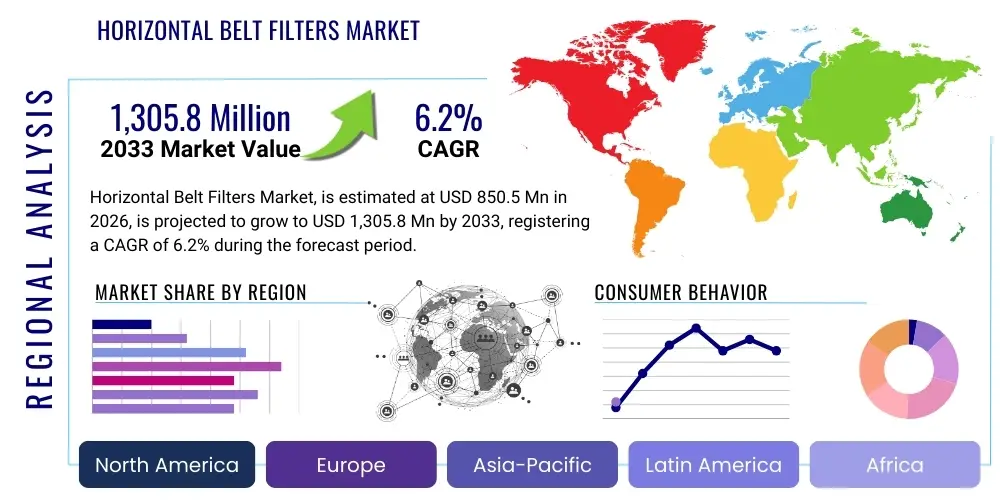

Horizontal Belt Filters Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438624 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Horizontal Belt Filters Market Size

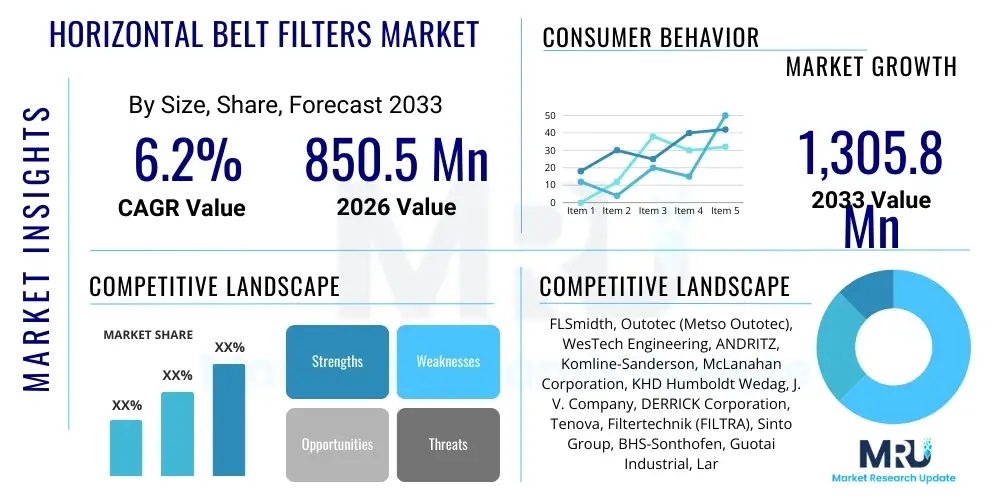

The Horizontal Belt Filters Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.2% between 2026 and 2033. The market is estimated at USD 850.5 Million in 2026 and is projected to reach USD 1,305.8 Million by the end of the forecast period in 2033.

Horizontal Belt Filters Market introduction

The Horizontal Belt Filter (HBF) market encompasses specialized equipment designed for continuous solid-liquid separation, predominantly utilizing gravity and vacuum to efficiently dewater slurries. These industrial filtration units are characterized by a continuous filtering medium—typically a rubber or synthetic belt—which transports the slurry through various stages including feeding, filtration, washing, dewatering, and discharge. HBFs are essential in processing large volumes of material, offering superior efficiency and flexibility in handling diverse material characteristics, particle sizes, and required dryness levels. Their robust design allows for stringent control over cake thickness and wash cycles, making them indispensable in sectors where product purity and high throughput are critical determinants of operational success.

Major applications of horizontal belt filters span across highly regulated and resource-intensive industries, including mining and metallurgy, chemical processing, fertilizer production, flue gas desulfurization (FGD) in power generation, and wastewater treatment. In the mining sector, HBFs are vital for dewatering concentrates of minerals such as copper, iron ore, and gold, significantly reducing transportation costs and preparing material for subsequent refining stages. For chemical and pharmaceutical industries, these filters ensure high purity levels through counter-current washing capabilities, minimizing solvent loss and maximizing product yield. The versatility and scalability of HBF systems allow manufacturers to customize solutions to specific process demands, addressing challenges related to corrosion, high temperatures, and abrasive materials, thereby solidifying their role as cornerstone technology in modern industrial separation processes.

The primary driving factors for market expansion include the increasing global demand for processed minerals driven by infrastructure development and the electric vehicle transition, which necessitates efficient dewatering technologies. Furthermore, stringent environmental regulations globally, particularly concerning water usage and slurry disposal, compel industries to adopt advanced filtration systems that maximize water recovery and minimize moisture content in waste residues. The inherent benefits of HBFs, such as their continuous operation, relatively simple maintenance structure, and capacity for large-scale processing, position them favorably against batch-based or less efficient continuous filtration alternatives. Ongoing technological advancements focused on automation, durable belt materials, and energy optimization further enhance their appeal and market adoption.

Horizontal Belt Filters Market Executive Summary

The Horizontal Belt Filters Market is experiencing sustained growth, fundamentally driven by robust business trends centered around sustainability mandates and the escalating requirements of the global mining industry. Key business trends include the shift towards high-capacity, automated systems that integrate digital twin technology for predictive maintenance and operational efficiency. Manufacturers are increasingly focusing on modular designs to facilitate quicker installation and lower capital expenditure (CAPEX) for large projects. Moreover, the demand for specialized, corrosion-resistant belts made from advanced polymers and composite materials is growing rapidly, reflecting the increasing complexity and aggressiveness of slurries processed in chemical and metallurgical plants. Successful market players are those offering full-lifecycle services, encompassing installation, commissioning, spares, and performance monitoring, thereby creating stronger vendor-client partnerships.

Regionally, the Asia Pacific (APAC) continues to dominate the market share, fueled by massive resource extraction activities, especially in China, Australia, and India, alongside significant investments in industrial chemical production and power generation infrastructure requiring FGD filtration. North America and Europe demonstrate mature market characteristics, emphasizing replacement cycles and technology upgrades, specifically adopting advanced automation and compliance-focused filtration systems to meet strict environmental standards regarding effluent quality. Latin America, rich in mineral resources like copper and lithium, presents significant growth opportunities, characterized by new mining projects demanding high-efficiency HBFs. Geopolitical stability and investment security remain critical factors influencing capital project initiation in these emerging mining regions.

In terms of segmentation, the Rubber Belt segment holds the largest share due to its durability and widespread application in highly abrasive environments like mining, though the composite materials segment is exhibiting the fastest growth driven by specialty chemical applications requiring high chemical resistance. By application, the mining and metallurgy sector remains the primary revenue generator, but water and wastewater treatment applications are anticipated to grow substantially as municipal and industrial entities invest in tertiary treatment and sludge dewatering. The market is also segmented by filtration area, showing a strong trend towards large-area filters (over 50 m²) to accommodate increasing plant capacities and economies of scale. These segment trends underscore the market’s reliance on capital investments in heavy industry and environmental compliance infrastructure.

AI Impact Analysis on Horizontal Belt Filters Market

Common user questions regarding AI’s impact on the Horizontal Belt Filters Market primarily center on how artificial intelligence can move beyond simple automation to enable genuine predictive capabilities, minimize downtime, and optimize complex filtration parameters. Users frequently inquire about the feasibility of integrating machine learning models for real-time cake moisture prediction, self-adjusting wash cycles based on slurry characteristics (which fluctuate greatly), and automated fault detection in mechanical components like vacuum pumps and belt alignment systems. The consensus highlights a strong expectation that AI will transform HBF operation from reactive maintenance schedules to proactive, performance-based optimization, directly impacting operational expenditure (OPEX) and extending the mean time between failures (MTBF). This collective inquiry suggests that the industry is looking for AI solutions that yield tangible improvements in filtration efficiency, resource consumption (water and energy), and overall equipment effectiveness (OEE).

The application of AI in the HBF domain focuses intensely on data analytics derived from numerous sensors monitoring vacuum pressure, belt speed, cake thickness, and moisture content. Machine learning algorithms analyze these multivariate datasets to establish optimal operating points, often compensating dynamically for material input variations that would typically destabilize traditional control systems. This level of optimization is particularly valuable in resource recovery operations where maintaining high purity and low moisture content simultaneously is a continuous challenge. By using neural networks trained on historical operational data, HBF systems can now forecast maintenance requirements far in advance, scheduling shutdowns during optimal non-production times, thereby maximizing plant utilization rates.

Furthermore, AI is instrumental in enhancing the safety and environmental performance of HBF operations. Through advanced pattern recognition, AI systems can detect minor anomalies that might indicate premature failure or filter cloth deterioration, preventing catastrophic equipment failure or the discharge of non-compliant effluent. The integration of AI-driven process simulation also allows operators to test different operational scenarios virtually, leading to faster commissioning times and optimized standard operating procedures (SOPs). This transition toward intelligent filtration management is positioning HBFs not just as mechanical separators, but as integral, smart components of a digitally connected industrial plant infrastructure.

- AI enables predictive maintenance, forecasting component failure and optimizing spare parts inventory.

- Machine learning algorithms optimize filtration parameters (vacuum, speed, washing intensity) in real-time based on slurry input.

- Digital twins powered by AI facilitate virtual testing and training, speeding up commissioning and process optimization.

- Enhanced quality control through AI vision systems monitoring cake formation and discharge consistency.

- Optimization of water and energy consumption by minimizing unnecessary wash cycles and vacuum pump operation.

DRO & Impact Forces Of Horizontal Belt Filters Market

The Horizontal Belt Filters Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively generating powerful impact forces on market trajectory. The primary driver is the accelerating global demand for high-purity, dewatered mineral concentrates, stemming from major infrastructure projects and the energy transition (e.g., lithium and cobalt processing). Concurrently, global water scarcity and increasingly strict environmental discharge regulations mandate the adoption of high-efficiency dewatering solutions capable of maximizing water recovery and minimizing solid waste volume. These two factors—resource demand and environmental compliance—form a potent demand push, ensuring continuous investment in advanced filtration technologies. The continuous, high-throughput capability of HBFs makes them the preferred choice for large-scale operations seeking economies of scale and reliable performance.

However, the market faces significant restraints. The most prominent restraint is the high initial capital expenditure (CAPEX) associated with installing large-scale HBF systems, which often includes extensive supporting infrastructure such as vacuum pump stations, slurry feed systems, and structural supports. This high entry cost can deter smaller operations or delay investment in emerging markets. Furthermore, the operational complexity and dependence on skilled maintenance personnel—particularly for belt tracking and vacuum box sealing—pose persistent challenges, increasing operational expenditure (OPEX). The susceptibility of filter belts and components to abrasive wear and chemical corrosion in harsh operating environments necessitates frequent replacements and high-cost material specification, adding to the overall cost of ownership and sometimes limiting adoption where simpler, though less efficient, equipment might suffice.

The main opportunities for market growth reside in the emerging field of rare earth element (REE) processing, which requires meticulous separation and washing processes ideally suited to HBF capabilities. Furthermore, the global push towards circular economy models and treating industrial wastewater sludge for resource recovery presents a significant, untapped application segment. Technological advancements focused on developing low-maintenance, modular HBF designs, incorporating IoT sensors and AI for predictive performance, will mitigate the current restraints of high OPEX and complexity. These innovations create a substantial opportunity for manufacturers to differentiate their offerings based on total cost of ownership (TCO) rather than just initial CAPEX. The combined impact forces are heavily weighted towards technological evolution and regulatory necessity, demanding higher efficiency and sustainability from filtration providers.

Segmentation Analysis

The Horizontal Belt Filters Market is meticulously segmented across several critical parameters, including filter material type, application, operating principle, and filtration area, allowing for a precise understanding of market dynamics and specialized end-user requirements. This segmentation structure reflects the diverse industrial environments where HBFs are deployed, ranging from acidic chemical plants to high-volume mineral processing sites. The robust performance and customization capabilities of HBFs necessitate this granular approach, as filtration needs vary drastically between industries. For instance, applications in pharmaceuticals demand stainless steel components and specific non-leaching belt materials, contrasting sharply with the heavy-duty, abrasion-resistant requirements of the mining sector.

The segmentation by filter material is crucial, dividing the market between rubber, composite/synthetic (like polyethylene or polypropylene), and specialized materials. Rubber belts dominate high-abrasion applications due to their durability and robustness, while synthetic belts are preferred in chemical processing where resistance to specific corrosive agents and high temperatures is mandatory. Segmentation by application clearly defines market size by end-use industry, with mining and chemical processing acting as the primary revenue pillars. Other high-growth areas include flue gas desulfurization (FGD) sludge dewatering, which is tightly linked to global environmental policies and coal-fired power generation, and specialized filtration within the food and beverage industry.

Furthermore, geographic segmentation underscores the localized drivers and regulatory frameworks influencing adoption. Asia Pacific leads due to intensive raw material extraction and rapid industrialization, while North America and Europe lead in technological adoption and replacement markets focused on efficiency and compliance. Understanding these segment trends is vital for manufacturers to tailor their R&D investments, supply chain strategies, and marketing efforts towards the most lucrative and rapidly evolving sub-sectors. The overarching trend is the increasing demand for HBFs with larger filtration areas and higher degrees of automation across all major segments, driven by global demand for efficiency and scale.

- By Type:

- Rubber Belt Filters

- Composite/Synthetic Belt Filters (Polypropylene, Polyethylene)

- Others (e.g., Specialized Materials)

- By Application:

- Mining and Metallurgy (e.g., Copper, Iron Ore, Gold, Rare Earth Elements)

- Chemical Processing (e.g., Fertilizers, Pigments, Acids)

- Power Generation (Flue Gas Desulfurization – FGD)

- Food and Beverage Processing

- Water and Wastewater Treatment

- Pharmaceuticals and Biotechnology

- By Filtration Area:

- Small (Under 10 m²)

- Medium (10 m² to 50 m²)

- Large (Above 50 m²)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Horizontal Belt Filters Market

The value chain for the Horizontal Belt Filters market is structured around the specialized nature of the equipment and the reliance on high-quality component suppliers, extending from raw material sourcing to complex project commissioning. The chain begins with the upstream suppliers providing critical materials, predominantly high-grade rubber and polymers for the filtration belts, and specialized alloys (such as stainless steel or high-nickel alloys) for the structural components and vacuum boxes, which must withstand severe corrosive or abrasive operating conditions. The performance and longevity of the HBF system are fundamentally dependent on the quality and durability of these sourced materials. Procurement strategies often prioritize long-term contracts with specialized material suppliers to ensure consistency and cost predictability, mitigating risks associated with supply volatility.

The core manufacturing stage involves the precision engineering and assembly of the filter units, often requiring sophisticated fabrication techniques for the large, precise vacuum tables and the installation of complex mechanical systems like belt tracking and drive mechanisms. Manufacturers often engage in vertical integration for certain critical components, such as control panels and vacuum receivers, to maintain intellectual property and quality control. Distribution channels for HBFs are typically highly specialized, characterized by both direct sales and indirect channels involving Engineering, Procurement, and Construction (EPC) firms. Direct sales are common for customized, high-value replacement units or smaller projects, allowing manufacturers to maintain direct control over customer relationships and service delivery.

However, the bulk of large-scale HBF deployments, especially in mining and power generation, are managed indirectly through global EPC contractors. These contractors integrate the HBF system into a larger plant design, managing installation, commissioning, and performance guarantees. Downstream activities involve comprehensive after-sales service, including spare parts supply (belts, filter cloths, vacuum seals), routine maintenance, and performance optimization consulting. The end-users—mining companies, chemical manufacturers, and utility providers—are highly reliant on prompt, expert service to minimize costly downtime. The value chain is inherently influenced by project cycles and capital expenditure approvals within heavy industry, requiring robust financial planning and strong partnerships between manufacturers and EPC specialists to navigate complex project execution globally.

Horizontal Belt Filters Market Potential Customers

Potential customers for Horizontal Belt Filters are predominantly organizations within the heavy industrial sectors that require high-efficiency continuous solid-liquid separation processes for resource recovery or waste minimization. The largest and most consistent customer segment is the mining and metallurgy industry, including major producers of copper, iron ore, gold, and bauxite, who utilize HBFs extensively for dewatering concentrates prior to smelting or shipping. These customers seek filters that offer high throughput, maximum cake dryness to reduce energy costs in subsequent thermal drying stages, and extreme robustness to handle abrasive mineral slurries. As global resource demand grows, investment in new mine sites and expansion of existing processing plants solidify this segment as the market's primary revenue driver.

The chemical processing industry represents another critical customer base, particularly manufacturers of fertilizers (phosphate and potash), specialty chemicals, and inorganic pigments. In this sector, the primary need for HBFs centers on rigorous washing capabilities, often employing counter-current washing to achieve high product purity and recover valuable solvents or reagents. Chemical plant operators prioritize chemical resistance in filter materials and systems designed for contained operation to handle hazardous substances safely. This segment is driven by global agricultural demand for fertilizers and the continuous optimization of chemical manufacturing processes aimed at minimizing waste and maximizing yield.

Furthermore, environmental compliance and infrastructure development drive demand from the power generation sector (Flue Gas Desulfurization, FGD) and municipal/industrial wastewater treatment facilities. In FGD applications, HBFs dewater gypsum sludge created during scrubbing, a mandated process to reduce sulfur dioxide emissions. Wastewater utilities use HBFs for high-volume dewatering of primary and secondary sludge to reduce disposal volume and costs. These customers are highly sensitive to operational costs, system reliability, and compliance with stringent discharge limits, making total cost of ownership (TCO) and proven reliability key purchasing criteria. The diversification of HBF applications across these high-stakes industries underscores the broad and resilient customer base supporting market growth.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850.5 Million |

| Market Forecast in 2033 | USD 1,305.8 Million |

| Growth Rate | 6.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | FLSmidth, Outotec (Metso Outotec), WesTech Engineering, ANDRITZ, Komline-Sanderson, McLanahan Corporation, KHD Humboldt Wedag, J. V. Company, DERRICK Corporation, Tenova, Filtertechnik (FILTRA), Sinto Group, BHS-Sonthofen, Guotai Industrial, Larox (now Outotec), Hebei Huatai, Wuxi Mineral Equipment, Shanghai Zhongshi, Zibo Taisheng, Fuxin Mining Machinery |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Horizontal Belt Filters Market Key Technology Landscape

The technological landscape of the Horizontal Belt Filters Market is rapidly evolving, driven primarily by the need for increased efficiency, reduced operational expenditure (OPEX), and enhanced system reliability in demanding industrial environments. A key trend involves advanced material science, focusing on developing highly durable and chemical-resistant filter belts and wear components. Manufacturers are increasingly utilizing composite polymers and specialized rubber blends that offer superior resistance to abrasion and corrosion, significantly extending the service life of critical parts and reducing downtime associated with frequent replacements. Furthermore, the design of the vacuum system is continually being optimized through computational fluid dynamics (CFD) to ensure uniform vacuum distribution across the filtration area, maximizing dewatering effectiveness and minimizing energy consumption by the vacuum pump station.

Another major technological shift is the extensive integration of Industry 4.0 concepts, particularly the Internet of Things (IoT) and advanced automation. Modern HBF systems are equipped with numerous sensors that monitor key performance indicators (KPIs) such as vacuum level, belt tension and alignment, slurry density, and cake moisture content in real-time. This sensor data feeds into sophisticated Process Logic Controllers (PLCs) and Distributed Control Systems (DCS) that enable automated parameter adjustments, ensuring optimal operation regardless of variations in feed characteristics. The implementation of smart monitoring allows for proactive alerts regarding potential belt misalignment or vacuum leaks, drastically improving operational safety and preventing costly equipment damage.

Furthermore, modularization and design flexibility are becoming paramount. Many leading manufacturers are shifting towards modular HBF designs, which facilitate quicker installation and commissioning, especially important for remote mining sites. These modular units often incorporate innovative belt washing and tensioning systems that simplify maintenance procedures. Research and development efforts are also concentrated on enhancing washing efficiency through optimized spray nozzle configurations and vacuum zones, supporting the high-purity requirements of the chemical and pharmaceutical industries. The combination of robust materials, integrated intelligence, and user-friendly design defines the current competitive technology landscape, positioning HBFs as sophisticated, high-performance separation instruments rather than merely mechanical filters.

Regional Highlights

The global consumption and production of Horizontal Belt Filters display distinct characteristics across major geographical regions, influenced by localized industrial activities, environmental regulations, and resource availability.

- Asia Pacific (APAC): APAC is the dominant market and the engine of growth for the HBF industry. This supremacy is rooted in extensive mining operations (particularly in Australia, China, and Indonesia) focused on commodities like coal, iron ore, and base metals. Furthermore, rapid industrialization, large-scale fertilizer production, and the significant construction of coal-fired power plants (requiring FGD systems) drive sustained high demand for large-area HBF units. China, in particular, leads both in consumption and local manufacturing capacity, benefiting from continuous infrastructure investment and stringent government policies aimed at reducing industrial pollution and maximizing water recovery.

- North America: North America represents a mature, high-value market characterized by replacement demand and technological upgrades rather than large-scale new project construction, though significant activity exists in the processing of oil sands, phosphates, and non-metallic minerals. The demand is heavily influenced by strict environmental standards, driving the need for highly automated, efficient HBF systems for flue gas desulfurization and advanced wastewater sludge dewatering in municipal and industrial settings. Manufacturers in this region focus on reliability, compliance, and integrating Industry 4.0 technologies.

- Europe: The European market is highly regulated and focuses intensely on sustainable practices and resource efficiency. Demand is driven by the chemical and pharmaceutical industries, which require specialized HBFs for high-purity separation, and by the strict implementation of environmental directives related to industrial emissions and waste treatment. The region's emphasis is on high-quality engineering, energy efficiency, and low-emissions processing, making customization and advanced material specifications key competitive factors.

- Latin America (LATAM): LATAM is a region offering substantial growth potential, primarily driven by massive copper, iron ore, and increasingly, lithium extraction projects across Chile, Peru, and Brazil. New greenfield mining projects necessitate the installation of high-capacity HBF systems to efficiently dewater concentrates in challenging geological and logistical environments. Investment stability and commodity price fluctuations significantly impact project timelines and, consequently, HBF demand in this region.

- Middle East and Africa (MEA): Growth in MEA is highly localized. The Middle East sees demand linked to large-scale fertilizer and petrochemical complexes, demanding highly chemical-resistant filtration solutions. Africa, dominated by mining activities (gold, platinum, diamonds), presents sporadic but substantial demand for rugged, dependable HBFs capable of operating reliably in often harsh and remote conditions. Infrastructure development and water management initiatives are slowly expanding the application base beyond traditional mining.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Horizontal Belt Filters Market.- FLSmidth

- Outotec (Metso Outotec)

- WesTech Engineering

- ANDRITZ

- Komline-Sanderson

- McLanahan Corporation

- KHD Humboldt Wedag

- J. V. Company

- DERRICK Corporation

- Tenova

- Filtertechnik (FILTRA)

- Sinto Group

- BHS-Sonthofen

- Guotai Industrial

- Larox (now Outotec)

- Hebei Huatai

- Wuxi Mineral Equipment

- Shanghai Zhongshi

- Zibo Taisheng

- Fuxin Mining Machinery

Frequently Asked Questions

Analyze common user questions about the Horizontal Belt Filters market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary operational benefits of using Horizontal Belt Filters over alternative dewatering equipment?

HBFs offer continuous operation, high throughput capacity, and exceptional washing efficiency, crucial for achieving low cake moisture content and high product purity. Their design allows for customizable filtration stages, including multi-stage counter-current washing, which is superior for complex mineral or chemical slurries compared to filter presses or centrifuges.

How do environmental regulations specifically impact the demand for Horizontal Belt Filters?

Stringent environmental regulations worldwide, particularly concerning water consumption and effluent discharge quality, significantly drive HBF demand. HBFs maximize water recovery from slurries and reduce the volume and moisture content of solid waste (tailings/sludge), helping industries achieve compliance and improve sustainable water management practices.

What key factors determine the lifespan and necessary maintenance frequency of an HBF system?

The lifespan is primarily determined by the abrasiveness and corrosiveness of the filtered slurry, the quality of the filter belt material, and operational practices. Key maintenance areas include periodic replacement of the filter cloth and belt, ensuring proper belt alignment, and servicing the vacuum box seals and pump systems. Modern HBFs utilize AI-driven predictive maintenance to optimize servicing intervals and minimize costly unplanned downtime.

Which specific industries represent the largest end-use markets for Horizontal Belt Filters globally?

The mining and metallurgy sector is the largest end-use market, driven by the need to dewater high volumes of mineral concentrates (copper, iron ore). The chemical processing industry (fertilizers, pigments) and the power generation sector (Flue Gas Desulfurization or FGD) also represent major consumers due to their strict requirements for product purity and waste sludge volume reduction.

How is technological innovation improving the efficiency and reducing the TCO of Horizontal Belt Filters?

Technological innovation focuses on integrating IoT sensors and AI for real-time process optimization and predictive maintenance, reducing energy consumption and operational risk. Improvements in material science yield more durable, abrasion- and chemical-resistant filter belts, significantly extending the time between replacement cycles and lowering the Total Cost of Ownership (TCO).

Why is the Asia Pacific region the market leader in terms of HBF market share?

The APAC region leads due to extensive, large-scale mining operations, particularly in Australia and China, coupled with massive investments in industrial capacity, including fertilizer manufacturing and coal-fired power plants. These activities require high-capacity, continuous solid-liquid separation equipment, making APAC the dominant geographical segment.

What is the difference between Rubber Belt Filters and Composite Belt Filters in terms of application?

Rubber Belt Filters are favored in mining and abrasive environments due to their superior durability and resistance to wear. Composite or Synthetic Belt Filters (e.g., polypropylene) are generally used in chemical and pharmaceutical processing where high chemical resistance, anti-corrosion properties, and specific temperature tolerances are required, often involving highly corrosive acids or solvents.

How does the filtration area size segment the HBF market?

HBFs are segmented into small, medium, and large filtration areas (typically above 50 m²). Large filters are crucial for high-volume, global-scale mining and FGD applications where high throughput and economies of scale are vital. Smaller units cater to specialty chemical, pilot plant, or specialized industrial waste applications.

What role do EPC contractors play in the Horizontal Belt Filters value chain?

Engineering, Procurement, and Construction (EPC) contractors play a crucial intermediary role, especially in large capital projects. They integrate the HBF system into the overall plant design, manage complex procurement processes, handle installation and commissioning, and ensure the filtration system meets the project’s specified performance guarantees, facilitating indirect sales for manufacturers.

What are the key technical specifications required by customers in the Rare Earth Elements (REE) processing sector?

REE processing requires HBFs with exceptional washing efficiency to separate valuable elements from leach liquors. Technical specifications often demand highly corrosion-resistant materials (due to strong acids used in leaching), precise control over wash water distribution, and the ability to maintain uniform cake formation for effective purification and yield maximization.

How does the high capital expenditure restrain market growth for HBFs?

The high initial cost of purchasing and installing large, sophisticated HBF systems, including vacuum generation and auxiliary components, acts as a barrier, particularly for smaller companies or in regions with limited capital access. This often leads potential customers to opt for lower-CAPEX, albeit less efficient, dewatering alternatives, thus restraining overall market growth.

What is the primary function of the vacuum system in a Horizontal Belt Filter?

The vacuum system generates a differential pressure across the filter medium. This vacuum draws the liquid through the cake layer and filter cloth, substantially accelerating the dewatering process, removing residual moisture content, and ensuring optimal cake dryness before discharge. The efficiency of the vacuum system is paramount to the HBF’s performance.

In what ways can advanced automation enhance the operational stability of HBFs?

Advanced automation, utilizing PLCs and feedback loops, ensures consistent operational stability by continuously monitoring and adjusting critical parameters such as belt speed, vacuum strength, and slurry gate positions. This real-time adjustment mitigates the impact of variable slurry feed characteristics, preventing operational upsets and maintaining peak filtration performance.

What is meant by the term "cake thickness control" in HBF operations?

Cake thickness control refers to the precise regulation of the layer of solids deposited on the filter belt. Optimized cake thickness is essential for efficient dewatering and washing; if the cake is too thin, flow rate suffers; if too thick, washing is inefficient and the vacuum may be compromised. HBFs allow operators to mechanically adjust the feed mechanism to achieve the desired thickness for optimal filtration results.

How do fluctuations in commodity prices affect the Horizontal Belt Filters Market?

Since a significant portion of HBF demand comes from the mining sector, fluctuations in the prices of key commodities (e.g., copper, iron ore) directly impact investment decisions. High commodity prices incentivize new mine development and plant expansions, driving demand for HBFs. Conversely, low prices often lead to the postponement or cancellation of capital projects, softening market demand.

What is the current trend regarding the size of Horizontal Belt Filter units being deployed?

The current trend shows a strong market preference for large-area HBF units (over 50 m² filtration area). This trend is driven by the necessity for high throughput in modern mining and power generation facilities seeking greater economies of scale and maximizing processing capacity within a limited plant footprint.

How does the pharmaceutical industry utilize specialized Horizontal Belt Filters?

The pharmaceutical industry uses specialized HBFs for separating crystalline products or intermediates. Requirements are extremely stringent, often demanding features like stainless steel construction, containment systems for volatile or toxic substances, and sanitary design (CIP/SIP capability) to ensure product sterility and prevent cross-contamination.

What are the critical aspects of upstream material sourcing for HBF manufacturing?

Upstream sourcing focuses on obtaining high-performance materials. This includes specialized, flexible elastomers for the rubber belts and highly corrosion-resistant alloys (like Duplex stainless steel) for the filter troughs and vacuum components. The quality and specification of these materials dictate the system’s longevity, chemical resistance, and ability to handle abrasive materials.

Why is energy efficiency becoming a key selling point for HBF manufacturers?

Energy efficiency is paramount because vacuum generation is highly energy-intensive. Manufacturers are optimizing vacuum pump selection, utilizing energy recovery systems, and designing improved vacuum box seals to minimize air leakage, thereby reducing the overall energy consumption (OPEX) and improving the sustainability profile of the filtration system.

What competitive advantage does modular design offer in the HBF market?

Modular design offers significant competitive advantages by reducing installation time and costs. It simplifies logistics for deployment in remote areas and allows for easier future capacity expansion or relocation. Modular units also standardize componentry, simplifying maintenance and spare parts management for end-users.

Define the role of predictive maintenance in modern Horizontal Belt Filter operations.

Predictive maintenance uses IoT sensors and AI algorithms to analyze operational data and forecast when a component is likely to fail or when performance will drop below a critical threshold. This allows maintenance to be scheduled proactively, minimizing unscheduled downtime, extending equipment life, and ensuring consistent operational efficiency.

What is the significance of the Flue Gas Desulfurization (FGD) application segment?

The FGD segment involves dewatering the gypsum sludge produced by scrubbers in coal-fired power plants to comply with air quality standards. As governments mandate cleaner emissions, the need for efficient HBFs to handle large volumes of this sludge and recover water remains a critical and stable application market.

How does the concept of Total Cost of Ownership (TCO) influence purchasing decisions for HBFs?

TCO is increasingly important, moving beyond initial CAPEX to include operational costs (energy, water, spares) and maintenance costs over the equipment's lifecycle. Customers favor HBF suppliers that can demonstrate high efficiency, low maintenance requirements, and reliable long-term performance, leading to a lower overall TCO, despite potentially higher initial investment.

What challenges do HBF manufacturers face in the Latin American mining sector?

Manufacturers in LATAM often face challenges related to logistical complexity for transporting large equipment to remote mine sites, inconsistent infrastructure, and the necessity to provide robust, high-availability service and spares networks due to the critical nature of the filtration process in high-volume operations.

Explain the significance of counter-current washing in high-purity applications.

Counter-current washing involves applying wash fluid in multiple stages, moving opposite to the solid cake flow. This method minimizes the use of wash fluid while maximizing the removal of impurities trapped within the cake, achieving higher product purity levels essential in the chemical and fertilizer industries.

What technological advancement is currently addressing the issue of belt tracking in HBFs?

Modern HBF systems utilize sophisticated automatic belt tracking mechanisms that rely on laser sensors, pneumatic actuators, and advanced controls. These systems detect slight misalignments in real-time and apply immediate corrective action, preventing belt damage and ensuring the filter belt runs optimally, reducing a major source of operational failure and maintenance.

How is the need for sustainable practices influencing filter material development?

The drive for sustainability encourages the development of filter materials that are longer-lasting, recyclable, and capable of operating with minimal wear or chemical degradation, thus reducing waste generation and the frequency of material disposal, aligning with circular economy principles.

What is the typical operating pressure utilized by vacuum Horizontal Belt Filters?

Horizontal Belt Filters typically operate under vacuum pressure, ranging from 0.4 to 0.8 bar absolute pressure, depending on the required flow rate, slurry viscosity, and desired cake moisture content. The vacuum system design must be optimized to handle large volumes of air and filtrate efficiently.

Which sub-segment within chemical processing is showing the fastest growth for HBF adoption?

The production of phosphate and potash fertilizers is exhibiting robust growth in HBF adoption globally. These processes require efficient dewatering and acid washing steps, where the HBF’s large capacity and controlled washing capabilities provide distinct advantages over alternative separation technologies.

What is the role of digital twin technology in the future of HBF systems?

Digital twin technology creates a virtual replica of the physical HBF system. This allows operators to simulate various operational scenarios, test firmware upgrades, optimize filtration parameters before deployment, and train personnel in a risk-free environment, leading to accelerated performance improvements and process reliability.

How do abrasive slurries impact the structural design of Horizontal Belt Filters?

Abrasive slurries necessitate the use of heavy-duty construction materials, hardened wear plates, specialized rubber compounds, and protective coatings on all parts that come into contact with the slurry. Structural components, like the vacuum box and feed mechanisms, are designed to be robust and often replaceable to withstand constant wear and extend the overall equipment lifespan.

What distinguishes the competitive landscape among the top HBF manufacturers?

Competition among major players like FLSmidth, Metso Outotec, and ANDRITZ is distinguished by their global service networks, long-standing process expertise (especially in mining), R&D focus on automation and efficiency, and the ability to provide integrated plant solutions that incorporate filtration alongside other processing steps.

In what context are Horizontal Belt Filters utilized for environmental remediation projects?

HBFs are used in environmental remediation for the dewatering of polluted sludge or contaminated soils treated with chemical reagents. Their high capacity for solid-liquid separation helps reduce the volume of hazardous waste requiring final disposal and often facilitates the recovery of valuable resources or cleaner water.

What is the definition of "filter medium" in the context of HBF technology?

The filter medium is the physical fabric or cloth (typically synthetic fiber) laid over the rubber belt that performs the actual separation. It retains the solid particles while allowing the liquid (filtrate) to pass through. The selection of the medium is critical, depending on particle size distribution, chemical compatibility, and required filtration speed.

How are manufacturers addressing the issue of energy consumption related to the vacuum pump station?

Manufacturers are addressing this through the adoption of variable frequency drives (VFDs) on vacuum pumps to precisely match vacuum generation to instantaneous process demand, along with advanced system designs that minimize air leakage and maximize the efficiency of the vacuum generation hardware.

Which geographical region shows promising emerging market growth outside of the APAC mining sector?

Latin America, particularly in the processing of battery minerals like lithium, is showing strong emerging market growth. The global electric vehicle transition is spurring massive investments in South American lithium extraction, requiring sophisticated filtration systems for lithium compounds.

What considerations are critical for HBF installation in high-altitude mining environments?

High-altitude installations require specialized considerations due to lower atmospheric pressure, which affects the efficiency of vacuum pumps and dewatering performance. Equipment must also be robust enough to handle extreme temperature variations and challenging logistics, often necessitating compact, modular designs.

Why is belt alignment a persistent challenge in HBF operation?

Maintaining perfect belt alignment is challenging due to the large scale of the belts, uneven tension caused by material loading, and wear on idlers. Misalignment can quickly damage the belt edges and vacuum seals, leading to operational failure. This requires continuous monitoring and automated tracking systems for mitigation.

How does the shift towards sustainable mining affect HBF demand?

Sustainable mining demands efficient tailings management and maximum water recycling. HBFs are essential for dewatering fine tailings to produce stackable dry cake, which reduces the volume and environmental risk associated with wet tailings ponds, directly increasing demand for large-scale filtration solutions.

What are the key differences between continuous and batch filtration methods?

Continuous filtration (like HBF) processes slurry flow uninterruptedly, ideal for high volumes, offering high throughput and consistent output. Batch filtration (like filter presses) processes fixed volumes sequentially, offering higher dryness levels but lower overall throughput, typically used for smaller volumes or specialty products.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager