecast period ending in 2033.

AI Impact Analysis on Homogeneous Flooring Market

User queries regarding AI's influence on the Homogeneous Flooring Market typically revolve around optimizing manufacturing efficiency, enhancing quality control through automated inspection, and leveraging predictive analytics for demand forecasting and inventory management. Key themes include the implementation of AI-driven smart factory solutions to reduce material waste during the calendering and pressing processes, leading to cost savings and improved sustainability metrics. Users are also keen on understanding how AI can personalize design options, potentially enabling architects and designers to rapidly visualize and procure highly customized floor patterns based on complex aesthetic parameters or operational requirements. The primary concern often centers on the initial investment costs associated with adopting AI and automation technologies, and the necessity for upskilling the existing workforce to manage these sophisticated systems effectively.

AI's role in the manufacturing sector of resilient flooring is evolving rapidly, moving beyond basic automation. It facilitates real-time monitoring of production lines, ensuring precise control over variables such as temperature, pressure, and material flow, which are critical for maintaining the uniform structure and dimensional stability inherent to high-quality homogeneous products. Furthermore, sophisticated machine vision systems powered by AI are capable of detecting minute surface defects that would be undetectable by human inspectors, dramatically increasing the throughput of flawless materials. This level of precision is essential for meeting the stringent quality requirements mandated by high-end institutional customers, such as those in pharmaceutical clean rooms or high-security data centers requiring zero-tolerance defect standards for their resilient flooring installations.

In the commercial domain, AI significantly impacts market strategy and customer engagement. Predictive modeling, utilizing historical sales data, construction project timelines, and macroeconomic indicators, allows manufacturers to forecast regional demand variations with greater accuracy, optimizing supply chain logistics and reducing storage costs. Moreover, AI-powered design tools are emerging, allowing end-users to input functional requirements (e.g., foot traffic level, required chemical resistance, specific color codes) and instantaneously generate viable homogeneous flooring options that meet all specifications, streamlining the specification process for large-scale construction projects and enhancing the overall speed of project completion within the construction industry ecosystem.

- AI-driven optimization of material compounding and thermal processing for structural integrity.

- Automated defect detection using machine vision systems for real-time quality assurance.

- Predictive maintenance scheduling for calendering and embossing machinery, minimizing downtime.

- Enhanced demand forecasting and supply chain optimization through machine learning algorithms.

- AI-enabled design tools offering rapid customization and aesthetic simulation for architects.

- Optimization of energy consumption during the curing and pressing phases of production.

DRO & Impact Forces Of Homogeneous Flooring Market

The dynamics of the Homogeneous Flooring Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively summarized as the DRO framework, alongside external Impact Forces such as technological shifts and regulatory changes. The primary Drivers revolve around the stringent hygiene requirements in institutional settings, the superior longevity and low lifecycle cost of homogeneous materials compared to alternatives, and the accelerating pace of hospital and school construction globally, particularly in developing nations. These factors create sustained foundational demand, ensuring the market's continuous expansion and attracting capital investments into production capacity optimization across major manufacturing hubs, predominantly in Asia and Europe.

However, significant Restraints challenge market growth, notably the price volatility of key raw materials, primarily PVC resin, plasticizers, and pigments, which are susceptible to fluctuations in crude oil and petrochemical markets. Furthermore, environmental concerns regarding the long-term disposal and recyclability of PVC-based products, despite industry efforts toward sustainable formulations (e.g., bio-based plasticizers and improved recycling schemes), pose a regulatory and consumer perception hurdle, especially in environmentally conscious Western European markets. The requirement for professional, seamless installation, which demands skilled labor, also acts as a minor restraint, potentially limiting adoption in regions where qualified installation specialists are scarce or costly, complicating large-volume project rollouts.

The key Opportunities lie in the shift towards sustainable and bio-based homogeneous flooring options, leveraging advanced polymer technology to create high-performance, environmentally certified products that meet stringent green building standards like LEED and BREEAM. Moreover, geographical expansion into untapped markets in Africa and Latin America, coupled with diversification into specialized industrial applications (e.g., logistics centers and specialized manufacturing plants requiring static control), presents significant revenue potential. The ongoing development of user-friendly installation systems, such as advanced adhesives or specialized click-lock mechanisms designed for homogeneous materials, will further facilitate faster project completion and lower labor costs, enhancing overall market penetration and competitive positioning against traditional hard surfaces.

Segmentation Analysis

The Homogeneous Flooring Market is primarily segmented based on material type, application, and distribution channel, providing a granular view of market dynamics and regional preferences. The Material Type segmentation delineates between PVC-based, Rubber-based, and other specialty polymer compositions, with PVC dominating due to its versatility, cost-effectiveness, and established chemical resistance profile suitable for most institutional environments. Application segmentation is critical, highlighting the varying demands and specifications required by major end-users such as Healthcare (which demands anti-microbial properties and seamless installation), Education (prioritizing durability and acoustic dampening), and Retail (focusing on aesthetic flexibility and high abrasion resistance). These segmentations are crucial for manufacturers to tailor their product development and strategic marketing efforts effectively.

- Material Type

- Polyvinyl Chloride (PVC)

- Rubber

- Other Polymers (e.g., Polyurethane, Specialty Vinyls)

- Application

- Healthcare Facilities (Hospitals, Clinics, Laboratories)

- Educational Institutions (Schools, Universities, Daycares)

- Commercial Spaces (Offices, Retail Stores, Shopping Centers)

- Sports and Leisure Facilities (Gyms, Indoor Arenas)

- Industrial & Transportation (Manufacturing Plants, Airports, Trains)

- Color/Design

- Solid Color

- Speckled/Chip Design

- Marbled/Textured

- Distribution Channel

- Direct Sales (B2B)

- Distributors/Wholesalers

- Online Retail

Value Chain Analysis For Homogeneous Flooring Market

The value chain for the homogeneous flooring market begins with upstream activities, focusing on the procurement and processing of fundamental raw materials. This phase involves sourcing petrochemical derivatives, primarily PVC resin, plasticizers (increasingly non-phthalate or bio-based), stabilizers, pigments, and fillers (such as calcium carbonate). Key suppliers in the chemical and polymer industries play a crucial role, as the quality and pricing of these inputs directly impact the final product cost and performance characteristics. Manufacturers then engage in compounding and mixing processes, where these raw materials are blended precisely before undergoing thermal processing, typically calendering or continuous pressing, to form the single, uniform layer characteristic of homogeneous flooring, ensuring dimensional stability and pattern integrity throughout the entire thickness.

The midstream segment involves the core manufacturing process, followed by quality control, surface treatment (e.g., PUR reinforcement for enhanced durability and easy cleaning), cutting, and packaging. After manufacturing, the products enter the downstream segment, where distribution channels play a critical role. Direct sales models are prevalent for large institutional projects (hospitals or major public tenders), allowing manufacturers direct control over logistics and installation support. Conversely, indirect distribution utilizes a robust network of regional distributors, specialized flooring wholesalers, and general building material retailers, particularly for smaller commercial projects and maintenance purchases, ensuring broad geographic reach and inventory accessibility.

Installation and post-sales services form the final critical stages of the value chain. Highly specialized installers are essential for homogeneous flooring, especially in clinical environments where seamless, welded installations are required for hygiene compliance. Customer relationships are maintained through long-term maintenance contracts, focusing on specific cleaning requirements and wear layer restoration techniques (e.g., polishing or light grinding) unique to homogeneous materials, thereby ensuring the longevity promised by the product. Efficiency in this value chain is increasingly reliant on digitalization, using BIM (Building Information Modeling) and integrated supply chain management software to connect raw material suppliers, manufacturers, and installation contractors, optimizing project turnaround times.

Homogeneous Flooring Market Potential Customers

The primary consumers and end-users of homogeneous flooring are typically large organizations and institutions that prioritize operational efficiency, longevity, and stringent hygiene standards over immediate upfront cost. The largest single customer segment is the Healthcare sector, including public and private hospitals, specialized clinics, pharmaceutical laboratories, and elderly care homes. These facilities require flooring that can withstand heavy traffic, frequent chemical cleaning, provide seamless barriers against contaminants, and often incorporate specific anti-static or conductive properties for equipment protection. The purchasing cycle is usually long, involving detailed specifications from architects, project managers, and infection control specialists, favoring suppliers with strong technical support and verifiable certification compliance.

Another major customer base includes educational institutions, ranging from primary schools and high schools to universities and research centers. Customers in this segment seek extremely durable, low-maintenance, and cost-effective flooring that can withstand aggressive abrasion from heavy foot traffic, chair movements, and potential spills, while also contributing positively to the indoor acoustic environment. Government procurement policies often influence purchasing decisions here, favoring products with high sustainability ratings and long warranties. Furthermore, homogeneous flooring is increasingly specified for public buildings such as municipal offices, libraries, and transport hubs (airports and train stations), where the blend of robust performance and ease of restoration provides a superior lifecycle value compared to alternative flooring options available in the construction market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.8 Billion USD |

| Market Forecast in 2033 | $9.2 Billion USD |

| Growth Rate | 6.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tarkett, Gerflor, Polyflor, Forbo, Armstrong Flooring, LG Hausys, Mohawk Industries, Mannington Mills, Altro, Nora Systems, Kinle Group, Sika AG, Interface Inc., Flowcrete, Mipolam, Milliken & Company, HMTX Industries, Responsive Industries, KCC Corporation, Zhejiang Tianhui. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Homogeneous Flooring Market Key Technology Landscape

The technological landscape of the homogeneous flooring market is predominantly characterized by continuous process advancements aimed at improving material composition, enhancing surface performance, and optimizing manufacturing efficiency. The foundational technology remains calendering and pressing, where compounded raw materials are processed through heavy rollers under high heat and pressure to achieve the required density and uniform thickness. Recent innovations focus heavily on closed-loop manufacturing systems and automation, ensuring precise material feed rates and temperature control to eliminate internal stresses and defects, thereby guaranteeing the dimensional stability critical for high-quality installation, especially in large, seamless areas required by institutional clients. A major technological thrust involves developing advanced coating technologies, particularly factory-applied polyurethane (PUR) surface treatments, which significantly boost resistance to scratching, staining, and chemical attack, reducing the need for traditional waxing and stripping procedures and drastically lowering long-term maintenance costs.

Material science innovation represents the second crucial pillar of the technology landscape. Leading manufacturers are investing heavily in research and development to transition away from traditional phthalate plasticizers towards safer, bio-based or alternative non-phthalate plasticizers, meeting increasingly stringent European Union regulations (REACH) and consumer demands for improved indoor air quality (low VOC emissions). Furthermore, there is continuous improvement in antibacterial and antiviral additive technologies integrated directly into the flooring compound or surface treatment. These specialized additives utilize mechanisms such as silver ion technology or natural organic compounds to actively inhibit microbial growth, making the flooring surface hostile to pathogens, which is a paramount requirement for healthcare applications and a major differentiator in the competitive market.

Beyond material and surface treatments, installation technology is also seeing significant innovation. While traditional homogeneous flooring requires skilled hot-welding for seamless seams, manufacturers are developing specialized flexible adhesives and semi-rigid backing systems that facilitate faster, cleaner, and less labor-intensive installation. The development of loose-lay homogeneous products, although challenging due to the inherent flexibility and weight of the material, aims to minimize adhesive use and allow for easier replacement, catering to the modularity demands of modern commercial construction. Furthermore, digital printing technology, long established in heterogeneous flooring, is slowly being adapted for homogeneous products, potentially allowing for greater aesthetic complexity and realistic textural effects without compromising the uniform material depth, although this adaptation is highly challenging due to the single-layer structure.

Regional Highlights

The global Homogeneous Flooring Market exhibits distinct growth patterns across major geographical regions, influenced by economic development, construction standards, and regulatory environments. North America, characterized by mature healthcare infrastructure and high spending on commercial renovations, maintains a significant market share. The United States and Canada adhere to strict building codes (e.g., ADA compliance and specific requirements for hospital environments), favoring high-performance, durable, and certified flooring solutions. Growth in this region is stable, driven primarily by replacement cycles and the increasing adoption of sustainable, low-VOC products, with consumers and specifiers paying premium prices for products with robust environmental accreditations like FloorScore and Declare Labels. Key demand drivers include expanding outpatient facilities and modernization projects within aging university campuses, focusing on products that offer superior acoustic dampening and ergonomic comfort for staff.

Europe represents a technologically advanced and highly competitive market, marked by stringent environmental regulations (e.g., focused restrictions on certain chemical additives and emphasis on end-of-life recycling). Countries like Germany, France, and the Nordics are leaders in demanding certified phthalate-free and bio-based flooring, pushing manufacturers to continuously innovate their material formulations and production practices to comply with local certifications such as Blue Angel. While the European construction sector shows moderate, steady growth, the replacement market is extremely strong, with institutional buyers consistently investing in high-quality, long-life products from established regional manufacturers known for their sustainability commitments. The high density of hospitals and educational facilities, coupled with a cultural preference for robust materials, sustains strong demand for premium homogeneous solutions in both public and private sectors across the continent.

Asia Pacific (APAC) stands out as the primary engine for future market expansion, registering the highest projected CAGR during the forecast period. This rapid growth is attributable to massive government investments in infrastructure, fueled by swift urbanization and population growth in developing economies like China, India, and Southeast Asian nations. The region is seeing unprecedented construction of new healthcare facilities, schools, and commercial centers, often leapfrogging older construction standards directly to modern, high-performance materials. While price sensitivity remains a factor, the escalating awareness regarding hygiene and safety, particularly post-pandemic, is accelerating the adoption of homogeneous flooring in institutional settings. Localized manufacturing capacities are rapidly increasing in APAC, often benefiting from lower production costs, although quality control and adherence to global sustainability standards remain key competitive challenges for regional players seeking international market entry.

Latin America (LATAM) and the Middle East & Africa (MEA) currently hold smaller, yet rapidly emerging, market shares. In the Middle East, large-scale, high-value construction projects, including state-of-the-art hospitals, luxurious commercial complexes, and extensive airport expansions in nations like the UAE and Saudi Arabia, are driving demand for high-end, aesthetically sophisticated homogeneous flooring. Climate resilience and heat stability are specific product requirements unique to this region. In Africa, market penetration is relatively low but is expected to accelerate, particularly in South Africa and Nigeria, driven by growing investments in public health infrastructure and rising foreign direct investment in commercial property development, demanding cost-effective and durable flooring solutions that can withstand challenging environmental conditions and high utilization rates.

- Asia Pacific (APAC): Highest growth market driven by urbanization, infrastructure spending in China and India, and rising demand for hygienic hospital flooring.

- Europe: Mature market focused on sustainability, demanding bio-based and phthalate-free products, driven by stringent regulatory frameworks (REACH).

- North America: Stable growth fueled by healthcare and educational renovation projects, emphasizing high durability and adherence to specialized safety standards (e.g., slip resistance).

- Middle East & Africa (MEA): Emerging market characterized by large-scale, high-value commercial and transport infrastructure developments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Homogeneous Flooring Market.- Tarkett S.A.

- Gerflor Group

- Polyflor International

- Forbo Holding AG

- Armstrong Flooring, Inc.

- LG Hausys (LX Hausys)

- Mohawk Industries, Inc. (IVC Commercial)

- Mannington Mills, Inc.

- Altro Limited

- Nora Systems GmbH (A part of Interface Inc.)

- Kinle Group

- Sika AG

- Interface Inc.

- Flowcrete (Part of RPM International)

- Mipolam (Gerflor Brand)

- Milliken & Company

- HMTX Industries

- Responsive Industries Ltd.

- KCC Corporation

- Zhejiang Tianhui Industrial Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Homogeneous Flooring market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between homogeneous and heterogeneous flooring?

Homogeneous flooring consists of a single layer with uniform composition and pattern throughout its thickness, offering high durability and restorability. Heterogeneous flooring, conversely, is multi-layered, featuring a printed design layer and often a foam or fiberglass backing, which is generally less expensive but cannot be fully refinished like homogeneous types.

Which application segment drives the highest demand for homogeneous flooring globally?

The Healthcare sector is the largest end-user segment for homogeneous flooring, driven by stringent requirements for hygiene, seamless installation (preventing microbial growth), chemical resistance, and the ability to withstand heavy rolling traffic and intense cleaning protocols, ensuring a long material lifecycle.

Are there sustainable or eco-friendly options available in the homogeneous flooring market?

Yes, sustainability is a major trend. Manufacturers are increasingly producing phthalate-free vinyl options, incorporating recycled content, and utilizing bio-based plasticizers to improve the environmental profile. Products with low VOC emissions and specific green building certifications are highly preferred in mature markets like Europe and North America.

What are the key technical advantages of homogeneous PVC flooring over standard vinyl products?

Homogeneous PVC flooring offers superior wear resistance and can be repeatedly refurbished (buffed or polished) without affecting the pattern, extending its life cycle significantly. Its single-layer construction provides better indentation resistance and inherent durability critical for areas with extreme foot traffic, such as corridors and public lobbies.

How does the volatile price of PVC resin impact the market?

Price volatility in PVC resin, derived from petrochemicals, is a significant restraint. Fluctuations directly affect the manufacturing cost of homogeneous flooring, potentially leading to variable product pricing and impacting profit margins, particularly for companies that do not have integrated backward supply chains for raw material production.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager