Horse Bedding Products Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431774 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Horse Bedding Products Market Size

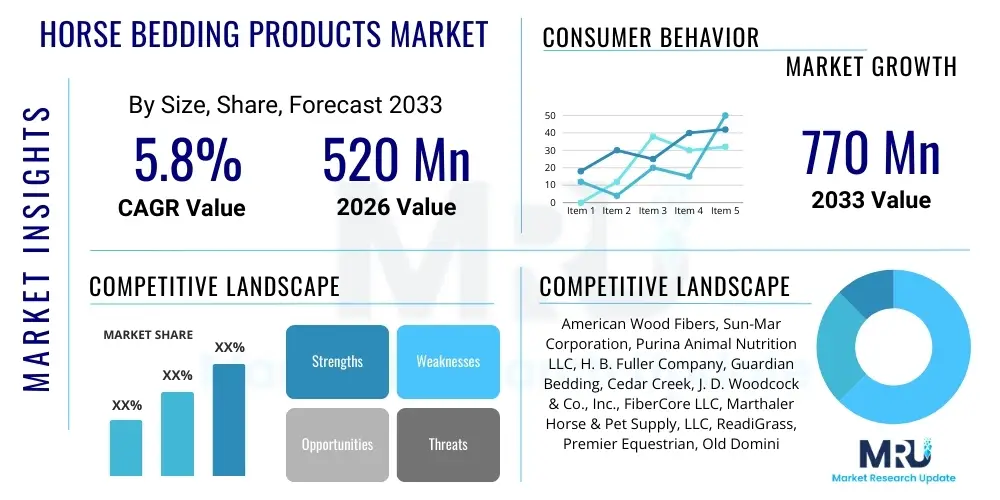

The Horse Bedding Products Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 520 Million in 2026 and is projected to reach USD 770 Million by the end of the forecast period in 2033.

Horse Bedding Products Market introduction

The Horse Bedding Products Market constitutes an essential component of the global equine care industry, encompassing a specialized range of organic and processed materials critical for maintaining optimal stable hygiene and horse comfort. These products are engineered not only to provide a comfortable lying surface, which is paramount for equine orthopedic health and rest cycles, but also to possess high efficacy in moisture absorption, ammonia neutralization, and thermal insulation. The complexity of the market arises from the diverse requirements across various equine disciplines, ranging from high-intensity racing environments demanding dust-free, high-performance materials to small, private stables prioritizing affordability and localized sourcing. Products span a material spectrum including fine wood shavings, highly compressed wood pellets, chopped straw, processed paper and cardboard, and specialty materials such as industrial hemp and flax. The primary driver for purchasing decisions revolves around the material's impact on respiratory health, especially minimizing particulate matter (dust) which is a major contributor to equine asthma and other chronic lung conditions prevalent in stabled horses. This focus on preventative healthcare expenditure is consistently driving the market towards premium, scientifically validated bedding solutions.

Global demand is further intensified by the rising institutionalization and professionalization of the equine sector. Large-scale breeding operations, international competition venues, and professional training facilities require bulk quantities of consistently high-quality bedding delivered through reliable logistical channels. The shift is palpable, moving away from low-cost, traditional materials like unprocessed straw, which often carry risks of mold, fungi, and high dust content, toward standardized, factory-processed materials. Key benefits driving this adoption include significant reduction in stable odors through effective ammonia sequestration, minimized labor costs associated with less frequent mucking out due to superior absorbency, and decreased veterinary costs resulting from improved overall stable sanitation. Manufacturers are heavily investing in research and development to enhance these functional attributes, focusing on increasing the material's surface area for faster absorption and developing materials resistant to pathogen growth. The integration of advanced drying and screening technologies during production ensures a sterile and uniform final product, meeting the rigorous standards demanded by elite equestrian facilities.

Moreover, the environmental profile of bedding materials is becoming a critical purchasing criterion. There is increasing pressure from end-users and regulatory bodies to ensure that bedding products are sourced sustainably and are easily and safely disposable. This pressure is creating significant market opportunities for materials derived from waste streams, such as recycled paper and sustainably managed agricultural by-products, including industrial hemp stalk. The market is evolving rapidly, with innovation cycles shortening as manufacturers strive to balance high performance characteristics—like low dust and high absorbency—with ecological responsibility. Key driving factors include the escalating number of registered competition horses globally, the associated rise in expenditure on sophisticated equine management practices, and governmental initiatives in various regions promoting better animal husbandry standards. The market introduction phase is mature in developed economies, but product differentiation based on specific health benefits (e.g., materials specifically designed for foaling stalls or therapeutic use) continues to fuel segmental growth and innovation.

Horse Bedding Products Market Executive Summary

The Horse Bedding Products Market exhibits resilient growth characterized by a strong global pivot toward premium and specialty materials. Major business trends include the increasing necessity for vertical integration among large manufacturers to secure stable, high-quality raw material inputs, particularly wood fiber, given its scarcity and fluctuating pricing. Strategic partnerships between bedding manufacturers and equestrian organizations are becoming common, serving to endorse specific products and establish brand loyalty within key competitive segments like racing and show jumping. Furthermore, companies are leveraging technological advancements in compression and packaging to reduce transportation costs, a significant logistical burden for this high-volume, low-density commodity. Financial metrics indicate a strong return on investment for companies specializing in highly refined, dust-extracted pellets and specialized hemp bedding, reinforcing the premiumization trend across North America and Europe. The competitive landscape is intensely focused on material science to achieve superior ammonia control, thereby differentiating standard offerings from value-added solutions tailored for maximum equine health benefits. Market leaders are increasingly investing in global logistics networks to service the rapidly expanding, high-growth markets in Asia Pacific.

Regional trends reveal a clear dichotomy between mature markets and rapidly developing regions. North America and Europe maintain dominance, characterized by highly developed distribution channels and sophisticated consumer demand for certified, high-performance products. In these regions, market growth is sustained by continuous innovation in sustainable alternatives and the replacement of traditional materials with processed forms. Conversely, the Asia Pacific region is experiencing exponential demand growth, stemming from significant governmental and private investments in equestrian infrastructure and the corresponding rise in horse populations. This demand is largely being met through imports of premium western bedding products, although local manufacturing is beginning to scale up, focusing initially on cost-competitive straw and rice hull derivatives. Regional adoption rates are significantly influenced by localized raw material availability; for instance, European manufacturers capitalize on flax and hemp fiber availability, while North American markets rely heavily on specialized pine and cedar wood processing capabilities. Climatic differences also dictate regional preferences, with arid regions favoring materials that help control dust, and humid regions requiring maximum fungicidal protection, leading to localized product development strategies.

Segmental trends underscore the long-term shift away from conventional agricultural residues towards engineered materials. The Wood Products segment, encompassing both shavings and pellets, retains the largest market share due to unparalleled performance metrics in absorption and handling, especially for commercial use. Within this segment, pellets are gaining traction due to their enhanced compression ratio, reducing storage and freight costs dramatically. The Alternative Materials segment, including hemp and recycled paper, is registering the highest CAGR, appealing primarily to environmentally conscious owners and stables managing horses with severe respiratory sensitivities. This sub-segment's growth is driven by the perceived superior health profile and the lower environmental impact of disposal. Distribution channel analysis confirms that Direct Sales remain critical for securing large, multi-year contracts with major professional facilities, while the E-commerce channel is experiencing rapid expansion, successfully catering to the logistical needs and convenience preferences of the private ownership demographic, offering smaller, palletized quantities directly to the consumer’s location. The ongoing innovation in moisture-activated absorbency ensures sustained preference for manufactured bedding over raw agricultural waste.

AI Impact Analysis on Horse Bedding Products Market

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is beginning to profoundly influence the Horse Bedding Products Market, primarily through advanced optimization of production processes, enhanced quality control, and the creation of highly efficient stable management systems. Common user questions often center on how AI can predict commodity price shifts for materials like wood fiber, straw, and flax, thereby allowing manufacturers to hedge risks and optimize procurement strategies months in advance. Users are keen to understand the application of AI in analyzing real-time sensor data from stables to precisely determine the lifespan of bedding materials, thereby shifting from fixed replenishment cycles to dynamic, needs-based maintenance. This dynamic optimization is viewed as the key to reducing material waste, lowering labor costs associated with unnecessary mucking, and ensuring consistently high air quality. The core expectation is that AI will transform bedding from a passive material into an active component of intelligent stable infrastructure, making equine facility management more sustainable, cost-effective, and centered on preventative health measures, contributing substantially to overall operational efficiency in large equestrian centers. The ability of AI to process non-linear data sets, such as weather patterns combined with stable density, to inform optimal product delivery timing is a major area of exploration.

In manufacturing, AI models are being trained on historical production data, environmental variables, and sensor feedback from machinery to predict equipment failures, optimize drying times, and ensure the stringent consistency of particle size and moisture content, which are critical quality determinants. This level of precision is impossible with traditional quality assurance methods, allowing top-tier manufacturers to guarantee 'ultra-low dust' claims with higher scientific certainty. Furthermore, AI is crucial in material innovation; ML algorithms can analyze the physiochemical properties of various waste streams and identify novel combinations or processing techniques to create next-generation absorbent materials that are both cost-effective and environmentally superior. The ability of AI to model complex decomposition rates and ammonia generation profiles under various environmental conditions allows for the creation of targeted products, such as bedding tailored specifically for wet climates or for stalls housing highly active horses, demonstrating a move towards precision product development and significantly shortening the R&D cycle for new specialty products. The use of predictive maintenance based on AI is ensuring maximum uptime for high-throughput pelletizing equipment.

For end-users, the immediate visible impact of AI is through smart monitoring systems. These systems utilize low-cost IoT sensors embedded in the stall floor or air to collect data on temperature, humidity, and chemical markers (e.g., ammonia). AI algorithms interpret this vast dataset to identify patterns indicative of deteriorating bedding quality or rising health risks. This data-driven approach enables predictive mucking, where management is alerted precisely when the ammonia concentration reaches a predefined safety threshold, rather than waiting for a scheduled clean-out. This enhances stable hygiene, extends the functional life of the bedding, and ensures maximum comfort for the horse. Long-term, AI will facilitate truly automated stable environments where environmental controls (ventilation, temperature) are dynamically linked to the bedding condition, potentially integrating with automated waste removal systems for a fully closed-loop, hyper-efficient operation, ultimately reducing the total cost of equine ownership and setting a new benchmark for animal welfare standards. The combination of AI analytics with highly absorbent bedding materials results in an optimized and proactive management regime.

- AI-driven Predictive Maintenance: Utilizing machine learning algorithms to analyze sensor data on moisture and ammonia buildup, optimizing bedding replacement intervals to minimize material consumption and labor costs by 15-25% while maintaining strict hygiene parameters.

- Supply Chain Optimization: AI tools forecast demand fluctuations, including seasonal variation and large-scale event needs, managing complex raw material sourcing (timber waste, agricultural residues) and reducing lead times and supply chain volatility by up to 10% through advanced route and inventory modeling.

- Automated Quality Control: Implementing AI-powered visual inspection systems during the packaging line to ensure consistent particle size, uniform dust extraction efficacy, and material density, guaranteeing premium product quality and minimizing customer complaints related to contamination or inconsistency in bulk shipments.

- Smart Stable Integration: AI systems analyze environmental data (temperature, humidity, air quality) in relation to stall usage, automatically adjusting ventilation and recommending the optimal moisture management protocols for specific bedding types and high-risk health scenarios, particularly for sensitive or recovering animals.

- Customer Profiling and Product Customization: Machine learning identifies specific needs of large equine facilities based on breed, activity level, and geographic location, allowing manufacturers to tailor bedding formulations (e.g., highly absorbent wood pellet blends vs. insulating hemp fiber) for superior functional fit and targeted health outcomes.

- Ammonia Detection and Mitigation: AI algorithms interpret chemical sensor readings to alert stable managers immediately when ammonia levels exceed safe thresholds, directly linking bedding performance to equine respiratory health and providing actionable insights for immediate environmental remediation or material replacement strategies.

- Logistics Efficiency Modeling: AI optimizes transportation routes and pallet loading strategies for bulky bedding products, drastically reducing shipping expenditures and carbon footprint, leading to higher profit margins and enhanced sustainability credentials for manufacturers and distributors alike.

DRO & Impact Forces Of Horse Bedding Products Market

The dynamics of the Horse Bedding Products Market are intrinsically tied to a distinct set of drivers, restraints, and opportunities, which exert considerable influence on investment decisions and competitive strategy. A major driver is the accelerating legislative and ethical scrutiny concerning animal welfare across developed nations, compelling professional stables and private owners alike to adopt premium bedding that demonstrably minimizes health risks. This includes regulations governing acceptable particulate matter in stables and mandates for proper waste handling. Furthermore, the global expansion of competitive equestrian disciplines, which involves high-value animals requiring peak physical condition and rigorous preventative care, significantly boosts demand for performance-enhancing bedding materials. The ability of modern bedding to drastically reduce ammonia levels—a known respiratory irritant—is a core performance attribute that dictates market adoption, especially in closed, high-density stable environments, thus providing a consistent impetus for market growth and material innovation. The increased adoption of evidence-based veterinary practices globally reinforces the demand for scientifically validated bedding solutions that provide measurable health benefits. The perceived value proposition of reduced long-term veterinary costs often outweighs the higher initial investment in premium materials.

Despite robust demand, the market faces critical restraints, chief among them being the considerable volatility and escalating costs associated with primary raw materials, notably wood fiber (pine, cedar) and agricultural by-products (flax, straw). These materials are subject to competing demands from construction, biofuel, and other agricultural sectors, creating significant supply chain instability and driving up manufacturing costs, which are difficult to fully pass on to the price-sensitive bulk buyer. Additionally, the logistical complexity associated with the product—being high-volume and low-density—imposes substantial limitations on distribution efficiency, particularly across international borders. Transportation costs represent a disproportionately high component of the total delivered cost, leading manufacturers to invest heavily in compression technology (pellets) to mitigate this financial and logistical barrier, yet the hurdle remains significant for conventional shavings and straw. Further restraint stems from the inertia of traditional methods, where some smaller, cost-conscious farmers resist adopting modern processed materials, favoring localized and often inferior agricultural residues, thereby capping the growth potential in certain rural segments. Managing the seasonality of raw material harvest and procurement presents another ongoing operational challenge.

However, the market is brimming with opportunities centered on sustainability and product specialization. The shift toward utilizing industrial hemp, flax, and recycled paper/cardboard streams offers manufacturers the chance to bypass traditional wood supply chain volatility while meeting consumer demands for ecological responsibility. These alternative materials often boast superior absorption and decomposition profiles. Geographically, emerging economies in APAC and LATAM represent vast, largely untapped markets where the equestrian industry is professionalizing and actively seeking high-quality, reliable bedding solutions, offering substantial growth avenues for international market leaders willing to establish localized processing facilities. The ongoing development of specialized, fortified bedding—such as those treated with anti-microbial agents or enhanced with targeted odor control additives—provides lucrative niche markets focused on high-value end-users who prioritize therapeutic benefits and advanced hygiene over marginal cost savings. Successfully navigating these impact forces requires a dual strategy: securing supply through vertical integration while simultaneously driving innovation in sustainable material science and logistical efficiency, thereby creating barriers to entry for new, unspecialized competitors. The rising global concern over stable waste management also creates opportunities for manufacturers who can provide comprehensive, sustainable disposal solutions integrated with their product offerings.

Segmentation Analysis

A rigorous segmentation of the Horse Bedding Products Market illuminates the complex purchasing behavior and material preferences across the diverse equine industry. Segmentation by Material Type is the most defining criterion, reflecting the intrinsic differences in performance characteristics: Wood Shavings, favored for their cushioning and affordability; Wood Pellets, prized for maximum absorbency and minimal storage footprint; Straw, a traditional, cost-effective option prevalent in agricultural regions; and Alternative Materials (Hemp, Flax, Paper), selected for ultra-low dust, superior environmental credentials, and high specialization for sensitive animals. Understanding the subtle performance trade-offs—such as the thermal insulation offered by straw versus the superior moisture wicking of pellets—is essential for market positioning, as each material category appeals to distinct sub-segments of the end-user base based on their specific stable design, labor availability, and climate challenges. Manufacturers must calibrate their production to account for the varying processing complexity and cost structure inherent in each material type to maintain competitive margins across the product portfolio.

The Application segmentation further refines market targeting by distinguishing between Professional Stables (racing, breeding, high-level competition) and Private Ownership/Hobbyists. Professional facilities constitute the engine of bulk demand, requiring highly consistent, performance-guaranteed materials often procured directly from the manufacturer on long-term contracts. Their decisions are data-driven, prioritizing equine health metrics and operational efficiency (labor savings). Conversely, private owners, while purchasing smaller volumes, prioritize convenience, availability through local retail channels, and ease of use, often showing a higher propensity to try new, innovative products seen as enhancing their personal investment in their animal. Equestrian Centers and Clubs represent a third distinct segment, often balancing cost constraints with the need for high-throughput hygiene standards, frequently relying on cost-effective, easily disposable bulk materials. Understanding the distinct procurement cycle—annual contracting for professional stables versus intermittent retail purchasing for private owners—is crucial for effective inventory and sales forecasting across the entire market.

Segmentation by Distribution Channel reveals the critical logistical pathways through which these bulky products reach the end-user. Direct Sales dominate the commercial sector, where manufacturers negotiate large annual contracts, enabling optimized, scheduled delivery. This channel maximizes manufacturer margins and provides the stable with supply reliability. The Retail channel (feed stores, pet supply outlets) remains indispensable for small and medium-sized farms and private owners seeking immediate, smaller quantities, benefiting from local presence and strong advisory relationships. Crucially, the E-commerce channel is the fastest-growing segment, overcoming the logistical challenge of bulk delivery through optimized palletized shipping and subscription models, offering unparalleled convenience to remote or dispersed customers. The successful navigation of the market requires robust investment across all three distribution modalities, ensuring both bulk commercial needs and individual consumer convenience are met effectively and cost-efficiently. E-commerce platforms are increasingly utilized for specialty, high-margin alternative bedding products that benefit from national or international reach.

- By Material Type:

- Wood Shavings (Standard, Dust-extracted, Specialty woods like cedar or pine)

- Wood Pellets (Standard, Enhanced absorption, Treated for ammonia control)

- Straw (Chopped, Dust-treated, Traditional)

- Paper/Cardboard (Recycled, Shredded, Highly processed)

- Alternative Materials (Industrial Hemp Fiber, Flax Shives, Peat Moss derivatives, Rubber Mats used with minimal bedding)

- By Application:

- Professional Stables (Racing, Breeding, Training Facilities, High-Level Competition Yards)

- Private Ownership/Hobbyists (Small farms, Individual recreational riders, Backyard keepers)

- Equestrian Centers and Clubs (Riding schools, Therapy centers, Boarding facilities, Veterinary clinics)

- By Distribution Channel:

- Direct Sales (Bulk supply and contractual agreements with large farms and institutions)

- Retail Stores (Agricultural supply stores, Feed and tack shops, Hardware stores)

- E-commerce (Online retail platforms, Manufacturer direct-to-consumer sales, Subscription services for bedding)

Value Chain Analysis For Horse Bedding Products Market

The robust value chain for Horse Bedding Products begins with the critical Upstream Analysis, which focuses exclusively on the procurement and initial preparation of raw biomass. This stage is highly decentralized and susceptible to commodity market forces. Primary raw material suppliers, including sawmills (for wood waste), large agricultural operations (for straw and flax), and recycling centers (for paper/cardboard), dictate the consistency and cost baseline. The immediate technological requirements upstream involve highly efficient material collection systems and preliminary processing—such as kiln drying of wood waste to reduce moisture content below 10-15% and screening to remove large debris. Strategic long-term sourcing contracts are paramount here, as price volatility for wood residuals, influenced by the housing and construction industries, poses a constant threat to profitability. Manufacturers who successfully integrate backwards into sawmilling or establish captive sourcing agreements with large timber operators gain a significant competitive advantage by controlling material costs and quality specifications from the origin point. Efficient upstream management is essential to minimize logistics costs before processing begins, given the low value-to-volume ratio of raw materials.

The Midstream phase involves the sophisticated transformation of raw materials into finished bedding products. This is the stage where value addition and product differentiation are maximized. Key processes include advanced dust extraction, where multi-stage cyclonic filtration systems ensure ultra-low particulate contamination, and high-pressure pelletizing for compressed wood products. Furthermore, proprietary treatments, such as applying natural antimicrobial agents or specialized binders to enhance ammonia neutralization, occur during this phase. Manufacturing complexity requires substantial capital investment in specialized machinery, making economies of scale crucial. Operations must be highly mechanized to handle massive throughput volumes efficiently while maintaining rigorous quality control (e.g., density testing, moisture mapping) to meet the stringent demands of high-end users. Success in the midstream segment relies on patent protection for unique processing technologies and operational efficiency that minimizes energy consumption, especially in drying processes, which represent a major operating expense. Continuous process optimization through lean manufacturing principles is vital for cost leadership in this segment.

Downstream Analysis centers on the efficient distribution and market penetration of the bulky finished goods. The distribution channel is sharply divided between Direct and Indirect routes. Direct Sales involve customized logistics for bulk deliveries (e.g., 50-ton truckloads of blown shavings or palletized pellets) straight to large commercial stables, bypassing intermediaries and offering competitive pricing based on volume contracts. This channel relies on dedicated logistics fleets and strong sales relationships. Indirect channels encompass wholesale distribution to agricultural retailers and the rapidly expanding E-commerce platform. E-commerce success requires innovative packaging solutions, often utilizing highly compressed small bags or customized small-batch palletization, to manage the high cubic volume and weight ratio through parcel carriers or localized last-mile delivery. The ultimate success downstream is measured by the ability to offer reliable supply, rapid fulfillment, and convenient access points across all geographic segments, ensuring minimal inventory holding requirements for the end-user while maximizing logistical velocity for the manufacturer. Effective inventory management at distribution hubs is critical to avoid spoilage and meet highly seasonal demand fluctuations.

Horse Bedding Products Market Potential Customers

The potential customer base for horse bedding products is highly diversified yet centrally focused on entities responsible for the welfare and management of equines. The most significant segment comprises professional equestrian facilities, including world-renowned racing stables, high-stakes thoroughbred breeding farms, and elite performance training centers. These customers are high-volume, continuous buyers, prioritizing specialized, top-tier bedding materials with guaranteed low dust content, exceptional moisture absorption, and consistency, as these factors directly secure their multi-million dollar investments in equine athletes. Their procurement process is often sophisticated, requiring detailed performance specifications and reliable, scalable bulk delivery logistics, often necessitating customized delivery schedules and long-term contracts. This segment demands specialized products engineered for continuous intensive use and minimal labor input, viewing bedding quality as a key component of animal asset management.

A second major segment consists of recreational horse owners and smaller private farms, often managed as hobby farms or for leisure riding. While purchasing lower volumes per transaction, this group is highly sensitive to product convenience, local availability, and overall value. The purchasing decision for private owners is frequently influenced by recommendations from local veterinarians, equine nutritionists, and community feed store advisors, emphasizing convenience and ease of handling. This customer group predominantly utilizes retail and e-commerce channels, favoring easily managed, packaged products like compressed pellets or bagged shavings. The increasing prevalence of horse ownership as a leisure activity, particularly in suburban and exurban areas of developed economies, ensures sustained and growing demand from this consumer segment, which favors products that simplify stall management and waste disposal, often prioritizing aesthetically pleasing and natural, environmentally friendly options.

Finally, institutional customers such as accredited riding schools, specialized therapeutic riding centers, and agricultural universities also represent vital end-users. These organizations require reliable, cost-effective, and safe bedding that meets high standards for both animal comfort and regulatory compliance. Therapeutic centers, in particular, may require highly specialized, dust-minimized bedding to protect both horses and human volunteers or riders, some of whom may have compromised respiratory systems. These institutional customers often procure through competitive bidding processes or governmental contracts, favoring suppliers who can guarantee continuous supply and stable pricing over multi-year contract periods. Their purchasing mandates high levels of operational compliance, detailed product safety data sheets, and comprehensive environmental certification from the bedding manufacturers, reinforcing the market trend toward quality assurance and accountability in the supply chain.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 520 Million |

| Market Forecast in 2033 | USD 770 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | American Wood Fibers, Sun-Mar Corporation, Purina Animal Nutrition LLC, H. B. Fuller Company, Guardian Bedding, Cedar Creek, J. D. Woodcock & Co., Inc., FiberCore LLC, Marthaler Horse & Pet Supply, LLC, ReadiGrass, Premier Equestrian, Old Dominion Wood Products, Inc., Bekaert Fibre Technologies, New England Wood Pellet LLC, Lignetics, Inc., Bluegrass Horse Feed, Shavings Plus, Equine Fresh, P. H. McNiff & Son, Pineridge Stables, ESCO Feed & Supply, Shavings USA, North American Pellet Corp, Bedding Blends International, Triple Crown Feed, Woodpecker Bedding, Silverado Premium Bedding, East Coast Shavings, Pellet Supply Inc., Sweet PDZ Horse Stall Refresher. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Horse Bedding Products Market Key Technology Landscape

The technological evolution in the Horse Bedding Products Market is defined by a shift from simple material processing to sophisticated material science and environmental management integration. A foundational technology involves advanced mechanical processing aimed at optimizing particle morphology and maximizing functional performance. This includes high-precision shredding and milling techniques used to create wood shavings and fibers of uniform size, which is vital for ensuring consistent absorption and cushioning. Crucially, the implementation of multi-stage, industrial-grade air classification and cyclonic separation systems represents a significant technological leap. These systems are designed to virtually eliminate micro-particulate dust (below 10 microns), thereby producing 'dust-extracted' or 'screened' products that meet veterinary standards for horses with high respiratory sensitivity. This technological capability is a core differentiator, separating high-quality producers from commodity suppliers, and requires substantial ongoing investment in capital equipment maintenance and monitoring, ensuring adherence to increasingly stringent industry-specific particulate matter standards.

Material enhancement technologies focus on embedding additional functionality into the biomass matrix. This often involves applying proprietary thermal and chemical treatments. For instance, high-temperature heat treatment (kiln drying) not only reduces moisture content to ideal levels (preventing mold growth) but also sterilizes the material, eliminating pathogens and insects without resorting to harsh chemical additives. Furthermore, innovation includes the development of absorbent additives or binders, often natural mineral composites or specialized polymers, which are integrated during the pelletization process. These additives are engineered to specifically target and bind ammonia molecules released from urine, converting them into less volatile and harmless compounds. This active odor control technology provides a critical value proposition, significantly improving stable air quality and enhancing the product's functional lifespan, effectively addressing the primary challenge of stall management. Research into nanofiber coating technology for enhanced absorption is an emerging area of technological exploration designed to maximize moisture wicking capabilities without increasing the bulk volume of the product.

Looking forward, the most transformative technology is the convergence of the Internet of Things (IoT) and Artificial Intelligence (AI) for real-time stable environment monitoring. This involves developing robust, cost-effective sensor solutions that can withstand the harsh, moist, and chemically active environment of a horse stall. These specialized sensors continuously measure critical parameters such as relative humidity within the bedding pack, ambient temperature, and, most importantly, parts per million (PPM) of ammonia and other volatile organic compounds. The data is fed into a cloud-based AI platform that utilizes predictive algorithms to alert stable managers not just to poor conditions, but to predict when conditions will degrade beyond an acceptable threshold based on historical usage and environmental factors. This technology moves beyond product creation into preventative management solutions, offering large professional facilities an unprecedented level of operational control and evidence-based justification for their premium bedding choices, solidifying the market's trajectory toward highly specialized and technology-integrated offerings that prioritize equine welfare through continuous environmental data analysis and corrective action recommendations.

Regional Highlights

- North America: The North American market is characterized by technological maturity and substantial consumer affluence. The U.S. and Canada host massive equine populations spanning professional racing, competitive sports (hunter/jumper, dressage), and recreational riding. The region’s strong timber industry facilitates abundant raw material supply for wood shavings and pellets, which dominate the market. Demand is overwhelmingly focused on premium, processed products certified as low-dust and highly absorbent, often utilizing locally sourced pine and cedar species. Strict state-level environmental regulations governing stable waste disposal also favor highly biodegradable and compactable materials, driving investment in recycling and waste-to-energy solutions for spent bedding. Market penetration is high, with competitive strategies focused on superior logistics, brand reputation, and leveraging direct sales channels to large commercial farms.

- Europe: Europe represents a densely segmented and highly environmentally conscious market. Western Europe (UK, Germany, France) exhibits high demand for alternative materials like industrial hemp and flax, leveraging localized agricultural economies and strong consumer preference for ecological products. EU directives on animal welfare are among the world's most stringent, directly influencing stable management standards and favoring bedding materials that demonstrably contribute to lower instances of respiratory disease. The market is highly diverse, with a strong emphasis on traceability and the use of certified sustainable raw materials. Logistics are highly efficient within the Schengen Area, allowing for rapid cross-border distribution of palletized products, but price competition is intense due to the variety of available regional substitutes.

- Asia Pacific (APAC): The APAC region is a high-potential growth market driven by increasing urbanization and the rising disposable income of the middle and upper classes, leading to massive investments in equestrian sports and luxury horse ownership, particularly in China and Australia. While Australia has a mature domestic market for wood products, the rest of Asia is heavily reliant on imports of premium bedding materials from North America and Europe to supply new, high-specification training centers. The primary market opportunity lies in establishing reliable local manufacturing and distribution chains to service this rapidly expanding, yet logistically challenging, geographic expanse, currently constrained by insufficient local high-grade raw material processing capabilities and complex import taxation regimes.

- Latin America (LATAM): Market penetration in LATAM is heterogeneous, concentrated primarily in major equine hubs such as Brazil, Argentina, and Mexico, linked to thoroughbred racing and large cattle ranching operations. The market remains highly cost-sensitive, with traditional materials like unprocessed wood chips and straw holding significant share, particularly in rural areas. However, professional facilities are increasingly adopting higher-quality imported wood pellets and shavings to improve equine health metrics. Growth is steady but dependent on macroeconomic stability and infrastructure investment, with localized sourcing and complex import tariffs posing significant barriers to entry for international suppliers targeting mass-market penetration, requiring strategic partnerships with local distributors to succeed.

- Middle East and Africa (MEA): The MEA market is largely defined by the exceptionally high standards of the Arabian Gulf countries, which host prestigious racing and endurance events. Due to arid climates and lack of indigenous timber resources, nearly all premium bedding (high-grade pellets, specialized synthetic alternatives) must be imported. These facilities demand the highest performance, focusing on materials that minimize dust and offer maximum cooling/insulation properties against harsh desert climates. The purchasing power is extremely high, mitigating price sensitivity, and quality assurance is paramount. The broader African market is nascent and largely reliant on basic, locally available agricultural residues, with premium demand restricted to specialized expatriate-run facilities and government-sponsored racing initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Horse Bedding Products Market.- American Wood Fibers

- Sun-Mar Corporation

- Purina Animal Nutrition LLC

- H. B. Fuller Company

- Guardian Bedding

- Cedar Creek

- J. D. Woodcock & Co., Inc.

- FiberCore LLC

- Marthaler Horse & Pet Supply, LLC

- ReadiGrass

- Premier Equestrian

- Old Dominion Wood Products, Inc.

- Bekaert Fibre Technologies

- New England Wood Pellet LLC

- Lignetics, Inc.

- Bluegrass Horse Feed

- Shavings Plus

- Equine Fresh

- P. H. McNiff & Son

- Pineridge Stables

- ESCO Feed & Supply

- Shavings USA

- North American Pellet Corp

- Bedding Blends International

- Triple Crown Feed

- Woodpecker Bedding

- Silverado Premium Bedding

- East Coast Shavings

- Pellet Supply Inc.

- Sweet PDZ Horse Stall Refresher

Frequently Asked Questions

Analyze common user questions about the Horse Bedding Products market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for specialized, dust-free horse bedding?

The central driver is the global emphasis on equine health and welfare, specifically mitigating respiratory diseases such as Chronic Obstructive Pulmonary Disease (COPD). Low-dust bedding (e.g., highly screened wood pellets or processed hemp) significantly improves stable air quality, reducing veterinarian costs and enhancing athletic performance, justifying the premium price for professional facilities. The increasing scientific documentation linking stable air quality to respiratory health solidifies this purchasing priority among serious equine professionals.

Which material type currently dominates the Horse Bedding Products Market and why?

Wood products, specifically wood shavings and compressed wood pellets, dominate the market share. They offer an optimal balance of high absorbency, reasonable cost, ease of handling, and consistency. Wood pellets, in particular, maximize absorbency and minimize storage space due to high compression ratios, making them highly efficient for large-scale commercial stable management where storage and logistics are critical operational considerations.

How do fluctuating raw material prices impact the profitability of bedding manufacturers?

Profitability is significantly affected by the volatility of raw material input costs, primarily timber waste and agricultural residues. Manufacturers must implement robust supply chain strategies and potentially vertically integrate operations to secure steady supply and mitigate price risk. Price fluctuations necessitate frequent, and sometimes unpredictable, adjustments in wholesale pricing, which can strain long-term contractual relationships with bulk buyers who depend on predictable operating expenses.

What role does sustainability play in current horse bedding purchasing decisions?

Sustainability is a crucial factor, especially in Europe and North America. Buyers increasingly favor products that are biodegradable, derived from recycled materials (like paper/cardboard), or sourced sustainably (e.g., FSC-certified wood). Environmentally conscious disposal is a key concern, favoring materials that compost quickly and efficiently after use, aligning with zero-waste goals of modern farming operations and institutional facilities that must manage large volumes of waste.

How is technology expected to change stable management practices related to bedding?

Technology is moving towards 'Smart Stable' integration, utilizing IoT sensors embedded in or near the bedding to monitor moisture levels, ammonia concentration, and temperature in real-time. This data, analyzed by AI, allows stable managers to optimize mucking schedules dynamically, reducing bedding waste, lowering labor costs, and maintaining ideal air quality autonomously, shifting management from fixed routines to data-driven performance optimization, thereby enhancing predictive care.

Why are wood pellets increasingly preferred over traditional wood shavings in commercial stables?

Wood pellets offer significant logistical and performance advantages. They are extremely compact, reducing storage requirements by 50-70% compared to shavings, and their high compression ratio translates to superior absorbency upon activation (wetting). This high performance reduces mucking frequency and significantly lowers transportation costs, providing a substantial operational economy for large facilities despite a potentially higher initial material cost, justifying the transition.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager