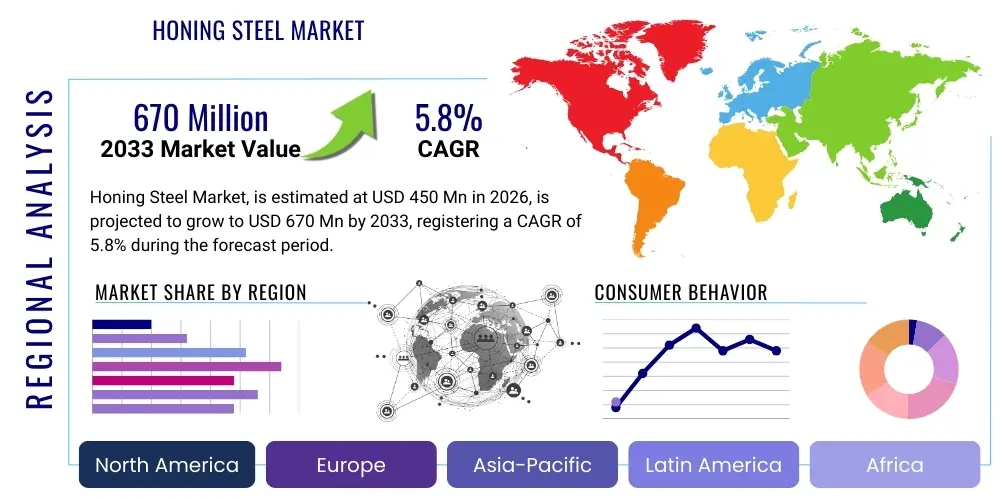

Honing Steel Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435975 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Honing Steel Market Size

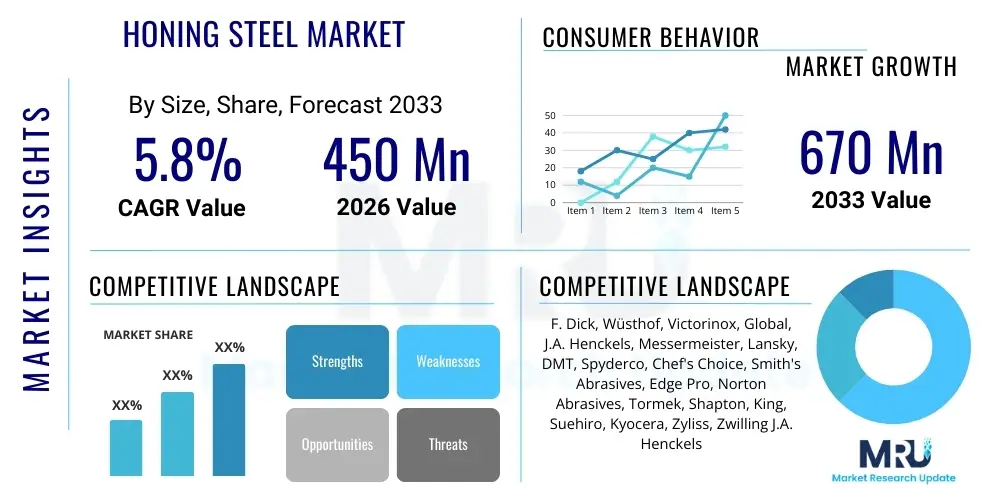

The Honing Steel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 670 Million by the end of the forecast period in 2033.

Honing Steel Market introduction

The Honing Steel Market is defined by the manufacturing and distribution of specialized rods used primarily for maintaining the sharp edge of knives and other cutting tools, often referred to as truing or realigning the microscopic edge deformation (burr). While commonly called "sharpening steels," their fundamental function is honing—a process distinct from actual material removal or grinding, which is typically reserved for severe dulling. These tools are crucial components in both professional culinary environments and specialized industrial applications where edge precision is paramount. The market encompasses various materials, including ceramic, diamond-coated, and high-carbon steel options, each catering to different types of blade materials and user expertise levels.

The core product, the honing steel, serves as an essential maintenance tool, ensuring operational longevity and safety for cutting instruments across sectors. Major applications span household use, high-volume commercial kitchens, meat processing facilities, and specialized industrial workshops dealing with precision cutting instruments. The primary benefit derived from the consistent use of honing steels is the significant reduction in the frequency required for more aggressive sharpening methods, thereby preserving the structural integrity and usable life of expensive blades. Furthermore, maintaining a consistently honed edge drastically improves efficiency, reduces user fatigue, and enhances safety during cutting tasks by preventing slippage caused by dull instruments.

Driving factors fueling the expansion of this market include the global increase in culinary professionalism, rising consumer interest in high-quality kitchenware, and stringent safety regulations in the food service industry demanding consistently maintained tools. Furthermore, technological advancements in material science, leading to the introduction of advanced materials like ultra-fine ceramic and monocrystalline diamond coatings, offer superior edge maintenance capabilities, attracting professional and enthusiast segments alike. The durability, portability, and relative ease of use compared to traditional whetstones also contribute significantly to their market adoption, particularly in fast-paced commercial settings requiring rapid edge realignment.

Honing Steel Market Executive Summary

The Honing Steel Market is currently characterized by moderate growth, primarily driven by increasing disposable incomes in emerging economies and the expanding global food service industry. Key business trends indicate a strong shift towards premiumization, with consumers and professionals increasingly favoring specialized honing materials (such as fine-grit ceramics and diamond-impregnated steels) that offer optimized edge retention characteristics for modern, high-hardness stainless steel and carbon steel alloys. Manufacturers are focusing on ergonomic design and integration of safety features, such as non-slip handles and protective guards, to appeal to a wider demographic. Strategic acquisitions and vertical integration within the cutlery and kitchen tool supply chain are common tactics employed by major players to secure distribution channels and raw material supply, maintaining competitive advantages in a fragmenting but quality-conscious market.

Regional trends highlight the dominance of North America and Europe, supported by established culinary cultures and high rates of adoption of specialized kitchen tools. However, the Asia Pacific (APAC) region is emerging as the fastest-growing market, propelled by rapid urbanization, the proliferation of global fast-food chains, and a growing middle class investing in durable, high-quality household goods. The manufacturing base remains heavily concentrated in East Asia, though high-end, specialty production often resides in Western Europe, reflecting expertise in metallurgy and precision engineering. Demand variations across regions are noticeable; for instance, European markets show a preference for traditional high-carbon steel hones, while North American markets exhibit higher demand for diamond and ceramic alternatives due to perceived faster performance and versatility.

Segmentation trends reveal that the Commercial Kitchen application segment holds the largest market share due to the high volume of knife usage and mandatory maintenance protocols in professional environments. Within the product type segment, Ceramic Honing Steels are experiencing rapid market uptake because of their ability to hone extremely hard German and Japanese steel alloys effectively without excessive material removal, striking a favorable balance between maintenance quality and blade preservation. Distribution channels are undergoing a transformation, with e-commerce platforms increasingly capturing market share from traditional retail outlets, driven by their ability to offer niche, high-specification products directly to specialized consumer groups and small commercial entities worldwide, thereby streamlining the logistics for bulk and customized orders.

AI Impact Analysis on Honing Steel Market

User inquiries regarding AI's influence on the Honing Steel Market primarily focus on the potential for automation in manufacturing processes, the role of predictive maintenance for industrial cutting tools, and the development of 'smart' sharpening systems. Key concerns revolve around whether AI could lead to the obsolescence of traditional manual honing tools by introducing fully automated, precision sharpening robots or whether AI analytics could fundamentally change material selection and product design. Users are seeking clarity on how AI-driven analysis of blade wear patterns, generated via specialized sensors or machine vision, could inform consumers or commercial users about the optimal type and frequency of honing required, moving the process from subjective experience to objective data. Expectations center on enhanced manufacturing precision, optimized inventory management, and personalized recommendations for honing techniques based on usage data.

The immediate and tangible impact of AI is less about replacing the physical honing tool itself and more about enhancing the operational efficiency across the value chain. In manufacturing, AI and Machine Learning (ML) algorithms are being implemented to monitor and optimize the grinding and finishing processes of the honing rods, ensuring microscopic consistency in abrasive texture and geometric alignment. This results in higher quality products with tighter tolerances, crucial for meeting the demands of professional users who rely on absolute precision. Furthermore, predictive supply chain analytics, often powered by AI, allow manufacturers to forecast demand fluctuations based on seasonal culinary trends or industrial production cycles, optimizing raw material procurement and reducing overhead costs associated with inventory holding.

In the end-user application sphere, though still nascent, AI’s impact is visible in quality control systems and specialized industrial maintenance robots. AI-driven machine vision systems are increasingly utilized in high-volume industrial cutting operations (e.g., meat processing) to instantly assess the sharpness and edge integrity of tools, triggering automated maintenance cycles which may include specialized automated honing equipment. While the traditional manual honing steel remains dominant for individual culinary use, AI contributes indirectly by making the manufacturing process of these steels more consistent, by improving logistical efficiency, and by driving the quality standards that manual tools must meet to remain competitive against emerging automated solutions.

- AI-driven optimization of abrasive texture and geometric tolerance in honing rod manufacturing, ensuring superior product consistency.

- Predictive maintenance schedules for industrial cutting tools based on AI analysis of wear patterns, reducing unscheduled downtime and optimizing tool life.

- Integration of machine learning algorithms in supply chain management to forecast demand and optimize inventory for specialty steel alloys and abrasive materials.

- Development of smart sharpening systems utilizing computer vision to recommend the appropriate honing steel type and technique based on the specific blade alloy and usage history.

- Enhanced quality control systems utilizing AI to detect microscopic defects in finished honing steels, significantly reducing product failure rates.

DRO & Impact Forces Of Honing Steel Market

The Honing Steel Market dynamics are governed by a complex interplay of Drivers (D), Restraints (R), and Opportunities (O), which collectively shape the market's trajectory and define the Impact Forces currently at play. Primary drivers include the robust expansion of the global food industry, characterized by increasing numbers of professional chefs, culinary schools, and specialized food processing plants that necessitate high-quality tool maintenance. Simultaneously, heightened consumer awareness regarding kitchen safety and the benefits of properly maintained equipment fuels demand in the household segment. Restraints largely center on the competition posed by alternative sharpening technologies, such as advanced electric sharpeners and specialized whetstone systems, which, while often more expensive, offer permanent sharpening rather than mere edge alignment. Furthermore, the lack of consumer education regarding the critical difference between honing (realigning the edge) and actual sharpening (material removal) often leads to incorrect product selection and suboptimal results, impacting user satisfaction.

Significant opportunities arise from the ongoing development of novel material technologies, specifically ultra-hard ceramics and hybrid composites, enabling manufacturers to create honing steels capable of effectively maintaining the increasingly hard alloys used in premium cutlery. Geographical expansion into emerging markets, particularly Southeast Asia and Latin America, also presents substantial growth potential as these regions experience modernization in commercial food infrastructure. The key impact forces dictating market behavior include intense competition among major manufacturers leading to continuous product innovation and aggressive pricing strategies. Regulatory standards regarding food preparation hygiene and worker safety also exert substantial force, pushing commercial entities towards high-quality, easily sanitized honing tools. Economic cycles, particularly those affecting construction and manufacturing output (where industrial cutting tools are prevalent), indirectly influence demand for industrial-grade honing systems.

Ultimately, the market propulsion is critically dependent on sustained investment in consumer and commercial education to distinguish honing steels from true sharpening devices, ensuring users select the correct maintenance tool for their specific needs. The increasing trend of direct-to-consumer sales through digital channels provides a unique avenue for manufacturers to deliver this essential educational content, thereby mitigating the restraint imposed by misinformation and capitalizing on the opportunity presented by a digitally engaged consumer base. The balance between maintaining affordability for high-volume markets and investing in R&D for premium, specialized materials remains a central strategic challenge for market participants navigating these dynamic forces.

Segmentation Analysis

The Honing Steel Market segmentation provides a crucial framework for understanding the diverse applications and material preferences characterizing the industry. The market is primarily segmented based on Type (material composition), Application (end-user environment), and Distribution Channel. This granular analysis is essential for manufacturers developing targeted product lines and marketing strategies, ensuring that the unique demands of high-volume commercial kitchens are met differently than those of the specialized domestic enthusiast. The dominance of the Type segment highlights the consumer's growing sophistication in choosing the appropriate tool based on their blade's material hardness—a critical factor given the recent proliferation of advanced Japanese and German steel alloys requiring specific honing textures and hardness levels.

Segmentation by Application reveals that the Industrial Tools segment, though smaller in volume, accounts for a significant portion of the revenue due to the high cost and specialized nature of their honing systems, often integrated into production lines. However, the Commercial Kitchen segment represents the largest volume consumer, driving the demand for durable, standardized, and easily sanitized stainless steel and polymer-handled hones. The emergence of the Online Distribution Channel as a major force reflects the growing ability of specialty retailers to deliver niche, high-performance ceramic and diamond-coated honing steels directly to a geographically dispersed market of discerning customers who value product reviews and technical specifications provided digitally, bypassing traditional retail intermediaries.

The combination of these segments underscores the market's complexity. For instance, a commercial meat processing plant requires large-scale, easy-to-clean high-carbon steel hones (Type: Steel; Application: Commercial), while a high-end sushi chef might prefer a delicate, fine-grit ceramic hone (Type: Ceramic; Application: Commercial) acquired through a specialized Online distributor. Understanding these unique intersections allows market players to optimize their production capacity and inventory management, focusing capital investment on high-growth segments such as fine ceramics and robust e-commerce logistics, thereby ensuring maximum market penetration and return on investment.

- Type:

- Ceramic Honing Steels

- Diamond Honing Steels

- High-Carbon Steel Honing Steels

- Composite/Hybrid Honing Steels

- Application:

- Household Use

- Commercial Kitchens (Restaurants, Catering)

- Industrial Tools (Meat Processing, Specialized Manufacturing)

- Distribution Channel:

- Online Retail (E-commerce Platforms, Brand Websites)

- Offline Retail (Department Stores, Specialty Kitchen Stores, Hardware Stores)

Value Chain Analysis For Honing Steel Market

The Value Chain for the Honing Steel Market begins with upstream activities centered on the procurement and processing of specialized raw materials. This includes high-grade carbon steel, specialized stainless steel alloys, ceramic compounds (such as aluminum oxide or zirconia), and industrial-grade diamond dust for coating applications. Upstream suppliers are typically global metal and advanced material manufacturers. Critical activities at this stage involve meticulous quality control over material composition and purity, as the hardness and texture of the raw material directly determine the final product's efficacy. Manufacturing complexity increases when dealing with ceramics, requiring high-temperature sintering and precision grinding to achieve the desired surface finish and rod geometry, demanding significant capital investment in specialized machinery.

Midstream activities involve the primary manufacturing processes: forging, grinding, hardening, coating application (for diamond and composite steels), handle attachment, and final surface treatment. Precision engineering is vital here, particularly ensuring that the honing steel rod maintains perfect straightness and uniform taper across its length, minimizing the potential for uneven honing. Quality assurance and compliance with international standards for food contact materials are critical steps within the manufacturing phase. Distribution channels, both direct and indirect, form a crucial component of the middle to downstream section. Indirect distribution relies heavily on large global retailers, wholesale distributors specializing in kitchenware, and industrial equipment suppliers. These intermediaries manage warehousing, logistics, and localized marketing efforts, providing market access to smaller manufacturers.

Downstream analysis focuses on reaching the end-user. Direct channels, increasingly prominent via e-commerce, allow manufacturers to build strong brand identities, offer customized product bundles, and gather direct customer feedback, which is vital for agile product iteration. Potential customers span commercial establishments (restaurants, hotels, food processing plants) requiring bulk, durable solutions, and individual consumers seeking high-precision tools. The final link involves post-sale service, including providing detailed usage instructions and replacement guarantees, particularly critical for expensive ceramic or diamond steels. The competitive advantage throughout the value chain is secured through intellectual property protection relating to specialized coating methods and ergonomic handle designs, alongside robust logistical operations capable of supporting global retail and e-commerce fulfillment.

Honing Steel Market Potential Customers

The primary customer base for Honing Steels is highly fragmented but can be broadly categorized into commercial users and domestic consumers, differentiated by volume demand, quality requirements, and usage frequency. Commercial end-users, primarily professional chefs, restaurant groups, catering services, and large-scale food processing facilities (such as slaughterhouses and meat packaging plants), represent the most lucrative segment due to their requirement for constant, high-frequency tool maintenance. These buyers prioritize durability, ease of sanitation, and consistency in performance, often purchasing specialized industrial-grade hones in bulk, leading to predictable, large-volume revenue streams for manufacturers. They typically require longer, heavy-duty honing steels made of high-carbon steel or polymer-handled ceramic models that can withstand rigorous daily use in demanding environments.

The second major segment consists of domestic consumers, ranging from culinary enthusiasts and home cooks who invest in high-quality cutlery, to general households requiring basic tool maintenance. While individual purchases are smaller, the collective volume of this segment is substantial. Enthusiasts often seek specialty diamond or ceramic honing steels to maintain expensive, high-hardness Japanese and German knives, requiring specialized products that cater to precise edge geometry. General household users, conversely, typically purchase more budget-friendly, standardized steel hones from mass-market retailers. The purchasing decision for domestic consumers is heavily influenced by branding, packaging, and instructional support, often facilitated through online reviews and digital educational content provided by manufacturers.

A specialized, yet growing, segment includes craftspeople and industrial users dealing with specialized cutting edges outside of food preparation, such as woodworkers, leatherworkers, and medical equipment maintenance technicians. These users require extremely fine-grit honing surfaces to maintain precision tools, often opting for ultra-fine ceramic or specialized composite materials. Manufacturers targeting this niche must focus on precision specifications and specialized distribution channels, such as industrial supply houses or technical online forums. Catering to this diverse array of buyers—from the volume-driven food industry to the precision-focused craft segment—requires a diversified product portfolio and a multi-channel distribution strategy that addresses unique purchasing behaviors and performance expectations across the spectrum.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 670 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | F. Dick, Wüsthof, Victorinox, Global, J.A. Henckels, Messermeister, Lansky, DMT, Spyderco, Chef's Choice, Smith's Abrasives, Edge Pro, Norton Abrasives, Tormek, Shapton, King, Suehiro, Kyocera, Zyliss, Zwilling J.A. Henckels |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Honing Steel Market Key Technology Landscape

The technological landscape of the Honing Steel Market is defined by continuous innovation in material science, surface engineering, and manufacturing precision, moving beyond simple steel rods to specialized abrasive composites. A key technology advancement involves the development of high-density ceramic matrix composites (CMCs), such as zirconia and alumina blends, which offer extreme hardness approaching that of industrial diamonds but with finer grit surface textures. This allows for superior edge alignment and micro-deburring on ultra-hard steel alloys (e.g., VG10, S30V) without imparting excessive abrasion. These ceramics are sintered at extremely high temperatures and polished to specific micron tolerances, ensuring a smooth, consistent honing surface that significantly extends blade life. The technology also focuses on reducing the porosity of ceramic rods to enhance hygienic properties, a critical requirement for commercial food service applications.

Another significant technological focus is on Diamond Coating Technology. Traditional diamond steels utilized polycrystalline diamond fragments, which offered high aggression but sometimes resulted in an overly coarse finish. Modern advancements involve chemical vapor deposition (CVD) and electroplating techniques to apply monocrystalline diamond coatings with highly uniform density and controlled grit sizes (often measured in microns, ranging from coarse 600 grit to ultra-fine 3000 grit equivalents). The key challenge overcome by modern technology is achieving durable adhesion of the diamond particles to the substrate (steel or aluminum core) to prevent flaking under heavy commercial use, thereby ensuring longevity and consistent performance. This precise control over grit size allows for diamond hones to be used not only for aggressive burr removal but also for genuine micro-sharpening tasks, blurring the lines between honing and light sharpening.

Furthermore, technology is improving the ancillary components, specifically the handles and core materials. Ergonomics in handle design utilizes engineered polymers and composite materials to enhance grip, balance, and hygiene, reducing the risk of accidents in fast-paced kitchen environments. Magnetic or mechanical retention systems are being integrated into storage solutions to protect the delicate honing surface of ceramic and diamond rods. For traditional high-carbon steels, metallurgical advancements focus on optimizing the steel's hardness (typically Rockwell C 64-66) and magnetic properties to ensure the steel is harder than the knife blade while still effectively attracting and removing micro-burrs. This technological evolution ensures that honing steels remain relevant and essential maintenance tools, adapting to the increasing hardness and sophistication of modern cutlery alloys.

Regional Highlights

The global Honing Steel Market exhibits distinct regional consumption and production patterns, driven by local culinary traditions, economic maturity, and the presence of major food processing and manufacturing industries. North America, encompassing the US and Canada, represents a mature, high-value market characterized by strong consumer spending on premium kitchen appliances and high standards in commercial food service safety. Demand here leans towards versatile, high-performance materials like diamond and ceramic honing steels, valued for their efficiency in maintaining a wide range of imported cutlery. The region also benefits from a robust e-commerce infrastructure, facilitating the distribution of specialized and niche products directly to consumers and small businesses, often bypassing traditional brick-and-mortar limitations.

Europe, particularly Western Europe (Germany, France, UK), holds significant market influence due to its historical dominance in cutlery manufacturing and established culinary arts scene. European consumers and professionals often exhibit a strong preference for traditional, high-quality, high-carbon steel hones, reflecting a legacy commitment to time-tested maintenance methods. Germany remains a key manufacturing hub, housing several world-renowned cutlery and honing tool producers, driving both innovation and quality benchmarks. Regulatory compliance related to food contact safety and material traceability is exceptionally stringent in the European Union, influencing product design and material selection across the supply chain, often favoring non-porous and easily sanitized options.

The Asia Pacific (APAC) region is poised for the most rapid expansion throughout the forecast period. This growth is fueled by massive infrastructure development in commercial food services, rapid urbanization, and a burgeoning middle class in countries like China, India, and Southeast Asian nations adopting Western culinary practices and investing in durable household goods. While low-cost steel hones dominate the basic segments, there is rapidly escalating demand for premium ceramic hones, particularly in markets adjacent to major Japanese and South Korean cutlery manufacturing centers, reflecting an appreciation for precision and traditional sharpening techniques. Manufacturing concentration in this region also provides a competitive cost advantage, making APAC both a key production center and a primary consumption driver globally.

- North America (USA, Canada): High demand for premium, diamond-coated, and ceramic hones; strong e-commerce penetration; driven by commercial food service and affluent household segment.

- Europe (Germany, UK, France): Market mature and stable; preference for traditional, high-carbon steel; strict regulatory environment mandates high quality and hygiene standards; major manufacturing base.

- Asia Pacific (China, Japan, India): Highest growth potential; rapid commercial kitchen expansion; dual market structure with high-volume low-cost segment and specialized high-end ceramic segment; manufacturing hub for global supply.

- Latin America (Brazil, Mexico): Emerging market potential tied to professionalization of culinary industry; demand growth driven by foreign culinary chains and modern retail expansion.

- Middle East and Africa (MEA): Growth concentrated in urban centers and hospitality sectors (hotels, large catering); reliance on imported products; focus on standard, durable stainless steel options.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Honing Steel Market.- F. Dick GmbH

- Wüsthof Trident GmbH

- Victorinox AG

- Global (Yoshikin)

- J.A. Henckels International

- Messermeister

- Lansky Sharpeners

- DMT (Diamond Machining Technology)

- Spyderco, Inc.

- Chef's Choice (EdgeCraft Corporation)

- Smith's Abrasives, Inc.

- Edge Pro Inc.

- Norton Abrasives

- Tormek AB

- Shapton Co., Ltd.

- King Grinding Stone Co., Ltd.

- Suehiro Mfg. Co., Ltd.

- Kyocera Corporation

- Zyliss

- Zwilling J.A. Henckels AG

Frequently Asked Questions

Analyze common user questions about the Honing Steel market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a Honing Steel and a Sharpening Stone?

A honing steel primarily realigns microscopic metal burrs on a knife's cutting edge (truing the edge) without removing significant material, thus maintaining sharpness. A sharpening stone (whetstone) uses abrasive material to grind away metal, creating a new, sharp bevel, a process used when the blade is truly dull or damaged.

Which type of honing steel is best for high-hardness Japanese cutlery?

Ceramic honing steels, particularly those with ultra-fine grit, are generally considered best for high-hardness Japanese cutlery (above 60 HRC). Their non-porous structure and fine abrasive surface effectively align the hard, delicate edge without causing excessive abrasion or chipping, preserving the acute edge angle.

How often should a commercial kitchen knife be honed?

In high-volume commercial kitchens, a knife should ideally be honed frequently—often before or after every major cutting task, and potentially every few hours during continuous use. Consistent honing maintains peak performance and dramatically reduces the need for aggressive, time-consuming sharpening sessions.

Are Diamond Honing Steels suitable for all knife types?

Diamond honing steels are highly effective and versatile for most knife types due to their extreme hardness, which allows them to work on both soft and hard steels. However, because they are more aggressive than ceramic or traditional steel hones, they perform a micro-sharpening action and must be used with light pressure to avoid removing excessive material, especially on soft European steels.

What are the key drivers for market growth in the Asia Pacific region?

Market growth in the APAC region is primarily driven by the rapid expansion and modernization of the commercial food service sector, increasing urbanization leading to greater adoption of specialized kitchenware by the growing middle class, and the region's strong position as a global manufacturing and export hub for cutlery and related maintenance tools.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager