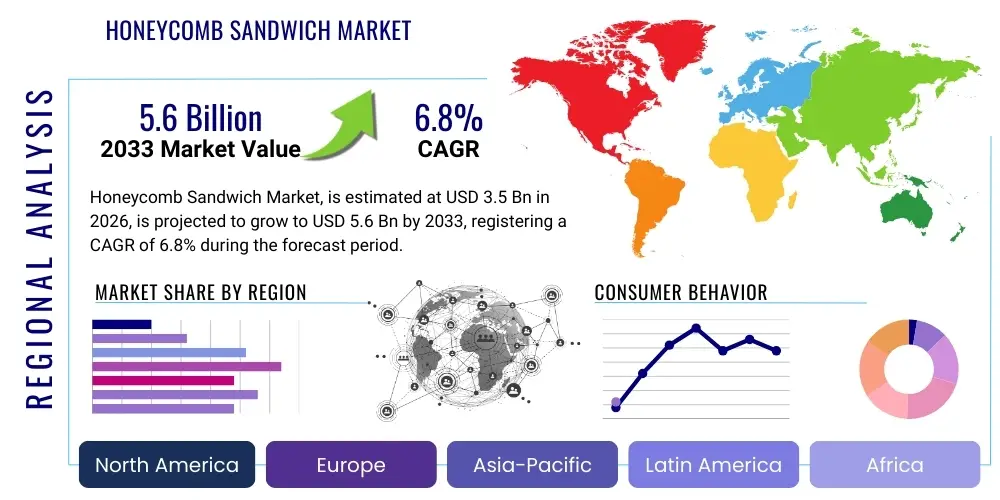

Honeycomb Sandwich Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439065 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Honeycomb Sandwich Market Size

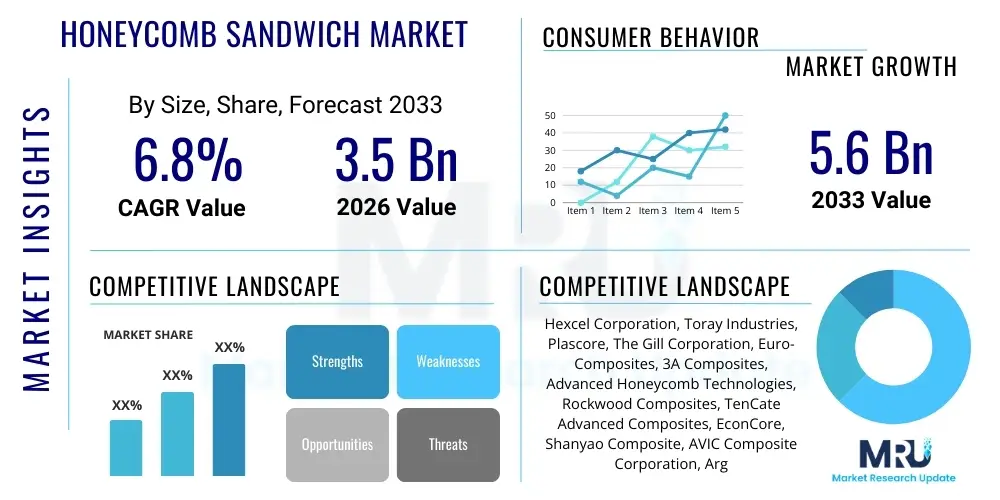

The Honeycomb Sandwich Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.6 Billion by the end of the forecast period in 2033.

Honeycomb Sandwich Market introduction

Honeycomb sandwich structures represent advanced composite materials characterized by an optimized ratio of high strength-to-weight and exceptional rigidity. These structures typically consist of a lightweight core material, frequently resembling a hexagonal honeycomb structure, sandwiched between two thin, strong facing sheets (skins). The fundamental design principle leverages the geometry of the honeycomb core to efficiently resist shear forces and buckling, while the facings handle tensile and compressive loads. This construction methodology allows for significant material savings and subsequent weight reduction, which is critically important in performance-driven applications such as aerospace, high-speed rail, and advanced automotive manufacturing.

The primary applications of honeycomb sandwiches span critical sectors demanding lightweighting and structural integrity. In the aerospace industry, these composites are indispensable for manufacturing aircraft interiors, leading edges, flaps, bulkheads, and flooring. Their use reduces fuel consumption and enhances payload capacity. Furthermore, in the construction sector, they are utilized in prefabricated walls, facade panels, and cleanroom environments where acoustic damping and thermal insulation are valued alongside lightweight installation. The versatility of core materials, which range from aluminum and aramid paper (Nomex) to thermoplastic and specialized fiber-reinforced plastics, allows customization for specific environmental and performance requirements, including fire resistance, moisture resistance, and extreme temperature tolerance.

Major driving factors include the intensifying global focus on fuel efficiency and emissions reduction in transportation sectors, particularly commercial aviation and electric vehicles. The inherent benefits of honeycomb structures—superior energy absorption, high impact resistance, and customizable material combinations—position them as preferred alternatives to traditional monolithic materials. The rapid expansion of wind energy infrastructure, requiring large, rigid, yet lightweight turbine blades, also significantly contributes to market growth. Additionally, advancements in manufacturing technologies, such as automated layup and enhanced bonding agents, are improving production efficiency and lowering the cost barriers associated with these high-performance materials.

Honeycomb Sandwich Market Executive Summary

The Honeycomb Sandwich Market is experiencing robust growth driven predominantly by the escalating demand for lightweight, high-performance materials across strategic industries. Current business trends indicate a strong shift towards non-metallic and thermoplastic honeycomb cores, offering enhanced design flexibility and recyclability compared to traditional aluminum cores. Key manufacturers are focusing heavily on vertical integration and investing in automation technologies, specifically resin infusion processes and robotic assembly, to meet the stringent quality control standards required by the aerospace and defense sectors. Furthermore, there is a clear trend toward developing specialized composite cores with inherent fire, smoke, and toxicity (FST) properties, particularly crucial for mass transit and commercial aircraft applications.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, primarily fueled by massive infrastructure development, expansion of domestic aircraft fleets in countries like China and India, and surging production in the automotive and wind energy sectors. North America and Europe, while mature, remain dominant in terms of technological innovation and consumption of high-specification, carbon fiber-based honeycomb structures, driven by defense spending and established aerospace primes. Strategic partnerships between raw material suppliers, core manufacturers, and end-use fabricators are crucial for establishing localized supply chains and navigating complex regulatory environments, particularly those concerning material certifications.

Segmentation trends reveal that the aerospace and defense application segment maintains the largest market share due to the high material value and strict certification requirements. However, the construction and automotive sectors are projected to exhibit higher growth rates, driven by the need for quick-assembly, energy-efficient building solutions and the electric vehicle (EV) revolution, which relies heavily on lightweight materials for extending battery range. By material type, aramid-based honeycombs (like Nomex) are dominating based on their excellent FST characteristics and superior performance-to-cost ratio, though carbon fiber cores are gaining traction in premium, ultra-lightweight applications where cost constraints are less severe.

AI Impact Analysis on Honeycomb Sandwich Market

Analysis of common user questions related to the impact of Artificial Intelligence (AI) on the Honeycomb Sandwich Market reveals significant interest in optimization, quality control, and predictive maintenance. Users frequently inquire about how AI can accelerate the complex material design process, specifically regarding optimizing cell geometry and material combinations for specific load cases. A core concern revolves around leveraging machine learning to detect subtle manufacturing defects (e.g., unbonded areas, core crushing) during automated production, which are often invisible to traditional non-destructive testing (NDT) methods. Expectations center on AI dramatically reducing material waste and improving the traceability and certification timeline for highly regulated applications like civil aviation, making the production process more efficient and reliable.

AI's primary influence is expected to manifest in two critical areas: optimizing the structural design phase and enhancing manufacturing precision. In design, generative AI algorithms can quickly iterate through thousands of potential honeycomb core geometries, fiber orientations, and adhesive selections to achieve optimal mechanical properties (stiffness, damping, acoustic performance) while minimizing weight. This capability drastically reduces the time and cost associated with physical prototyping and simulation. For instance, AI models can predict the precise behavior of a panel under complex loading conditions, such as impact or fatigue, allowing engineers to refine designs before the tooling stage, a major bottleneck in traditional composite manufacturing.

On the production floor, AI-powered computer vision and sensor fusion technologies are transforming quality assurance. AI systems analyze real-time data from ultrasonic testing, thermal imaging, and pressure sensors during the bonding and curing phases. By identifying anomalies that correlate with future failure points, these systems ensure higher fidelity bonding and consistency across large production runs. Furthermore, AI contributes to predictive maintenance of production equipment, minimizing costly downtime associated with high-precision machinery like CNC cutters and automated layup systems, thereby sustaining high throughput levels required by increasing market demand.

- AI-driven topology optimization for core cell design, maximizing strength-to-weight ratio.

- Machine learning algorithms enhance NDT processes, detecting micro-defects in adhesive bonding layers.

- Predictive maintenance of high-precision composite manufacturing equipment, ensuring minimal downtime.

- Automated analysis of certification data, streamlining material traceability and compliance reporting.

- Simulation enhancement through AI, rapidly predicting panel performance under complex loading scenarios (impact, vibration).

DRO & Impact Forces Of Honeycomb Sandwich Market

The dynamics of the Honeycomb Sandwich Market are shaped by a complex interplay of Drivers (D), Restraints (R), and Opportunities (O), which collectively dictate the Impact Forces. A primary driver is the pervasive global mandate for lightweighting across aerospace and automotive industries to meet stringent fuel efficiency and emission standards. The inherent structural efficiency of honeycomb composites provides a direct solution to these industry pressures, pushing traditional materials like aluminum and steel out of high-performance applications. Simultaneously, the rapid growth in wind energy, demanding longer, more resilient rotor blades, further strengthens market momentum. However, restraints persist, notably the high initial cost associated with raw materials (especially carbon fiber and aramid paper) and the complexity and high cost of manufacturing and repair processes, requiring specialized skilled labor and capital investment in autoclave and curing facilities. Opportunities lie in the emerging application of thermoplastic honeycombs, offering cost-effective, recyclable, and easily formable alternatives, alongside the expansion into marine and high-speed train manufacturing.

Impact forces are currently dominated by the regulatory environment and technological maturity. Regulatory demands from bodies like the FAA and EASA regarding FST (Fire, Smoke, Toxicity) performance in aircraft interiors necessitate constant material innovation, favoring high-performance materials like Nomex and specialty glass fiber cores. The technological impact force relates to continuous improvements in adhesive technology and non-autoclave manufacturing methods (like vacuum infusion and rapid curing systems) that lower production barriers and make these materials accessible to a broader range of industrial applications beyond traditional aerospace. Geopolitical stability also plays an indirect role, as defense spending remains a significant consumer of high-grade aluminum and carbon fiber honeycomb panels.

The long-term market sustainability hinges on overcoming cost barriers through scaling production and material substitution. The opportunity to integrate honeycomb structures into mass-market electric vehicle platforms, particularly for battery protection and structural chassis elements, represents a massive potential inflection point. If manufacturers can standardize production processes and reduce the complexity of repair in non-critical applications, the market growth rate will likely accelerate beyond current projections. Conversely, any sustained economic downturn impacting global aircraft orders or construction projects would represent a severe constraint due to the significant upfront capital required for these specialty materials.

Segmentation Analysis

The Honeycomb Sandwich Market is extensively segmented based on core material type, skin material, application, and end-use industry, reflecting the diverse performance requirements across various sectors. This segmentation allows manufacturers to tailor products precisely, balancing parameters such as weight, cost, fire resistance, and stiffness. The material segmentation is critical, as it defines the structural integrity and environmental resistance of the final product. Aluminum cores are favored for high-strength, high-temperature applications; aramid (Nomex) cores dominate commercial aerospace interiors due to their superior FST properties, while thermoplastic cores are gaining traction in cost-sensitive, recyclable industrial uses.

Application segmentation clarifies where the highest value resides, with Aerospace and Defense being the largest segment by revenue due to strict performance demands and high material costs. However, sectors like Construction (facades, cleanrooms) and Wind Energy (rotor blades) are rapidly increasing their consumption volume, driving demand for larger-format, cost-effective honeycomb panels. The automotive segment, focusing on electric vehicle components and lightweight structural elements, is expected to exhibit the fastest growth over the forecast period as manufacturers seek proven lightweighting solutions to maximize battery range and comply with stringent safety standards.

Understanding these segments is essential for strategic planning, allowing companies to focus R&D efforts on emerging material technologies, such as advanced carbon fiber composites for high-end applications or sustainable, bio-based core materials for eco-conscious construction projects. The market structure emphasizes a shift from traditional, heavy materials towards highly engineered, multi-functional composite structures that offer integrated benefits, including improved acoustics, thermal insulation, and electromagnetic shielding, broadening the potential customer base significantly beyond conventional engineering sectors.

- By Core Material Type: Aluminum, Aramid (Nomex/Kevlar), Fiberglass, Carbon Fiber, Thermoplastic (Polypropylene, Polycarbonate), Paper/Wood.

- By Skin Material Type: Fiberglass, Carbon Fiber, Aluminum, Specialty Composites, Steel.

- By Application: Aerospace & Defense (Interior panels, radomes, wings, floors), Automotive & Transportation (EV components, rail cars), Construction (Facades, cleanrooms, partitions), Marine (Yachts, high-speed ferries), Wind Energy (Rotor blades), Others (Sports equipment, Medical).

- By End-Use Industry: Commercial, Military, Industrial.

Value Chain Analysis For Honeycomb Sandwich Market

The value chain for the Honeycomb Sandwich Market is highly complex, beginning with the upstream supply of specialized raw materials. The upstream segment involves the production of critical components such as high-grade aluminum foils, aramid papers (like DuPont’s Nomex), advanced carbon and glass fibers, and specialized structural adhesives/resins (epoxies, phenolics). This stage is characterized by high capital intensity and requires sophisticated chemical processing and quality control to ensure material properties meet aerospace and defense standards. The performance and cost of the final honeycomb panel are directly tied to the quality and price volatility of these upstream inputs. Consolidation among primary raw material suppliers often dictates pricing power and innovation capacity within the entire chain.

The midstream segment involves the core manufacturing process, where raw materials are converted into honeycomb slices and blocks through expansion, slicing, and corrugation techniques, followed by the crucial step of lamination and bonding to the skin materials. Specialized fabricators and core manufacturers dominate this stage, applying patented expansion processes and proprietary bonding techniques. Distribution channels are typically dual: direct and indirect. Direct distribution is prevalent for large, highly customized orders, especially in aerospace, where manufacturers work closely with Tier 1 suppliers or aircraft OEMs to deliver certified structural parts. This ensures traceability and compliance with rigid design specifications.

Indirect distribution involves specialized distributors and composite material suppliers who cater to smaller industrial customers, marine, and general construction sectors. Downstream activities involve final assembly, integration, and repair/maintenance. End-users, such as aircraft maintenance organizations (MROs) or large construction firms, take the finished panels and integrate them into final structures. The effectiveness of the value chain relies heavily on robust logistics for transporting large, yet fragile, panels and ensuring rigorous quality assurance (QA) throughout the entire process, given the critical nature of these components in structural applications.

The market trend shows increased vertical integration, with core manufacturers acquiring or partnering with facing material producers or panel fabricators to gain control over the entire production cycle, thereby optimizing cost structures and speed to market. This strategy is particularly important for high-volume, standardized products demanded by the burgeoning EV and wind energy markets, mitigating supply chain risks associated with specialized bonding agents and curing technologies.

Honeycomb Sandwich Market Potential Customers

The primary end-users and buyers of Honeycomb Sandwich products are concentrated in industries that place a premium on structural efficiency, weight reduction, and safety compliance. The largest and most demanding customer segment is the Aerospace Industry, encompassing commercial aircraft OEMs (e.g., Boeing, Airbus), military aircraft manufacturers, and MRO facilities. These customers utilize honeycomb panels for everything from interior cabins, galleys, luggage bins, and lavatories (requiring FST compliance) to critical exterior flight control surfaces and radomes (requiring high strength and stiffness). The purchase decisions in this segment are highly regulated, driven by long certification cycles, and focused on specified materials like Nomex and specialized aluminum cores.

The second major segment includes the Transportation sector, specifically high-speed rail manufacturers and, increasingly, the Electric Vehicle (EV) industry. Rail manufacturers use honeycombs for interior panels, doors, and floors to reduce train mass, enhancing energy efficiency and speed. EV manufacturers are rapidly adopting these materials for battery enclosures, structural floor components, and crash protection systems where the energy absorption capabilities and ultra-lightweight nature of composite sandwich panels are critical to extending driving range and ensuring safety. Automotive customers typically seek high-volume, cost-effective thermoplastic or low-density aluminum cores manufactured via automated, non-autoclave methods.

Other significant buyers include the Construction and Marine sectors. Construction firms use honeycomb panels for lightweight, modular building elements, high-performance facades, and cleanroom environments where inert, easy-to-clean surfaces are required. The Marine sector uses them for yacht hulls, decks, and bulkheads in high-speed vessels where weight is a primary factor determining fuel consumption and speed. Customers in the Wind Energy sector require large volumes of structural honeycomb materials (often specialized foam/honeycomb hybrids) for the root and shear webs of large turbine blades, demanding materials that offer excellent fatigue resistance and structural rigidity over decades of operation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.6 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hexcel Corporation, Toray Industries, Plascore, The Gill Corporation, Euro-Composites, 3A Composites, Advanced Honeycomb Technologies, Rockwood Composites, TenCate Advanced Composites, EconCore, Shanyao Composite, AVIC Composite Corporation, Argosy International, ACP Composites, Composite Panel Solutions, General Plastics, Mitsubishi Chemical Advanced Materials, Gurit Holding AG, SABIC, Solvay S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Honeycomb Sandwich Market Key Technology Landscape

The technological landscape of the Honeycomb Sandwich Market is constantly evolving, focusing on optimizing material composition, enhancing manufacturing speed, and developing non-destructive evaluation (NDE) techniques. A critical technology involves the continuous development of fire-retardant resins and bonding agents, essential for meeting stringent FST standards in public transportation applications. Advancements in aramid paper production allow for lighter, higher-density cores with improved structural integrity under extreme thermal loads. Furthermore, the integration of nanotechnologies into facing materials is being explored to enhance surface hardness, scratch resistance, and embedded sensing capabilities without adding significant weight, thereby increasing the durability and functional lifespan of the sandwich panels.

Manufacturing process innovations are pivotal for scalability and cost reduction. The transition from traditional, time-consuming autoclave curing to faster, lower-pressure non-autoclave (OOA) processes, such as vacuum infusion and resin transfer molding (RTM) adapted for honeycomb structures, is a key technology trend. These OOA methods dramatically reduce cycle times and energy consumption, making honeycomb panels more viable for high-volume sectors like automotive and consumer electronics. Precision cutting and shaping technologies, including high-speed CNC routers and waterjet cutters, are necessary to handle the delicate nature of the honeycomb core before lamination, ensuring accurate component integration.

Another crucial technological focus lies in repair and recycling methodologies. Due to the high value and complexity of composite structures, efficient in-situ repair techniques, such as specialized patch bonding kits and localized heat application methods, are highly sought after by MRO providers. On the sustainability front, technologies focused on separating the core material from the skin and adhesive—especially critical for thermoplastic cores—are gaining prominence. Developing cost-effective recycling processes for materials like aramid paper and carbon fiber composites remains a technical hurdle but offers a significant long-term opportunity to address environmental concerns and fluctuating raw material costs, driving circularity in composite manufacturing.

Regional Highlights

The global distribution of the Honeycomb Sandwich Market reveals distinct growth drivers and technological maturity levels across key geographical regions. North America holds a dominant market share, primarily due to the massive presence of aerospace and defense contractors (Boeing, Lockheed Martin) and substantial R&D investment in advanced composite manufacturing. The region is a leader in adopting high-specification materials, particularly carbon fiber and advanced aluminum honeycombs, driven by military modernization programs and high demand for MRO services for aging aircraft fleets. The focus here is on performance, material certification, and implementing highly automated production lines, often involving complex material traceability systems mandated by regulatory bodies.

Asia Pacific (APAC) is projected to be the fastest-growing region, driven by rapid industrialization, massive investments in civil infrastructure, and the expansion of indigenous aircraft manufacturing capabilities in countries like China and India. The demand for lightweight materials in high-speed rail, automotive manufacturing (especially EV production), and renewable energy (wind farms) is skyrocketing. The APAC market is characterized by strong competition, a focus on optimizing cost-efficiency, and the increasing reliance on locally sourced materials and manufacturing expertise. Government initiatives promoting domestic aerospace development and infrastructure spending are key catalysts for growth in this region.

Europe represents a mature yet highly innovative market, characterized by stringent environmental regulations and a strong emphasis on sustainability and recycling. The European aerospace industry (Airbus, Dassault) and automotive sector are primary consumers, focusing on advanced thermoplastic cores that facilitate end-of-life recycling and meet evolving EU directives on materials and waste management. Furthermore, Europe is a strong consumer of honeycombs for the construction sector, driven by a demand for energy-efficient, prefabricated building solutions. The Middle East and Africa (MEA) and Latin America currently represent smaller but growing markets, primarily driven by investments in national defense, oil and gas infrastructure, and commercial aviation fleet expansion, relying heavily on imports of high-end composite materials and expertise from North America and Europe.

- North America: Dominant market share due to established aerospace and defense infrastructure and high technological maturity in carbon fiber composite use.

- Asia Pacific (APAC): Fastest growing, fueled by infrastructure development, EV production, and expansion of wind energy capacity in China, India, and Southeast Asia.

- Europe: Strong focus on sustainability, advanced thermoplastic cores, and high consumption in the automotive and construction sectors under strict environmental standards.

- Middle East and Africa (MEA): Growth driven by defense spending and new airline procurement programs, requiring certified aircraft interior materials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Honeycomb Sandwich Market.- Hexcel Corporation

- Toray Industries

- Plascore

- The Gill Corporation

- Euro-Composites

- 3A Composites

- Advanced Honeycomb Technologies

- Rockwood Composites

- TenCate Advanced Composites

- EconCore

- Shanyao Composite Material Technology Co., Ltd.

- AVIC Composite Corporation

- Argosy International Inc.

- ACP Composites

- Composite Panel Solutions

- General Plastics Manufacturing Co.

- Mitsubishi Chemical Advanced Materials

- Gurit Holding AG

- SABIC

- Solvay S.A.

Frequently Asked Questions

Analyze common user questions about the Honeycomb Sandwich market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of using honeycomb sandwich structures in aircraft manufacturing?

The primary advantages are exceptional strength-to-weight ratios, superior stiffness, and inherent efficiency in energy absorption. These properties allow manufacturers to significantly reduce the overall weight of aircraft components, leading to lower fuel consumption and increased payload capacity, while maintaining required structural integrity and compliance with FST (Fire, Smoke, Toxicity) standards using materials like Nomex.

How does the type of core material affect the performance and cost of a honeycomb panel?

Core material type directly determines performance and cost. Aluminum cores offer high strength and thermal conductivity at a moderate cost, suitable for structural parts. Aramid cores (Nomex) are essential for fire resistance and acoustic damping in commercial interiors. Carbon fiber cores provide the highest stiffness and lowest weight but come at a premium cost, reserved for high-performance applications like military aircraft and Formula 1 components.

What is driving the shift towards thermoplastic honeycomb cores?

The shift towards thermoplastic honeycomb cores, such as those made from polypropylene or polycarbonate, is primarily driven by their lower processing costs, ease of thermoforming, and crucial recyclability. Thermoplastics allow for faster, non-autoclave manufacturing processes, making them highly attractive for high-volume sectors like automotive (EVs) and consumer goods seeking sustainable and cost-effective lightweight solutions.

Which application segment accounts for the largest market share in the honeycomb sandwich industry?

The Aerospace and Defense segment currently accounts for the largest market share in revenue. This dominance is due to the mandatory requirement for high-performance, highly certified materials in critical structures, interior components, and flight surfaces, leading to higher average selling prices for specialized, high-grade composite honeycomb panels.

What major technological challenges restrict the wider adoption of composite honeycomb panels?

Major technological challenges include the high initial cost of raw materials (especially carbon fiber), the complexity of the bonding and curing processes requiring specialized equipment (autoclaves), and the difficulty and expense associated with repairing damaged honeycomb structures without compromising the panel's internal structural integrity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Honeycomb Sandwich Material Market Statistics 2025 Analysis By Application (Aerospace & Defense, Transportation, Construction, Others), By Type (Aluminum Core, Aramid Core, Thermoplastic Core, Other), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Honeycomb Sandwich Material Market Statistics 2025 Analysis By Application (Aerospace & Defense, Transportation, Construction), By Type (Aluminum Core, Aramid Core, Thermoplastic Core, Other), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Superalloy Honeycomb Sandwich Market Statistics 2025 Analysis By Application (Aerospace, Industrial Gas Turbine (IGT)), By Type (Nickel-based, Iron-based), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Honeycomb Sandwich TPS Panel Market Statistics 2025 Analysis By Application (Aerospace & Defense, Transportation, Construction), By Type (Aluminum Core, Aramid Core, Thermoplastic Core), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager