Honing Machines Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434783 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Honing Machines Market Size

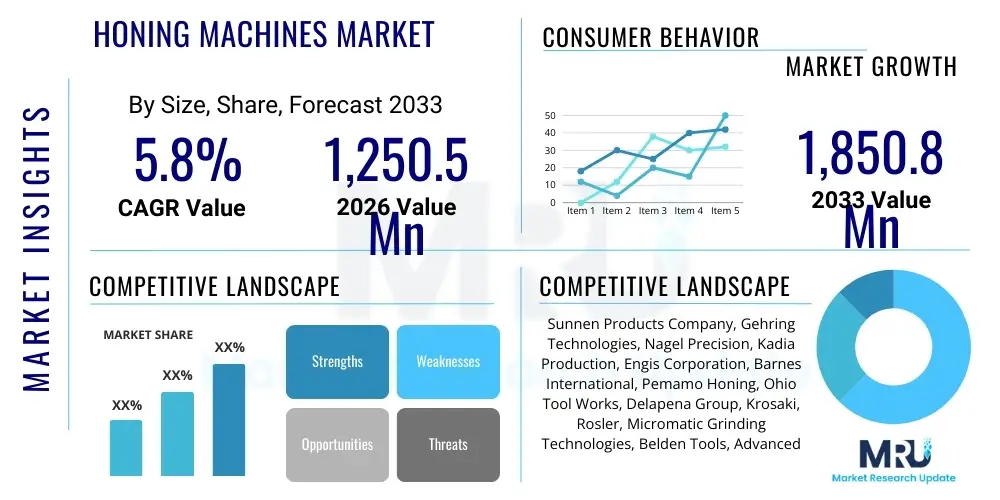

The Honing Machines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $1.25 Billion in 2026 and is projected to reach $1.85 Billion by the end of the forecast period in 2033.

Honing Machines Market introduction

The Honing Machines Market encompasses specialized industrial equipment designed to achieve precise dimensional tolerance and superior surface finish on internal and external cylindrical surfaces. Honing is a critical abrasive machining process that utilizes honing stones or superabrasive tools (like CBN and diamond) mounted on a mandrel, oscillating and rotating simultaneously within the workpiece bore. This technique is indispensable in high-precision manufacturing, particularly for components requiring extremely tight geometric accuracy, such as engine cylinders, hydraulic components, gears, and compressor bores. The primary objective of honing is not material removal but rather improving bore geometry (roundness, straightness, taper) and surface texture (cross-hatch pattern) crucial for optimal performance, sealing, and wear resistance in complex mechanical systems. The increasing demand for efficient, high-performance engines and transmission systems, especially in the automotive and aerospace sectors, fundamentally drives the adoption of advanced honing technologies, characterized by higher automation and adaptive control systems.

Major applications of honing machines span across heavy industries, including automotive manufacturing, where honing ensures the longevity and efficiency of engine blocks and brake systems; aerospace, focusing on critical hydraulic cylinders and landing gear components; and oil and gas, for high-pressure valve bodies and pump assemblies. The intrinsic benefits derived from the honing process, such such as extended component lifespan, reduced friction, improved oil retention, and enhanced fluid sealing capability, solidify its necessity in modern engineering workflows. Furthermore, the global shift towards electrification, paradoxically, maintains demand for honing, as components in battery cooling systems, electric motor housings, and highly complex planetary gears still necessitate ultra-precise finishes to manage thermal efficiency and noise, vibration, and harshness (NVH) levels effectively. Manufacturers are continually investing in hybrid honing systems that combine conventional abrasive techniques with digital precision control to meet stringent industry specifications, pushing the boundaries of accuracy down to sub-micron levels.

The market's expansion is intrinsically linked to global industrial output and the stringent regulatory environment demanding higher fuel efficiency and lower emissions from combustion engines, which necessitates higher precision in powertrain components. Key driving factors include the rapid industrialization across Asia Pacific, particularly in automotive and construction equipment manufacturing hubs in China and India, and technological advancements in abrasive materials, allowing for faster cycle times and better material adaptability. The continuous innovation in machine design, focusing on vertical honing, horizontal honing, and specialized tooling for complex geometries, ensures that the market remains robust, adapting seamlessly to new materials like ceramics and specialized alloys that are difficult to machine using traditional methods. This ongoing pursuit of precision and efficiency serves as the foundational pillar supporting the growth trajectory of the Honing Machines Market through the forecast period.

Honing Machines Market Executive Summary

The Honing Machines Market is experiencing transformative business trends driven by the pursuit of ultra-precision manufacturing and the integration of Industry 4.0 technologies. The shift toward digitized manufacturing is leading to the prevalence of CNC honing centers equipped with advanced monitoring and adaptive control systems capable of compensating for tool wear and material variability in real-time, thereby maximizing throughput and minimizing scrap rates. Furthermore, the automotive sector's dual focus on optimizing internal combustion engines (ICE) components for stringent emission standards and developing highly accurate components for electric vehicle (EV) powertrains (such as high-precision bores for motor casings and planetary gear carriers) ensures sustained market vitality. Regional trends indicate that Asia Pacific, spearheaded by China and India, remains the dominant growth engine due to expansive automotive production and robust heavy machinery industries, while North America and Europe continue to focus on high-value, niche applications like aerospace, medical devices, and high-performance motors, prioritizing sophisticated, automated multi-spindle honing solutions over high volume output. Consolidation among key players and strategic acquisitions focused on specialized tooling expertise are also defining competitive dynamics.

Segmentation trends highlight the increasing demand for advanced horizontal honing machines for handling larger, longer components commonly found in oil and gas, mining, and heavy equipment industries, contrasted with the continued robust demand for vertical honing machines dominant in mass-production automotive lines. By product type, the demand for conventional abrasive honing machines is stable, but there is a noticeable acceleration in the adoption of superabrasive tools (CBN and diamond) due to their superior longevity, material removal rates, and ability to process extremely hard materials efficiently. The end-use segmentation reinforces the dependence on the automotive industry, which accounts for the largest share, although the contribution of the hydraulic and pneumatic industries is rapidly escalating, driven by the need for frictionless linear motion and reliable sealing systems in industrial automation and fluid power applications. The market is also seeing a segment-specific focus on customized, flexible honing solutions that can quickly switch between different component geometries, addressing the growing trend towards smaller batch sizes and personalized manufacturing requirements characteristic of specialized industrial markets.

Overall, the market remains moderately consolidated, with strong competition centered around technological innovation, particularly in abrasive material composition, machine rigidity, and software integration capabilities. The immediate challenges involve navigating fluctuating raw material costs and skilled labor shortages for operating and maintaining highly complex CNC honing centers. However, opportunities abound in developing markets and in leveraging advanced analytics—specifically machine learning—to optimize the honing process through predictive maintenance and closed-loop quality control. The overarching theme is the transition from mechanical accuracy reliance to digital accuracy assurance, ensuring that the Honing Machines Market continues to support the global evolution toward more efficient and precise mechanical engineering systems.

AI Impact Analysis on Honing Machines Market

User inquiries regarding AI's influence on the Honing Machines Market predominantly revolve around three critical themes: automation and workforce displacement, the potential for achieving zero-defect production through predictive quality control, and the optimization of tooling lifespan and maintenance schedules. Users are keen to understand how AI-driven adaptive control systems can transcend conventional feedback loops to anticipate material behavior during the honing cycle, thereby dynamically adjusting pressure, speed, and oscillation frequency to maintain optimal performance despite variations in the workpiece or wear on the superabrasive tools. Concerns often surface regarding the integration cost and the necessary data infrastructure required to leverage AI effectively in traditional manufacturing environments. The expectation is that AI will transform honing from a highly skill-dependent process to a data-driven operation, drastically improving throughput and reducing the reliance on highly experienced operators for crucial process adjustments, ultimately leading to significant operational cost savings and unparalleled consistency in geometric and surface finish metrics, thus pushing the boundaries of precision manufacturing.

- AI-Driven Adaptive Control: Implementation of machine learning algorithms to continuously monitor vibration, torque, temperature, and acoustic emissions, allowing for real-time dynamic adjustment of honing parameters (feed rate, rotational speed) to maintain geometric consistency and optimize material removal rates regardless of tool wear or workpiece variability.

- Predictive Maintenance (PdM): Use of AI models to analyze sensor data from spindles, hydraulics, and gearboxes to forecast potential component failures, scheduling maintenance proactively and dramatically reducing unplanned machine downtime, thereby boosting Overall Equipment Effectiveness (OEE).

- Quality Assurance Automation: Deployment of computer vision and AI-powered metrology integration (such as inline bore measurement systems) that compare scanned surface topography against ideal parameters, providing instantaneous feedback and enabling closed-loop correction without human intervention, ensuring near zero-defect output.

- Process Optimization and Energy Efficiency: AI analyzing historical production data to identify optimal machining recipes for various material types and component sizes, leading to reduced cycle times, minimized abrasive consumption, and lower energy usage per part.

- Tool Wear Management: Algorithms predicting the remaining useful life (RUL) of honing stones and mandrels based on material processed and cutting forces encountered, ensuring timely replacement and maintaining peak machining performance consistently.

DRO & Impact Forces Of Honing Machines Market

The dynamics of the Honing Machines Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces dictating market trajectory. The core driver remains the unrelenting demand for enhanced precision components across high-stakes industries such as aerospace, defense, and high-performance automotive. As engine downsizing and forced induction technologies become standard, the necessity for components capable of withstanding higher operating pressures and temperatures, requiring extremely tight tolerances and superior surface finishes to minimize friction and wear, drives machine adoption. Coupled with this is the global tightening of emission standards (e.g., Euro 7, CAFE standards), compelling manufacturers to invest in the latest honing technology to maximize internal combustion engine efficiency, even as electrification gains momentum. The inherent opportunity lies in leveraging Industry 4.0 technologies—specifically IoT connectivity and data analytics—to develop smart, self-optimizing honing cells capable of remote diagnostics and production monitoring, catering to the growing need for distributed and agile manufacturing capabilities worldwide. These technological advancements not only enhance machine capability but also open new revenue streams through software and service contracts.

However, the market faces significant restraints, primarily stemming from the high initial capital investment required for advanced CNC honing systems. These machines, often custom-engineered for specific applications, carry substantial price tags that can be prohibitive for small and medium-sized enterprises (SMEs). Furthermore, the operation and maintenance of these complex systems require a highly specialized and skilled workforce, posing a challenge in regions experiencing manufacturing skills gaps. The transition toward electric vehicles (EVs) represents a long-term structural restraint, as traditional engine block honing demand may plateau or decline eventually. While EVs require high-precision components, the sheer volume of cylinder bore honing associated with ICE production remains unmatched currently. Manufacturers must therefore strategically pivot their product portfolios to address new EV component requirements, such as precision honing for reduction gears, differential casings, and stator bores, which present different technical challenges and volume expectations.

The impact forces are steering the market towards specialization and advanced material processing. Opportunities are strongest in specialized segments, including medical device manufacturing (e.g., joint replacement components, surgical tools) and customized industrial automation where demand for highly reliable hydraulic and pneumatic actuators is robust. Another significant opportunity lies in the retooling and retrofitting market, where older machines are upgraded with modern CNC controls and digital sensors to extend their useful life and integrate them into smart factory networks without requiring full capital expenditure replacement. Successfully navigating the high cost of superabrasive tooling and specialized fixtures by implementing advanced tool management strategies, potentially utilizing AI, will be crucial for competitive positioning, ensuring that the Honing Machines Market maintains its critical role in enabling the next generation of high-precision mechanical engineering globally.

Segmentation Analysis

The Honing Machines Market is comprehensively segmented based on machine type, technology, automation level, end-use industry, and geography, reflecting the diversity of manufacturing requirements across different sectors. This segmentation allows manufacturers to tailor their offerings—ranging from basic manually operated machines used for small-batch maintenance work to fully automated, multi-spindle CNC systems integrated into high-volume automotive production lines. The analysis of these segments is vital for understanding specific demand drivers; for instance, the horizontal segment caters primarily to large, long components typical in energy and defense, whereas the vertical segment dominates the mass-market automotive sphere due to its efficient footprint and ease of integration into continuous flow production lines. Growth within the segments is highly influenced by regional manufacturing maturity and the prevalence of specific heavy industries, guiding strategic investment decisions regarding product development and localized distribution channels.

- By Machine Type:

- Vertical Honing Machines (Dominant in automotive and high-volume manufacturing)

- Horizontal Honing Machines (Used for long components like oil and gas pipes, aerospace shafts)

- Automatic Honing Machines

- Manual/Semi-Automatic Honing Machines

- By Technology:

- Conventional Abrasive Honing (Stone Honing)

- Superabrasive Honing (Diamond and CBN)

- Electro-chemical Honing (Niche applications)

- Plateau Honing/Finishing Techniques

- By Automation Level:

- CNC Honing Machines (High precision, adaptive control)

- PLC Controlled Machines

- By End-Use Industry:

- Automotive (Engine blocks, connecting rods, hydraulic components)

- Aerospace & Defense (Landing gear, actuators, fuel system components)

- Hydraulic & Pneumatic Systems (Cylinders, valves, pumps)

- Oil & Gas (Downhole tools, compressor cylinders)

- Medical Devices (Implants, surgical tools)

- General Manufacturing

Value Chain Analysis For Honing Machines Market

The value chain for the Honing Machines Market begins with the upstream suppliers responsible for raw materials and highly specialized components. Upstream activities involve the procurement of high-grade steel and alloys for machine frames and critical moving parts, sophisticated hydraulic and electrical systems (pumps, valves, motors), and highly specialized control systems (CNC controllers, sensors, HMI interfaces). Crucially, the supply chain for abrasive materials—specifically synthetic diamond and Cubic Boron Nitride (CBN) used in high-performance honing stones—forms a vital and often proprietary segment, requiring specialized material science expertise. The quality and stability of these input components directly dictate the final machine’s precision, durability, and operational efficiency, making reliable supplier partnerships essential for leading machine manufacturers.

Mid-stream activities encompass the core manufacturing processes: research and development, machine design, component machining, assembly, testing, and quality control. Machine manufacturers often differentiate themselves not just on the physical build quality (rigidity, thermal stability) but also on proprietary tooling and advanced process control software that integrates adaptive honing cycles and metrology feedback. Distribution channels are complex, involving both direct sales models for large, custom-engineered systems sold directly to major Original Equipment Manufacturers (OEMs) in automotive and aerospace, and indirect models utilizing specialized industrial equipment distributors and local sales agents. These indirect channels are particularly critical for reaching SMEs and offering localized installation, maintenance, and training services, forming a critical link in the value delivery process.

Downstream activities center on deployment, usage, and aftermarket services. The end-users, such as Tier 1 automotive suppliers or specialized hydraulic cylinder producers, integrate these machines into their high-volume or high-precision production lines. Aftermarket support, including spare parts supply, consumables (honing stones, oil), preventative maintenance contracts, and software updates, constitutes a significant revenue stream and a core differentiator. The increasing technical complexity of modern honing machines necessitates deep technical support, driving manufacturers to offer training programs and remote diagnostic capabilities. The overall value chain is highly specialized and knowledge-intensive, where success depends on integrating high-quality material inputs with advanced mechatronics and sophisticated process software, ensuring the final product delivers the required micron-level precision and repeatability demanded by critical manufacturing industries.

Honing Machines Market Potential Customers

Potential customers for honing machines are predominantly large-scale industrial manufacturers and specialized component producers whose finished products require superior internal bore precision and surface integrity. The largest customer segment remains the global automotive industry, including both OEMs and Tier 1 and Tier 2 suppliers, who rely on honing for engine blocks, cylinder liners, connecting rod bores, transmission components, and turbocharger elements. The continuous pressure to improve fuel efficiency and durability means these customers are consistently seeking higher-tolerance honing solutions, driving the demand for advanced CNC and adaptive machines capable of processing high-strength alloys and composite materials commonly used in modern powertrains. This segment is characterized by high volume, stringent quality standards, and a strong preference for fully automated, integrated manufacturing solutions.

The second major segment comprises the hydraulic and pneumatic industries, which require flawless bore finishes for cylinders and valve bodies to prevent fluid leakage, ensure optimal sealing, and maximize the operational life of actuators and pumps used in construction, agriculture, and industrial automation equipment. For these customers, the quality of the honed surface directly correlates with the efficiency and reliability of the fluid power system, making precision honing non-negotiable. Additionally, the aerospace and defense sectors represent a high-value, niche customer base, demanding specialized honing solutions for critical components like landing gear actuators, weapon systems, and intricate hydraulic manifolds, where failures are catastrophic. These customers prioritize machine reliability, certification, and the ability to process exotic materials used in high-stress applications.

Emerging and specialized customers include medical device manufacturers, particularly those producing orthopedic implants (hip and knee components) and specialized surgical instruments, where bio-compatibility and extremely smooth surface finishes are paramount. Furthermore, heavy equipment and mining machinery producers, requiring durable and highly efficient large-bore cylinders, constitute a growing market segment for large horizontal honing machines. These potential customers are united by the need to meet or exceed increasingly tight geometric tolerances, leverage automated processes to reduce labor costs, and achieve predictable, repeatable quality, making the honing machine an essential, precision-enabling capital expenditure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1,250.5 Million |

| Market Forecast in 2033 | $1,850.8 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sunnen Products Company, Gehring Technologies, Nagel Precision, Kadia Production, Engis Corporation, Barnes International, Pemamo Honing, Ohio Tool Works, Delapena Group, Krosaki, Rosler, Micromatic Grinding Technologies, Belden Tools, Advanced Machine & Engineering, AZ spa, Stahli USA, Lissmac, Koellmann Maschinenbau, Bates Technologies, Falco SpA. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Honing Machines Market Key Technology Landscape

The technological evolution within the Honing Machines Market is predominantly characterized by the integration of advanced computer numerical control (CNC) systems and the widespread adoption of superabrasive materials. Modern honing machines utilize sophisticated multi-axis CNC controls to manage simultaneous motions—rotation, oscillation, and feed pressure—with micron-level accuracy, moving far beyond the capabilities of older hydraulic or mechanical systems. This shift to CNC allows for complex bore geometry corrections, such as controlled taper or barrel shapes, which are critical for optimizing component performance under specific load conditions. Furthermore, closed-loop feedback systems incorporating high-resolution displacement sensors and pressure transducers are essential, allowing the machine to adapt the honing cycle in real-time based on actual bore measurement data, ensuring high repeatability and drastically reducing the operator's influence on final quality. The focus is squarely on achieving highly repeatable, automated processes that minimize variance, a necessity for industries pursuing Six Sigma quality levels.

A second crucial area of innovation is in tooling and abrasive technology. The market has largely transitioned from traditional aluminum oxide or silicon carbide stones to superabrasives, specifically Cubic Boron Nitride (CBN) and diamond. CBN and diamond tools offer significantly increased hardness and wear resistance, enabling faster material removal rates and much longer tool life, particularly when processing modern, hard materials like hardened steel, ceramic coatings, or cast iron alloys used in engine components. Complementing the tooling is the continuous development in coolants and honing oils, which are formulated to efficiently remove swarf, maintain thermal stability, and optimize the cutting action of the superabrasives without causing surface smearing or micro-fractures. The interaction between the machine, the abrasive material, and the proprietary cutting fluid is often the key determinant of the final surface quality and cycle time, prompting significant R&D investment in this area.

Moreover, the integration of Industry 4.0 principles, including the Industrial Internet of Things (IIoT), is reshaping the landscape. Honing machines are now equipped with extensive sensor packages monitoring parameters like spindle load, vibration, and thermal drift, generating massive datasets. This data is leveraged for predictive analytics, facilitating condition monitoring and predictive maintenance, thereby maximizing machine uptime. Additionally, manufacturers are embedding sophisticated metrology solutions—such as in-process air gaging or laser interferometers—directly into the machine tool area, allowing for immediate measurement and automated compensation adjustments. This trend toward self-monitoring and self-correcting honing cells represents the apex of current technological capability, ensuring components meet increasingly stringent quality requirements while operating within a fully digitized, optimized manufacturing ecosystem.

Regional Highlights

The global Honing Machines Market exhibits distinct regional dynamics driven by localized industrial maturity, investment trends, and regulatory environments. Asia Pacific (APAC) stands out as the predominant growth region, primarily fueled by the massive scale of automotive production, motorcycle manufacturing, and heavy equipment industries in countries like China, India, and Japan. China, in particular, drives high-volume demand for honing machines, often prioritizing automated vertical systems to support its expanding domestic and export markets for internal combustion engines and related components. This region is also characterized by increasing adoption of advanced CNC technologies as local manufacturers upgrade their capabilities to meet global quality standards. The sheer volume of industrial output and rapid infrastructure development ensures that APAC remains the most lucrative market, necessitating localized manufacturing and service hubs for major global players.

North America and Europe represent mature markets characterized by stable but high-value demand, focusing intensely on technological precision and customized solutions rather than mass volume. Europe, led by Germany's robust precision engineering sector, shows strong demand from the aerospace, luxury automotive, and specialized hydraulic industries, emphasizing sophisticated, multi-spindle machines capable of processing challenging materials to the highest possible tolerances. Similarly, North America leverages honing technology extensively in aerospace, defense contracting, and high-performance engine tuning, driving demand for specialized horizontal and deep-hole honing applications. Investment in these regions often centers on retrofitting existing equipment with smart factory features and acquiring machines that offer superior process control and integration capabilities necessary for complex, mission-critical component manufacturing.

- Asia Pacific (APAC): Dominates market share and growth trajectory due to high volume manufacturing in automotive, two-wheeler, and heavy machinery sectors. Driven by industrialization and rising standards for precision manufacturing in China and India.

- Europe: Focuses on high-precision, niche applications in aerospace, luxury automotive, and specialized hydraulics. High adoption rate of advanced CNC and automation technologies, with strong emphasis on German engineering quality and durability.

- North America: Significant demand originating from the aerospace and defense industries, requiring ultra-precise and often large-scale honing solutions for hydraulic components and engine parts. Also maintains a strong market for reconditioning and high-performance automotive applications.

- Latin America (LATAM) and Middle East & Africa (MEA): Emerging markets driven by localized oil and gas extraction equipment maintenance (requiring horizontal honing for pump and valve bores) and growing automotive assembly capabilities. Growth is often linked to foreign direct investment in local manufacturing infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Honing Machines Market.- Sunnen Products Company

- Gehring Technologies

- Nagel Precision

- Kadia Production

- Engis Corporation

- Barnes International

- Pemamo Honing

- Ohio Tool Works

- Delapena Group

- Krosaki

- Rosler

- Micromatic Grinding Technologies

- Belden Tools

- Advanced Machine & Engineering

- AZ spa

- Stahli USA

- Lissmac

- Koellmann Maschinenbau

- Bates Technologies

- Falco SpA

Frequently Asked Questions

Analyze common user questions about the Honing Machines market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical difference between honing and grinding?

Honing is an abrasive process primarily focused on improving the internal geometry (roundness, straightness) and surface finish of bores, using stones that move in a combined rotational and oscillatory motion, generating a critical cross-hatch pattern for optimal oil retention and wear resistance. Grinding, conversely, is typically focused on stock removal and achieving general dimensioning, often used on external surfaces or flat faces, characterized by high peripheral speeds and localized material removal.

How is the transition to Electric Vehicles (EVs) affecting the demand for honing machines?

While the demand for traditional cylinder bore honing in internal combustion engines (ICE) is expected to gradually stabilize or decline, the EV transition introduces new demand for high-precision honing. EVs require ultra-precise honing for components in gear reduction boxes, differential housings, and cooling system bores to manage NVH (Noise, Vibration, and Harshness), improve energy efficiency, and ensure optimal sealing and durability for electric motor components. Manufacturers are pivoting products to address these new precision requirements.

Which technology offers better efficiency: conventional abrasives or superabrasives (CBN/Diamond)?

Superabrasives (CBN and Diamond) offer significantly superior efficiency and longevity compared to conventional abrasives. They allow for faster material removal rates, maintain their shape longer, and are essential for processing modern, hard materials such as hardened steel and ceramics. Although superabrasive tooling has a higher initial cost, the reduction in cycle time, consistency in surface finish, and extended tool life generally yield a far better total cost of ownership (TCO) in high-volume or high-precision manufacturing.

What role does Industry 4.0 play in modern honing machine operations?

Industry 4.0 integration—leveraging IoT sensors and AI—is critical for modern honing. It enables real-time condition monitoring, predictive maintenance (PdM) to minimize downtime, and adaptive control systems that automatically adjust machining parameters based on sensor feedback and metrology data. This digitization ensures higher machine utilization, improves process repeatability, and facilitates integration into centralized smart factory management systems for comprehensive quality control.

What factors determine whether a vertical or horizontal honing machine is required?

The choice between vertical and horizontal honing is dictated primarily by the size, length, and volume of the workpiece. Vertical honing machines are preferred for shorter, larger diameter components (like engine blocks) and high-volume production due to their smaller footprint and gravity-assisted setup. Horizontal honing machines are necessary for extremely long components, such as shafts, deep hydraulic cylinders, and oil field pipes, where bore straightness over extended lengths is critical and requires the workpiece to be supported horizontally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager